马科维茨投资组合有效集、最优投资组合

目的

按照马科维茨的均值方差理论,构建股票的可行集,得到有效前沿,并根据夏普比率获得有效前沿上的最优投资组合,并按照一定的无风险资产配置进行投资,使用测试集检验该种方法的有效程度。

数据来源

1.使用tushare的python数据包。

2.以’300458’, ‘000948’, ‘300327’,‘300735’, '603496’五只股票作为测试。

3.选择2018.1.1-2018.12.31的股票作为训练集,2019.1.1-2019.12.31的股票作为测试集。

理论依据

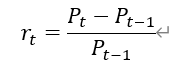

1.收益的度量:使用日收益率作为证券收益率的随机变量,第t期的日收益率计算公式为:

其中为Pt第t期的收盘价,Pt-1为第t-1期的收盘价。

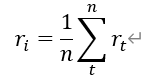

第i种证券的平均收益率表示为:

此处使用算术平均的方法求得平均收益率,其中蕴涵了一个假设:过去的每一期收益率发生的概率是相等的。(在无法得知过去收益率分布的情况下可据此近似计算,或采用几何平均的计算方法)

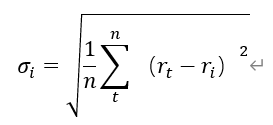

2.风险的度量:使用证券日收益率的波动程度表示证券的风险,即证券日收益率的标准差,第i种证券的标准差计算公式为:

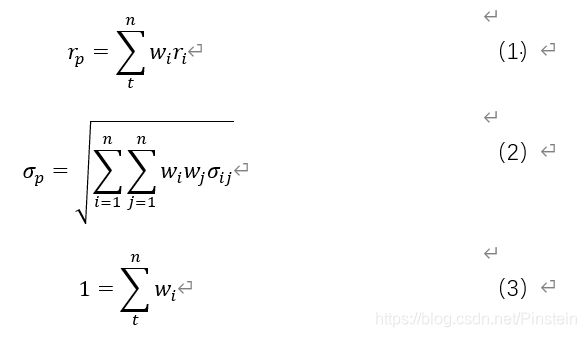

3.约束条件:构建投资组合的可行集应该满足一下三个约束条件:

式(1)表示投资组合的收益率;

式(2)表示投资组合的风险,表示第种证券和第种证券的协方差;

式(3)表示不允许卖空的情况下,所有证券的持有比例加起来为1.

过程

1.两只股票的情形

使用’300735’,和’603496’两只股票构建投资组合,绘制组合的“收益-风险“图形如下:

2.五只股票的情形

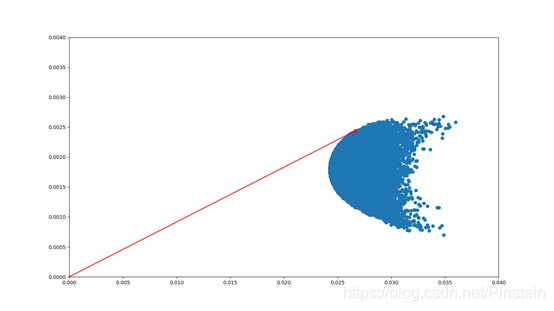

使用’300458’,‘000948’, ‘300327’, ‘300735’, '603496’五只股票构建投资组合,绘制其可行集如下:

图2

对比图1和图2可看出,当投资组合中证券数量增多时,收益率不仅没有下降,风险还随之减少了。

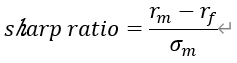

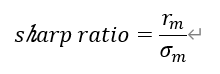

根据马科维茨的理论,我们可以选取的投资组合位于有效前沿上。为了进一步筛选有效前沿上的投资组合,我们采用夏普比率进行筛选,取有效前沿上的夏普比率最高的投资组合为最佳投资组合。夏普比率计算公式如下所示:

其中为投资组合的收益率,无风险资产的收益率,我们假设不持有无风险资产,则夏普比率变为:

由夏普比率可绘制资本市场线(CML)如图2红线所示,红点处即为夏普比率最高的投资组合

#股票的相关系数、收益率的均值和方差

import tushare as ts

import pandas as pd

import math

def get_yield_rate(code, Start, End): #获取股票的单期收益率

df = ts.get_hist_data(code, start=Start, end=End) #从接口获取股票数据

close = df['close'] #收盘价

lagclose = close.shift(-1) #让收盘价滞后-1期

yield_rate = (close-lagclose)/lagclose #计算单期收益率

yield_rate.name = 'yield_rate' #给series设置名字

yield_rate = pd.DataFrame(yield_rate) #将series变为DataFrame

yield_rate = yield_rate.fillna(method='backfill', axis=0) #向上填充列

yield_rate = yield_rate.fillna(method='ffill', axis=0) #向下填充列

return yield_rate

def EX(yield_rate): #计算收益率的均值

result = 0

for i in yield_rate.index:

result = result + yield_rate.loc[i, 'yield_rate']

mean_value = result/len(yield_rate)

return mean_value

def X_EX(yield_rate): #计算X-EX

mean_value = EX(yield_rate)

yield_rate['mean_value'] = mean_value

result = yield_rate['yield_rate'] - yield_rate['mean_value']

return result

def CovXY(yield_rate1, yield_rate2): #计算Cov(X,Y)

x_Ex = X_EX(yield_rate1)

y_Ey = X_EX(yield_rate2)

result = x_Ex * y_Ey

result.name = '(X-EX)(Y-EY)'

result = pd.DataFrame(result)

mean = 0

for i in result.index:

mean = mean + result.loc[i, '(X-EX)(Y-EY)']

Cov = mean/len(yield_rate1)

return Cov

def DX(yield_rate): #计算方差

x_Ex = X_EX(yield_rate)

x_Ex2 = x_Ex * x_Ex

x_Ex2.name = '(X-EX)^2'

x_Ex2 = pd.DataFrame(x_Ex2)

result = 0

for i in x_Ex2.index:

result = result + x_Ex2.loc[i, '(X-EX)^2']

Dx = result/len(yield_rate)

return Dx

def ruo(code1, code2, Start, End):

yield_rate1 = get_yield_rate(code1, Start, End)

yield_rate2 = get_yield_rate(code2, Start, End)

Cov = CovXY(yield_rate1, yield_rate2)

Dx = DX(yield_rate1)

Dy = DX(yield_rate2)

R = Cov/((math.sqrt(Dx))*math.sqrt(Dy))

return R

def get_EX(code, Start, End): #返回均值

yield_rate = get_yield_rate(code, Start, End)

Ex = EX(yield_rate)

return Ex

def get_DX(code, Start, End): #返回方差

yield_rate = get_yield_rate(code, Start, End)

Dx = DX(yield_rate)

return Dx

#股票的相关系数矩阵

import security_data

import pandas as pd

def get_ruo(list, Start, End): #建立相关系数矩阵

ruo_df = pd.DataFrame()

for i in list:

ruo_df.loc[i, ] = 0

for j in list:

ruo = security_data.ruo(i, j, Start, End)

ruo_df.loc[i, j] = ruo

return ruo_df

def get_Ex_Dx(list, Start, End): #计算均值和方差

Ex_Dx_df = pd.DataFrame()

for i in list:

Ex = security_data.get_EX(i, Start, End)

Dx = security_data.get_DX(i, Start, End)

Ex_Dx_df.loc[i, 'EX'] = Ex

Ex_Dx_df.loc[i, 'DX'] =Dx

return Ex_Dx_df

def get_correlation_matrix(Start, End, security_list):

ruo_df = get_ruo(security_list, Start, End)

Ex_Dx_df = get_Ex_Dx(security_list, Start, End)

return ruo_df, Ex_Dx_df

#比较股票的相关系数

import security_data as sd

import tushare as ts

import pandas as pd

def get_code():

code_list = []

df = ts.get_sz50s()

for i in df.loc[:, 'code']:

code_list.append(i)

return code_list

def get_ruo(Start, End):

ruo_df = pd.DataFrame()

code_list = get_code()

for i in code_list:

for j in code_list:

ruo = sd.ruo(i, j, Start, End)

if ruo <= 0:

ruo_df.loc[i, j] = ruo

print(i, j, ruo_df.loc[i, j])

return ruo_df

Start = '2019-01-01'

End = '2019-12-24'

ruo_df = get_ruo(Start, End)

print(ruo_df)

#绘制两两股票的有效边界

import correlation as cor

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

import math

import tushare as ts

def effecient_set(r1, r2, D1, D2, ruo_12): #绘制两只股票的有效边界

x = []

y = []

if r1 > r2:

a = np.linspace(r2, r1, 50)

else:

a = np.linspace(r1, r2, 50)

for i in a:

x.append(i)

y.append((math.sqrt(math.pow(((i - r2) * math.sqrt(D1) + (r1 - i) * math.sqrt(D2)), 2) +

2 * (i - r2) * (r1 - i) * (ruo_12 - 1) * math.sqrt(D1) * math.sqrt(D2))) \

/ abs(r1 - r2))

plt.plot(y, x)

def begin(Start, End):

code_list = []

df = ts.get_sz50s()

for i in df.loc[:, 'code']:

code_list.append(i)

ruo_df, Ex_Dx_df = cor.get_correlation_matrix(Start, End, code_list)

plt.figure()

for i in range(len(code_list)-1):

for j in range(len(code_list)-i-1):

r1 = Ex_Dx_df.loc[code_list[i], 'EX']

r2 = Ex_Dx_df.loc[code_list[i+j+1], 'EX']

D1 = Ex_Dx_df.loc[code_list[i], 'DX']

D2 = Ex_Dx_df.loc[code_list[i+j+1], 'DX']

ruo_12 = ruo_df.loc[code_list[i], code_list[i+j+1]]

effecient_set(r1, r2, D1, D2, ruo_12)

plt.show()

Start = '2019-01-01'

End = '2019-12-24'

begin(Start, End)

#有效前沿 effciency_set

import correlation as cor

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

import math

import tushare as ts

import random

import time

def get_original_weight(number): #获得50只股票的随机权重

x = np.random.rand(number)

ratio = 1/sum(x)

x = x * ratio

x = list(x)

return x

def get_rp(weight, Ex_Dx_df): #计算总收益率

rp = 0

count = 0

for i in Ex_Dx_df.index:

rp = rp + Ex_Dx_df.loc[i, 'EX'] * weight[count]

count = count + 1

return rp

def get_sgm_p(weight, ruo_df, Ex_Dx_df): #计算总风险

sgm_p = 0

count1 = -1

for i in Ex_Dx_df.index:

count1 = count1 + 1

weight1 = weight[count1]

sgm1 = math.sqrt(Ex_Dx_df.loc[i, 'DX'])

count2 = -1

for j in Ex_Dx_df.index:

count2 = count2 + 1

weight2 = weight[count2]

sgm2 = math.sqrt(Ex_Dx_df.loc[j, 'DX'])

ruo12 = ruo_df.loc[i, j]

sgm_p = sgm_p + weight1 * weight2 * sgm1 * sgm2 * ruo12

return math.sqrt(sgm_p)

def plot_CML(sgm_i, sharp_ratio):

x = []

y = []

a = np.linspace(0, sgm_i, 50)

for i in a:

x.append(i)

y.append(i * sharp_ratio)

plt.plot(x, y, c='r')

def get_weight(Start, End, code_list, portfolio_number):

x = []

y = []

sharp_ratio = 0

ruo_df, Ex_Dx_df = cor.get_correlation_matrix(Start, End, code_list)

for i in range(portfolio_number):

weight = get_original_weight(len(code_list))

rp = get_rp(weight, Ex_Dx_df)

sgm_p = get_sgm_p(weight, ruo_df, Ex_Dx_df)

y.append(rp)

x.append(sgm_p)

sharp_ratio_temp = rp / sgm_p

if sharp_ratio_temp > sharp_ratio:

sharp_ratio = sharp_ratio_temp

ri = rp

sgm_i = sgm_p

weight_final = weight

plt.figure()

plt.xlim([0, 0.04]) # 设置绘图X边界

plt.ylim([0, 0.004])

plt.scatter(x, y)

plot_CML(sgm_i, sharp_ratio)

plt.scatter(sgm_i, ri)

plt.show()

print('ri:', ri, 'sgm_i:', sgm_i)

print('weight:', weight_final)

start = time.clock()

Start = '2018-01-01'

End = '2018-12-31'

code_list = ['300458', '000948', '300327', '300735', '603496']

get_weight(Start, End, code_list, 1000000)

elapsed = (time.clock() - start)

print("Time used:",elapsed)

#ri_19 = 0.002507473327125009

#sgm_i_19 = 0.027271707336635868

#weight_19: [0.560259898457182, 0.0011445939423587268, 0.18022505839139358, 0.25549792575307023, 0.0028725234559953145]

#ri_18: 0.0007537633778995758 sgm_i_18: 0.03786930749207172

#weight_18: [0.005199184879159315, 0.01004921278630503, 0.0032974530547201057, 0.9789594590449071, 0.0024946902349084646]

list = ['600000', '600009', '600016', '600028', '600030', '600031', '600036', '600048', '600050', '600104', '600196', '600276', '600309', '600340', '600519', '600547', '600585', '600690', '600703', '600837', '600887', '601012', '601066', '601088', '601111', '601138', '601166', '601186', '601211', '601236', '601288', '601318', '601319', '601328', '601336', '601390', '601398', '601601', '601628', '601668', '601688', '601766', '601818', '601857', '601888', '601939', '601988', '601989', '603259', '603993']

#测试投资组合收益率 test_set

import pandas as pd

import matplotlib.pyplot as plt

import numpy as np

import math

import tushare as ts

import random

import time

#import efficiency_set as es

import security_data as sd

def test(code_list, Start, End):

return_all = []

#weight = es.get_weight(Start, End, code_list, portfolio_number)

weight = [0.005199184879159315, 0.01004921278630503, 0.0032974530547201057, 0.9789594590449071, 0.0024946902349084646]

for c in range(len(code_list)):

yield_rate = sd.get_yield_rate(code_list[c], Start, End)

return_item = 1

for i in yield_rate.index:

return_item = return_item * (1 + yield_rate.loc[i, 'yield_rate'])

return_item = return_item * weight[c]

return_all.append(return_item)

print(return_all)

sum = 0

for i in return_all:

sum = sum + i

print('sum:', sum)

Start = '2019-01-01'

End = '2019-12-31'

code_list = ['300458', '000948', '300327', '300735', '603496']

test(code_list, Start, End)

#capm模型分析股票收益率 capm

import tushare as ts

import pandas as pd

import numpy as np

import security_data as sd

import time

def get_yield_rate(code, Start, End): #获取股票的单期收益率

df = ts.get_hist_data(code, start=Start, end=End) #从接口获取股票数据

close = df['close'] #收盘价

lagclose = close.shift(-1) #让收盘价滞后-1期

yield_rate_series = (close-lagclose)/lagclose #计算单期收益率

yield_rate_series.name = 'yield_rate' # 给series设置名字

yield_rate_df = pd.DataFrame(yield_rate_series) # 将series变为DataFrame

yield_rate_df = yield_rate_df.fillna(method='backfill', axis=0) # 向上填充列

yield_rate_df = yield_rate_df.fillna(method='ffill', axis = 0) # 向下填充列

return yield_rate_df

#以沪深300构建市场组合

def get_market_portfolio(Start, End):

hs300_df = ts.get_hs300s()

code_list = [] #储存沪深300的股票代码

weight = [] #储存沪深300的股票权重

yield_rate_init = pd.DataFrame()

for i in hs300_df.loc[:, 'code']:

code_list.append(i)

for i in hs300_df.loc[:, 'weight']:

weight.append(i)

M_yield_rate = get_yield_rate(code_list[0], Start, End)

M_yield_rate.loc[:, 'yield_rate'] = 0 #初始化市场组合M日收益率

for code_number in range(len(code_list)):

yield_rate = get_yield_rate(code_list[code_number], Start, End)

M_yield_rate = pd.merge(M_yield_rate, yield_rate, how='left', on='date')

M_yield_rate = M_yield_rate.fillna(method='backfill', axis=0) # 向上填充列

M_yield_rate = M_yield_rate.fillna(method='ffill', axis=0) # 向下填充列

M_yield_rate = M_yield_rate.fillna(0) # 若存在股票尚未上市的情况,用0填充所有收益率

yield_rate_init['yield_rate'] = M_yield_rate.loc[:, 'yield_rate_x'] + weight[code_number]*M_yield_rate.loc[:, 'yield_rate_y']

M_yield_rate = yield_rate_init

yield_rate_init = pd.DataFrame()

return M_yield_rate

time_start = time.clock()

Start = '2018-01-01'

End = '2018-12-31'

code = '600000'

item_yield_rate = get_yield_rate(code, Start, End)

M_yield_rate = get_market_portfolio(Start, End)

Cov = sd.CovXY(M_yield_rate, item_yield_rate)

Dm = sd.DX(M_yield_rate)

rm = sd.EX(M_yield_rate)

ri = (Cov/Dm)*rm

print(ri)

elapsed = (time.clock() - time_start)

print("Time used:", elapsed)