量化投资 现代投资组合理论(MPT)

量化投资 现代投资组合理论(MPT)

问题:构建投资组合,达到目标收益率的同时拥有最小的 risk exposure.

-

有 J J J 个可交易证券,期望收益率为 R = [ R 1 , ⋯ , R j ] T R=[R_1,\,\cdots,\,R_j]^T R=[R1,⋯,Rj]T,无风险利率为 R f R^f Rf ;

-

令 μ ∈ R J \mu\in \mathbb{R}^J μ∈RJ 为期望收益率, Σ \Sigma Σ 为期望收益率的协方差矩阵;

-

投资组合 θ = [ θ 1 , ⋯ , θ J ] J \theta=[\theta_1,\,\cdots,\,\theta_J]^J θ=[θ1,⋯,θJ]J ,满足 θ T e = 1 \theta^Te=1 θTe=1 , θ i \theta_i θi 代表投资于第 j j j 个证券的资产比例;

-

投资组合 θ \theta θ 的期望收益率为: μ [ θ ] = R θ = R f + θ T ( μ − R f e ) \mu[\theta]=R^{\theta}=R^f+\theta^T(\mu-R^fe) μ[θ]=Rθ=Rf+θT(μ−Rfe) ,标准差为 σ [ θ ] = ( θ T Σ θ ) 1 2 \sigma[\theta]=(\theta^T\Sigma\theta)^{\frac{1}{2}} σ[θ]=(θTΣθ)21 ;

-

不同投资组合之间的协方差为: σ [ θ , θ ′ ] = θ T Σ θ ′ \sigma[\theta,\,\theta']=\theta^T\Sigma\theta' σ[θ,θ′]=θTΣθ′ ;

有效投资组合 Efficient Portfolio:投资组合 θ 0 \theta_0 θ0 在 μ 0 \mu_0 μ0 处是 mean-variance efficient,若 θ 0 \theta_0 θ0 的期望收益为 μ 0 \mu_0 μ0 ,并且不存在其他达到同样期望收益率且拥有更小方差的投资组合。即:

θ 0 ∈ arg min { σ 2 [ θ ] ∣ μ [ θ ] = μ 0 } \theta_0 \in \arg \min\{\sigma^2[\theta]\,|\,\mu[\theta]=\mu_0\} θ0∈argmin{σ2[θ]∣μ[θ]=μ0}

该问题可以写成最优化问题:

θ 0 = arg min { 1 2 θ 0 T Σ θ 0 : θ T μ = μ 0 and θ T e = 1 } \theta_0=\arg \min\{\frac{1}{2}\theta_0^T\Sigma\theta_0:\,\theta^T\mu=\mu_0\text{ and }\theta^Te=1\} θ0=argmin{21θ0TΣθ0:θTμ=μ0 and θTe=1}

其中的 1 2 \frac{1}{2} 21 是为了便于求导。构建 Lagrangian:

L = 1 2 θ T Σ θ + λ 1 ( θ T μ − μ 0 ) + λ 2 ( θ T e − 1 ) L=\frac{1}{2}\theta^T\Sigma\theta+\lambda_1(\theta^T\mu-\mu_0)+\lambda_2(\theta^Te-1) L=21θTΣθ+λ1(θTμ−μ0)+λ2(θTe−1)

得到 FOC 为:

{ Σ θ + λ 1 μ + λ 2 e = 0 θ T μ = μ 0 θ T e = 1 \left\{ \begin{array}{l} \Sigma\theta+\lambda_1\mu+\lambda_2e=0 \\ \theta^T\mu=\mu_0 \\ \theta^Te=1 \end{array} \right. ⎩ ⎨ ⎧Σθ+λ1μ+λ2e=0θTμ=μ0θTe=1

由第一个式子,我们可以得到:

θ = − Σ − 1 [ μ , e ] [ λ 1 λ 2 ] \theta=-\Sigma^{-1}[\mu,\,e]\begin{bmatrix} \lambda_1 \\ \lambda_2 \end{bmatrix} θ=−Σ−1[μ,e][λ1λ2]

由第二个式子,我们可以得到:

[ μ , e ] T θ = [ μ 0 1 ] [\mu,\,e]^T\theta=\begin{bmatrix} \mu_0 \\ 1 \end{bmatrix} [μ,e]Tθ=[μ01]

两个式子联立得到:

− [ μ , e ] T Σ − 1 [ μ , e ] [ λ 1 λ 2 ] = [ μ 0 1 ] -[\mu,\,e]^T\Sigma^{-1}[\mu,\,e]\begin{bmatrix} \lambda_1 \\ \lambda_2 \end{bmatrix}=\begin{bmatrix} \mu_0 \\ 1 \end{bmatrix} −[μ,e]TΣ−1[μ,e][λ1λ2]=[μ01]

令 A = [ μ , e ] T Σ − 1 [ μ , e ] A=[\mu,\,e]^T\Sigma^{-1}[\mu,\,e] A=[μ,e]TΣ−1[μ,e] ( A A A 是一个 2 × 2 2\times 2 2×2 的方阵),则:

[ λ 1 λ 2 ] = − A − 1 [ μ 0 1 ] \begin{bmatrix} \lambda_1 \\ \lambda_2 \end{bmatrix}=-A^{-1}\begin{bmatrix} \mu_0 \\ 1 \end{bmatrix} [λ1λ2]=−A−1[μ01]

再代回去,得到:

θ = Σ − 1 [ μ , e ] A − 1 [ μ 0 , 1 ] \theta=\Sigma^{-1}[\mu,\,e]A^{-1}[\mu_0,\,1] θ=Σ−1[μ,e]A−1[μ0,1]

方差为:

σ 0 2 = θ T Σ θ = [ μ 0 , 1 ] A − 1 [ μ 0 , 1 ] T \sigma_0^2=\theta^T\Sigma\theta=[\mu_0,\,1]A^{-1}[\mu_0,\,1]^T σ02=θTΣθ=[μ0,1]A−1[μ0,1]T

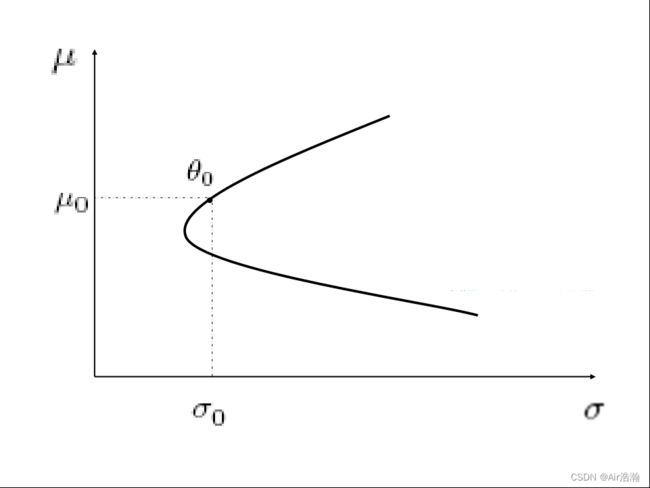

Markowitz’s MV Efficient Frontier:将上述解析解画出图像,可以得到:

最小方差投资组合:从图像中可以看出,投资组合中具有将 σ \sigma σ 最小化的点,对应的最优化问题为:

min θ T Σ θ s . t . θ T e = 1 \min \theta^T\Sigma\theta \quad s.t.\,\,\,\theta^Te=1 minθTΣθs.t.θTe=1

Lagrangian 为:

L ( θ ; λ ) = θ T Σ θ + λ ( 1 − θ T e ) L(\theta;\,\lambda)=\theta^T\Sigma\theta+\lambda(1-\theta^T e) L(θ;λ)=θTΣθ+λ(1−θTe)

FOC 为:

{ ∂ L ∂ θ = 2 Σ θ − λ e = 0 ∂ L ∂ λ = 1 − ∑ i = 1 n θ i = 0 \left\{ \begin{array}{l} \frac{\partial L}{\partial \theta}=2\Sigma\theta-\lambda e=0 \\ \frac{\partial L}{\partial \lambda}=1-\sum\limits_{i=1}^n\theta_i=0 \end{array} \right. ⎩ ⎨ ⎧∂θ∂L=2Σθ−λe=0∂λ∂L=1−i=1∑nθi=0

解得:

{ θ ‾ = Σ − 1 e e T Σ − 1 e λ = 2 e T Σ − 1 e \left\{ \begin{array}{l} \underline{\theta} = \frac{\Sigma^{-1}e}{e^T\Sigma^{-1}e} \\ \lambda = \frac{2}{{e^T\Sigma^{-1}e}} \end{array} \right. {θ=eTΣ−1eΣ−1eλ=eTΣ−1e2

即最小方差和最小方差对应的期望收益率为:

μ ‾ = μ T θ ‾ = μ T Σ − 1 e e T Σ − 1 e σ ‾ 2 = θ ‾ T Σ θ ‾ = e T Σ − 1 T e ( e T Σ − 1 e ) 2 \begin{aligned} \underline{\mu}=&\,\mu^T\underline{\theta}=\frac{\mu^T\Sigma^{-1}e}{e^T\Sigma^{-1}e} \\ \underline{\sigma}^2=&\,\underline{\theta}^T\Sigma\underline{\theta}=\frac{e^T\Sigma^{-1T}e}{(e^T\Sigma^{-1}e)^2} \end{aligned} μ=σ2=μTθ=eTΣ−1eμTΣ−1eθTΣθ=(eTΣ−1e)2eTΣ−1Te

最大夏普率投资组合:以纵坐标上一点 ( 0 , R f ) (0,\,R^f) (0,Rf) 向 frontier 做上切线,可以知道切点对应的投资组合是曲线上夏普率最大的投资组合(称为 tangency portfolio),对应最优化问题为:

max θ T μ − R f ( θ T Σ θ ) 1 2 s.t. θ T e = 1 \max \frac{\theta^T \mu-R_f}{(\theta^T\Sigma\theta)^{\frac{1}{2}}}\quad \text{s.t.}\,\,\theta^Te=1 max(θTΣθ)21θTμ−Rfs.t.θTe=1

Lagrangian 为:

L ( θ ; λ ) = ( θ T μ − R f ) ( θ T Σ θ ) − 1 2 + λ ( 1 − θ T e ) L(\theta;\,\lambda)=(\theta^T \mu-R_f)(\theta^T\Sigma\theta)^{-\frac{1}{2}}+\lambda(1-\theta^Te) L(θ;λ)=(θTμ−Rf)(θTΣθ)−21+λ(1−θTe)

FOC 为:

{ ∂ L ∂ θ = μ ( θ T Σ θ ) − 1 2 − ( θ T μ − R f ) ( θ T Σ θ ) − 3 2 Σ θ − λ e = 0 ∂ L ∂ λ = 1 − θ T e = 0 \left\{ \begin{array}{l} \frac{\partial L}{\partial \theta}=\mu(\theta^T\Sigma\theta)^{-\frac{1}{2}}-(\theta^T \mu-R_f)(\theta^T\Sigma\theta)^{-\frac{3}{2}}\Sigma\theta-\lambda e=0 \\ \frac{\partial L}{\partial \lambda}=1-\theta^Te=0 \end{array} \right. {∂θ∂L=μ(θTΣθ)−21−(θTμ−Rf)(θTΣθ)−23Σθ−λe=0∂λ∂L=1−θTe=0

解得(这个没解出来。。。看的答案):

{ θ T = Σ − 1 ( μ − R f e ) e T Σ − 1 ( μ − R f e ) λ = R f ( θ T T Σ θ T ) − 1 \left\{ \begin{array}{l} \theta_T= \frac{\Sigma^{-1}(\mu-R_fe)}{e^T\Sigma^{-1}(\mu-R_fe)} \\ \lambda = R_f(\theta_T^T\Sigma\theta_T)^{-1} \end{array} \right. {θT=eTΣ−1(μ−Rfe)Σ−1(μ−Rfe)λ=Rf(θTTΣθT)−1