目录

- QuantLib 金融计算——收益率曲线之构建曲线(4)

- 概述

- 三次样条函数与期限结构

- knots 的选择

- 实现三次样条函数

- 实现拟合方法

- 测试

- 参考文献

如果未做特别说明,文中的程序都是 C++11 代码。

QuantLib 金融计算——收益率曲线之构建曲线(4)

本文代码对应的 QuantLib 版本是 1.15。相关源代码可以在 QuantLibEx 找到。

概述

QuantLib 中提供了用三次 B 样条函数拟合期限结构的功能,但是,并未提供使用三次样条函数拟合期限结构的功能。本文展示了如何在 QuantLib 的框架内实现三次样条函数,并拟合期限结构。

示例所用的样本券交易数据来自专门进行期限结构分析的 R 包——termstrc。具体来说是数据集 govbonds 中的 GERMANY 部分,包含 2008-01-30 这一天德国市场上 52 只固息债的成交数据。

注意:为了适配 QuantLib,实际计算中删除了两只债券的数据,以保证所有样本券的到期时间均不相同。样本券数据在《收益率曲线之构建曲线(3)》的附录中列出。

三次样条函数与期限结构

用三次样条函数拟合期限结构,实质上是用若干三次样条函数的组合近似贴现因子曲线的形状,

\[ d(t,\beta) = 1 + \sum_{l=1}^n \beta_l c_l(t) \]

贴现因子 \(d(t,\beta)\) 表示为三次样条函数的线性组合,\(\beta_l\) 是最优化计算需要估计出的参数。

三次样条函数 \(c_l(t)\) 的形式基于文献 (Ferstl and Hayden, 2010),

\[ \begin{cases} & \text{ if } l=n, c_l(t)=t\\ & \text{ else }, c_{l}\left(t\right)= \left\{\begin{array}{ll} 0 & {t

对于有 \(n\) 个参数的贴现因子曲线,用户需要提供 \(n-1\) 个 knots \(k_i(1\le i\lt n)\),并令 \(k_0 = 0\) 以及 \(k_n = k_{n-1}\)。

knots 的选择

knots 的选择基于文献 (McCulloch, 1975),也可以参考文献 (Ferstl and Hayden, 2010),

\[ \begin{cases} & \text{ if } l=1, k_l = 0\\ & \text{ else if } l=n-1,k_l=m_N \\ & \text{ else }, k_l = m_h + \theta(m_{h+1} - m_h) \end{cases} \]

其中,\(h=\left\lceil\frac{(l-1) k}{n-2}\right\rceil\),\(\theta=\frac{(l-1) k}{n-2}-h\),\(n = \left\lfloor\sqrt{k}+0.5 \right\rfloor\),\(m_i(1 \le i\le N)\) 是升序排列后样本券的剩余期限。

实现三次样条函数

三次样条函数类 CubicSpline 的实现仿照已存在的 BSpline 类,

CubicSpline.hpp

class CubicSpline {

public:

CubicSpline(const std::vector& knots);

~CubicSpline();

Real operator()(Natural i, Real x) const;

private:

Size n_;

std::vector knots_ex_;

}; CubicSpline.cpp

CubicSpline::CubicSpline(const std::vector& knots)

: n_(knots.size() + 1), knots_ex_(knots) {

knots_ex_.insert(knots_ex_.begin(), 0.0);

knots_ex_.insert(knots_ex_.end(), knots.back());

}

CubicSpline::~CubicSpline() {

}

Real CubicSpline::operator()(Natural i, Real x) const {

using namespace std;

if (i < n_) {

Real q = knots_ex_[i], q_minus = knots_ex_[i - 1], q_plus = knots_ex_[i + 1];

if (x < q_minus) {

return 0.0;

} else if (q_minus <= x and x < q) {

return pow(x - q_minus, 3) / (6.0 * (q - q_minus));

} else if (q <= x and x < q_plus) {

return pow(q - q_minus, 2) / 6.0

+ (q - q_minus) * (x - q) / 2.0

+ pow(x - q, 2) / 2.0

- pow(x - q, 3) / (6.0 * (q_plus - q));

} else {

return (q_plus - q_minus)

* ((2.0 * q_plus - q - q_minus) / 6.0

+ (x - q_plus) / 2.0);

}

} else {

return x;

}

} 实现拟合方法

拟合方法 CubicSplinesFitting 的实现仿照已存在的 CubicBSplinesFitting 类,两者均是 FittedBondDiscountCurve::FittingMethod 的派生类,

CubicSplinesFitting.hpp

class CubicSplinesFitting

: public FittedBondDiscountCurve::FittingMethod {

public:

CubicSplinesFitting(const std::vectorCubicSplinesFitting.cpp

CubicSplinesFitting::CubicSplinesFitting(const std::vector& knots,

const Array& weights,

ext::shared_ptr optimizationMethod,

const Array& l2)

: FittedBondDiscountCurve::FittingMethod(

false, weights, optimizationMethod, l2),

splines_(knots) {

Size basisFunctions = knots.size() + 1;

size_ = basisFunctions;

N_ = 0;

}

CubicSplinesFitting::CubicSplinesFitting(const std::vector& knots,

const Array& weights,

const Array& l2)

: FittedBondDiscountCurve::FittingMethod(

false, weights, ext::shared_ptr(), l2),

splines_(knots) {

Size basisFunctions = knots.size() + 1;

size_ = basisFunctions;

N_ = 0;

}

Real CubicSplinesFitting::basisFunction(Integer i,

Time t) const {

return splines_(i, t);

}

QL_UNIQUE_OR_AUTO_PTR CubicSplinesFitting::clone() const {

return QL_UNIQUE_OR_AUTO_PTR(

new CubicSplinesFitting(*this));

}

Size CubicSplinesFitting::size() const {

return size_;

}

DiscountFactor CubicSplinesFitting::discountFunction(const Array& x,

Time t) const {

DiscountFactor d = 1.0;

for (Size i = 0; i < size_; ++i) {

d += x[i] * splines_(i + 1, t);

}

return d;

}

std::vector CubicSplinesFitting::autoKnots(const std::vector& maturities) {

using namespace std;

vector m(maturities);

sort(m.begin(), m.end());

Size k = m.size();

Size n(floor(sqrt(k) + 0.5));

vector knots(n - 1);

knots[0] = 0.0;

knots[n - 1] = m.back();

for (Size l = 1; l < n - 1; ++l) {

Size h(ceil(Real(l * k) / Real(n - 2)));

Real theta = Real(l * k) / Real(n - 2) - h;

knots[l] = m[h - 1] + theta * (m[h] - m[h - 1]);

}

return knots;

} 测试

用上述两个类拟合样本券的期限结构,并和 termstrc 的结果做比较。

辅助函数 CubicSplineSpotRate 用于将样条函数表示的贴现因子转换成即期利率。

QuantLib::Real CubicSplineSpotRate(const std::vector& knots,

const QuantLib::Array& weights,

const QuantLib::Time& t) {

using namespace std;

using namespace QuantLib;

CubicSpline spline(knots);

Size s = weights.size();

Real d = 1.0, r;

for (Size i = 0; i < s; ++i) {

d += weights[i] * spline(i + 1, t);

}

r = -std::log(d) / t;

return r;

} 测试函数

void TestCubicSplineFitting() {

using namespace std;

using namespace QuantLib;

// 样本券数据,以及相关配置

Size bondNum = 50;

vector cleanPrice = {

100.002, 99.92, 99.805, 99.75, 100.305, 99.76, 99.75, 99.975, 100.0416, 100.0574,

99.5049, 101.0971, 101.137, 100.7199, 99.8883, 100.908, 103.3553, 99.5034, 103.913, 97.4229,

104.5636, 99.7527, 104.3708, 99.6051, 104.8603, 101.3415, 105.29, 102.4969, 103.7602, 100.2803,

102.6046, 102.5291, 99.4748, 95.9702, 97.1815, 114.2849, 100.2847, 112.23, 98.397, 102.0235,

99.8483, 121.2711, 125.9157, 114.5791, 103.2202, 123.4668, 113.4694, 103.1873, 91.5603, 95.4441};

vector> priceHandle(bondNum);

for (Size i = 0; i < bondNum; ++i) {

ext::shared_ptr q(

new SimpleQuote(cleanPrice[i]));

Handle hq(q);

priceHandle[i] = hq;

}

vector issueYear = {

2002, 2006, 2003, 2006, 1998, 2006, 2003, 2006, 1999, 2007,

2004, 2007, 1999, 2007, 2004, 2007, 1999, 2005, 2000, 2005,

2000, 2006, 2001, 2006, 2001, 2007, 2002, 2007, 2002, 2003,

2003, 2004, 2004, 2005, 2005, 1986, 2006, 1986, 2006, 2007,

2007, 1993, 1997, 1998, 1998, 2000, 2000, 2003, 2004, 2006};

vector issueMonth = {

Aug, Mar, Apr, May, Jul, Aug, Sep, Nov, Jan, Feb,

Feb, May, Jul, Aug, Aug, Sep, Oct, Feb, May, Aug,

Sep, Feb, May, Aug, Dec, Feb, Jun, Aug, Dec, Jun,

Oct, Apr, Oct, Apr, Oct, Jun, Apr, Sep, Oct, Apr,

Sep, Dec, Jul, Jan, Oct, Jan, Oct, Jan, Dec, Dec};

vector issueDay = {

14, 8, 11, 30, 4, 30, 25, 30, 4, 28, 2, 30, 4, 24, 25, 21, 22,

24, 5, 26, 29, 26, 23, 30, 28, 28, 26, 24, 31, 24, 21, 25, 27, 28,

30, 20, 26, 20, 31, 27, 21, 29, 3, 4, 7, 4, 27, 22, 24, 28};

vector maturityYear = {

2008, 2008, 2008, 2008, 2008, 2008, 2008, 2008, 2009, 2009,

2009, 2009, 2009, 2009, 2009, 2009, 2010, 2010, 2010, 2010,

2011, 2011, 2011, 2011, 2012, 2012, 2012, 2012, 2013, 2013,

2014, 2014, 2015, 2015, 2016, 2016, 2016, 2016, 2017, 2017,

2018, 2024, 2027, 2028, 2028, 2030, 2031, 2034, 2037, 2039};

vector maturityMonth = {

Feb, Mar, Apr, Jun, Jul, Sep, Oct, Dec, Jan, Mar,

Apr, Jun, Jul, Sep, Oct, Dec, Jan, Apr, Jul, Oct,

Jan, Apr, Jul, Oct, Jan, Apr, Jul, Oct, Jan, Jul,

Jan, Jul, Jan, Jul, Jan, Jun, Jul, Sep, Jan, Jul,

Jan, Jan, Jul, Jan, Jul, Jan, Jan, Jul, Jan, Jul};

vector maturityDay = {

15, 14, 11, 13, 4, 12, 10, 12, 4, 13, 17, 12, 4, 11, 9, 11,

4, 9, 4, 8, 4, 8, 4, 14, 4, 13, 4, 12, 4, 4, 4, 4, 4, 4, 4,

20, 4, 20, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4, 4};

vector issueDate(bondNum), maturityDate(bondNum);

for (Size i = 0; i < bondNum; ++i) {

Date idate(issueDay[i], issueMonth[i], issueYear[i]);

Date mdate(maturityDay[i], maturityMonth[i], maturityYear[i]);

issueDate[i] = idate;

maturityDate[i] = mdate;

}

vector couponRate = {

0.0425, 0.03, 0.03, 0.0325, 0.0475, 0.035, 0.035, 0.0375, 0.0375, 0.0375,

0.0325, 0.045, 0.045, 0.04, 0.035, 0.04, 0.05375, 0.0325, 0.0525, 0.025,

0.0525, 0.035, 0.05, 0.035, 0.05, 0.04, 0.05, 0.0425, 0.045, 0.0375, 0.0425,

0.0425, 0.0375, 0.0325, 0.035, 0.06, 0.04, 0.05625, 0.0375, 0.0425, 0.04,

0.0625, 0.065, 0.05625, 0.0475, 0.0625, 0.055, 0.0475, 0.04, 0.0425};

Frequency frequency = Annual;

Actual365Fixed dayCounter(Actual365Fixed::Standard);

BusinessDayConvention paymentConv = Unadjusted;

BusinessDayConvention terminationDateConv = Unadjusted;

BusinessDayConvention convention = Unadjusted;

Real redemption = 100.0;

Real faceAmount = 100.0;

Germany calendar(Germany::Eurex);

Date today = calendar.adjust(Date(30, Jan, 2008));

Settings::instance().evaluationDate() = today;

Natural bondSettlementDays = 0;

Date bondSettlementDate = calendar.advance(

today,

Period(bondSettlementDays, Days));

vector> instruments(bondNum);

vector maturity(bondNum);

// 配置 helper

for (Size i = 0; i < bondNum; ++i) {

vector bondCoupon = {couponRate[i]};

Schedule schedule(

issueDate[i],

maturityDate[i],

Period(frequency),

calendar,

convention,

terminationDateConv,

DateGeneration::Backward,

false);

ext::shared_ptr helper(

new FixedRateBondHelper(

priceHandle[i],

bondSettlementDays,

faceAmount,

schedule,

bondCoupon,

dayCounter,

paymentConv,

redemption));

maturity[i] = dayCounter.yearFraction(

bondSettlementDate, helper->maturityDate());

instruments[i] = helper;

}

Real tolerance = 1.0e-6;

Natural max = 5000;

ext::shared_ptr optMethod(

new LevenbergMarquardt());

vector knots = CubicSplinesFitting::autoKnots(maturity);

vector termstrcKnotes = {

0.000000, 1.006027, 2.380274, 5.033425, 9.234521, 31.446575};

cout << "QuantLib knots:\t";

for (auto v : knots) {

cout << setprecision(6) << fixed << v << ", ";

}

cout << endl;

cout << "termstrc knots:\t";

for (auto v : termstrcKnotes) {

cout << setprecision(6) << fixed << v << ", ";

}

cout << endl;

cout << endl;

CubicSplinesFitting csf(

knots, Array(), optMethod);

FittedBondDiscountCurve tsCubicSplines(

bondSettlementDate,

instruments, dayCounter,

csf, tolerance, max);

Array weights = tsCubicSplines.fitResults().solution();

Array termstrcWeights(7);

termstrcWeights[0] = 1.9320e-02, termstrcWeights[1] = -8.4936e-05,

termstrcWeights[2] = -3.2009e-04, termstrcWeights[3] = -3.7101e-04,

termstrcWeights[4] = 7.2921e-04, termstrcWeights[5] = 2.0159e-03,

termstrcWeights[6] = -4.1632e-02;

cout << "QuantLib weights: \t" << weights << endl;

cout << "termstrc weights: \t" << termstrcWeights << endl;

cout << endl;

cout << "QuantLib final cost value:\t"

<< tsCubicSplines.fitResults().minimumCostValue() << endl;

cout << endl;

// 比较 QuantLib 和 termstrc 的结果

Real spotRate, termstrcSpot;

for (Size i = 0; i < bondNum; ++i) {

Time t = dayCounter.yearFraction(

bondSettlementDate, maturityDate[i]);

spotRate =

tsCubicSplines.zeroRate(t, Compounding::Continuous, frequency).rate() * 100.0;

termstrcSpot =

CubicSplineSpotRate(termstrcKnotes, termstrcWeights, t) * 100.0;

cout << setprecision(3) << fixed

<< t << ",\t"

<< spotRate << ",\t"

<< termstrcSpot << ",\t"

<< spotRate - termstrcSpot << endl;

}

}

部分结果:

QuantLib knots: 0.000000, 1.117808, 2.690411, 5.430137, 9.432877, 31.446575,

termstrc knots: 0.000000, 1.006027, 2.380274, 5.033425, 9.234521, 31.446575,

QuantLib weights: [ 0.005281; 0.004565; -0.002934; 0.000804; 0.000652; 0.001886; -0.038316 ]

termstrc weights: [ 0.019320; -0.000085; -0.000320; -0.000371; 0.000729; 0.002016; -0.041632 ]

QuantLib final cost value: 0.000338

0.044, 3.823, 4.125, -0.302

0.121, 3.809, 4.061, -0.253

0.197, 3.794, 4.001, -0.207

0.370, 3.761, 3.878, -0.116

...

..

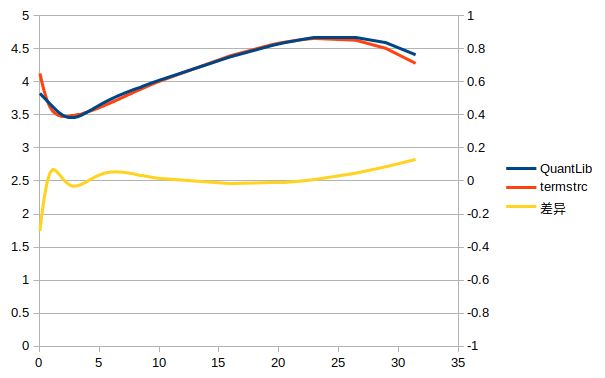

.图 1:结果对比

注意:尽管以 termstrc 的结果作为基准,并不意味着基准就是正确答案。

由于样本券的数量不同(termstrc 使用了 52 只券),两者的 knots 差异较大。同时,因为优化方法的不同(termstrc 使用 OLS,QuantLib 使用 Levenberg-Marquardt 算法),估计出的参数也有差异。最终导致两个期限结构在两端差异较大。

不过,考虑到最终的 cost value,QuantLib 的结果可能更好一些。

参考文献

- Ferstl.R, Hayden.J (2010). "Zero-Coupon Yield Curve Estimation with the Package

termstrc." Journal of Statistical Software, Volume 36, Issue 1. - McCulloch JH (1975). "The Tax-Adjusted Yield Curve." The Journal of Finance, 30(3), 811–830.