python时间序列分析2-平稳时间序列分析

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

数据预处理

data = pd.read_csv('./data/catfish.csv',parse_dates=[0],squeeze=True,index_col= 0)

data.head(3)

Date

1986-01-01 9034

1986-02-01 9596

1986-03-01 10558

Name: Total, dtype: int64

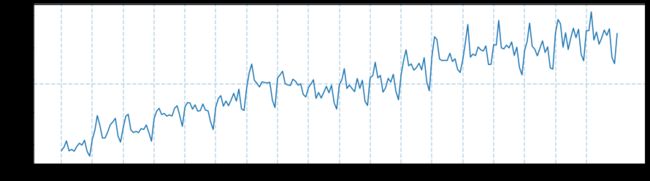

绘制时序图(判断平稳性)

plt.figure(figsize=(15,4))

plt.plot(data['1986-01-01':'2004-01-01'])

for year in range(1986,2004):

plt.axvline(pd.to_datetime(str(year)+'-01-01'),linestyle = '--',alpha = 0.3)

plt.axhline(data['1986-01-01':'2004-01-01'].mean(),alpha=0.3,linestyle='--')

plt.show()

时间序列呈现明显的上升趋势和周期性,因此是不平稳时间序列

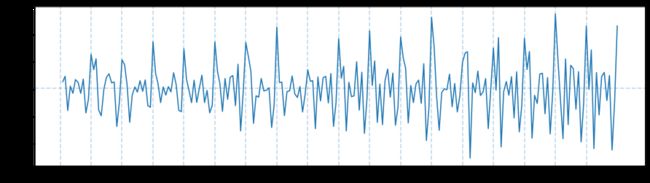

差分处理

# 一阶差分

data_diff = data.diff()[1:]

plt.figure(figsize=(15,4))

plt.plot(data_diff['1986-01-01':'2004-01-01'])

for year in range(1986,2004):

plt.axvline(pd.to_datetime(str(year)+'-01-01'),linestyle = '--',alpha = 0.3)

plt.axhline(data_diff['1986-01-01':'2004-01-01'].mean(),alpha=0.3,linestyle='--')

plt.show()

可以看到时间序列在0均值上下移动,可认为平稳

白噪声检验

from statsmodels.stats.diagnostic import acorr_ljungbox

df = acorr_ljungbox(data_diff,lags=[6,12,18],return_df=True,boxpierce = True)

df

| lb_stat | lb_pvalue | bp_stat | bp_pvalue | |

|---|---|---|---|---|

| 6 | 95.719733 | 1.957855e-18 | 94.002129 | 4.460230e-18 |

| 12 | 373.541488 | 1.498233e-72 | 360.830939 | 7.259069e-70 |

| 18 | 466.300398 | 1.243989e-87 | 448.452496 | 6.846258e-84 |

LB检验和Q检验的P值都远小于0.05,可以认为此序列不是白噪声序列

选择ARMA模型

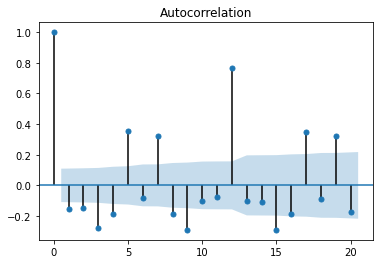

绘制自相关图

from statsmodels.graphics.tsaplots import plot_acf

plot_acf(data_diff,alpha=0.05,lags=20)

不具有截尾性,因此选择MA(0)或MA(1)

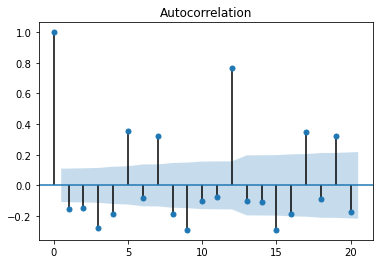

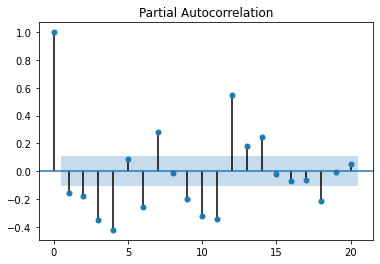

绘制偏自相关系数

from statsmodels.graphics.tsaplots import plot_pacf

plot_pacf(data_diff,alpha=0.05,lags=20)

近似4阶截尾,选择AR(4)模型

划分数据集

train_end = pd.to_datetime('2003-07-01')

test_end = pd.to_datetime('2004-07-01')

train_data = data_diff[:train_end]

test_data = data_diff[train_end+pd.Timedelta(days = 1):test_end]

AR模型

from statsmodels.tsa.ar_model import AR

import time

model1 = AR(train_data,freq='MS')

start = time.time()

model1_fit = model1.fit(max_lag = 4)

end = time.time()

print('Model Fitting Time:', end - start)

Model Fitting Time: 0.009086370468139648

print(model1_fit.summary())

AR Model Results

==============================================================================

Dep. Variable: T - o t

Model: AR(14) Log Likelihood -1614.336

Method: cmle S.D. of innovations 913.668

Date: Thu, 01 Apr 2021 AIC 13.798

Time: 10:29:29 BIC 14.066

Sample: 02-01-1986 HQIC 13.907

- 07-01-2003

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

const 192.0433 90.030 2.133 0.033 15.587 368.499

L1.Total -0.4668 0.072 -6.461 0.000 -0.608 -0.325

L2.Total -0.4105 0.077 -5.318 0.000 -0.562 -0.259

L3.Total -0.2621 0.069 -3.787 0.000 -0.398 -0.126

L4.Total -0.2194 0.071 -3.071 0.002 -0.359 -0.079

L5.Total -0.1355 0.072 -1.880 0.060 -0.277 0.006

L6.Total -0.2207 0.071 -3.105 0.002 -0.360 -0.081

L7.Total -0.0990 0.072 -1.375 0.169 -0.240 0.042

L8.Total -0.1737 0.072 -2.403 0.016 -0.315 -0.032

L9.Total -0.2368 0.071 -3.314 0.001 -0.377 -0.097

L10.Total -0.1644 0.073 -2.253 0.024 -0.307 -0.021

L11.Total -0.1564 0.072 -2.161 0.031 -0.298 -0.015

L12.Total 0.6155 0.071 8.634 0.000 0.476 0.755

L13.Total 0.2541 0.079 3.224 0.001 0.100 0.409

L14.Total 0.1846 0.075 2.457 0.014 0.037 0.332

Roots

==============================================================================

Real Imaginary Modulus Frequency

------------------------------------------------------------------------------

AR.1 0.8839 -0.5102j 1.0206 -0.0833

AR.2 0.8839 +0.5102j 1.0206 0.0833

AR.3 1.1629 -0.0000j 1.1629 -0.0000

AR.4 0.5001 -0.8689j 1.0026 -0.1669

AR.5 0.5001 +0.8689j 1.0026 0.1669

AR.6 0.0021 -1.0224j 1.0224 -0.2497

AR.7 0.0021 +1.0224j 1.0224 0.2497

AR.8 -1.0331 -0.0000j 1.0331 -0.5000

AR.9 -0.8696 -0.5052j 1.0057 -0.4162

AR.10 -0.8696 +0.5052j 1.0057 0.4162

AR.11 -0.5194 -0.9276j 1.0631 -0.3312

AR.12 -0.5194 +0.9276j 1.0631 0.3312

AR.13 -0.7503 -1.7439j 1.8985 -0.3147

AR.14 -0.7503 +1.7439j 1.8985 0.3147

------------------------------------------------------------------------------

所以模型是 x t = 192.0433 − 0.4668 x t − 1 − 0.4105 x t − 2 . . . x_t = 192.0433-0.4668x_{t-1}-0.4105x_{t-2}... xt=192.0433−0.4668xt−1−0.4105xt−2...

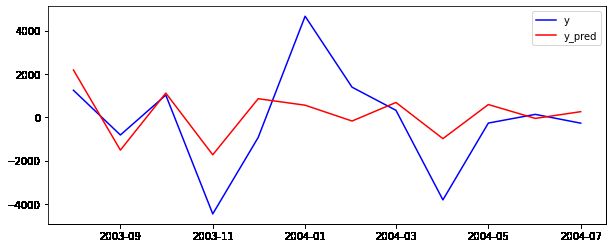

查看预测结果

#起始点、终止点

pred_start_date = test_data.index[0]

pred_end_date = test_data.index[-1]

#预测值和残差

predictions = model1_fit.predict(start=pred_start_date, end=pred_end_date)

residuals = test_data - predictions

plt.figure(figsize=(10,4))

plt.plot(test_data,label = 'y',color = 'b')

plt.plot(predictions,label = 'y_pred',color = 'r')

plt.legend()

plt.show()

ARMA模型

from statsmodels.tsa.arima_model import ARMA

model2 = ARMA(train_data,freq='MS',order = (4,1))

start = time.time()

model2_fit = model2.fit()

end = time.time()

print('Model Fitting Time:', end - start)

Model Fitting Time: 0.7675204277038574

model2_fit.summary()

| Dep. Variable: | Total | No. Observations: | 210 |

|---|---|---|---|

| Model: | ARMA(4, 1) | Log Likelihood | -1835.240 |

| Method: | css-mle | S.D. of innovations | 1505.051 |

| Date: | Thu, 01 Apr 2021 | AIC | 3684.480 |

| Time: | 10:52:30 | BIC | 3707.910 |

| Sample: | 02-01-1986 | HQIC | 3693.952 |

| - 07-01-2003 |

| coef | std err | z | P>|z| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 85.2394 | 48.166 | 1.770 | 0.077 | -9.163 | 179.642 |

| ar.L1.Total | -0.8138 | 0.086 | -9.459 | 0.000 | -0.982 | -0.645 |

| ar.L2.Total | -0.4284 | 0.071 | -6.055 | 0.000 | -0.567 | -0.290 |

| ar.L3.Total | -0.5665 | 0.070 | -8.075 | 0.000 | -0.704 | -0.429 |

| ar.L4.Total | -0.5620 | 0.058 | -9.620 | 0.000 | -0.676 | -0.447 |

| ma.L1.Total | 0.5534 | 0.090 | 6.149 | 0.000 | 0.377 | 0.730 |

| Real | Imaginary | Modulus | Frequency | |

|---|---|---|---|---|

| AR.1 | 0.4829 | -1.0659j | 1.1702 | -0.1823 |

| AR.2 | 0.4829 | +1.0659j | 1.1702 | 0.1823 |

| AR.3 | -0.9870 | -0.5704j | 1.1399 | -0.4166 |

| AR.4 | -0.9870 | +0.5704j | 1.1399 | 0.4166 |

| MA.1 | -1.8071 | +0.0000j | 1.8071 | 0.5000 |

predictions = model2_fit.predict(start=pred_start_date, end=pred_end_date)

residuals = test_data - predictions

plt.figure(figsize=(10,4))

plt.plot(test_data,label = 'y',color = 'b')

plt.plot(predictions,label = 'y_pred',color = 'r')

plt.legend()

plt.show()

模型比较

model1_fit.aic,model2_fit.aic

(13.798200287066459, 3684.480163721421)

可以看到AR(14)的模型AIC显著小于ARMA(4,1)模型,因此选择AR(14)模型

模型检验

print(model1_fit.pvalues)

const 3.291656e-02

L1.Total 1.039287e-10

L2.Total 1.049426e-07

L3.Total 1.527589e-04

L4.Total 2.133285e-03

L5.Total 6.012763e-02

L6.Total 1.900197e-03

L7.Total 1.690425e-01

L8.Total 1.626242e-02

L9.Total 9.182977e-04

L10.Total 2.423953e-02

L11.Total 3.070085e-02

L12.Total 5.932908e-18

L13.Total 1.264368e-03

L14.Total 1.399151e-02

dtype: float64

model1_fit.pvalues>0.05

const False

L1.Total False

L2.Total False

L3.Total False

L4.Total False

L5.Total True

L6.Total False

L7.Total True

L8.Total False

L9.Total False

L10.Total False

L11.Total False

L12.Total False

L13.Total False

L14.Total False

dtype: bool

L5和L7参数不符合显著性要求,所以应该删除掉