关于Python的ARCH包(五)

1.4 预测示例

1.4.1 数据

1.4.2 基本预测

1.4.3 替代预测方案

1.4.4 TARCH

××××××××××××××××××××××

1.4.1 Data

这些示例是用来Yahoo网站的标准普尔500指数,并通过pandas-datareader包管理数据下载。

import datetime as dt

import sys

import numpy as np

import pandas as pd

import pandas_datareader.data as web

from arch import arch_model

start = dt.datetime(2000,1,1)

end = dt.datetime(2017,1,1)

data = web.get_data_famafrench('F-F_Research_Data_Factors_daily', start=start, end=end)

mkt_returns = data[0]['Mkt-RF'] + data[0]['RF']

returns = mkt_returns

1.4.2 基本预测

预测可以使用标准GARCH(p,q)模型及以下三种方法的任一种生成:

- 解析法

- 基于模拟法

- 基于自举法

默认预测将用完样本中的最后一个观察值,对样本外的数据进行预测。

预测开始时,将使用给定的模型和估计所得到的参数。

am = arch_model(returns, vol='Garch', p=1, o=0, q=1, dist='Normal')

res = am.fit(update_freq=5)Iteration: 5, Func. Count: 39, Neg. LLF: 6130.463290920333

Iteration: 10, Func. Count: 71, Neg. LLF: 6128.4731771407005

Optimization terminated successfully. (Exit mode 0)

Current function value: 6128.4731681952535

Iterations: 11

Function evaluations: 77

Gradient evaluations: 11forecasts = res.forecast()预测被放在 ARCHModelForecast目标类中,其具有四个属性:

mean- 预测均值residual_variance- 预测残差的方差,即 。

。variance- 预测过程的方差,即 . 当模型均值动态变化时,比如是一个AR过程时,该方差不同于残差方差。

. 当模型均值动态变化时,比如是一个AR过程时,该方差不同于残差方差。simulations- 一个包括模拟详细信息的对象类,仅仅在预测方法设为模拟或自举时可用;如果使用解析方法analytical,则该选项不可用。

这三种结果均返回h.#列的DataFrame格式数据, # 表示预测步数。也就是说,h.1 对应于提前一步预测,而h.10对应于提前10步预测。

默认预测仅仅产生1步预测。

print(forecasts.mean.iloc[-3:])

print(forecasts.residual_variance.iloc[-3:])

print(forecasts.variance.iloc[-3:]) h.1

Date

2016-12-28 NaN

2016-12-29 NaN

2016-12-30 0.061286

h.1

Date

2016-12-28 NaN

2016-12-29 NaN

2016-12-30 0.400956

h.1

Date

2016-12-28 NaN

2016-12-29 NaN

2016-12-30 0.400956更长步数的预测可以通过传递horizon参数进行计算得出。

forecasts = res.forecast(horizon=5)

print(forecasts.residual_variance.iloc[-3:]) h.1 h.2 h.3 h.4 h.5

Date

2016-12-28 NaN NaN NaN NaN NaN

2016-12-29 NaN NaN NaN NaN NaN

2016-12-30 0.400956 0.416563 0.431896 0.446961 0.461762没有计算的值则用 nan 填充。

1.4.3 替代预测方案

1.4.3.1 固定窗口预测

固定窗口预测使用截至给定日期的数据来产生此日期后的全部预测结果。在初始化模型时,可以通过传递进全部数据,在使用fit.forecast()时使用last_obs将会产生该日期后的全部预测结果。

注意: last_obs 遵从Python序列规则,因此last_obs中的实际日期并非在样本中。

res = am.fit(last_obs = '2011-1-1', update_freq=5)

forecasts = res.forecast(horizon=5)

print(forecasts.variance.dropna().head())Iteration: 5, Func. Count: 38, Neg. LLF: 4204.91956121224

Iteration: 10, Func. Count: 72, Neg. LLF: 4202.815024845146

Optimization terminated successfully. (Exit mode 0)

Current function value: 4202.812110685669

Iterations: 12

Function evaluations: 84

Gradient evaluations: 12

h.1 h.2 h.3 h.4 h.5

Date

2010-12-31 0.365727 0.376462 0.387106 0.397660 0.408124

2011-01-03 0.451526 0.461532 0.471453 0.481290 0.491043

2011-01-04 0.432131 0.442302 0.452387 0.462386 0.472300

2011-01-05 0.430051 0.440239 0.450341 0.460358 0.470289

2011-01-06 0.407841 0.418219 0.428508 0.438710 0.4488251.4.3.2 滚动窗口预测

滚动窗口预测使用固定长度样本,且随即产生基于最后一个观察值的一步式预测。这个可以通过first_obs和last_obs来实现。

index = returns.index

start_loc = 0

end_loc = np.where(index >= '2010-1-1')[0].min()

forecasts = {}

for i in range(20):

sys.stdout.write('.')

sys.stdout.flush()

res = am.fit(first_obs=i, last_obs=i+end_loc, disp='off')

temp = res.forecast(horizon=3).variance

fcast = temp.iloc[i+end_loc-1]

forecasts[fcast.name] = fcast

print()

print(pd.DataFrame(forecasts).T) h.1 h.2 h.3

2009-12-31 0.598199 0.605960 0.613661

2010-01-04 0.771974 0.778431 0.784837

2010-01-05 0.724185 0.731008 0.737781

2010-01-06 0.674237 0.681423 0.688555

2010-01-07 0.637534 0.644995 0.652399

2010-01-08 0.601684 0.609451 0.617161

2010-01-11 0.562393 0.570450 0.578447

2010-01-12 0.613401 0.621098 0.628738

2010-01-13 0.623059 0.630676 0.638236

2010-01-14 0.584403 0.592291 0.600119

2010-01-15 0.654097 0.661483 0.668813

2010-01-19 0.725471 0.732355 0.739187

2010-01-20 0.758532 0.765176 0.771770

2010-01-21 0.958742 0.964005 0.969229

2010-01-22 1.272999 1.276121 1.279220

2010-01-25 1.182257 1.186084 1.189883

2010-01-26 1.110357 1.114637 1.118885

2010-01-27 1.044077 1.048777 1.053442

2010-01-28 1.085489 1.089873 1.094223

2010-01-29 1.088349 1.092875 1.0973672.3.3 递归预测方案

除了初始数据维持不变意外,其他方面递归方法与滚动方法类似. 这个可以方便地通过略掉first_obs选项而实现。

import pandas as pd

import numpy as np

index = returns.index

start_loc = 0

end_loc = np.where(index >= '2010-1-1')[0].min()

forecasts = {}

for i in range(20):

sys.stdout.write('.')

sys.stdout.flush()

res = am.fit(last_obs=i+end_loc, disp='off')

temp = res.forecast(horizon=3).variance

fcast = temp.iloc[i+end_loc-1]

forecasts[fcast.name] = fcast

print()

print(pd.DataFrame(forecasts).T) h.1 h.2 h.3

2009-12-31 0.598199 0.605960 0.613661

2010-01-04 0.772200 0.778629 0.785009

2010-01-05 0.723347 0.730126 0.736853

2010-01-06 0.673796 0.680934 0.688017

2010-01-07 0.637555 0.644959 0.652306

2010-01-08 0.600834 0.608511 0.616129

2010-01-11 0.561436 0.569411 0.577324

2010-01-12 0.612214 0.619798 0.627322

2010-01-13 0.622095 0.629604 0.637055

2010-01-14 0.583425 0.591215 0.598945

2010-01-15 0.652960 0.660231 0.667447

2010-01-19 0.724212 0.730968 0.737673

2010-01-20 0.757280 0.763797 0.770264

2010-01-21 0.956394 0.961508 0.966583

2010-01-22 1.268445 1.271402 1.274337

2010-01-25 1.177405 1.180991 1.184549

2010-01-26 1.106326 1.110404 1.114450

2010-01-27 1.040930 1.045462 1.049959

2010-01-28 1.082130 1.086370 1.090577

2010-01-29 1.082251 1.086487 1.090690

1.4.4 TARCH模型

1.4.4.1 解析预测

所有的 ARCH-类模型都可以进行一步解析预测。更长步数的解析预测仅针对特定模型的特别设定而言。TARCH模型下当步数大于1时,不存在解析式预测(封闭式预测) 。因此,更长步数的解析需要采用模拟或自举方法。尝试使用解析方法mothod='analytical'去产生大于1步的预测结果,则会返回ValueError错误值。

# TARCH specification

am = arch_model(returns, vol='GARCH', power=2.0, p=1, o=1, q=1)

res = am.fit(update_freq=5)

forecasts = res.forecast()

print(forecasts.variance.iloc[-1])Iteration: 5, Func. Count: 44, Neg. LLF: 6037.930348422024

Iteration: 10, Func. Count: 82, Neg. LLF: 6034.462051044527

Optimization terminated successfully. (Exit mode 0)

Current function value: 6034.461795464493

Iterations: 12

Function evaluations: 96

Gradient evaluations: 12

h.1 0.449483

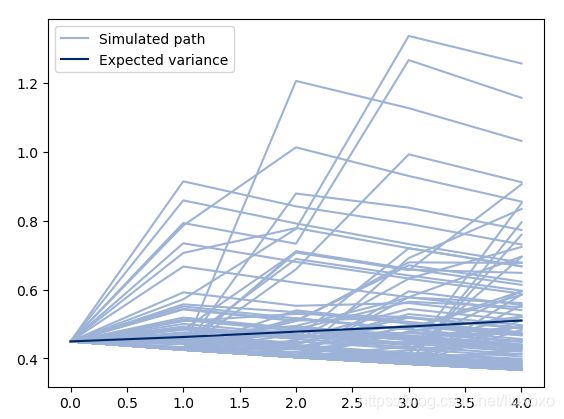

Name: 2016-12-30 00:00:00, dtype: float641.4.4.2 模拟预测

当使用模拟或自举方法进行预测时,关于ARCHModelForecast对象的一种属性非常有价值– simulation.

import matplotlib.pyplot as plt

fig, ax = plt.subplots(1,1)

subplot = (res.conditional_volatility['2016'] ** 2.0).plot(ax=ax, title='Conditional Variance')forecasts = res.forecast(horizon=5, method='simulation')

sims = forecasts.simulations

lines = plt.plot(sims.residual_variances[-1,::10].T, color='#9cb2d6')

lines[0].set_label('Simulated path')

line = plt.plot(forecasts.variance.iloc[-1].values, color='#002868')

line[0].set_label('Expected variance')

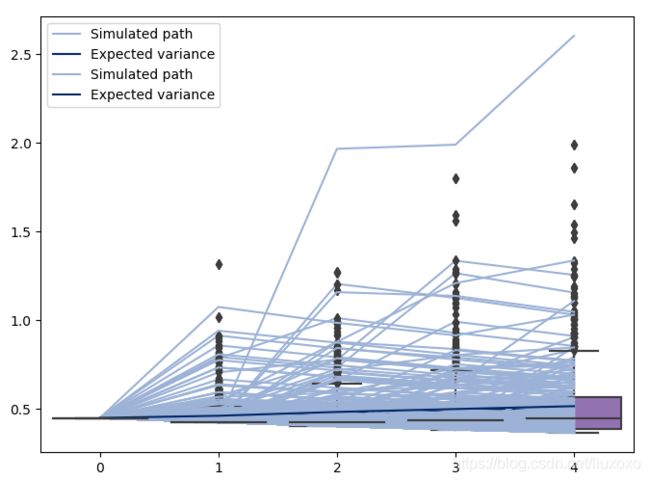

legend = plt.legend()import seaborn as sns

sns.boxplot(data=sims.variances[-1])1.4.4.3 自举预测

除了基于历史数据而非基于假定分布以外,自举预测方法几乎与模拟预测一致。使用这种方法的预测也返回一个ARCHModelForecastSimulation对象类,包括关于模拟路径的信息。

forecasts = res.forecast(horizon=5, method='bootstrap')

sims = forecasts.simulations

lines = plt.plot(sims.residual_variances[-1,::10].T, color='#9cb2d6')

lines[0].set_label('Simulated path')

line = plt.plot(forecasts.variance.iloc[-1].values, color='#002868')

line[0].set_label('Expected variance')

legend = plt.legend()