基于逻辑回归的金融风控贷款违约预测分析(笔记)

一、背景与思路

(一)背景

核心问题:对贷款偿债能力的评估

1. 方法:利用逻辑回归(理解简单,可解释性强)

2. 信用评分卡的构建

| 金融风控 | |

| 定性分析 | 逻辑回归 |

| 定量分析 | 信用评分卡 |

(二)流程

1. 数据获取:包括获取存量客户及潜在客户的数据;

2. 数据预处理:包括数据清洗、缺失值处理;

3. 探索性分析:获取样本总体的大概情况,描述样本总体情况的指标主要包括直方图、箱型图等;

4. 变量选择:主要通过统计学方法,筛选出对违约状态影响最显著的特征;

5. 模型开发:包括变量分段,变量的WOE变换和逻辑回归估计;

6. 模型评估:评估模型的区分能力、预测能力、稳定性,并形成模型评估报告;

7. 信用评分:根据逻辑回归的系数和WOE等确定信用评分方法,将Logistic模型转换为标准评分形式;

8. 建立评分系统:根据信用评分方法,建立自动信用评分系统。

(三)思路

学以致用,解决问题!

第一阶段:基于逻辑回归的贷款违约预测分析(机器学习中的分类学习思路)

第二阶段:基于WOE构建信用评分卡

二、基于逻辑回归的贷款违约预测分析

(一)思路

1. 读取数据,了解数据

2. 数据清洗(缺失、异常、重复值处理)

3. 数据探索分析(变量特征工程)

4. 变量处理与选择

5. 建模分析

(二)案例

1. 读取数据

# 读取数据

import pandas as pd

data = pd.read_csv("cs-training.csv")

data = data.iloc[:,1:] # 去掉第一列,也可以用drop

data.info() # 注意数据类型(int/float)、变量含义# 简单查看数据

data.head() # 查看数据

data.describe() # 对数据进行简单描述统计2. 数据清洗

(1)缺失值处理——关键点:跟业务结合;没有统一标准

data.isnull().sum() # 缺失值统计# 创建数据表,分析数据表

def draw_missing_data_table(df):

tatal = df.isnull().sum().sort_value(ascending = True)

percent = (df.isnull().sum()/df.isnull().count().sort_value(ascending = True))

missing_data = pd.concat([total, percent, axis=1, keys=["Total", "Percent"])

return missing_data

# 调用函数,统计缺失值

draw_missing_data_table(data)(1)缺失值处理——步骤

第一步:删除(数量比较少;绝对量和相对量,结合业务问题)

第二步:填充:任意值;均值;关系填充(根据业务问题)

例:人口普查age缺失,显然不能填任意值或均值,但可根据该人身份证、社会关系等业务信息进行填充。

# 填充MonthlyInccom,填充中位数

value = data.MonthlyIncome.median()

data.MonthlyIncome = data.MonthlyIncome.fillna(value)

# 填充NumberofDependents,没有家庭,填充0

data.NumberOfDependents = data.NumberOfDependents.fillna(0)

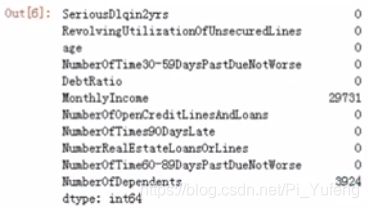

data.isnull().sum()

# 结果为0(2)重复值处理

data.duplicated().sum()

data = data.drop_duplicates()

data.info()(3)异常值处理——更多的是业务问题

方法:describe、箱线图

data.describe([0.01, 0.05, 0.10, 0.25, 0.50, 0.75, 0.90, 0.95, 0.99]) # 分别查看1%/5%/...99%分位数

# 作图导入库

import matplotlib.pyplot as plt

%matplotlib inline

import seaborn as sns

sns.boxplot(data["age"]) # 查看年龄的箱线图,发现有0岁、100多岁的异常值

# 一个一个变量作图过于繁琐,可利用for循环作图

data.colums # 查看变量

features = ["RevolvingUtilizationOfUnsecuredLines","age"...] # 将变量赋值于features

for i in features:

sns.boxplot(data[i])

plt.show()# 进行异常值删除

data = data[data["age"]>18]

data = data[data["age"]<100]

data = data[data["RevolvingUtilizationOfUnsecuredLines"]<1.00]

data = data[data["NumberOfOpenCreditLinesAndLoans"]<24.00]

data = data[data["NumberRealEstateLoansOrLines"]<4.00]

data = data[data["DebtRatio"]<5000.00]

data = data[data["NumberOfTime30-59DaysPastDueNotWorse"]<5000.00]

data.info()

# 保存处理后的数据

data.to_csv("processeddata.csv")3. 数据探索分析

(1)数据分布特征探索

sns.distplot(data["age"]) # 绘制分布图

sns.distplot(data["MonthlyIncome"]<10000) # 分布很离散,可以加个限定条件“<10000”查看分布情况(2)各个变量跟Y关系

count_classes = pd.value_counts(data["SeriousDlqin2yrs"], sort=True).sort_index()

count_classes

count_classes.plot(kind="bar")

# 查看age跟y关系

sns.boxplot(x="SeriousDlqin2yrs", y="age", data=data)

# 直接使用前面的features循环,查看所有变量与y的关系

for i in features:

sns.boxplot(x="SeriousDlqin2yrs", y=i, data=data)

plt.show()4. 特征工程(变量选择)

特征工程包括:虚拟化、标准化、变量生成、变量降维等。

下面使用相关系数进行变量选择。

data.corr() # 计算变量相关系数矩阵,查看各变量与y的相关系数

# 为了更好展示,可以做相关系数热力图

cor = data.corr()

plt.figure(figsize=(10,10)) # 调整图的大小

sns.heatmap(cor, annot=True, cmap="YlCnBu") # annot在每块上标上系数数值方便读,cmap调整颜色

# 根据相关系数>0.05,选择变量1,2,3,7,9;考虑变量自相关与过拟合问题,最终选择变量1,2,35. 建模分析

(1)划分X和Y,划分样本集

Y = data["SeriousDlqin2ys"]

X = data.iloc[:,[1,2,3]]

Y # 查看Y

X.head() # 查看Xfrom sklearn.model_selsction import train_test_split

X_train, X_test, Y_train, Y_test = train_test_split(X, Y, test_size=0.3, random_state=0) # 设置random_state=0保证每次相同地方开始划分(2)模型建立

from sklearn.linear_model import LogisticRegression

lrmodel = LogisticRegression()

lrmodel.fit(X_train, Y_train) # 使用训练集数据拟合模型

lrmodel.coef_ # 查看各变量系数

lrmodel.intercept_ # 查看截距项系数(3)模型评估

Y_predict = lrmodel.predict(X_test) # 进行预测

Y_predict[0:20] # 查看前20个预测值

# 生成报告,查看模型效果

from sklearn.metrics import classification_report

report = classification_report(Y_test, Y_predict)

print(report)

# 查看ROC/AUC

from sklearn.metrics import accuracy_score, roc_auc_score

print(accuracy_score(Y_test, Y_predict))

print(roc_auc_score(Y_test, Y_predict))小结

后续问题:模型调整(1. 数据处理:WOE和IV变量选择建模;2. 参数调整)

三、基于WOE信用评分的逻辑回归模型建立信用评分卡

(一)步骤

1. 导入数据

2. 数据清洗

3. 数据探索分析

4. 特征工程(变量选择)【数据分箱——woe-iv-变量选择】

5. 建立逻辑回归模型

5.1 划分数据

5.2 数据转化【新增】

5.3 建立模型

5.4 评估模型

5.5 建立信用评分卡【新增】

(二)举例进行woe和iv值计算

| 变量 | 全称 | 含义 |

| WOE | Weight of Evidence | 自变量取某个值时对违约比例的一种影响 |

| IV | Information Value | 信息价值 |

1. 读取数据

import pandas as pd

data = pd.read_csv("processeddata.csv")

data.info()

# 读取发现多了一个Unamed,下面删去

data = data.iloc[:,1:]

data.info()2. 举例说明woe和iv值的计算

| 分箱方法 | |

| 等距分箱 | 距离相等,样本不相等 |

| 等深分箱 | 距离不相等,样本相等 |

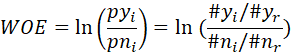

分箱后得到:总数,好样本数,坏样本数,根据分箱后的结果计算woe,woe公式如下:

WOE数值有什么问题? 1. 有正有负; 2. 不好理解

因此下面计算IV值:

IV值有什么好处:1. 都是正数; 2. 好理解,越大越好

(1)数据分箱

data["age"].head()

data_cut = pd.cut(data["age"],10) # 等距分箱,分4类

data_cut(2)数据分箱后计算样本数/坏样本数/好样本数

# 统计总样本数

cut_group_all = data["SeriousDlqin2yrs"].groupby(data_cut).count()

# 统计坏样本数

cut_y = data["SeriousDlqin2yrs"].groupby(data_cut).sum() # 坏的就是违约了“yes”,即“y”;违约了是“1”,没违约的是“0”,直接用sum加总就可以得到

# 统计好样本数

cut_n = cut_group_all-cut_y # normal正常,好的就是总的减去坏的

# 汇总数据

df = pd.DateFrame()

df["总数"] = cut_group_all

df["坏样本数"] = cut_y

df["好样本数"] = cut_n

df(3)数据分箱以后计算坏样本比率和好样本比率(并非比例)

df["坏样本比率"] = df["坏样本数"]/df["坏样本数"].sum()

df["好样本比率"] = df["好样本数"]/df["好样本数"].sum()

df(4)计算WOE值

import numpy as np

df["WOE的值"] = np.log(df["坏样本比率"]/df["好样本比率"])

df

# 注意一个问题:如果出现∞,需要以0进行替换

df = df.replace(["WOE的值":[np.inf:0, -inf:0]])(5)计算IV的值

df["IV的值"] = df["WOE的值"]*(df["坏样本比率"]-df["好样本比率"])

dfage_IV = df["IV的值"].sum()

age_IV(三)根据woe和iv值进行变量选择

1. 构建函数进行woe和iv值计算

from sklearn.model_selsction import train_test_split

Y = data["SeriousDlqin2ys"]

X = data,iloc[:,1:]

X_train, X_test, Y_train, Y_test = train_test_split(X, Y, test_size=0.3, random_state=0) # 设置random_state=0保证每次相同地方开始划分

train = pd.concat([Y_train, X_train], axis=1)

test = pd.concaat([Y_test, X_test], axis=1)

train.to_csv("TrainData.csv", index=False)

test.to_csv("TestData.csv", index=False)from sklearn.model_selsction import train_test_split

Y = data["SeriousDlqin2ys"]

X = data,iloc[:,1:]

X_train, X_test, Y_train, Y_test = train_test_split(X, Y, test_size=0.3, random_state=0) # 设置random_state=0保证每次相同地方开始划分

train = pd.concat([Y_train, X_train], axis=1)

test = pd.concaat([Y_test, X_test], axis=1)

train.to_csv("TrainData.csv", index=False)

test.to_csv("TestData.csv", index=False)import scipy.stats as stats

import numpy as np

# 根据r,p划分

def mono_bin(Y,X,n=20):

bad = Y.sum()

good = Y.count()-bad

r = 0

while np.abs(r) < 1:

d1 = pd.DataFrame(['X':X, 'Y':Y, 'Bucket':pd.cut(X, n, duplicate="drop")])

d2 = d1.groupby(['Bucket'], as_index=True)

r,p = stats.spearmanr(d2['X'].mean(), d2['Y'].mean()) # spearman秩相关系数是度量两个变量之间的统计相关性的指标

n = n-1

d3 = pd.DataFrame(d2['X'].min(), columns=['min']) # 为什么是空表

d3['min'] = d2['X'].min()

d3['max'] = d2['X'].max()

d3['sum'] = d2['Y'].sum()

d3['total'] = d2['Y'].count()

d3['rate'] = d2['Y'].mean()

d3['badattribute'] = d3['sum'] / bad

d3['goodattribute'] = (d3['total'] - d3['sum']) / good

d3['woe'] = np.log(d3['badattribute'] / d3['goodattribute'])

iv = ((d3['badattribute'] - d3['goodattribute']) * d3['woe']).sum()

d4 = (d3.sort_values(by = 'min'))

woe = list(d4['voe'].value)

print(d4)

print('-' * 30)

# 根据分位数进行切分

cut = []

cut.append(float('-inf'))

for i in range(1,n+1):

qua = X.quantile(i/(n+1)) # quantile求分位数,pos = (n+1)*p,n为数据的总个数,p为0-1之间的值

cut.append(round(qua,4)) # round()方法返回浮点数x的四舍五入值

cut.append(float('inf'))

return d4,iv,woe,cutdfx1, ivx1, woex1, cutx1 = mono_bin(train['SeriousDlqin2yrs'], train['RevolvingUtilizationOfUnsecuredLines'], n=10)

dfx2, ivx2, woex2, cutx2 = mono_bin(train['SeriousDlqin2yrs'], train['age'], n=20)

dfx4, ivx4, woex4, cutx4 = mono_bin(train['SeriousDlqin2yrs'], train['DebtRatio'], n=10)

dfx5, ivx5, woex5, cutx5 = mono_bin(train['SeriousDlqin2yrs'], train['MonthlyIncome'], n=10)# 剩下的几个变量不连续,人工定义

# 针对不能最优分箱的变量

def self_bin(Y, X, cat):

bad = Y.sum()

good = Y.count() - bad

d1 = pd.DataFrame(['X':X, 'Y':Y, 'Bucket':pd.cut(X, cat)])

d2 = d1.groupby(['Bucket'], as_index=True)

d3 = pd.DataFrame(d2['X'].min(), columns=['min'])

d3['min'] = d2['X'].min()

d3['max'] = d2['X'].max()

d3['sum'] = d2['Y'].sum()

d3['total'] = d2['Y'].count()

d3['rate'] = d2['Y'].mean()

d3['badattribute'] = d3['sum'] / bad

d3['goodattribute'] = (d3['total'] - d3['sum']) / good

# d3['woe'] = np.log((d3['rate'] / (1 - d3['rate'])) / (bad / good))

d3['woe'] = np.log(d3['badattribute'] / d3['goodattribute'])

iv = ((d3['badattribute'] - d3['goodattribute']) * d3['woe']).sum()

d4 = (d3.sort_values(by = 'min'))

woe = list(d4['voe'].value)

print(d4)

print('-' * 30)

woe = list(d3['woe'].values)

return d4, iv, woe

# 自己定义cut

ninf = float('-inf')

pinf = float('inf')

cutx3 = [ninf, 0, 1, 3, 5, pinf]

cutx6 = [ninf, 1, 2, 3, 5, pinf]

cutx7 = [ninf, 0, 1, 3, 5, pinf]

cutx8 = [ninf, 0, 1, 2, 3, pinf]

cutx9 = [ninf, 0, 1, 3, pinf]

cutx10 = [ninf, 0, 1, 2, 3, 5, pinf]

dfx3, ivx3, woex3 = self_bin(train['SeriousDlqin2yrs'], train['NumberOfTime30-59DaysPastDueNotWorse'], cutx3)

dfx6, ivx6, woex6 = self_bin(train['SeriousDlqin2yrs'], train['NumberOfOpenCreditLinesAndLoans'], cutx6)

dfx7, ivx7, woex7 = self_bin(train['SeriousDlqin2yrs'], train['NumberOfTimes90DayLate'], cutx7)

dfx8, ivx8, woex8 = self_bin(train['SeriousDlqin2yrs'], train['NumberRealEstateLoansOrLines'], cutx8)

dfx9, ivx9, woex9 = self_bin(train['SeriousDlqin2yrs'], train['NumberOfTime60-89DaysPastDueNotWorse'], cutx9)

dfx10, ivx10, woex10 = self_bin(train['SeriousDlqin2yrs'], train['NumberOfDependents'], cutx10)2. 变量选择

import matplotlib.pyplot as plt

%matplotlib inline

ivall = pd.Series([ivx1, ivx2, ivx3, ivx4, ivx5, ivx6, ivx7, ivx8, ivx9, ivx10])

ivall.plot(kind = "bar")

plt.show()根据IV值选择变量1,2,3,7,9

3. 建模分析

(1)划分数据集(已完成)

(2)WOE转换

# WOE转换函数

from pandas import Series

def replace_woe(series, cut, woe):

list = []

i = ()

while i < len(series):

value = series[i]

j = len(cut) - 2

m = len(cut) - 2

while j >= 0:

if value >=cut[j]

j = -1

else:

j -= 1

m -= 1

list.append(woe[m])

i += 1

return listtrain = pd.read_csv("TrainData.csv")

train['RevolvingUtilizationOfUnsecuredLines'] = Series(replace_woe(train['RevolvingUtilizationOfUnsecuredLines'], cutx1, woex1))

train['age'] = Series(replace_woe(train['age'], cutx2, woex2))

train['NumberOfTime30-59DaysPastDueNotWorse'] = Series(replace_woe(train['NumberOfTime30-59DaysPastDueNotWorse'], cutx3, woex3))

train['DebtRatio'] = Series(replace_woe(train['DebtRatio'], cutx4, woex4))

train['MonthlyIncome'] = Series(replace_woe(train['MonthlyIncome'], cutx5, woex5))

train['NumberOfOpenCreditLinesAndLoans'] = Series(replace_woe(train['NumberOfOpenCreditLinesAndLoans'], cutx6, woex6))

train['NumberOfTimes90DaysLate'] = Series(replace_woe(train['NumberOfTimes90DaysLate'], cutx7, woex7))

train['NumberRealEstateLoansOrLines'] = Series(replace_woe(train['NumberRealEstateLoansOrLines'], cutx8, woex8))

train['NumberOfTime60-89DaysPastDueNotWorse'] = Series(replace_woe(train['NumberOfTime60-89DaysPastDueNotWorse'], cutx9, woex9))

train['NumberOfDependents'] = Series(replace_woe(train['NumberOfDependents'], cutx10, woex10))

train.info()test = pd.read_csv("TestData.csv")

test['RevolvingUtilizationOfUnsecuredLines'] = Series(replace_woe(test['RevolvingUtilizationOfUnsecuredLines'], cutx1, woex1))

test['age'] = Series(replace_woe(test['age'], cutx2, woex2))

test['NumberOfTime30-59DaysPastDueNotWorse'] = Series(replace_woe(test['NumberOfTime30-59DaysPastDueNotWorse'], cutx3, woex3))

test['DebtRatio'] = Series(replace_woe(test['DebtRatio'], cutx4, woex4))

test['MonthlyIncome'] = Series(replace_woe(test['MonthlyIncome'], cutx5, woex5))

test['NumberOfOpenCreditLinesAndLoans'] = Series(replace_woe(test['NumberOfOpenCreditLinesAndLoans'], cutx6, woex6))

test['NumberOfTimes90DaysLate'] = Series(replace_woe(test['NumberOfTimes90DaysLate'], cutx7, woex7))

test['NumberRealEstateLoansOrLines'] = Series(replace_woe(test['NumberRealEstateLoansOrLines'], cutx8, woex8))

test['NumberOfTime60-89DaysPastDueNotWorse'] = Series(replace_woe(test['NumberOfTime60-89DaysPastDueNotWorse'], cutx9, woex9))

test['NumberOfDependents'] = Series(replace_woe(test['NumberOfDependents'], cutx10, woex10))

test.info()

3. 建模分析

Y_train = train["SeriousDlqin2ys"]

X_train = train.iloc[:,[1,2,3,7,9]]

Y_test = test["SeriousDlqin2ys"]

X_test = test.iloc[:,[1,2,3,7,9]]from sklearn.linear_model import LogisticRegression

woelr = LogisticRegression()

woelr.fit(X_train, Y_train) # 使用训练集数据拟合模型woelr.coef_ # 查看各变量系数

woelr.intercept_ # 查看截距项系数4. 模型评估

Y_pred = woelr.predict(X_test) # 进行预测

Y_pred[0:20] # 查看前20个预测值

# 生成报告,查看模型效果

from sklearn.metrics import classification_report

report = classification_report(Y_test, Y_pred)

print(report)

# 查看ROC/AUC

from sklearn.metrics import accuracy_score, roc_auc_score

print(accuracy_score(Y_test, Y_pred))

print(roc_auc_score(Y_test, Y_pred))5. 建立信用评分卡

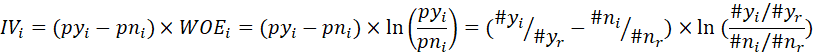

Logistics模型转换为标准评分卡,根据相关论文理论:

每个属性对应的分值可以通过下面的公式计算;WOE乘该变量的回归系数,加上回归截距,再乘上比例因子,最后加上偏移量:

对于评分卡的分值,我们可以这样计算:

即:a = log(p_good/p_bad) Score = offset + factor*log(odds)

建立标准评分卡之前需要选取几个评分卡参数:基础分值、PDO(比率翻倍的分值)和好坏比。此处,基础分值取600分,PDO为20(每高20分好坏比翻一倍),好坏比取20。

个人总评分 = 基础分 + 各部分得分

import numpy as np

factor = 20 / np.log(2)

# 计算分数函数

def get_score(coe, woe, factor):

score = []

for w in woe:

score = round(coe*w*factor, 0)

scores.append(score)

return scores

# coe 即前面计算的 woelr.coef()

coe = [0.66005628, 0.54226153, 1.05903419, 1.93717555, 1.20941815]

# 计算每个变量得分

x1 = get_score(coe[0], woex1, factor)

x2 = get_score(coe[1], woex2, factor)

x3 = get_score(coe[2], woex3, factor)

x7 = get_score(coe[3], woex7, factor)

x9 = get_score(coe[4], woex9, factor)

# 打印出每个特征对应的分数

print("可用额度比值对应的分数:[]", format(x1))

print("年龄对应的分数:[]", format(x2))

print("逾期30-59天笔数对应的分数:[]", format(x3))

print("逾期90天笔数对应的分数:[]", format(x7))

print("逾期60-89天笔数对应的分数:[]", format(x9))

# 定义函数,根据变量计算分数

def compute_score(series, cut, scores):

i = 0

list = []

while i < len(series)

value = series[i]

j = len(cut) - 2

m = len(cut) - 2

while j >= 0:

if value >= cut[j]

j = -1

else:

j = j-1

m = m-1

list.append(score[m])

i = i+1

return list

# 对测试集进行得分判断

test1 = pd.read_csv('TestData.csv')

test1['BaseScore'] = 600

test1['x1'] = Series(compute_score(test1['RevolvingUtilizationOfUnsecuredLines'], cutx1, x1))

test1['x2'] = Series(compute_score(test1['age'], cutx2, x2))

test1['x3'] = Series(compute_score(test1['NumberOfTime30-59DaysPastDueNotWorse'], cutx3, x3))

test1['x7'] = Series(compute_score(test1['NumberOfTimes90DaysLate'], cutx7, x7))

test1['x9'] = Series(compute_score(test1['NumberOfTime60-89DaysPastDueNotWorse'], cutx9, x9))

test1['score'] = test1['x1'] + test1['x2'] + test1['x3'] + test1['x7'] + test1['x9'] + test1['BaseScore']

test1.to_csv("ScoreData.csv", index=False)

test2 = test1.iloc[:,[0,11,12,13,14,15,16,17]]

test2.head()四、总结

(一)重点

1. 逻辑回归的思路;

2. 基于WOE逻辑回归建立信用评分卡的思路;

3. 过程中结合思路,对相关知识点进行掌握,重在操作。

(二)改进

1. 数据处理和样本处理、参数调整等较少;

2. 没有对测试数据进行分析,思路三部曲(训练模型,用有Y的测试数据进行测试然后不断完善模型,实战应用cs-test.csv)。