我有小广播,你要听我说:小姐姐辛苦翻译分享,心疼小姐姐的转载总可以注明来路吧!!如遇币豪们,文章下面有小姐姐的打赏地址,收基于ERC-20的各种币,一个都不嫌弃哦!

八 APPENDIX

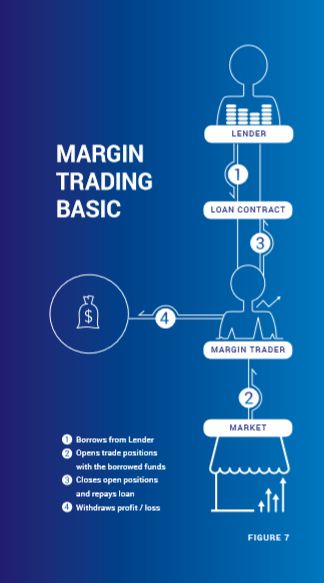

From here on, margin trading seemed a logical first use case for Lendroid.

8.1 MARGIN TRADING 1.0

If a trader wishes to monetize his confidence in the price of an asset increasing/decreasing, he would take a position by purchasing/selling the asset. If he is extremely certain, he

would build a leveraged position by borrowing additional funds from a lender to magnify his profits [11].See Figure 7. While the positions are subject to market risks and the trader’s decisions, the loan terms are typically defined by a contract, replete with interest rates, a specific time frame for repayment of the loan amount, and legal/punitive action in case of defaulting. Despite its volatility (or perhaps because of it), margin trading is a widely adopted process globally. It is typically carried out through a centralized exchange, which manages the Margin Account.

8.1.1. Margin Account and Levels

A Trader is mandated to maintain some predetermined levels in his Margin Account at all

times. A dip in these levels can trigger warnings or lead to automatic liquidation of the Margin Account. To guard against risk, while exchanges have defined a range of levels exclusive to particular economic systems, some of these levels are used consistently in exchanges around the world.

a. Initial Level: The trader deposits an initial margin, which is a certain percentage of the total traded value. The deposit can be in funds and/or in securities. This initial margin too is determined by the exchange. Centralized exchanges typically set the initial level at 40%. Trading can commence once the initial level is deposited.The trader’s adherence to the initial level is used to determine whether or not a loan can be granted.

b. Liquidation Level: Volatility and price are dynamic during trading, and the exchange lends itself to a certain level of uncertainty. However, there is a point at which confidence in the performance of the margin account disappears. The absolute level at which an account is liquidated - the collateral and positions sold off - is the liquidation level. Typically, if the initial level is at 30% to 40%, the liquidation level is set at 15% to 20%.

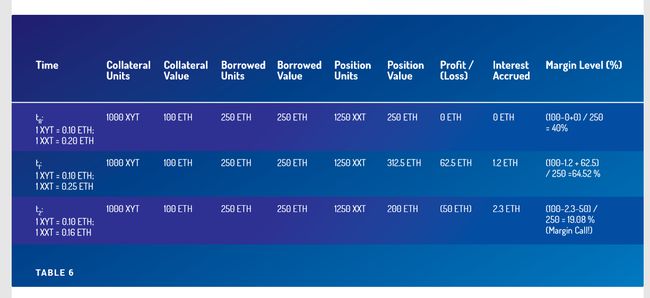

CONSIDER THE FOLLOWING SCENARIO:

Assumption: 1 XYT(a fictional token) = 0.10 ETH; 1 XXT (a fictional token) = 0.20 ETH

A Margin Trader deposits 1000 XYT as collateral. For an initial margin of 40%, the Margin Trader gets 2.5 times the collateral value, that is, upto 250 ETH. This is the total borrowed amount which she then uses to open a position on XXT for an initial value of 1250 XXT. For a liquidation level set to 20%, Table 1 shows how a few possible scenarios can play out over a timeline. At each time ti, the Margin Level is calculated by the formula: Margin Level = ( (Net Value of Margin Account - Loss in Position) / total borrowed amount ) * 100 %

T0:

Collateral value = 1000 XYT * 0.1 ETH = 100 ETH

Total borrowed value = 250 ETH

Position value = 1250 XXT * 0.2 ETH = 250 ETH

Interest accrued = 0 ETH

P/L = Position value - Total borrowed value = 0 ETH

Margin level = Collateral value/Total borrowed value =100/250 = 40%

Margin level = (Collateral value-Interest accrued + P/L) / Total borrowed value = (100-0+0) / 250 = 40%

8.2. CENTRALIZED EXCHANGE

A centralized exchange is a complex structure,

built upon three layers. See Figure 1.

• Liquidity related activities

- User interface for lender and trader

- Order book maintenance

- Offer book maintenance

• Custodianship of user funds

- Loan funds and collateral management

- Accounting

- Trade position management

• Margin account monitoring

- Margin-level maintenance

- Margin account liquidation

- Loan repayment to lender

Centralized exchanges are heavily regulated by the governments of the countries they operate in. They are monolithic, inaccessible except to pre-approved participants,

and subject to censorship. Even under ordinary circumstances, the level of risk can seem prohibitive. For instance, when a margin account reaches the liquidation level, there is no taking over of positions; just straightforward liquidation at the market price. It is not unusual for such ‘unrestricted’ liquidation to trigger what is known as a flash crash, a domino effect of dropping levels among margin accounts. But most of all, centralized exchanges have proven to be porous to human error or malicious attacks. Even periodic auditing might not be an airtight solution, since the vulnerability is inherent, even if the threat has not materialized yet. Such exchanges are subject to the same costs, risks and vulnerabilities that any centralized repository of funds or private data would be. This makes such a system the antithesis of the blockchain ecosystem, which is premised on decentralization, on absolute protection and anonymity by global consensus. However, even within the blockchain ecosystem, margin trading happens, for the most part, via centralized exchanges.

8.3. WHY BYPASS THE BLOCKCHAIN ADVANTAGE?

There are a few digital asset exchanges (poloniex, bitfinex, kraken) that offer margin trading to their customers today. They do this by inviting lenders to their platform and creating a peer-to-peer (P2P) lending pool. The lenders have little to no legal recourse in terms of repayment, and thus fully rely on the exchanges to make sure they get repaid properly.

Thus, exchanges on the blockchain ecosystem, like their counterparts in conventional financial systems, are left with the onerous, dual responsibility of funds and collateral management as well as keeping the traders from defaulting [8]. The exchanges hedge part of the risk by demanding that margin traders hold sufficient margins at any given time, and intervene if there is a risk of default. A relatively high initial margin (20%-40% compared to 2%-10% requested by traditional derivatives exchanges) is demanded and the margin accounts are continuously monitored, and margin traders are requested to rebalance their margin from time to time. If the margin trader fails to maintain sufficient margin levels, the exchange could step in and partially or full liquidate positions. This operation of managing margin accounts is particularly difficult with crypto due to the high price volatility, but exchanges have managed to handle margin calls quite well (barring a few incidents [12][13]) and continue to maintain market integrity. However, as custodians of customer funds, centralized exchanges expose them to attacks such as DDoS and hacks [14]. This shatters market confidence, and becomes an extra burden on the decision the lender has to make. This dissuasion results in higher overall costs of margin trading. The exchanges also come under the tight scanner of regulatory agencies in the countries they operate in. These agencies might instruct censoring of certain tokens, ceasing users funds and in some cases denying access to certainusers by segregation (geographically) [15]. A decentralized margin trading protocol would help mitigate these issues by moving away from central custodians.

holding user funds, and by creating a platform that is censorship resistant and can be accessed globally. Further, a global network of lenders will increase liquidity and reduce overall margin trading costs.

However, there are a few shortcomings that are preventing this from happening today.

• Firstly, participants in the decentralized network are not bound by a legal system, but

by autonomously binding smart contracts. To decrease the likelihood of a margin trader defaulting, the system has to ensure that at any given time, the margin trader has put up enough collateral to cover any losses he might incur due to sharp changes in market conditions.

• The system should be vigilant in liquidating those margin accounts that are at risk of

defaulting.

• The design and computing capabilities of Ethereum are not suited to support on-chain

margin trading as it demands recurring computations, access to external data, and a small cost to every operation performed on chain.

• Without a platform for the lenders and

borrowers to interact, they are left to discover an appropriate match on their own, making

this an expensive and tedious process. 0x paved the way to viable alternatives.

从这里开始,保证金交易似乎是Lendroid合乎逻辑的第一个使用案例。

8.1 保证金交易1.0

如果交易者希望通过增加/减少资产价格来获利,那么他会通过购买/出售资产来获取头寸。 如果他非常确定,他会通过从贷方借入额外资金来建立一个杠杆头寸获得更大利润。

见图

虽然仓位受到市场风险和交易者的决定的影响,但是贷款条款通常是由合同定义的,具有充足的利率,偿还贷款金额的具体时间框架以及在违约情况下的法律/惩罚性行动。

尽管保证金交易存在波动(或者可能是因为它),但在全球范围内,保证金交易是一个被广泛采用的过程。通常通过管理保证金账户的中央交易所进行。

8.1.1保证金账户和级别

交易者有权在任何时候在其保证金账户中维持一些预定的水平。 在这些水平下跌可能触发警告或导致保证金账户的自动清算。为了防范风险,交易所已经确定了特定经济体系独有的水平范围,其中一些在世界各地的交易所中一直使用。

Initial Level初始水平:

交易者存入的初始保证金是交易总价值的一定百分比。 存款可以是资金和/或证券。 这个初始保证金也是由交易所决定的。中心化的交易所通常会设置最初的水平在40%。一旦初始保证金存放,交易就可以开始。交易者遵守初始水平的保证金用于确定是可以发放贷款。

清算水平:

波动性和价格在交易时是动态的,交易所本身就有一定程度的不确定性。 然而,保证金账户表现不好。清算账户的绝对标准 – 是抵押品和头寸抛售 – 就是清算水平。通常情况下,如果初始水平在30%到40%之间,清算水平设定在15%到20%之间。

考虑以下情况:

假设:1个XYT(虚构标记)= 0.10 ETH; 1 XXT(虚构标记)= 0.20 ETH

保证金交易者存入1000个XYT作为抵押品。 对于40%的初始保证金,保证金交易者获得2.5倍的抵押品价值,即高达250 ETH。

这是她用来打开头寸的总借入金额

XXT初始值为1250 XXT。

清算水平设定为20%,表1显示了几个可能的情况如何在时间表上播放。 在每个时间点ti,保证金水平由以下公式计算:

保证金水平=((保证金账户净值 - 亏损头寸)/借入总额)* 100%

T0:

抵押品价值= 1000 XYT * 0.1 ETH = 100 ETH

总借入价值= 250 ETH

位置值= 1250 XXT * 0.2 ETH = 250 ETH

应计利息= 0 ETH

P / L =头寸价值 - 总借入价值= 0 ETH

保证金水平=抵押价值/借入总价值= 100/250 = 40%

保证金水平=(抵押价值 - 应计利息+ P / L)/借款总额=(100-0 + 0)/ 250 = 40%

8.2. CENTRALIZED EXCHANGE 集中交易所

集中交易所是一个复杂的结构,建立在三层之上。 见图1

•与流动性相关的活动

-贷方和交易者的用户界面

- 订单簿维护

- offer簿维护

•用户资金的托管

- 贷款和抵押品管理

-会计

- 贸易头寸管理

•保证金账户监控

-保证金级维护

-保证金账户清算

-贷款偿还贷款

集中交易受到所在国家政府的严格监管。除了事先核准的参与者外,他们是单一难以进入的,并且受到审查。

即使在一般情况下,风险程度似乎也是过高的。 例如,当保证金账户达到清算水平时,没有接管头寸; 按市场价格直接清算。 这种“不受限制”的清算触发所谓的“闪电崩盘”,在保证金账户中降低水平的多米诺骨牌效应并不罕见。

但是最重要的是,中心化的交易所已经被证明了对黑客等其他攻击是由漏洞的,即使定期监察不是一个密不透风的解决方案,因为即使威胁没有实现,这个漏洞是存在的。

这样的交易所的成本,风险和脆弱性的限制。 这使得这样一个体系成为了以分权为前提的区块链生态系统,以全球共识为基础的绝对保护和匿名的对立面。

然而,即使在区块链生态系统中,保证金交易大部分也是通过集中交易进行的。

8.3 为什么要绕过区块链的好处?

有几个数字资产交易所(poloniex,bitfinex,kraken)向客户提供保证金交易。他们通过邀请贷款人访问他们的平台并创建点对点(P2P)借贷池来实现这一点。 贷款人在还款方面几乎没有法律追索权,因此完全依靠交易所来确保其得到适当的偿还。

因此,区块链生态系统中的交易与传统金融体系中的交易一样,在资金和抵押品管理方面肩负着繁重的双重责任,同时也使交易者不承担违约责任[8]。

交易所通过要求保证金交易者在任何给定时间保持足够的利润来对冲部分风险,并在存在违约风险时进行干预。相对较高的初始保证金(20%-40%,相比于2%-10%传统的衍生品交易所),并且保证金账户不断被监控,并要求保证金交易者不时重新平衡保证金额度。

如果保证金交易者未能保持足够的保证金水平,交易所可以进入并部分或全部清算头寸。

由于价格波动,这种保证金账户管理的操作特别困难,但交易所设法很好地处理了保证金要求(除少数事件[12] [13]),并继续保持市场完整性。

但是,作为客户资金的管理者,集中式交易暴露了DDoS和黑客等攻击,这破坏了市场信心,并成为贷款人做出的决定的额外负担。这导致保证金交易的整体成本较高。

这些交易所也受到其所在国监管机构的严格监管。这些机构可能会提出审查某些代币,停止使用资金,并在某些情况下,通过隔离(地理上)拒绝某些用户的使用[15]。

一个分步式的保证金交易协议将有助于缓解这些问题,摆脱持有用户资金的中央托管人,并创建一个抵制审查和全球访问的平台。此外,全球网络将增加流动性,降低整体保证金交易成本。

但是,有一些缺陷正在阻止这一情况的发生。

•首先,分步式网络的参与者不受法律制度约束,而是自主约束于智能合约。为了降低保证金交易者违约的可能性,系统必须确保在任何时候,保证金交易者已经提供了足够的抵押品来弥补由于市场条件的急剧变化而可能招致的任何损失。

• 在清算那些有违约风险的保证金账户时,系统应保持警惕

•以太坊的设计和计算能力不适合支持链上保证金交易,因为它需要经常性的计算,访问外部数据以及在链上执行的每项操作都需要小额成本。

•如果没有贷款人和借款人互动的平台,他们只能自己发现适当的匹配,这是一个昂贵而 冗长的过程。

0x为可行的替代品铺平了道路。·

Lola

区块链研习社精英群成员

2018.02.04 今日立春

祝福一切重生的,迭代的,归零的,新纪元开始了,我看到了你们与我一起,都在路上.......

--------------------------------------------------------------------------------

小姐姐的打赏地址:(imToKen)

0x9a91F261dDA8619fC8E022886D293e0f64FA9e8c