金融风控建模实战——以某银行客户数据制作评分卡(A卡)

一、知识准备

1.1 熟悉Python的数据分析库numpy、pandas和scikit算法库

1. 2 熟悉逻辑回归和随机森林算法

二、项目主题

在银行借贷场景中,评分卡是一种以分数形式来衡量一个客户的信用风险大小的手段,它衡量向别人借钱的人(受信人,需要融资的公司)不能如期履行合同中的还本付息责任,并让借钱给别人的人(授信人,银行等金融机构), 造成经济损失的可能性。一般来说,评分卡打出的分数越高,客户的信用越好,风险越小。

这些”借钱的人“,可能是个人,有可能是有需求的公司和企业。对于企业来说,我们按照融资主体的融资用途,分

别使用企业融资模型,现金流融资模型,项目融资模型等模型。而对于个人来说,我们有”四张卡“来评判个人的信用程度:A卡,B卡,C卡和F卡。而众人常说的“评分卡”其实是指A卡,又称为申请者评级模型,主要应用于相关融资类业务中新用户的主体评级,即判断金融机构是否应该借钱给一个新用户,如果这个人的风险太高,我们可以拒 绝贷款。

三、项目目标

-

能够使用RF算法对缺失值进行补充

-

能够掌握样本不平衡问题

-

熟练掌握评分卡的分箱操作

四、知识要点

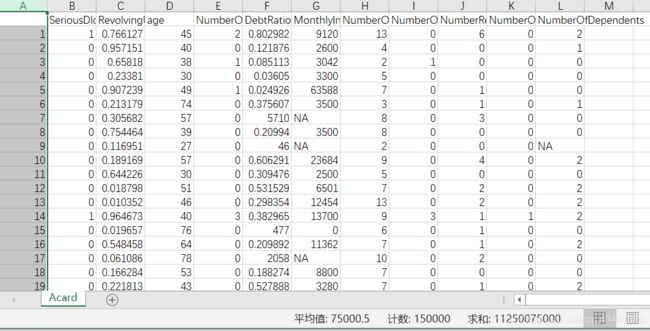

4.1 原始数据

4.1.1 导库/获取数据

%matplotlib inline

import numpy as np

import pandas as pd

data = pd.read_csv("Acard.csv",index_col=0)

#观察数据类型

data.head()

#观察数据结构

data.shape

data.info() # 每列的缺失值情况4.1.2 去重复值

data.drop_duplicates(inplace=True)

data.index = range(data.shape[0])

data.info()4.1.3 填补缺失值

data.isnull().sum()/data.shape[0] # data.isnull().mean()

data["NumberOfDependents"].fillna(int(data["NumberOfDependents"].mean()),inplace=True)

data.isnull().mean()

def fill_missing_rf(X, y, to_fill):

"""

X:要填补的特征矩阵

y:完整的,没有缺失值的标签

to_fill:字符串,要填补的那一列的名称/MonthlyIncome

"""

# 构建新特征矩阵和新标签

df = X.copy()

fill = df.loc[:, to_fill]

df = pd.concat([df.loc[:, df.columns != to_fill], pd.DataFrame(y)], axis=1)

#找出训练集和测试集

Ytrain = fill[fill.notnull()]

Ytest = fill[fill.isnull()]

Xtrain = df.iloc[Ytrain.index, :]

Xtest = df.iloc[Ytest.index, :]

from sklearn.ensemble import RandomForestRegressor as rfr

#用随机森林回归来填补缺失值

rfr = rfr(n_estimators=100)

rfr = rfr.fit(Xtrain, Ytrain)

Ypredict = rfr.predict(Xtest)

return Ypredict

X = data.iloc[:,1:]

y = data["SeriousDlqin2yrs"]

y_pred = fill_missing_rf(X,y,"MonthlyIncome")

#确认我们的结果合理之后,我们就可以将数据覆盖了

data.loc[data.loc[:,"MonthlyIncome"].isnull(),"MonthlyIncome"] = y_pred

y_pred.shape4.2 描述性统计

4.2.1 处理异常值

import seaborn as sns

from matplotlib import pyplot as plt

x1=data['age']

fig,axes = plt.subplots()

axes.boxplot(x1)

axes.set_xticklabels(['age'])

data = data[data['age']>0]

data = data[data['age']<100]

data.describe([0.01,0.1,0.25,.5,.75,.9,.99])

(data["age"] == 0).sum()

data = data[data["age"] != 0]

data[data.loc[:,"NumberOfTimes90DaysLate"] > 90].count()

data = data[data.loc[:,"NumberOfTimes90DaysLate"] < 90]

data.index = range(data.shape[0])

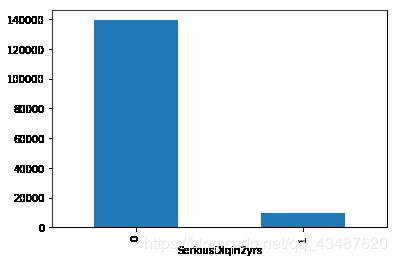

data.info() 4.2.2 处理样本不均衡问题

#探索标签的分布

X = data.iloc[:,1:]

y = data.iloc[:,0]

y.value_counts()

n_sample = X.shape[0]

n_1_sample = y.value_counts()[1]

n_0_sample = y.value_counts()[0]

grouped = data['SeriousDlqin2yrs'].groupby(data['SeriousDlqin2yrs']).count()

grouped.plot(kind='bar')

print('样本个数:{}; 1占{:.2%}; 0占 {:.2%}'.format(n_sample,n_1_sample/n_sample,n_0_sample/n_sample))

样本个数:149152; 1占6.62%; 0占 93.38%

from imblearn.over_sampling import SMOTE #conda install -c glemaitre imbalanced-learn

import imblearn

from imblearn.over_sampling import SMOTE

sm = SMOTE(random_state=42) #实例化

X,y = sm.fit_sample(X,y)

n_sample_ = X.shape[0]

pd.Series(y).value_counts()

n_1_sample = pd.Series(y).value_counts()[1]

n_0_sample = pd.Series(y).value_counts()[0]

print('样本个数:{}; 1占{:.2%}; 0占{:.2%}'.format(n_sample_,n_1_sample/n_sample_,n_0_sample/n_sample_))

样本个数:278560; 1占50.00%; 0占50.00%

4.2.3 训练集和测试集

from sklearn.model_selection import train_test_split

X = pd.DataFrame(X)

y = pd.DataFrame(y)

X_train, X_vali, Y_train, Y_vali = train_test_split(X,y,test_size=0.3,random_state=420)

model_data = pd.concat([Y_train, X_train], axis=1)

model_data.index = range(model_data.shape[0])

model_data.columns = data.columns

vali_data = pd.concat([Y_vali, X_vali], axis=1)

vali_data.index = range(vali_data.shape[0])

vali_data.columns = data.columns

model_data.to_csv("model_data.csv")

vali_data.to_csv("vali_data.csv")

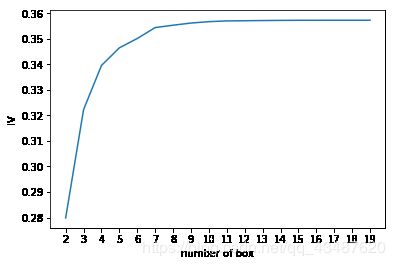

4.3 分箱处理

4.3.1 等频分箱

#retbins 默认为False,为True是返回值是元组

#q:分组个数

model_data["qcut"], updown = pd.qcut(model_data["age"], retbins=True, q=20)

coount_y0 = model_data[model_data["SeriousDlqin2yrs"] == 0].groupby(by="qcut").count() ["SeriousDlqin2yrs"]

coount_y1 = model_data[model_data["SeriousDlqin2yrs"] == 1].groupby(by="qcut").count() ["SeriousDlqin2yrs"]

#num_bins值分别为每个区间的上界,下界,0出现的次数,1出现的次数

num_bins = [*zip(updown,updown[1:],coount_y0,coount_y1)]

#注意zip会按照最短列来进行结合

num_bins4.3.2 封装WOE和IV函数

- 为了衡量特征上的信息量以及特征对预测函数的贡献,银行业定义了概念Information value(IV)

- IV = (good% - bad%) * WOE

- 银行业中用来衡量违约概率的指标,中文叫做证据权重(weight of Evidence),本质其实就是优质客户 比上坏客户的比例的对数。WOE是对一个箱子来说的,WOE越大,代表了这个箱子里的优质客户越多。

- WOE = ln(good% / bad%)

def get_woe(num_bins):

columns = ["min","max","count_0","count_1"]

df = pd.DataFrame(num_bins,columns=columns)

df["total"] = df.count_0 + df.count_1

df["percentage"] = df.total / df.total.sum()

df["bad_rate"] = df.count_1 / df.total

df["good%"] = df.count_0/df.count_0.sum()

df["bad%"] = df.count_1/df.count_1.sum()

df["woe"] = np.log(df["good%"] / df["bad%"])

return df

# 计算IV值

def get_iv(df):

rate = df["good%"] - df["bad%"]

iv = np.sum(rate * df.woe)

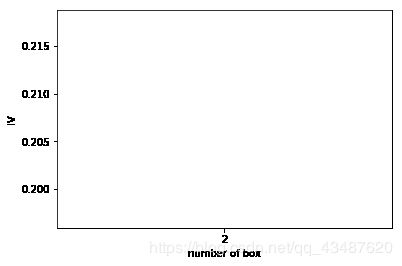

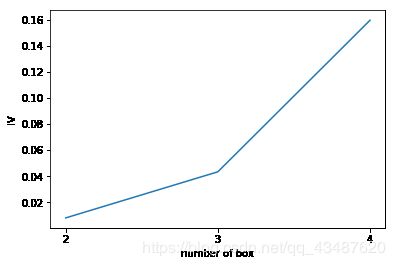

return iv 4.3.3 用卡方检验来合并箱体画出IV曲线

num_bins_ = num_bins.copy()

import matplotlib.pyplot as plt

import scipy

IV = []

axisx = []

while len(num_bins_) > 2:

pvs = []

for i in range(len(num_bins_) - 1):

x1 = num_bins_[i][2:]

x2 = num_bins_[i + 1][2:]

pv = scipy.stats.chi2_contingency([x1, x2])[1]

pvs.append(pv)

i = pvs.index(max(pvs))

num_bins_[i:i + 2] = [(num_bins_[i][0],num_bins_[i+1][1],num_bins_[i][2]+num_bins_[i+1][2],num_bins_[i][3]+num_bins_[i+1][3])]

bins_df = get_woe(num_bins_)

axisx.append(len(num_bins_))

IV.append(get_iv(bins_df))

plt.figure()

plt.plot(axisx, IV)

plt.xticks(axisx)

plt.xlabel("number of box")

plt.ylabel("IV")

plt.show()

def get_bin(num_bins_,n):

while len(num_bins_) > n:

pvs = []

# 获取 num_bins_两两之间的卡方检验的置信度(或卡方值)

for i in range(len(num_bins_) - 1):

x1 = num_bins_[i][2:]

x2 = num_bins_[i + 1][2:]

# 0 返回 chi2 值,1 返回 p 值。

pv = scipy.stats.chi2_contingency([x1, x2])[1]

# chi2 = scipy.stats.chi2_contingency([x1,x2])[0]

pvs.append(pv)

# 通过 p 值进行处理。合并 p 值最大的两组

i = pvs.index(max(pvs))

num_bins_[i:i + 2] = [(num_bins_[i][0],num_bins_[i+1][1],num_bins_[i][2]+num_bins_[i+1][2],num_bins_[i][3]+num_bins_[i+1][3])]

return num_bins_

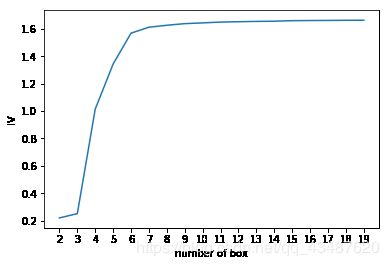

4.3.4 用最佳分箱个数分箱,并验证分箱结果

def graphforbestbin(DF, X, Y, n=5,q=20,graph=True):

DF = DF[[X,Y]].copy()

DF["qcut"],bins = pd.qcut(DF[X],retbins=True,q=q,duplicates="drop")

coount_y0 = DF.loc[DF[Y]==0].groupby(by="qcut").count()[Y]

coount_y1 = DF.loc[DF[Y]==1].groupby(by="qcut").count()[Y]

num_bins = [*zip(bins,bins[1:],coount_y0,coount_y1)]

# 确保每个箱中都有0和1

for i in range(q):

if 0 in num_bins[0][2:]:

num_bins[0:2] = [(num_bins[0][0],num_bins[1][1],num_bins[0][2]+num_bins[1][2],num_bins[0][3]+num_bins[1][3])]

continue

for i in range(len(num_bins)):

if 0 in num_bins[i][2:]:

num_bins[i-1:i+1] = [(num_bins[i-1][0],num_bins[i][1],num_bins[i-1][2]+num_bins[i][2],num_bins[i-1][3]+num_bins[i][3])]

break

else:

break

#计算WOE

def get_woe(num_bins):

columns = ["min","max","count_0","count_1"]

df = pd.DataFrame(num_bins,columns=columns)

df["total"] = df.count_0 + df.count_1

df["good%"] = df.count_0/df.count_0.sum()

df["bad%"] = df.count_1/df.count_1.sum()

df["woe"] = np.log(df["good%"] / df["bad%"])

return df

#计算IV值

def get_iv(df):

rate = df["good%"] - df["bad%"]

iv = np.sum(rate * df.woe)

return iv

# 卡方检验,合并分箱

IV = []

axisx = []

while len(num_bins) > n:

global bins_df

pvs = []

for i in range(len(num_bins)-1):

x1 = num_bins[i][2:]

x2 = num_bins[i+1][2:]

pv = scipy.stats.chi2_contingency([x1,x2])[1]

pvs.append(pv)

i = pvs.index(max(pvs))

num_bins[i:i+2] = [(num_bins[i][0],num_bins[i+1][1],num_bins[i][2]+num_bins[i+1][2],num_bins[i][3]+num_bins[i+1][3])]

bins_df = pd.DataFrame(get_woe(num_bins))

axisx.append(len(num_bins))

IV.append(get_iv(bins_df))

if graph:

plt.figure()

plt.plot(axisx,IV)

plt.xticks(axisx)

plt.xlabel("number of box")

plt.ylabel("IV")

plt.show()

return bins_df

for i in model_data.columns[1:-1]:

print(i)

graphforbestbin(model_data,i ,"SeriousDlqin2yrs",n=2,q = 20)

.

.

.

# 根据图像观察手动把特征进行最佳分箱操作

# 特征名称:分箱的个数/箱子的转折点

auto_bins = {'RevolvingUtilizationOfUnsecuredLines':5

,'age':6

,'DebtRatio':4

,'MonthlyIncome':3

,'NumberOfOpenCreditLinesAndLoans':7

}

# 手动处理对于不能分箱的特征

hand_bins = {'NumberOfTime30-59DaysPastDueNotWorse':[0,1,2,13]

,'NumberOfTimes90DaysLate':[0,1,2,17]

,'NumberRealEstateLoansOrLines':[0,1,2,4,54]

,'NumberOfTime60-89DaysPastDueNotWorse':[0,1,2,8]

,'NumberOfDependents':[0,1,2,3]

}

#用np.-inf , np.inf

hand_bins = {k:[-np.inf,*v[:-1],np.inf] for k,v in hand_bins.items()}

bins_of_col = {}

for col in auto_bins:

bins_df = graphforbestbin(model_data,col,'SeriousDlqin2yrs',n = auto_bins[col],q=20,graph=False)

bins_list = sorted(set(bins_df['min']).union(bins_df['max']))

bins_list[0],bins_list[-1] = -np.inf,np.inf

bins_of_col[col] = bins_list

bins_of_col.update(hand_bins)

bins_of_col

4.4 计算各箱的WOE并映射到数据

data = model_data.copy()

data = data[["age","SeriousDlqin2yrs"]].copy()

data["cut"] = pd.cut(data["age"],[-np.inf, 36.0, 52.0, 56.0, 61.0, 74.0, np.inf])

# 不同的年龄段/箱子对于的年龄和标签

data.groupby("cut")["SeriousDlqin2yrs"].value_counts()

#使用unstack()来将分支状结构变成表状结构

data.groupby("cut")["SeriousDlqin2yrs"].value_counts().unstack()

bins_df = data.groupby("cut")["SeriousDlqin2yrs"].value_counts().unstack()

bins_df["woe"] = np.log((bins_df[0]/bins_df[0].sum())/(bins_df[1]/bins_df[1].sum()))

对所有的特征进行计算箱子的WOE

# df:数据表

# col:列

# bins:箱子的个数

def get_woe(df,col,y,bins):

df = df[[col,y]].copy()

df["cut"] = pd.cut(df[col],bins)

bins_df = df.groupby("cut")[y].value_counts().unstack()

woe = bins_df["woe"] = np.log((bins_df[0]/bins_df[0].sum())/(bins_df[1]/bins_df[1].sum()))

iv = np.sum((bins_df[0]/bins_df[0].sum()-bins_df[1]/bins_df[1].sum())*bins_df['woe'])

return woe

# 所有的WOE

woeall = {}

for col in bins_of_col:

woeall[col] = get_woe(model_data,col,"SeriousDlqin2yrs",bins_of_col[col])

woeall

model_woe = pd.DataFrame(index=model_data.index)

for col in bins_of_col:

model_woe[col] = pd.cut(model_data[col],bins_of_col[col]).map(woeall[col])

model_woe["SeriousDlqin2yrs"] = model_data["SeriousDlqin2yrs"]

model_woe #这就是建模数据

4.5 建模与模型验证

woeall_vali = {}

for col in bins_of_col:

woeall_vali[col] = get_woe(vali_data,col,"SeriousDlqin2yrs",bins_of_col[col])

# 测试数据

vali_woe = pd.DataFrame(index=vali_data.index)

for col in bins_of_col:

vali_woe[col] = pd.cut(vali_data[col],bins_of_col[col]).map(woeall_vali[col])

vali_woe["SeriousDlqin2yrs"] = vali_data["SeriousDlqin2yrs"]

vali_x = vali_woe.iloc[:,:-1]

vali_y = vali_woe.iloc[:,-1]

from sklearn.linear_model import LogisticRegression as LR

# 训练集

x = model_woe.iloc[:,:-1]

y = model_woe.iloc[:,-1]

lr = LR().fit(x,y)

lr.score(vali_x,vali_y)

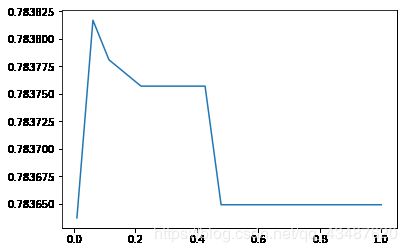

- C是正则化强度的倒数,C越小,损失函数就越小,模型对损失函数的惩罚越重

- solver:默认是liblinear,针对小数据量是个不错的选择,用于求解使模型最优化参数的算法,即最优化问题的算法

- max_iter:所有分类的实际迭代次数,对于liblinear求解器,会给出最大的迭代次数

c_1 = np.linspace(0.01,1,20)

c_2 = np.linspace(0.01,0.2,20)

score = []

for i in c_1:

lr = LR(solver="liblinear",C = i).fit(x,y)

score.append(lr.score(vali_x,vali_y))

plt.figure()

plt.plot(c_1,score)

plt.show()import warnings

warnings.filterwarnings('ignore')

score = []

for i in [1,2,3,4,5,6]:

lr = LR(solver="liblinear" ,C = 0.025 , max_iter=i).fit(x,y)

score.append(lr.score(vali_x , vali_y))

plt.figure()

plt.plot([1,2,3,4,5,6],score)

plt.show()

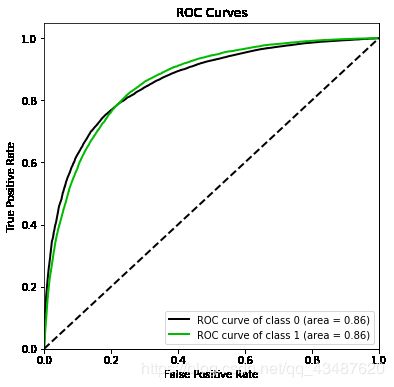

import scikitplot as skplt #pip install scikit-plot

vali_proba_df = pd.DataFrame(lr.predict_proba(vali_x))

skplt.metrics.plot_roc(vali_y, vali_proba_df, plot_micro=False,figsize=(6,6),plot_macro=False) 4.6 制作评分卡

- 评分卡中的分数,由以下公式计算:Score = A - B *log(odds)

- A与B是常数,A叫做“补偿”,B叫做“刻度

- log(odds)代表了一个人违约的可能性,逻辑回归的结果取对数几率形式会得到θX,即参数*特征矩阵,所以log(odds)其实就是参数。两个常数可以通过两个假设的分值带入公式求出,这两个假设分别是:

- 某个特定的违约概率下的预期分值

- 指定的违约概率翻倍的分数(PDO)

- 例如,假设对数几率为1/60时,设定的特定分数为600,PDO=20,那么对数几率为1/30时的分数就是620。带入以上线性表达式,可以得到:

- 600 = A - B*log(1/60)

- 620 = A - B*log(1/30)

B = 20/np.log(2)

A = 600 + B*np.log(1/60)

base_score = A - B*lr.intercept_

base_score

lr.coef_[0][1]*B # log(odds)

score_age = woeall["age"] * (-B*lr.coef_[0][0])

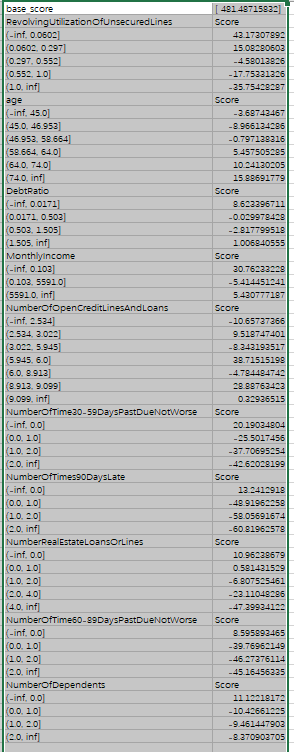

file = "ScoreData.csv"

with open(file,"w") as fdata:

fdata.write("base_score,{}\n".format(base_score))

for i,col in enumerate(x.columns):

score = woeall[col] * (-B*lr.coef_[0][i])

score.name = "Score"

score.index.name = col

score.to_csv(file,header=True,mode="a")最终打分结果 :