评分卡模型开发--上线监测

转自:https://cloud.tencent.com/developer/article/1016299

那么我们的评分卡上线后,如何对评分卡的效果进行有效监测,监测哪些指标,监测的指标阈值达到多少我们需要对现有评分卡进行调整更新?这是我们在评分卡上线后需要持续性监测、关注的问题,今天就来跟大家分享一下互金行业评分卡监测的常用手段。

1. 模型稳定性

包括评分卡得分分布的PSI(Population Stability Index), 评分卡所有涉及变量的PSI. 模型分数分布稳定性:监测模型的打分结果的分布是否有变化,主要将评分卡上线后的样本RealData与建模时的样本Train_Data比较。使用的统计指标为PSI(Population Stability Index).使用的指标是PSI.

变量稳定性:监测模型的输入变量的分布是否有变化,主要将评分卡上线后的样本RealData与建模时的样本Train_Data比较。使用的指标也是PSI.

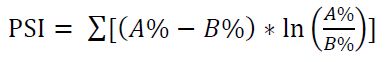

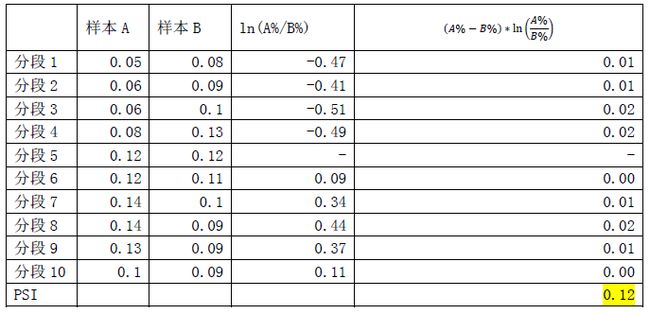

PSI 计算步骤: 假设我们要比较样本A与样本B中某一变量Y的分布,首先按照同一标准将Y分为几个区间(通常分为10段),计算样本A和样本B中每个区间的占比。在每个区间段上,将两个样本的各自占比相除再取对数,然后乘以各自占比之差,最后将各个区间段的计算值相加,得到最终PSI.

以“联名贷”产品申请评分卡监测过程为例,代码实现:

realdata<-read.csv("C:/Users/5609/Desktop/每日定时报表/20171023/CacheData_LMD.csv",header = TRUE)

modeldata<-read.csv("D:/sissi/联名贷/联名贷分数_建模样本.csv",header=TRUE)

realdata$申请日期<-as.Date(realdata$time)

modeldata$申请日期<-as.Date(modeldata$申请日期)

vars <- read.table("variable list.txt", sep = "\t")

vars <- as.character(vars[,1])

for (i in vars){

if(is.character(modeldata[,i]) | is.logical(modeldata[,i])){

modeldata[,i] <- as.factor(modeldata[,i])

}

}

modeldata1<-modeldata[,c("申请编号","申请日期",vars,"pred","groups","groups_n")]

realdata1<-realdata[,c("申请编号","申请日期",vars,"final_score","group")]

# 联名贷评分卡分组

breaks_g <- c( 0, 3.67,

4.49,

5.21,

5.99,

6.83,

8.02,

9.59,

12.44,

19.90,

100.00

)

realdata1$groups <- cut(realdata1$final_score, breaks = breaks_g, include.lowest = FALSE, right = TRUE)

realdata1$groups_n<-as.numeric(realdata1$groups)

####建模数据

tab <- summary(modeldata$groups)

write.table(tab, "clipboard", sep = "\t")

t1 <- summary(modeldata$groups)/dim(modeldata)[1]

write.table(t1, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 每组样本量 更新至excel

tab <- summary(realdata1$groups)

write.table(tab, "clipboard", sep = "\t")

# 每组占比 更新至excel

t2 <- summary(realdata1$groups)/dim(realdata1)[1]

write.table(t2, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

PSI <- sum((t2-t1)*log(t2/t1))

PSI

# 变量 PSI ----------------------------------------------------------------

vars <- read.table("variable list.txt", sep = "\t")

vars <- as.character(vars[,1])

# 调整变量值 (评分卡对输入变量的值有调整,将调整后的值与建模时的数据做比较)

#loan_query_12MA_level

realdata1$loan_query_12MA_level <- cut(realdata1$loan_query_12MA, breaks = c(0, 1.5,Inf),

include.lowest = TRUE)

realdata1$loan_query_12MA_level <- as.character(realdata1$loan_query_12MA_level)

index <- is.na(realdata1$loan_query_12MA_level)

realdata1[index, "loan_query_12MA_level"] <- "NA"

realdata1$loan_query_12MA_level <- as.factor(realdata1$loan_query_12MA_level)

levels(realdata1$loan_query_12MA_level) <- c( "2_(1.5,Inf]", "1_[0,1.5] & NA","1_[0,1.5] & NA" )

realdata1$loan_query_12MA_level <- as.character(realdata1$loan_query_12MA_level)

# 未结清贷款笔数

realdata1$未结清贷款笔数_level <- cut(realdata1$未结清贷款笔数_level,

breaks = c(0, 5, Inf),

include.lowest = TRUE, right = FALSE)

realdata1$未结清贷款笔数_level <- as.factor(as.character(realdata1$未结清贷款笔数_level))

index <- is.na(realdata1$未结清贷款笔数_level)

realdata1[index, "未结清贷款笔数_level"] <- "[0,5)"

#贷款类别

realdata1$贷款类别 <- as.factor(as.character(realdata1$贷款类别))

levels(realdata1$贷款类别) <- c( "新贷款", "再贷","续贷" )

modeldata1[, "贷款类别"] <- ordered(

modeldata1[, "贷款类别"],

levels=c("新贷款", "再贷", "续贷"),

labels=c('新贷款', '再贷', '续贷')

);

table(modeldata1[, "贷款类别"])

#modeldata1[order(modeldata1[, "贷款类别"]),]

#名下物业数量_所有联名人

index <- is.na(realdata1$名下物业数量_所有联名人)

realdata1[index, "名下物业数量_所有联名人"] <- 0

index <- realdata1$名下物业数量_所有联名人 > 3

realdata1[index, "名下物业数量_所有联名人"] <- 3

#要求贷款期限_level

realdata1$要求贷款期限_level <- cut(realdata1$要求贷款期限, breaks = c(0,18,36),

include.lowest = FALSE, right = TRUE)

realdata1$HZ_score<-realdata1$HZ_score/100

realdata1$主贷人分数<-realdata1$主贷人分数/100

PSI <- NULL

########"HZ_score"

var_name <- "HZ_score"

breaks_v <- unique(quantile(modeldata1[,var_name], seq(0,1,.2), na.rm = TRUE))

N <- length(breaks_v)

breaks_v <- c(-99,breaks_v[2:(N-1)], Inf)

breaks_v

modeldata1$groups_v <- cut(modeldata1[, var_name], breaks = breaks_v, include.lowest = TRUE, right = FALSE)

index <- !is.na(modeldata1[,var_name])

t1 <- summary(modeldata1[index,"groups_v"])/sum(index)

realdata1$groups_v <- cut(realdata1[, var_name], breaks = breaks_v, include.lowest = TRUE, right = FALSE)

index <- !is.na(realdata1[,var_name])

t2 <- summary(realdata1[index,"groups_v"])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[1] <- sum((t2-t1)*log(t2/t1))

########"主贷人分数"

var_name <- "主贷人分数"

breaks_v <- unique(quantile(modeldata1[,var_name], seq(0,1,.2), na.rm = TRUE))

N <- length(breaks_v)

breaks_v <- c(-99,breaks_v[2:(N-1)], Inf)

breaks_v

modeldata1$groups_v <- cut(modeldata1[, var_name], breaks = breaks_v, include.lowest = TRUE, right = FALSE)

index <- !is.na(modeldata1[,var_name])

t1 <- summary(modeldata1[index,"groups_v"])/sum(index)

realdata1$groups_v <- cut(realdata1[, var_name], breaks = breaks_v, include.lowest = TRUE, right = FALSE)

index <- !is.na(realdata1[,var_name])

t2 <- summary(realdata1[index,"groups_v"])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[2] <- sum((t2-t1)*log(t2/t1))

########loan_query_12MA_level

modeldata1$loan_query_12MA_level<-as.character(modeldata1$loan_query_12MA_level)

var_name <- "loan_query_12MA_level"

index <- !is.na(modeldata1[,var_name])

t1 <- table(modeldata1[index,var_name])/sum(index)

index <- !is.na(realdata1[,var_name])

t2 <- table(realdata1[index,var_name])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[3] <- sum((t2-t1)*log(t2/t1))

#######未结清贷款笔数_level

#modeldata1$未结清贷款笔数_level<-as.character(modeldata1$未结清贷款笔数_level)

var_name <- "未结清贷款笔数_level"

index <- !is.na(modeldata1[,var_name])

t1 <- table(modeldata1[index,var_name])/sum(index)

index <- !is.na(realdata1[,var_name])

t2 <- table(realdata1[index,var_name])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[4] <- sum((t2-t1)*log(t2/t1))

########名下物业数量_所有联名人

#modeldata1$名下物业数量_所有联名人<-as.character(modeldata1$名下物业数量_所有联名人)

#realdata1$名下物业数量_所有联名人<-as.character(realdata1$名下物业数量_所有联名人)

var_name <- "名下物业数量_所有联名人"

index <- !is.na(modeldata1[,var_name])

t1 <- table(modeldata1[index,var_name])/sum(index)

index <- !is.na(realdata1[,var_name])

t2 <- table(realdata1[index,var_name])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[5] <- sum((t2-t1)*log(t2/t1))

########要求贷款期限_level

modeldata1$要求贷款期限_level<-as.character(modeldata1$要求贷款期限_level)

var_name <- "要求贷款期限_level"

index <- !is.na(modeldata1[,var_name])

t1 <- table(modeldata1[index,var_name])/sum(index)

index <- !is.na(realdata1[,var_name])

t2 <- table(realdata1[index,var_name])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[6] <- sum((t2-t1)*log(t2/t1))

###########最近1_3月信用卡是否逾期

var_name <- "最近1_3月信用卡是否逾期"

index <- !is.na(modeldata1[,var_name])

t1 <- table(modeldata1[index,var_name])/sum(index)

index <- !is.na(realdata1[,var_name])

t2 <- table(realdata1[index,var_name])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[7] <- sum((t2-t1)*log(t2/t1))

###########贷款类别

var_name <- "贷款类别"

index <- !is.na(modeldata1[,var_name])

t1 <- table(modeldata1[index,var_name])/sum(index)

index <- !is.na(realdata1[,var_name])

t2 <- table(realdata1[index,var_name])/sum(index)

sum((t2-t1)*log(t2/t1))

PSI[8] <- sum((t2-t1)*log(t2/t1))PSI<0.1 样本分布有微小变化 PSI 0.1~0.2 样本分布有变化 PSI>0.2 样本分布有显著变化

计算完建模变量的PSI值,需要重点关注PSI>0.2的变量,说明这几项的分布较建模时已经发生比较显著的变化,需要考虑是否是客户质量变化引起的PSI变动。

##### 观测PSI大于0.2的变量#####

xx<-tapply(Data$未结清贷款笔数, substr(aa$申请日期,1,7),mean, na.rm = TRUE)

write.table(xx, "clipboard", sep = "\t", col.names = FALSE, row.names = TRUE)

yy<-tapply(Data$名下物业数量_所有联名人, substr(aa$申请日期,1,7),mean, na.rm = TRUE)

write.table(yy, "clipboard", sep = "\t", col.names = FALSE, row.names = TRUE)

zz<-tapply(Data$要求贷款期限, substr(aa$申请日期,1,7),mean, na.rm = TRUE)

write.table(zz, "clipboard", sep = "\t", col.names = FALSE, row.names = TRUE)此为实例数据,可以看到PSI>0.2的变量较建模初期存在较大波动,风控部门提供监测数据,业务部门需总结变量出现异常性或趋势性波动的原因。

2. 坏账变现

以9个月内逾期60天为坏账标准,或12个月内逾期90天为坏账标准,观测模型的表现。(坏账标准具体需根据不同产品来定义) 我常用的坏账监测标准:60days/9m;90days/12m;30+监测(适用于续贷产品或催收评分卡) 监测所使用的统计量:可使用AUC,KS来监测评分卡模型在样本上的预测效果。

以后置评分卡监测过程为例,代码实现:

# 模型表现 60d/9M --------------------------------------------------------------

# 读取数据 合并

Data2016 <- read.csv("d:/sissi/Data/2016Data/HZ_score_201601_201606.csv", header = TRUE)

Data201607 <- read.csv("d:/sissi/Data/2016Data/HZ_score_201607_201612.csv", header = TRUE)

index <- Data2016$app_no %in% Data201607$app_no

Data2016 <- Data2016[!index,]

Data2016 <- rbind(Data2016, Data201607)

# 对数据进行新版分组

breaks_g <- c(0,

3.73,

4.45 ,

5.05 ,

5.61 ,

6.21 ,

6.87 ,

7.54 ,

8.25 ,

9.14 ,

10.02 ,

11.09 ,

12.13 ,

13.24 ,

14.66 ,

16.67 ,

19.20 ,

22.96 ,

28.73 ,

39.24 ,

100.00

)

Data2016$groups <- cut(Data2016$score, breaks = breaks_g, include.lowest = FALSE, right = TRUE)

# 读取Data Source需更新至最新

DS <- read.csv("D:/sissi/ds201710/DataSource-2017年10月10日.csv", header = TRUE)

Data2016 <- merge(Data2016, DS[,c("申请编号", "合同起始日", "状态.贷前.","录单营业部","贷款产品")], by.x = "app_no", by.y = "申请编号", all.x = TRUE)

Data2016 <- Data2016[Data2016$合同起始日!="",]

Data2016$合同起始日 <- as.Date(Data2016$合同起始日)

# 读取2015年数据

Data2015 <- read.csv("D:/sissi/后置/Score_HZ_201206_201512.csv", header = TRUE)

Data2015 <- Data2015[!duplicated(Data2015$app_no),]

Data2015 <- merge(Data2015, DS[,c("申请编号", "状态.贷前.", "合同起始日","是否联名贷款","实际贷款额度","要求贷款额度","录单营业部","贷款产品")], by.x = "app_no", by.y = "申请编号", all.x = TRUE)

Data2015 <- Data2015[Data2015$合同起始日!="",]

Data2015$合同起始日 <- as.Date(Data2015$合同起始日)

Data2015$groups <- cut(Data2015$pred_refitted*100, breaks = breaks_g, include.lowest = FALSE, right = TRUE)

Data2016$pred_refitted <- Data2016$score/100

# 合并数据

vars <- c( "app_no" , "合同起始日" ,"pred_refitted","状态.贷前.","groups","录单营业部","贷款产品")

Data_all <- rbind(Data2015[,vars], Data2016[,vars])

# 读取旧评分卡分数

old_score_card1 <- read.csv("D:/sissi/评分卡监测/20170206/旧版评分卡分数_201510_201608.csv")

old_score_card2<-SCORE_CARD_RESULT[,c("申请编号","后置评分卡计算结果")]

old_score_card<-rbind(old_score_card1,old_score_card2)

old_score_card<-old_score_card[!(duplicated(old_score_card$申请编号)),]

breaks_g_old <- c(0,6.84, 8.97, 10.58, 12.12, 13.4, 14.75,

16.19, 17.56, 19.02, 20.46, 22, 23.93, 26.14,

28.58, 31.46, 35.16, 39.76, 45.86, 54.97, 100)

old_score_card$后置评分卡计算结果<-as.numeric(old_score_card$后置评分卡计算结果)

old_score_card$分组 <- cut(old_score_card$后置评分卡计算结果, breaks = breaks_g_old, include.lowest = FALSE, right = TRUE)

old_score_card <- old_score_card[!duplicated(old_score_card$申请编号),]

# 从OverDueDate报表中读取9个月时的逾期状态 Dates中日期需更新至最新一月一号 OverDueDate报表需保存成csv格式

data_out <- NULL

Dates <- c("2012-01-01","2012-02-01","2012-03-01","2012-04-01","2012-05-01","2012-06-01",

"2012-07-01","2012-08-01","2012-09-01","2012-10-01","2012-11-01","2012-12-01",

"2013-01-01","2013-02-01","2013-03-01","2013-04-01","2013-05-01","2013-06-01",

"2013-07-01","2013-08-01","2013-09-01","2013-10-01","2013-11-01","2013-12-01",

"2014-01-01","2014-02-01","2014-03-01","2014-04-01","2014-05-01","2014-06-01",

"2014-07-01","2014-08-01","2014-09-01","2014-10-01","2014-11-01","2014-12-01",

"2015-01-01","2015-02-01","2015-03-01","2015-04-01","2015-05-01","2015-06-01",

"2015-07-01","2015-08-01","2015-09-01","2015-10-01","2015-11-01","2015-12-01",

"2016-01-01","2016-02-01","2016-03-01","2016-04-01","2016-05-01","2016-06-01",

"2016-07-01","2016-08-01","2016-09-01","2016-10-01","2016-11-01","2016-12-01",

"2017-01-01","2017-02-01","2017-03-01","2017-04-01","2017-05-01","2017-06-01",

"2017-07-01","2017-08-01","2017-09-01","2017-10-01")

Table <- matrix(nrow = 100, ncol = 7)

for (i in 1:(length(Dates)-10)) {

StartDate <- Dates[i]

EndDate <- Dates[i+1]

Date1 <- Dates[i+10]

file1 <- paste("D:/sissi/OverdueDaily/OverDueDate",Date1,".csv",sep = "")

overdue <- read.csv(file1, header = TRUE, sep = ",")

data <- subset(Data_all, Data_all$合同起始日 < EndDate & Data_all$合同起始日 >= StartDate)

if (dim(data)[1]==0) {next }

data <- merge(data, overdue[, c("申请编号","逾期天数","逾期日期","贷款剩余本金","账户状态")],

by.x = "app_no", by.y = "申请编号", all.x = TRUE)

data[is.na(data$逾期天数), "逾期天数"] <- 0

data$overdue60 <- ifelse(data$逾期天数>=60, TRUE, FALSE)

index <- !is.na(data$账户状态) & data$账户状态 %in% c("ACCOOA","RWOCOOA", "RWOCORA", "RWOCOXX","WOCOOA", "WOCORA", "WOCOXX")

data[index, "overdue60"] <- TRUE

index <- data$overdue60 == FALSE

data[index, "贷款剩余本金"] <- 0

data <- data[,c("app_no","逾期日期","逾期天数","overdue60","贷款剩余本金")]

if (is.null(data_out)) {

data_out <- data

} else {

data_out <- rbind(data_out,data)

}

}

Data_all <- merge(Data_all, data_out[,c("app_no", "overdue60","贷款剩余本金")], by = "app_no", all.x = TRUE)

Data_all <- merge(Data_all, DS[,c("申请编号", "实际贷款额度", "贷款类别","申请日期","合作方")], by.x = "app_no", by.y = "申请编号", all.x = TRUE)

Data_all$申请日期 <- as.Date(Data_all$申请日期)

Data_all <- subset(Data_all, Data_all$状态.贷前.=="AC" & Data_all$贷款类别 != "续贷")

Data_all <- merge(Data_all, old_score_card[, c("申请编号", "后置评分卡计算结果","分组")],

by.x = "app_no", by.y = "申请编号", all.x = TRUE)

# 有2笔债务重组无评分卡分数

index <- !is.na(Data_all$后置评分卡计算结果) & !is.na(Data_all$overdue60) &

Data_all$合同起始日 >= "2015-11-01" & Data_all$申请日期 >= "2015-11-01" & !is.na(Data_all$overdue60)

# 旧版评分卡AUC

gbm.roc.area(Data_all[index,"overdue60"],Data_all[index,"后置评分卡计算结果"]/100)

# 新版评分卡AUC

gbm.roc.area(Data_all[index,"overdue60"],Data_all[index,"pred_refitted"])

subData1 <- Data_all[index,]

# 新版评分卡KS

b_points <- quantile(subData1$pred_refitted, seq(0,1,.01))

C_R <- NULL

C_N <- NULL

for (i in 1:100){

index <- subData1$pred_refitted<=b_points[i+1]

C_R[i] <- sum(subData1[index, "overdue60"]==1)/sum(subData1[,"overdue60"]==1)

C_N[i] <- sum(subData1[index, "overdue60"]==0)/sum(subData1[,"overdue60"]==0)

}

KS <- max(C_N - C_R)

KS

# 旧版评分卡 KS

b_points <- quantile(subData1$后置评分卡计算结果/100, seq(0,1,.01))

C_R <- NULL

C_N <- NULL

for (i in 1:100){

index <- subData1$后置评分卡计算结果/100<=b_points[i+1]

C_R[i] <- sum(subData1[index, "overdue60"]==1)/sum(subData1[,"overdue60"]==1)

C_N[i] <- sum(subData1[index, "overdue60"]==0)/sum(subData1[,"overdue60"]==0)

}

KS <- max(C_N - C_R)

KS

# 新版每组坏账 (A/C)

tab <- tapply(subData1$overdue60, subData1$groups, mean)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 新版每组样本量

tab <- tapply(subData1$overdue60, subData1$groups, length)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

#新版每组占比

tab <- tapply(subData1$overdue60, subData1$groups, length)/dim(subData1)[1]

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 新版每组逾期金额

tab <- tapply(subData1$贷款剩余本金, subData1$groups, sum)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 新版每组合同金额

tab <- tapply(subData1$实际贷款额度, subData1$groups, sum)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 旧版每组坏账 (A/C)

tab <- tapply(subData1$overdue60, subData1$分组, mean)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 旧版每组样本量

tab <- tapply(subData1$overdue60, subData1$分组, length)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

#旧版每组占比

tab <- tapply(subData1$overdue60, subData1$分组, length)/dim(subData1)[1]

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 旧版每组逾期金额

tab <- tapply(subData1$贷款剩余本金, subData1$分组, sum)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 旧版每组合同金额

tab <- tapply(subData1$实际贷款额度, subData1$分组, sum)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)

# 按新版每组比例对旧版进行重新分组 将新版cumulative占比结果更新至下面quantile函数

breaks_g <- quantile(subData1$后置评分卡计算结果, c(0, 0.0626,

0.1170 ,

0.1749 ,

0.2244 ,

0.2863 ,

0.3463 ,

0.3997 ,

0.4527 ,

0.5158 ,

0.5744 ,

0.6339 ,

0.6783 ,

0.7214 ,

0.7686 ,

0.8232 ,

0.8691 ,

0.9108 ,

0.9522 ,

0.9835 ,

1.0000

))

subData1$分组_new <- cut(subData1$后置评分卡计算结果, breaks = breaks_g, include.lowest = TRUE, right = FALSE )

# 旧版新分组 坏账率(A/C)

tab <- tapply(subData1$overdue60, subData1$分组_new, mean)

write.table(tab, "clipboard", sep = "\t")

# 旧版新分组 样本量

tab <- tapply(subData1$overdue60, subData1$分组_new, length)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE)

# 旧版新分组 逾期金额

tab <- tapply(subData1$贷款剩余本金, subData1$分组_new, sum)

write.table(tab, "clipboard", sep = "\t")

# 旧版新分组 合同金额

tab <- tapply(subData1$实际贷款额度, subData1$分组_new, sum)

write.table(tab, "clipboard", sep = "\t", row.names = FALSE, col.names = FALSE)3. 拒绝原因

针对每个变量,根据其取值,按照样本量平均分为3~5组,计算每一组中的平均得分。对每一个客户的各个变量,根据实际值落入的组判断对应的平均分X, 再减去该变量各组平均分的最小值X_min, X-X_min为该变量对应的差值。将每个变量对应的差值从高到低排序,输出头三个不同的拒绝原因。例如,最近120天内查询这个变量,根据其样本中的取值,可以分为5组,每组中的平均分数如下:

某客户,其最近120天内查询次数为4次,落入第四组,该组平均得分为14.36,全部5组中,最低分为7.3,所以该客户这个变量对应的差值为7.06. 对应的拒绝原因为“近期征信查询过多”。将该客户的所有变量按照同样的方法计算差值,再排序,可得到输出的拒绝原因。

该部分代码主要监测被拒绝客户的拒绝原因,以及被评分卡拒绝的客户的拒绝原因明细。

# 读取拒绝原因 需更新至最新

RJ_REASON <- read.table("D:/sissi/评分卡监测/20171017/V_RJ_REASON_DETAIL.txt", header = TRUE,stringsAsFactors=FALSE)

RJ_REASON1 <- read.table("D:/sissi/评分卡监测/20171017/V_RJ_REASON_DETAIL1.txt", header = TRUE,stringsAsFactors=FALSE)

RJ_REASON<-rbind(RJ_REASON,RJ_REASON1)

RJ_REASON<-RJ_REASON[!(duplicated(RJ_REASON$申请编号)),]

RJ_REASON <- RJ_REASON[RJ_REASON$申请编号!="null" & !is.na(RJ_REASON$申请编号),]

RealData <- merge(RealData, SCORE_CARD_RESULT[, c("申请编号", "后置评分卡计算结果", "后置评分卡分组")],

by.x = "app_no", by.y = "申请编号", all.x = TRUE)

RealData <- merge(RealData, RJ_REASON[, c("申请编号", "状态","拒绝原因","贷款类型","贷款产品")],

by.x = "app_no", by.y = "申请编号", all.x = TRUE)

RealData <- merge(RealData, DS[, c("申请编号", "状态.贷前.", "主拒绝原因" )], by.x = "app_no", by.y = "申请编号", all.x = TRUE)

index <- is.na(RealData$状态)

RealData[index, "状态"] <- RealData[index, "状态.贷前."]

# 拒绝原因 --------------------------------------------------------------------

index <- is.na(RealData$拒绝原因) | RealData$拒绝原因 == "null"

RealData$拒绝原因 <- as.character(RealData$拒绝原因)

RealData[index, "拒绝原因"] <- as.character(RealData[index, "主拒绝原因"])

index <- RealData$状态.贷前.=="RJ"

subData <- RealData[index,]

summary(subData)

# 整体被拒绝原因

library(stringr)

temp <- unlist(str_split(subData[,"拒绝原因"], ","))

tab <- summary(as.factor(temp))

write.table(tab, "clipboard", sep = "\t")

# 被评分卡拒绝的

index <- RealData$状态.贷前.=="RJ" & grepl("综合评分差", RealData$拒绝原因)

subData <- RealData[index,]

# 拒绝原因1

tab <- summary(subData$RJ_reason1)

write.table(tab, "clipboard", sep = "\t")

# 拒绝原因2

tab <- summary(subData$RJ_reason2)

write.table(tab, "clipboard", sep = "\t")

# 拒绝原因3

tab <- summary(subData$RJ_reason3)

write.table(tab, "clipboard", sep = "\t")关于监测频率,对于一般金融产品,以每月一次的监测频率进行监测;对于催收评分卡或某些特殊需求的金融产品,需每周做一次监测。监测结果需定时上传,在监测指标明显波动的情况下需考虑更新或重建评分卡。