- COLLABORATION STRATEGIES

合作战略

Open Banking players are learning from the collaborative strategies used in fintech lending.

开放银行参与者正在学习金融科技贷款业务中使用的协作策略。

Whereas the early stages of online lending innovation were marked by debate over whether fintechs or banks would ‘win’ market leadership and how, banks and fintechs in Open Banking are starting early on combining their strengths.

在线借贷创新的早期阶段被人们议论纷纷的主题是,金融科技公司和银行哪个将获得市场领导地位以及如何做,银行和金融科技公司正在开放银行中进行其优势的初期结合。

Indeed, collaboration is now an unavoidable strategy in this space.

实际上,现在,合作在这个领域是不可避免的战略。

The collaborations are taking the form of partnerships as well as early M&A activity.

合作采用的方式有合作伙伴形式以及早期的并购活动。

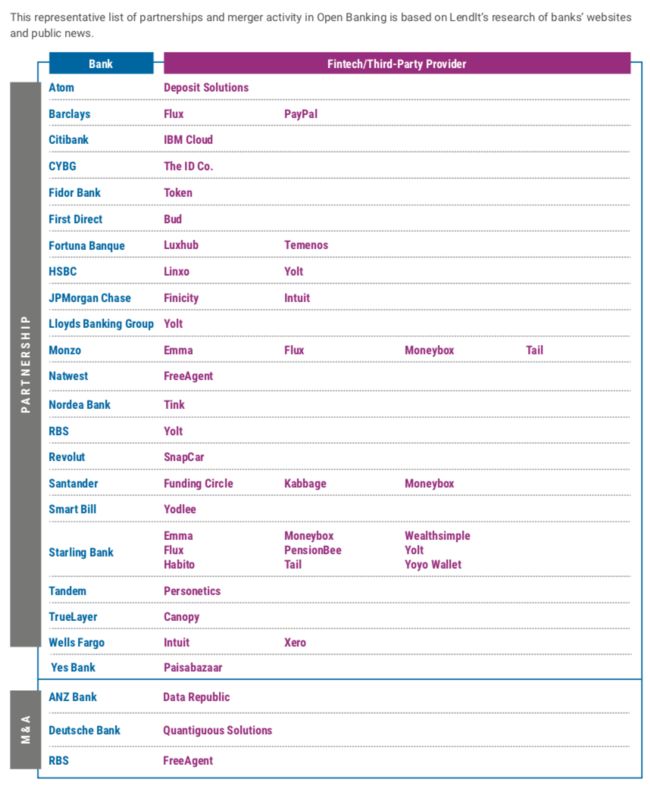

Recent M&A or partnerships of leading banks in the Open Banking space:

最近在开放银行领域的主要银行合作或并购:

During the past year, banks, fintech startups, and TPPs have been collaborating to launch new apps and services.

在过去的一年中,银行、金融科技公司和第三方服务提供尚一直在合作推出新的应用和服务。

In addition, large incumbent banks are also creating APIs in-house, as well as collaborating with small fintech startups to integrate innovative technologies.

此外,大型负担银行也在内部创建API,并与小型金融科技公司合作整合创新技术。

(注:Incumbent Bank 负担银行 ,Direct Bank 直销银行,前者有线下网点等繁复的组织结构,后者依靠信息技术纯在线服务)

For example, First Direct, a subsidiary of HSBC, entered into a partnership with London-based fintech Bud, which is providing the API integration layer to connect financial services from scores of providers into one app.

例如,汇丰的子公司First Direct与总部位于伦敦的金融科技公司Bud建立了合作关系,提供API集成层,将来自数十家供应商的金融服务连接到一个应用中。

Meanwhile, Barclays tied up with PayPal to offer customer services to manage their money and payments.

与此同时,巴克莱与PayPal合作提供客户服务来管理他们的资金和支付。

In addition, Starling Bank partnered with Flux, an app that collects loyalty cards into a single online wallet.

此外,Starling Bank与Flux合作,推出一款应用将会员卡收集到一个在线钱包中。

Many other traditional banks are working on their in-house capabilities: HSBC has ‘Connected Money’ while BBVA has Denizen.

许多其他传统银行正在耕耘其内部能力:汇丰银行拥有“Connected Money”,而BBVA拥有Denizen。

These partnerships incorporate spending analyzer, money management, loyalty management, budget management, digital receipts, and debt tracking as their key services.

这些合作混合支出分析、资金管理、会员管理、预算管理,数字收据和债务跟踪为一体作为其关键服务。

This representative list of partnerships and merger activity in Open Banking is based on LendIt’s research of banks’ websites and public news.

这份具有代表性的开放银行合伙与合并活动清单,来源于朗迪对银行网站和公共新闻的研究。

Threat of disintermediation

脱媒的威胁

(注:脱媒,去中介)

Open APIs help modularize the functions of customer acquisition, user application development, sophisticated advisory services, and back-office processing.

开放API有助于模块化获客、用户应用开发、复杂咨询服务和后台处理等功能。

This raises existential questions for today’s financial services leaders about which activities to keep in-house, which will deliver long-term profitability, and how to retain customer loyalty in an environment where the end-users’ primary attachment may be to someone else’s application.

这为今天的金融服务领导者提出了存在的问题,即哪些活动要保留在内部,哪些可以带来长期盈利,以及如何在最终用户的主要粘性可能在其他应用程序的环境中保持客户忠诚度。

Traditional banks:

传统银行

• Third-party providers or fintech players may disintermediate banks’ interaction with customersby offering low cost, innovative financial products by accessing bank’s data.

第三方提供商或金融科技公司可通过访问银行数据提供低成本、创新的金融产品,可能会消灭银行作为中介与客户的互动。

(注:disintermediate,去中介,的意思是减少或消除生产者和消费者之间使用中介。)

Big banks facing threat of disintermediation are partnering with third-party providers and fintech companies to offer a wide range of services to help their customers. 面临脱媒威胁的大银行正在与第三方供应商和金融科技公司合作,提供广泛的服务来帮助他们的客户。

• Major banks have launched their own APIs through fintech ventures/apps.

很多银行通过金融科技投资或应用推出了自己的API。

(注:ventures 风投,指银行自己投资金融科技)

For example ING-owned Yolt allows users to optimize their money management by letting them see the balances of their bank accounts from multiple banks.

例如,ING旗下的Yolt允许让用户查看自己来自多家银行的账户余额来优化用户的资金管理。

CMA9 and challenger banks such as Monzo also are collaborating with Yolt.

CMA9和Monzo等挑战者银行也与Yolt合作。

To address disintermediation head-on, Nigel Verdon, CEO of Railsbank, proposes that traditional banks consider incorporating a ‘utility bank’ strategy, where they are paid by the customer-facing company to provide core deposit services as well as reinforce consumer trust.

为了正面解决脱媒问题,Railsbank的首席执行官Nigel Verdon建议传统银行考虑采用“公用银行”战略,为面向客户的公司支付提供核心存款服务以加强消费者信任。

(注:公用银行(Utility Banking)和赌场银行 (Casino Banking)这两个词首先由英国《金融时报》评论员马丁·沃尔夫(Martin Wolf) 在 2008 年 9 月的一次公开讨论中提出,金融危机后被广泛引用。虽然没有严格的定义,但这两个词要表达的意思还是比较清楚的。金融服务有两大类:一类是所有人都需要的基本服务,比如稳定的支付结算系统;另一类是只适合一部分人的风险投资。)

“Traditionally with consumer bank accounts, the cost of customer acquisition could be USD 350 while the lifetime value was only USD 250; a losing proposition. With a utility banking model, the cost of acquiring a customer account could be USD 10 while the lifetime value of that account may be USD 40 - profitable, even though the bank no longer owns the customer relationship.”

传统上消费者银行的账户,获客成本可能是350美元,与此同时其存续期价值仅为250美元;是个赔本买卖。使用公用银行模式,获取客户账户的成本可能是10美元,而该账户的存续期价值可能是40美元 - 即使银行不再拥有客户关系也是有利可图的。

This approach of course can complement direct customer acquisition and retention, if the bank carefully distinguishes customer segments and matches them to the optimal channels. 如果银行仔细区分客户群并将其与最佳渠道相匹配,这种方法当然可以补足直接客户的获取和保留。

Payment service providers (PSPs):

支付服务提供商

• Open Banking is likely to impact payment service providers such as Visa, PayPal, and MasterCard due to disintermediation.

由于脱媒,开放银行可能会影响Visa、PayPal和MasterCard等支付服务提供商。

Visa and Mastercard are responding by playing the role of facilitator, building trust in the ecosystem to drive Open Banking transformation.

Visa和Mastercard以促进者的角色为己任,为生态系统建立信任来推动开放银行转型。

These players are forging partnerships across the value chain to be part of the next phase of innovation in payments, endorsing the Open Banking initiative and the new line of up-and-coming fintech players.

这些参与者正在整个价值链上建立伙伴关系,成为下一阶段支付创新的一部分,背书开放银行倡议和新一代即将到来的金融科技公司。

• Mastercard plans to facilitate the Open Banking transformation by offering solutions such as a directory of third-party providers, fraud monitoring services, dispute resolution mechanisms, and connectivity hubs that will help third-parties establish and maintain communication with banks.

万事达卡组织计划通过提供第三方供应商目录、欺诈监控服务、争议解决机制和帮助第三方与银行建立和维持沟通的连接中心等解决方案来促进开放银行的转型。

• Visa is focusing on partnerships and investments (USD 100 Mn investment fund) in fintech startups to build APIs for third-party providers and banks for transaction processing, authorization, fraud prevention self- checkouts, and people-to-people payments.

Visa专注于金融科技创业公司的合作和投资(1亿美元投资基金),为第三方提供商和银行构建API,用于交易处理,验证授权,防欺诈自助结算和点对点付款。

Despite these steps, fintech companies such as Vibe Pay are likely to diminish the dominance of well-established payment gateways and traditional banking products (debit/ credit cards).

尽管采取了这些措施,Vibe Pay等金融科技公司很可能会削弱固有的支付网关与传统银行产品(借记卡/信用卡)的主导地位。

Because of open APIs, which allow for peer- to-peer transfers among application providers and funds repositories, no longer is a central “switch” essential to the clearance of transactions.

由于开放API允许应用提供商和资金存储节点之间的点对点传输,因此清算交易的中央“交换”不再是必须。

(注:no longer is … 倒装还原 It is no longer that a central “switch”essential to the clearance of transactions.)

If banks are willing to challenge their a priori beliefs, there are multiple ways to win in this new world.

如果银行愿意挑战他们的先验信念,那么在这个新世界中有多种方式可以获胜。