基于ricequant线性回归量化交易

研究平台代码

import pandas as pd

import numpy as np

from sklearn.linear_model import LinearRegression

# 确定每月日期 2014-01-01~2016-01-01

dates = get_trading_dates(start_date="2014-01-01", end_date="2016-01-01")

# 每天日期---->每月月末

# 每月最后一个交易日, 按月计算收益率

month_date = []

for i in range(len(dates) -1):

if dates[i].year != dates[i+1].year:

month_date.append(dates[i])

elif dates[i].month != dates[i+1].month:

month_date.append(dates[i])

#把最后一个交易日加入

month_date.append(dates[-1])

stocks = index_components("000300.XSHG")

all_data = pd.DataFrame()

len_date = len(month_date[:-1])

for i in range(0, len_date):

date = month_date[i]

date_next = None

if i + 1 < len_date:

date_next = month_date[i+1]

fund = get_factor(stocks, ["pe_ratio_lyr","pb_ratio_lyr","market_cap","ev_lyr","return_on_asset_net_profit_lyr","du_return_on_equity_lyr","basic_earnings_per_share","net_profit_to_revenue_lyr","total_expense"]

,start_date=date,end_date=date)

fund.reset_index(inplace=True)

fund.sort_index(inplace=True)

fund['next_month_return'] = np.nan

if not (date_next is None):

for i in range(0, fund.shape[0]):

stock = fund.iloc[i]["order_book_id"]

price1 = get_price(stock, start_date=date, end_date=date, fields='close')

price2 = get_price(stock, start_date=date_next, end_date=date_next, fields='close')

if (price1 is not None) and (price2 is not None):

price1.reset_index(inplace=True)

price2.reset_index(inplace=True)

fund.loc[i:i,('next_month_return')] = (float)(price2["close"] / price1["close"]) - 1 #赋值不强转就赋值不上

# 进行每月因子数据拼接

all_data = pd.concat([all_data, fund])

# 把收益率为空删除

all_data = all_data.dropna()

def mad(factor):

"""3倍中位数去极值

"""

# 求出因子值的中位数

med = np.median(factor)

# 求出因子值与中位数的差值,进行绝对值

mad = np.median(np.abs(factor - med))

# 定义几倍的中位数上下限

high = med + (3 * 1.4826 * mad)

low = med - (3 * 1.4826 * mad)

# 替换上下限以外的值

factor = np.where(factor > high, high, factor)

factor = np.where(factor < low, low, factor)

return factor

def stand(factor):

"""标准化

"""

mean = np.mean(factor)

std = np.std(factor)

return (factor - mean)/std

#随机打乱,并采样,index已乱

all_data = all_data.sample(frac=0.7)

#训练数据

x = all_data[["pe_ratio_lyr","pb_ratio_lyr","market_cap","ev_lyr","return_on_asset_net_profit_lyr","du_return_on_equity_lyr","basic_earnings_per_share","net_profit_to_revenue_lyr","total_expense"]].copy()

# 取出目标值

y = all_data[['next_month_return']].copy()

# 1、特征值处理

# 去极值、标准化、中性化

for name in x.columns:

x[name] = mad(x[name])

x[name] = stand(x[name])

x_market_cap = x["market_cap"]

for name in x.columns:

if name == "market_cap":

continue

# 准备特征值、目标值

# x_market_cap

y_factor = x[name]

# 线性回归方程建立

lr = LinearRegression()

lr.fit(x_market_cap.values.reshape(-1, 1), y_factor)

y_predict = lr.predict(x_market_cap.values.reshape(-1, 1))

# 得出真实值与预测之间的误差当做新的因子值

x[name] = y_factor - y_predict

# 收益率目标值y

y = stand(y)

lr = LinearRegression()

lr.fit(x, y)

lr.coef_得出回归系数

# 可以自己import我们平台支持的第三方python模块,比如pandas、numpy等。

# 回测区间:2014-01-01~2018-01-01

# 选股:

# 范围:沪深300

# 因子:

# 方法:回归法,利用系数相乘(矩阵相乘运算)得出结果排序

import numpy as np

import pandas as pd

from sklearn.preprocessing import StandardScaler

from sklearn.linear_model import LinearRegression, Ridge

# 在这个方法中编写任何的初始化逻辑。context对象将会在你的算法策略的任何方法之间做传递。

def init(context):

context.stock_num = 20

# 定义沪深300指数股

context.hs300 = index_components("000300.XSHG")

scheduler.run_monthly(regression_select, tradingday=1)

def regression_select(context, bar_dict):

"""回归法进行选择股票

准备因子数据、数据处理(缺失值、去极值、标准化、中性化)

预测每个股票对应这一天的结果,然后排序选出前20只股票

""" fundamentals.income_statement.total_expense).filter(fundamentals.stockcode.in_(context.hs300))

# fund = get_fundamentals(q,expect_df=True)

fund = get_factor(context.hs300, ["pe_ratio_lyr","pb_ratio_lyr","market_cap","ev_lyr","return_on_asset_net_profit_lyr","du_return_on_equity_lyr","basic_earnings_per_share","net_profit_to_revenue_lyr","total_expense"])

factors_data = fund

# 2、处理数据

# 缺失值

factors_data = factors_data.dropna()

# 保留原来的数据,后续处理

factors1 = pd.DataFrame()

# 去极值

for name in factors_data.columns:

factors1[name] = mad(factors_data[name])

# logger.info(factors1)

# 标准化

std = StandardScaler()

# factors1 dataframe --->

factors1 = std.fit_transform(factors1)

# 将factors1还原成dataframe,方便后面取数据处理

factors1 = pd.DataFrame(factors1, index=factors_data.index, columns=factors_data.columns)

# 给中心化处理

# 确定中性化:特征值:原始的市值,目标值:处理过后的因子数据

x = factors_data['market_cap']

for name in factors1.columns:

# 跳过market_cap

if name == "market_cap":

continue

# 取出因子作为目标值

y = factors1[name]

# 建立回归方程,得出预测结果

# 用真是结果-预测结果得到残差,即为新的因子值

lr = LinearRegression()

lr.fit(x.values.reshape(-1, 1), y.values)

# 预测结果

y_predict = lr.predict(x.values.reshape(-1, 1))

# 得出没有相关性的残差部分

res = y - y_predict

# 将残差部分作为新的因子值

factors1[name] = res

# 处理结束,factors1即为我们最终需要的数据结果

# 3、选股

# 建立回归方程,得出预测结果,然后排序选出30个股票

# 特征值:factors1:9个因子特征值

# 训练的权重系数为:9个权重

# 假如5月1日,

# 得出的结果:相当于预测接下来的5月份收益率,哪个收益率高选谁

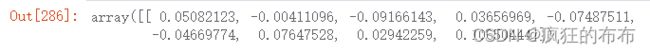

weights = np.array([ 0.05082123, -0.00411096, -0.09166143, 0.03656969, -0.07487511,

-0.04669774, 0.07647528, 0.02942259, 0.10650444])

# 进行特征值与权重之间的矩阵运算

# (m行,n列) *(n行,l列) = (m行,l列)

# (300, 9) * (9, 1) = (300, 1)

return_ = np.matmul(factors1, weights.reshape(-1, 1))

# logger.info(stock_return)

# 根据收益率的大小排序去选股

# 将股票的代码和收益率绑定一起排序

factors1 = factors1.reset_index()

return_ = return_.reset_index()

#print(len(return_["order_book_id"]))

return_ = return_.dropna()

# print(len(return_[0]))

# print(return_["order_book_id"])

#stock_return = dict(zip(factors1.index, return_))

stock_return = dict(zip(return_["order_book_id"], return_[0]))

# logger.info(stock_return)

# 对字典进行排序

score = sorted(stock_return.items(), key=lambda x: x[1], reverse=True)[:20]

# 取出score的股票代码

context.stocklist = [x[0] for x in score]

# logger.info(context.stocklist)

rebalance(context)

def rebalance(context):

# 卖出

for stock in context.portfolio.positions.keys():

if context.portfolio.positions[stock].quantity > 0:

if stock not in context.stocklist:

order_target_percent(stock, 0)

weight = 1.0 / len(context.stocklist)

# 买入

for stock in context.stocklist:

order_target_percent(stock, weight)

# before_trading此函数会在每天策略交易开始前被调用,当天只会被调用一次

def before_trading(context):

pass

# 你选择的证券的数据更新将会触发此段逻辑,例如日或分钟历史数据切片或者是实时数据切片更新

def handle_bar(context, bar_dict):

# 开始编写你的主要的算法逻辑

# bar_dict[order_book_id] 可以拿到某个证券的bar信息

# context.portfolio 可以拿到现在的投资组合信息

# 使用order_shares(id_or_ins, amount)方法进行落单

# TODO: 开始编写你的算法吧!

#order_shares(context.s1, 1000)

pass

# after_trading函数会在每天交易结束后被调用,当天只会被调用一次

def after_trading(context):

pass

def mad(factor):

"""3倍中位数去极值

"""

# 求出因子值的中位数

med = np.median(factor)

# 求出因子值与中位数的差值,进行绝对值

mad = np.median(np.abs(factor - med))

# 定义几倍的中位数上下限

high = med + (3 * 1.4826 * mad)

low = med - (3 * 1.4826 * mad)

# 替换上下限以外的值

factor = np.where(factor > high, high, factor)

factor = np.where(factor < low, low, factor)

return factor

测试结果:

获得超过市场预期1倍的收益