A few months ago, chatting with my friend, she mentioned that her company was already using robots working in Finance Share Center. The robots can work 7x24 hours per week, no complains, no overtime pays. It saved around 20 headcounts. Yes, we are living in the Big Data era. More and more people believe that Big Data will change our lives and works thoroughly within the next three years. Big Data delivers the potential to find value no one knew before, whether you are trying to maximize production, cut costs or boost efficiency. Data can be turned into dollars.

Internet of Things (IoT) is the basis of Big Data. It refers to network of physical devices, vehicles, buildings and other items which are embedded with electronics, software sensors, actuators & network connectivity that enable these objects to collect & exchange data. Anything that can be connected, will be connected. The internet is leveling the playing field. IoT is a game change technology. To be competitive in the future, companies will need to take action now.

• Real time operating data – Information for agile decision-making to improve the bottom line

• Advanced solutions – Cloud – enabled software that achieves greater connectivity, unifies systems, processes more data and finds more ways to use data to run a smarter operation.

• Reduced unplanned downtime - Data analytics identify patterns that reliably predict future events, giving companies the tools to detect and prevent abnormal situations.

Under the environment of Big Data explosion and rapid growth of IoT, customers expect companies to provide faster, agile & flexible analytics and solutions. In order to better serve customers, not only high-tech companies, but also a lot of traditional companies are enhancing their strategy to grow software and data analytics capabilities.

Along with business transformation, finance also need to deploy transformation. Comparing to traditional finance structure, the major changes of future state came from:

• Commercial finance would be the primary partners of business. It would be embedded into the business as one core part of management theme to deliver P&L results, involve planning & forecasting, making investment decisions and cost management.

• In the meanwhile, finance operations would be centralized in corporate level to provide consistent high-value finance services to all businesses, such as management reporting & analysis, closing and booking reconciliation, collections & payments management, travel & expense management.

The changes of finance operating model would help commercial finance to split from routine daily finance transactions so as to concentrate on driving business profitable growth. All business performance will be finally reflected by finance reports. Stakeholders would like commercial finance team to improve on below 3 aspects:

• Helping business to achieve growth target.

• Anticipating needs and requirements proactively

• Providing user friendly finance tools and reports.

To achieve the target from report-driven to analysis-driven and improve satisfaction of stakeholders, finance need to deploy a series of activities on business analytics transformation.

Common Process / System

Multi-national companies normally organize several of Business Groups. Each business group has several of business units and each business units has several of line of business. Some legal entities are shared by several of business units. Some legal entities are standalone for exact business unit.

In addition to the complex legal entity structure, multi-national companies have the complicated business models as well, not only including comprehensive product basis business in different kinds of industries, but also long term project basis business which combined products, engineering delivery, service, software etc. to provide total solutions to customers. Furthermore, besides organic growth, multi-national companies always seek growth opportunities from merger and acquisitions. All these factors put together have increased the complexity on finance management dramatically.

Under this circumstance, Common Process / System is needed to cultivate one company culture. The vision is to deliver common best practice business processes with enabling systems and technologies to drive profitable growth and business transformation across corporation. The program is using global design model to connect commercial and Integrated Supply Chain (ISC) initiatives, deliver measurable business value, and best in class business processes.

Common process system not only provides more security and uniform environment, but also supplies better integration interfaces for merger & acquisitions.

Multi-national companies will take benefits through common process system deployment.

• Consistent approach into defining and agreeing the business scope.

• Early engagement of senior business leadership. The project management tools such as Business Readiness Scorecard and project plan provide better visibility on the progress of the project and business readiness.

• Focus on Business Engagement drives commitments and ownership into the business. Clarity of business readiness to implement the change.

• The structure, methods and phases gate outcomes drive the quality and consistency in the projects approach and outcomes. Business team prepared for successful operation from day one.

• A consistent focus on the measurement of Business Readiness ensures superior outcomes during project and post go live.

Standardization Deployment

Although standardization deployment was an operational excellence initiative which initially designed to improve the capabilities of manufacturing sites, it has proven successful in functional areas as well. Processes optimization is fostering speed and entrepreneurialism among our global business enterprises while allowing us to leverage the scale and process strength of a large company.

Taking standardization deployment from plant to back office is one of development strategy for many famous companies. Standardization deployment will position finance organization for growth and improve business partnership through better process streamline across different business groups to increase efficiency and improve accuracy.

Finance standardization has not only the benefit to decrease the number of touch points so as to achieve fewer mistakes and quicker turnaround time, but also has the benefit to utilize existing personnel in higher impact activities, such as analytical tasks and greater professional growth. Finance transition will occur in the following aspects

• Implementation of leadership standard work: Listing activities of daily / weekly / quarterly / annually for each finance roles such as finance analyst, finance manager, finance director, controllership etc. Ensuring people focus on the right thing consistently.

• Documentation of top three Standard Operating Procedures (SOPs) for each finance function: Reducing variability in process and approaches. It also help finance operation team to maintain high job quality even if challenged by high turnover rate.

• Implementation of tiered accountability: Engaging all in identifying, developing and implementing improvements for the business. Harnessing the many and not just relying on the few.

• Visual management: Putting important documents in share folder and giving access to all team members. Making things simple, easy to understand and providing effective communication.

• Rapid problem solving and value stream mapping: Involving functional experts on process design and streamline. Fixing issues quickly and finally, rather than letting them re-occur.

Global Data Warehouse (GDW) Initiative

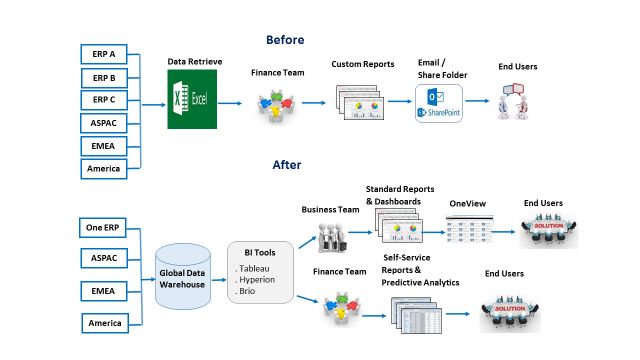

Through common process system and standardization implementation, it provides a good basis for GDW initiative. With ERP, for example Oracle, SAP, Hyperion etc. and business intelligence technology, such as Tableau, Brio, Global Data Warehouse (GDW) tool provides platform for optimal business intelligence solutions.

Before GDW implementation, since most analysis and reporting are done offline using Excel, it directly leads to finance team spending most of their time on report maintenance rather than value-added activities for business. Furthermore, the manual reports have the following gaps:

• Insufficient analytical capability (end-to-end, drilling, cross-functional analysis)

• Inadequate visualization tools

• No mechanism for rapid integration of acquisition financial data

• Lack of consolidated reporting across business unit

• Human mistakes

After GDW implementation, it helps company to gain below benefits:

• The tool is intuitive and easy to use. It provides real-time, actionable information, enabling faster, better decision making.

• Enable self-service reporting and analysis. It will involve business team to participate in dashboard design, facilitate the perception of elevated service while doing it yourself.

• Enable advanced analytics capabilities by data drilldown and visualization.

• Simplify and streamline development of dashboards, reports, and analytics. It provides forward-looking, predictive insights.

• Enable rapid integration of acquisition data

• Enable business unit integration data into business segment consolidated reporting.

• Enable commercial finance and operation finance employees to focus on analysis and business partnering activities

Refer to below chart for the Changes from Global Data Warehouse Initiative.

Once Global Data Warehouse project 100% implementation, finance will change from current state to focus on “what happened” and “why” to future state to focus on “what will happen” and “what should we do”. That is great changes on business analytics transformation.

Conclusions

It may spend millions of dollars and it may suffer a lot of pain points during the transformation. But from the long run, it is worthy of it. Analytics is changing the way we do business.

In the Big Data Era, in order to survive and achieve sustainable growth, the company needs to keep evolving to become even more global, more of a software company, and more nimble in a new era. In the meanwhile, as commercial finance, embracing analytics culture, we need to recognize data as an asset, link analysis to value and link analysis to action. We need to think about analytics all the time to ensure we are on the right track and taking the right approach on:

• Improving revenue growth, margin expansion, and free cash flow efficiency.

• Improving pricing decision

• Improving integrated supply chain productivity

Last but not least, I like the word “Data is the new oil and analytics are the new refinery”. It was quoted by many people recently although I don’t know where is the original. As long as you are a finance leader with wisdom, I trust big data era bring you more opportunities rather than challenges. Robots do the simple work and release us to do high value-added jobs.

Endnote:

"Internet of Things Global Standards Initiative". ITU. Retrieved 26 June 2015.

Note: Original. Welcome to repost but please give sources if citing another article or passage.