RSI标志买方和卖方的相对力量强弱

R S I = 100 ∗ U P U P + D O W N RSI=100 * \frac{UP}{UP+DOWN} RSI=100∗UP+DOWNUP

UP表示t期内股价上涨的平均值,DOWN表示t期内股价下跌的平均值

以交通银行为例进行分析

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

BOCM=pd.read_csv('BOCM.csv')

BOCM.index=BOCM.iloc[:,1]

BOCM=BOCM.iloc[:,2:]

BOCM.head()

|

Open |

High |

Low |

Close |

Volume |

| Date |

|

|

|

|

|

| 2014-01-02 |

3.82 |

3.84 |

3.80 |

3.82 |

57317900 |

| 2014-01-03 |

3.81 |

3.83 |

3.76 |

3.79 |

64039600 |

| 2014-01-06 |

3.79 |

3.79 |

3.72 |

3.75 |

73494700 |

| 2014-01-07 |

3.73 |

3.79 |

3.72 |

3.77 |

48477500 |

| 2014-01-08 |

3.77 |

3.84 |

3.76 |

3.80 |

47952000 |

BOCMclp=BOCM.Close

clprcChange=BOCMclp-BOCMclp.shift(1)

clprcChange=clprcChange.dropna()

clprcChange[0:6]

Date

2014-01-03 -0.03

2014-01-06 -0.04

2014-01-07 0.02

2014-01-08 0.03

2014-01-09 -0.01

2014-01-10 0.01

Name: Close, dtype: float64

indexprc=clprcChange.index

upPrc=pd.Series(0,index=indexprc)

upPrc[clprcChange>0]=clprcChange[clprcChange>0]

downPrc=pd.Series(0,index=indexprc)

downPrc[clprcChange<0]=-clprcChange[clprcChange<0]

rsidata=pd.concat([BOCMclp,clprcChange,upPrc,downPrc],axis=1)

rsidata.columns=['Close','PrcChange','upPrc','downPrc']

rsidata=rsidata.dropna()

rsidata.head()

/Users/yaochenli/anaconda3/lib/python3.7/site-packages/ipykernel_launcher.py:8: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

|

Close |

PrcChange |

upPrc |

downPrc |

| 2014-01-03 |

3.79 |

-0.03 |

0.00 |

0.03 |

| 2014-01-06 |

3.75 |

-0.04 |

0.00 |

0.04 |

| 2014-01-07 |

3.77 |

0.02 |

0.02 |

0.00 |

| 2014-01-08 |

3.80 |

0.03 |

0.03 |

0.00 |

| 2014-01-09 |

3.79 |

-0.01 |

0.00 |

0.01 |

SMUP=[]

SMDOWN=[]

for i in range(6,len(upPrc)+1):

SMUP.append(np.mean(upPrc.values[(i-6):i],dtype=np.float32))

SMDOWN.append(np.mean(downPrc.values[(i-6):i], dtype=np.float32))

rsi6=[100*SMUP[i]/(SMUP[i]+SMDOWN[i]) for i in range(0, len(SMUP))]

indexRsi=indexprc[5:]

Rsi6=pd.Series(rsi6,index=indexRsi)

Rsi6.head()

Date

2014-01-10 42.857141

2014-01-13 61.538465

2014-01-14 66.666665

2014-01-15 46.153845

2014-01-16 30.000001

dtype: float64

Rsi6.describe()

count 327.000000

mean 51.742495

std 27.787794

min 0.000000

25% 30.000001

50% 51.298706

75% 74.547477

max 100.000000

dtype: float64

UP=pd.Series(SMUP, index=indexRsi)

DOWN=pd.Series(SMDOWN,index=indexRsi)

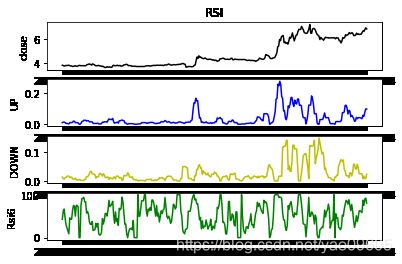

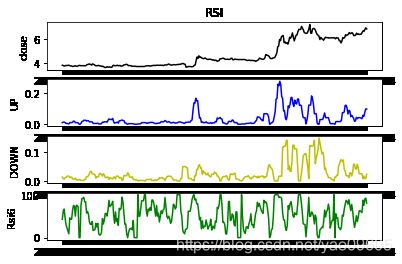

plt.subplot(411)

plt.plot(BOCMclp,'k')

plt.xlabel('date')

plt.ylabel('close')

plt.title('RSI')

plt.subplot(412)

plt.plot(UP,'b')

plt.ylabel('UP')

plt.subplot(413)

plt.plot(DOWN,'y')

plt.ylabel('DOWN')

plt.subplot(414)

plt.plot(Rsi6,'g')

plt.ylabel('Rsi6')

plt.show()

RSI函数

def rsi(price,period=6):

import pandas as pd

clprcChange=price-price.shift(1)

clprcChange=clprcChange.dropna()

indexprc=clprcChange.index

upPrc=pd.Series(0,index=indexprc)

upPrc[clprcChange>0]=clprcChange[clprcChange>0]

downPrc=pd.Series(0,index=indexprc)

downPrc[clprcChange<0]=-clprcChange[clprcChange<0]

rsidata=pd.concat([price,clprcChange,upPrc,downPrc],\

axis=1)

rsidata.columns=['price','PrcChange','upPrc','downPrc']

rsidata=rsidata.dropna();

SMUP=[]

SMDOWN=[]

for i in range(period,len(upPrc)+1):

SMUP.append(np.mean(upPrc.values[(i-period):i],\

dtype=np.float32))

SMDOWN.append(np.mean(downPrc.values[(i-period):i],\

dtype=np.float32))

rsi=[100*SMUP[i]/(SMUP[i]+SMDOWN[i]) \

for i in range(0,len(SMUP))]

indexRsi=indexprc[(period-1):]

rsi=pd.Series(rsi,index=indexRsi)

return(rsi)

Rsi12=rsi(BOCMclp,12)

Rsi12.tail()

/Users/yaochenli/anaconda3/lib/python3.7/site-packages/ipykernel_launcher.py:11: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

# This is added back by InteractiveShellApp.init_path()

/Users/yaochenli/anaconda3/lib/python3.7/site-packages/ipykernel_launcher.py:11: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

# This is added back by InteractiveShellApp.init_path()

Date

2015-04-08 72.522525

2015-04-09 68.867922

2015-04-10 66.666665

2015-04-13 70.334930

2015-04-14 66.976744

dtype: float64

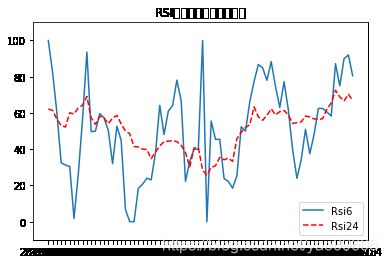

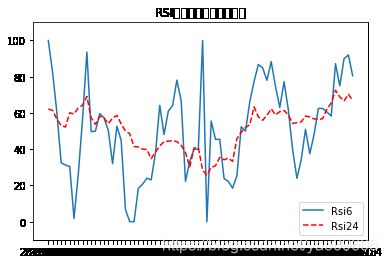

RSI天数差异

Rsi24=rsi(BOCMclp,24)

Rsi24.tail()

/Users/yaochenli/anaconda3/lib/python3.7/site-packages/ipykernel_launcher.py:11: FutureWarning: Sorting because non-concatenation axis is not aligned. A future version

of pandas will change to not sort by default.

To accept the future behavior, pass 'sort=False'.

To retain the current behavior and silence the warning, pass 'sort=True'.

# This is added back by InteractiveShellApp.init_path()

Date

2015-04-08 72.522525

2015-04-09 68.867922

2015-04-10 66.666665

2015-04-13 70.334930

2015-04-14 66.976744

dtype: float64

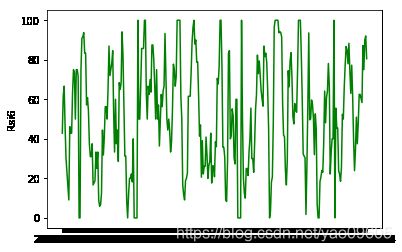

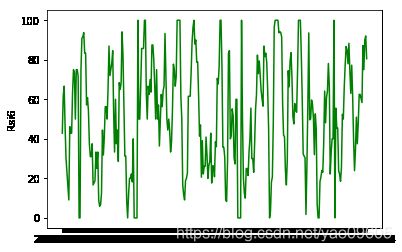

plt.plot(Rsi6,'g')

plt.ylabel('Rsi6')

Text(0, 0.5, 'Rsi6')

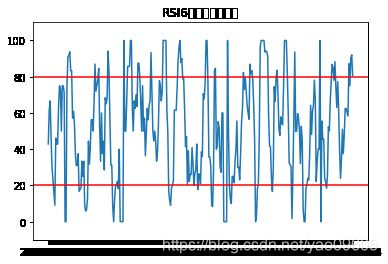

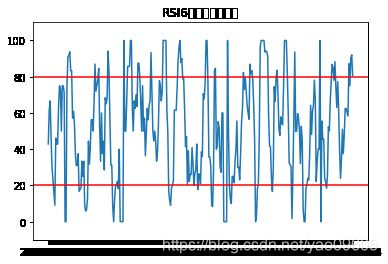

RSI的黄金交叉和死亡交叉

plt.plot(Rsi6)

plt.title('RSI6指标超买和超卖')

plt.ylim(-10,110)

plt.axhline(y=80,color='red')

plt.axhline(y=20,color='red')

plt.show()

plt.plot(Rsi6['2015-01-03':],label="Rsi6")

plt.plot(Rsi24['2015-01-03':],\

label="Rsi24",color='red',\

linestyle='dashed')

plt.title("RSI的黄金交叉与死亡交叉")

plt.ylim(-10,110)

plt.legend()

交通银行实测

BOCM=pd.read_csv('BOCM.csv')

BOCM.index=BOCM.iloc[:,1]

BOCM.index=pd.to_datetime(BOCM.index, format='%Y-%m-%d')

BOCMclp=BOCM.Close

BOCMclp[0:4]

Date

2014-01-02 3.82

2014-01-03 3.79

2014-01-06 3.75

2014-01-07 3.77

Name: Close, dtype: float64

rsi6=rsi(BOCMclp,6)

rsi24=rsi(BOCMclp,24)

Sig1=[]

for i in rsi6:

if i>80:

Sig1.append(-1)

elif i<20:

Sig1.append(1)

else:

Sig1.append(0)

date1=rsi6.index

Signal1=pd.Series(Sig1,index=date1)

Signal1[Signal1==1].head(n=3)

Signal1[Signal1==-1].head(n=3)

Date

2014-02-11 -1

2014-02-12 -1

2014-02-13 -1

dtype: int64

Signal2=pd.Series(0,index=rsi24.index)

lagrsi6= rsi6.shift(1)

lagrsi24= rsi24.shift(1)

for i in rsi24.index:

if (rsi6[i]>rsi24[i]) & (lagrsi6[i]<lagrsi24[i]):

Signal2[i]=1

elif (rsi6[i]<rsi24[i]) & (lagrsi6[i]>lagrsi24[i]):

Signal2[i]=-1

signal=Signal1+Signal2

signal[signal>=1]=1

signal[signal<=-1]=-1

signal=signal.dropna()

tradSig=signal.shift(1)

ret=BOCMclp/BOCMclp.shift(1)-1

ret.head()

Date

2014-01-02 NaN

2014-01-03 -0.007853

2014-01-06 -0.010554

2014-01-07 0.005333

2014-01-08 0.007958

Name: Close, dtype: float64

ret=ret[tradSig.index]

buy=tradSig[tradSig==1]

buyRet=ret[tradSig==1]*buy

sell=tradSig[tradSig==-1]

sellRet=ret[tradSig==-1]*sell

tradeRet=ret*tradSig

plt.rcParams['font.sans-serif'] = ['SimHei']

plt.rcParams['axes.unicode_minus'] = False

plt.subplot(211)

plt.plot(buyRet,label="buyRet",color='g')

plt.plot(sellRet,label="sellRet",color='r',linestyle='dashed')

plt.title("RSI指标交易策略")

plt.ylabel('strategy return')

plt.legend()

plt.subplot(212)

plt.plot(ret,'b')

plt.ylabel('stock return')

/Users/yaochenli/anaconda3/lib/python3.7/site-packages/pandas/plotting/_converter.py:129: FutureWarning: Using an implicitly registered datetime converter for a matplotlib plotting method. The converter was registered by pandas on import. Future versions of pandas will require you to explicitly register matplotlib converters.

To register the converters:

>>> from pandas.plotting import register_matplotlib_converters

>>> register_matplotlib_converters()

warnings.warn(msg, FutureWarning)

Text(0, 0.5, 'stock return')

def strat(tradeSignal,ret):

indexDate=tradeSignal.index

ret=ret[indexDate]

tradeRet=ret*tradeSignal

tradeRet[tradeRet==(-0)]=0

winRate=len(tradeRet[tradeRet>0])/len(\

tradeRet[tradeRet!=0])

meanWin=sum(tradeRet[tradeRet>0])/len(\

tradeRet[tradeRet>0])

meanLoss=sum(tradeRet[tradeRet<0])/len(\

tradeRet[tradeRet<0])

perform={'winRate':winRate,\

'meanWin':meanWin,\

'meanLoss': meanLoss}

return(perform)

BuyOnly=strat(buy,ret)

SellOnly=strat(sell,ret)

Trade=strat(tradSig,ret)

Test=pd.DataFrame({"BuyOnly":BuyOnly,\

"SellOnly":SellOnly,"Trade":Trade})

Test

|

BuyOnly |

SellOnly |

Trade |

| meanLoss |

-0.009230 |

-0.028476 |

-0.019797 |

| meanWin |

0.012996 |

0.015883 |

0.014691 |

| winRate |

0.530612 |

0.569231 |

0.547826 |

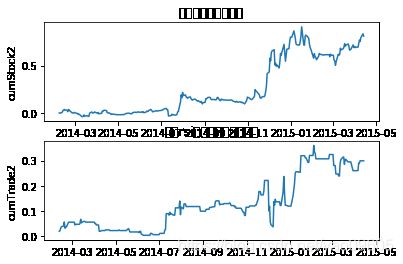

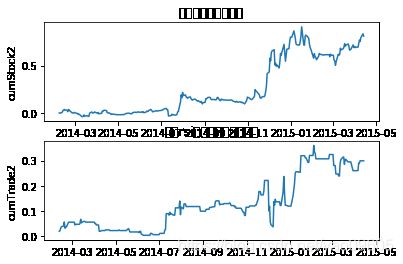

cumStock=np.cumprod(1+ret)-1

cumTrade=np.cumprod(1+tradeRet)-1

plt.subplot(211)

plt.plot(cumStock)

plt.ylabel('cumStock')

plt.title('股票本身累计收益率')

plt.subplot(212)

plt.plot(cumTrade)

plt.ylabel('cumTrade')

plt.title('rsi策略累计收益率')

Text(0.5, 1.0, 'rsi策略累计收益率')

tradSig2=signal.shift(3)

ret2=ret[tradSig2.index]

buy2=tradSig[tradSig2==1]

buyRet2=ret2[tradSig2==1]*buy2

sell2=tradSig2[tradSig2==-1]

sellRet2=ret2[tradSig2==-1]*sell2

tradeRet2=ret2*tradSig2

BuyOnly2=strat(buy2,ret2)

SellOnly2=strat(sell2,ret2)

Trade2=strat(tradSig2,ret2)

Test2=pd.DataFrame({"BuyOnly":BuyOnly2,\

"SellOnly":SellOnly2,"Trade":Trade2})

Test2

|

BuyOnly |

SellOnly |

Trade |

| meanLoss |

-0.013085 |

-0.016942 |

-0.015167 |

| meanWin |

0.018347 |

0.017260 |

0.016922 |

| winRate |

0.523810 |

0.537313 |

0.537815 |

cumStock2=np.cumprod(1+ret2)-1

print(cumStock2[-1])

cumTrade2=np.cumprod(1+tradeRet2)-1

print(cumTrade2[-1])

0.809523809523808

0.29917157813927653

plt.subplot(211)

plt.plot(cumStock2)

plt.ylabel('cumStock2')

plt.title('股票本身累计收益率')

plt.subplot(212)

plt.plot(cumTrade2)

plt.ylabel('cumTrade2')

plt.title('修改rsi执行策略累计收益率')

Text(0.5, 1.0, '修改rsi执行策略累计收益率')

总结一下,股票原来的收益率是80% RSI的结果是29.9%,考虑2014到2015是牛市,可能出现该现象,需要分析更多数据来判断这个指标是否有效,以及指标的参数。