Python-量化投资(二)

投资组合理论及其拓展

- 投资组合的收益与风险

- Markowitz均值-方差模型

- 绘制最小方差前缘曲线

- Black-Litterman模型(BL模型)

投资组合的收益与风险

import numpy as np

import math

import matplotlib.pyplot as plt

def cal_mean(frac):

return(0.08*frac+0.15*(1-frac))

mean=list(map(cal_mean,[x/50 for x in range(51)]))

sd_mat=np.array([list(map(lambda x: math.sqrt((x**2)*0.12**2+

((1-x)**2)*0.25**2+2*x*(1-x)*(-1.5+i*0.5)*0.12*0.25),[x/50 for x in range(51)])

) for i in range(1,6)])

#[expression for variable in sequence] list comprehension

plt.plot(sd_mat[0,:],mean,label='-1')

plt.plot(sd_mat[1,:],mean,label='-0.5')

plt.plot(sd_mat[2,:],mean,label='0')

plt.plot(sd_mat[3,:],mean,label='0.5')

plt.plot(sd_mat[4,:],mean,label='1')

plt.legend(loc='upper left')

Markowitz均值-方差模型

利用Markowitz模型进行数量化的资产配置,用Python实现

| 股票代码 | 股票名称 |

|---|---|

| 600004 | 白云机场 |

| 600015 | 华夏银行 |

| 600023 | 浙能电力 |

| 600033 | 福建高速 |

| 600183 | 生益科技 |

import pandas as pd

stock=pd.read_table('stock.txt',sep='\t',index_col='Trddt')

stock.index=pd.to_datetime(stock.index)

fjgs = stock.loc[stock.Stkcd==600033,"Dretwd"]

fjgs.name="fjgs"

zndl=stock.loc[stock.Stkcd==600023,'Dretwd']

zndl.name='zndl'

sykj=stock.loc[stock.Stkcd==600183,'Dretwd']

sykj.name='sykj'

hxyh=stock.loc[stock.Stkcd==600015,'Dretwd']

hxyh.name='hxyh'

byjc=stock.loc[stock.Stkcd==600004,'Dretwd']

byjc.name='byjc'

sh_return = pd.concat([fjgs,zndl,sykj,kxyh,byjc],axis=1)

sh_return.head()

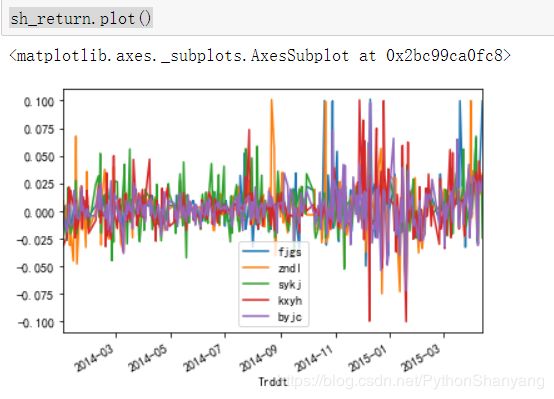

- 查看各股的回报率

sh_return=sh_return.dropna()

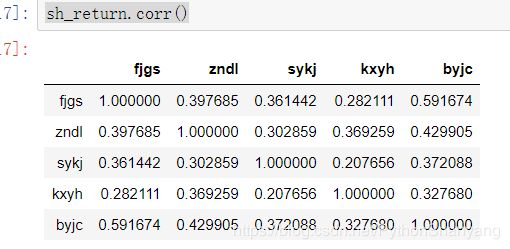

sh_return.corr() #删除nan,以及空缺的

sh_return.plot()

- 查看各股的累计收益

cumreturn= (1+sh_return).cumprod() #(1+sh_return) +1 表示加上本身

cumreturn.plot() #累计收益

- 查看各股回报率的相关性

sh_return.corr()

从相关系数矩阵可以看出,5只股票之间都是正向相关的。若股票之间的相关性太高,投资组合降低风险的效果就比较有限。

绘制最小方差前缘曲线

借助Python构建一个MeanVariance类,该类可以根据输入的收益率序列,求解二次规划问题,计算出最优资产比例,并绘制最小方差前缘曲线。

import ffn

from scipy import linalg

class MeanVariance:

#定义构造器,传入收益率数据

def __init__(self,returns):

self.returns=returns

#定义最小化方差的函数,即求解二次规划

def minVar(self,goalRet):

covs=np.array(self.returns.cov())

means=np.array(self.returns.mean())

L1=np.append(np.append(covs.swapaxes(0,1),[means],0),

[np.ones(len(means))],0).swapaxes(0,1)

L2=list(np.ones(len(means)))

L2.extend([0,0])

L3=list(means)

L3.extend([0,0])

L4=np.array([L2,L3])

L=np.append(L1,L4,0)

results=linalg.solve(L,np.append(np.zeros(len(means)),[1,goalRet],0))

return(np.array([list(self.returns.columns),results[:-2]]))

#定义绘制最小方差前缘曲线函数

def frontierCurve(self):

goals=[x/500000 for x in range(-100,4000)]

variances=list(map(lambda x: self.calVar(self.minVar(x)[1,:].astype(np.float)),goals))

plt.plot(variances,goals)

#给定各资产的比例,计算收益率均值

def meanRet(self,fracs):#fracs 概率

meanRisky=ffn.to_returns(self.returns).mean()

assert len(meanRisky)==len(fracs), 'Length of fractions must be equal to number of assets'

return(np.sum(np.multiply(meanRisky,np.array(fracs))))

#给定各资产的比例,计算收益率方差

def calVar(self,fracs):

return(np.dot(np.dot(fracs,self.returns.cov()),fracs))

- 绘制最小方差前缘曲线

minvar=MeanVariance(sh_return)

minvar.frontierCurve() #收益方差最低点

- 假设目标期望收益率(日期期望收益率)是0.003,然后将整个数据集分为训练集和测试集,用训练集的数据来得到最优资产配置,用测试集来看资产配置是否有效。

#选取训练集和测试集

train_set=sh_return["2014"]

test_set=sh_return["2015"]#训练数据,分别导入2014,2015

#选取组合

varMinmize = MeanVariance(train_set)

goal_return = 0.003

profolio_weight = varMinmize.minVar(goal_return) #计算最小方差

profolio_weight

'''

profolio_weight 权重,五种股票的比例权重

array([['fjgs', 'zndl', 'sykj', 'kxyh', 'byjc'],

['0.8121632841002377', '-0.4801112026506777',

'0.43018219629259896', '0.34747305363072123',

'-0.10970733137288022']], dtype='

#

#计算测试集的收益率

#计算测试集的收益率

test_return=np.dot(test_set,np.array([profolio_weight[1,:].astype(np.float)]).swapaxes(0,1))

test_return=pd.DataFrame(test_return,index=test_set.index)

test_cum_return = (1+test_return).cumprod()#累计收益

plt.plot(test_cum_return.index,test_cum_return)

sim_weight=np.random.uniform(0,1,(100,5))

#叠加

sim_weight=np.apply_along_axis(lambda x: x/sum(x),1,sim_weight)#随机数

sim_return=np.dot(test_set,sim_weight.swapaxes(0,1))

sim_return=pd.DataFrame(sim_return,index=test_cum_return.index)

sim_cum_return=(1+sim_return).cumprod()

plt.plot(sim_return.index,sim_cum_return)

plt.plot(test_cum_return.index,test_cum_return,color="yellow")

Black-Litterman模型(BL模型)

不同于Markowitz模型对于得到的最优资产配置比对输入过于敏感。

def blacklitterman(returns,tau, P, Q):

mu=returns.mean()

sigma=returns.cov()

pi1=mu

ts = tau * sigma

Omega = np.dot(np.dot(P,ts),P.T) * np.eye(Q.shape[0])

middle = linalg.inv(np.dot(np.dot(P,ts),P.T) + Omega)

er = np.expand_dims(pi1,axis=0).T + np.dot(np.dot(np.dot(ts,P.T),middle),

(Q - np.expand_dims(np.dot(P,pi1.T),axis=1)))

posteriorSigma = sigma + ts - np.dot(ts.dot(P.T).dot(middle).dot(P),ts)

return [er, posteriorSigma]

- 条件1的P和Q

pick1=np.array([1,0,1,1,1])

q1 = np.array([0.003*4])

- 条件2的P和Q

pick2=np.array([0.5,0.5,0,0,-1])

q2 = np.array([0.001])

- P和Q

P=np.array([pick1,pick2])

Q=np.array([q1,q2])

- 修正后验收收益

res=blacklitterman(sh_return,0.1, P, Q)

p_mean=pd.DataFrame(res[0],index=sh_return.columns,columns=['posterior_mean'])

p_mean

p_cov=res[1]

p_cov

- 计算权重

def blminVar(blres,goalRet):

#covs=np.array(blres[1])

#means=np.array(blres[0])

covs = np.array(blres[1],dtype=float)

means = np.array(blres[0],dtype=float)

L1=np.append(np.append((covs.swapaxes(0,1)),[means.flatten()],0),

[np.ones(len(means))],0).swapaxes(0,1)

L2=list(np.ones(len(means)))

L2.extend([0,0])

L3=list(means)

L3.extend([0,0])

L4=np.array([L2,L3])

L=np.append(L1,L4,0)

results=linalg.solve(L,np.append(np.zeros(len(means)),[1,goalRet],0))

return(pd.DataFrame(results[:-2],

index=blres[1].columns,columns=['p_weight']))

- 结合投资人观点的资产后验分布结果res以及投资人目标收益率(年收益率为75%)作为blminVar()函数的输入变量,可得最优资产配置比

blresult = blminVar(res,0.75/252)

print(blresult)