Issuer/borrower : Supranational organizations, Sovereign (national) governments, Non-sovereign (local) governments, Quasi-government entities - MBS, Companies (i.e., corporate issuers), SPE/SPV - ABS

Bondholder: Suppliers of capital - Maturity date OR Term to maturity(tenor)

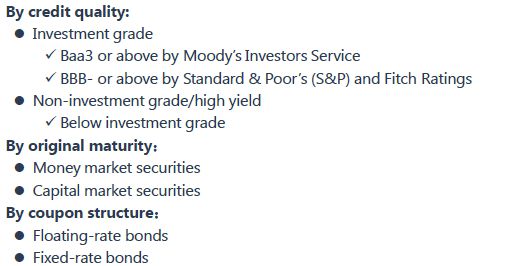

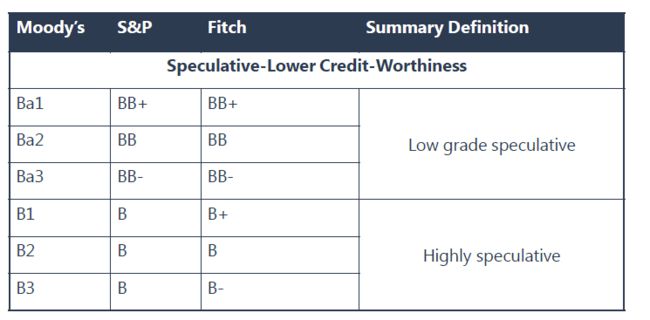

Bondholders are exposed to credit risk - full and timely payments of interest and/or repayments of principal. BB : Junk Bond

Asset or collateral backing: a way to reduce credit risk: Unsecured bonds, Secured bonds - debentures are unsecured bonds

External credit enhancement: Surety bond & Bank guarantee - Surety bond/Bank guarantee , Letter of credit

Limitation of External credit enhancement - The deterioration of credit quality of the guarantor will also reduce the credit quality of the covered bond.

Affirmative VS. negative covenants

Affirmative covenants: are typically administrative in nature, the promise of making the contractual payments.

Negative covenants: frequently costly and do materially constrain the issuer's potential business decisions.

Tax consideration:

the ordinary income tax rate, Municipal debts,

Capital gain or loss: due to sell a coupon bond prior to maturity, the tax rate for long-term capital gains is lower than the tax rate for short-term capital gains, and the tax rate for short-term capital gains is equal to the ordinary income tax rate;

Original issue discount (OID) bonds: a prorated portion of thediscount must be included in interest income every tax year

Premium bonds

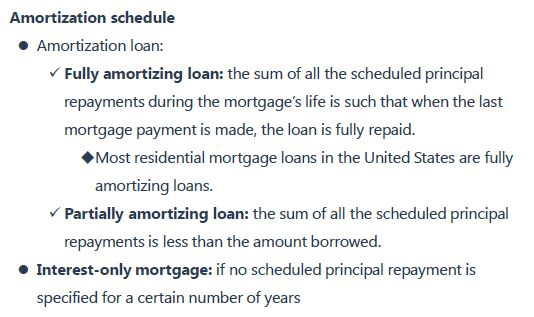

Amortizing loan: means the gradual reduction of the amount borrowed over time

- Fully amortizing: the sum of all the scheduled principal repayments during the mortgage’s life is such that when the last mortgage payment is made, the loan is fully repaid.

- Partially amortizing: the sum of all the scheduled principal repayments is less than the amount borrowed.

The sinking fund provision is used to reduce the credit risk of the bondholder. Sinking fund provision: requires the issuer to retire a portion of a bond issue at specific times during the bonds’ life. Doubling option / accelerated sinking fund:

Sinking fund arrangement: a sinking fund was a specified cash reserve, select by lottery the serial numbers, redeeming a steadily increasing amount of the bond's notional principal, repurchase the bonds at the market price, at par, or at a specified sinking fund price.

The bonds to be retired are selected at random based on serial number

Some indentures, however, allow issuers to use a doubling option to repurchase double the required number of bonds.

The coupon rate determined at the coupon reset date is the rate that the issuer promises to pay at the next coupon date.

The upper limit is called the cap.

The lower limit is called the floor

When a floating-rate security has both a upper limit and a lower limit, the feature is called a collar

Variable-rate note: Similar to a floating-rate note, except that the spread isvariable rather than constant.

Inverse floaters (also called reverse floaters) have coupon rates that movein the opposite direction from the change in the reference rate.

Inverse floaters with a coupon leverage greater than zero but lower than one are called deleveraged inverse floaters (0-1). Inverse floaters with acoupon leverage greater than one are called leveraged inverse floaters(>1).

Deferred coupon bonds/split coupon bond: interest payments aredeferred for a specified number of years.

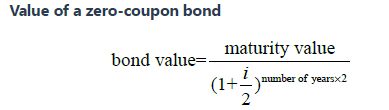

Zero-coupon bonds: no periodic coupon payments; always be traded at a discount—— one type of deferred coupon bond.

Credit-linked coupon bond: has a coupon that changes when the bond’scredit rating changes.

Pay-in-kind ( PIK ) bond: allows the issuer to pay interest in the form ofadditional amounts of the bond issue rather than as a cash payment.

Equity-linked notes (ELN): no periodic interest payments, and the paymentat maturity is based on an equity index.

Index-linked bond: has its coupon payments and/or principal repaymentlinked to a specified index.)

TIPS: pay semiannual coupons, at maturity

Make-whole call provision: requires the issuer to make a lump-sum payment to the bondholders based on the present value of the future coupon payments and principal repayment not paid because of the bond being redeemed early.

Convertible bond is a hybrid security with both debt and equity features (referred to as hybrid security). It gives bondholders the right to exchange the bond for a specified number of common shares in the issuing company.

Two main advantages of issuer:Reduce interest expense, Reduce debt when conversion option is exercised

Warrants are beneficial to the bondholders: Warrants is actually not an embedded option but rather an “attached”option.

Fixed-income indices: a multi-purpose tool used by investors and managers to describe a given bond market or sector, as well as to evaluate the performance of investments and investment managers.

Primary market: Primary bond markets are markets in which issuers initially sell bonds to investors to raise capital.

Public offering: Investment banks play a critical role in bond issuance by assisting the issuer in accessing the primary market and by providing an array of financial services;

Private placement: sale of an entire issue to a qualified investor or a group of investors, which are typically large institutions.

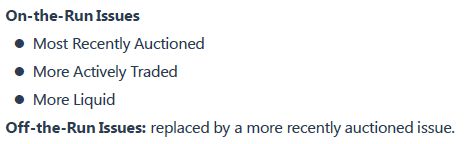

Secondary markets: trade of previously issued bonds. Exchange market, OTC Dealer Market (largest), Electronic Trading Network (growth)

Sovereign bonds: issued by national governments and backed by their tax power.

Nonsovereign government bonds: issued by governments below the national level.

Supranational bonds: issued by supranational agencies (multilateral agencies) that operate across national.

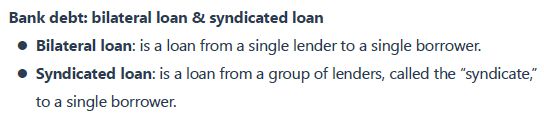

Commercial paper: short term, unsecured, low rate ( issued by corporations of high credit quality) debt.

-Exempt from registration, directly placed (sold directly by issuer) or dealer placed (sold to investor through agents/brokers);

-There is very little secondary trading of commercial paper;

-Reissued or rolled over when it matures.

-Rollover risk: a risk that the issuer will be unable to issue new paper at maturity;

-Backup lines of credit/ liquidity enhancement/backup liquidity lines: a type of credit enhancement provided by a bank to a issuer of commercial paper to ensure that the issuer will have access to sufficient liquidity to repay maturing commercial paper if rolled over is not available.

Corporate bonds

Serial bond issue: with several maturity dates (known at issuance) and can be redeemed periodically.

Term maturity structure: all the bonds maturing on the same date.

Customer deposits

Checking accounts: have immediate access to the funds in their deposit accounts and use the funds as a form of payment for transactions;

Saving accounts: pay interest and allow depositors to accumulate wealth in a very liquid form;

Money market mutual funds: an intermediate between checking and saving accounts, pay interest.

Repo margin/haircut: the difference between the market value of thesecurity used as collateral and the value of the loan.

The repo margin islower when:

-Repo term is shorter;

-Credit quality of the collateral security is higher;

-Credit quality of the borrower is higher;

-Collateral security is in high demand or low supply.

Structured financial instruments represent a broad sector of financial instruments. This sector includes asset backed securities (ABS),collateralized debt obligations (CDOs) and other structured financial instruments such as

-Capital protected instruments;

-Yield enhancement instruments;

-Participation instruments;

-Leveraged instruments

Capital Protected Instruments

The combination of the zero coupon bond and the call option can be prepackaged as a structured financial instrument called a guarantee certificate.

Yield Enhancement Instruments

Yield enhancement refers to increasing risk exposure in the hope of realizing a higher expected return. A credit linked note (CLN) is an example of a yield enhancement instrument;

Participation Instruments

As the name suggests, a participation instrument is one that allows investors to participate in the return of an underlying asset. Floating-rate bonds can be viewed as a type of participation instrument.

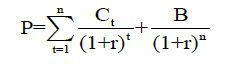

Bond Valuation Process

The general procedure for valuing fixed-income securities is to take the present values of all the expected cash flows and add them up to get the value of the security.

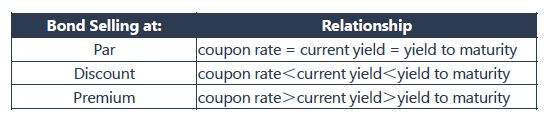

Relationships Between Price and Yield

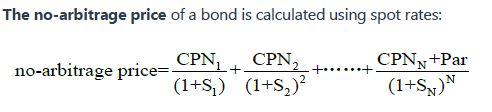

Valuation with Spot Rates

Spot rates: are market discount rates for single payments to be made in the future.

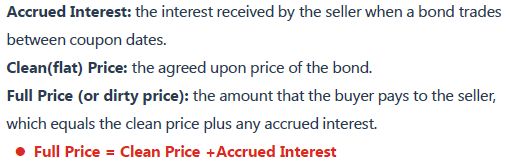

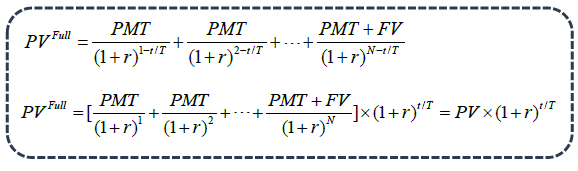

Full Price, Clean Price, Accrued Interest

Accrued Interest

Matrix Pricing: a method of estimating the required YTM of bonds that are currently not traded or infrequently traded bonds according to the yields of traded bonds with the same credit quality.

Linear interpolation can be used when the maturities between the valued bond and the traded bond are different

Yield Measures for Fixed-Rate Bonds

Periodicity of the annual rate: an annualized and compounded yield on a fixed-rate bond depends on the assumed number of periods in the year.

Street convention yield: Yield measures that neglect weekends and holidays are quoted on what is called street convention. assuming the payments are made on the scheduled dates.

True yield: internal rate of return on the cash flows using the actual calendar of weekends and bank holidays.The true yield is never higher than the street convention yield because weekends and holidays delay the time to payment.

Current yield (income or interest yield): not consider capital gains/loss or reinvestment income.

Simple yield: It is the sum of the coupon payments plus the straight-line amortized share of the gain or loss, divided by the flat price.

Coupon rate = reference rate + quoted margin

Quoted margin: margin used to calculate the bond coupon payments

Discount rate = reference rate + required margin (or discount margin)

Forward Rates is the interest rate on a bond or money market instrument traded in a forward market. Marginal return for extending the time-to-maturity for an additional period

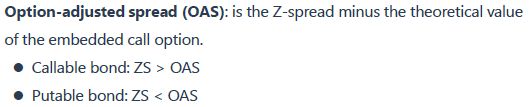

Benchmark spread: the yield spread over a specific benchmark, usually measured in basis points.

Asset-backed securities:

Fixed income securities that are backed, or collateralized, by a pool(collection) of assets such as loans or receivables are referred to as asset-backed securities

Credit tranching: Different tranches have different risk exposures

Time tranching:Bond classes that posses different expected maturities.

Mortgage loan

A mortgage is a loan that is collateralized with a specific piece of real property, either residential or commercial.

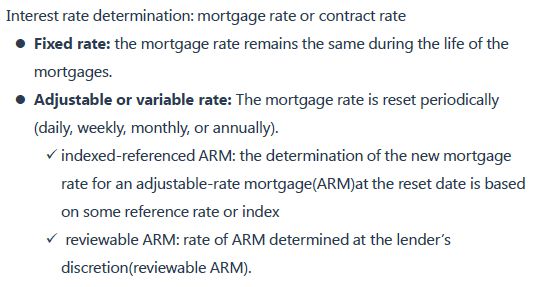

The interest rate on the loan is called the mortgage rate or contract rate.

A conventional mortgage is the most common residential mortgage. The loan is based on the creditworthiness of the borrower and is collateralized by the residential real estate that it is used to purchase.

Four important features of fixed-rate, level payment, fully amortized mortgage loans:

The amount of the principal payment increases as time passes

The amount of interest decreases as time passes

The servicing fee also declines as time passes

The ability of the borrower to prepay results in prepayment risk.

Rights of the lender in a foreclosure

Recourse loan: the lender has a claim against the borrower for the shortfall between the amount of the mortgage balance outstanding and the proceeds received from the sale of the property.

- Residual mortgage in most European countries are recourse loan

Nonrecourse loan: the lender does not have such a claim, so the lender can look only to the property to recover the outstanding mortgage balance.

- In the United States, residential mortgages are typically non-recourse loans.

Weighted average maturity (WAM): the weighted maturities average of all the mortgages in the pool, each weighted by the relative outstanding mortgage balance to the value of the entire pool.

Weighted average coupon (WAC): weight the mortgage rate of each mortgage loan in the pool by the percentage of the mortgage outstanding relative to the outstanding amount of all the mortgages in the pool.

Prepayment: any payment toward the repayment of principal that is in excess of the scheduled principal repayment.

Prepayment option (early repayment option): a mortgage loan may entitle the borrower to prepay all or part of the outstanding mortgage principal prior to the scheduled due date the principal must be repaid.

Prepayment penalty mortgage: The mortgage may stipulate some sort of monetary penalty when a borrower prepays within a certain time period after the mortgage is originated. This time period may extend for the full life of the loan.

Prepayment risk: Uncertainty that the timing of the actual cash flows will be different from the scheduled cash flows as set forth in the loan agreement due to the borrowers’ ability to alter payments, usually to take advantage of interest rate movements.

Residential Mortgage-Backed Securities

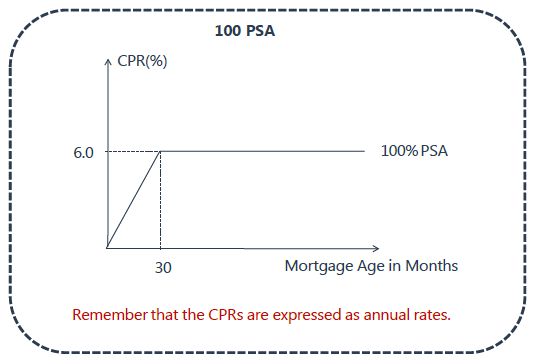

Monthly prepayment rate: single monthly mortality rate (SMM)

Mortgage pass-through security cash flow construction

The underlying pool of mortgage has a par value of US$800 million;

The mortgages are fixed-rate, level-payment, and fully amortizing loans;

The weighted average of the coupon rate(WAC) for the mortgage loans in the pool is 6%;

The weighted average of the maturity (WAM) for the mortgage loans in the pool is 357 months;

The pass-through rate (that is, the coupon rate net of servicing and other fees) is 5.5%;

Prepayment rate assumed to be 165PSA.

Creating collateralized Mortgage Obligations (CMO)

CMOs are securities issued against pass-through securities for which the cash flow have been reallocated to different tranches.

Each CMO tranche represents a different mixture of contraction and extension risk.

Redistribution of the original passthrough securities’ cash flows does not eliminate contraction and extension risk.

Different types of CMOs

1. Sequential Pay tranches

2.Planned amortization class (PAC) and Support tranche

A PAC is a tranche that is amortized based on a sinking fund schedule that is established within a range of prepayment speeds called the initial PAC collar.

This is a principal repayment schedule that must be satisfied

PAC bondholders have priority over all other classes in the CMO structure in receiving principal repayments from the collateral.

The greater certainty of the cash flow for the PAC bonds comes at the expense of the non-PAC tranches (support tranches). It is these tranches that absorb the prepayment risk.

PAC tranches have protection against both extension risk and contraction risk, providing two-sided prepayment protection.

Support tranche

Support tranches are included in a structure with PAC tranches specifically to provide prepayment protection for the PAC tranches.

The extent of prepayment risk protection provided by a support tranche increases as its par value increases relative to its associated PAC tranche.

The certainty of PAC bond cash flow comes at the expense of increased risk to the support tranches.

When the support tranches will eventually be paid off, and the principal will then go to the PAC holders, and the PAC is referred to as a broken or busted PAC. Essentially, the PAC tranche becomes an ordinary sequential pay structure.

Floating-rate tranche

Constructing a floater and an inverse floater combination from any of the fixed-rate tranches in a CMO structure.

- Floating rate tranche pays a higher rate when interest rates go up

- The inverse floater pays a lower rate when interest rate go up

Differences between Agency and Non-agency securities

Credit enhancement

Internal credit enhancements

Reserve funds: provide credit support by paying for possible future losses.

Overcollateralization: the value of the collateral exceeds the amount of the par value of the outstanding bond classes issued by SPV.

External credit enhancements: Credit support in the case of defaults resulting in losses in the pool of loans is provided in the form of a financial guarantee by a third party to the transaction

Warm-up——CMBS (Commercial mortgage-backed securities) are backed by a pool of commercial mortgages on income-producing property, such as:

Multifamily properties (e.g„ apartment buildings)

Office buildings, industrial properties (including warehouses)

Shopping centers; Hotels

Health care facilities (e.g., senior housing care facilities).

Commercial mortgages are non-recourse loans, the lender can look only to the income-producing property backing the loan for interest payments and principal repayments;

The residential mortgage lender can use only the proceeds from the sale of the property for repayment and has no recourse to the borrower for any unpaid balance

Basic CMBS Structure – Call Protection

A critical investment feature that distinguishes CMBS from RMBS is the protection against early prepayments available to investors’ known as a call protection. The call protection comes either at the structure level or at the loan level.

Call protection at the structure level

Call protection at the loan level

Basic CMBS Structure - Balloon Maturity Provision

Non-Mortgage Asset-backed Securities(ABS)

1. Auto Loan ABS

The cash flows for auto loan-backed securities consist of scheduled monthly payments (that is, interest payments and scheduled principal repayments) and any prepayments.

All auto loan-backed securities have some form of credit enhancement.

Senior/subordinated structure

Overcollateralization

Reserve account

- Excess spread account / excess interest cash flow, is an amount that can be retained and deposited into a reserve account and that can serve as a first line of protection against losses.

2. Credit Card Receivable ABS: credit card receivables are used as collateral for the issuance, non-amortizing loans

Collateralized debt obligation (CDO) is a generic term used to describe a security backed by a diversified pool of one or more debt obligations:

CDO Structure

A CDO involves the creation of an SPE.

In a CDO, there is a need for a CDO manager, also called “collateral manager”, to buy and sell debt obligations for and from the CDO’s collateral (that is, the portfolio of assets) to generate sufficient cash flows to meet obligations to the CDO bondholders.

These debt obligations are bond classes or tranches and include senior bond classes, mezzanine bond classes, and subordinated bond classes, often referred to as the residual or equity tranches.

CDO Transaction:

In typical structure, one or more of the tranches is a floating-rate security.

Asset manager uses interest rate swap to deal with the mismatch

Three sources of return:

Receipt of the promised coupon and principal payments on the scheduled dates;

Reinvestment of coupon payments;

Potential capital gains or losses on the sale of the bond prior to maturity.

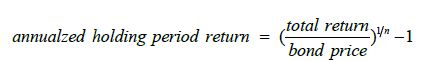

Total return: future value of reinvested coupon interest payments and the sale price (par value if the bond is held to maturity);

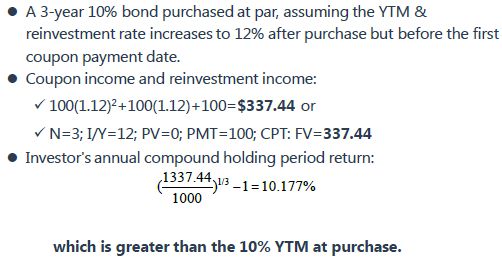

Results to gain from the analysis presented here.

Situation 1: a fixed-rate bond, hold to maturity, earn an annualized rate of return equal to the YTM of the bond when purchased.

Situation 2: sells a bond prior to maturity, earn a rate of return equal to the YTM at purchase if the YTM at sale has not changed since purchase.

Situation 3: market YTM for the bond, reinvestment rate increases (decreases) after the bond is purchased but before the first coupon date, a investor's realized return will be higher (lower) than the YTM of the bond when purchased when hold to maturity.

Situation 4: market YTM for the bond, reinvestment rate, increases after the bond is purchased but before the first coupon date, a bond investor will earn a rate of return that is lower than the YTM at bond purchase if the bond is held for a short period.

Situation 5: market YTM for the bond, reinvestment rate decreases after the bond is purchased but before the first coupon date, a bond investor will earn a rate of return that is higher than the YTM at bond purchase if the bond is held for a long period.

Two types of interest rate risk

Coupon reinvestment risk: uncertainty about income from reinvesting coupon payments. Increases with a higher coupon rate and a longer investment horizon.

Market price risk: uncertainty about a bond price

These risks offset each other: an increase (decrease) in YTM decreases (increases) a bond’s price but increases (decreases) its reinvestment income.

Interest risk

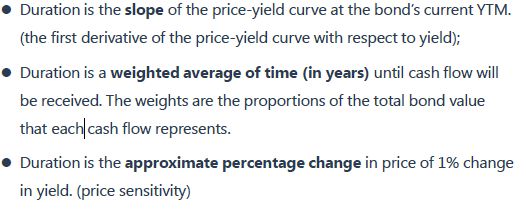

Duration measures the sensitivity of the bond’s full price to changes in benchmark interest rates.

Interpreting duration:

Duration and Maturity

Relationships Between Price and Yield

Inverse effect: The bond price is inversely related to the market discount rate. When the market discount rate increases, the bond price decreases.

Coupon effect: For the same time-to-maturity, a lower-coupon bond has a greater percentage price change than a higher-coupon bond when their market discount rates change by the same amount.

Maturity effect: Generally, for the same coupon rate, a longer-term bond has a greater percentage price change than a shorter-term bond when their market discount rates change by the same amount.

Convexity effect: For the same coupon rate and time-to-maturity, the percentage price change is greater (in absolute value, meaning without regard to the sign of the change) when the market discount rate goes down than when it goes up.

Portfolio duration:

key rate duration: is a measure of a bond’s sensitivity to a change in the benchmark yield curve at a specific maturity segment.

Convexity

Effective Convexity

Term structure of yield volatility: the relationship between maturity and yield volatility.

The importance of yield volatility in measuring interest rate risk is that bond price changes are products of two factors:

(1) the impact per basis-point change in the yield-to-maturity;

(2) the number of basis points in the yield-to-maturity change.

Duration gap

Duration gap = Macaulay duration – investment horizon

Positive gap exposes the investor to market price risk from increasing interest rates

Negative gap exposes the investor to reinvestment risk from decreasing interest rates

Credit and liquidity Spread

Credit risk is the risk of loss resulting from the borrower (issuer of debt)failing to make full and timely payments of interest and/or principal. It hastwo components.

Spread risk: Corporate bonds and other “credit-risky” debt instruments typically trade at a yield premium, or spread, to bonds that have been considered “default-risk free”.

Capital Structure: the composition and distribution across operating units of a company’s debt and equity, including bank debt, bonds of all seniority rankings, preferred stock, and common equity.

Seniority Ranking

Secured debt: the debtholder has a direct claim – a pledge from the issuer – on certain assets and their associated cash flows.

Unsecured debt is often referred to as debentures. Unsecured bondholders have only a general claim on an issuer’s assets and cash flow.

Priority of claims: in the event of default, unsecured debtholders claim rank below (i.e., get paid after) those of secured creditors.

Pari Passu: All creditors at the same level of the capital structure are treated as one class; thus, a senior unsecured bondholder whose debt is due in 30 years has the same pro rata claim in bankruptcy as one whose debt matures in six months. This provision is referred to as bonds ranking pari passu (“on an equal footing”) in right of payment.

Issuer credit rating: address an obligor’s overall creditworthiness – its ability and willingness to make timely payments of interest and principal on its debt.

The four Cs of credit analysis

Capacity refers to the ability of the borrower to make its debt payments on time.

Collateral refers to the quality and value of the assets supporting the issuer’s indebtedness.

Covenants are the terms and conditions of lending agreements that the issuer must comply with.

Character refers to the quality of management.

Capacity:

Industry analysis

Company fundamentals

Comments on issuer’s liquidity

Factors affect the spreads on corporate bonds:

Credit risk VS. return: yields and spreads