【读书笔记】Python for Finance 笔记#1

1. Implied Volatility, 隐藏波动性

关于期权报价的分析?

Black-Scholes-Merton(1973) functions

#

#Valuation of European call options in Black-Scholes-Merton model

#incl. Vega function and implied volatility estimation

#bsm_functions.py

#

#Analytical Black-Scholes-Merton (BSM) Formula

def bsm_call_value(S0,K, T,r, sigma):

"""Valuation of European call option in BSM model.

Analytical formula

Parameters

==========

S0 : float

initial stok/index level

K : float

strike price

T : float

maturity date (in year fractions)

r : float

constant risk-free short rate

sigma : float

volatility factor in diffusion term

Returns

=======

value : float

present value of the European call option

"""

from math import log, sqrt, exp

from scipy import stats

S0 = float(S0)

d1 = (log(S0/K)+(r+0.5*sigma**2)*T)/(sigma*sqrt(T))

d2 = (log(S0/K)+(r-0.5*sigma**2)*T)/(sigma*sqrt(T))

value = (S0*stats.norm.cdf(d1,0.0,1.0)

-K*exp(-r*T)*stats.norm.cdf(d2,0.0,1.0))

#stats.norm.cdf --> cumulative distribution function 累计分布函数

# for normal distribution

return value

#Vega function

def bsm_vega(S0, K, T, r, sigma):

'''Vega of European option in BSM model.

Parameters

==========

S0 : float

initial stok/index level

K : float

strike price

T : float

maturity date (in year fractions)

r : float

constant risk-free short rate

sigma : float

volatility factor in diffusion term

Returns

=======

vega : float

partial derivative of BSM formula with respect to sigma, i.e. Vega

'''

from math import log, sqrt

from scipy import stats

S0 = float(S0)

d1 = (log(S0/K)+(r+0.5*sigma**2)*T/(sigma*sqrt(T)))

vega = S0*stats.norm.cdf(d1, 0.0, 1.0)*sqrt(T)

#Implied volatility function

def bsm_call_vol(S0, K, T, r, C0, sigma_est, it=100):

'''Implied volatility of European call option in BSM model.

Parameters

==========

S0 : float

initial stok/index level

K : float

strike price

T : float

maturity date (in year fractions)

r : float

constant risk-free short rate

sigma_est : float

estimate of impl. volatility

it : integer

number of interations

Returns

=======

sigma_est : float

numericall estimated implied volatility

'''

for i in range(it):

sigma_est -= ((bsm_call_value(S0, K, T, r, sigma_est)-C0)/bsm_vega(S0, K, T, r, sigma_est))

return sigma_est2. Monte Carlo simulation, 蒙特·卡罗方法(Monte Carlo method),也称统计模拟方法

跟股票指数有关?

Monte Carlo method是金融和数据科学的重要算法之一。可以解决高维度问题。

缺点,需要非常大的计算能力。

比较三种方法计算欧式期权(European Option)的Monte Carlo-based value

Pure Python : 用python的标准库计算Monte Carlo 值

Vectorized Numpy : 用Numpy库

Fully vertorized Numpy : 结合不同的数据公式来实现

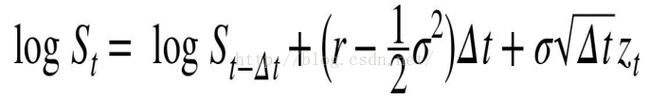

Black-Scholes-Merton(1973) 随机微分方程

其中, Z是布朗运动系数(Brownian motion)

Euler discretization of SDE(stochastic differential equation)

使用Pure Python实现Monte Carlo valuation of European call option(欧式买方期权)

#

#Monte Carlo valuation of European call options with pure Python

#msc_pure_python.py

#

from time import time

from math import exp, sqrt, log

from random import gauss, seed

seed(20000)

t0=time()

#Parameters

S0=100 #initial value

K = 105. #strike price,成交价

T = 1.0 #maturity

r = 0.05 #riskless short rate

sigma = 0.2 #volatility

M = 50 #number of time steps

dt = T/M #length of time interval

I = 250000 #number of paths

# Simulating I paths with M time steps

S=[]

for i in range(I):

path = []

for t in range(M+1):

if t==0:

path.append(S0)

else:

z= gauss(0.0, 1.0)

St = path[t-1]*exp((r-0.5*sigma**2)*dt

+sigma*sqrt(dt)*z)

path.append(St)

S.append(path)

#Calculating the Monte Carlo estimator

C0 = exp(-r*T)*sum([max(path[-1]-K,0) for path in S])/I

#Results output

tpy = time() - t0

print "European Option Value %7.3f" %C0

print "Duration in Seconds %7.3f" %tpy输出结果:

European Option Value 7.999

Duration in Seconds 33.419Monte Carlo valuation of European call option with Numpy(first version)

#

# Monte Carlo valuation of European call options with Numpy

# msc_vector_numpy.py

#

import math

import numpy as np

from time import time

np.random.seed(20000)

# 一般计算机的随机数都是伪随机数,以一个真随机数(种子)作为初始条件,然后用一定的算法不停迭代产生随机数

t0 = time()

#Parameters

S0 = 100.

K = 105.

T = 1.0

r = 0.05

sigma = 0.2

M = 50

dt = T/M

I = 250000

#Simulating I path with M time stemps

S = np.zeros((M+1, I))

S[0] = S0

for t in range(1, M+1):

z = np.random.standard_normal(I) #pseudorandom numbers

S[t] = S[t-1] * np.exp((r-0.5*sigma**2)*dt

+sigma*math.sqrt(dt)*z)

#vertorized operation per time step over all paths

# Calculating the Monte Carlo estimator

C0 = math.exp(-r*T)*np.sum(np.maximum(S[-1]-K, 0))/I

# Results output

tnp1 = time() - t0

print "European Option Value %7.3f"%C0

print "Duration in Seconds %7.3f"%tnp1输出结果

European Option Value 8.037

Duration in Seconds 1.382Full Vetorization wtih Log Euler Scheme

采用Log微分,Euler discretization of SDE(log verion)

#

# Monte Carlo valuation of European call options with Numpy (log version)

# msc_full_vector_numpy.py

#

import math

from numpy import *

from time import time

random.seed(20000)

t0 = time()

#Parameters

S0 = 100.

K = 105.

T = 1.0

r = 0.05

sigma = 0.2

M = 50

dt = T/M

I = 250000

#Simulating I paths with M time steps

S = S0*exp(cumsum((r-0.5*sigma**2)*dt+sigma*math.sqrt(dt)*random.standard_normal((M+1, I)),axis=0))

#sum instead of cumsum would also do if only the final values are of interest

S[0] = S0

C0 = math.exp(-r*T)*sum(maximum(S[-1]-K,0))/I

# Results output

tnp1 = time() - t0

print "European Option Value %7.3f"%C0

print "Duration in Seconds %7.3f"%tnp1输出结果:

European Option Value 8.166

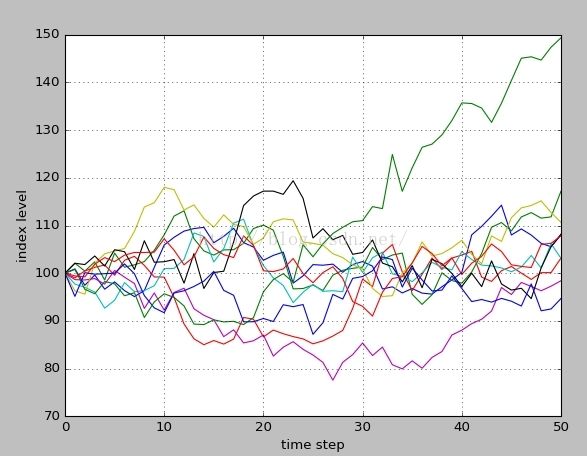

Duration in Seconds 2.020图形化模拟过程

import matplotlib.pyplot as plt

plt.plot(S[:, :10])

plt.grid(True)

plt.xlabel('time step')

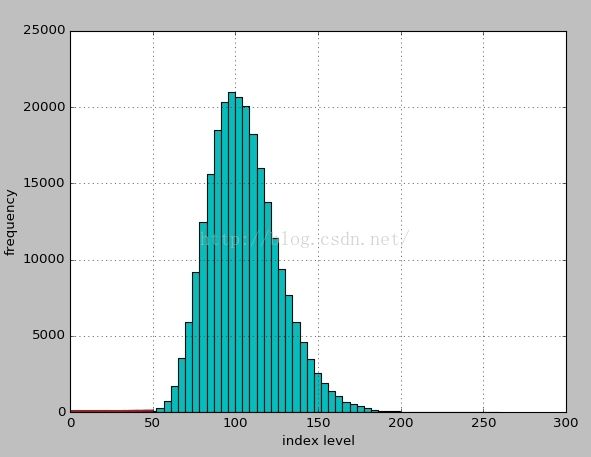

plt.ylabel('index level')显示模拟指数的频率

plt.hist(S[-1], bins = 50)

plt.grid(True)

plt.xlabel('index level')

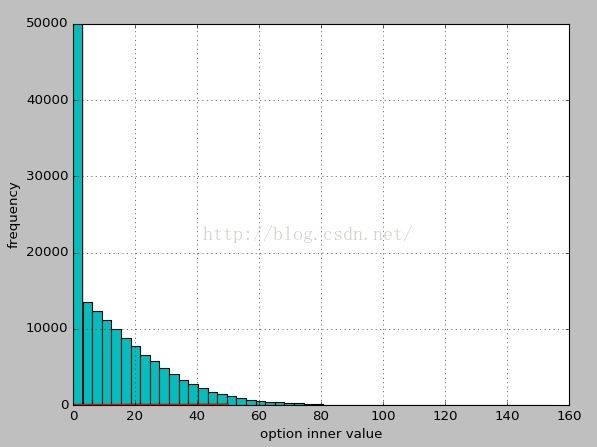

plt.ylabel('frequency')option inner value??

plt.hist(np.maximum(S[-1]-K,0), bins = 50)

plt.grid(True)

plt.xlabel('option inner value')

plt.ylabel('frequency')

plt.ylim(0,50000)3. Technical Analysis, 技术分析

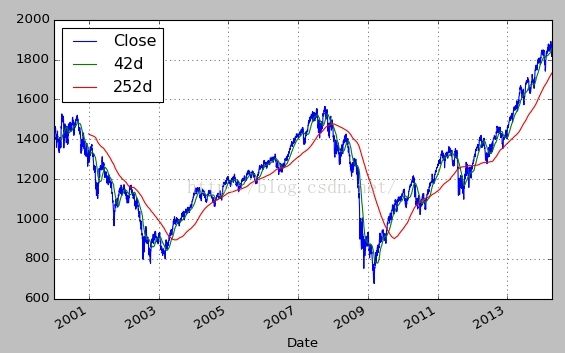

根据历史数据回测投资策略的趋势信号

从yahoo finance下载SP500指数数据,并画出42日均线和252日均线

import numpy as np

import pandas as pd

import pandas.io.data as web

sp500 = web.DataReader('^GSPC',data_source='yahoo', start = '1/1/2000', end = '4/14/2014')

#print sp500.info()

#42天均线,和252天均线

sp500['42d'] = np.round(pd.rolling_mean(sp500['Close'],window=42),2)

sp500['252d'] = np.round(pd.rolling_mean(sp500['Close'],window=252),2)

sp500[['Close','42d','252d']].plot(grid = True, figsize = (8,5))