原文链接:Op-ed: Keeping a cool head in China's simmering tech sector

Op-ed: Keeping a cool head in China's simmering tech sector

专栏文章:冷静看待中国逐渐升温的科技产业

Michel Brekelmans, at L.E.K. Consulting breaks down investment trends and troubles in Chinese tech, media and telecom.

艾意凯咨询公司的 Michel Brekelmans 对中国科技、传媒和电信行业的投资趋势和问题分别加以分析。

Last September Alibaba shattered global records with a US$25 billion initial public offering in New York, capping a year in which 50% of venture capital investment in China was focused on Internet industries and technology, media, and telecom, or TMT.

去年九月,阿里巴巴在纽约完成史上最大规模首次公开募股,融资 250 亿美元。而就在这一年,中国 50% 的风险投资都聚集于互联网行业以及科技、传媒和电信领域(后三者简称为 TMT)。

That's only natural: Since 2010, investors in China have been increasingly focused on the tech sector, driven by the ongoing digitization of the economy and rapid consumer adoption of new technology. China is the largest smartphone market in the world with more than one billion users, an install base that has not only created the largest market for mobile applications globally, but also signalled to businesses that Chinese consumers are ready to go mobile-first for many goods and services.

自 2010 年以来,在数字化经济不断发展和新技术迅速走向消费市场的驱动下,中国投资者的目光自然越来越多地聚焦于科技产业。中国是全世界最大的智能手机市场,拥有超过 10 亿用户,庞大的用户基数不仅造就了全世界最大的手机应用市场,对于企业来说,这更是一个信号,表明中国消费者更愿意优先使用手机对很多商品和服务进行支付。

But rising valuations don't always translate to market-shaking innovations, and some start-ups clearly aren't worth their implied sticker price. To better understand what is driving overblown investments, and whether they could blow up in investors' faces, it is necessary to peek beneath the hood of China's tech sector to understand who is investing in what—and how.

但飙升的估值往往并不能带来引领市场的创新,而在过高的估值下,某些初创企业的实际价值明显难副其实。为了更清晰地了解是什么造成了过热的投资,以及这些投资是否会让投资人血本无归,我们有必要绕过重重遮蔽,近距离审视中国科技产业,以便了解是哪些人在投资,以及他们的投资对象和途径。

A TMT boom

科技、传媒和电信行业的爆发

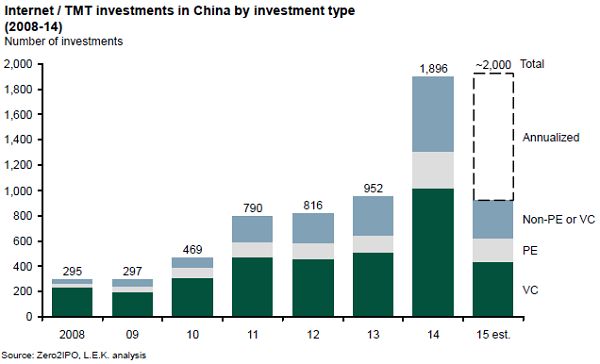

Over the last six years, the number of tech deals in China has grown approximately 36% on average, with deals doubling from 2013 to 2014. The recent increase in volume and valuation of deals has industry participants increasingly whispering of a bubble. We see four key drivers that explain the boom in venture capital and private equity deals (see above chart).

过去六年,中国科技投资数量平均增加约 36%,2014 年的投资数量比 2013 年翻一番。近期投资数量和价值的增长,使得越来越多业内人士看衰投资前景,担忧投资泡沫。我们了解到四个关键驱动因素,可以解释风险投资和私募股权投资的爆发(见上图)。

First, there has been a massive increase in available capital from both domestic and foreign sources. In addition to the number of deals doubling, the amount of funds raised targeting venture capital investments in China almost doubled from US$7 billion in 2013 to US$13 billion in 2014.

首先,来自本土和国外的可用资本大量增长。除投资数量倍增之外,中国以风险投资为目的的基金总量从 2013 年的 70 亿美元增长至 2014 年的 130 亿美元,近乎翻倍。

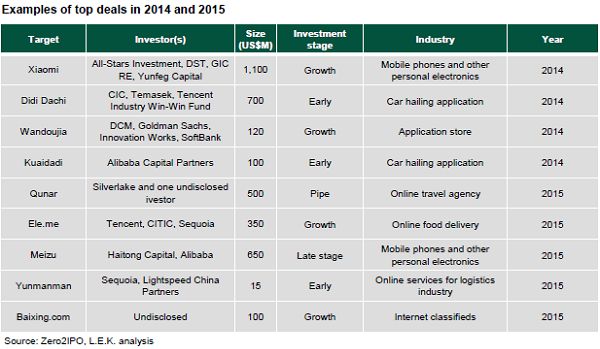

Second, investors have been drawn to the sector by the success of China's now-established tech giants. Tencent and Baidu laid the foundation over a decade ago, followed by a second generation led by JD and Alibaba, and who arrived just as innovations in online payments had taken off. Now tech start-ups-turned-heavyweights such as Xiaomi and Dianping are making headlines by demonstrating how private equity and venture capital technology investments can be more than just futile grasps after the global tech leadership crown of Silicon Valley. That has attracted still more foreign investors eager to partake in the growth. In 2014, the Carlyle Group made one of its first Chinese Internet investments (US$100 million) in Ganji, an online classifieds company, during its series F round.

其次,中国现有科技巨头的成功吸引了投资者来到这一产业。腾讯和百度初创于十多年之前,其后是以京东和阿里巴巴为首的第二代企业,而阿里的到来正好处于在线支付创新大获成功之时。现在,如小米和大众点评网等逐渐变得举足轻重的初创企业成为新闻头条,因为它们证明了私募股权和风险资本科技投资的另一种可能,即可以不再仅仅局限于早已投资人遍地的全球科技中心硅谷。科技产业的发展已吸引了更多国外投资人的热情参与。2014 年,凯雷投资集团首次投资中国互联网企业,其中一笔投资给了分类信息网站赶集网,在赶集网进行第六轮融资时,凯雷集团向其投资 1 亿美元。

Third, successful entrepreneurs are becoming investors, creating a disproportionate number of specialized tech-focused funds. Banyan Capital, founded in 2013 with more than US$700 million under management, focuses exclusively on investments in the TMT space. Investors include founders and managers of Tencent, Alibaba, Baidu, JD and Xiaomi; founding fund managers all have experience and success in tech industry investment.

第三,成功的企业家变身为投资者,创立了数量众多的专门对科技产业进行投资的基金。成立于 2013 年的高榕资本,拥有超过 7 亿美元可支配资金,只针对科技、传媒和电信行业进行投资。其投资者包括腾讯、阿里巴巴、京东和小米的创始人及高层管理人员,聘请的基金经理均在科技产业具有成功的投资经验。

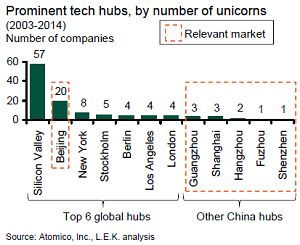

Finally, thriving communities of tech entrepreneurs are creating more investment opportunities. Cities such as Beijing, Shenzhen, and Hangzhou are becoming technology hubs that attract engineers, investors and other industry professionals. Of the 30 Chinese Internet and software start-ups that achieved billion-dollar valuations in the last decade, 20 were in Beijing, making it the second most prominent tech hub globally behind Silicon Valley.

最后,逐渐壮大的科技行业企业家群体正创造着更多的投资机会。北京、深圳和杭州等城市正逐步变为科技产业中心,吸引着工程师、投资者和其他专业人士。过去十年,实现十亿美元估值的 30 个中国互联网和软件初创企业中,有 20 个在北京,这使得北京成为仅次于硅谷的全球第二大科技产业中心。

Competitive streaks

竞争特点

As investment funds have become more widely available, so has the competition over investment opportunities.

随着投资基金的目标变得更加广泛,对投资机会的争夺也无处不在。

Many traditional international players, most notably the Silicon Valley firms, have been well-grounded in the Chinese market for several years and have successfully adapted to it. We increasingly see senior deal makers spinning out from these groups to set up their own shops, often backed by Chinese institutional investors.

很多传统国际投资公司,如著名的硅谷各家公司,在中国市场经营多年,早已站稳脚跟并成功适应于此。我们越来越多地看到从这些公司离开的资深投资者去创建自己的公司,这背后通常有中国机构投资者的支持。

Several local firms that often apply a less 'rigid' decision making process have emerged in recent years, resulting in very aggressive timelines. Their shared strategy is to deploy capital as quickly as possible, and they typically avoid applying traditional investment metrics. Thanks to the rise of intermediaries, few good deals are proprietary anymore, and in such a competitive environment there will likely always be some players in the mix who feel they can justify the highest valuation in an attempt to win the bid.

以决策灵活为标志的多家本土投资公司近些年已崭露头角,并开展了一系列积极进取的行动。它们共同的策略是以最快的速度部署资本,并且通常拒绝采用传统的投资衡量标准。中间人的兴起,使得优质的投资机会通常不再可能被独享,在这样的竞争环境中,往往会有多家投资公司联合进行投资,他们认为可以通过给予最高估值来赢得投资机会。

Besides these players, funds from a range of non-traditional sources – including sovereign wealth funds, super angels and tech millionaires – are hungry for a slice of the China tech sector. Even many private equity (PE) firms and institutions that normally only participate in later-stage investment are delving into relatively untested pre-revenue assets.

除了这些投资公司之外,一些来自非传统渠道的基金,包括主权财富基金、超级天使基金和科技界的百万富翁等,也迫不及待地想从中国科技产业中分得一杯羹。甚至很多通常只参与后期投资的私募股权 (PE) 公司和机构也在寻觅相对风险较大的天使投资机会。

Some sovereign wealth funds are no longer serving as passive asset investors, opting instead to act as lead partners in early-stage tech company fundraising. In 2013 Temasek – Singapore's state-owned investment fund with investments in Xiaomi, Alibaba, Cloudary, and Dididache – established the Enterprise Development Group (EDG), which specializes in funding new businesses and helping them grow with coaching from Temasek's private equity fund.

一些主权财富基金不再扮演被动资产投资者的角色,转而选择作为主要合作伙伴参与科技公司的早期融资。淡马锡公司是新加坡国有投资基金,其在小米、阿里巴巴、Cloudary 和滴滴打车均有过投资。2013 年,淡马锡公司成立企业发展部 (EDG),专门对新兴企业进行投资,并通过淡马锡的私募股权基金提供指导,助力投资对象发展壮大。

Opportunities' cost

机会的成本

With more funds targeting a necessarily limited supply of promising investment opportunities, valuations are growing markedly. Average deal sizes for the TMT/Internet segment almost doubled from US$6.5 million in 2013 to US$11.6 million last year. While that average is skewed by some high-profile deals, median deal size also nearly doubled for the same period. The business fundamentals often don't justify these levels, but valuations can take on a momentum of their own, driven by a scarcity of deals and the fear of being left out.

那些数量有限的具有良好发展前景的投资机会,成为越来越多的基金争夺的目标,其结果是投资对象的估值显著增长。TMT 和互联网领域的平均投资规模从 2013 年的 650 万美元增至 2014 年的 1160 万美元,几乎翻倍。虽然一些高额投资拉高了这一平均值,但同期中等规模投资的平均值也已近乎翻倍。这样的投资规模与当前的商业基础并不匹配,但估值仍然可以呈现飙升的势头,主因便是优质投资机会的稀缺和投资人对无处投资的恐惧。

This valuation momentum is further exacerbated by a lack of traditional, disciplined commercial due diligence among early stage companies: Abandoning traditional metrics means that start-ups are pitching themselves more on the basis of a sexy business plan, a gut feeling and the track record of their management team than any detailed model of the market. After all, many argue, how would one even model a ground-breaking, disruptive innovation?

由于缺乏对早期初创公司进行传统的缜密的商业谨慎性调查,这种估值趋势正愈演愈烈。摒弃传统投资衡量标准意味着初创企业为自己标价时,更多的是基于诱人的商业计划、非理性的感觉以及管理团队的过往业绩,而非任何具体的商业模式。毕竟,很多人都在争论,如何才算得上是空前的,具有颠覆性的创新呢?

The risk is that this mentality, suitable when placing bets of $5-10 million, is being carried over into much larger and later rounds of funding for companies that are still in their early days, but whose valuations have ballooned due to momentum and intensified competition among investors for deals.

这种心态只适合进行 500 万到 1000 万美元的投资,风险在于,投资人正抱此心态,以更大规模的资金对那些仍处于早期阶段的公司进行后几轮投资,但这些公司的估值已因投资人的热情势头及其之间的激烈竞争而激增。

When this bubble eventually bursts it will be the late and repeat entrants who are most likely to get burned, whether from stepping in at the wrong time or due to having failed to cash in on huge returns from investments completed three to four years prior. It is true that firms like Temasek, Sequoia, and Shenzhen Capital have all enjoyed fantastic returns from the tech industry and are not afraid to continue making hundred-million-dollar bets wherever they please. But while such established investors should be able to weather the storm with full coffers, more recent investors will likely go under.

当这个泡沫最终破灭之时,那些介入较晚的、重复投资的投资者们最有可能蒙受损失,或是因为选择了错误的时间进行投资,或是因为已无法从三四年前的投资中获得理想的回报。淡马锡、红杉资本、深圳创新投资集团等一批公司确实均已从科技产业中获得了相当丰厚的投资回报,并且不会惧怕在他们喜欢的领域继续进行亿美元量级的投资。但是,虽然实力如此雄厚的投资者应该能够安然度过这场风暴而不受损失,而更多的根基未稳的投资者将可能血本无归。

Old-school rigor

老派的严谨

In order to make intelligent investments in China's potentially tumultuous tech sector, investors must be willing to take on more risk than is the norm in Silicon Valley. The current self-fulfilling momentum of deal volume and value in particular must be given appropriate consideration before making a first foray into the mainland tech sector.

相对于投资环境规范的硅谷,为了在中国暗潮汹涌的科技产业中实现明智的投资,投资者必须愿意承担更多的风险。在初次涉足大陆科技产业之前,必须对其中的投资数量和价值,特别是当前自我实现式的投资形势予以适当的考虑。

As deal sizes creep up from the $5-10 million range into the tens or even hundreds of millions of dollars, investors will need to start taking a different, more rigorous approach to ensure the value and risk are justified. Many of the traditional commercial due diligence techniques used in evaluating commercial risks associated with established companies can still be applied, albeit in a somewhat modified way, including consumer testing, benchmarking comparable business models and stress testing market and financial projections.

随着投资规模从 500~1000 万美元逐渐增长至几千万甚至上亿美元,投资者需要采取不同以往的更加严格缜密的投资方式,以确保价值与风险在合理的比例之中。评估知名公司商业风险时所使用的很多传统的商业谨慎性调查方法,包括消费者测试、基准可比性商业模式以及市场和财务压力测试预测等等,虽然用途稍作改变,但仍然可以拿来使用。

Indeed, it is in this context of slipping standards and ballooning valuations that we think due diligence is more important than ever and that in TMT, as elsewhere, tailoring one's entry plan to take local conditions into account is the hallmark of a smart China investment strategy. While it might look from a distance like funding rounds for mainland tech start-ups will maintain their stratospheric trajectory for the foreseeable future, the stock market's nosedive this summer should serve as a fresh reminder that investor exuberance can only take one so far off the ground before gravity takes hold.

实际上,在投资标准愈发宽松和投资估值不断激增的情况下,我们认为谨慎性调查比以往更为重要,而且在 TMT 领域,亦如其他领域一样,充分考虑中国大陆的投资环境,因地制宜地制定投资计划,才称得上是明智的投资策略。虽然以旁观者的角度看起来,大陆科技初创公司的多轮融资可以支撑它们在可预见的未来达到其发展轨迹的巅峰,但今年夏天股票市场的暴跌却是一个近在咫尺的教训,投资者的过度热情只会让一家初创公司自不量力地膨胀,然后走向衰亡。

Michel Brekelmans is a Partner at L.E.K. and Managing Director and co-head of L.E.K.'s China practice based in Shanghai since 2006. L.E.K is a global consulting firm that supports clients in evaluating investments and in developing strategies and organizational capabilities that have significant impact on performance. L.E.K has been operating in China since 1998 through offices in Shanghai and Beijing.

Michel Brekelmans 是艾意凯咨询公司的合伙人,也是其中国业务部门(2006 年成立于上海)总裁和联席主管。艾意凯咨询公司是一家全球性咨询公司,可在投资评估、战略制订和运营能力构建等对业绩具有重大影响的方面给予客户有力支持。1998 年,艾意凯咨询公司在中国开设分支机构,办公地点位于上海和北京。

今年第二篇练笔,感觉难度挺大,尽力翻译了出来~