2019独角兽企业重金招聘Python工程师标准>>> ![]()

平时交易的时候,交易员喜欢盯着盘面数据,why?原因是,关心行情的异动,找个机器人帮你盯着是个很好的办法。 言归正传,在商品期货交易策略中 经常看到 不同品种的 组合对冲策略,比如 焦煤、铁矿石 和 螺纹钢 对冲, 这种跨品种对冲策略是不是也能用到数字货币交易中呢? 不过风险依然是不容忽视的,那么最简单的就是 回测一下 大致验证一下策略思路是否可行。

1.前提条件

我们选用价格差相对合适的 比特币(BTC) 、以太坊(ETH) 作为对冲 品种。

2.策略描述

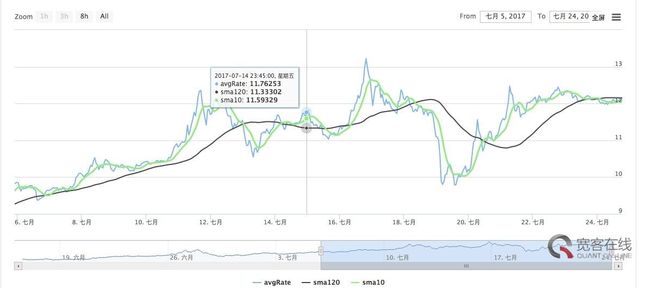

我们在 BTC/ETH 比例小的时候 空ETH多BTC , 在比例大的时候 平仓, 可以使用SMA指标来进行择时。

3.策略地址 : https://www.botvs.com/strategy/48536 使用了 “画线类库” 、 “ 数字货币交易类库” 这两个模板(可复用的模块代码)

4.DEMO 很方便的把想法画在了图表上, 其实还有很多地方要优化,这里只是抛个砖,探讨思路方法,接下来准备 优化 扩展 看看是否靠谱可行。

抛砖引玉般的DEMO ( JS 语言 基于发明者平台)

/*exchanges

A : BTC

B : ETH

*/

var RateUpDateTime = new Date().getTime()

var UpDateCyc = 60 * 60 * 1000

var SumInCyc = 0

var AddCounts = 1

var RateArray = []

var BTC_hold_amount = 0

var ETH_hold_amount = 0

var IDLE = 0

var PLUS = 1

var STATE = IDLE

var fee_btc = {

buy : 0.2, // 0.2 % , 千分之四

sell : 0.2

}

var fee_eth = {

buy : 0.2,

sell : 0.2

}

var ModeStr = ["BOLL", "SMA"][Mode]

function CalcPriceForNoFee(price, fee, type){

if(type == "buy"){

return price * (1 - fee / 100)

}else if(type == "sell"){

return price * (1 + fee / 100)

}

}

function loop(nowTime){

var depthA = exchanges[0].GetDepth()

var depthB = exchanges[1].GetDepth()

var sma120 = null

var sma10 = null

var boll = null

if(!depthA || !depthB || depthA.Asks.length == 0 || depthA.Bids.length == 0 || depthB.Asks.length == 0 || depthB.Bids.length == 0){

return

}

var Rate = CalcPriceForNoFee((depthA.Bids[0].Price + depthA.Asks[0].Price) / 2, 0.2, "buy") / CalcPriceForNoFee((depthB.Bids[0].Price + depthB.Asks[0].Price) / 2, 0.2, "sell")

if(nowTime - RateUpDateTime > UpDateCyc){

RateArray.push(Rate)

$.PlotLine("avgRate", RateArray[RateArray.length - 2], RateUpDateTime)

if(RateArray.length > 60){

if(ModeStr == "SMA"){

sma120 = talib.SMA(RateArray, 60)

sma10 = talib.SMA(RateArray, 10)

$.PlotLine("sma120", sma120[sma120.length - 2], RateUpDateTime)

$.PlotLine("sma10", sma10[sma10.length - 2], RateUpDateTime)

}else if(ModeStr == "BOLL"){

boll = TA.BOLL(RateArray, 20, 2.5)

$.PlotLine("up", boll[0][boll[0].length - 2], RateUpDateTime)

$.PlotLine("down", boll[2][boll[2].length - 2], RateUpDateTime)

}

}

RateUpDateTime += UpDateCyc

SumInCyc = 0

AddCounts = 1

}else{

SumInCyc += Rate

AddCounts++

RateArray[RateArray.length - 1] = (SumInCyc / AddCounts)

$.PlotLine("avgRate", RateArray[RateArray.length - 1], RateUpDateTime)

if(RateArray.length > 60){

if(ModeStr == "SMA"){

sma120 = talib.SMA(RateArray, 60)

sma10 = talib.SMA(RateArray, 10)

$.PlotLine("sma120", sma120[sma120.length - 1], RateUpDateTime)

$.PlotLine("sma10", sma10[sma10.length - 1], RateUpDateTime)

}else if(ModeStr == "BOLL"){

boll = TA.BOLL(RateArray, 20, 2.5)

$.PlotLine("up", boll[0][boll[0].length - 1], RateUpDateTime)

$.PlotLine("down", boll[2][boll[2].length - 1], RateUpDateTime)

}

}

}

if(ModeStr == "SMA"){

if(STATE == IDLE && (sma120 && sma10) && sma120[sma120.length - 2] > sma10[sma10.length - 2] && sma120[sma120.length - 1] < sma10[sma10.length - 1]){

// PLUS

var SellInfo = $.Sell(exchanges[1], 5)

var sumMoney = SellInfo.price * SellInfo.amount

var amount = _N(sumMoney / depthA.Asks[0].Price, 2)

var BuyInfo = $.Buy(exchanges[0], amount)

ETH_hold_amount = SellInfo.amount

BTC_hold_amount = amount

STATE = PLUS

// throw "stop" // ceshi

}

if(STATE == PLUS && (sma120 && sma10) && sma120[sma120.length - 2] < sma10[sma10.length - 2] && sma120[sma120.length - 1] > sma10[sma10.length - 1]){

// COVER

var BuyInfo = $.Buy(exchanges[1], ETH_hold_amount)

var SellInfo = $.Sell(exchanges[0], BTC_hold_amount)

ETH_hold_amount = 0

BTC_hold_amount = 0

STATE = IDLE

Log(exchanges[0].GetAccount(), exchanges[1].GetAccount())

}

}

}

function main() {

var AccountA = exchanges[0].GetAccount()

var AccountB = exchanges[1].GetAccount()

Log("AccountA:", AccountA, "AccountB:", AccountB)

while(true){

var beginTime = new Date().getTime()

loop(beginTime)

Sleep(500)

}

}

阅读原文