交易相关偶对

import numpy as np

from matplotlib.pyplot import plot

from matplotlib.pyplot import show

bhp = np.loadtxt('BHP.csv', delimiter=',', usecols=(6,), unpack=True)

bhp_returns = np.diff(bhp) / bhp[ : -1]

vale = np.loadtxt('VALE.csv', delimiter=',', usecols=(6,), unpack=True)

vale_returns = np.diff(vale) / vale[ : -1]

covariance = np.cov(bhp_returns, vale_returns)

print "Covariance", covariance

'''

Covariance [[ 0.00028179 0.00019766]

[ 0.00019766 0.00030123]]

'''

print "Covariance diagonal", covariance.diagonal()

print "Covariance trace", covariance.trace()

print covariance/ (bhp_returns.std() * vale_returns.std())

print "Correlation coefficient", np.corrcoef(bhp_returns, vale_returns)

'''

[[ 1.00173366 0.70264666]

[ 0.70264666 1.0708476 ]]

'''

difference = bhp - vale

avg = np.mean(difference)

dev = np.std(difference)

print "Out of sync", np.abs(difference[-1] - avg) > 2 * dev

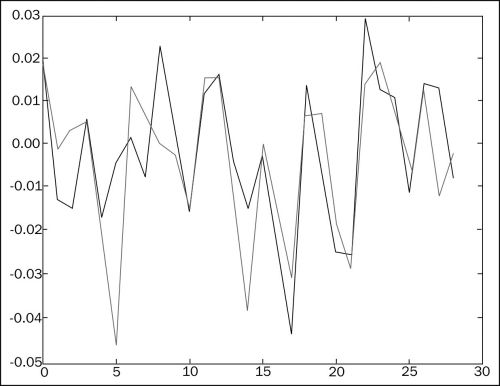

t = np.arange(len(bhp_returns))

plot(t, bhp_returns, lw=1)

plot(t, vale_returns, lw=2)

show()

多项式拟合

import numpy as np

import sys

from matplotlib.pyplot import plot

from matplotlib.pyplot import show

bhp=np.loadtxt('BHP.csv', delimiter=',', usecols=(6,), unpack=True)

vale=np.loadtxt('VALE.csv', delimiter=',', usecols=(6,), unpack=True)

t = np.arange(len(bhp))

poly = np.polyfit(t, bhp - vale, int(sys.argv[1]))

print "Polynomial fit", poly

print "Next value", np.polyval(poly, t[-1] + 1)

print "Roots", np.roots(poly)

der = np.polyder(poly)

print "Derivative", der

print "Extremas", np.roots(der)

vals = np.polyval(poly, t)

print np.argmax(vals)

print np.argmin(vals)

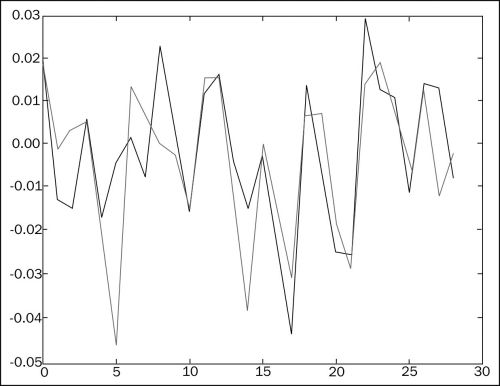

plot(t, bhp - vale)

plot(t, vals)

show()

平衡成交量

import numpy as np

c, v=np.loadtxt('BHP.csv', delimiter=',', usecols=(6, 7), unpack=True)

change = np.diff(c)

print "Change", change

'''

Change [ 1.92 -1.08 -1.26 0.63 -1.54 -0.28 0.25 -0.6 2.15 0.69 -1.33 1.16

1.59 -0.26 -1.29 -0.13 -2.12 -3.91 1.28 -0.57 -2.07 -2.07 2.5 1.18

-0.88 1.31 1.24 -0.59]

'''

signs = np.sign(change)

print "Signs", signs

'''

Signs [ 1. -1. -1. 1. -1. -1. 1. -1. 1. 1. -1. 1. 1. -1. -1. -1. -1. -1.

-1. -1. -1. 1. 1. 1. -1. 1. 1. -1.]

'''

pieces = np.piecewise(change, [change < 0, change > 0], [-1, 1])

print "Pieces", pieces

print "Arrays equal?", np.array_equal(signs, pieces)

print "On balance volume", v[1:] * signs

'''

[ 2620800. -2461300. -3270900. 2650200. -4667300. -5359800. 7768400.

-4799100. 3448300. 4719800. -3898900. 3727700. 3379400. -2463900.

-3590900. -3805000. -3271700. -5507800. 2996800. -3434800. -5008300.

-7809799. 3947100. 3809700. 3098200. -3500200. 4285600. 3918800.

-3632200.]

'''

使用向量化来避免循环

import numpy as np

import sys

o, h, l, c = np.loadtxt('BHP.csv', delimiter=',', usecols=(3, 4, 5, 6), unpack=True)

def calc_profit(open, high, low, close):

buy = open * float(sys.argv[1])

if low < buy < high:

return (close - buy)/buy

else:

return 0

func = np.vectorize(calc_profit)

profits = func(o, h, l, c)

print "Profits", profits

real_trades = profits[profits != 0]

print "Number of trades", len(real_trades), round(100.0 * len(real_trades)/len(c), 2), "%"

print "Average profit/loss %", round(np.mean(real_trades) * 100, 2)

winning_trades = profits[profits > 0]

print "Number of winning trades", len(winning_trades), round(100.0 * len(winning_trades)/len(c), 2), "%"

Number of winning trades 16 53.33 %

print "Average profit %", round(np.mean(winning_trades) * 100, 2)

losing_trades = profits[profits < 0]

print "Number of losing trades", len(losing_trades), round(100.0 * len(losing_trades)/len(c), 2), "%"

print "Average loss %", round(np.mean(losing_trades) * 100, 2)

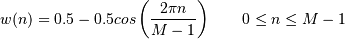

使用海宁函数实现平滑

import numpy as np

import sys

from matplotlib.pyplot import plot

from matplotlib.pyplot import show

N = int(sys.argv[1])

weights = np.hanning(N)

print "Weights", weights

'''

Weights [ 0. 0.1882551 0.61126047 0.95048443 0.95048443 0.61126047

0.1882551 0. ]

'''

bhp = np.loadtxt('BHP.csv', delimiter=',', usecols=(6,), unpack=True)

bhp_returns = np.diff(bhp) / bhp[ : -1]

smooth_bhp = np.convolve(weights/weights.sum(), bhp_returns)[N-1:-N+1]

vale = np.loadtxt('VALE.csv', delimiter=',', usecols=(6,), unpack=True)

vale_returns = np.diff(vale) / vale[ : -1]

smooth_vale = np.convolve(weights/weights.sum(), vale_returns)[N-1:-N+1]

K = int(sys.argv[1])

t = np.arange(N - 1, len(bhp_returns))

poly_bhp = np.polyfit(t, smooth_bhp, K)

poly_vale = np.polyfit(t, smooth_vale, K)

poly_sub = np.polysub(poly_bhp, poly_vale)

xpoints = np.roots(poly_sub)

print "Intersection points", xpoints

'''

Intersection points [ 27.73321597+0.j 27.51284094+0.j 24.32064343+0.j

18.86423973+0.j 12.43797190+1.73218179j 12.43797190-1.73218179j

6.34613053+0.62519463j 6.34613053-0.62519463j]

'''

reals = np.isreal(xpoints)

print "Real number?", reals

xpoints = np.select([reals], [xpoints])

xpoints = xpoints.real

print "Real intersection points", xpoints

print "Sans 0s", np.trim_zeros(xpoints)

plot(t, bhp_returns[N-1:], lw=1.0)

plot(t, smooth_bhp, lw=2.0)

plot(t, vale_returns[N-1:], lw=1.0)

plot(t, smooth_vale, lw=2.0)

show()