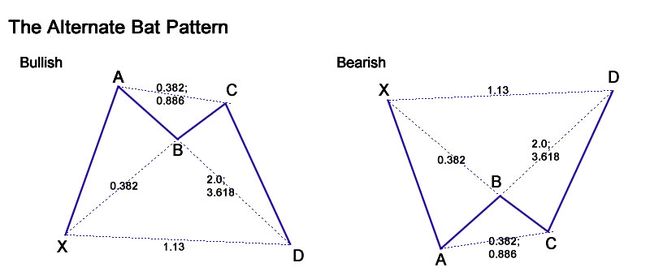

Alt Bat

The Alternate Bat pattern is a precise harmonic pattern discovered by Scott Carney in 2003. The pattern incorporates the 1.13 XA retracement, as the defining element in the D area. The B point retracement must be a 0.382 retracement or less of the XA leg. The Alternate Bat utilizes a minimum 2.0 BC projection. In addition, the AB=CD pattern within the Alternate Bat is always extended and usually requires a 1.618 AB=CD calculation.

The Alternate Bat is an incredibly accurate pattern that works exceptionally well in the RSI BAMM divergence setup.

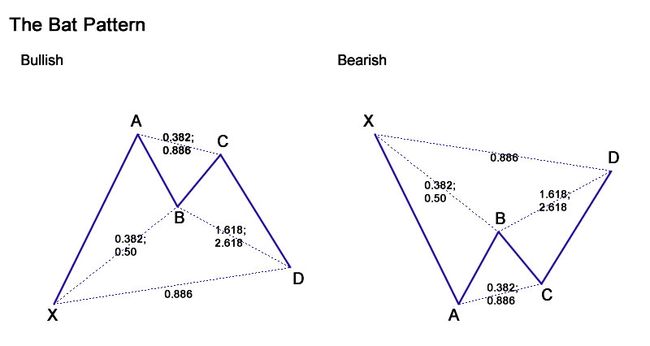

Bat Pattern

The Bat pattern is a precise harmonic pattern discovered by Scott Carney in 2001. The pattern incorporates the 0.886XA retracement, as the defining element in the Potential Reversal Zone (PRZ). The B point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the XA leg. The Bat utilizes a minimum 1.618BC projection. In addition, the AB=CD pattern within the Bat is extended and usually requires a 1.27AB=CD calculation. It is an incredibly accurate pattern and requires a smaller stop loss than most patterns.

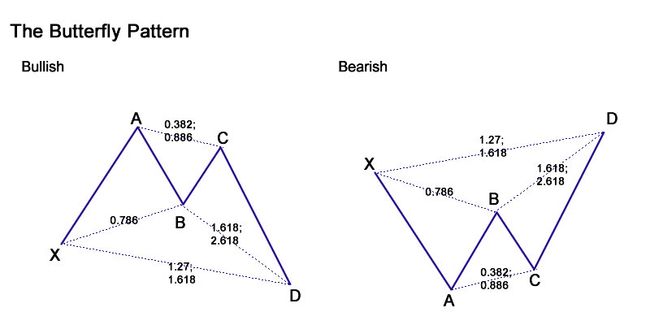

Butterfly Pattern

These measurements include a mandatory 0.786 retracement of the XA leg at the B point, which defines a more precise Potential Reversal Zone (PRZ) and more significant trading opportunities. Also, the Butterfly pattern must include an AB=CD pattern to be a valid signal. Frequently, the AB=CD pattern will possess an extended CD leg that is 1.27 or 1.618 of the AB leg. Although this is an important requirement for a valid trade signal, the most critical number in the pattern is the 1.27 XA leg. The XA calculation is usually complemented by an extreme (2.00, 2.24, 2.618) BC projection. These numbers create a specific Potential Reversal Zone (PRZ) that can yield powerful reversals, especially when the pattern is in all-time (new highs/new lows) price levels.

Crab Pattern

The critical aspect of this pattern is the tight Potential Reversal Zone created by the 1.618 of the XA leg and an extreme (2.24, 2.618, 3.14, 3.618) projection of the BC leg but employs an 0.886 retracement at the B point unlike the regular version that utilizes a 0.382-0.618 at the mid-point. The pattern requires a very small stop loss and usually volatile price action in the Potential Reversal Zone.

Deep Crab Pattern

The primary difference between a Crab and a Deep Crab is the retracement of point B.

A Deep Crab has a much deeper retracement, yet keeps the same 1.618 projection of the XA leg to point D, which allows it to keep the same “Crab” name.

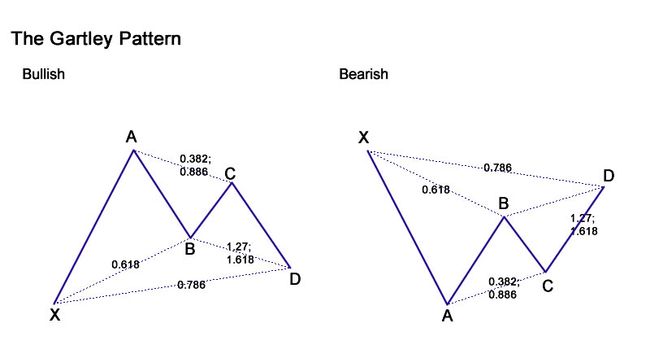

Gartley Pattern

the specific retracements of the B point at a 0.618 and the D point at a 0.786 were assigned to the pattern. There are others who have assigned Fibonacci retracements to this framework. However, they use a variety of Fibonacci numbers at the B and D points. Despite these variations, the Fibonacci retracements that yield the most reliable reversals are the 0.618 at the B point and the 0.786 at the D point. Furthermore, the pattern should possess a distinct AB=CD pattern that converges in the same area as the 0.786 XA retracement and the BC projection (1.272 to 1.618). The most critical aspect of the Gartley is the B point retracement, which must be at a 0.618 of the XA leg.

Shark Pattern

The Shark Pattern is dependent upon the powerful 88.6% retracement and the 113% Reciprocal Ratio, works extremely well retesting prior support/resistance points (0.886/1.13) as a strong counter-trend reaction. Represents a temporary extreme structure that seeks to capitalize on the extended nature of the Extreme Harmonic Impulse Wave. Demands immediate change in price action character immediately following pattern completion. Extreme Harmonic Impulse Wave utilized depends upon location of 88.6% level – these are minimum requirements. Requires an active management strategy to capture high probability profit segments.

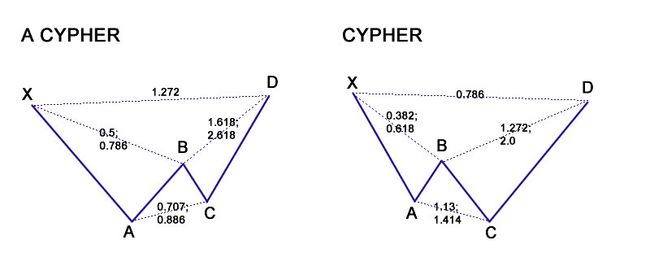

Cypher

The Cypher pattern is the second of our “class 2” patterns, where point C exceeds the AB leg. Other than using different ratios from the Shark pattern, the Cypher also looks for point C to be 1.272 to 1.414 projection of the XA leg, rather than the AB leg.

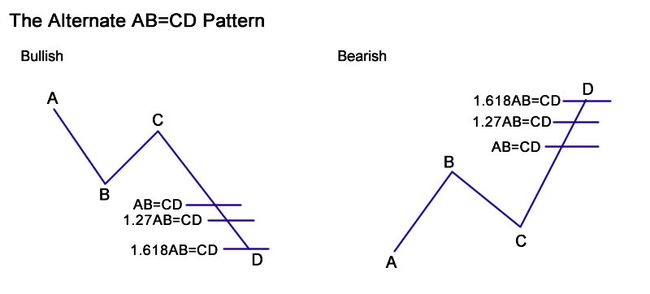

AB=CD

The AB=CD pattern is a price structure where each price leg is equivalent. The Fibonacci numbers in the pattern must occur at specific points. In an ideal AB=CD, the C point must retrace to either a 0.618 or 0.786. This retracement sets up the BC projection that should converge at the completion of the AB=CD.

Alt AB=CD

Based on the retracement of point C, there are other extensions of the CD leg to look for. Namely, either a 1.27 or 1.618. When there is a 0.618 retracement at the C point, then look for a 1.618 BC projection. If there is a larger 0.786 retracement at the C point, then look for a 1.27 projection. The most important consideration to remember is that the BC projection should converge closely with the completion of the AB=CD.

Three Drive Pattern

Although it was not specifically identified, one of the first references to a Three Drives Pattern was outlined in Robert Prechter’s book, “Elliot Wave Principle.” He described the general nature of price action that possessed either a three-wave or a five-wave structure. Adapted from this principle, symmetrical price movements that possess identical Fibonacci projections in a 5- wave price structure constitute a Three Drives pattern. In “The Harmonic Trader,” the patterns importance of other larger retracements and projections improved the accuracy of the pattern in real trading situations. The book was one of the first to emphasize the the critical aspect of this pattern that each drive complete precisely at consecutive harmonic ratios – either a 1.13, 1.27 or a 1.618. Also, the price legs should possess clear symmetry with each drive forming over equivalent time periods.

Harmonic Pattern Guide