- 什么是RFM模型

走过冬季

学习笔记大数据数据分析

RFM模型是客户价值分析中一种经典且实用的量化模型,它通过三个关键维度评估用户价值,帮助企业识别最有价值的客户群体。名称RFM由三个核心指标的英文首字母组成:R(Recency)-最近一次消费时间定义:用户上一次发生交易行为距今的时间长度(如多少天前)。意义:衡量用户的活跃度和流失风险。R值越小(最近有消费),说明用户越活跃,流失风险越低;R值越大(很久没消费),用户流失风险越高。母婴场景示例:一

- 数据分析常用指标名词解释及计算公式

走过冬季

学习笔记数据分析大数据

数据分析中有大量常用指标,它们帮助我们量化业务表现、用户行为、产品健康度等。下面是一些核心指标的名词解释及计算方式,按常见类别分类:一、流量与用户规模指标页面浏览量名词解释:用户访问网站或应用时,每次加载或刷新一个页面就算一次PV。它衡量的是页面被打开的总次数。计算方式:PV=∑(所有页面被加载的次数)(通常由埋点或日志直接统计)独立访客数名词解释:在特定时间范围内(如一天、一周、一月),访问网站

- 24GB GPU 中的 DeepSeek R1:Unsloth AI 针对 671B 参数模型进行动态量化

知识大胖

NVIDIAGPU和大语言模型开发教程人工智能deepseekollama

简介最初的DeepSeekR1是一个拥有6710亿个参数的语言模型,UnslothAI团队对其进行了动态量化,将模型大小减少了80%(从720GB减少到131GB),同时保持了强大的性能。当添加模型卸载功能时,该模型可以在24GBVRAM下以低令牌/秒的推理速度运行。推荐文章《本地构建AI智能分析助手之01快速安装,使用PandasAI和Ollama进行数据分析,用自然语言向你公司的数据提问为决策

- 在 Obsidian 中本地使用 DeepSeek — 无需互联网!

知识大胖

NVIDIAGPU和大语言模型开发教程人工智能deepseek

简介您是否想在Obsidian内免费使用类似于ChatGPT的本地LLM?如果是,那么本指南适合您!我将引导您完成在Obsidian中安装和使用DeepSeek-R1模型的确切步骤,这样您就可以在笔记中拥有一个由AI驱动的第二大脑。推荐文章《24GBGPU中的DeepSeekR1:UnslothAI针对671B参数模型进行动态量化》权重1,DeepSeek类《在RaspberryPi上运行语音识别

- 卫星分析系列之 使用卫星图像量化野火烧毁面积 在 Google Colab 中使用 Python 使用 Sentinel-2 图像确定森林火灾烧毁面积

知识大胖

NVIDIAGPU和大语言模型开发教程pythonsentinel开发语言

简介几年前,当大多数气候模型预测如果我们不采取必要措施,洪水、热浪和野火将会发生更多时,我没想到这些不寻常的灾难现象会成为常见事件。其中,野火每年摧毁大量森林面积。如果你搜索不同地方的重大野火表格,你会发现令人震惊的统计数据,显示由于野火,地球上有多少森林面积正在消失。在本教程中,我将结合我已经发表过的关于下载、处理卫星图像和可视化野火的故事,量化加州发生的其中一场重大野火的烧毁面积。与之前的帖子

- 在mac m1基于llama.cpp运行deepseek

lama.cpp是一个高效的机器学习推理库,目标是在各种硬件上实现LLM推断,保持最小设置和最先进性能。llama.cpp支持1.5位、2位、3位、4位、5位、6位和8位整数量化,通过ARMNEON、Accelerate和Metal支持Apple芯片,使得在MACM1处理器上运行Deepseek大模型成为可能。1下载llama.cppgitclonehttps://github.com/ggerg

- 短剧小程序开发全攻略:从0到1打造爆款内容平台

weixin_lynhgworld

小程序短剧

核心内容:行业趋势分析:短剧市场年增长率超300%,用户规模突破5亿,抖音、快手等平台加速布局。小程序成为短剧分发核心渠道:轻量化、低成本、社交裂变优势显著。开发核心功能模块:内容管理:支持多格式上传、分集管理、标签分类。播放体验优化:弹幕互动、倍速播放、清晰度切换、离线缓存。付费系统:单集付费、会员订阅、广告解锁等多元化盈利模式。社交裂变:分享奖励、邀请排行榜、拼团观影功能。技术实现难点:视频流

- 全网最全100道C语言高频经典面试题及答案解析:C语言程序员面试题库分类总结

猿享天开

学懂C语言-C语言从入门到精通c语言c++面试

前言在计算科学领域,C语言犹如一座横跨硬件与软件的桥梁——其简洁的语法背后,承载着操作系统、数据库、嵌入式系统等基础软件的运行命脉。当开发者面对大厂面试中"用户态与内核态切换的开销量化"或"自旋锁在NUMA架构下的性能陷阱"等深度问题时,仅凭教科书知识往往难以应对。本文正是为解决这一痛点而生。我们摒弃传统面试题集的简单罗列模式,精选100个直指系统编程本质的问题,每个案例均包含:工业级场景还原:基

- OpenCV探索之旅:多尺度视觉与形状的灵魂--图像金字塔与轮廓分析

在我们学会用Canny算法勾勒处世界的轮廓之后,一个更深层次的问题摆在了面前:这些由像素组成的线条,如何才能被赋予“生命”,成为我们能够理解和分析的“形状”?如果一个物体在图像中时大时小,我们又该如何稳定地识别它?欢迎来到本次的探索之旅。我们将建造两种强大的“金字塔”,赋予我们跨越尺度的“鹰之眼”;然后,我们将不仅仅是找到轮廓,更要深入其内部,测量它的面积、周长,找到它的重心,甚至量化它的“形状”

- YOLOv8 环境监测五大场景 —— 二、 森林火灾早期预警 之无人机巡逻监测 详细解释及代码完整示例

路飞VS草帽

YOLOv8原理与源代码讲解---六大章YOLOv各版本的应用详细说明及代码示例环境监测五大场景YOLO无人机环境监测森林火灾早期预警无人机巡逻监测YOLOv8

YOLOv8无人机森林火灾巡逻监测系统系统架构设计无人机火灾监测系统组成:1.飞行平台-多旋翼无人机(续航≥60分钟)-双光吊舱(可见光+红外)-RTK高精度定位-4G/5G数据链2.机载计算单元-JetsonOrinNX(AI加速)-轻量化YOLOv8模型-实时火情分析3.地面控制站-飞行路径规划-实时视频监控-火情预警系统4.云端协同-多机任务分配-火势扩散预测-应急资源调度完整代码实现1.无

- 【个人思考】如何理解量化交易与做空?初学者必读的金融交易入门指南

姚瑞南Raynan

个人思考人工智能AIGC

本文原创作者:姚瑞南AI-agent大模型运营专家/音乐人/野生穿搭model,先后任职于美团、猎聘等中大厂AI训练专家和智能运营专家岗;多年人工智能行业智能产品运营及大模型落地经验,拥有AI外呼方向国家专利与PMP项目管理证书。(转载需经授权)目录金融交易中的一些常见概念:量化交易、做空以及更多1️⃣量化交易:数据驱动的交易方式2️⃣做空:预测价格下跌赚取差价个人做空的理解:借西瓜赚差价3️⃣做

- 小型化与低功耗工业数据采集卡的在哪些行业有强劲需求?

番茄老夫子

数据采集卡

小型化与低功耗工业数据采集卡在汽车、医疗、能源等多个行业有着强劲需求,以下是具体介绍:汽车行业:在汽车电子系统中,如电池管理系统、电机控制和自动驾驶系统等,需要采集大量传感器数据。小型化低功耗的数据采集卡可轻松嵌入汽车内部紧凑空间,且能在车辆长时间运行中保持低能耗,例如用于实时监控车载网络信号,优化ECU性能,同时满足汽车对零部件小型化、轻量化以及节能的要求。医疗行业:医疗设备如呼吸机、心脏监测仪

- Manus AI与多语言手写识别

ManusAI与多语言手写识别背景与概述手写识别技术的发展现状与挑战ManusAI的核心技术与应用场景多语言手写识别的市场需求与难点ManusAI的技术架构深度学习在手写识别中的应用多语言支持的模型设计数据预处理与特征提取方法多语言手写识别的关键挑战不同语言字符的多样性处理上下文语义与书写风格适应性低资源语言的训练数据获取解决方案与优化策略迁移学习在多语言任务中的应用端到端模型的优化与轻量化用户反

- 中药细粒度图像分类

小lo想吃棒棒糖

分类数据挖掘人工智能

在细粒度图像分类(FGVC)领域,BilinearCNN(BCNN)模型因其能够捕捉图像中的局部特征交互而受到广泛关注。该模型通过双线性池化操作将两个不同CNN提取的特征进行外积运算,从而获得更加丰富的特征表示,这对于区分外观相似但属于不同子类别的物体尤其有效。然而,BCNN通常计算成本较高,限制了其在移动设备或资源受限环境下的应用。为了实现轻量化并保持高精度的细粒度分类,可以考虑将MobileN

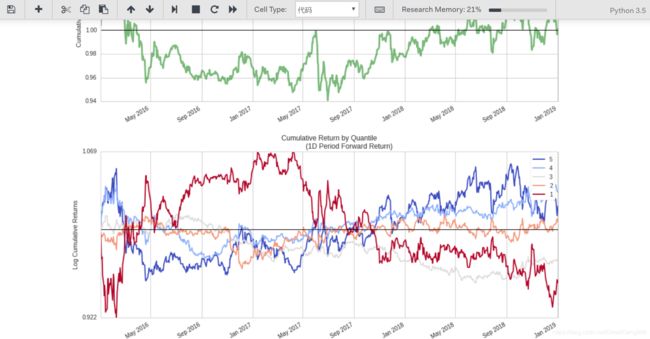

- 使用Qlib基于LightGBM预测沪深300涨跌

DeepReinforce

量化投资

Qlib是一个专为量化金融和算法交易研究设计的开源库。本文配置一个基于LightGBM的梯度提升决策树(GBDT)模型,并使用金融数据集(包含158个技术指标特征)进行训练和预测。1.导入必要的模块pythonCollapseWrapRunCopyfromqlib.contrib.model.gbdtimportLGBModelfromqlib.contrib.data.handlerimport

- 专知智库数据要素全链路基础设施:数字经济时代的“数据生态操作系统”

人形机器人专利池研究中心

数据场景生态首席数据官3.0数据场景架构师首席数据官3.0数据零件架构师数据场景架构师

专知智库数据要素全链路基础设施:数字经济时代的“数据生态操作系统”引言:数据要素的“生态困局”——从“资源孤岛”到“价值共生”的破局之道在数字经济时代,数据已从“企业私有财产”跃升为“社会公共资源”,成为驱动产业升级、创新商业模式的核心生产要素。但数据要素的价值释放,始终面临着三大核心矛盾:“散”——数据分散在各主体,难以整合;“死”——数据价值难量化,无法定价;“疑”——数据流通缺信任,交易成本

- Semantic text 就是那么强大,还附带一包( BBQ )薯片!配有可配置的分块设置和索引选项。

Elastic 中国社区官方博客

ElasticsearchAI大数据elasticsearch搜索引擎全文检索人工智能ai图搜索

作者:来自ElasticKathleenDeRusso语义文本搜索现在可以自定义,支持可配置的分块设置和索引选项,用于自定义向量量化,使semantic_text在专业用例中更强大。Elasticsearch拥有大量新功能,帮助你为你的用例构建最佳搜索解决方案。深入查看我们的示例笔记本以了解更多信息,开始免费云试用,或者立即在本地机器上体验Elastic。随着Elasticsearch8.18和9

- YOLOv11模型轻量化挑战技术文章大纲

程序猿全栈の董(董翔)

githubYOLOv11

模型轻量化的背景与意义目标检测模型YOLOv11的性能与应用场景轻量化的必要性:边缘设备部署、实时性需求、计算资源限制轻量化面临的挑战:精度与速度的权衡、模型压缩方法的选择YOLOv11的轻量化技术方向网络结构优化:深度可分离卷积、分组卷积、瓶颈设计模型剪枝:结构化剪枝与非结构化剪枝策略知识蒸馏:教师-学生模型框架与特征匹配方法量化与低比特压缩:FP16/INT8量化与二值化网络轻量化实现的具体方

- KTO(Kahneman-Tversky Optimization)技术详解与工程实现

DK_Allen

大模型深度学习pytorch人工智能KTO

KTO(Kahneman-TverskyOptimization)技术详解与工程实现一、KTO核心思想KTO是基于行为经济学前景理论(ProspectTheory)的偏好优化方法,突破传统偏好学习需要成对数据的限制,仅需单样本绝对标注(好/坏)即可优化模型。其创新性在于:损失函数设计:将人类对"收益"和"损失"的非对称心理反应量化数据效率:无需构建偏好对(y_w>y_l),直接利用松散标注二、KT

- 更新!「3D Web轻量化引擎」HOOPS Communicator发布2025.2.0版本:全新WebViewer用户界面、

工业3D_大熊

3DCAD开发工具3d3D建模3D模型轻量化工业3D3D数据格式转换3D模型可视化3DWeb轻量化

3DWeb轻量化引擎HOOPSCommunicator此前发布2025.2.0版本!此次更新聚焦于提升用户体验和稳定性,通过引入创新的界面设计以及对若干问题的修复,确保用户能够更加高效、流畅地处理3D数据可视化任务。以下将详细阐述本次更新的核心内容。一、增强功能本次更新的重点在于对WebViewer用户界面的革新。我们精心打造了全新的WebViewerUI,其核心基于WebComponents技术

- 量化价值投资中的深度学习技术:TensorFlow实战

量化价值投资中的深度学习技术:TensorFlow实战关键词:量化价值投资,深度学习,TensorFlow,股票预测,因子模型,LSTM神经网络,量化策略摘要:本文将带你走进"量化价值投资"与"深度学习"的交叉地带,用小学生都能听懂的语言解释复杂概念,再通过手把手的TensorFlow实战案例,教你如何用AI技术挖掘股票市场中的价值宝藏。我们会从传统价值投资的痛点出发,揭示深度学习如何像"超级分析

- 上下文工程:AI 智能体架构落地的关键新技术

一休哥助手

人工智能人工智能架构

摘要随着大语言模型(LLM)驱动的智能体(Agent)逐渐成为下一代人机交互的核心范式,上下文管理已成为决定智能体性能与可靠性的关键瓶颈。本文提出“上下文工程”(ContextEngineering)作为智能体架构落地的核心技术方向,系统阐述其在解决长上下文依赖、多轮交互一致性、动态知识更新等挑战中的核心作用。通过分层架构设计、动态压缩策略与向量化增强技术,上下文工程显著提升智能体的记忆效率与推理

- 目标检测YOLO实战应用案例100讲-基于深度学习的自动驾驶目标检测算法研究(续)

林聪木

目标检测YOLO深度学习

目录基于双蓝图卷积的轻量化自动驾驶目标检测算法5.1引言5.2DarkNet53网络冗余性分析5.3双蓝图卷积网络5.4实验结果及分析基于深度学习的自动驾驶目标检测算法研究与应用传统的目标检测算法目标检测基线算法性能对比与选择相关理论和算法基础2.1引言2.2人工神经网络2.3FCOS目标检测算法2.4复杂交通场景下的目标检测难点与FCOS改进方案基于FCOS的目标检测算法改进3.1引言3.2Re

- 【FFT】基于FPGA的FFT傅里叶变换和相位计算系统设计

fpga和matlab

★FPGA项目经验板块19:信号发生器fpga开发FFT相位计算

1.软件版本ISE14.7,modeslimSE,10.1c2.系统仿真与分析第1步:信号源的产生主要通过rom将产生的数据保存到rom中,然后,我们再仿真的时候调用即可。这个部分仿真效果如下所示,你给的程序中,这个部分主要有两个数据源,一个是1025,一个是N为1024,我们这里分别将这两个数据量化之后保存到rom中,仿真如下所示:

- Apache Cloudberry 向量化实践(二):如何识别和定位向量化系统的性能瓶颈?

数据库

如何系统性识别并定位向量化执行链路中的性能瓶颈?本文将结合分析方法论与实践案例,帮助大家建立起优化的基本盘。性能问题从何而来?向量化系统中的性能瓶颈往往不易察觉。它可能是某个操作符计算效率低下,也可能是某次调度延迟过大,甚至是系统某一阶段发生了资源争抢。大致来看,性能瓶颈来源可分为以下几类:计算瓶颈(on-CPU):如表达式编译低效、算子计算逻辑复杂等。等待瓶颈(off-CPU):如线程调度延迟、

- 计算机视觉:Transformer的轻量化与加速策略

xcLeigh

计算机视觉CV计算机视觉transformer人工智能AI策略

计算机视觉:Transformer的轻量化与加速策略一、前言二、Transformer基础概念回顾2.1Transformer架构概述2.2自注意力机制原理三、Transformer轻量化策略3.1模型结构优化3.1.1减少层数和头数3.1.2优化Patch大小3.2参数共享与剪枝3.2.1参数共享3.2.2剪枝3.3知识蒸馏四、Transformer加速策略4.1模型量化4.2.2TPU加速4.

- AI产品经理技术篇:从传统AI到生成式AI,解密大模型的核心概念

让我看看好学吗

人工智能产品经理学习深度学习自然语言处理

在人工智能技术飞速发展的今天,AI产品经理不仅需要理解业务逻辑,还需深入技术底层,把握从传统AI到生成式AI的演进脉络。传统AI以分类、预测和规则驱动为核心,而生成式AI则颠覆了这一范式,通过大模型实现内容创作、对话生成等创造性任务。这种转变背后,是参数规模、模型架构和训练方式的根本性革新。作为AI产品经理,理解大模型的核心概念至关重要。从“参数”的意义到“Token”的向量化,从Transfor

- 人工智能-基础篇-18-什么是RAG(检索增强生成:知识库+向量化技术+大语言模型LLM整合的技术框架)

weisian151

人工智能人工智能语言模型自然语言处理

RAG(Retrieval-AugmentedGeneration,检索增强生成)是一种结合外部知识检索与大语言模型(LLM)生成能力的技术框架,旨在提升生成式AI在问答、内容创作等任务中的准确性、实时性和领域适应性。1、核心概念大语言模型(LLM)的两大局限性:时效性不足:LLM的训练数据截止于某一时间点,无法获取最新信息(如2025年后的新事件)。知识幻觉:当问题超出模型训练数据范围时,LLM

- 「无痛成长」框架:用辩证思维搭建可持续变强的底层逻辑

默大老板是在下

表达想法思考人工智能学习经验分享重构

核心前提:成长是「动态平衡系统」真正的成长既不是「苦熬式内卷」,也不是「躺平式摆烂」,而是在「自我突破」与「接纳现状」之间找支点——就像开发软件时既要迭代功能,又要兼容旧系统,最终形成一套轻量化、低内耗的「个人成长操作系统」。一、认知基石:3个「辩证成长观」(打破非黑即白)核心逻辑:成长的底层矛盾不是「选A还是选B」,而是「A与B如何协同」:「敢想」与「落地」的平衡术误区:要么空想「月入十万」却从

- 集成学习中的多样性密码:量化学习器的多样性

元楼

集成学习学习机器学习人工智能

合集-scikit-learn(69)1.【scikit-learn基础】--概述2023-12-022.【scikit-learn基础】--『数据加载』之玩具数据集2023-12-043.【scikit-learn基础】--『数据加载』之真实数据集2023-12-064.【scikit-learn基础】--『数据加载』之样本生成器2023-12-085.【scikit-learn基础】--『数据

- 微信开发者验证接口开发

362217990

微信 开发者 token 验证

微信开发者接口验证。

Token,自己随便定义,与微信填写一致就可以了。

根据微信接入指南描述 http://mp.weixin.qq.com/wiki/17/2d4265491f12608cd170a95559800f2d.html

第一步:填写服务器配置

第二步:验证服务器地址的有效性

第三步:依据接口文档实现业务逻辑

这里主要讲第二步验证服务器有效性。

建一个

- 一个小编程题-类似约瑟夫环问题

BrokenDreams

编程

今天群友出了一题:

一个数列,把第一个元素删除,然后把第二个元素放到数列的最后,依次操作下去,直到把数列中所有的数都删除,要求依次打印出这个过程中删除的数。

&

- linux复习笔记之bash shell (5) 关于减号-的作用

eksliang

linux关于减号“-”的含义linux关于减号“-”的用途linux关于“-”的含义linux关于减号的含义

转载请出自出处:

http://eksliang.iteye.com/blog/2105677

管道命令在bash的连续处理程序中是相当重要的,尤其在使用到前一个命令的studout(标准输出)作为这次的stdin(标准输入)时,就显得太重要了,某些命令需要用到文件名,例如上篇文档的的切割命令(split)、还有

- Unix(3)

18289753290

unix ksh

1)若该变量需要在其他子进程执行,则可用"$变量名称"或${变量}累加内容

什么是子进程?在我目前这个shell情况下,去打开一个新的shell,新的那个shell就是子进程。一般状态下,父进程的自定义变量是无法在子进程内使用的,但通过export将变量变成环境变量后就能够在子进程里面应用了。

2)条件判断: &&代表and ||代表or&nbs

- 关于ListView中性能优化中图片加载问题

酷的飞上天空

ListView

ListView的性能优化网上很多信息,但是涉及到异步加载图片问题就会出现问题。

具体参看上篇文章http://314858770.iteye.com/admin/blogs/1217594

如果每次都重新inflate一个新的View出来肯定会造成性能损失严重,可能会出现listview滚动是很卡的情况,还会出现内存溢出。

现在想出一个方法就是每次都添加一个标识,然后设置图

- 德国总理默多克:给国人的一堂“震撼教育”课

永夜-极光

教育

http://bbs.voc.com.cn/topic-2443617-1-1.html德国总理默多克:给国人的一堂“震撼教育”课

安吉拉—默克尔,一位经历过社会主义的东德人,她利用自己的博客,发表一番来华前的谈话,该说的话,都在上面说了,全世界想看想传播——去看看默克尔总理的博客吧!

德国总理默克尔以她的低调、朴素、谦和、平易近人等品格给国人留下了深刻印象。她以实际行动为中国人上了一堂

- 关于Java继承的一个小问题。。。

随便小屋

java

今天看Java 编程思想的时候遇见一个问题,运行的结果和自己想想的完全不一样。先把代码贴出来!

//CanFight接口

interface Canfight {

void fight();

}

//ActionCharacter类

class ActionCharacter {

public void fight() {

System.out.pr

- 23种基本的设计模式

aijuans

设计模式

Abstract Factory:提供一个创建一系列相关或相互依赖对象的接口,而无需指定它们具体的类。 Adapter:将一个类的接口转换成客户希望的另外一个接口。A d a p t e r模式使得原本由于接口不兼容而不能一起工作的那些类可以一起工作。 Bridge:将抽象部分与它的实现部分分离,使它们都可以独立地变化。 Builder:将一个复杂对象的构建与它的表示分离,使得同

- 《周鸿祎自述:我的互联网方法论》读书笔记

aoyouzi

读书笔记

从用户的角度来看,能解决问题的产品才是好产品,能方便/快速地解决问题的产品,就是一流产品.

商业模式不是赚钱模式

一款产品免费获得海量用户后,它的边际成本趋于0,然后再通过广告或者增值服务的方式赚钱,实际上就是创造了新的价值链.

商业模式的基础是用户,木有用户,任何商业模式都是浮云.商业模式的核心是产品,本质是通过产品为用户创造价值.

商业模式还包括寻找需求

- JavaScript动态改变样式访问技术

百合不是茶

JavaScriptstyle属性ClassName属性

一:style属性

格式:

HTML元素.style.样式属性="值";

创建菜单:在html标签中创建 或者 在head标签中用数组创建

<html>

<head>

<title>style改变样式</title>

</head>

&l

- jQuery的deferred对象详解

bijian1013

jquerydeferred对象

jQuery的开发速度很快,几乎每半年一个大版本,每两个月一个小版本。

每个版本都会引入一些新功能,从jQuery 1.5.0版本开始引入的一个新功能----deferred对象。

&nb

- 淘宝开放平台TOP

Bill_chen

C++c物流C#

淘宝网开放平台首页:http://open.taobao.com/

淘宝开放平台是淘宝TOP团队的产品,TOP即TaoBao Open Platform,

是淘宝合作伙伴开发、发布、交易其服务的平台。

支撑TOP的三条主线为:

1.开放数据和业务流程

* 以API数据形式开放商品、交易、物流等业务;

&

- 【大型网站架构一】大型网站架构概述

bit1129

网站架构

大型互联网特点

面对海量用户、海量数据

大型互联网架构的关键指标

高并发

高性能

高可用

高可扩展性

线性伸缩性

安全性

大型互联网技术要点

前端优化

CDN缓存

反向代理

KV缓存

消息系统

分布式存储

NoSQL数据库

搜索

监控

安全

想到的问题:

1.对于订单系统这种事务型系统,如

- eclipse插件hibernate tools安装

白糖_

Hibernate

eclipse helios(3.6)版

1.启动eclipse 2.选择 Help > Install New Software...> 3.添加如下地址:

http://download.jboss.org/jbosstools/updates/stable/helios/ 4.选择性安装:hibernate tools在All Jboss tool

- Jquery easyui Form表单提交注意事项

bozch

jquery easyui

jquery easyui对表单的提交进行了封装,提交的方式采用的是ajax的方式,在开发的时候应该注意的事项如下:

1、在定义form标签的时候,要将method属性设置成post或者get,特别是进行大字段的文本信息提交的时候,要将method设置成post方式提交,否则页面会抛出跨域访问等异常。所以这个要

- Trie tree(字典树)的Java实现及其应用-统计以某字符串为前缀的单词的数量

bylijinnan

java实现

import java.util.LinkedList;

public class CaseInsensitiveTrie {

/**

字典树的Java实现。实现了插入、查询以及深度优先遍历。

Trie tree's java implementation.(Insert,Search,DFS)

Problem Description

Igna

- html css 鼠标形状样式汇总

chenbowen00

htmlcss

css鼠标手型cursor中hand与pointer

Example:CSS鼠标手型效果 <a href="#" style="cursor:hand">CSS鼠标手型效果</a><br/>

Example:CSS鼠标手型效果 <a href="#" style=&qu

- [IT与投资]IT投资的几个原则

comsci

it

无论是想在电商,软件,硬件还是互联网领域投资,都需要大量资金,虽然各个国家政府在媒体上都给予大家承诺,既要让市场的流动性宽松,又要保持经济的高速增长....但是,事实上,整个市场和社会对于真正的资金投入是非常渴望的,也就是说,表面上看起来,市场很活跃,但是投入的资金并不是很充足的......

- oracle with语句详解

daizj

oraclewithwith as

oracle with语句详解 转

在oracle中,select 查询语句,可以使用with,就是一个子查询,oracle 会把子查询的结果放到临时表中,可以反复使用

例子:注意,这是sql语句,不是pl/sql语句, 可以直接放到jdbc执行的

----------------------------------------------------------------

- hbase的简单操作

deng520159

数据库hbase

近期公司用hbase来存储日志,然后再来分析 ,把hbase开发经常要用的命令找了出来.

用ssh登陆安装hbase那台linux后

用hbase shell进行hbase命令控制台!

表的管理

1)查看有哪些表

hbase(main)> list

2)创建表

# 语法:create <table>, {NAME => <family&g

- C语言scanf继续学习、算术运算符学习和逻辑运算符

dcj3sjt126com

c

/*

2013年3月11日20:37:32

地点:北京潘家园

功能:完成用户格式化输入多个值

目的:学习scanf函数的使用

*/

# include <stdio.h>

int main(void)

{

int i, j, k;

printf("please input three number:\n"); //提示用

- 2015越来越好

dcj3sjt126com

歌曲

越来越好

房子大了电话小了 感觉越来越好

假期多了收入高了 工作越来越好

商品精了价格活了 心情越来越好

天更蓝了水更清了 环境越来越好

活得有奔头人会步步高

想做到你要努力去做到

幸福的笑容天天挂眉梢 越来越好

婆媳和了家庭暖了 生活越来越好

孩子高了懂事多了 学习越来越好

朋友多了心相通了 大家越来越好

道路宽了心气顺了 日子越来越好

活的有精神人就不显

- java.sql.SQLException: Value '0000-00-00' can not be represented as java.sql.Tim

feiteyizu

mysql

数据表中有记录的time字段(属性为timestamp)其值为:“0000-00-00 00:00:00”

程序使用select 语句从中取数据时出现以下异常:

java.sql.SQLException:Value '0000-00-00' can not be represented as java.sql.Date

java.sql.SQLException: Valu

- Ehcache(07)——Ehcache对并发的支持

234390216

并发ehcache锁ReadLockWriteLock

Ehcache对并发的支持

在高并发的情况下,使用Ehcache缓存时,由于并发的读与写,我们读的数据有可能是错误的,我们写的数据也有可能意外的被覆盖。所幸的是Ehcache为我们提供了针对于缓存元素Key的Read(读)、Write(写)锁。当一个线程获取了某一Key的Read锁之后,其它线程获取针对于同

- mysql中blob,text字段的合成索引

jackyrong

mysql

在mysql中,原来有一个叫合成索引的,可以提高blob,text字段的效率性能,

但只能用在精确查询,核心是增加一个列,然后可以用md5进行散列,用散列值查找

则速度快

比如:

create table abc(id varchar(10),context blog,hash_value varchar(40));

insert into abc(1,rep

- 逻辑运算与移位运算

latty

位运算逻辑运算

源码:正数的补码与原码相同例+7 源码:00000111 补码 :00000111 (用8位二进制表示一个数)

负数的补码:

符号位为1,其余位为该数绝对值的原码按位取反;然后整个数加1。 -7 源码: 10000111 ,其绝对值为00000111 取反加一:11111001 为-7补码

已知一个数的补码,求原码的操作分两种情况:

- 利用XSD 验证XML文件

newerdragon

javaxmlxsd

XSD文件 (XML Schema 语言也称作 XML Schema 定义(XML Schema Definition,XSD)。 具体使用方法和定义请参看:

http://www.w3school.com.cn/schema/index.asp

java自jdk1.5以上新增了SchemaFactory类 可以实现对XSD验证的支持,使用起来也很方便。

以下代码可用在J

- 搭建 CentOS 6 服务器(12) - Samba

rensanning

centos

(1)安装

# yum -y install samba

Installed:

samba.i686 0:3.6.9-169.el6_5

# pdbedit -a rensn

new password:123456

retype new password:123456

……

(2)Home文件夹

# mkdir /etc

- Learn Nodejs 01

toknowme

nodejs

(1)下载nodejs

https://nodejs.org/download/ 选择相应的版本进行下载 (2)安装nodejs 安装的方式比较多,请baidu下

我这边下载的是“node-v0.12.7-linux-x64.tar.gz”这个版本 (1)上传服务器 (2)解压 tar -zxvf node-v0.12.

- jquery控制自动刷新的代码举例

xp9802

jquery

1、html内容部分 复制代码代码示例: <div id='log_reload'>

<select name="id_s" size="1">

<option value='2'>-2s-</option>

<option value='3'>-3s-</option