原文链接:http://blogs.wsj.com/cfo/2016/03/03/more-companies-freezing-corporate-pension-plans/

A growing number of companies are freezing their defined benefit pension plans as they seek toreduce their retirement burdens.

Since thefinancial crisis, the percentage of Fortune 500 companies that havefrozentheir corporate pensions nearlydoubledto 39% in 2015 from 21% in 2009, according to risk advisor and benefits management firm Willis Towers Watson.

Frozen plans stop earning further benefits for workers.

In recent years, companies includingBoeing Co.,American International Group Inc.and United States Steel Corp. froze theirdefined benefit plans—in whichemployers manage the investment portfolio and guarantee set payments to retirees—andshifted employees to defined contribution plans. In these 401(k) plans, workers are responsible for theirown investment decisions.

The number of Fortune 500 companies that only offerdefined contribution plansto workersjumped to 401 in 2015 from 333 in 2009. The total hasdoubledsince 1998, according to Willis Towers Watson.

A bevy(一群)ofregulationsgoverning the defined benefit plans,higher costs for employeesthat areliving longerandincreasing feescharged by regulators have made the plansless attractive for corporations, said Alan Glickstein, a senior retirement consultant at Willis Towers Watson.

The defined benefit plans, while an attractive benefit for workers, are alsoa big burden on corporate balance sheets.

The 100 largest corporate pension plans had acollective deficitof $326 billion in January, according toconsulting firm Milliman. That meansthe value of the assets in their plans don’t match the amount they owe. The plans werein surplusin 2007, butfell into deficit during the financial crisisof 2008.Plunging突然往下的stock pricesand low interest ratescombined to push them into the red.

Pensions depend onstock returns to boost their asset values, whilelow interest rates increase the present-day values of the future liabilities.Years ofratesnear historical lows havemore than offsetany gains the plans made fromstock gains.

文章大意:

阐述了比起09年,15年很多公司逐渐冻结defined pension plan(或转成defined contribute plan)这一现象,以及给出背后的原因。

个人感受:

国家政策与公司决策息息相关……(如影响interest rate的政策,对pension plan的regulation)

Employee的权利太小?????当所有公司都转成这种plan的时候就没有人会因为这个理由而跳槽?

公司的做法某层面上打击employee, maybe会motivation减弱,因为毕竟DB多少是base on employee salary, performance etc,但DC就是base on their investment decision因此他们干活可能不会那么积极对公司也许造成负面影响;但不管怎么说这个决策为公司减少了很多tangible的负担? 而且要是公司不这么干的话有可能账面很难看导致investor失去信心不投资他们然后最坏结果就是破产破了就更没法还employee??

金融危机带来的危害真大……

相关知识:

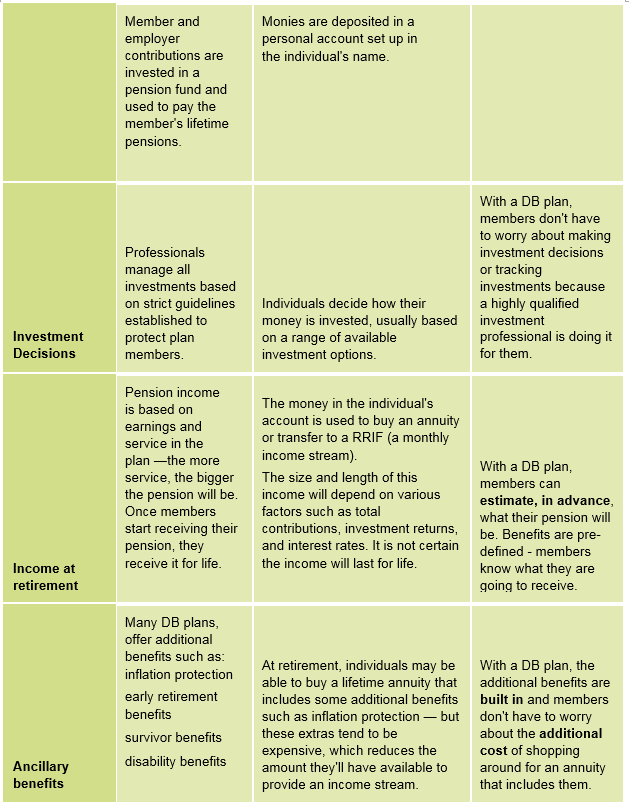

Defined-benefit plan

A type ofpension planin which an employer/sponsor promises a specified monthly benefit on retirement that is predetermined by aformulabased on the employee'searningshistory, tenure of service andage, rather than depending directly on individualinvestmentreturns/An employer-sponsored retirement plan where employee benefits are sorted out based on a formula using factors such as salary history and duration of employment. Investment risk andportfolio managementare entirely under the control of the company. There are also restrictions on when and how you can withdraw these funds without penalties.

Defined-contribution plan

A type ofretirement planin which the employer, employee or both make contributions on a regular basis.[1]Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employer contributions and, if applicable, employee contributions) plus any investment earnings on the money in the account. Only employer contributions to the account are guaranteed, not the future benefits. In defined contribution plans, future benefits fluctuate on the basis of investment earnings. The most common type of defined contribution plan is a savings and thrift plan. Under this type of plan, the employee contributes a predetermined portion of his or her earnings (usually pretax) to an individual account, all or part of which is matched by the employer

简单说法:

DB是员工在工作的时候定期向公司交定量的钱,但是最终他们退休的时候公司还他们多少钱是根据一系列的公式计算的,其中的factor包括他们的salary,工作时长等,并且终生有效(really?)。而公司如何有钱还员工就是从他们事先交的钱里拿去投资,但是退休金和投资的return没有关系。

DC是员工预先将他们的salary拿出一部分来放到一个独立的账户里面进行投资,估计一人一个账户。投资的decision要么公司会给你一些建议,要么靠自己。最终退休得到的退休金根据investment return来定。

注意:

The money in the individual's account is used to buy an annuity or transfer to a RRIF (a monthly income stream).

应该是说他们退休的时候所赚的钱拿来买annuity(一个contract specified每时间段会给你多少钱),如果你想要有additional benefit的话没时间段的coupon估计会减少或者价格升高吧。

总的来说对比他俩:

DC类似saving了,要求employee承受的风险更大(investment risk),面临additional cost的可能性(为了得到ancillary benefits), benefit更难保障。

疑问:那他妈谁会买这种plan?都没有一个好的。好在哪里,刚开始每年交的钱不用那么多?

其他:

Pension fund是buy-side,并且long-term investment,因此这种fund最不受市场短期波动影响,所以liquidity risk(马上要把investment兑现的能力)最小;而hedge fund是capture market的,因此liquidity risk最大

Milliman,a large international, independentactuarialandconsultingfirm

句子理解与疑惑:

Frozen plans stop earning further benefits for workers.

这句话是什么意思?不是DB按照规定formula计算吗,合同都签好了你咋不给人约定的benefit?还是说frozen专指DB转成DC这一行为?(因为后者公司不承担责任)估计后面这话是对的。

倒数第四段:

A bevy(一群)ofregulationsgoverning the defined benefit plans,higher costs for employeesthat areliving longerandincreasing feescharged by regulators have made the plansless attractive for corporations, said Alan Glickstein, a senior retirement consultant at Willis Towers Watson.

higher costs for employeesthat areliving longerà这是在讲对公司不好的地方对吗,因为活得长就要给钱给的时间长,right?

Defined benefit plan对公司的坏处:

1. higher costs for employeesthat areliving longer

2. increasing feescharged by regulators

倒数第五段:从Balance sheets分析DB对公司的不好

The 100 largest corporate pension plans had acollective deficitof $326 billion in January, according toconsulting firm Milliman. That meansthe value of the assets in their plans don’t match the amount they owe. The plans werein surplusin 2007, butfell into deficit during the financial crisisof 2008.Plunging突然往下的stock pricesand low interest ratescombined to push them into the red.

Pensions depend onstock returns to boost their asset values, whilelow interest rates increase the present-day values of the future liabilities.Years ofratesnear historical lows havemore than offsetany gains the plans made fromstock gains.

Asset = Liability + Equity

Collective deficit存在于plan里面,不管账面关系因为我不会就直接理解成这个plan带给公司的价值减去公司要还employee的钱=- 326.谁能教我从A,L,E分析分析?有关吗?

现象:own-owe= - 326

金融危机时从surplus转deficit的原因:

1)plunging stock prices (own更少)

我的理解是,公司把这些钱invest到项目中去,因此stock price影响公司获利的多少。Stock price下跌说明公司手上能还employee的钱更少,asset方面减少

2)low interest rates (owe更多)

Present value计算公式是CASH FLOW/(1+interest rate)^t ,因此公司欠employee的钱在分母不变情况下,ir减小,pv增大。这个增大是在liability(owe) size

综合就是欠的更多,获得的更少,总体账面亏欠更多。

问题:

是不是balance sheet是会把公司欠employee的pension plan都要算成pv写上去?(那他们怎么预测最终的payout是多少?)