聪明钱因子(R语言实现)

聪明钱因子

最近回到了csdn,打算记录一下自己在量化策略方面的学习历程。

正好最近也快R语言的期末考试了,这几天就用R实现了一个简单的聪明钱因子,但不得不说R语言的读入数据是真的慢。。。

根据研报上的信息,将 α = ∣ p c t c h g ∣ v o l u m e \alpha=\frac{|pct_{chg}|}{\sqrt{volume}} α=volume∣pctchg∣作为一个中间变量,其中 p c t c h g pct_{chg} pctchg为涨跌幅, v o l u m e volume volume为交易量,对每分钟的交易数据处理 α \alpha α。

其中, α \alpha α可以认为是交易行为聪明度的体现,

当涨跌幅大,交易量小时,则 α \alpha α大,在此时间段进行的交易更为聪明。(简单理解为 涨跌代表套利空间,交易量小代表行动是否有先瞻性)

令 β \beta β为聪明钱交易中前1/4不聪明的分钟记录 的交易均价 除以 整个周期内的交易均价(周期设置为一周)

β \beta β值越小,则代表价格底部发生了大量的聪明交易,往往是建仓的信号; β \beta β值越大,则代表价格顶部发生了大量的聪明交易,往往是出货的信号。

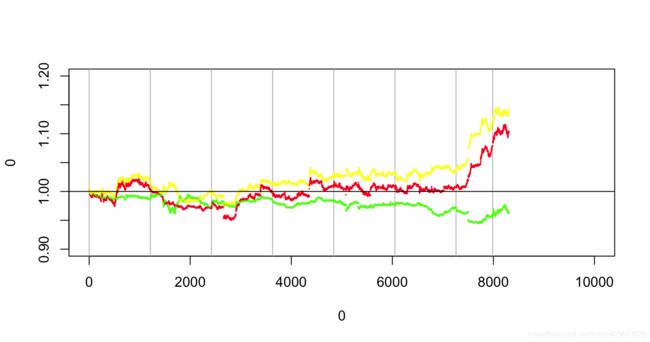

因此,根据 β \beta β值将股票池中的股票从小到大分为三组,空仓组、无仓组、多仓组,将多仓组、无仓组进行对冲后即可得到简单的聪明钱因子 实现。(根据上周数据决定本周开盘首日调仓行为)

数据选取了2020-4-30 9:30am 开始的10,000条分钟数列,对冲结果表现还行。

囿于数据确实,没有办法进行更多股票池与更长时间的测试。

rm(list=ls())

wd="~/Desktop/QuantData"

setwd(wd)

filename=c('002001.SZ.xlsx',

'002216.SZ.xlsx',

'300274.SZ.xlsx',

'600009.SH.xlsx',

'600048.SH.xlsx',

'600377.SH.xlsx',

'600519.SH.xlsx',

'600535.SH.xlsx',

'600585.SH.xlsx',

'601186.SH.xlsx',

'601398.SH.xlsx',

'601966.SH.xlsx',

'603288.SH.xlsx')

library(xlsx)

?read.xlsx

DATA=NULL

for(i in filename)

{

print(i)

tmp=read.xlsx(file=i,sheetIndex=1,startRow=3)

tmp["name"]=i

tmp["price"]=tmp['amt']/tmp['volume']

for(j in 2:length(tmp$price))

if(tmp$volume[j]==0)

tmp$price[j]=tmp$price[j-1]

tmp["fact"]=abs(tmp["pct_chg"])/(sqrt(tmp["volume"]))*1e4

DATA=rbind(DATA,tmp)

}

MAXTIME=max(DATA$Time)

minutes=60

hours=3600

days=3600*24

weeks=7*days

t=DATA$Time[1]

ed=t+weeks

?aggregate

buy=matrix(rep(0,length(DATA$Time)),nrow=length(filename))

weekn=1

while(t<MAXTIME)

{

st=t

ed=st+weeks

tmp=DATA[which((DATA$Time<ed)&(DATA$Time>=st)),]

t=ed

n=0

l=rep(0,length(filename))

for(i in 1:length(filename))

{

tmp2=tmp[which(tmp$name==filename[i]),"fact"]

tmp2=as.numeric((tmp2))+1e-7*(1:length(tmp2))

# tmp2=sort(tmp2)

# l[i]=sum(tmp2[1:as.integer(length(tmp2)/4)])/sum(tmp2)

tmp2=rank(tmp2)

smart_rank=which(tmp2<=as.integer(length(tmp2)/4))

l[i]=sum(tmp[smart_rank,"amt"])/sum(tmp[smart_rank,"volume"])/(sum(tmp["amt"])/sum(tmp["volume"]))

}

short_p=quantile(l,probs=0.25)

long_p=quantile(l,probs=0.75)

short_index= which(l<=short_p)

long_index=which(l>long_p)

weekn=weekn+1

buy[short_index,weekn]=-1

buy[long_index,weekn]=1

}

long_ret=1

short_ret=1

st=DATA$Time[1]

st=weeks*2+st

laslong=1

lasshort=1

long_cnt=NULL

short_cnt=NULL

plot.new()

plot(x=0,y=0,xlim=c(0,10000),ylim=c(0.9,1.2),cex=0.1)

la_point_cnt=0

point_cnt=0

for( i in (2:(weekn-1)))

{

long_index=which(buy[,i]==1)

short_index=which(buy[,i]==-1)

ed=st+weeks

tmp=DATA[which((DATA$Time<ed)&(DATA$Time>=st)),]

if(length(tmp$Time)==0)

next

totl=0

for(j in long_index)

{

tmp2=tmp[which(tmp$name==filename[j]),]

price=tmp2$price[1]

totl=totl+price

}

tots=0

for(j in short_index)

{

tmp2=tmp[which(tmp$name==filename[j]),]

price=tmp2$price[1]

tots=tots+price

}

totl=totl/length(long_index)

tots=tots/length(short_index)

if(i==2)

{

ss=1

sl=1

lasshort=tots

laslong=totl

}else

{

ss=short_cnt[point_cnt]

sl=long_cnt[point_cnt]

lasshort=tots

laslong=totl

}

ss=ss*1.0001

sl=sl*0.9999

time_length=as.integer(length(tmp$Time)/length(filename))

short_start=short_index[1:length(short_index)]-1

short_start=short_start*time_length

long_start=long_index[1:length(long_index)]-1

long_start=long_start*time_length

abline(v=point_cnt,col='grey')

print (0-la_point_cnt+point_cnt)

la_point_cnt=point_cnt

for(j in 1:time_length)

{

for(ck in short_start)

if(all(filename[short_index]!=tmp[ck+j,'name']))

print("short_error")

stmp=ss*mean(tmp[short_start+j,"price"])/lasshort

ltmp=sl*mean(tmp[long_start+j,"price"])/laslong

short_cnt=c(short_cnt,stmp)

long_cnt=c(long_cnt,ltmp)

point_cnt=point_cnt+1

if(point_cnt>=5079&&point_cnt<=5083)

{

print(short_start)

print(stmp)

print(tmp[short_start+j,"name"])

print(tmp[short_start+j-1,"price"])

print(tmp[short_start+j,"price"])

print(tmp[short_start+j,"Time"])

print("\n")

print("\n")

}

points(x=point_cnt,y=stmp,col='green',cex=0.1)

points(x=point_cnt,y=ltmp,col='red',cex=0.1)

points(x=point_cnt,y=1+ltmp-stmp,col='yellow',cex=0.1)

}

st=ed

}

abline(h=1)