用Python实现选股票(Pandas,Matplotlib)

找出股票中的机会

# 0.设定基础数据

# 股票代码和日期

import pandas as pd

import numpy as np

%matplotlib inline

%matplotlib notebook

import matplotlib.pyplot as plt

import pandas_datareader.data as web

import time

stock_code='600036.SS'

stock_date_from = '2010-01-01'

mask='01-2020'

ma_shift_before = 3

# 筛选条件

ma1_higher_ma5_rate = 1.01

ma1_higher_ma10_rate = 1.01

ma1_higher_ma30_rate = 1.01

ma5_higher_ma10_rate = 1.01

ma5_higher_ma30_rate = 1.01

ma10_higher_ma30_rate = 1.01

ma1_lower_ma5_rate = 1

ma1_lower_ma10_rate = 1

ma1_lower_ma30_rate = 1.1

ma30_increase_day = 3

from datetime import datetime

now = datetime.now()

today='2020-10-26'

#today = ('{0}-{1}-{2}'.format(now.year,now.month,now.day-15))

def get_gold_folk(stock_code,stock_date_from,mask,ma1_higher_ma30_rate,ma5_higher_ma30_rate,ma10_higher_ma30_rate,ma30_increase_day,today):

## 获得股票金叉时间点,若today是金叉日,则输出报表

# 1.获得股票信息

price = web.get_data_yahoo(stock_code, stock_date_from,today)['Adj Close']

#price[-5:]

# 2.1画图 历史数据

ma5 = pd.DataFrame.rolling(price,5).mean()

ma10 = pd.DataFrame.rolling(price,10).mean()

ma30 = pd.DataFrame.rolling(price,30).mean()

# 2.2画图 2020年1月之后

ma1 = price

#ma1.plot(label='ma1')

ma5 = pd.DataFrame.rolling(price,5).mean()

#ma5[mask:].plot(label='ma5')

ma10 = pd.DataFrame.rolling(price,10).mean()

#ma10[mask:].plot(label='ma10')

ma30 = pd.DataFrame.rolling(price,30).mean()

#ma30[mask:].plot(label='ma30')

#plt.legend()

#plt.savefig('{}.jpg'.format(stock_code),bbox='tight')

# 3.将移动平均数整合成一个

ma_df = pd.DataFrame([ma1,ma5,ma10,ma30],index=['ma1', 'ma5', 'ma10' ,'ma30'])

# 通过T将日期设为index

ma_df = ma_df.T

#print(ma_df)

# 4.1 整合条件

# 条件4:ma30的变化率过去10日有8个为正

ma_df_copy = ma_df.copy()

ma_df_copy['shift1'] = ma_df_copy[['ma30']].pct_change().shift(1)

ma_df_copy['shift2'] = ma_df_copy[['ma30']].pct_change().shift(2)

ma_df_copy['shift3'] = ma_df_copy[['ma30']].pct_change().shift(3)

ma_df_copy['shift4'] = ma_df_copy[['ma30']].pct_change().shift(4)

ma_df_copy['shift5'] = ma_df_copy[['ma30']].pct_change().shift(5)

ma_df_copy['shift6'] = ma_df_copy[['ma30']].pct_change().shift(6)

ma_df_copy['shift7'] = ma_df_copy[['ma30']].pct_change().shift(7)

ma_df_copy['shift8'] = ma_df_copy[['ma30']].pct_change().shift(8)

ma_df_copy['shift9'] = ma_df_copy[['ma30']].pct_change().shift(9)

ma_df_copy['shift10'] = ma_df_copy[['ma30']].pct_change().shift(10)

# 将百分比转化为True,False

ma_df_copy = ma_df_copy[['shift1','shift2','shift3','shift4','shift5',

'shift6','shift7','shift8','shift9','shift10',]] > 0

ma_df_copy = ma_df_copy.replace(False, 0)

ma_df_copy = ma_df_copy.replace(True, 1)

ma_df_copy['+_summary'] = (ma_df_copy.shift1 + ma_df_copy.shift2 + ma_df_copy.shift3 + ma_df_copy.shift4 + ma_df_copy.shift5

+ ma_df_copy.shift6 + ma_df_copy.shift7 + ma_df_copy.shift8 + ma_df_copy.shift9 + ma_df_copy.shift10)

#print(ma_df_copy)

# 4.2 将summary合并到ma_df中

ma_df2 = pd.merge(ma_df,ma_df_copy[['+_summary']],on=ma_df.index,left_index=True)

ma_df2['stock_code'] = stock_code

ma_df2 = ma_df2[['stock_code','ma1','ma5','ma10','ma30','+_summary']]

#print(ma_df2)

# 4.3 将MA1.shift(5)小于MA30.shift(5)纳入考量范围

ma_df_copy2 = ma_df.copy()

ma_df_copy2['ma1_shift'] = ma_df_copy2[['ma1']].shift(ma_shift_before)

ma_df_copy2['ma5_shift'] = ma_df_copy2[['ma5']].shift(ma_shift_before)

ma_df_copy2['ma10_shift'] = ma_df_copy2[['ma10']].shift(ma_shift_before)

ma_df_copy2['ma30_shift'] = ma_df_copy2[['ma30']].shift(ma_shift_before)

# 将 ma1

ma_df2 = pd.merge(ma_df2,ma_df_copy2[['ma1_shift','ma5_shift','ma10_shift','ma30_shift']]

,on=ma_df2.index,left_index=True)

ma_df2['stock_code'] = stock_code

ma_df2 = ma_df2[['stock_code','ma1','ma5','ma10','ma30','+_summary',

'ma1_shift','ma5_shift','ma10_shift','ma30_shift']]

#print(ma_df2)

# 5.进行金叉判断

# 判断6:标记买入卖出

# 标记买入

mask = ((ma_df2['ma1']<=ma_df2['ma30']*0.88))

ma_if_df = ma_df2[mask]

ma_if_df['Buy'] = 'Buy'

ma_df2 = ma_df2.join(ma_if_df[['Buy']])

#标记卖出

mask_sell = ((ma_df2['ma1']>=ma_df2['ma30']*1.12) )

ma_if_df2 = ma_df2[mask_sell]

ma_if_df2['Sell'] = 'Sell'

ma_df2 = ma_df2.join(ma_if_df2[['Sell']])

# 判断5:标记买入卖出

# # 标记买入

# mask = ((ma_df2['ma1']>=ma_df2['m30']*0.88) &

# (ma_df2['ma1']>=ma_df2['ma10']*ma1_higher_ma10_rate) &

# (ma_df2['ma1']>=ma_df2['ma30']*ma1_higher_ma30_rate) &

# (ma_df2['ma5_shift'] <= ma_df2['ma30_shift']) &

# (ma_df2['ma10_shift'] <= ma_df2['ma30_shift']) &

# (ma_df2['ma30'] >= ma_df2['ma30_shift']*0.95) )

# ma_if_df = ma_df2[mask]

# ma_if_df['Buy'] = 'Buy'

# ma_df2 = ma_df2.join(ma_if_df[['Buy']])

# #标记卖出

# mask_sell = ((ma_df2['ma1']>=ma_df2['ma30']*1.12) )

# ma_if_df2 = ma_df2[mask_sell]

# ma_if_df2['Sell'] = 'Sell'

# ma_df2 = ma_df2.join(ma_if_df2[['Sell']])

# 判断4:标记买入卖出

# # 标记买入

# mask = ((ma_df2['ma1']>=ma_df2['ma5']*ma1_higher_ma5_rate) &

# (ma_df2['ma1']>=ma_df2['ma10']*ma1_higher_ma10_rate) &

# (ma_df2['ma1']>=ma_df2['ma30']*ma1_higher_ma30_rate) &

# (ma_df2['ma5_shift'] <= ma_df2['ma30_shift']) &

# (ma_df2['ma10_shift'] <= ma_df2['ma30_shift']) )

# ma_if_df = ma_df2[mask]

# ma_if_df['Buy'] = 'Buy'

# ma_df2 = ma_df2.join(ma_if_df[['Buy']])

# #标记卖出

# mask_sell = ((ma_df2['ma1']<=ma_df2['ma5']*ma1_lower_ma5_rate) &

# (ma_df2['ma1']<=ma_df2['ma10']*ma1_lower_ma10_rate) &

# (ma_df2['ma1']<=ma_df2['ma30']*ma1_lower_ma30_rate) &

# (ma_df2['ma5_shift'] >= ma_df2['ma30_shift']) &

# (ma_df2['ma10_shift'] >= ma_df2['ma30_shift']) )

# ma_if_df2 = ma_df2[mask_sell]

# ma_if_df2['Sell'] = 'Sell'

# ma_df2 = ma_df2.join(ma_if_df2[['Sell']])

# 判断3:标记买入

# mask = ((ma_df2['ma1']>=ma_df2['ma5']*ma1_higher_ma5_rate) &

# (ma_df2['ma1']>=ma_df2['ma10']*ma1_higher_ma10_rate) &

# (ma_df2['ma1']>=ma_df2['ma30']*ma1_higher_ma30_rate) &

# (ma_df2['ma5_shift'] <= ma_df2['ma30_shift']) &

# (ma_df2['ma10_shift'] <= ma_df2['ma30_shift']) )

# ma_if_df = ma_df2[mask]

# ma_if_df['Buy'] = 'Buy'

# ma_df2 = ma_df2.join(ma_if_df[['Buy']])

# 判断2:shift MA低于MA30

# ma_if_df = ma_df2[(ma_df2['ma1']>=ma_df2['ma5']*ma1_higher_ma5_rate) &

# (ma_df2['ma1']>=ma_df2['ma10']*ma1_higher_ma10_rate) &

# (ma_df2['ma1']>=ma_df2['ma30']*ma1_higher_ma30_rate) &

# (ma_df2['ma5_shift'] <= ma_df2['ma30_shift']) &

# (ma_df2['ma10_shift'] <= ma_df2['ma30_shift']) ]

# 判断1:连续上涨天数

# ma_if_df = ma_df2[(ma_df2['ma1']>=ma_df2['ma5']*ma1_higher_ma5_rate) &

# (ma_df2['ma1']>=ma_df2['ma10']*ma1_higher_ma10_rate) &

# (ma_df2['ma1']>=ma_df2['ma30']*ma1_higher_ma30_rate) &

# (ma_df2['ma5']>=ma_df2['ma10']*ma5_higher_ma10_rate) &

# (ma_df2['ma5']>=ma_df2['ma30']*ma5_higher_ma30_rate) &

# (ma_df2['ma10']>=ma_df2['ma30']*ma10_higher_ma30_rate) &

# (ma_df2['+_summary']>=ma30_increase_day) &

# (ma_df2['+_summary']<=ma30_increase_day+2)]

# 参考条件

# 条件1:ma1>ma30+5%

# 条件2:ma5>ma30+5%

# 条件3:ma10>ma30+5%

# 条件4:ma30的变化率过去10日有8个为正

# 条件5:日期包含今天

# 6.将符合条件的数据导出

if ma_df2.iloc[-1,-2]=='Buy' and ma_df2.iloc[-1,-1]=='Sell':

ma_if_df.to_excel('{}-stock-buy.xlsx'.format(stock_code))

ma_if_df2.to_excel('{}-stock-sell.xlsx'.format(stock_code))

ma_df2.to_excel('{}-stock-Detail.xlsx'.format(stock_code))

print('导出-买入-卖出',stock_code)

elif ma_df2.iloc[-1,-2]=='Buy':

ma_if_df.to_excel('{}-stock-buy.xlsx'.format(stock_code))

ma_df2.to_excel('{}-stock-Detail.xlsx'.format(stock_code))

print('导出-买入',stock_code)

elif ma_df2.iloc[-1,-1]=='Sell':

ma_if_df2.to_excel('{}-stock-sell.xlsx'.format(stock_code))

ma_df2.to_excel('{}-stock-Detail.xlsx'.format(stock_code))

print('导出-卖出',stock_code)

else:

print('未导出',stock_code)

ma_df2.to_excel('{}-stock-Detail.xlsx'.format(stock_code))

#print(ma_if_df)

print('ok')

读取股票数据

# 读取股票数据

import openpyxl

from openpyxl import load_workbook

wb = load_workbook("AA_stock_config.xlsx")

sheet = wb.get_sheet_by_name('stock')

rows=sheet.max_row

stock_codes=[]

for i in range(1,rows+1):

stock_code_i = sheet.cell(row=i,column=1).value

stock_codes.append('{}.SS'.format(stock_code_i))

print(stock_codes[:5])

# ['600000.SS', '600004.SS', '600006.SS', '600008.SS', '600009.SS']

产生股票推荐结果

for stock_code in stock_codes[:]:

get_gold_folk(stock_code,stock_date_from,mask,ma1_higher_ma30_rate,ma5_higher_ma30_rate,ma10_higher_ma30_rate,ma30_increase_day,today)

time.sleep(0.2)

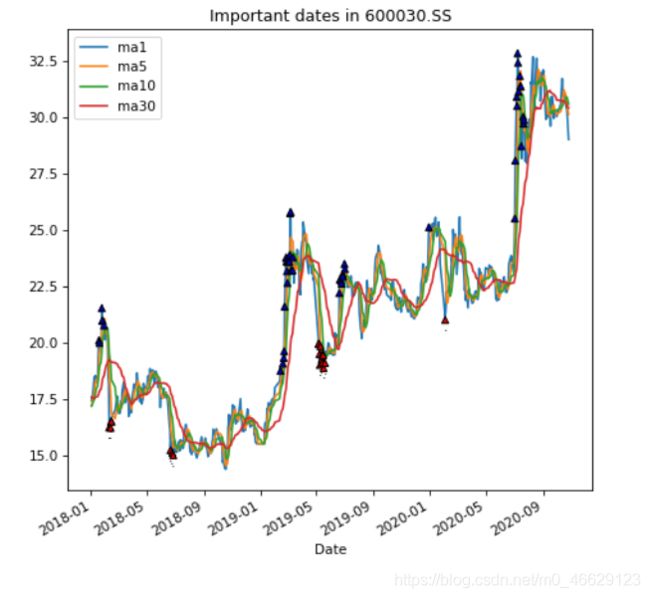

标记特定股票的买卖点

# annotate

import matplotlib.pyplot as plt

%matplotlib inline

%matplotlib notebook

stock_file='{}-stock-Detail.xlsx'.format(stock_code)

stock = pd.read_excel(stock_file,index_col=0)

stock = stock['2018-01':'2020-10']

stock = stock[['ma1','ma5','ma10','ma30','Buy','Sell']]

# 导出原始图表

fig = plt.figure(figsize=(7,7))

ax = fig.add_subplot(1,1,1)

#stock.plot(ax=ax,style=['g','y','r','b'])

stock.plot(ax=ax)

# 修正图表1

# 找出buy的date

index1 = stock[stock['Buy']=='Buy'].index

crisis_data_buy = [x for x in index1]

#print(crisis_data_buy)

crisis_data1 = [(i,'.') for i in crisis_data_buy]

for date,label in crisis_data1:

ax.annotate(label,xy=(date,stock['ma1'].asof(date)-0.01),

xytext=(date,stock['ma1'].asof(date)-0.2),

arrowprops=dict(arrowstyle="simple",facecolor='red'),

horizontalalignment='center',verticalalignment='top')

# 修正图表2

index2 = stock[stock['Sell']=='Sell'].index

crisis_data_sell = [x for x in index2]

#print(crisis_data_sell)

crisis_data2 = [(i,'.') for i in crisis_data_sell]

#crisis_data2 = [(datetime(2020,4,22),'.'),(datetime(2020,8,25),'.')]

for date,label in crisis_data2:

ax.annotate(label,xy=(date,stock['ma1'].asof(date)+0.01),

xytext=(date,stock['ma1'].asof(date)+0.2),

arrowprops=dict(arrowstyle="simple",facecolor='blue'),

horizontalalignment='center',verticalalignment='top')

#ax.set_xlim(['1/1/2020','12/31/2020'])

#ax.set_ylim([600,1800])

ax.set_title('Important dates in {}'.format(stock_code))

# 导出最终图表

plt.savefig('Stock.jpg',bbox_inches='tight')