北京房价预测图说

前言

曾听人说过,中国经济是房地产市场,美国经济是股票市场。中国房地产市场超过400万亿,房地产总值是美国、欧盟、日本总和,但是股市才50万亿,不到美欧日的十分之一。可见房地产对于中国来说地位尤其明显!对于我们很难在一线城市买房的年轻刚需族来说,这确是一个十分头疼的问题。于此,萌生了分析房价并预测的想法(曾经采用R做过尝试,这次将采用python)。

本次将基于北京房价作为测试数据,后期通过爬虫将抓取包括北上广深等城市的数据以供分析。

数据

感谢Qichen Qiu提供链家网2011-2017北京房价数据,感谢Jonathan Bouchet提供的思路。

本次分析基于python3,代码将稍后整理提供于github。

数据特征包含,kaggle上有具体介绍,在此暂不赘述:

url: the url which fetches the data( character )

id: the id of transaction( character )

Lng: and Lat coordinates, using the BD09 protocol. ( numerical )

Cid: community id( numerical )

tradeTime: the time of transaction( character )

DOM: active days on market.( numerical )

followers: the number of people follow the transaction.( numerical )

totalPrice: the total price( numerical )

price: the average price by square( numerical )

square: the square of house( numerical )

livingRoom: the number of living room( character )

drawingRoom: the number of drawing room( character )

kitchen: the number of kitchen( numerical )

bathroom the number of bathroom( character )

floor: the height of the house. I will turn the Chinese characters to English in the next version.( character )

buildingType: including tower( 1 ) , bungalow( 2 ),combination of plate and tower( 3 ), plate( 4 )( numerical )

constructionTime: the time of construction( numerical )

renovationCondition: including other( 1 ), rough( 2 ),Simplicity( 3 ), hardcover( 4 )( numerical )

buildingStructure: including unknow( 1 ), mixed( 2 ), brick and wood( 3 ), brick and concrete( 4 ),steel( 5 ) and steel-concrete composite ( 6 ).( numerical )

ladderRatio: the proportion between number of residents on the same floor and number of elevator of ladder. It describes how many ladders a resident have on average.( numerical )

elevator have ( 1 ) or not have elevator( 0 )( numerical )

fiveYearsProperty: if the owner have the property for less than 5 years( numerical )

EDA

了解数据以后,首先进行探索分析,查看缺失值情况:

url 0

id 0

Lng 0

Lat 0

Cid 0

tradeTime 0

DOM 0

followers 0

totalPrice 0

price 0

square 0

livingRoom 0

drawingRoom 0

kitchen 0

bathRoom 0

floor 0

buildingType 2021

constructionTime 0

renovationCondition 0

buildingStructure 0

ladderRatio 0

elevator 32

fiveYearsProperty 32

subway 32

district 0

communityAverage 463

get_floor 32

province 0

dtype: int64

采用msno图形化查看:

msno.matrix(source_data)

test_data.fillna({'DOM': test_data['DOM'].median()}, inplace=True)

test_data['buildingType'] = [makeBuildingType(x) for x in test_data['buildingType']]

test_data = test_data[(test_data['buildingType'] != 'wrong_coded') & (test_data['buildingType'] != 'missing')]

test_data['renovationCondition'] = [makeRenovationCondition(x) for x in test_data['renovationCondition']]

test_data['buildingStructure'] = [makeBuildingStructure(x) for x in test_data['buildingStructure']]

test_data['elevator'] = ['has_elevator' if x==1 else 'no_elevator' for x in test_data['elevator']]

test_data['subway'] = ['has_subway' if x==1 else 'no_subway' for x in test_data['subway']]

test_data['fiveYearsProperty'] = ['owner_less_5y' if x==1 else 'owner_more_5y' for x in test_data['fiveYearsProperty']]

pd.to_numeric(test_data['constructionTime'], errors='coerce')

test_data = test_data[(test_data['constructionTime'] != '未知')]

# pd.value_counts(test_data['constructionTime'])

test_data['district'].astype("category")

print(pd.value_counts(test_data['district']))

结果如下:

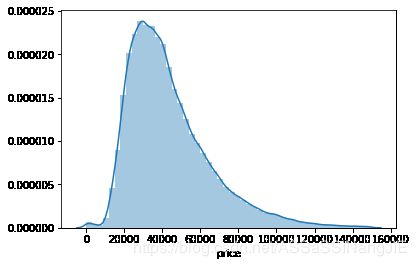

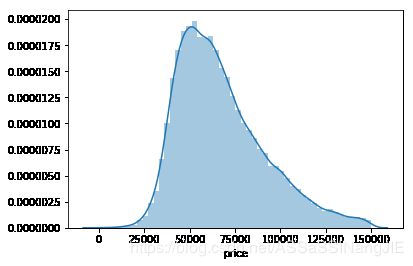

我们来看一看房价情况:

首先总体情况:

再看一看2017年的情况:

可见房价总体满足正偏分布。

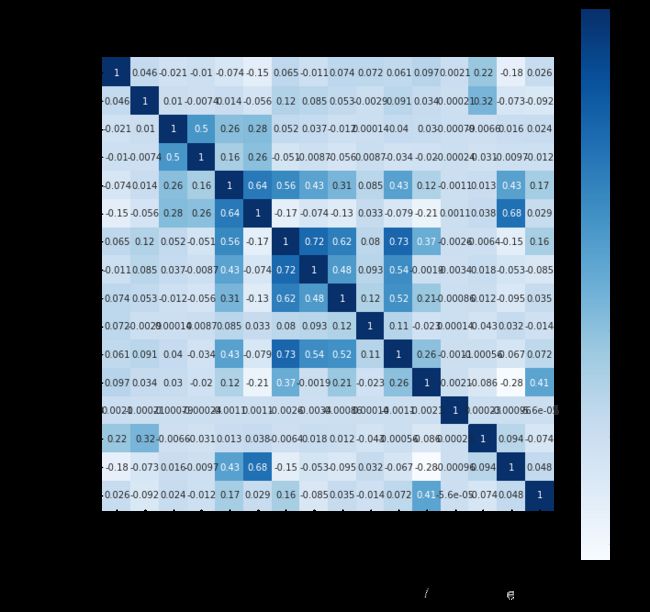

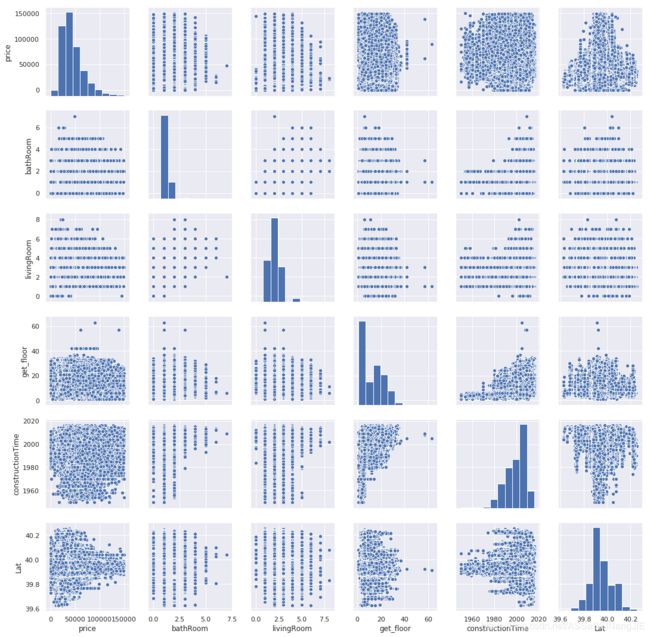

处理下数据看一看相关性:

test_data['tradeTime'] = pd.to_datetime(test_data['tradeTime'])

test_data['constructionTime'] = pd.to_numeric(test_data['constructionTime'])

test_data['livingRoom'] = pd.to_numeric(test_data['livingRoom'])

test_data['drawingRoom'] = pd.to_numeric(test_data['drawingRoom'])

test_data['bathRoom'] = pd.to_numeric(test_data['bathRoom'])

test_data['get_floor'] = pd.to_numeric(test_data['get_floor'])

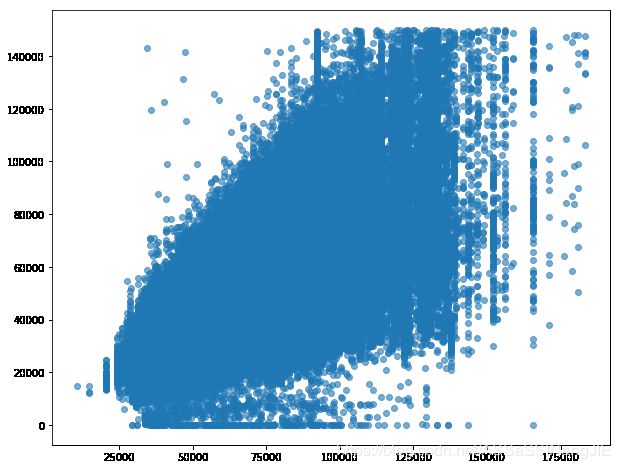

抽部分特征看一看:

communityAverage:

square:

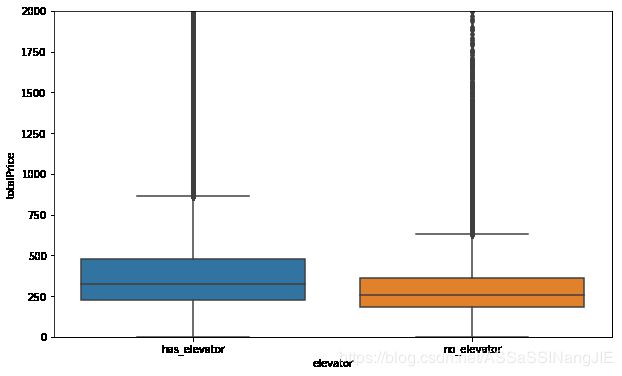

再看看电梯和区域:

房价真的是没有最高只有更高!一般情况下,尽量分区域进行分析会更直观也更准确。比如海淀和通州就会差别较大。

包括卧室,浴室等特征基本上都与总价成正相关,不过还有单价或总价为0的需要考虑是缺失还是已售/待定等情况,这些在自己抓取房价的时候要注意分析。

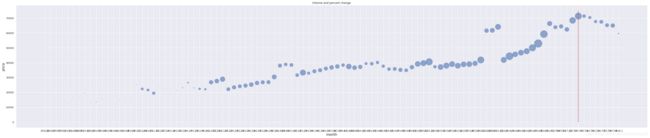

最后看一下均价和计数:

price_data = test_data[['price','year-month']]

price_data.head()

price_group = price_data.groupby(['year-month']).agg(['mean','count'])

price_group.head()

2017年中旬出现拐点,点的大小代表该价格计数。

到这里已经很想加上2018年的数据看看了!

回归

试试多元线性回归:

用2017年以前的数据进行训练,预测2017的价格。

训练模型:

x_train = temp_train.drop(['tradeTime','totalPrice','floor','province'], axis=1)

y_train = temp_train[['totalPrice']]

model = LinearRegression(fit_intercept=True, normalize=False, copy_X=True, n_jobs=1)

model.fit(x_train,y_train)

x_test = temp_test.drop(['tradeTime','totalPrice','floor','province'], axis=1)

y_test = temp_test[['totalPrice']]

print(model.score(x_test,y_test))

第一次拟合优度0.7971355163827527.

预测值普遍偏低。

后期将用更多的特征组合以及参数来进行尝试,并采用不同的方式进行预测。