【经济模型】CAPM模型实例验证

CAPM模型,全称为Capital Asset Pricing Model

E ( R t ) − R f = β × [ E ( R M t ) − R f ] E(R_t)-R_f=\beta \times [E(RM_t)-R_f] E(Rt)−Rf=β×[E(RMt)−Rf]

验证CAPM模型是否成立,代码示例如下:

选用数据源为聚宽,以600000.XSHG,600352.XSHG,000001.XSHG,000012.XSHG数据为例。

获取数据

from jqdatasdk import *

auth('用户名', '密码')

is_auth=is_auth()

print(is_auth)

stock_ids=["600000.XSHG","600352.XSHG","000001.XSHG","000012.XSHG"]

for stock_id in stock_ids:

print(stock_id)

stock_price=get_bars(stock_id,50,unit='1M',fields=['date','open','high','low','close'],end_dt='2020-06-01')

stock_price.to_csv(stock_id+".csv")

print(stock_price)

计算月度收益率曲线

import os

import time,datetime

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from sklearn.linear_model import LinearRegression

import statsmodels.api as sm

def log_ret(x):

test=x.map(lambda x:np.log(1+x/100))

return (np.exp(test.sum())-1)

def get_cum_ret(ret):

cum_ret=ret.copy()

for i in range(len(ret)):

for j in range(ret.shape[1]-1):

cum_ret.iloc[i,j+1]=log_ret(ret.iloc[:i+1,j+1])*100

return cum_ret

fig=plt.figure(figsize=(24,12))

ax1=fig.add_subplot(2,1,1)

ax2=fig.add_subplot(2,1,2)

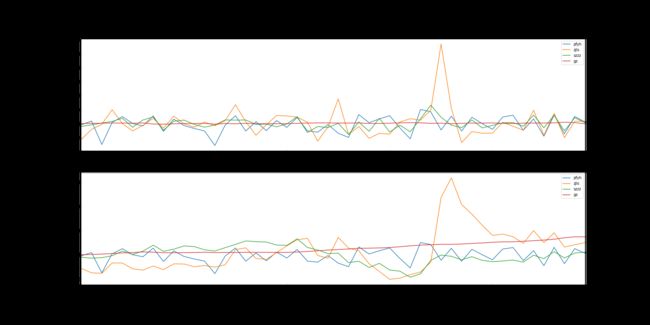

ax1.set_title("monthly return")

ax2.set_title("cumalated return")

stock_ids=["600000.XSHG","600352.XSHG","000001.XSHG","000012.XSHG"]

stock_names=['pfyh','zjls','szzz','gz']

df=pd.DataFrame()

for i in range(len(stock_ids)):

stock_id=stock_ids[i]

stock_name=stock_names[i]

data=pd.read_csv(stock_id+".csv",index_col="date")

df[stock_name]=(data["close"]-data["open"])/data["open"]*100

df_cumulate=get_cum_ret(df)

df.to_csv("stock_returns.csv")

df_cumulate.to_csv("stock_cumulative_returns.csv")

#draw return graph

df.plot(ax=ax1)

df_cumulate.plot(ax=ax2)

ax1.legend()

ax2.legend()

plt.show()

fig.savefig("ret.png")

计算相关系数

#calculate the correlation

def get_cov(ret):

data=ret.iloc[:,[1,2]]/100

print("data is",data)

output=pd.DataFrame()

output['average']=data.mean()

output['variance']=data.var()

output['stdvariance']=data.std()

covxy=np.cov(data.iloc[:,0].values,data.iloc[:,1].values)

coefxy=np.corrcoef(data.iloc[:,0].values,data.iloc[:,1].values)

output['covariance']=[np.NaN,covxy[0,1]]

output['rcoefficient']=[np.NaN,coefxy[0,1]]

return output

df=pd.read_csv("stock_returns.csv")

print("Ans3:correlation of two stocks(浦发银行、浙江龙盛)")

cov=get_cov(df)

print(cov)

CAPM模型计算

#4.capm estimation

ret=pd.read_csv("stock_returns.csv")

#iloc[:,[1,2,3,4]]-->'pfyh','zjls','szzz','gz'

x=ret.iloc[:,[1,3]]

x.columns=["constant_term","market_abnormal_return"]

x["constant_term"]=1

x["market_abnormal_return"]=ret.iloc[:,3]-ret.iloc[:,4]#x is the abnormal return of szzz

y1=ret.iloc[:,1]-ret.iloc[:,4]#y1 is the abnormal return of pfyh

print(x.head())

fig2=plt.figure(figsize=(24,24))

ax1=fig2.add_subplot(2,1,1)

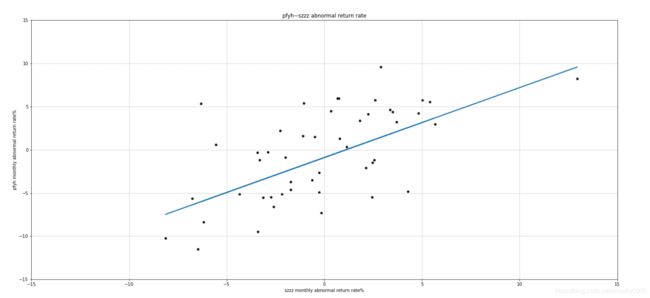

ax1.set_title("pfyh~szzz abnormal return rate")

ax1.scatter(x.iloc[:,1],y1,s=30,c='black',marker='o',alpha=0.9,linewidths=0.3,label="scatter_points_graph")

ax1.set_xlim(-15,15)

ax1.set_ylim(-15,15)

reg1=LinearRegression().fit(x,y1)

pred1=reg1.predict(x)

ax1.plot(x.iloc[:,1],pred1,linewidth=2,label="pfyh-SCL")

ax1.grid(ls='--')

ax1.set_xlabel('szzz monthly abnormal return rate%')

ax1.set_ylabel('pfyh monthly abnormal return rate%')

y2=ret.iloc[:,2]-ret.iloc[:,4]

ax2=fig2.add_subplot(2,1,2)

ax2.scatter(x.iloc[:,1],y2,s=30,c='black',marker='o',alpha=0.9,linewidths=0.3,label="scatter_points_graph")

ax2.set_xlim(-15,15)

ax2.set_ylim(-15,15)

reg2=LinearRegression().fit(x,y2)

pred2=reg2.predict(x)

ax2.plot(x.iloc[:,1],pred2,linewidth=2,label="zjls-SCL")

ax2.grid(ls='--')

ax2.set_xlabel('szzz monthly abnormal return rate%')

ax2.set_ylabel('zjls monthly abnormal return rate%')

ax2.set_title("zjls~szzz abnormal return rate")

plt.show()

fig2.savefig("capm.png")

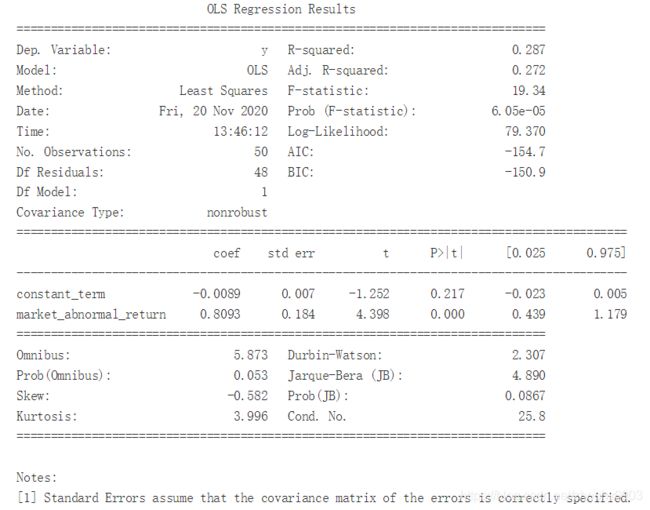

计算 α \alpha α和 β \beta β

#5.alpha & beta

def get_OLS1(ret):

x=ret.iloc[:,[1,4]]

x.columns=["constant_term","market_abnormal_return"]

x["constant_term"]=1

x["market_abnormal_return"]=(ret.iloc[:,3]-ret.iloc[:,4])/100#x is the abnormal return of szzz

y1=(ret.iloc[:,1]-ret.iloc[:,4])/100

X=sm.add_constant(x)

model1=sm.OLS(y1,x)

model1=model1.fit()

return model1

def get_OLS2(ret):

x=ret.iloc[:,[2,4]]

x.columns=["constant_term","market_abnormal_return"]

x["constant_term"]=1

x["market_abnormal_return"]=(ret.iloc[:,3]-ret.iloc[:,4])/100#x is the abnormal return of szzz

y2=(ret.iloc[:,2]-ret.iloc[:,4])/100

X=sm.add_constant(x)

model2=sm.OLS(y2,x)

model2=model2.fit()

return model2

ret=pd.read_csv("stock_returns.csv")

model1=get_OLS1(ret)

model2=get_OLS2(ret)

print(model1.summary())

print(model2.summary())