绘制相同到期日欧式期权组合收益图(python)

This article does not consider option premium.

1.Single option

1.1call option(看涨)

1.1.1buy call

The payoff is max(0,![]() -K), where K is the strike price,

-K), where K is the strike price, ![]() is the spot price at maturity T.

is the spot price at maturity T.

import matplotlib.pyplot as plt

import numpy as np

K1=40

St=np.linspace(0,80,81)

def buycall(K,S):

if S-K>0:

payoff=S-K

else:

payoff=0

return payoff

buycallpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

buycallpayoff[i]=buycall(K1,St[i])

plt.plot(St,buycallpayoff)

plt.title('buycallpayoff')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('strike price(K)')

plt.show()1.1.2sell call

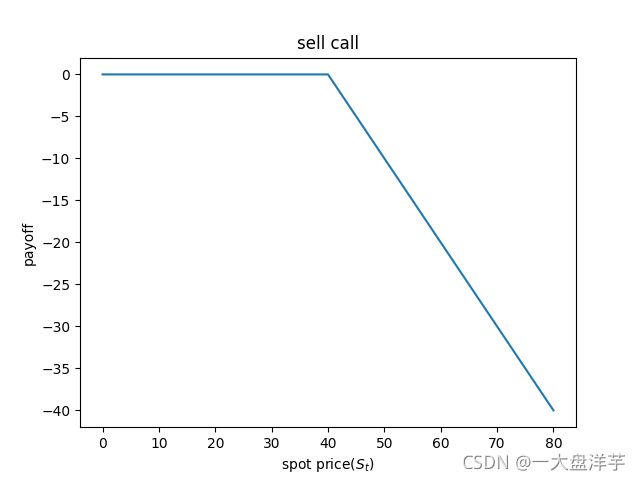

The payoff is min(0,K-![]() )

)

def sellcall(K,S):

if K-S<0:

payoff=K-S

else:

payoff=0

return payoff

sellcallpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

sellcallpayoff[i]=sellcall(K1,St[i])

plt.plot(St,sellcallpayoff)

plt.title('sellcallpayoff')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('strike price(K)')

plt.show()1.2put option(看跌)

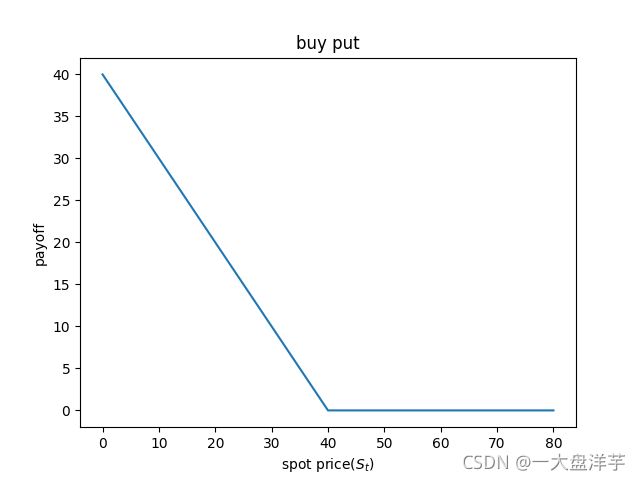

1.2.1buy put

The payoff is max(0,K-![]() )

)

def buyput(K,S):

if K-S>0:

payoff=K-S

else:

payoff=0

return payoff

buyputpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

buyputpayoff[i]=buyput(K1,St[i])

plt.plot(St,buyputpayoff)

plt.title('buy put')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('payoff')

plt.show()1.2.2sell put

The payoff is min(0,![]() -K)

-K)

def sellput(K,S):

if S-K<0:

payoff=S-K

else:

payoff=0

return payoff

sellputpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

sellputpayoff[i]=sellput(K1,St[i])

plt.plot(St,sellputpayoff)

plt.title('sell put')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('payoff')

plt.show()2.Option portfolio

2.1straddle(跨式组合)

2.1.1bottom (buy) straddle (底部买入的跨式组合)

The portfolio is that buy one call option and one put option with same strike price and expiration date(买入相同交割价格和到期日的一份看涨和一份看跌期权).

The payoff is max(0, ![]() -K)+max(0,k-

-K)+max(0,k- ![]() )=|

)=| ![]() -K|.

-K|.

def bottomstraddle(K,S):

payoff=abs(S-K)

return payoff

bottomstraddlepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstraddlepayoff[i]=bottomstraddle(K1,St[i])

plt.plot(St,bottomstraddlepayoff)

plt.title('bottom (buy) straddle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.1.2top (sell) straddle(顶部卖出的跨式组合)

The portfolio is that sell one call option and one put option with same strike price and expiration date(卖出相同交割价格和到期日的一份看涨和一份看跌期权).

The payoff is min(0, ![]() -K)+min(0,k-

-K)+min(0,k- ![]() )=-|

)=-| ![]() -K|.

-K|.

def topstraddle(K,S):

payoff=-abs(S-K)

return payoff

topstraddlepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstraddlepayoff[i]=topstraddle(K1,St[i])

plt.plot(St,topstraddlepayoff)

plt.title('top (sell) straddle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

2.2strip(条式组合)

2.2.1bottom (buy) strip(底部买入的条式组合)

The portfolio is that buy one call option and two put options with same strike price and expiration date(买入相同交割价格和到期日的一份看涨和两份看跌期权).

The payoff is max(0, ![]() -K)+2max(0,k-

-K)+2max(0,k- ![]() )=|

)=| ![]() -K|+max(0,k-

-K|+max(0,k- ![]() ).

).

def bottomstrip(K,S):

if K-S>0:

payoff=abs(S-K)+K-S

else:

payoff=abs(S-K)

return payoff

bottomstrippayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstrippayoff[i]=bottomstrip(K1,St[i])

plt.plot(St,bottomstrippayoff)

plt.title('bottom (buy) strip')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.2.2top (sell) strip(顶部卖出的条式组合)

The portfolio is that sell one call option and two put options with same strike price and expiration date(卖出相同交割价格和到期日的一份看涨和两份看跌期权).

The payoff is 2min(0, ![]() -K)+min(0,k-

-K)+min(0,k- ![]() )=-|

)=-| ![]() -K|+min(0,

-K|+min(0, ![]() -K).

-K).

def topstrip(K,S):

if S-K<0:

payoff=-abs(S-K)+S-K

else:

payoff=-abs(S-K)

return payoff

topstrippayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstrippayoff[i]=topstrip(K1,St[i])

plt.plot(St,topstrippayoff)

plt.title('top (sell) strip')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.3strap(带式组合)

2.3.2bottom (buy) strap(底部买入的带式组合)

The portfolio is that buy two call options and one put option with same strike price and expiration date(买入相同交割价格和到期日的两份看涨和一份看跌期权).

The payoff is 2max(0, ![]() -K)+max(0,k-

-K)+max(0,k- ![]() )=|

)=| ![]() -K|+max(0,

-K|+max(0, ![]() -K).

-K).

def bottomstrap(K,S):

if S-K>0:

payoff=abs(S-K)+S-K

else:

payoff=abs(S-K)

return payoff

bottomstrappayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstrappayoff[i]=bottomstrap(K1,St[i])

plt.plot(St,bottomstrappayoff)

plt.title('bottom (buy) strap')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.3.2top (sell) strap(顶部卖出的带式组合)

The portfolio is that sell two call options and one put option with same strike price and expiration date(卖出相同交割价格和到期日的两份看涨和一份看跌期权).

The payoff is min(0,![]() -K)+2min(0,k-

-K)+2min(0,k-![]() )=-|

)=-|![]() -K|+min(0,k-

-K|+min(0,k-![]() ).

).

def topstrap(K,S):

if K-S<0:

payoff=-abs(S-K)+K-S

else:

payoff=-abs(S-K)

return payoff

topstrappayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstrappayoff[i]=topstrap(K1,St[i])

plt.plot(St,topstrappayoff)

plt.title('top (sell) strap')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.4strangle(宽跨式组合)

2.4.1bottom (buy) strangle(底部买入的宽跨式组合)

The portfolio is that buy one call option with strike price KC and one put option with strike price KP , where KC > KP,and they have same expiration date(买入相同到期日的一份看涨和一份看跌期权,且看涨期权的交割价格高于看跌期权).

The payoff is max(0,![]() -KC)+max(0,KP-

-KC)+max(0,KP-![]() ).

).

KC=50

KP=30

def bottomstrangle(KC,KP,S):

if S-KC>0:

callpayoff=S-KC

else:

callpayoff=0

if KP-S>0:

putpayoff=KP-S

else:

putpayoff=0

payoff=callpayoff+putpayoff

return payoff

bottomstranglepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstranglepayoff[i]=bottomstrangle(KC,KP,St[i])

plt.plot(St,bottomstranglepayoff)

plt.title('bottom (buy) strangle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

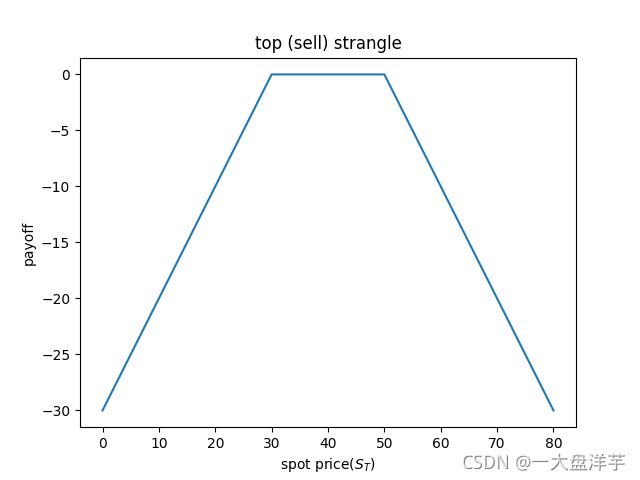

plt.show()2.4.2top (sell) strangle(顶部卖出的宽跨式组合)

The portfolio is that sell one call option with strike price KC and one put option with strike price KP , where KC > KP,and they have same expiration date(卖出相同到期日的一份看涨和一份看跌期权,且看涨期权的交割价格高于看跌期权).

The payoff is min(0,![]() -KP)+min(0,KC-

-KP)+min(0,KC-![]() ).

).

def topstrangle(KC,KP,S):

if KC-S<0:

callpayoff=KC-S

else:

callpayoff=0

if S-KP<0:

putpayoff=S-KP

else:

putpayoff=0

payoff=callpayoff+putpayoff

return payoff

topstranglepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstranglepayoff[i]=topstrangle(KC,KP,St[i])

plt.plot(St,topstranglepayoff)

plt.title('top (sell) strangle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.5bull spreads(牛市差价组合)(低价买高价卖)

2.5.1call bull spreads(看涨牛市差价组合)

The portfolio is that buy one call option with low strike price KCL and sell one call option with high strike price KCH , and they have same expiration date(买入一份较低交割价格看涨期权和卖出一份较高交割价格看涨期权,且到期日相同).

The payoff is max(0,![]() -KCL)+min(0,KCH-

-KCL)+min(0,KCH-![]() ).

).

KCL=30

KCH=50

def callbullspreads(KCL,KCH,S):

if S-KCL>0:

lowcallpayoff=S-KCL

else:

lowcallpayoff=0

if KCH-S<0:

highcallpayoff=KCH-S

else:

highcallpayoff=0

payoff=lowcallpayoff+highcallpayoff

return payoff

callbullspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callbullspreadspayoff[i]=callbullspreads(KCL,KCH,St[i])

plt.plot(St,callbullspreadspayoff)

plt.title('call bull spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.5.2put bull spreads(看跌牛市差价组合)

The portfolio is that buy one put option with low strike price KPL and sell one put option with high strike price KPH , and they have same expiration date(买入一份较低交割价格看跌期权和卖出一份较高交割价格看跌期权,且到期日相同).

The payoff is max(0,KPL-![]() )+min(0,

)+min(0,![]() -KPH).

-KPH).

KPL=30

KPH=50

def putbullspreads(KPL,KPH,S):

if KPL-S>0:

lowputpayoff=KPL-S

else:

lowputpayoff=0

if S-KPH<0:

highputpayoff=S-KPH

else:

highputpayoff=0

payoff=lowputpayoff+highputpayoff

return payoff

putbullspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putbullspreadspayoff[i]=putbullspreads(KPL,KPH,St[i])

plt.plot(St,putbullspreadspayoff)

plt.title('put bull spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.6bear spreads(熊市差价组合)(低价卖高价买)

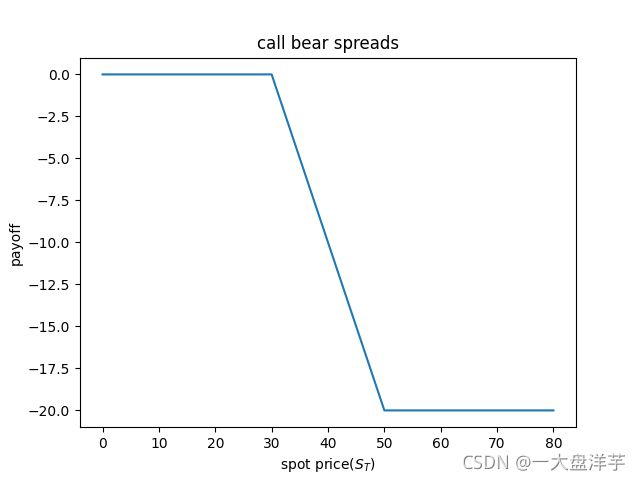

2.6.1call bear spreads(看涨熊市差价组合)

The portfolio is that sell one call option with low strike price KCLB and buy one call option with high strike price KCHB , and they have same expiration date(卖出一份较低交割价格看涨期权和买入一份较高交割价格看涨期权,且到期日相同).

The payoff is min(0,KCLB-![]() )+max(0,

)+max(0,![]() -KCHB).

-KCHB).

KCLB=30

KCHB=50

def callbearspreads(KCLB,KCHB,S):

if KCLB-S<0:

lowcallpayoff=KCLB-S

else:

lowcallpayoff=0

if S-KCHB>0:

highcallpayoff=S-KCHB

else:

highcallpayoff=0

payoff=lowcallpayoff+highcallpayoff

return payoff

callbearspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callbearspreadspayoff[i]=callbearspreads(KCLB,KCHB,St[i])

plt.plot(St,callbearspreadspayoff)

plt.title('call bear spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.6.2put bear spreads(看跌熊市差价组合)

The portfolio is that sell one put option with low strike price KPLB and buy one put option with high strike price KPHB , and they have same expiration date(卖出一份较低交割价格看跌期权和买入一份较高交割价格看跌期权,且到期日相同).

The payoff is min(0,![]() -KPLB)+max(0,KPHB-

-KPLB)+max(0,KPHB-![]() ).

).

KPLB=30

KPHB=50

def putbearspreads(KPLB,KPHB,S):

if S-KPLB<0:

lowputpayoff=S-KPLB

else:

lowputpayoff=0

if KPHB-S>0:

highputpayoff=KPHB-S

else:

highputpayoff=0

payoff=lowputpayoff+highputpayoff

return payoff

putbearspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putbearspreadspayoff[i]=putbearspreads(KPLB,KPHB,St[i])

plt.plot(St,putbearspreadspayoff)

plt.title('put bear spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.7butterfly spreads(蝶式差价组合)

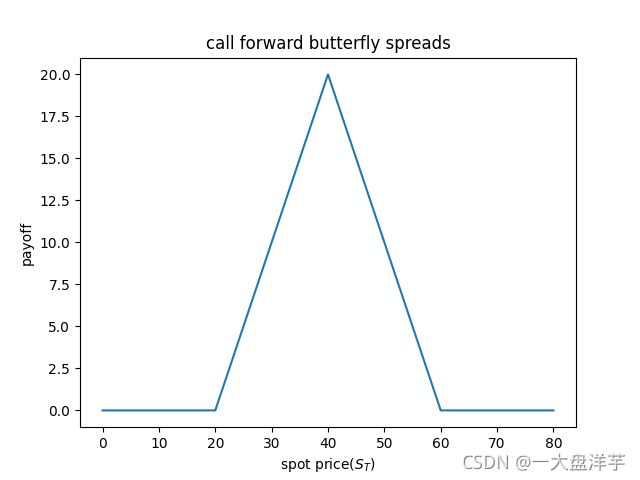

2.7.1forward butterfly spreads(正向蝶式差价组合)(买高低,卖中间)

2.7.1.1call forward butterfly spreads(看涨正向蝶式差价组合)

The portfolio is that buy one call option with low strike price KLb, sell two call options with middle strike price KMb and buy one call option with high strike price KHb, where KHb-KMb=KMb-KLb, and they have same expiration date(买入一份较低交割价格看涨期权,卖出两份中间交割价格看涨期权和买入一份较高交割价格看涨期权,三个价格成等差数列,且到期日相同).

The payoff is max(0,![]() -KLb)+2min(0,KMb-

-KLb)+2min(0,KMb-![]() )+max(0,

)+max(0,![]() -KHb).

-KHb).

KLb=20

KMb=40

KHb=60

def callforwardbutterflyspreads(KLb,KMb,KHb,S):

if S-KLb>0:

lowcallpayoff=S-KLb

else:

lowcallpayoff=0

if KMb-S<0:

middlecallpayoff=2*(KMb-S)

else:

middlecallpayoff=0

if S-KHb>0:

highcallpayoff=S-KHb

else:

highcallpayoff=0

payoff=lowcallpayoff+middlecallpayoff+highcallpayoff

return payoff

callforwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callforwardbutterflyspreadspayoff[i]=callforwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,callforwardbutterflyspreadspayoff)

plt.title('call forward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.7.1.2put forward butterfly spreads(看跌正向蝶式差价组合)

The portfolio is that buy one put option with low strike price KLb, sell two put options with middle strike price KMb and buy one put option with high strike price KHb, where KHb-KMb=KMb-KLb, and they have same expiration date(买入一份较低交割价格看跌期权,卖出两份中间交割价格看跌期权和买入一份较高交割价格看跌期权,三个价格成等差数列,且到期日相同).

The payoff is max(0,KLb-![]() )+2min(0,

)+2min(0,![]() -KMb)+max(0,KHb-

-KMb)+max(0,KHb-![]() ).

).

def putforwardbutterflyspreads(KLb,KMb,KHb,S):

if KLb-S>0:

lowputpayoff=KLb-S

else:

lowputpayoff=0

if S-KMb<0:

middleputpayoff=2*(S-KMb)

else:

middleputpayoff=0

if KHb-S>0:

highputpayoff=KHb-S

else:

highputpayoff=0

payoff=lowputpayoff+middleputpayoff+highputpayoff

return payoff

putforwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putforwardbutterflyspreadspayoff[i]=putforwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,putforwardbutterflyspreadspayoff)

plt.title('put forward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

2.7.2backward butterfly spreads(反向蝶式差价组合)(买中间,卖高低)

2.7.2.1call backward butterfly spreads(看涨反向蝶式差价组合)

The portfolio is that sell one call option with low strike price KLb, buy two call options with middle strike price KMb and sell one call option with high strike price KHb, where KHb-KMb=KMb-KLb, and they have same expiration date(卖出一份较低交割价格看涨期权,买入两份中间交割价格看涨期权和卖出一份较高交割价格看涨期权,三个价格成等差数列,且到期日相同).

The payoff is min(0,KLb-![]() )+2max(0,

)+2max(0,![]() -KMb)+min(0,KHb-

-KMb)+min(0,KHb-![]() ).

).

def callbackwardbutterflyspreads(KLb,KMb,KHb,S):

if KLb-S<0:

lowcallpayoff=KLb-S

else:

lowcallpayoff=0

if S-KMb>0:

middlecallpayoff=2*(S-KMb)

else:

middlecallpayoff=0

if KHb-S<0:

highcallpayoff=KHb-S

else:

highcallpayoff=0

payoff=lowcallpayoff+middlecallpayoff+highcallpayoff

return payoff

callbackwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callbackwardbutterflyspreadspayoff[i]=callbackwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,callbackwardbutterflyspreadspayoff)

plt.title('call backward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()2.7.2.2put backward butterfly spreads(看跌反向蝶式差价组合)

The portfolio is that sell one put option with low strike price KLb, buy two put options with middle strike price KMb and sell one put option with high strike price KHb, where KHb-KMb=KMb-KLb, and they have same expiration date(卖出一份较低交割价格看跌期权,买入两份中间交割价格看跌期权和卖出一份较高交割价格看跌期权,三个价格成等差数列,且到期日相同).

The payoff is min(0,![]() -KLb)+2max(0,KMb-

-KLb)+2max(0,KMb-![]() )+min(0,

)+min(0,![]() -KHb).

-KHb).

def putbackwardbutterflyspreads(KLb,KMb,KHb,S):

if S-KLb<0:

lowcallpayoff=S-KLb

else:

lowcallpayoff=0

if KMb-S>0:

middlecallpayoff=2*(KMb-S)

else:

middlecallpayoff=0

if S-KHb<0:

highcallpayoff=S-KHb

else:

highcallpayoff=0

payoff=lowcallpayoff+middlecallpayoff+highcallpayoff

return payoff

putbackwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putbackwardbutterflyspreadspayoff[i]=putbackwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,putbackwardbutterflyspreadspayoff)

plt.title('put backward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()完整代码:

import matplotlib.pyplot as plt

import numpy as np

K1=40

St=np.linspace(0,80,81)

def buycall(K,S):

if S-K>0:

payoff=S-K

else:

payoff=0

return payoff

buycallpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

buycallpayoff[i]=buycall(K1,St[i])

plt.plot(St,buycallpayoff)

plt.title('buy call')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('payoff')

plt.show()

def sellcall(K,S):

if K-S<0:

payoff=K-S

else:

payoff=0

return payoff

sellcallpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

sellcallpayoff[i]=sellcall(K1,St[i])

plt.plot(St,sellcallpayoff)

plt.title('sell call')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('payoff')

plt.show()

def buyput(K,S):

if K-S>0:

payoff=K-S

else:

payoff=0

return payoff

buyputpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

buyputpayoff[i]=buyput(K1,St[i])

plt.plot(St,buyputpayoff)

plt.title('buy put')

plt.xlabel('spot price'+'($S_{t}$)')

plt.ylabel('payoff')

plt.show()

def sellput(K,S):

if S-K<0:

payoff=S-K

else:

payoff=0

return payoff

sellputpayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

sellputpayoff[i]=sellput(K1,St[i])

plt.plot(St,sellputpayoff)

plt.title('sell put')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def bottomstraddle(K,S):

payoff=abs(S-K)

return payoff

bottomstraddlepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstraddlepayoff[i]=bottomstraddle(K1,St[i])

plt.plot(St,bottomstraddlepayoff)

plt.title('bottom (buy) straddle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def topstraddle(K,S):

payoff=-abs(S-K)

return payoff

topstraddlepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstraddlepayoff[i]=topstraddle(K1,St[i])

plt.plot(St,topstraddlepayoff)

plt.title('top (sell) straddle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def bottomstrip(K,S):

if K-S>0:

payoff=abs(S-K)+K-S

else:

payoff=abs(S-K)

return payoff

bottomstrippayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstrippayoff[i]=bottomstrip(K1,St[i])

plt.plot(St,bottomstrippayoff)

plt.title('bottom (buy) strip')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def topstrip(K,S):

if S-K<0:

payoff=-abs(S-K)+S-K

else:

payoff=-abs(S-K)

return payoff

topstrippayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstrippayoff[i]=topstrip(K1,St[i])

plt.plot(St,topstrippayoff)

plt.title('top (sell) strip')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def bottomstrap(K,S):

if S-K>0:

payoff=abs(S-K)+S-K

else:

payoff=abs(S-K)

return payoff

bottomstrappayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstrappayoff[i]=bottomstrap(K1,St[i])

plt.plot(St,bottomstrappayoff)

plt.title('bottom (buy) strap')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

KC=50

KP=30

def bottomstrangle(KC,KP,S):

if S-KC>0:

callpayoff=S-KC

else:

callpayoff=0

if KP-S>0:

putpayoff=KP-S

else:

putpayoff=0

payoff=callpayoff+putpayoff

return payoff

bottomstranglepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

bottomstranglepayoff[i]=bottomstrangle(KC,KP,St[i])

plt.plot(St,bottomstranglepayoff)

plt.title('bottom (buy) strangle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def topstrangle(KC,KP,S):

if KC-S<0:

callpayoff=KC-S

else:

callpayoff=0

if S-KP<0:

putpayoff=S-KP

else:

putpayoff=0

payoff=callpayoff+putpayoff

return payoff

topstranglepayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

topstranglepayoff[i]=topstrangle(KC,KP,St[i])

plt.plot(St,topstranglepayoff)

plt.title('top (sell) strangle')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

KCL=30

KCH=50

def callbullspreads(KCL,KCH,S):

if S-KCL>0:

lowcallpayoff=S-KCL

else:

lowcallpayoff=0

if KCH-S<0:

highcallpayoff=KCH-S

else:

highcallpayoff=0

payoff=lowcallpayoff+highcallpayoff

return payoff

callbullspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callbullspreadspayoff[i]=callbullspreads(KCL,KCH,St[i])

plt.plot(St,callbullspreadspayoff)

plt.title('call bull spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

KPL=30

KPH=50

def putbullspreads(KPL,KPH,S):

if KPL-S>0:

lowputpayoff=KPL-S

else:

lowputpayoff=0

if S-KPH<0:

highputpayoff=S-KPH

else:

highputpayoff=0

payoff=lowputpayoff+highputpayoff

return payoff

putbullspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putbullspreadspayoff[i]=putbullspreads(KPL,KPH,St[i])

plt.plot(St,putbullspreadspayoff)

plt.title('put bull spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

KLb=30

KHb=50

def callbearspreads(KLb,KHb,S):

if KLb-S<0:

lowcallpayoff=KLb-S

else:

lowcallpayoff=0

if S-KHb>0:

highcallpayoff=S-KHb

else:

highcallpayoff=0

payoff=lowcallpayoff+highcallpayoff

return payoff

callbearspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callbearspreadspayoff[i]=callbearspreads(KLb,KHb,St[i])

plt.plot(St,callbearspreadspayoff)

plt.title('call bear spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

KPLB=30

KPHB=50

def putbearspreads(KPLB,KPHB,S):

if S-KPLB<0:

lowputpayoff=S-KPLB

else:

lowputpayoff=0

if KPHB-S>0:

highputpayoff=KPHB-S

else:

highputpayoff=0

payoff=lowputpayoff+highputpayoff

return payoff

putbearspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putbearspreadspayoff[i]=putbearspreads(KPLB,KPHB,St[i])

plt.plot(St,putbearspreadspayoff)

plt.title('put bear spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

KLb=20

KMb=40

KHb=60

def callforwardbutterflyspreads(KLb,KMb,KHb,S):

if S-KLb>0:

lowcallpayoff=S-KLb

else:

lowcallpayoff=0

if KMb-S<0:

middlecallpayoff=2*(KMb-S)

else:

middlecallpayoff=0

if S-KHb>0:

highcallpayoff=S-KHb

else:

highcallpayoff=0

payoff=lowcallpayoff+middlecallpayoff+highcallpayoff

return payoff

callforwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callforwardbutterflyspreadspayoff[i]=callforwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,callforwardbutterflyspreadspayoff)

plt.title('call forward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def putforwardbutterflyspreads(KLb,KMb,KHb,S):

if KLb-S>0:

lowputpayoff=KLb-S

else:

lowputpayoff=0

if S-KMb<0:

middleputpayoff=2*(S-KMb)

else:

middleputpayoff=0

if KHb-S>0:

highputpayoff=KHb-S

else:

highputpayoff=0

payoff=lowputpayoff+middleputpayoff+highputpayoff

return payoff

putforwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putforwardbutterflyspreadspayoff[i]=putforwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,putforwardbutterflyspreadspayoff)

plt.title('put forward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def callbackwardbutterflyspreads(KLb,KMb,KHb,S):

if KLb-S<0:

lowcallpayoff=KLb-S

else:

lowcallpayoff=0

if S-KMb>0:

middlecallpayoff=2*(S-KMb)

else:

middlecallpayoff=0

if KHb-S<0:

highcallpayoff=KHb-S

else:

highcallpayoff=0

payoff=lowcallpayoff+middlecallpayoff+highcallpayoff

return payoff

callbackwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

callbackwardbutterflyspreadspayoff[i]=callbackwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,callbackwardbutterflyspreadspayoff)

plt.title('call backward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()

def putbackwardbutterflyspreads(KLb,KMb,KHb,S):

if S-KLb<0:

lowcallpayoff=S-KLb

else:

lowcallpayoff=0

if KMb-S>0:

middlecallpayoff=2*(KMb-S)

else:

middlecallpayoff=0

if S-KHb<0:

highcallpayoff=S-KHb

else:

highcallpayoff=0

payoff=lowcallpayoff+middlecallpayoff+highcallpayoff

return payoff

putbackwardbutterflyspreadspayoff=np.linspace(0,1,len(St))

for i in range(len(St)):

putbackwardbutterflyspreadspayoff[i]=putbackwardbutterflyspreads(KLb,KMb,KHb,St[i])

plt.plot(St,putbackwardbutterflyspreadspayoff)

plt.title('put backward butterfly spreads')

plt.xlabel('spot price'+'($S_{T}$)')

plt.ylabel('payoff')

plt.show()