The market rebounded in December. A-sharemarket continue its rally in the previous two month. Finance market money iscreating thanks to the regulation of government about the real estate. Risk capital was stopped frequently. Underthe situation like this, shock was driven by a rebound trend and market tradingactivity was also increased dramatically. The Shanghai index has a full monthlyrange of 3094-3301.

Since the latter half of theyear, the net value of actively equity fund has been rising as market has fullyrecovered. According to Oriental wealth Choice data, the net worth growth rateof the actively managed fund was 8.39 per cent on average, with about 300 pieceof fund rose over 20 per cent this year.

Compared market’s poor performancein the first half, today's stock market is full flowering, for example, newenergy vehicles, apple industry chain, and coal non-ferrous plate had severalrounds of rally. It becomes the most important topic for investors to choose a suitablefund under the situation of market index rising.

As we all know, the market isgood now and the capital is increasing, it is beneficial to the short-terminvestors to select a fund that follows the trend of market. Pick up a stock fundthat is close to the market index within a safe range. For example, thecorrelation between the following two funds, HSBC jinxin technology pioneer andhua 'an anxin is respectively 0.68 and 0.73. They all belong to the mid-riskgroup and they can bring a profit for those who was looking for a “Market” fund.

However, investors who havedifferent risk tolerance should do a choice based on their own risk aversion. Afeasible suggestion is that other securities should be supplemented to spreadrisk or increase reasonable income.

�

Now look at the investment style of these two funds. Relevance between market index and HSBC Jin Xin is lower than Hua’an, because HSBC invest about 10-25% in small market, so the risk will be higher than Hua’an( expected yields will be higher at the same time). The selection of these two funds depends on the risk tolerance of investors and their judgment of market trend.

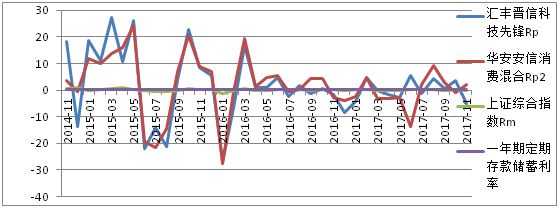

For long-term investors, they should pay attention to the long-term trend of investment products to find valuable securities. Still make HSBC jin xin and hua an consumption as example, Before May 2016, the two funds yield jar volatility. They may take very aggressiveinvestment strategies. After that, yields were close to the Market index. They may keep up with market. Incomes were not as good as before, but more steadily and the yield in most cases is superior to market.

Comparing the cumulative returns of these two funds with Market index over the past five years, it can be seen that HSBC jinxin technology is also better than hua 'an's consumer goods to be a long-term investment product. Its yield has been higher than Market index for a long time, but hua 'an anxin consumption is not behave well like HSBC.

In recent data(2017.6-2017.11), hua an consumption has a instability and jar violently. On contrast, HSBC jin Xin technology are now being in a low and undervalued state. Hold on it for over six months will give investors high return.

Besides, save money in bank is irrational because the interest rate is extremely low, almost close to zero. In every year we all have mild inflation, a large sums of money in the bank will be erode by inflation little by little.

So, if you are a long-term (over 5 years) investor, HSBC Jin Xin technologyis superior to Hua an consumption. But if you want to keep up with the market, Huaan will be better. If you are a shortterm (about 6 months) investors, HSBC Jin Xin has a profit space.

Choosing different funds also requires to assess individual risk level and position ofthe investors should also be taken into account. But in any case it is not awise action to put large amount of money in the bank.