机器学习之用逻辑回归制作评分卡(分类分析:基于UCI的german信用评分卡设计)

文章目录

- 前言

- 一、知识准备

- 二、数据获取及读入

- 三、数据处理

-

- 3.1.缺失值处理

- 3.2.异常值处理

- 3.3.重复值处理

- 四、探索性分析

-

- 4.1.查看数据分布是否平衡

- 4.2.样本平衡

- 4.3.离散型变量在好坏客户上的分布

- 4.4.连续型变量在好坏客户上的分布

- 五、数据预处理

-

- 5.1.离散变量WOE值转换

- 5.2.连续型变量的分箱及WOE值转换

- 六、特征选择

- 七、Logistic回归模型构建

-

- 7.1.划分训练集和测试集

- 7.2.探索模型最优参数及训练模型

- 八、模型检验

-

- 8.1.测试集预测值与真实的好坏样本分布图

- 8.2.混淆矩阵及PR曲线

- 8.3.ROC曲线

- 九、评分卡构建

-

- 9.1.基础得分

- 9.2.各评分结果

前言

提示:这里可以添加本文要记录的大概内容:

本次实验希望通过利用来自UCI数据集中的german.data进行数据处理和特征选择。之后通过逻辑回归进行模型构建与评估,然后构建评分卡模型,分数转化生成评分卡,最后制作符合业务要求且兼顾用户体验的评分卡。

提示:工具选择:JupyterLab notebook

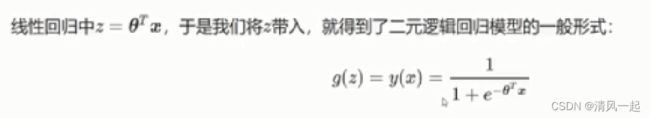

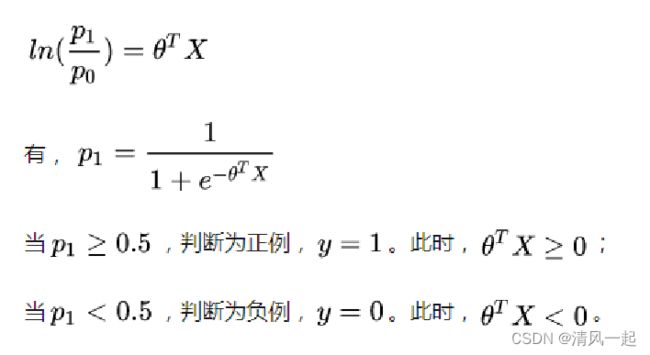

一、知识准备

1.构建逻辑回归模型

Sigmoid函数

逻辑回归(Logistic Regression)是对数几率回归,属于广义线性模型(GLM),它的因变量一般只有0或1.

线性回归并没有对数据的分布进行任何假设,而逻辑回归隐含了一个基本假设 :每个样本均独立服从于伯努利分布(0-1分布)

2.分箱

分箱方法:等频分箱、等距分箱(pandas的cut和qcut函数)、Chi-megerd卡方分箱,Best-KS方法(局限性较多,不建议使用),IV最优分箱,基于树的最优分箱(信息增益,gini指数等)。

3.特征选择

4.评分卡构建

关于评分卡的构建的理论知识,读者可仔细阅读以下文章:

1.信用评分卡模型的理论准备

2.让你彻底理解信用评分卡原理(Python实现评分卡代码)

二、数据获取及读入

- 数据准备:来自UCI数据集https://archive.ics.uci.edu/ml/machine-learning-databases/statlog/german/

- 读入数据

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

plt.rcParams['font.sans-serif'] = ['Arial Unicode MS'] # SimHei.ttf

plt.rcParams['axes.unicode_minus'] = False

rc = {'font.sans-serif': 'SimHei',

'axes.unicode_minus': False}

data = pd.read_csv('数据/german.data',header = None ,sep='\\s+')

# display(df.head(2))

#变量重命名

#account_status((定性)现有支票帐户的状况);period((数值)月份持续时间,还了多久的贷款了);history_credit((定性)信用记录)

#credit_purpose((定性)贷款目的);credit_limit((数值)信用额);saving_account((定性)储蓄账户/债券)

#person_employee((定性)目前就业(就业年限));income_installment_rate((数值)分期付款率按可支配收入的百分比计算);marry_sex((定性)个人地位和性别)

#other_debtor((定性)其他债务人/担保人);address((数值)现在居住地);property((定性)属性)

#age(数值)年龄;installment_plans((定性)其他分期付款计划);housing((定性)住房)

#credits_num((数值)此银行现有的信用额);job((定性)工作);dependents((数值)可还款人数)

#have_phone((定性)电话);foreign_worker((定性)外国工人);target( 信用好坏)

columns = ["account_status","period","history_credit","credit_purpose","credit_limit","saving_account","person_employee",

"income_installment_rate","marry_sex","other_debtor","address","property","age","installment_plans","housing","credits_num","job","dependents","have_phone","foreign_worker","target"]

data.columns = columns

##将标签变量由状态1,2转为0,1;0表示好用户,1表示坏用户

data.target = data.target - 1

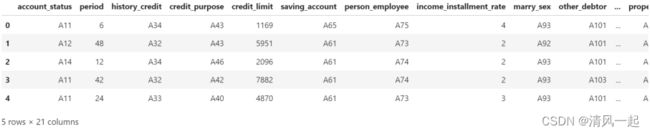

data.head()

三、数据处理

3.1.缺失值处理

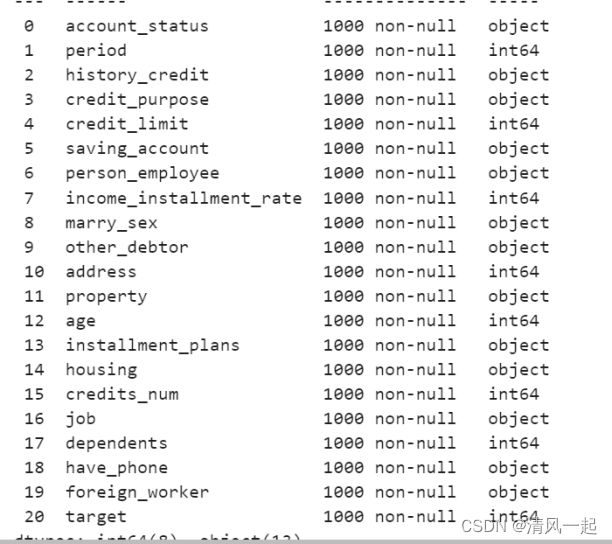

#查看数据属性

data.info()

由上图可以看出,每一列并不存在缺失值,不需要进行缺失值处理。

3.2.异常值处理

#查看连续变量数据分布

data.describe()

由上图及结合各个列数据的含义及实际情况,认为各连续变量均分布在合理范围内。

3.3.重复值处理

#查看是否有重复值

data[data.duplicated()==True]

#异常值应该不存在,不做探究

四、探索性分析

#分辨出连续变量与离散变量

feature_names = ["account_status","period","history_credit","credit_purpose","credit_limit","saving_account","person_employee",

"income_installment_rate","marry_sex","other_debtor","address","property","age","installment_plans","housing","credits_num","job","dependents","have_phone","foreign_worker"]

#所有列名

categorical_var = [] #保存离散变量列名

numerical_var = [] #保存连续型变量列名

##先判断类型,如果是int或float就直接作为连续变量

numerical_var = list(data[feature_names].select_dtypes(include=['int','float','int32','float32','int64','float64']).columns.values)

categorical_var = [x for x in feature_names if x not in numerical_var]

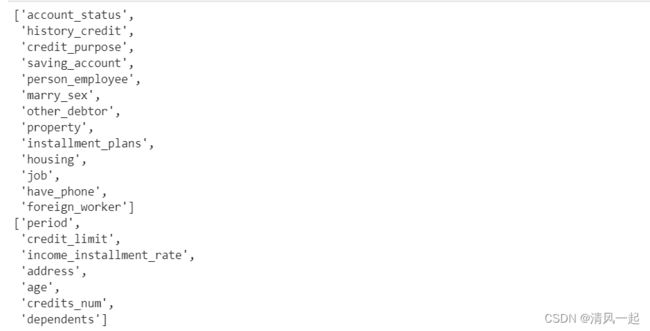

display(categorical_var)

display(numerical_var)

4.1.查看数据分布是否平衡

#查看一下好坏客户分布

sns.set(style = 'darkgrid',color_codes = True,rc=rc)

sns.countplot(x = df['target'],data = df)

4.2.样本平衡

由上面结果,我们可以知道,存在样本不平衡问题,需要进行样本平衡,采用过采样(上采样)的方法。RandomOverSampler通过对少数类样本进行有放回地随机采样来生成少数类的样本。

#样本平衡

from imblearn.over_sampling import RandomOverSampler

ros = RandomOverSampler(random_state=42)

X,y= ros.fit_resample(X,y)

n_sample_ = X.shape[0]#278584

pd.Series(y).value_counts()

n_1_sample = pd.Series(y).value_counts()[1]

n_0_sample = pd.Series(y).value_counts()[0]

print('样本个数:{}; 1占{:.2%}; 0占{:.2%}'.format(n_sample_,n_1_sample/n_sample_,n_0_sample/n_sample_))

#样本个数:278584; 1占50.00%; 0占50.00%

4.3.离散型变量在好坏客户上的分布

#离散型变量 在好客户与坏客户分布上的可视化

p = 1

plt.figure(figsize=(20,18))

row = 5 #画布为几行

col = 3 #画布为几列

for i in categorical_var[0:13]:

# df_var = "df_" + i

df_var = pd.crosstab(df[i],df["target"])

df_var["bad_rate"] = round(df_var[1]/(df_var[1]+df_var[0]),4)

# display(df_var)

# print(df_var.index)

# print(df_var.columns)

# print(p)

#添加子区间绘制,

ax1 = plt.subplot(row,col,p) #子区空间为n行n列

year = df_var.index # 横坐标

data1 = df_var[0] # 纵坐标 好用户

data2 = df_var[1] # 纵坐标 坏用户

data3 = df_var["bad_rate"] #坏用户占比

# 先得到year长度, 再得到下标组成列表

x = range(len(year))

bar_width = 0.3 #每一个柱子偏移的距离

# 好坏用户柱状图

ax1.bar(x, data1, width=bar_width, color='#3A669C', label="好用户")

# 向右移动0.2, 柱状条宽度为0.2

#坏用户柱状图

ax1.bar([i + bar_width for i in x], data2, width=bar_width, color='#C0504D',label="违约用户")

# 底部汉字移动到两个柱状条中间(本来汉字是在左边蓝色柱状条下面, 向右移动0.1)

plt.xticks([i + bar_width/2 for i in x], year)

if p == 1 or p == col+1:

ax1.set_ylabel('用户数量',size=10)

ax1.set_xlabel(i,size=10) #很坐标的标签设为列名

text_heiht = 3

# 为每个条形图添加数值标签

for x1,y1 in enumerate(data1):

ax1.text(x1, y1+text_heiht, y1,ha='center',fontsize=8)

for x2,y2 in enumerate(data2):

ax1.text(x2+bar_width,y2+text_heiht,y2,ha='center',fontsize=8)

# bad_rate线 共用纵坐标轴

ax2 = ax1.twinx()

p3 = ax2.plot([i + bar_width/2 for i in x], data3, color="gray",linestyle='--', label="坏用户占比")

if p == 3 or p == 6:

ax2.set_ylabel("坏用户占比")

showlabel=True

if p == 1 and showlabel == True:

ax1.legend(loc="upper center")

ax2.legend(loc=2)

p = p + 1

plt.show()

4.4.连续型变量在好坏客户上的分布

#连续性变量分布直方图

p = 1

plt.figure(figsize=(20,18))

row = 4 #画布为几行

col = 2 #画布为几列

for i in numerical_var[0:7]:

df_var = "df_" + i

df_var = pd.DataFrame({'target':df["target"],'variables':df[i]})

df_var_good = df_var.loc[df_var["target"]==0,]

df_var_good = df_var_good.sort_values(["variables"]) #排序

df_var_bad = df_var.loc[df_var["target"]==1,]

df_var_bad = df_var_bad.sort_values(["variables"]) #排序

plt.subplot(row,col,p) #子区空间为2行3列

if i == "period" or i == "age":

bins_i = 60

elif i == "credit_limit":

bins_i = 150

else:

bins_i = 50

#参数density=True表示是否归一化

plt.hist(df_var_good["variables"],bins=bins_i,color='r',alpha=0.5,rwidth=0.6,density=True,label='好用户')

plt.hist(df_var_bad['variables'],bins=bins_i,color='b',alpha=0.5,rwidth=0.6,density=True,label='坏用户')

plt.legend()

if p == 1:

plt.title('好坏用户分布直方图')

plt.xlabel(i)

plt.ylabel('count')

p = p+1

plt.show()

五、数据预处理

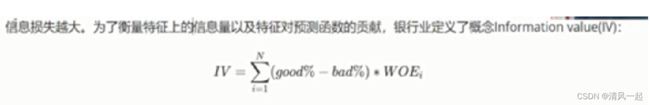

主要式分箱及WOE的转换

5.1.离散变量WOE值转换

woeall = {} #定义保存各分类(分箱)weo值字典

woe1 = {}

for i in categorical_var:

element = list(df[i].unique())

for j in element:

all1 = len(df[df[i]==j])

bad = len(df[(df[i]==j)&(df['target']==1)])

good = len(df[(df[i]==j)&(df['target']==0)])

woe = np.log((good/all1)/(bad/all1))

woe1[j] = round(woe,3)

df.loc[df[i]==j,i] = round(woe,3)

woeall[i] = woe1

woe1 = {}

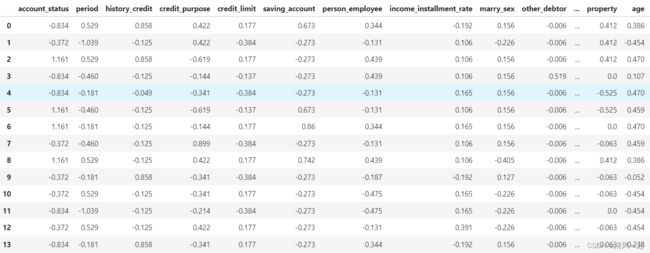

df.head(10)

#保存标签和weo值到字典中

woeall #查看以下各列各元素对应的WOE值

5.2.连续型变量的分箱及WOE值转换

1.定义预分箱函数(等距分箱)

# 在 统计学中, 以查尔斯·爱德华·斯皮尔曼命名的斯皮尔曼等级相关系数,即spearman相关系数。经常用希腊字母ρ表示。

# 它是衡量两个变量的依赖性的 非参数 指标。 它利用单调方程评价两个统计变量的相关性。

# 如果数据中没有重复值, 并且当两个变量完全单调相关时,斯皮尔曼相关系数则为+1或−1

#0表示好用户,1表示坏用户

# from scipy import stats

def mono_bin1(Y,X,n = 2):

# r = 0

bad = Y.sum() #坏客户的个数

good = Y.count()-bad #好客户的个数

list1 = []

while n < 11:

d1 = pd.DataFrame({"X":X,"Y":Y,"Bucket":pd.cut(X,n,duplicates='drop')}) ##将原数据离散化,分成20份区间

d2 = d1.groupby('Bucket',as_index = True) #以区间的分组

# r,p = stats.spearmanr(d2.mean().X,d2.mean().Y) #每一个区间的平均值与每一个区间分类的平均值

n = n+1

d3 = pd.DataFrame(d2.X.min(),columns = ['min']) #该分区的最小值

d3['min'] = d2.min().X

d3['max'] = d2.max().X

d3['sum'] = d2.sum().Y #坏客户总数

d3['total'] = d2.count().Y #客户总数

d3['rate'] = d2.mean().Y #这个是坏的客户的占比

d3['Distribution_Good'] = (d3['total'] - d3['sum']) / ((d3['total'] - d3['sum']).sum()) #相对于ppt中good%

d3['Distribution_Bad'] = d3['sum'] / d3['sum'].sum() #相对于ppt中bad%

d3['weo'] = np.log(d3['Distribution_Good'] / d3['Distribution_Bad'])

iv = (d3['weo'] * (d3['Distribution_Good'] - d3['Distribution_Bad'])).sum()

list1.append(iv)

return list1

# 1.定义DataFrame,存放我们的每一个列的iv值

df_iv = pd.DataFrame()

#连续变量列

dd = ['period',

'credit_limit',

'income_installment_rate',

'address',

'age',

'credits_num',

'dependents']

for i in dd:

df_iv[i] = mono_bin1(df['target'],df[i])

df_iv['份数'] =[2,3,4,5,6,7,8,9,10]

df_iv

# 1.定义DataFrame,存放我们的每一个列的iv值

df_iv = pd.DataFrame()

#连续变量列

dd = ['period',

'credit_limit',

'income_installment_rate',

'address',

'age',

'credits_num',

'dependents']

for i in dd:

df_iv[i] = mono_bin1(df['target'],df[i])

df_iv['份数'] =[2,3,4,5,6,7,8,9,10]

df_iv

p = 1

plt.figure(figsize=(22,18))

row = 5 #画布为几行

col = 2 #画布为几列

for i in df_iv.iloc[:,0:7]:

plt.subplot(row,col,p) #子区空间为2行3列

#参数density=True表示是否归一化

plt.plot(df_iv['份数'], df_iv[i], marker ='*', linewidth=2, linestyle='--', color='orange')

plt.title(i)

# plt.hist(df_iv[i],color='r',alpha=0.5,rwidth=0.6,density=True)

p = p+1

plt.show()

#0表示好用户,1表示坏用户

from scipy import stats

def mono_bin(Y,X,n):

bad = Y.sum() #坏客户的个数

good = Y.count()-bad #好客户的个数

d1 = pd.DataFrame({"X":X,"Y":Y,"Bucket":pd.cut(X,n,duplicates='drop')}) ##将原数据离散化

d2 = d1.groupby('Bucket',as_index = True) #以区间的分组

d5 = d1['Bucket'].sort_values().astype('str').unique()

d3 = pd.DataFrame(d2.X.min(),columns = ['min']) #该分区的最小值

d3['min'] = d2.min().X

d3['max'] = d2.max().X

d3['sum'] = d2.sum().Y #坏客户总数

d3['total'] = d2.count().Y #客户总数

d3['rate'] = d2.mean().Y #这个是坏的客户的占比

d3['Distribution_Good'] = (d3['total'] - d3['sum']) / ((d3['total'] - d3['sum']).sum()) #相对于ppt中good%

d3['Distribution_Bad'] = d3['sum'] / d3['sum'].sum() #相对于ppt中bad%

d3['weo'] = np.log(d3['Distribution_Good'] / d3['Distribution_Bad'])

iv = (d3['weo'] * (d3['Distribution_Good'] - d3['Distribution_Bad'])).sum()

d4 = (d3.sort_values(by = 'min')).reset_index(drop = True)

cut = []

cut.append(float('-inf'))

for i in range(len(d5)-1):

x = eval(d5[i].split(',')[1][:-1])

cut.append(x)

cut.append(float('inf'))

weo = list(d4['weo'].round(3))

woe1={}

for j in range(len(cut)-1):

val = '('+str(cut[j])+','+str(cut[j+1])+']'

woe1[val] = weo[j]

woeall[X.name] = woe1

woe1 = {}

return d4,iv,cut,weo

d4_period,iv_period,cut_period,weo_period = mono_bin(df['target'],df['period'],5)

d4_credit_limit ,iv_credit_limit,cut_credit_limit,weo_credit_limit = mono_bin(df['target'],df['credit_limit'],5)

d4_income_installment_rate ,iv_income_installment_rate,cut_income_installment_rate,weo_income_installment_rate = mono_bin(df['target'],df['income_installment_rate'],4)

d4_address ,iv_address,cut_address,weo_address= mono_bin(df['target'],df['address'],4)

d4_age ,iv_age,cut_age,weo_age= mono_bin(df['target'],df['age'],8)

d4_credits_num ,iv_credits_num,cut_credits_num,weo_credits_num= mono_bin(df['target'],df['credits_num'],4)

4.连续变量WOE值转换函数

#连续变量WEO转换

def replace_weo(series,cut,weo):

list1 = []

i = 0

while i<len(series):

value = series[i]

j = len(cut)-2

m = len(cut)-2

while j >=0:

if value >=cut[j]:

j = -1

else:

j = j-1

m = m -1

list1.append(weo[m])

i = i+1

return list1

df['period'] = pd.Series(replace_weo(df['period'],cut_period,weo_period))

df['credit_limit'] = pd.Series(replace_weo(df['credit_limit'],cut_credit_limit,weo_credit_limit))

df['income_installment_rate'] = pd.Series(replace_weo(df['income_installment_rate'],cut_income_installment_rate,weo_income_installment_rate))

df['address'] = pd.Series(replace_weo(df['address'],cut_address,weo_address))

df['age'] = pd.Series(replace_weo(df['age'],cut_age,weo_age))

df['credits_num'] = pd.Series(replace_weo(df['credits_num'],cut_credits_num,weo_credits_num))

df.head(30)

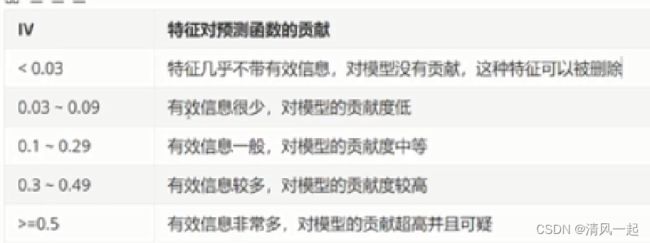

六、特征选择

df_columns = ["account_status","period","history_credit","credit_purpose","credit_limit","saving_account","person_employee",

"income_installment_rate","marry_sex","other_debtor","address","property","age","installment_plans","housing","credits_num","job","dependents","have_phone","foreign_worker"]

list_iv = []

for i in df_columns:

iv = 0

only = df[i].unique()

for j in only:

good_rate = len(df.loc[(df[i]==j)&(df['target']==0)])/len(df[df['target']==0])

bad_rate = len(df.loc[(df[i]==j)&(df['target']==1)])/len(df[df['target']==1])

iv = iv+(j*(good_rate-bad_rate))

list_iv.append(iv)

# list_iv

for i in range(len(list_iv)):

print(f"列:{df_columns[i]}, iv=:{list_iv[i]}")

columns1 = ["account_status","period","history_credit","credit_purpose","credit_limit","saving_account","person_employee",

"income_installment_rate","marry_sex","other_debtor","address","property","age","installment_plans","housing","credits_num","job","dependents","have_phone","foreign_worker"]

list_iv

#创建按一个以columns1为索引,list_iv为值的Series,便于我们画图

iv_plot = pd.Series(list_iv,index = columns1,name = "iv")

iv_plot = iv_plot.sort_values()

#可视化一下IV值排行(从小到大)

plt.figure(figsize = (25 ,7))

plt.bar(iv_plot.index ,iv_plot.values ,color = '#3beeb5')

# 对x轴进行翻转,竖向显示

plt.xticks(rotation=90, fontsize=14)

for a ,b in zip(iv_plot.index ,iv_plot.values.round(4)):

plt.text(a ,b + 0.01 ,b ,ha = 'center' ,va = 'bottom')

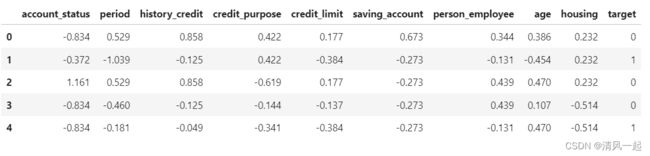

我只选取iv值大于0.1的变量作为特征变量,因此选取出以下变量

#剩下的目标变量

data = df[["account_status","period","history_credit","credit_purpose","credit_limit","saving_account","person_employee",

"age","housing","target"]]

data.head()

七、Logistic回归模型构建

7.1.划分训练集和测试集

from sklearn import model_selection as cv

data_train_woe, data_test_woe = cv.train_test_split(df, test_size=0.2, random_state=10, stratify=df.target)

7.2.探索模型最优参数及训练模型

from sklearn.model_selection import GridSearchCV

from sklearn.linear_model import LogisticRegression

##训练模型

####取出训练数据与测试数据

x_train = np.array(data_train_woe[[i for i in data_train_woe.columns if i!='target']])

y_train = np.array(data_train_woe.target)

x_test = np.array(data_test_woe[[i for i in data_test_woe.columns if i!='target']])

y_test = np.array(data_test_woe.target)

##网络搜索查找最优参数

lr_param = {'C': [0.01, 0.1, 0.2, 0.5, 1, 1.5, 2],

'class_weight': [{1: 1, 0: 1}, {1: 2, 0: 1}, {1: 3, 0: 1}, 'balanced'],

'max_iter': range(10,100,10)}

##逻辑回归模型

lr_gsearch = GridSearchCV(

estimator=LogisticRegression(random_state=0, fit_intercept=True, penalty='l2'),

param_grid=lr_param, cv=5, scoring='f1', n_jobs=-1, verbose=2)

##执行超参数优化

lr_gsearch.fit(x_train, y_train)

print('logistic model best_score_ is {0},and best_params_ is {1}'.format(lr_gsearch.best_score_,

lr_gsearch.best_params_))

##用最优参数,初始化Logistic模型

LR_model_2 = LogisticRegression(C=lr_gsearch.best_params_['C'], penalty='l2',

class_weight=lr_gsearch.best_params_['class_weight'],

max_iter=lr_gsearch.best_params_['max_iter'])

##训练Logistic模型

LR_model_fit = LR_model_2.fit(x_train, y_train)

print ('逻辑回归的准确率为:{0:.2f}%'.format(LR_model_fit.score(x_test, y_test) *100))

八、模型检验

8.1.测试集预测值与真实的好坏样本分布图

from sklearn.metrics import precision_recall_curve

#预测概率值

y_score_test = LR_model_fit.predict_proba(x_test)[:,1]

##计算不同概率阈值的精确召回对

test_precision,test_recall,thresholds=precision_recall_curve(y_test,y_score_test)

##区分测试集中真实的好坏样本数据

df_pre_all = pd.DataFrame({'y_score':y_score_test,'y_test':y_test})

df_pre_good = df_pre_all.loc[df_pre_all["y_test"]==0,]

df_pre_good = df_pre_good.sort_values(["y_score"])

df_pre_bad = df_pre_all.loc[df_pre_all["y_test"]==1,]

df_pre_bad = df_pre_bad.sort_values(["y_score"])

##结果绘图

plt.figure(figsize=(10,6))

plt.rcParams["font.family"]=['SimHei']

plt.rcParams['axes.unicode_minus']=False

plt.hist(df_pre_good["y_score"],bins=100,color='r',alpha=0.5,rwidth=0.6,density=True,label='好样本')

plt.hist(df_pre_bad['y_score'],bins=100,color='b',alpha=0.5,rwidth=0.6,density=True,label='坏样本')

plt.legend()

plt.title('好坏样本分布直方图')

plt.xlabel('predict y proba')

plt.ylabel('count')

plt.show()

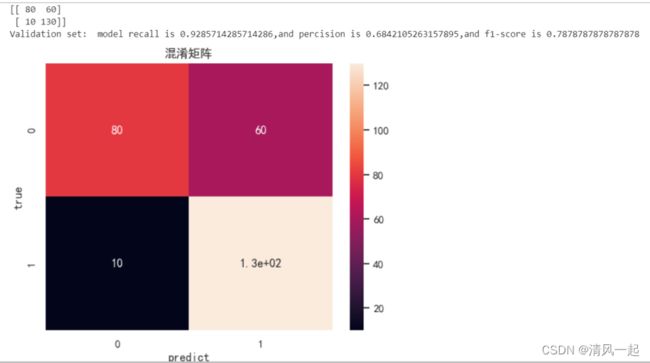

8.2.混淆矩阵及PR曲线

from sklearn.metrics import confusion_matrix

from sklearn.metrics import recall_score

from sklearn.metrics import precision_score

from sklearn.metrics import accuracy_score

from sklearn.metrics import f1_score

##计算混淆矩阵、P、R 与f1-score

y_pred = LR_model_fit.predict(x_test) #返回预测分类值数组

cnf_matrix = confusion_matrix(y_test, y_pred, labels=[0,1]) #建立混淆矩阵

recall_value = recall_score(y_test, y_pred)

precision_value = precision_score(y_test, y_pred)

acc = accuracy_score(y_test, y_pred)

f1 = f1_score(y_test, y_pred)

print(cnf_matrix)

print('Validation set: model recall is {0},and percision is {1},and f1-score is {2}'.format(recall_value,

precision_value,f1))

###绘制混淆矩阵

f,ax=plt.subplots()

sns.heatmap(cnf_matrix,annot=True,ax=ax) #画热力图

ax.set_title('混淆矩阵') #标题

ax.set_xlabel('predict') #x轴

ax.set_ylabel('true') #y轴

plt.show()

##绘制pr曲线,需要用到上面计算的不同概率阈值的精确召回对

#计算不同概率阈值的精确召回对

test_precision,test_recall,thresholds=precision_recall_curve(y_test,y_score_test)

plt.figure(figsize=(12,6))

lw = 2

fontsize_1 = 16

plt.plot(test_recall,test_precision,color='darkorange',lw=lw)

plt.plot([0,1],[0,1],color='navy',lw=lw,linestyle='--')

plt.xlim([0.0,1.0])

plt.ylim([0.0,1.05])

plt.xticks(fontsize=fontsize_1)

plt.yticks(fontsize=fontsize_1)

plt.xlabel('Recall',fontsize=fontsize_1)

plt.ylabel('Precision',fontsize=fontsize_1)

plt.title('PR曲线',fontsize=fontsize_1)

plt.show()

#给各变量赋值

# TP:表示预测为坏样本,实际上也是坏样本,正确拒绝的样本数 (130)

TP = cnf_matrix[1,1]

# FP:表示预测为坏样本,实际上是好样本,错误拒绝的样本数 (60)

FP = cnf_matrix[0,1]

# FN:表示预测为好样本,实际上是坏样本,漏报的样本,被错误准入的样本数 (10)

FN = cnf_matrix[1,0]

# TN:表示预测为好样本,实际上是好样本,正确准入的样本数 (80)

TN = cnf_matrix[0,0]

#我们知道在评分卡业务场景下更关注坏账率和通过率,理想的评分卡模型是最大化通过率,最小坏账率

pt = (FN+TN)/(FN+TN+TP+FP)#通过率

bd = FN/(FN+TN) #坏账率

E = (FN+FP)/(FN+FP+TP+TN) #错误率

Acc = (TP+TN)/(FN+FP+TP+TN) #精度

Recall = TP/(TP+FN) #召回率 :即所有坏样本中找到多少坏样本

Precisoin = TP/(TP+FP) #精准率:衡量所有模型预测为正例的样本中真实为正例的概率(一部分好样本预测成坏样本了)

print(f"通过率为:pt = {pt}")

print(f"坏账率为:bd = {bd}")

print(f"错误率为:E = {E}")

print(f"精度为:Acc = {Acc}")

print(f"召回率为:Recall = {Recall}")

print(f"精确率为:Precisoin = {Precisoin}")

#PR曲线中,我们求平衡点(BEP)来衡量,BEP越大,模型性能越好,更好的指标是F1

F1 = (2*Precisoin*Recall)/(Precisoin+Recall)

print(F1)

8.3.ROC曲线

from sklearn.metrics import roc_curve

from sklearn.metrics import auc

#真阳性率(TPR),假阳性率(FPR)

#我们目的是希望FPR尽可能小,TPR尽可能大

##计算TPR FPR ROC曲线 AUC AR gini等

fpr, tpr, thresholds = roc_curve(y_test, y_score_test)

roc_auc = auc(fpr, tpr)

ar = 2*roc_auc-1 #Gini系数时往往用ROC曲线曲线和中线围成的面积与中线之上面积的比例,也就是Gini=2AUC-1

gini = ar

ks = max(tpr - fpr)

print('test set: model AR is {0},and ks is {1},auc={2}'.format(ar,

ks,roc_auc))

##绘制ROC曲线

plt.figure(figsize=(10,6))

lw = 2

fontsize_1 = 16

plt.plot(fpr,tpr,color='darkorange',lw=lw,label='ROC curve(area=%.2f)' % roc_auc)

plt.plot([0,1],[0,1],color='navy',lw=lw,linestyle='--')

plt.xlim([0.0,1.0])

plt.ylim([0.0,1.05])

plt.xticks(fontsize=fontsize_1)

plt.yticks(fontsize=fontsize_1)

plt.xlabel('FPR',fontsize=fontsize_1)

plt.ylabel('TPR',fontsize=fontsize_1)

plt.title('ROC曲线',fontsize=fontsize_1)

plt.legend(loc='lower right',fontsize=fontsize_1)

plt.show()

九、评分卡构建

理论部分读者注意文章开头的知识准备

9.1.基础得分

lr = LR_model_fit

B = 20/np.log(2)

A = 600 + B*np.log(1/60)

base_score = A - B*lr.intercept_#lr.intercept_:截距

base_score

9.2.各评分结果

X = data_train_woe[[i for i in data_train_woe.columns if i!='target']]

df_fen = pd.DataFrame(columns = ['属性','区间','分数'])

list_key =[] #1.保存每一列的列名

list_value = [] #2.保存每一变量的区间(也叫分箱区间)

score_list=[] #3.保存每一个分箱的分数

list_key.append('基础得分')

list_value.append('无')

score_list.append(int(base_score))

for i,col in enumerate(X.columns):#[*enumerate(X.columns)]

list2 = []

list3 = []

for key,value in woeall[col].items():

# print(value)

list2.append(value)

list3.append(key)

score = np.array(list2) * (-B*lr.coef_[0][i])

for j in range(len(list3)):

list_key.append(col)

list_value.append(list3[j])

score_list.append(score[j])

list2 = []

list3 = []

df_fen['属性'] = list_key

df_fen['区间'] = list_value

df_fen['分数'] = score_list

df_fen['分数取整'] = df_fen['分数'].round()

df_fen.to_csv('评分卡分数.csv',header=True)

最后对评分卡进行规范化以及考虑使用该评分卡的用户的友好体验,对评分表进行优化:

1.增加没一个区间(分箱)的含义

2.基础分转化为100分

3.增加评分卡的使用说明

部分内容如下:

参考:

PYTHON机器学习之用逻辑回归制作评分卡(个人消费类贷款数据案例实战)

信用评分卡建模—基于German Credit德国信用数据集

《python金融大数据风控建模实战-基于机器学习》