Risk Management and Financial Institution Chapter 4 —— Mutual Funds, ETFs, and Hedge Funds

typora-copy-images-to: Risk Management and Financial Institution

文章目录

- typora-copy-images-to: Risk Management and Financial Institution

- Risk Management and Financial Institution Chapter 4 —— Mutual Funds, ETFs, and Hedge Funds

- 4.1 Mutual Funds

- 4.1.1 Index Funds 指数基金

- 4.1.2 Costs 费用

- 4.1.3 Close - end funds 封闭式基金

- 4.2 ETF 交易所交易基金

- 4.3 Active vs. Passive Management 消极与积极管理

- 4.4 Regulation 监管

- 4.5 Hedge Funds 对冲基金

- 4.5.1 FEEs 费用

- 4.5.2 Incentives of hedge fund Manager 对冲基金经理的动力

- 4.5.3 Prime Brokers 机构经纪人

- 4.6 Hedge Fund Strategies 对冲基金策略

- 4.6.1 Long/Short Equity

- 4.6.2 Dedicated Short 专事卖空型

- 4.6.3 distressed Securities 受压证券

- 4.6.4 Merger Arbitrage 并购套利

- 4.6.5 Convertible Arbitrage 可转债

- 4.6.6 Fixed Income Arbitrage 固定收益套利

- 4.6.7 Emerging Markets 新兴市场

- 4.6.8 Global Macro 全球宏观

- 4.6.9 管理期货型

- 4.7 Hedge Funds Performance 对冲基金的收益

Risk Management and Financial Institution Chapter 4 —— Mutual Funds, ETFs, and Hedge Funds

- 共同基金和ETF适用,small investors

- hedge fund 适用于pension funds 等

- Hedge funds are subject to much less regulation than mutual funds and ETFs

- hedge fund 更秘密,trading strategies 更广泛

4.1 Mutual Funds

-

most attraction of mutual funds is the diversification opportunities

-

realized diversification is at a low cost

-

open-end fund 橡胶人,可大可小,share 可多可少

-

fund 可以被银行,专门机构,以及保险公司发行提供

-

货币市场基金投资于有息工具,例如短期国债,商业票据,银行承兑票等等,是银行储蓄的替代产品,提供的利息高于银行,因为该产品并没有被美国政府承诺保险

-

三种主要的长期基金:

- 债券基金,固收产品,超过一年

- 股票基金,投资于普通股与优先股

- 混合基金,都投资

-

NAV (net asset value) ,always next nav apply to the transaction,以下午4点位节点

-

收到红利需要缴税

-

申报投资收益以及亏损,调整基金价格

4.1.1 Index Funds 指数基金

-

Designed to track a particular equity

- 要么按照比重投资于股指成分股票

- 要么选择一个小型股票组合,有效追踪股票指数

- 选择利用股指期货

-

How accurately do index funds track the index? 跟踪指数准确性的描述

- tracking error(定义为基金年回报率与指数年回报率之差的标准差)

- expense ratio (定义为每年为管理基金付出的费用占总资产比)

4.1.2 Costs 费用

-

Mutual Funds Cost

- 管理费用

- 销售佣金

- 审计会计费用

- 交易费用等等

-

Front- end load 前端收费 (定义:首次买入基金份额时收取的费用

-

back- end load 后端收费 (定义:随着持有的时间跨度递减)

-

所有的基金都收取年费,其他单独的管理费用会单独收取

-

total expense ration = total of annual fees charged per share / value of the share

-

费率排名:股票基金 > 债券基金 > 股指基金

4.1.3 Close - end funds 封闭式基金

- Close end funds are like regular corporation,fix shares outstanding,trade on a stock exchange.固定的股票份额

- 两个NAV 可以被计算

- price at which the shares of the fund are trading

- 基金组合的市场价值除以全部份额数量(公允市场价值)

- 公允市场价值一般大于基金份额价值,由于交付给基金经理的费用

4.2 ETF 交易所交易基金

-

2008年,SEC批准了主动型管理ETF

-

ETF 由机构投资者创立,deposits a block of securities with the ETF and obtains shares in the ETF,以股票换原始份额,称为creation units 创立基数,some or all share traded on a stock exchange.

-

在股票交易所进行交易赋予了ETF封闭式基金的特性

-

ETF重要特性:

- 机构投资人可以将大数量份额的ETF与底层资产互换

- ETF在交易所的价格与公允价值没有太大的出入

-

ETF的优势:

- can be bought and sold at any time of the day

- can be shorted

- ETF holdings disclosed twice a day

- cash is provided by another investor

- transaction cost are saved

- expense ration of ETF tend to be lower than mutual funds

4.3 Active vs. Passive Management 消极与积极管理

-

Active managed funds tend to have much higher expense ratios

-

More recent studies have confirmed Jensen’s conclusions. On average, mutual fund managers do not beat the market and past performance is not a good guide to future performance

-

In many countries, regulators have strict rules to ensure that mutual fund returns are not reported in a misleading way

-

The geometric mean of a set of numbers (not all the same) is always less than the arithmetic mean

-

投资回报率应当以几何平均计算而非算数平均

4.4 Regulation 监管

-

ETF and mutual funds 被严格监管,因为销售给中小投资者

-

具体的监管要求有:

- 防止利益冲突

- 在SEC注册

- 提供招股说明书

- 防止欺诈和超额费用

-

基金丑闻:

- 延迟交易(late trading),投资人与经纪人合谋

- 选时交易(market timing)

- 抢先交易(front running)明知大交易影响市场,预先通知某些客户交易

- 定向经纪(derected brokerage)合伙,推荐共同基金,回馈买入卖出指令

4.5 Hedge Funds 对冲基金

-

very little regulation,因为筹资是从有经验人士中获得

-

共同基金的监管包含:

- Shares be redeemable at any time 随时退出

- NAV calculated daily

- 投资策略公开

- 杠杠的使用被限制

-

“Hedge fund” implies that risks are being hedged

-

for some hedge funds,they take aggressive bets on the future direction of the market with no particular hedging policy

-

Many hedge funds are registered in tax‐favorable jurisdictions such as the Cayman Islands

-

hedge funds 投资于CDS ,distressed debt ,non- investment-grade bond markets,short ETF

4.5.1 FEEs 费用

-

annual management fee that is usually between 1% and 3% of assets under management is charged——for operating costs

-

Moreover, an incentive fee that is usually between 15% and 30% of realized net profits

-

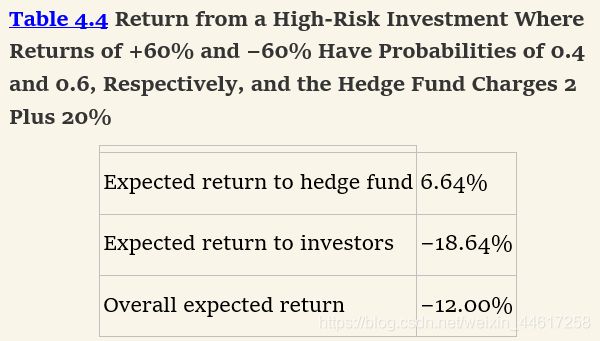

a typical hedge fund fee schedule might be expressed as “2 plus 20%”

-

通常有锁定期

-

对冲基金设置的条款,使绩效费用更容易被投资者接受:

- hurdle rate,minimum return necessary for the incentive fee 障碍率,设置最小回报率

- high - water mark clause 高潮位标记条款,前期损失必须全部补齐后,绩效费才生效,其中还可以设置(proportional adjustment clause)按比例调整

- claw back clause ,allows investors to apply part or all of previous incentive fees to current losses

4.5.2 Incentives of hedge fund Manager 对冲基金经理的动力

- fee structure also encourages them to take risks

- as losses mount for a hedge fund, the hedge fund managers have an incentive to wind up the hedge fund and start a new one

4.5.3 Prime Brokers 机构经纪人

-

Prime brokers are the banks that offer services to hedge funds.对冲基金的经纪人

-

prime broker 的功能:

- 净值结算,是否需要补充抵押品

- 借出证券,当需要空头仓位的时候

- 提供现金管理

- 为资产组合提供报告

- 为对冲基金提供融资

- 提供风险管理咨询以及投资客户推荐

-

Prime Brokers 是对冲基金的主要资金提供方,衡量对冲基金的风险,并决定对冲基金的杠杆

-

As a hedge fund gets larger, it is likely to use more than one prime broker,多个broker,使得没有一家银行能够看到完整的投资组合,并给投资基金带来更大的话语权,降低交易费用

4.6 Hedge Fund Strategies 对冲基金策略

- 此处讨论的策略与道琼斯瑞信提供的类似,并不完全

4.6.1 Long/Short Equity

- identifies undervalued by the market,and overvalued

- short overvalued long undervalued

- all about stock picking

- 可以维持多头净头寸或者空头净头寸

- 种类:

- equity- market-neutral 同时要保证 sector neutrality,行业需要平衡,不受其他的因素

- dollar - neutral

- beta - neutral , average weighted beta of long portfolio equals short portfolio,该组合对市场的波动并不敏感,通过对index future 的买入卖出,来对beta 进行控制维持

4.6.2 Dedicated Short 专事卖空型

- They are attempting to take advantage of the fact that brokers and analysts are reluctant to issue sell recommendations

- 合理认为任意时刻的市场上,高估的股票与低估的股票数目大致相当

4.6.3 distressed Securities 受压证券

-

Those with a credit rating of CCC are referred to as “distressed” and those with a credit rating of D are in default

-

The managers of funds specializing in distressed securities carefully calculate a fair value for distressed securities by considering possible future scenarios and their probabilities,经理计算在任意情况下的公允价值

-

distressed security cannot be shorted

-

bankruptcy usually lead to a reorganization or liquidation

-

passive and active , to have the right to influence a reorganization proposal

4.6.4 Merger Arbitrage 并购套利

-

Trading After a merger or acquisition is announced

-

方式:

- cash deals

- share for share exchanges

-

Merger‐arbitrage hedge funds can generate steady, but not stellar, returns,提供稳定的但是不出彩的收益

-

要与内幕交易区分开

4.6.5 Convertible Arbitrage 可转债

-

定义:Convertible bonds are bonds that can be converted into the equity of the bond issuer at certain specified future times with the number of shares received in exchange for a bond possibly depending on the time of the conversion

-

issure 可以回购债券

-

The convertible bond price depends in a complex way on the price of the underlying equity, its volatility, the level of interest rates, and the chance of the issuer defaulting

-

基金公司可以卖出发行公司的非转股债券来对冲利率与违约风险

4.6.6 Fixed Income Arbitrage 固定收益套利

- 固定收益交易的基本工具就是零息收益率曲线

- 策略:

- relative value strategy , buy bonds that the zero‐coupon yield curve indicates are undervalued by the market and sell bonds that it indicates are overvalued

- Market - neutral strategies 使得利率移动与收益无关

- LTCM 的案例

4.6.7 Emerging Markets 新兴市场

- 标的为新兴市场,寻找高估与低估的股票

- ADRs American Depository Receipts,better liquidity and lower transaction costs

- ADR 与当地股票会出现价格差异

- 投资新兴市场发行的债券

- Local currency bonds

- Eurobonds

4.6.8 Global Macro 全球宏观

- 代表人物,乔治索罗斯,反应全球宏观趋势的交易策略

- 在不平衡时押注,直到返回平衡

- 标的通常为利率以及汇率

4.6.9 管理期货型

- 试图预测商品期货的未来波动

- 预测的方式;

- technical analysis , use historical data , should tested out of sample

- fundamental analysis

4.7 Hedge Funds Performance 对冲基金的收益

- bias ,backfill bias

- 对冲基金的收益如同卖出了虚值期权