数据挖掘项目:银行信用评分卡建模分析(下篇)

以下是银行信用评分卡建模分析下篇的内容,包括特征工程,构建模型,模型评估,评分卡建立这四部分。其中如果有一些地方分析的不正确,希望大家多多指正,感谢!

上篇文章的链接:数据挖掘项目:银行信用评分卡建模分析(上篇)

4.特征工程

特征处理和特征生成

特征衍生

构建三个新的特征:总违约数,违约计数和每个月的支出。

def get_more_features(data):

data['AllNumlate']=data['NumberOfTime30-59DaysPastDueNotWorse']+data['NumberOfTime60-89DaysPastDueNotWorse']+data['NumberOfTimes90DaysLate']

data['Monthlypayment']=data['DebtRatio']*data['MonthlyIncome']

return data

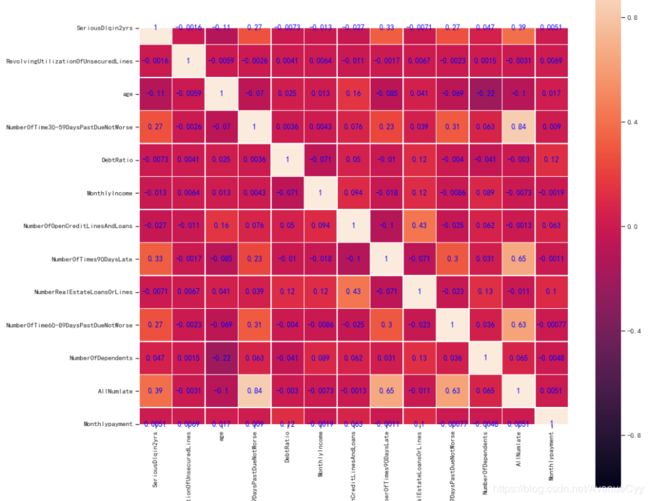

特征相关性

correlation_table = pd.DataFrame(train_data.corr())

fig = plt.figure(figsize=(15,15))

ax1 = fig.add_subplot(1,1,1)

sns.heatmap(correlation_table,annot=True,ax=ax1,square = True, vmax=1.0,vmin=-1.0,linewidths=.5,annot_kws={'size': 12, 'weight': 'bold', 'color': 'blue'})

- 总违约数和30-59天的违约数之间有很大的相关性,0.84。因为30-59天的违约数相比于60-89和90天以上的次数过多。但这个还是选择保留该特征,一是因为有比较重要的实际意义。

划分测试集和训练集

from sklearn.model_selection import train_test_split

X = pd.DataFrame(X)

y = pd.DataFrame(y)

X_train, X_vali, Y_train, Y_vali = train_test_split(X,y,test_size=0.3,random_state=0)

# 训练集

model_data = pd.concat([Y_train, X_train], axis=1)

model_data.index = range(model_data.shape[0])

model_data.columns = train_data.columns

#验证集

vali_data = pd.concat([Y_vali, X_vali], axis=1)

vali_data.index = range(vali_data.shape[0])

vali_data.columns = train_data.columns

数据分箱

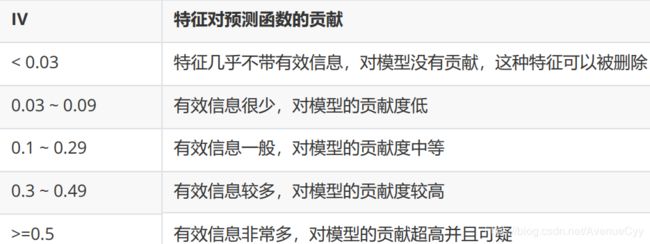

关于WOE和IV值的概念在数据分箱、WOE、IV的意义中有比较详细的描述。

这里让WOE的值单调是为了让woe(x)与y之间具备线性的关系,更有助于人们的理解。

数据分箱的大体思路如下:

- 等频分箱。由于不同的数据分组不一样,因此不采用等距分箱。这里等频分箱的分箱数一定要选的足够大20-40之间,因为有的样本占比太大,分箱数少的话,没有区分性。

- 确保每个箱内都有正负样本。由于要计算WOE和IV值,从公式上可以看出,要计算这两个值,需要每个分组内都包含正负样本。

- 卡方分箱。卡方可以检验两类别的相似性。可对等频分箱后的结果,进行更为精确的分箱。但这里并不采用卡方检验的p值决定最终的分箱。

- 根据WOE和IV值确定最佳分箱数。这里WOE要满足单调性,IV值要在一定的范围内,过大过小都说明该特征有问题。

以下为代码部分。

def graphforbestbin(DF, X, Y, n=5,q=20,graph=True):

global bins_df

DF = DF[[X,Y]].copy()

# 等频分箱

DF["qcut"],bins = pd.qcut(DF[X], retbins=True, q=q,duplicates="drop")

coount_y0 = DF.loc[DF[Y]==0].groupby(by="qcut").count()[Y]

coount_y1 = DF.loc[DF[Y]==1].groupby(by="qcut").count()[Y]

num_bins = [*zip(bins,bins[1:],coount_y0,coount_y1)]

# 判断分箱后每个箱内是否都有好坏样本,没有的进行合并

for i in range(q):

if 0 in num_bins[0][2:]:

num_bins[0:2] = [(

num_bins[0][0],

num_bins[1][1],

num_bins[0][2]+num_bins[1][2],

num_bins[0][3]+num_bins[1][3])]

continue

for i in range(len(num_bins)):

if 0 in num_bins[i][2:]:

num_bins[i-1:i+1] = [(

num_bins[i-1][0],

num_bins[i][1],

num_bins[i-1][2]+num_bins[i][2],

num_bins[i-1][3]+num_bins[i][3])]

break

else:

break

# 计算WOE值

def get_woe(num_bins):

columns = ["min","max","count_0","count_1"]

df = pd.DataFrame(num_bins,columns=columns)

df["total"] = df.count_0 + df.count_1

df["percentage"] = df.total / df.total.sum()

df["bad_rate"] = df.count_1 / df.total

df["good%"] = df.count_0/df.count_0.sum()

df["bad%"] = df.count_1/df.count_1.sum()

df["woe"] = np.log(df["good%"] / df["bad%"])

return df

# 计算IV值

def get_iv(df):

rate = df["good%"] - df["bad%"]

iv = np.sum(rate * df.woe)

return iv

# 利用卡方检验进行分箱,将两类相近的样本进行合并

# 合并方式为按照大小顺序改变上下限

IV = []

axisx = []

while len(num_bins) > n:

pvs = []

for i in range(len(num_bins)-1):

x1 = num_bins[i][2:]

x2 = num_bins[i+1][2:]

pv = scipy.stats.chi2_contingency([x1,x2])[1]

pvs.append(pv)

i = pvs.index(max(pvs))

num_bins[i:i+2] = [(

num_bins[i][0],

num_bins[i+1][1],

num_bins[i][2]+num_bins[i+1][2],

num_bins[i][3]+num_bins[i+1][3])]

bins_df = pd.DataFrame(get_woe(num_bins))

axisx.append(len(num_bins))

IV.append(get_iv(bins_df))

# 具体分多少箱,不看卡方值和p值,根据IV值来进行判断

# 绘制出不同分箱效果下的IV值,选取最佳的分箱策略

if graph:

plt.figure()

plt.plot(axisx,IV)

plt.xticks(axisx)

plt.xlabel("number of box")

plt.ylabel("IV")

plt.show()

return bins_df

for i in train.columns[1:]:

print(i)

graphforbestbin(model_data,i,"SeriousDlqin2yrs",n=2,q=20)

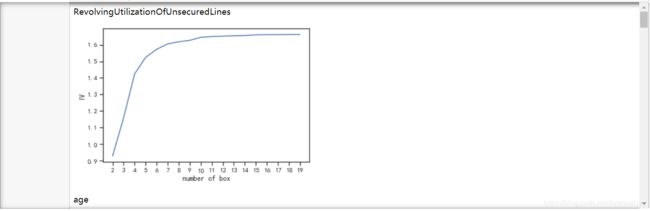

- 寻找随着分箱数的增加,IV增加的拐点,以确定分箱个数。

- 对于本身不是连续型的变量需要手动分箱,而连续变量可以采用以上方法进行自动分箱。

- 观察大致分箱结果的IV值,可以发现哪些特征是有用的,哪些是无用的,进行特征选择。

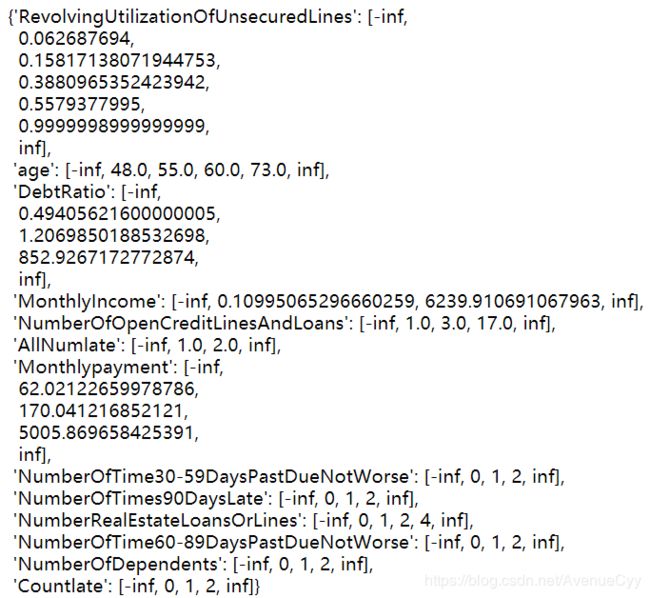

自动分箱和非自动分箱

对连续型数据采用自动分箱。

#能自动分箱的变量

auto_col_bins = {"RevolvingUtilizationOfUnsecuredLines":6,

"age":5,

"DebtRatio":4,

"MonthlyIncome":3,

"NumberOfOpenCreditLinesAndLoans":4}

#不能使用自动分箱的变量

hand_bins = {"NumberOfTime30-59DaysPastDueNotWorse":[0,1,2,13]

,"NumberOfTimes90DaysLate":[0,1,2,17]

,"NumberRealEstateLoansOrLines":[0,1,2,4,54]

,"NumberOfTime60-89DaysPastDueNotWorse":[0,1,2,8]

,"NumberOfDependents":[0,1,2,3]}

#保证区间覆盖使用 np.inf替换最大值,用-np.inf替换最小值。使分箱的拟合性更强。

hand_bins = {k:[-np.inf,*v[:-1],np.inf] for k,v in hand_bins.items()}

bins_of_col = {}

# 生成自动分箱的分箱区间和分箱后的 IV 值

for col in auto_col_bins:

bins_df = graphforbestbin(model_data,col

,"SeriousDlqin2yrs"

,n=auto_col_bins[col]

,q=20

,graph=False)

bins_list = sorted(set(bins_df["min"]).union(bins_df["max"]))

#保证区间覆盖使用 np.inf 替换最大值 -np.inf 替换最小值

bins_list[0],bins_list[-1] = -np.inf,np.inf

bins_of_col[col] = bins_list

#合并手动分箱数据

bins_of_col.update(hand_bins)

bins_of_col

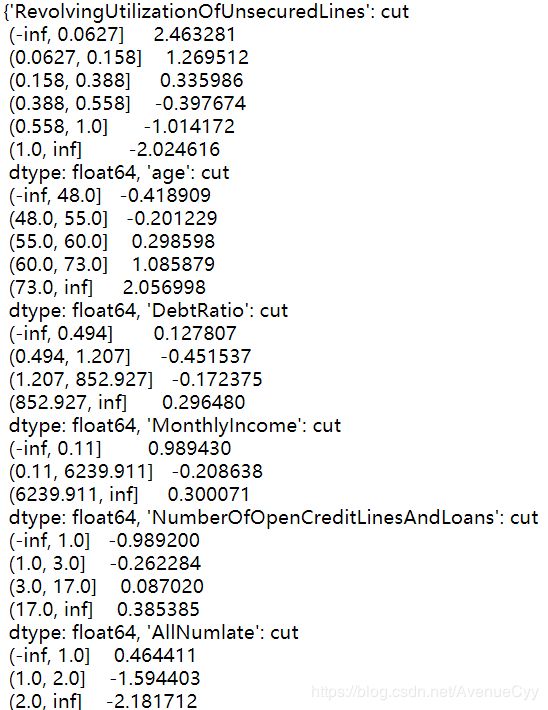

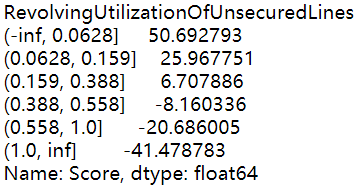

分箱后的WOE值

def get_woe(df,col,y,bins):

df = df[[col,y]].copy()

df["cut"] = pd.cut(df[col],bins)

bins_df = df.groupby("cut")[y].value_counts().unstack()

woe = bins_df["woe"] = np.log((bins_df[0]/bins_df[0].sum())/(bins_df[1]/bins_df[1].sum()))

return woe

woeall = {}

for col in bins_of_col:

woeall[col] = get_woe(model_data,col,"SeriousDlqin2yrs",bins_of_col[col])

woeall

- 发现DebtRatio,NumberOfOpenCreditLinesAndLoans,NumberRealEstateLoansOrLines这些特征的IV值很低。根据之前探索性数据分析的结果进行人为重新分箱。

- 对于WOE值不是单调变化的,需要重新人为进行调整。

- 若调整后的WOE和IV值仍然不满足要求,则将该特征删除。

#能自动分箱的变量

auto_col_bins = {"RevolvingUtilizationOfUnsecuredLines":6,

"age":6,

# "DebtRatio":5,

"MonthlyIncome":5,

# "NumberOfOpenCreditLinesAndLoans":4,

"Monthlypayment":6}

#不能使用自动分箱的变量

hand_bins = {"NumberOfTime30-59DaysPastDueNotWorse":[0,1,2,13]

,"NumberOfTimes90DaysLate":[0,1,2,17]

,"NumberRealEstateLoansOrLines":[0,1,2,4,54]

,"NumberOfTime60-89DaysPastDueNotWorse":[0,1,2,8]

,"NumberOfDependents":[0,1,2,3,5]

,"DebtRatio":[0,0.3,0.5,1,1.5,2]

,"NumberRealEstateLoansOrLines":[0,1,3,5]

,"NumberOfOpenCreditLinesAndLoans":[0,1,3,5,7]

,"AllNumlate":[0,1]

,"Countlate":[0,1,2,3]}

#保证区间覆盖使用 np.inf替换最大值,用-np.inf替换最小值

hand_bins = {k:[-np.inf,*v[:-1],np.inf] for k,v in hand_bins.items()}

这里对以上不合格的特征进行手动的人为分箱。

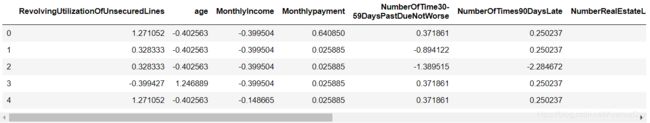

WOE替换分箱结果

model_woe = pd.DataFrame(index=model_data.index)

for col in bins_of_col:

model_woe[col] = pd.cut(model_data[col],bins_of_col[col]).map(woeall[col])

model_woe["SeriousDlqin2yrs"] = model_data["SeriousDlqin2yrs"]

对测试集采用同样的方法进行替换

vali_woe = pd.DataFrame(index=vali_data.index)

for col in bins_of_col:

vali_woe[col] = pd.cut(vali_data[col],bins_of_col[col]).map(woeall[col])

vali_woe["SeriousDlqin2yrs"] = vali_data["SeriousDlqin2yrs"]

vali_X = vali_woe.iloc[:,:-1]

vali_y = vali_woe.iloc[:,-1]

5.构建模型

X = model_woe.iloc[:,:-1]

y = model_woe.iloc[:,-1]

建立逻辑回归模型

逻辑回归算法说明

lr = LR().fit(X,y)

lr.score(vali_X,vali_y)

0.8011675781970135

- 最初没有对分箱探索时的结果是0.786。

调整模型参数

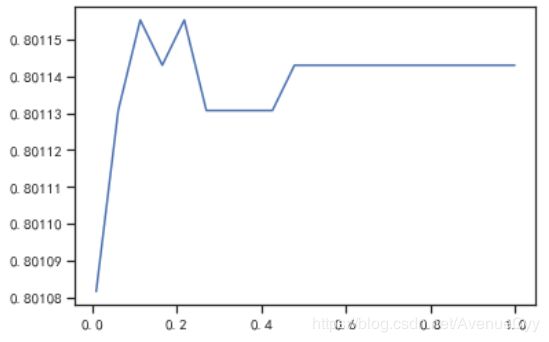

这里主要调整sklearn中逻辑回归的两个参数,惩罚系数C和最大迭代次数max_iter。

c_1 = np.linspace(0.01,1,20)

score = []

for i in c_1:

lr = LR(solver='liblinear',C=i).fit(X,y)

score.append(lr.score(vali_X,vali_y))

plt.figure()

plt.plot(c_1,score)

plt.show()

- 通过不断调整C的大小,找到使score最高的参数。最终得到的C为0.08

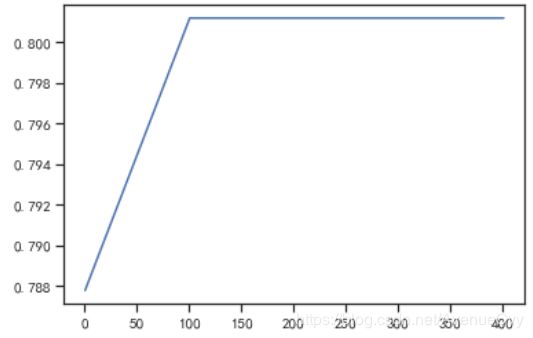

score = []

for i in np.arange(1,500,100):

lr = LR(solver='liblinear',C=0.025,max_iter=i).fit(X,y)

score.append(lr.score(vali_X,vali_y))

plt.figure()

plt.plot([1,2,3,4,5,6],score)

plt.show()

- 最优的迭代次数定为150。

最终将调整的参数带入模型后,发现模型的准确率并没有什么变化。说明初始的参数即为最优的参数。

6.模型评估

模型评估指标说明

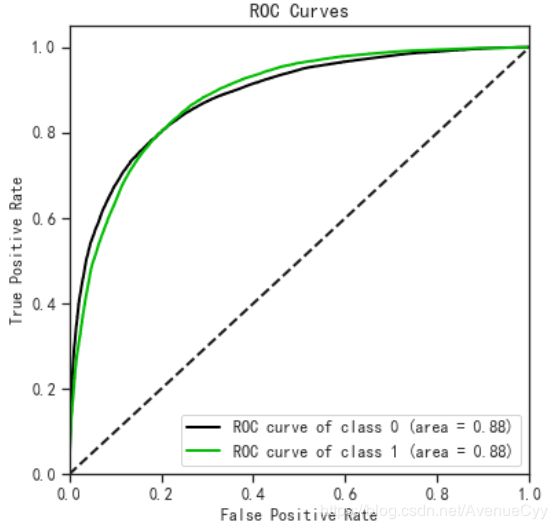

ROC-AUC曲线

绘制ROC曲线,计算AUC面积,查看模型分类的评估效果。

vali_proba_df = pd.DataFrame(lr.predict_proba(vali_X))

skplt.metrics.plot_roc(vali_y, vali_proba_df,

plot_micro=False,figsize=(6,6),

plot_macro=False)

- AUC面积为0.88,说明模型对正负样本的区分能力还可以。

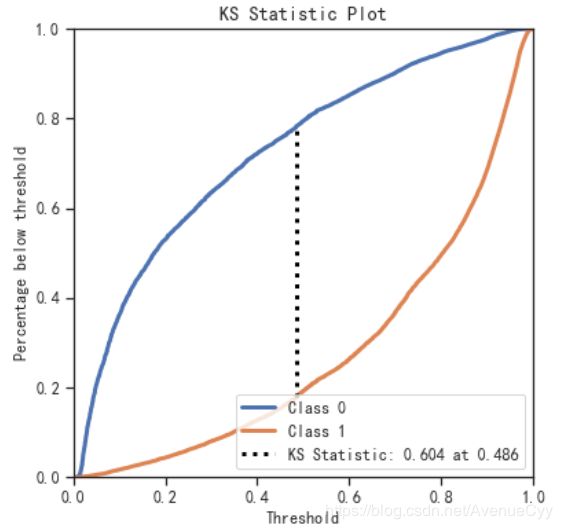

KS值

KS值和AUC值的关系

KS值计算

- KS值为0.604,模型预测性较好。

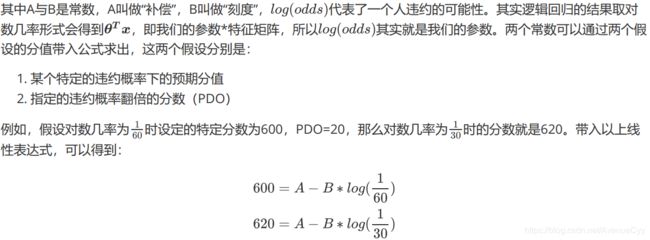

7.评分卡建立

B = 20/np.log(2)

A = 600 + B*np.log(1/60)

B,A

(28.85390081777927, 481.8621880878296)

- 这里的特定分数和PDO的值都是假定的。

base_score = A - B*lr.intercept_

base_score

array([481.86620974])

- 计算基础分数为481.87。

年龄中,每个分箱对应的数值

for i,col in enumerate(X.columns):#[*enumerate(X.columns)]

score = woeall[col] * (-B*lr.coef_[0][i])

score.name = "Score"

score.index.name = col

print(score)

总结

从整个项目来看,最耗时耗力的就是探索性数据分析,在对月薪和负债率的处理上,思考了好久,用尝试了很多的方法,但处理的原因和结果都不太理想,如果大家有好的想法,希望能指点下。

通过评分卡这个项目,了解到了WOE和IV值,虽然对别的模型可能用处不大,但增强了逻辑回归的理解,使其能像线性回归一样具备一定的可解释性。另外,由于数据中有很多的异常值不知道该怎么处理时,也见识到了数据分箱这种方法的强大。

以上就是银行信用评分卡建模分析项目的全部内容,如果对您有所帮助还希望能点赞关注下,感谢大家的阅读!

参考资料

https://www.bilibili.com/video/BV1WJ411k7L3?p=87

https://zhuanlan.zhihu.com/p/50051580

https://blog.csdn.net/gxhzoe/article/details/80428560

https://cloud.tencent.com/developer/article/1092198?from=10680