RSRS指标,相对阻力支撑指标的实现,qlib扩展自己的特征表达式

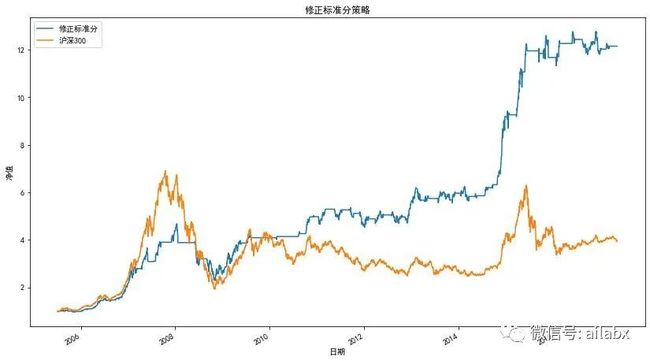

光大证券有一个RSRS指标,回测看来效果很不错,它也是基于突破的逻辑。与传统布林带这样的通道不同,它对$high最高价,与$low最低价之间做一个线性回归,看它的趋势。

只是RSRS指数要计算两个序列的相对斜率,这个指标,qlib没有实现。

——他们想到的,但还是todo。只能自己动手,丰衣足食。

# TODO: # support pair-wise rolling like `Slope(A, B, N)` class Slope(Rolling):

正好熟悉一下qlib的自定义指标。

其实过程不复杂,在初始化的时候,把自定义指标注册进去即可。就是下面代码里的“custom_ops”。

provider_uri = "~/.qlib/qlib_data/{}".format('index_data')

qlib.init(provider_uri=provider_uri, region=REG_CN, **{"custom_ops": [RSRS]})

而指标的实现过程如下,两个指标运算,继承自PairOperator,只需要实现这个_load_internal即可。加载数据逻辑是一样的,把se_left,se_right两个序列加载,然后进行计算。

import numpy as np

import pandas as pd

import qlib

from qlib.data import D

from qlib.data.ops import ElemOperator, PairOperator

from qlib.config import REG_CN

import statsmodels.api as sm

class PairSlope(PairOperator):

def __init__(self, feature_left, feature_right, N):

self.N = N

super(PairSlope, self).__init__(feature_left,feature_right)

def _load_internal(self, instrument, start_index, end_index, freq):

series_left = self.feature_left.load(instrument, start_index, end_index, freq)

series_right = self.feature_right.load(instrument, start_index, end_index, freq)

slope = []

#R2 = []

# 计算斜率值

n = self.N

for i in range(len(series_left)):

if i < (self.N - 1):

continue

else:

x = series_right[i - n + 1:i + 1]

# iloc左闭右开

x = sm.add_constant(x)

y = series_left.iloc[i - n + 1:i + 1]

regr = sm.OLS(y, x)

res = regr.fit()

beta = round(res.params[1], 2) # 斜率指标

slope.append(beta)

#R2.append(res.rsquared)

#df = df.iloc[n - 1:]

slope = pd.Series(slope)

return slope

if __name__ == '__main__':

provider_uri = "~/.qlib/qlib_data/{}".format('index_data')

qlib.init(provider_uri=provider_uri, region=REG_CN, **{"custom_ops": [PairSlope]})

instruments = ["sh000300"]

fields = ["PairSlope($high, $close,18)"]

print(D.features(instruments, fields, start_time="2010-01-01", end_time="2017-12-31", freq="day"))

然后我们需要实现一下pair_slope即可。

qlib自身有一个slope的计算函数。

# TODO:

# support pair-wise rolling like `Slope(A, B, N)`

class Slope(Rolling):

def __init__(self, feature, N):

super(Slope, self).__init__(feature, N, "slope")

def _load_internal(self, instrument, start_index, end_index, freq):

series = self.feature.load(instrument, start_index, end_index, freq)

if self.N == 0:

series = pd.Series(expanding_slope(series.values), index=series.index)

else:

series = pd.Series(rolling_slope(series.values, self.N), index=series.index)

return series

调用了rolling_slope这个函数。

from ._libs.rolling import rolling_slope, rolling_rsquare, rolling_resi from ._libs.expanding import expanding_slope, expanding_rsquare, expanding_resi

我调用了statsmodels.api线性回归算法计算了,性能可能差一点,后续可以优化。

有了指标,其实策略就很简单了。

由于计算时间较长,我使用了hdf5来缓存,hdf5可以原样保存dataframe的数据,而且性能很好,可以当离线的字典来用,csv大且慢,而且dataframe写csv再读出来,index,column信息会丢失,数据格式float可能会变成str,都要自己去转换。

store = pd.HDFStore('cache.h5')

if 'cache' in store.keys():

df = store.get(key='cache')

else:

features = ["$high", "$low", "PairSlope($high, $close,18)"]

features.append('$close / Ref($close,1) -1')

names = ['high', 'low', 'RSRS', 'rate']

# 'sh000905', 'sz399006'

df = logic.load_data(instruments=['sh000300',], features=features, names=names)

df = df['feature']

df['to_buy'] = df['RSRS'] > 1

df['to_sell'] =df['RSRS'] < 0.8

明天正式来实证RSRS策略,复现光大证券研报。

策略整合并模板化 | 从零实现AI量化回测平台 #5

"积木式"的策略框架 | 从零搭建自己的AI量化平台 #2

搭建回测系统主框架 | 从零搭建自己的AI量化平台 #1