MSc Quantitative Finance

Full time 1 Year

Programme Description

This specialist course gives you a thorough understanding of the full range of quantitative methods needed for financial decision making.

这门专业课程让你对金融决策所需的各种定量方法有一个全面的了解。

Programme Structure

During the course you will be taking 180 credits in all. The eight taught modules during semester one and two total 120 credits and consists of both compulsory and optional taught units which can be viewed in the list below.

一共需要完成180学分。必修课选修课合计120学分

Over the summer period, you will carry out your Research Dissertation, worth 60 credits. The dissertation gives you the opportunity to apply what you have learned in the taught part of the course. Our topics are aligned with the research interests of leading financial institutions from the City of London and internationally.

论文占60学分

Examples of recent dissertation project topics include: 近期论文主题包括:

Approximation of CVA/DVA/FVA

FVA and MM - quantitative analysis/illustration Continuous rainbow options on commodity outputs

Investigating dynamics and determinants of risk-neutral PDs

Using hazard models to forecast corporate bankruptcy

Analysing asset pricing implications from real options models

Pricing sovereign CDS contracts

Estimating liquidation probabilities of hedge funds

Course unit list 课程清单

The course unit details given below are subject to change, and are the latest example of the curriculum available on this course of study.

Title Code Credit rating Mandatory/optional

Interest Rate Derivatives BMAN63012 15 Mandatory

Derivative Securities BMAN70141 15 Mandatory

Asset Pricing Theory BMAN70381 15 Mandatory

Time Series Econometrics BMAN71122 15 Mandatory

Stochastic Calculus for Finance BMAN71541 15 Mandatory

Credit Risk Measurement and Management BMAN71572 15 Mandatory

Risk, Performance and Decision Analysis BMAN60092 15 Optional

Real Options in Corporate Finance BMAN70192 15 Optional

Cross Sectional Econometrics BMAN70211 15 Optional

Corporate Finance BMAN71152 15 Optional

Portfolio Investment BMAN71171 15 Optional

Simulation & Risk Analysis BMAN73941 15 Optional

Computational Finance MATH60082 15 Optional

Generalised Linear Models and Survival Analysis MATH68052 15 Optional

Scientific Computing MATH69111 15 Optional

Academic Requirements

We require a First or Upper Second class honours degree (2:1, with 60% average) from a UK university or the overseas equivalent.

我们要求获得英国大学或海外同等学历的一等或二等以上荣誉学位(2:1,平均60%)。

You ideally need a a degree in finance, economics, mathematics, statistics, physics, engineering, actuarial or decision sciences and have taken or be taking a significant number of modules in quantitative subjects, such as differential equations, econometrics or mathematical statistics in the final year of your degree, with excellent results.

你理想地需要金融、经济学、数学、统计学、物理、工程、精算或决策科学的学位,并且在你学位的最后一年已经或正在修读大量定量学科课程,如微分方程、计量经济学或数理统计,并且成绩优异。

We highly recommend GMAT or GRE and anticipate a well-balanced score with a strong performance in the quantitative sections

我们极力推荐提供GMAT或GRE成绩,并期待总体平衡,以及定量部分的优异表现。

When assessing your academic record, we take into account your grade average, position in class, references and the standing of the institution where you studied your qualification.

在评估你的学业成绩时,我们会综合考虑你的平均成绩、在班上的位置、推荐人和你学校的地位。

China 中国学生

4 year Bachelor degree with a minimum average of between 82-90% from a well ranked institution. Requirements vary dependent on the institution of study and the courses applied to.

四年制本科学历,平均水平在82-90%之间。要求根据申请大学和所申请的课程而有所不同。

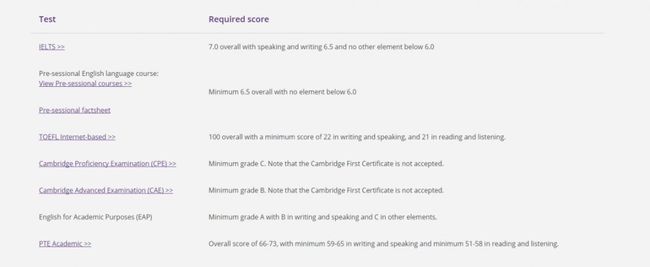

English Language Requirements

Fees and cost

Tuition fees per year 2019/20

UK/EU: £25,000 full-time

International: £25,000 full-time

The fees quoted above will be fully inclusive for the course tuition, administration and computational costs during your studies.

以上所列费用将完全包括您学习期间的学费、行政管理和计算费用。