【数据分析实战】金融评分卡建立

文章目录

- 一、导入数据

- 二、EDA

-

- 2.1 查看Revol特征

- 2.2 Age

- 2.3 DebtRatio

- 2.4 Numopen

- 2.5 Numestate

- 2.6 Numdepend

- 2.7 MonthlyIncome

- 2.8 Num30-59late Num60-89late Num90late

- 三、数据清洗

-

- 3.1 异常值

- 3.2 缺失值

- 3.3 进行过采样

- 四、特征预处理

-

- 4.1 连续值四舍五入

- 4.2 创建衍生变量

- 4.3 特征筛选

- 五、计算WOE值

-

- 5.1 特征分箱

- 5.2 WOE转化

- 5.3 逐步回归

- 六、建模和评估

- 七、评分卡建立

一、导入数据

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%config InlineBackend.figure_format = 'svg'

import toad

from toad.plot import bin_plot, badrate_plot

import math

from imblearn.over_sampling import SMOTE, RandomOverSampler

import seaborn as sns

sns.set()

# 数据来源:kaggle项目"give me some credit"

credit_df0 = pd.read_csv('data/GiveMeSomeCredit/cs-training.csv')

# 查看数据集

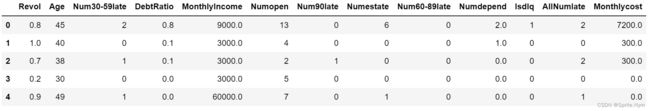

credit_df0.head()

# 查看描述性统计信息

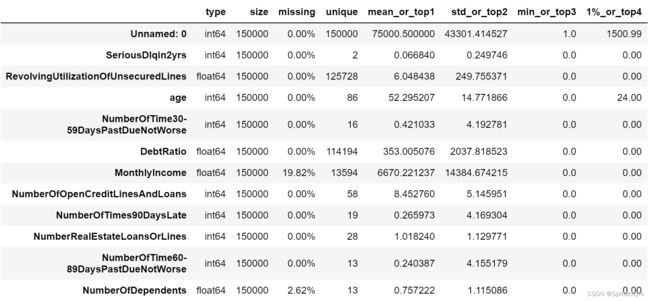

toad.detect(credit_df0)

- SeriousDlqin2yrs:超过90天或更糟的逾期拖欠

- RevolvingUtilizationOfUnsecuredLines:除了房贷车贷之外的信用卡账面金额(即贷款金额)/信用卡总额度

- age:贷款人年龄

- NumberOfTime30-59DaysPastDueNotWorse:35-59天逾期但不糟糕次数

- DebtRatio:负债比率

- MonthlyIncome:月收入

- NumberOfOpenCreditLinesAndLoans:开放式信贷和贷款数量,开放式贷款(分期付款如汽车贷款或抵押贷款)和信贷(如信用卡)的数量

- NumberOfTimes90DaysLate:借款者有90天或更高逾期的次数

- NumberRealEstateLoansOrLines:不动产贷款或额度数量

- NumberOfTime60-89DaysPastDueNotWorse:60-89天逾期但不糟糕次数

- NumberOfDependents:不包括本人在内的家属数量

二、EDA

# 丢弃编号列

credit_df1 = credit_df0.drop(['Unnamed: 0'], axis=1)

# 修改列名

colnames={'SeriousDlqin2yrs':'Isdlq',

'age':'Age',

'RevolvingUtilizationOfUnsecuredLines':'Revol',

'NumberOfTime30-59DaysPastDueNotWorse':'Num30-59late',

'NumberOfOpenCreditLinesAndLoans':'Numopen',

'NumberOfTimes90DaysLate':'Num90late',

'NumberRealEstateLoansOrLines':'Numestate',

'NumberOfTime60-89DaysPastDueNotWorse':'Num60-89late',

'NumberOfDependents':'Numdepend'}

credit_df1.rename(columns=colnames, inplace=True)

credit_df1.head()

# 查看好坏比

sns.countplot(credit_df1['Isdlq'])

print(f"好坏比:{np.round(100 * credit_df1['Isdlq'].mean(), 2)}%")

# 好坏比:6.68%

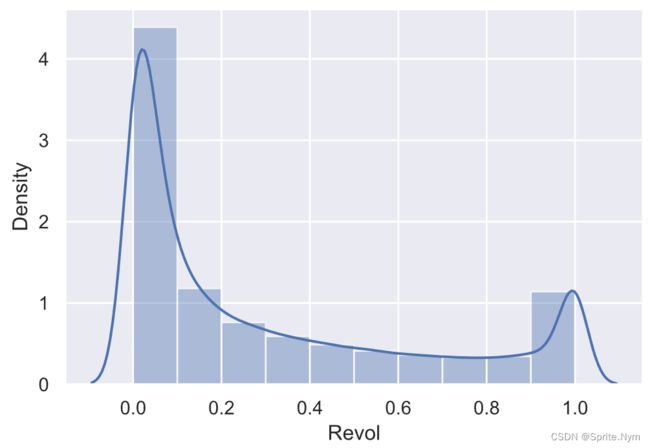

2.1 查看Revol特征

# 查看可用额度比的描述性统计信息

credit_df1['Revol'].describe([0.99, 0.999])

"""

count 150000.000000

mean 6.048438

std 249.755371

min 0.000000

50% 0.154181

99% 1.092956

99.9% 1571.006000

max 50708.000000

Name: Revol, dtype: float64

"""

明显分布异常

# 画出Revol小于1的分布图

sns.distplot(credit_df1[credit_df1['Revol']<1]['Revol'], bins=10)

# 定义一个分箱并统计箱内坏客户率的函数

def show_rate_by_box(df, target_name, feature_name, bins):

temp = pd.concat([df[target_name], pd.cut(df[feature_name], bins=bins, right=False)], axis=1)

return pd.pivot_table(temp, index=[feature_name], values=[target_name], aggfunc=['mean', 'count'])

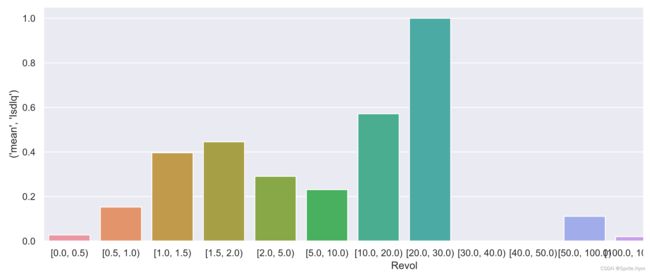

按理说Revol不应该大于1,所以我们重点查看大于1的数据违约率如何

# 初步分箱并查看各区间段的违约率分布,给后续分箱提供参考

revol_bins=[0,0.5,1,1.5,2,5,10,20,30,40,50,100,1000,5000,math.inf]

temp = show_rate_by_box(credit_df1, 'Isdlq', 'Revol', bins=revol_bins)

show_rate_by_box(credit_df1, 'Isdlq', 'Revol', bins=revol_bins)

# 画成图方便观看

plt.figure(figsize=(15, 5))

sns.barplot(x=temp.index, y=temp[( 'mean', 'Isdlq')])

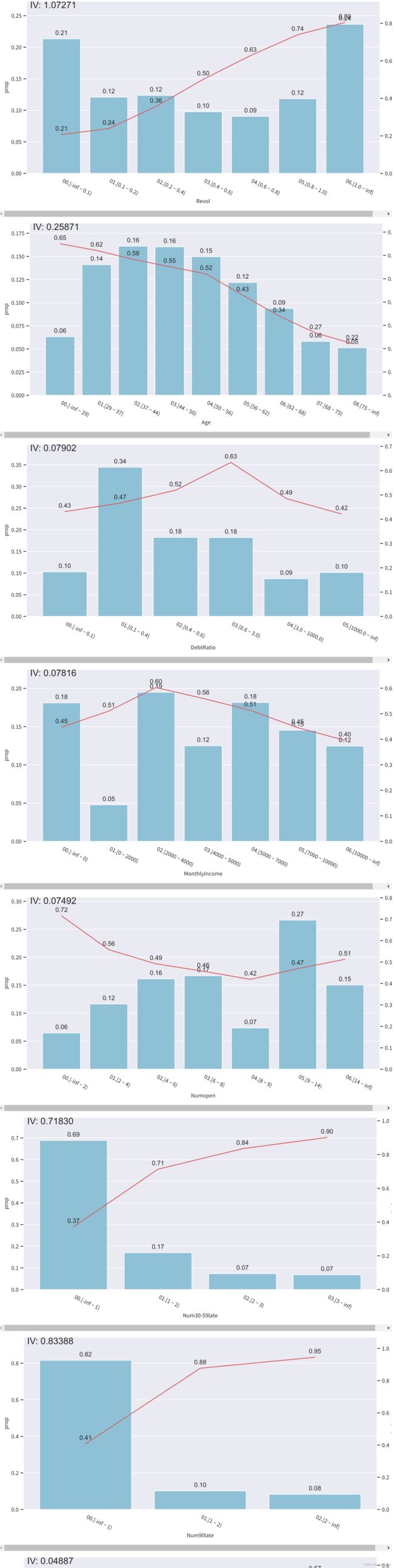

结论:1到20坏客户比率明显上升,20以上又降下来,将异常值阈值确定为20。高于20后续统一删除。

2.2 Age

# 查看年龄的描述性统计信息

credit_df1['Age'].describe([0.01])

"""

count 150000.000000

mean 52.295207

std 14.771866

min 0.000000

1% 24.000000

50% 52.000000

max 109.000000

Name: Age, dtype: float64

"""

年龄小于18岁不符合业务逻辑,后续准备统一排除

# 查看要删除的有几人

len(credit_df1[credit_df1['Age']<18])

# 1

# 画出分布图

sns.distplot(credit_df1['Age'])

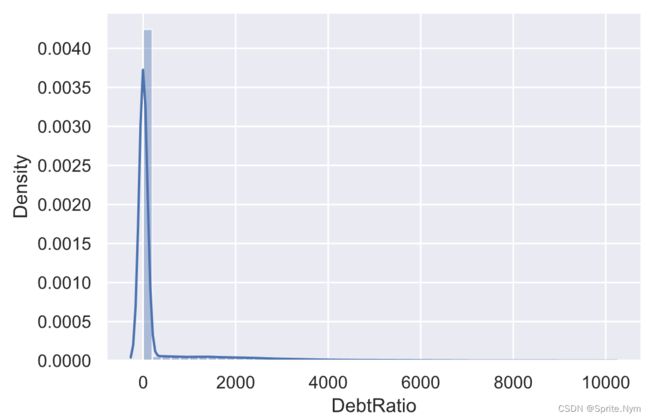

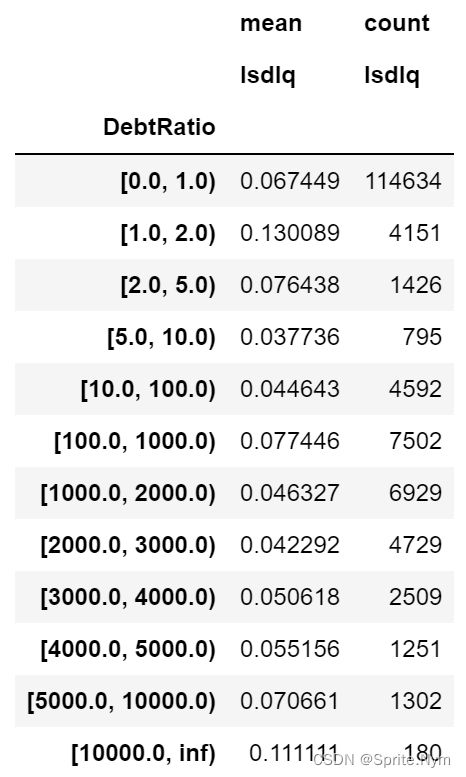

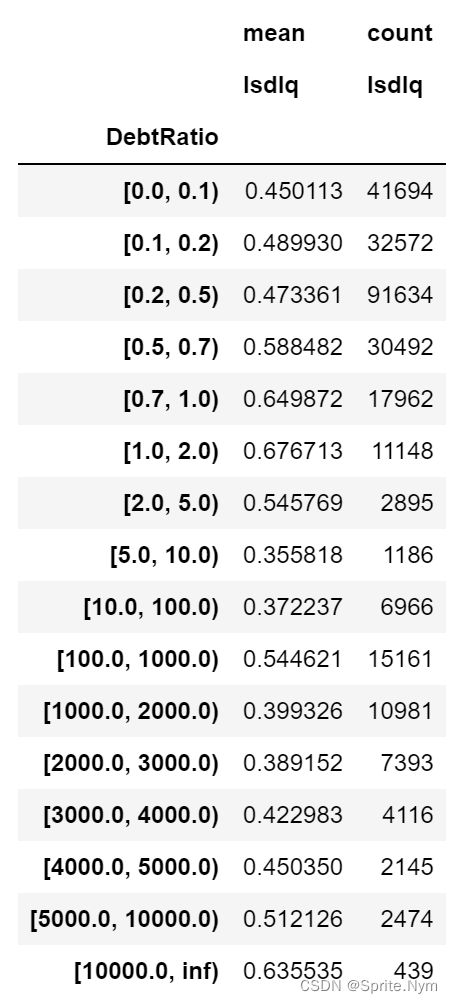

2.3 DebtRatio

# 查看负债率的描述性统计信息

credit_df1['DebtRatio'].describe([0.01, 0.99, 0.999])

"""

count 150000.000000

mean 353.005076

std 2037.818523

min 0.000000

1% 0.000000

50% 0.366508

99% 4979.040000

99.9% 10613.074000

max 329664.000000

Name: DebtRatio, dtype: float64

"""

# 画图查看分布

sns.distplot(credit_df1[credit_df1['DebtRatio']<10000]['DebtRatio'])

# 初步分箱并查看各区间段的违约率分布,给后续分箱提供参考

debtratio_bins=[0,1,2,5,10,100,1000,2000,3000,4000,5000,10000,math.inf]

show_rate_by_box(credit_df1, 'Isdlq', 'DebtRatio', bins=debtratio_bins)

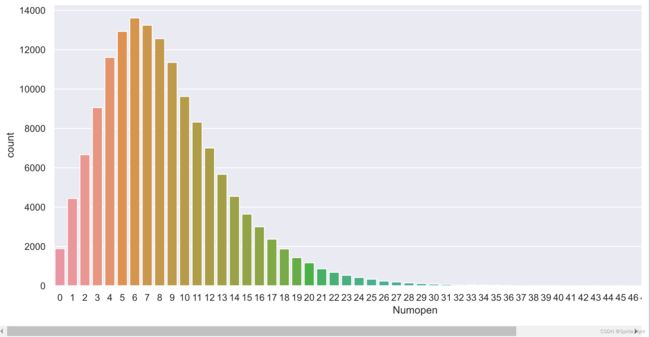

2.4 Numopen

# 查看开放式信贷和贷款数量的描述性统计信息

credit_df1['Numopen'].describe([0.99])

"""

count 150000.000000

mean 8.452760

std 5.145951

min 0.000000

50% 8.000000

99% 24.000000

max 58.000000

Name: Numopen, dtype: float64

"""

# 查看点分布

plt.figure(figsize=(15, 6))

sns.countplot(credit_df1['Numopen'])

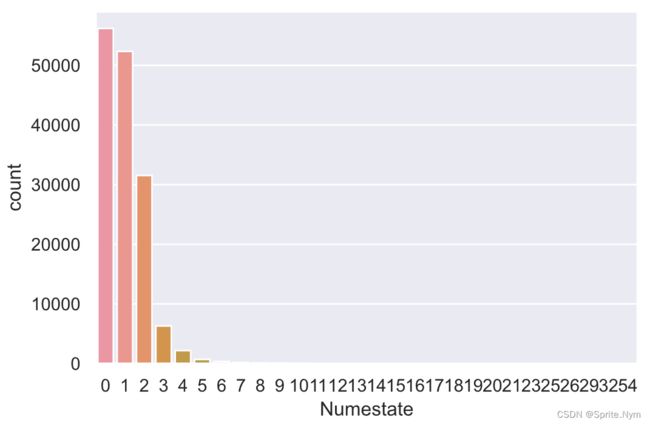

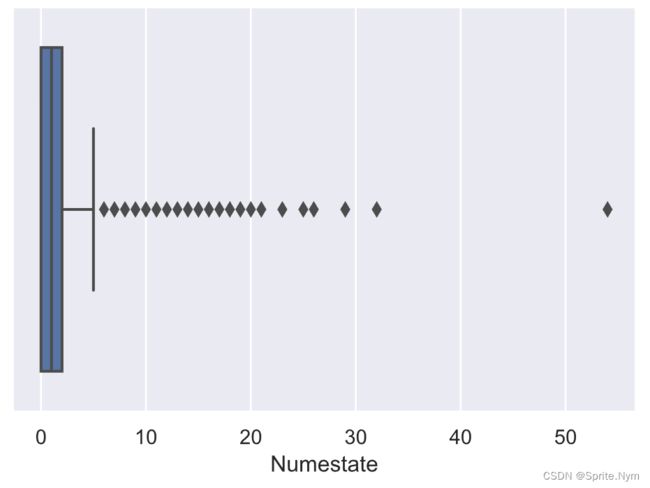

2.5 Numestate

# 查看房产和信用卡额度的数量

credit_df1['Numestate'].describe([0.99, 0.999])

"""

count 150000.000000

mean 1.018240

std 1.129771

min 0.000000

50% 1.000000

99% 4.000000

99.9% 9.000000

max 54.000000

Name: Numestate, dtype: float64

"""

# 查看数据点分布

sns.countplot(credit_df1['Numestate'])

# 箱线图查看数据分布

sns.boxplot(credit_df1['Numestate'])

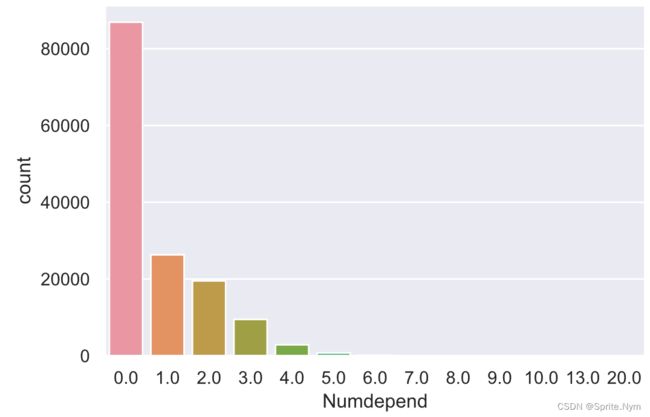

2.6 Numdepend

# 查看家属数量的描述性统计信息

credit_df1['Numdepend'].describe([0.99, 0.999])

"""

count 146076.000000

mean 0.757222

std 1.115086

min 0.000000

50% 0.000000

99% 4.000000

99.9% 6.000000

max 20.000000

Name: Numdepend, dtype: float64

"""

# 画图查看分布

sns.countplot(credit_df1['Numdepend'])

# 查看缺失值

credit_df1[credit_df1['Numdepend'].isnull()]

# 确认是否这3924个样本月收入全部缺失

credit_df1[credit_df1['Numdepend'].isnull()]['MonthlyIncome'].isnull().sum()

# 3924

决定使用月收入缺失,但家属人数未缺失的样本的众数来填充家属人数的缺失值

# 查看众数

credit_df1[(credit_df1['MonthlyIncome'].isnull())&(credit_df1['Numdepend'].notnull())]['Numdepend'].mode()

# 0

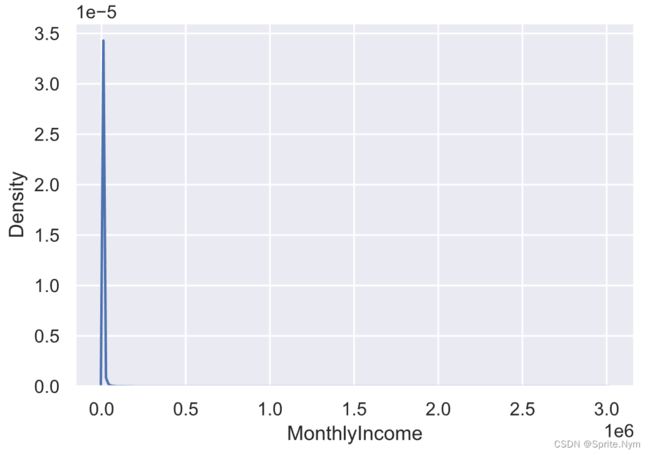

2.7 MonthlyIncome

# 查看描述性统计信息

credit_df1['MonthlyIncome'].describe([0.99, 0.999])

"""

count 1.202690e+05

mean 6.670221e+03

std 1.438467e+04

min 0.000000e+00

50% 5.400000e+03

99% 2.500000e+04

99.9% 7.839575e+04

max 3.008750e+06

Name: MonthlyIncome, dtype: float64

"""

# 画图查看分布

sns.kdeplot(credit_df1['MonthlyIncome'])

# 继续用箱线图查看

sns.boxplot(credit_df1['MonthlyIncome'])

缺失值一开始用detect查看时缺失值是19.8%,后期用随机森林填补。

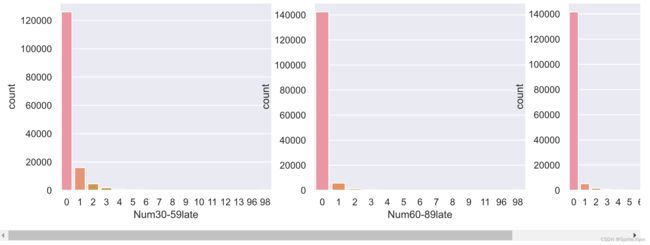

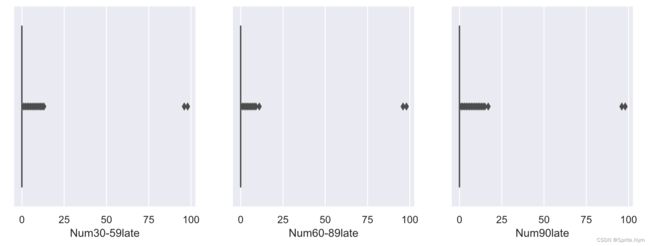

2.8 Num30-59late Num60-89late Num90late

# 查看数据点图

col_list = ['Num30-59late', 'Num60-89late', 'Num90late']

plt.figure(figsize=(15, 4))

for i in range(3):

plt.subplot(1, 3, i+1)

sns.countplot(credit_df1[col_list[i]])

# 查看箱线图

col_list = ['Num30-59late', 'Num60-89late', 'Num90late']

plt.figure(figsize=(12, 4))

for i in range(3):

plt.subplot(1, 3, i+1)

sns.boxplot(credit_df1[col_list[i]])

可以看出96、98明显是异常值,后期删除。

三、数据清洗

3.1 异常值

# Revol

# 删除之前提到的大于20的数据

credit_df1 = credit_df1[credit_df1['Revol']<=20]

# 查看描述性统计信息,现在最高值为18

credit_df1['Revol'].describe()

"""

count 149766.000000

mean 0.323388

std 0.378382

min 0.000000

25% 0.029788

50% 0.153560

75% 0.555997

max 18.000000

Name: Revol, dtype: float64

"""

# Age

# 删除18岁以下数据

credit_df1 = credit_df1[credit_df1['Age']>=18]

# Num30-59late Num60-89late Num90late

# 去除96、98两种异常值

col_list = ['Num30-59late', 'Num60-89late', 'Num90late']

for col in col_list:

credit_df1 = credit_df1[credit_df1[col]<90]

# Numestate

# 删除50以上数据

credit_df1 = credit_df1[credit_df1['Numestate']<50]

3.2 缺失值

# Numdepend

credit_df1['Numdepend'].fillna(0, inplace=True)

# MonthlyIncome缺失值填充

from sklearn.ensemble import RandomForestRegressor

from sklearn.model_selection import train_test_split

# 先得到训练集特征、标签和测试集

features_df = credit_df1[credit_df1['MonthlyIncome'].notnull()].drop(columns=['Isdlq', 'MonthlyIncome'])

target = credit_df1[credit_df1['MonthlyIncome'].notnull()]['MonthlyIncome']

test_df = credit_df1[credit_df1['MonthlyIncome'].isnull()].drop(columns=['Isdlq', 'MonthlyIncome'])

# 先看看效果

X_train, X_test, y_train, y_test = train_test_split(features_df, target, test_size=0.3)

RandomForestRegressor(max_depth=10, n_estimators=100).fit(X_train, y_train).score(X_test, y_test)

temp = pd.Series(data=RandomForestRegressor(max_depth=10, n_estimators=100).fit(features_df, target).predict(test_df), index=test_df.index, name='MonthlyIncome')

credit_df1['MonthlyIncome'] = pd.concat([target, temp])

credit_df1.describe()

这里我的MonthlyIncome用随机森林做回归效果很差,不仅R²值非常不稳定,甚至会出现负数,所以直接不处理了,但是为了便于后续的四舍五入,先把空值填充为-10。

credit_df1['MonthlyIncome'].fillna(-10, inplace=True)

3.3 进行过采样

# 写一个过采样函数

def over_sampled(df, target, model):

X = df.drop(columns=[target])

y = df[target]

X_oversampled, y_oversampled = model.fit_resample(X,y)

return pd.concat([X_oversampled, y_oversampled], axis=1)

# 使用RandomOverSampler过采样

credit_df1 = over_sampled(credit_df1, 'Isdlq', RandomOverSampler())

这里不过采样、SMOTE过采样和RandomOverSampler过采样我都试了,最后效果差别不大。

四、特征预处理

4.1 连续值四舍五入

某些连续值直接交给toad分箱运行时间太久,所以先进行四舍五入处理。

(1)Revol

# 再次调用之前的透视表函数查看每个箱内坏客户率

revol_bins=[0,0.1,0.2,0.3,0.4,0.5,0.6,0.7,0.8,0.9,1,1.5,2,5,10,20]

temp = show_rate_by_box(credit_df1, 'Isdlq', 'Revol', bins=revol_bins)

show_rate_by_box(credit_df1, 'Isdlq', 'Revol', bins=revol_bins)

Revol在1以下坏客户率有明显单调性,Revol在1以上坏客户率普遍挺高的,没有太大区分度,因此小于1的统一保留1位小数,大于1的统一保留0位小数,后续再交给toad分箱

credit_df1['Revol'] = credit_df1['Revol'].map(lambda x: np.round(x, 1) if x < 1 else np.round(x, 0))

(2)DebtRatio

debtratio_bins=[0,0.1,0.2,0.5,0.7,1,2,5,10,100,1000,2000,3000,4000,5000,10000,math.inf]

show_rate_by_box(credit_df1, 'Isdlq', 'DebtRatio', bins=debtratio_bins)

跨度太大,不是很好处理,决定同样进行四舍五入,但规则更复杂

credit_df1['DebtRatio'] = credit_df1['DebtRatio'].map(

lambda x: np.round(x, 1) if x < 1 else np.round(x, 1-(len(str(int(np.round(x, 0))))))

)

(3)MonthlyIncome

credit_df1['MonthlyIncome'] = credit_df1['MonthlyIncome'].map(

lambda x: np.round(x, -1) if x < 100 else

np.round(x, -2) if x < 1000 else np.round(x, 1-(len(str(int(np.round(x, 0))))))

)

(4)Numdepend

之前用SMOTE时出现了浮点数,处理一下

credit_df1['Numdepend'] = credit_df1['Numdepend'].map(lambda x: np.round(x, 0))

4.2 创建衍生变量

credit_df1['AllNumlate'] = credit_df1['Num30-59late'] + credit_df1['Num60-89late'] + credit_df1['Num90late']

credit_df1['Monthlycost'] = (credit_df1['MonthlyIncome'] * credit_df1['DebtRatio']).map(lambda x: -10 if x < 0 else x)

credit_df1.head()

4.3 特征筛选

# 查看iv值

toad.quality(credit_df1,'Isdlq', iv_only=True)

# 特征选择,iv值低于0.03丢弃,相关性高于0.8的两个特征丢弃低iv值特征

credit_df2, dropped = toad.selection.select(credit_df1, target='Isdlq', iv=0.03, corr=0.8, return_drop=True)

# 查看被丢弃特征

dropped

"""

{'empty': array([], dtype=float64),

'iv': array([], dtype=object),

'corr': array([], dtype=object)}

"""

没有被筛掉的,说明都还可以吧,特征数也不是很多,就都留下了。

五、计算WOE值

5.1 特征分箱

def show_toad_box(df, col_list, target, rules):

combiner = toad.transform.Combiner()

combiner.fit(df[col_list+[target]], y=target, method='chi', min_samples=0.05)

combiner.set_rules(rules)

return combiner

col_list = ['Revol', 'Age', 'DebtRatio', 'MonthlyIncome', 'Numopen', 'Num30-59late',

'Num90late', 'Numestate', 'Num60-89late', 'Numdepend', 'AllNumlate',

'Monthlycost']

rules = {

'MonthlyIncome':[0,2000,4000,5000,7000,10000],

'Monthlycost':[0,100,1000,3500]

# 'Numopen':[2,4],

# 'Num60-89late':[1],

# 'Revol':[0.2,0.4,0.6,0.8,1],

# 'DebtRatio':[0.6,0.8,3],

}

combiner = show_toad_box(credit_df2, col_list, 'Isdlq', rules=rules)

credit_df3 = combiner.transform(credit_df2, labels=True)

# 出图观察

for col in col_list:

bin_plot(credit_df3, x=col, target='Isdlq')

# 去除前面的编号

temp1 = credit_df3['Isdlq']

temp2 = credit_df3.drop(columns=['Isdlq'])

credit_df3 = pd.concat([temp1, temp2], axis=1)

credit_df3.iloc[:, 1:] = credit_df3.iloc[:, 1:].applymap(lambda x: x[3:])

5.2 WOE转化

# 实例化对象并转化

transfer = toad.transform.WOETransformer()

woe = transfer.fit_transform(credit_df3, credit_df3['Isdlq'], exclude=['Isdlq'])

# 查看WOE值

woe.head()

5.3 逐步回归

# 使用逐步回归筛选掉一些特征

credit_df4, dropped = toad.selection.stepwise(woe, target='Isdlq', estimator='ols', direction='both', criterion='aic', return_drop=True)

# 查看被丢弃的特征

dropped

# []

还是没有被筛选掉的特征。

六、建模和评估

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import train_test_split, GridSearchCV

from sklearn.metrics import roc_curve, roc_auc_score

# 网格搜索

params = {

'penalty':['l1', 'l2'],

'C':[0.1, 0.2, 0.3, 0.4, 0.5],

'max_iter':[50, 70, 100, 150, 200],

'solver':['newton-cg', 'lbfgs', 'liblinear', 'sag', 'saga']

}

gscv = GridSearchCV(estimator=LogisticRegression(), param_grid=params)

gscv.fit(credit_df4.drop(columns=['Isdlq']), credit_df4['Isdlq'])

# 得到最优参数

gscv.best_params_

# 划分训练集和测试集

X = credit_df4.drop(columns=['Isdlq'])

y = credit_df4['Isdlq']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3)

# 使用刚才得到的最优参数重新建模训练

lr = LogisticRegression(

solver='liblinear',

penalty='l1',

C=0.1,

max_iter=100

)

lr.fit(X_train, y_train)

lr_proba = lr.predict_proba(X_test)[:,1]

# 评估

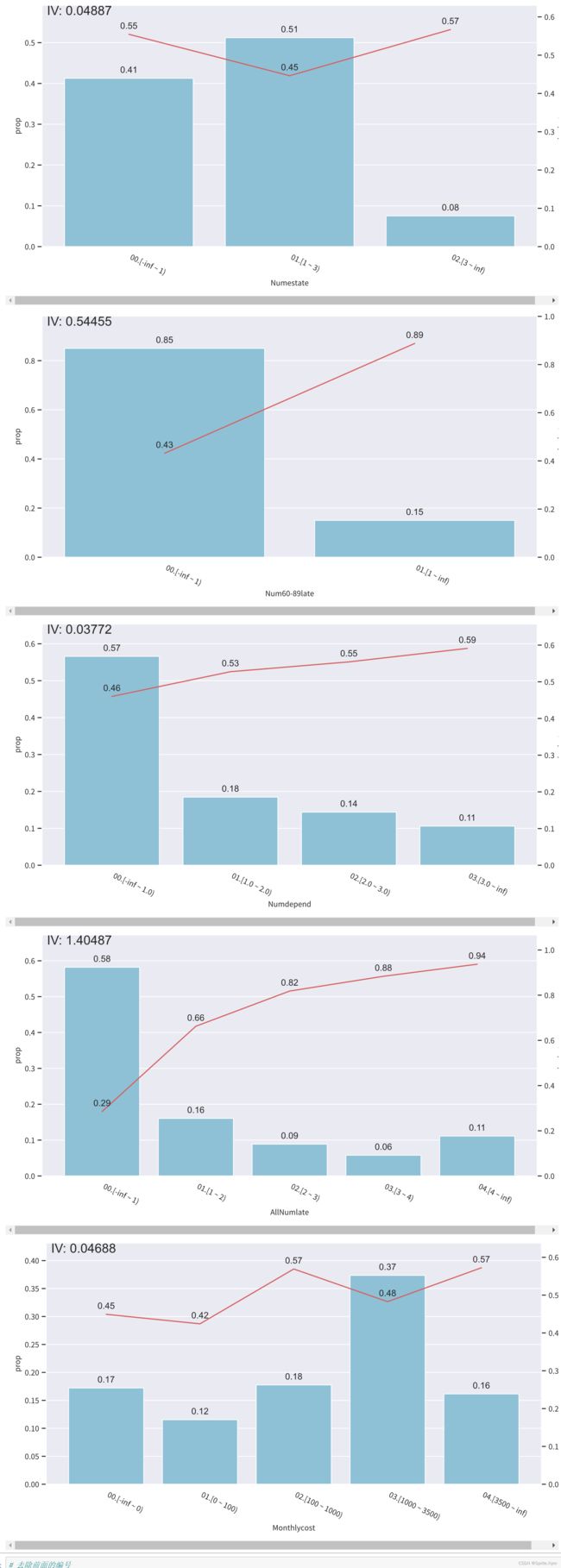

fpr, tpr, threshold = roc_curve(y_test, lr_proba)

auc = roc_auc_score(y_test, lr_proba)

plt.plot(fpr, tpr, label=f'AUC = {auc:.2f}')

plt.plot([0,1],[0,1],'--')

plt.axis([0,1,0,1])

plt.xlabel('FPR')

plt.ylabel('TPR')

plt.legend()

# 查看模型报告

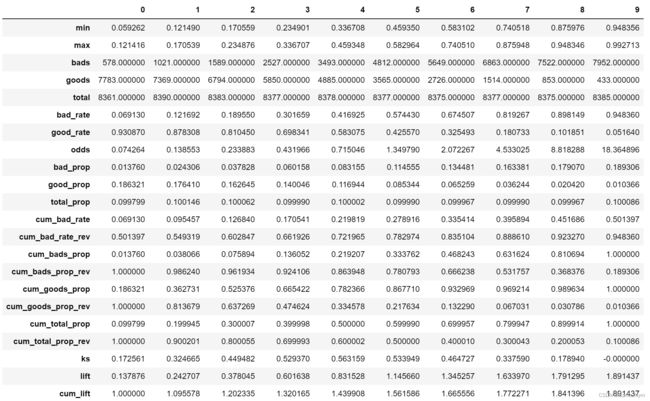

bucket = toad.metrics.KS_bucket(lr_proba, y_test, bucket=10, method='quantile')

bucket.T

# 计算KS值并绘制曲线

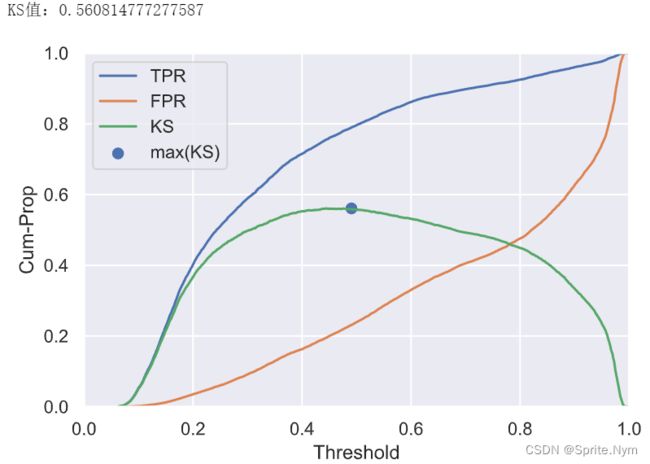

threshold1 = pd.Series(threshold).sort_values(ascending=True)

tpr1 = pd.Series(tpr).sort_values(ascending=True)

fpr1 = pd.Series(fpr).sort_values(ascending=True)

ks = tpr1-fpr1

print(f'KS值:{ks.max()}')

plt.plot(threshold1, tpr1, label='TPR')

plt.plot(threshold1, fpr1, label='FPR')

plt.plot(threshold1, ks, label='KS')

plt.scatter(threshold1[ks[ks==ks.max()].index], ks.max(), label='max(KS)', s=40)

plt.xlabel('Threshold')

plt.ylabel('Cum-Prop')

plt.axis([0,1,0,1])

plt.legend()

plt.show()

七、评分卡建立

# 实例化card对象

card = toad.ScoreCard(

# 使用之前的combiner

combiner = combiner,

# 使用之前的transfomer

transer = transfer,

# 使用之前的逻辑斯蒂回归参数

solver='liblinear',

penalty='l1',

C=0.1,

max_iter=100,

# 基准分

base_score=800,

# 基准好坏客户比

base_odds=20,

# 倍率(好坏客户比每翻rate倍,扣pdo分)

rate=2,

# 扣分

pdo=50

)

# 训练

card.fit(credit_df4.drop(columns=['Isdlq']), credit_df4['Isdlq'])

# 查看评分卡

pd.set_option('display.max_rows', None)

card.export(to_frame=True)

# 查看分数分布

pd.Series(card.predict(credit_df4)).describe()

"""

count 279258.000000

mean 585.138884

std 106.412042

min 320.131615

25% 529.078751

50% 619.335745

75% 678.356577

max 681.166471

dtype: float64

"""