逻辑回归制作评分卡

-

- 3.0 前言

-

- 逻辑回归与线性回归的关系

- 消除特征间的多重共线性

- 为什么使用逻辑回归处理金融领域数据

- 正则化的选择

- 特征选择的方法

- 分箱的作用

- 3.1导库

- 3.2数据预处理

-

- 3.2.1 去重复值

- 3.2.2 填补缺失值

- 3.2.3描述性统计处理异常值

- 3.2.4 以业务为中心,保持数据原貌,不统一量纲,与标准化数据分布

- 3.2.5 样本不均衡问题

- 3.2.6 分训练集和测试集

- 3.3 分箱

-

- 3.3.1 等频分箱

- 3.3.2 确保每个箱中都有0和1,这里没做

- 3.3.3 定义WOE和IV函数

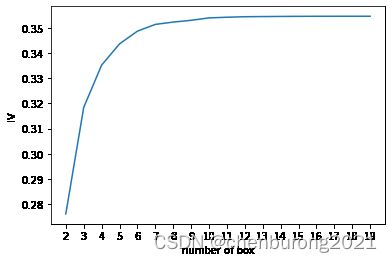

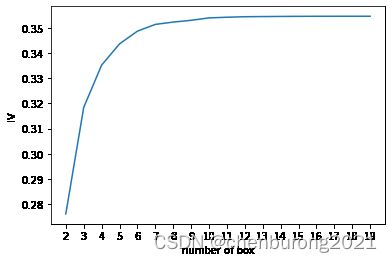

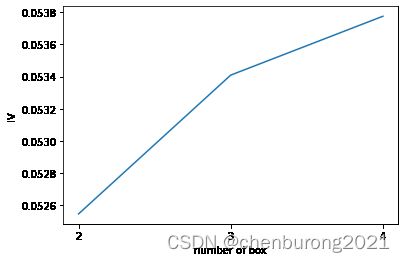

- 3.3.4 卡方检验,合并箱体,画出IV曲线

- 3.3.5 用最佳分箱个数分箱,并验证分箱结果

- 3.3.6 将选取最佳分箱个数的过程包装为函数

- 3.3.7 对所有特征进行分箱选择

- 3.4 计算各箱的WOE并映射到数据中

- 3.5建模与模型验证

- 3.6 制作评分卡

3.0 前言

逻辑回归与线性回归的关系

逻辑回归是用来处理连续型标签的算法

| 算法 |

线性回归 |

逻辑回归 |

| 输出 |

连续型 (可找到x与y的线性关系) |

连续型(可对应二分类) |

| 算法类型 |

回归算法 |

广义回归算法(可处理回归问题) |

逻辑回归使用了sigmoid函数,把线性回归方程z =>g(z),令其值在0-1,接近0为0,接近1为1,以此实现分类

| 函数 |

sigmoid |

MinMaxSclaer |

| 数据压缩范围 |

(0,1) |

[0,1] |

ln( g(z) / (1- g(z) ) )=z(线性回归方程)

消除特征间的多重共线性

线性回归对数据要求满足正态分布,需要消除特征间的多重共线性;

可使用方差过滤,方差膨胀因子VIF

为什么使用逻辑回归处理金融领域数据

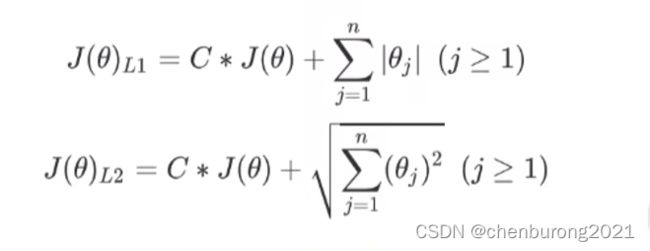

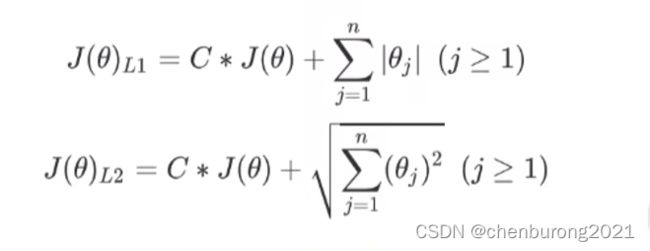

正则化的选择

:处理过拟合

| L1范数 |

L2范数 |

| 参数绝对值之和 |

每个参数的平方和开方 |

C:平衡损失函数与正则项

| L1正则化 |

L2正则化 |

| 部分参数为0,稀疏性 |

部分参数接近0 |

特征选择的方法

除了PCA,SVD此类会消除标签与特征之间的关系的算法

可以用Embedded嵌入法,方差,卡方,互信息法,包装法等

互信息法:是用来捕捉特征和标签之间的任意关系(包括线性和非线性关系)的过滤方法 ,和F检验相似

分箱的作用

特征离散化以后,简化了逻辑回归模型,降低了模型过拟合的风险。

离散特征数目易于更改,益于模型迭代;

离散特征数目少,运算速度快;

特征离散化后,模型会更稳定,组内差距减小,组间差距扩大,边缘数据仍不稳定

3.1导库

%matplotlib inline

import numpy as np

import pandas as pd

from sklearn.linear_model import LogisticRegression as LR

data = pd.read_csv(r"D:\class_file\day08_05\rankingcard.csv",index_col=0)

3.2数据预处理

data.head()

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

| 1 |

1 |

0.766127 |

45 |

2 |

0.802982 |

9120.0 |

13 |

0 |

6 |

0 |

2.0 |

| 2 |

0 |

0.957151 |

40 |

0 |

0.121876 |

2600.0 |

4 |

0 |

0 |

0 |

1.0 |

| 3 |

0 |

0.658180 |

38 |

1 |

0.085113 |

3042.0 |

2 |

1 |

0 |

0 |

0.0 |

| 4 |

0 |

0.233810 |

30 |

0 |

0.036050 |

3300.0 |

5 |

0 |

0 |

0 |

0.0 |

| 5 |

0 |

0.907239 |

49 |

1 |

0.024926 |

63588.0 |

7 |

0 |

1 |

0 |

0.0 |

data.info()

Int64Index: 150000 entries, 1 to 150000

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 SeriousDlqin2yrs 150000 non-null int64

1 RevolvingUtilizationOfUnsecuredLines 150000 non-null float64

2 age 150000 non-null int64

3 NumberOfTime30-59DaysPastDueNotWorse 150000 non-null int64

4 DebtRatio 150000 non-null float64

5 MonthlyIncome 120269 non-null float64

6 NumberOfOpenCreditLinesAndLoans 150000 non-null int64

7 NumberOfTimes90DaysLate 150000 non-null int64

8 NumberRealEstateLoansOrLines 150000 non-null int64

9 NumberOfTime60-89DaysPastDueNotWorse 150000 non-null int64

10 NumberOfDependents 146076 non-null float64

dtypes: float64(4), int64(7)

memory usage: 13.7 MB

3.2.1 去重复值

data.drop_duplicates(inplace=True)

data.info()

Int64Index: 149391 entries, 1 to 150000

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 SeriousDlqin2yrs 149391 non-null int64

1 RevolvingUtilizationOfUnsecuredLines 149391 non-null float64

2 age 149391 non-null int64

3 NumberOfTime30-59DaysPastDueNotWorse 149391 non-null int64

4 DebtRatio 149391 non-null float64

5 MonthlyIncome 120170 non-null float64

6 NumberOfOpenCreditLinesAndLoans 149391 non-null int64

7 NumberOfTimes90DaysLate 149391 non-null int64

8 NumberRealEstateLoansOrLines 149391 non-null int64

9 NumberOfTime60-89DaysPastDueNotWorse 149391 non-null int64

10 NumberOfDependents 145563 non-null float64

dtypes: float64(4), int64(7)

memory usage: 13.7 MB

data.index = range(data.shape[0])

data.shape[0]

149391

3.2.2 填补缺失值

data.info()

RangeIndex: 149391 entries, 0 to 149390

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 SeriousDlqin2yrs 149391 non-null int64

1 RevolvingUtilizationOfUnsecuredLines 149391 non-null float64

2 age 149391 non-null int64

3 NumberOfTime30-59DaysPastDueNotWorse 149391 non-null int64

4 DebtRatio 149391 non-null float64

5 MonthlyIncome 120170 non-null float64

6 NumberOfOpenCreditLinesAndLoans 149391 non-null int64

7 NumberOfTimes90DaysLate 149391 non-null int64

8 NumberRealEstateLoansOrLines 149391 non-null int64

9 NumberOfTime60-89DaysPastDueNotWorse 149391 non-null int64

10 NumberOfDependents 145563 non-null float64

dtypes: float64(4), int64(7)

memory usage: 12.5 MB

data.isnull().sum()/data.shape[0]

SeriousDlqin2yrs 0.000000

RevolvingUtilizationOfUnsecuredLines 0.000000

age 0.000000

NumberOfTime30-59DaysPastDueNotWorse 0.000000

DebtRatio 0.000000

MonthlyIncome 0.195601

NumberOfOpenCreditLinesAndLoans 0.000000

NumberOfTimes90DaysLate 0.000000

NumberRealEstateLoansOrLines 0.000000

NumberOfTime60-89DaysPastDueNotWorse 0.000000

NumberOfDependents 0.025624

dtype: float64

data.isnull().mean()

SeriousDlqin2yrs 0.000000

RevolvingUtilizationOfUnsecuredLines 0.000000

age 0.000000

NumberOfTime30-59DaysPastDueNotWorse 0.000000

DebtRatio 0.000000

MonthlyIncome 0.195601

NumberOfOpenCreditLinesAndLoans 0.000000

NumberOfTimes90DaysLate 0.000000

NumberRealEstateLoansOrLines 0.000000

NumberOfTime60-89DaysPastDueNotWorse 0.000000

NumberOfDependents 0.025624

dtype: float64

data["NumberOfDependents"].fillna(int(data["NumberOfDependents"].mean()),inplace=True)

data.info()

RangeIndex: 149391 entries, 0 to 149390

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 SeriousDlqin2yrs 149391 non-null int64

1 RevolvingUtilizationOfUnsecuredLines 149391 non-null float64

2 age 149391 non-null int64

3 NumberOfTime30-59DaysPastDueNotWorse 149391 non-null int64

4 DebtRatio 149391 non-null float64

5 MonthlyIncome 120170 non-null float64

6 NumberOfOpenCreditLinesAndLoans 149391 non-null int64

7 NumberOfTimes90DaysLate 149391 non-null int64

8 NumberRealEstateLoansOrLines 149391 non-null int64

9 NumberOfTime60-89DaysPastDueNotWorse 149391 non-null int64

10 NumberOfDependents 149391 non-null float64

dtypes: float64(4), int64(7)

memory usage: 12.5 MB

data.isnull().sum()/data.shape[0]

SeriousDlqin2yrs 0.000000

RevolvingUtilizationOfUnsecuredLines 0.000000

age 0.000000

NumberOfTime30-59DaysPastDueNotWorse 0.000000

DebtRatio 0.000000

MonthlyIncome 0.195601

NumberOfOpenCreditLinesAndLoans 0.000000

NumberOfTimes90DaysLate 0.000000

NumberRealEstateLoansOrLines 0.000000

NumberOfTime60-89DaysPastDueNotWorse 0.000000

NumberOfDependents 0.000000

dtype: float64

def fill_missing_rf(X,y,to_fill):

"""

随机森林填补某一个缺失值的函数

参数:

X:要填补的特征矩阵

y:完整的,没有缺失值的标签

to_fill:字符串,要填补的那一列的名称

"""

df = X.copy()

fill = df.loc[:,to_fill]

df = pd.concat([df.loc[:,df.columns != to_fill],pd.DataFrame(y)],axis=1)

Ytrain = fill[fill.notnull()]

Ytest = fill[fill.isnull()]

Xtrain = df.iloc[Ytrain.index,:]

Xtest = df.iloc[Ytest.index,:]

from sklearn.ensemble import RandomForestRegressor as rfr

rfr = rfr(n_estimators=100)

rfr = rfr.fit(Xtrain, Ytrain)

Ypredict = rfr.predict(Xtest)

return Ypredict

data.head()

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

| 0 |

1 |

0.766127 |

45 |

2 |

0.802982 |

9120.0 |

13 |

0 |

6 |

0 |

2.0 |

| 1 |

0 |

0.957151 |

40 |

0 |

0.121876 |

2600.0 |

4 |

0 |

0 |

0 |

1.0 |

| 2 |

0 |

0.658180 |

38 |

1 |

0.085113 |

3042.0 |

2 |

1 |

0 |

0 |

0.0 |

| 3 |

0 |

0.233810 |

30 |

0 |

0.036050 |

3300.0 |

5 |

0 |

0 |

0 |

0.0 |

| 4 |

0 |

0.907239 |

49 |

1 |

0.024926 |

63588.0 |

7 |

0 |

1 |

0 |

0.0 |

X = data.iloc[:,1:]

y = data["SeriousDlqin2yrs"]

X.shape

(149391, 10)

y_pred = fill_missing_rf(X,y,"MonthlyIncome")

y_pred

array([0.15, 0.28, 0.12, ..., 0.24, 0.16, 0. ])

y_pred.shape

(29221,)

data.loc[:,"MonthlyIncome"].isnull()

0 False

1 False

2 False

3 False

4 False

...

149386 False

149387 False

149388 True

149389 False

149390 False

Name: MonthlyIncome, Length: 149391, dtype: bool

data.loc[data.loc[:,"MonthlyIncome"].isnull(),"MonthlyIncome"]

6 NaN

8 NaN

16 NaN

32 NaN

41 NaN

..

149368 NaN

149369 NaN

149376 NaN

149384 NaN

149388 NaN

Name: MonthlyIncome, Length: 29221, dtype: float64

data.loc[data.loc[:,"MonthlyIncome"].isnull(),"MonthlyIncome"] = y_pred

data.info()

RangeIndex: 149391 entries, 0 to 149390

Data columns (total 11 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 SeriousDlqin2yrs 149391 non-null int64

1 RevolvingUtilizationOfUnsecuredLines 149391 non-null float64

2 age 149391 non-null int64

3 NumberOfTime30-59DaysPastDueNotWorse 149391 non-null int64

4 DebtRatio 149391 non-null float64

5 MonthlyIncome 149391 non-null float64

6 NumberOfOpenCreditLinesAndLoans 149391 non-null int64

7 NumberOfTimes90DaysLate 149391 non-null int64

8 NumberRealEstateLoansOrLines 149391 non-null int64

9 NumberOfTime60-89DaysPastDueNotWorse 149391 non-null int64

10 NumberOfDependents 149391 non-null float64

dtypes: float64(4), int64(7)

memory usage: 12.5 MB

3.2.3描述性统计处理异常值

data.describe([0.01,0.1,0.25,.5,.75,.9,.99]).T

|

count |

mean |

std |

min |

1% |

10% |

25% |

50% |

75% |

90% |

99% |

max |

| SeriousDlqin2yrs |

149391.0 |

0.066999 |

0.250021 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

1.000000 |

1.0 |

| RevolvingUtilizationOfUnsecuredLines |

149391.0 |

6.071087 |

250.263672 |

0.0 |

0.0 |

0.003199 |

0.030132 |

0.154235 |

0.556494 |

0.978007 |

1.093922 |

50708.0 |

| age |

149391.0 |

52.306237 |

14.725962 |

0.0 |

24.0 |

33.000000 |

41.000000 |

52.000000 |

63.000000 |

72.000000 |

87.000000 |

109.0 |

| NumberOfTime30-59DaysPastDueNotWorse |

149391.0 |

0.393886 |

3.852953 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

1.000000 |

4.000000 |

98.0 |

| DebtRatio |

149391.0 |

354.436740 |

2041.843455 |

0.0 |

0.0 |

0.034991 |

0.177441 |

0.368234 |

0.875279 |

1275.000000 |

4985.100000 |

329664.0 |

| MonthlyIncome |

149391.0 |

5423.900169 |

13228.153266 |

0.0 |

0.0 |

0.170000 |

1800.000000 |

4424.000000 |

7416.000000 |

10800.000000 |

23200.000000 |

3008750.0 |

| NumberOfOpenCreditLinesAndLoans |

149391.0 |

8.480892 |

5.136515 |

0.0 |

0.0 |

3.000000 |

5.000000 |

8.000000 |

11.000000 |

15.000000 |

24.000000 |

58.0 |

| NumberOfTimes90DaysLate |

149391.0 |

0.238120 |

3.826165 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

3.000000 |

98.0 |

| NumberRealEstateLoansOrLines |

149391.0 |

1.022391 |

1.130196 |

0.0 |

0.0 |

0.000000 |

0.000000 |

1.000000 |

2.000000 |

2.000000 |

4.000000 |

54.0 |

| NumberOfTime60-89DaysPastDueNotWorse |

149391.0 |

0.212503 |

3.810523 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

2.000000 |

98.0 |

| NumberOfDependents |

149391.0 |

0.740393 |

1.108272 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

1.000000 |

2.000000 |

4.000000 |

20.0 |

data=data[data["age"]!=0]

data.shape

(149390, 11)

data[data.loc[:,"NumberOfTimes90DaysLate"] > 90]

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

| 1732 |

1 |

1.0 |

27 |

98 |

0.0 |

2700.000000 |

0 |

98 |

0 |

98 |

0.0 |

| 2285 |

0 |

1.0 |

22 |

98 |

0.0 |

1448.611748 |

0 |

98 |

0 |

98 |

0.0 |

| 3883 |

0 |

1.0 |

38 |

98 |

12.0 |

1977.580000 |

0 |

98 |

0 |

98 |

0.0 |

| 4416 |

0 |

1.0 |

21 |

98 |

0.0 |

0.000000 |

0 |

98 |

0 |

98 |

0.0 |

| 4704 |

0 |

1.0 |

21 |

98 |

0.0 |

2000.000000 |

0 |

98 |

0 |

98 |

0.0 |

| ... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

| 146667 |

1 |

1.0 |

25 |

98 |

0.0 |

2132.805238 |

0 |

98 |

0 |

98 |

0.0 |

| 147180 |

1 |

1.0 |

68 |

98 |

255.0 |

86.120000 |

0 |

98 |

0 |

98 |

0.0 |

| 148548 |

1 |

1.0 |

24 |

98 |

54.0 |

385.430000 |

0 |

98 |

0 |

98 |

0.0 |

| 148634 |

0 |

1.0 |

26 |

98 |

0.0 |

2000.000000 |

0 |

98 |

0 |

98 |

0.0 |

| 148833 |

1 |

1.0 |

34 |

98 |

9.0 |

1786.770000 |

0 |

98 |

0 |

98 |

0.0 |

225 rows × 11 columns

data=data[data.loc[:,"NumberOfTimes90DaysLate"] <90]

data.index=range(data.shape[0])

data.shape

(149165, 11)

data.describe([0.01,0.1,0.25,.5,.75,.9,.99]).T

|

count |

mean |

std |

min |

1% |

10% |

25% |

50% |

75% |

90% |

99% |

max |

| SeriousDlqin2yrs |

149165.0 |

0.066188 |

0.248612 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.00000 |

1.000000 |

1.0 |

| RevolvingUtilizationOfUnsecuredLines |

149165.0 |

6.078770 |

250.453111 |

0.0 |

0.0 |

0.003174 |

0.030033 |

0.153615 |

0.553698 |

0.97502 |

1.094061 |

50708.0 |

| age |

149165.0 |

52.331076 |

14.714114 |

21.0 |

24.0 |

33.000000 |

41.000000 |

52.000000 |

63.000000 |

72.00000 |

87.000000 |

109.0 |

| NumberOfTime30-59DaysPastDueNotWorse |

149165.0 |

0.246720 |

0.698935 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

1.00000 |

3.000000 |

13.0 |

| DebtRatio |

149165.0 |

354.963542 |

2043.344496 |

0.0 |

0.0 |

0.036385 |

0.178211 |

0.368619 |

0.876994 |

1277.30000 |

4989.360000 |

329664.0 |

| MonthlyIncome |

149165.0 |

5428.186556 |

13237.334090 |

0.0 |

0.0 |

0.170000 |

1800.000000 |

4436.000000 |

7417.000000 |

10800.00000 |

23218.000000 |

3008750.0 |

| NumberOfOpenCreditLinesAndLoans |

149165.0 |

8.493688 |

5.129841 |

0.0 |

1.0 |

3.000000 |

5.000000 |

8.000000 |

11.000000 |

15.00000 |

24.000000 |

58.0 |

| NumberOfTimes90DaysLate |

149165.0 |

0.090725 |

0.486354 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.00000 |

2.000000 |

17.0 |

| NumberRealEstateLoansOrLines |

149165.0 |

1.023927 |

1.130350 |

0.0 |

0.0 |

0.000000 |

0.000000 |

1.000000 |

2.000000 |

2.00000 |

4.000000 |

54.0 |

| NumberOfTime60-89DaysPastDueNotWorse |

149165.0 |

0.065069 |

0.330675 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.00000 |

2.000000 |

11.0 |

| NumberOfDependents |

149165.0 |

0.740911 |

1.108534 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

1.000000 |

2.00000 |

4.000000 |

20.0 |

3.2.4 以业务为中心,保持数据原貌,不统一量纲,与标准化数据分布

3.2.5 样本不均衡问题

在逻辑回归中使用上采样(增加少数类样本,来平衡标签)

X = data.iloc[:,1:]

y = data.iloc[:,0]

y

0 1

1 0

2 0

3 0

4 0

..

149160 0

149161 0

149162 0

149163 0

149164 0

Name: SeriousDlqin2yrs, Length: 149165, dtype: int64

y.value_counts()

0 139292

1 9873

Name: SeriousDlqin2yrs, dtype: int64

n_sample = X.shape[0]

n_1_sample = y.value_counts()[1]

n_0_sample = y.value_counts()[0]

print('样本个数:{}; 1占{:.2%}; 0占{:.2%}'.format(n_sample,n_1_sample/n_sample,n_0_sample/n_sample))

样本个数:149165; 1占6.62%; 0占93.38%

import imblearn

from imblearn.over_sampling import SMOTE

sm = SMOTE(random_state=42)

X,y = sm.fit_resample(X,y)

n_sample_ = X.shape[0]

y.value_counts()

1 139292

0 139292

Name: SeriousDlqin2yrs, dtype: int64

n_1_sample = y.value_counts()[1]

n_0_sample = y.value_counts()[0]

print('样本个数:{}; 1占{:.2%}; 0占{:.2%}'.format(n_sample_,n_1_sample/n_sample_,n_0_sample/n_sample_))

样本个数:278584; 1占50.00%; 0占50.00%

3.2.6 分训练集和测试集

from sklearn.model_selection import train_test_split

X = pd.DataFrame(X)

y = pd.DataFrame(y)

X_train, X_vali, Y_train, Y_vali = train_test_split(X,y,test_size=0.3,random_state=420)

model_data = pd.concat([Y_train, X_train], axis=1)

model_data

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

| 81602 |

0 |

0.015404 |

53 |

0 |

0.121802 |

4728.000000 |

5 |

0 |

0 |

0 |

0.000000 |

| 149043 |

0 |

0.168311 |

63 |

0 |

0.141964 |

1119.000000 |

5 |

0 |

0 |

0 |

0.000000 |

| 215073 |

1 |

1.063570 |

39 |

1 |

0.417663 |

3500.000000 |

5 |

1 |

0 |

2 |

3.716057 |

| 66278 |

0 |

0.088684 |

73 |

0 |

0.522822 |

5301.000000 |

11 |

0 |

2 |

0 |

0.000000 |

| 157084 |

1 |

0.622999 |

53 |

0 |

0.423650 |

13000.000000 |

9 |

0 |

2 |

0 |

0.181999 |

| ... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

| 178094 |

1 |

0.916269 |

32 |

2 |

0.548132 |

6000.000000 |

10 |

0 |

1 |

0 |

3.966830 |

| 62239 |

1 |

0.484728 |

50 |

1 |

0.370603 |

5258.000000 |

12 |

0 |

1 |

0 |

2.000000 |

| 152127 |

1 |

0.850447 |

46 |

0 |

0.562610 |

8000.000000 |

9 |

0 |

1 |

0 |

2.768793 |

| 119174 |

0 |

1.000000 |

64 |

0 |

0.364694 |

10309.000000 |

7 |

0 |

3 |

0 |

0.000000 |

| 193608 |

1 |

0.512881 |

53 |

0 |

1968.401488 |

0.172907 |

12 |

0 |

1 |

0 |

0.000000 |

195008 rows × 11 columns

data.columns

Index(['SeriousDlqin2yrs', 'RevolvingUtilizationOfUnsecuredLines', 'age',

'NumberOfTime30-59DaysPastDueNotWorse', 'DebtRatio', 'MonthlyIncome',

'NumberOfOpenCreditLinesAndLoans', 'NumberOfTimes90DaysLate',

'NumberRealEstateLoansOrLines', 'NumberOfTime60-89DaysPastDueNotWorse',

'NumberOfDependents'],

dtype='object')

model_data.index = range(model_data.shape[0])

model_data.columns = data.columns

model_data

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

| 0 |

0 |

0.015404 |

53 |

0 |

0.121802 |

4728.000000 |

5 |

0 |

0 |

0 |

0.000000 |

| 1 |

0 |

0.168311 |

63 |

0 |

0.141964 |

1119.000000 |

5 |

0 |

0 |

0 |

0.000000 |

| 2 |

1 |

1.063570 |

39 |

1 |

0.417663 |

3500.000000 |

5 |

1 |

0 |

2 |

3.716057 |

| 3 |

0 |

0.088684 |

73 |

0 |

0.522822 |

5301.000000 |

11 |

0 |

2 |

0 |

0.000000 |

| 4 |

1 |

0.622999 |

53 |

0 |

0.423650 |

13000.000000 |

9 |

0 |

2 |

0 |

0.181999 |

| ... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

... |

| 195003 |

1 |

0.916269 |

32 |

2 |

0.548132 |

6000.000000 |

10 |

0 |

1 |

0 |

3.966830 |

| 195004 |

1 |

0.484728 |

50 |

1 |

0.370603 |

5258.000000 |

12 |

0 |

1 |

0 |

2.000000 |

| 195005 |

1 |

0.850447 |

46 |

0 |

0.562610 |

8000.000000 |

9 |

0 |

1 |

0 |

2.768793 |

| 195006 |

0 |

1.000000 |

64 |

0 |

0.364694 |

10309.000000 |

7 |

0 |

3 |

0 |

0.000000 |

| 195007 |

1 |

0.512881 |

53 |

0 |

1968.401488 |

0.172907 |

12 |

0 |

1 |

0 |

0.000000 |

195008 rows × 11 columns

vali_data = pd.concat([Y_vali, X_vali], axis=1)

vali_data.index = range(vali_data.shape[0])

vali_data.columns = data.columns

model_data.to_csv(r"D:\class_file\day08_05\model_data.csv")

vali_data.to_csv(r"D:\class_file\day08_05\vali_data.csv")

3.3 分箱

3.3.1 等频分箱

model_data["age"]

0 53

1 63

2 39

3 73

4 53

..

195003 32

195004 50

195005 46

195006 64

195007 53

Name: age, Length: 195008, dtype: int64

model_data["qcut"],updown=pd.qcut(model_data["age"],retbins=True,q=20)

model_data["qcut"]

0 (52.0, 54.0]

1 (61.0, 64.0]

2 (36.0, 39.0]

3 (68.0, 74.0]

4 (52.0, 54.0]

...

195003 (31.0, 34.0]

195004 (48.0, 50.0]

195005 (45.0, 46.0]

195006 (61.0, 64.0]

195007 (52.0, 54.0]

Name: qcut, Length: 195008, dtype: category

Categories (20, interval[float64, right]): [(20.999, 28.0] < (28.0, 31.0] < (31.0, 34.0] < (34.0, 36.0] ... (61.0, 64.0] < (64.0, 68.0] < (68.0, 74.0] < (74.0, 107.0]]

updown.shape

(21,)

updown

array([ 21., 28., 31., 34., 36., 39., 41., 43., 45., 46., 48.,

50., 52., 54., 56., 58., 61., 64., 68., 74., 107.])

model_data.head()

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

qcut |

| 0 |

0 |

0.015404 |

53 |

0 |

0.121802 |

4728.0 |

5 |

0 |

0 |

0 |

0.000000 |

(52.0, 54.0] |

| 1 |

0 |

0.168311 |

63 |

0 |

0.141964 |

1119.0 |

5 |

0 |

0 |

0 |

0.000000 |

(61.0, 64.0] |

| 2 |

1 |

1.063570 |

39 |

1 |

0.417663 |

3500.0 |

5 |

1 |

0 |

2 |

3.716057 |

(36.0, 39.0] |

| 3 |

0 |

0.088684 |

73 |

0 |

0.522822 |

5301.0 |

11 |

0 |

2 |

0 |

0.000000 |

(68.0, 74.0] |

| 4 |

1 |

0.622999 |

53 |

0 |

0.423650 |

13000.0 |

9 |

0 |

2 |

0 |

0.181999 |

(52.0, 54.0] |

model_data["qcut"].value_counts()

(36.0, 39.0] 12647

(20.999, 28.0] 11786

(58.0, 61.0] 11386

(48.0, 50.0] 11104

(46.0, 48.0] 10968

(31.0, 34.0] 10867

(50.0, 52.0] 10529

(43.0, 45.0] 10379

(61.0, 64.0] 10197

(39.0, 41.0] 9768

(52.0, 54.0] 9726

(41.0, 43.0] 9682

(28.0, 31.0] 9498

(74.0, 107.0] 9110

(64.0, 68.0] 8917

(54.0, 56.0] 8713

(68.0, 74.0] 8655

(56.0, 58.0] 7887

(34.0, 36.0] 7521

(45.0, 46.0] 5668

Name: qcut, dtype: int64

count_y0=model_data[model_data["SeriousDlqin2yrs"]==0].groupby(by="qcut").count()["SeriousDlqin2yrs"]

count_y0

qcut

(20.999, 28.0] 4243

(28.0, 31.0] 3571

(31.0, 34.0] 4075

(34.0, 36.0] 2908

(36.0, 39.0] 5182

(39.0, 41.0] 3956

(41.0, 43.0] 4002

(43.0, 45.0] 4389

(45.0, 46.0] 2419

(46.0, 48.0] 4813

(48.0, 50.0] 4900

(50.0, 52.0] 4728

(52.0, 54.0] 4681

(54.0, 56.0] 4677

(56.0, 58.0] 4483

(58.0, 61.0] 6583

(61.0, 64.0] 6968

(64.0, 68.0] 6623

(68.0, 74.0] 6753

(74.0, 107.0] 7737

Name: SeriousDlqin2yrs, dtype: int64

count_y1=model_data[model_data["SeriousDlqin2yrs"]==1].groupby(by="qcut").count()["SeriousDlqin2yrs"]

num_bins=[*zip(updown,updown[1:],count_y0,count_y1)]

num_bins

[(21.0, 28.0, 4243, 7543),

(28.0, 31.0, 3571, 5927),

(31.0, 34.0, 4075, 6792),

(34.0, 36.0, 2908, 4613),

(36.0, 39.0, 5182, 7465),

(39.0, 41.0, 3956, 5812),

(41.0, 43.0, 4002, 5680),

(43.0, 45.0, 4389, 5990),

(45.0, 46.0, 2419, 3249),

(46.0, 48.0, 4813, 6155),

(48.0, 50.0, 4900, 6204),

(50.0, 52.0, 4728, 5801),

(52.0, 54.0, 4681, 5045),

(54.0, 56.0, 4677, 4036),

(56.0, 58.0, 4483, 3404),

(58.0, 61.0, 6583, 4803),

(61.0, 64.0, 6968, 3229),

(64.0, 68.0, 6623, 2294),

(68.0, 74.0, 6753, 1902),

(74.0, 107.0, 7737, 1373)]

3.3.2 确保每个箱中都有0和1,这里没做

3.3.3 定义WOE和IV函数

def get_woe(num_bins):

columns = ["min","max","count_0","count_1"]

df = pd.DataFrame(num_bins,columns=columns)

df.head()

df["total"] = df.count_0 + df.count_1

df["percentage"] = df.total / df.total.sum()

df["bad_rate"] = df.count_1 / df.total

df["good%"] = df.count_0/df.count_0.sum()

df["bad%"] = df.count_1/df.count_1.sum()

df["woe"] = np.log(df["good%"] / df["bad%"])

return df

def get_iv(df):

rate = df["good%"] - df["bad%"]

iv = np.sum(rate * df.woe)

return iv

3.3.4 卡方检验,合并箱体,画出IV曲线

num_bins_=num_bins.copy()

import matplotlib.pyplot as plt

import scipy

x1=num_bins_[0][2:]

x1

(4243, 7543)

x2=num_bins_[1][2:]

x2

(3571, 5927)

scipy.stats.chi2_contingency([x1,x2])[0]

5.705081033738888

len(num_bins_)

20

pvs=[]

for i in range(len(num_bins_)-1):

x1=num_bins_[i][2:]

x2=num_bins_[i+1][2:]

pv=scipy.stats.chi2_contingency([x1,x2])[1]

pvs.append(pv)

len(pvs)

19

pvs.index(max(pvs))

1

num_bins_

[(21.0, 28.0, 4243, 7543),

(28.0, 31.0, 3571, 5927),

(31.0, 34.0, 4075, 6792),

(34.0, 36.0, 2908, 4613),

(36.0, 39.0, 5182, 7465),

(39.0, 41.0, 3956, 5812),

(41.0, 43.0, 4002, 5680),

(43.0, 45.0, 4389, 5990),

(45.0, 46.0, 2419, 3249),

(46.0, 48.0, 4813, 6155),

(48.0, 50.0, 4900, 6204),

(50.0, 52.0, 4728, 5801),

(52.0, 54.0, 4681, 5045),

(54.0, 56.0, 4677, 4036),

(56.0, 58.0, 4483, 3404),

(58.0, 61.0, 6583, 4803),

(61.0, 64.0, 6968, 3229),

(64.0, 68.0, 6623, 2294),

(68.0, 74.0, 6753, 1902),

(74.0, 107.0, 7737, 1373)]

num_bins_[7:9] = [(

num_bins_[7][0],

num_bins_[7+1][1],

num_bins_[7][2]+num_bins_[7+1][2],

num_bins_[7][3]+num_bins_[7+1][3])]

num_bins_

[(21.0, 28.0, 4243, 7543),

(28.0, 31.0, 3571, 5927),

(31.0, 34.0, 4075, 6792),

(34.0, 36.0, 2908, 4613),

(36.0, 39.0, 5182, 7465),

(39.0, 41.0, 3956, 5812),

(41.0, 43.0, 4002, 5680),

(43.0, 46.0, 6808, 9239),

(46.0, 48.0, 4813, 6155),

(48.0, 50.0, 4900, 6204),

(50.0, 52.0, 4728, 5801),

(52.0, 54.0, 4681, 5045),

(54.0, 56.0, 4677, 4036),

(56.0, 58.0, 4483, 3404),

(58.0, 61.0, 6583, 4803),

(61.0, 64.0, 6968, 3229),

(64.0, 68.0, 6623, 2294),

(68.0, 74.0, 6753, 1902),

(74.0, 107.0, 7737, 1373)]

len(num_bins_)

19

num_bins_ = num_bins.copy()

import matplotlib.pyplot as plt

import scipy

IV=[]

axisx=[]

while len(num_bins_)>2:

pvs=[]

for i in range(len(num_bins_)-1):

x1 = num_bins_[i][2:]

x2=num_bins_[i+1][2:]

pv=scipy.stats.chi2_contingency([x1,x2])[1]

pvs.append(pv)

i=pvs.index(max(pvs))

num_bins_[i:i+2]=[(

num_bins_[i][0],

num_bins_[i+1][1],

num_bins_[i][2]+num_bins_[i+1][2],

num_bins_[i][3]+num_bins_[i+1][3])]

bins_df=get_woe(num_bins_)

axisx.append(len(num_bins_))

IV.append(get_iv(bins_df))

plt.figure()

plt.plot(axisx,IV)

plt.xticks(axisx)

plt.xlabel("number of box")

plt.ylabel("IV")

plt.show()

3.3.5 用最佳分箱个数分箱,并验证分箱结果

def get_bin(num_bins_,n):

while len(num_bins_)>n:

pvs=[]

for i in range(len(num_bins_)-1):

x1 = num_bins_[i][2:]

x2=num_bins_[i+1][2:]

pv=scipy.stats.chi2_contingency([x1,x2])[1]

pvs.append(pv)

i=pvs.index(max(pvs))

num_bins_[i:i+2]=[(

num_bins_[i][0],

num_bins_[i+1][1],

num_bins_[i][2]+num_bins_[i+1][2],

num_bins_[i][3]+num_bins_[i+1][3])]

return num_bins_

num_bins_ = num_bins.copy()

afterbins=get_bin(num_bins_,7)

afterbins

[(21.0, 36.0, 14797, 24875),

(36.0, 46.0, 19948, 28196),

(46.0, 54.0, 19122, 23205),

(54.0, 61.0, 15743, 12243),

(61.0, 64.0, 6968, 3229),

(64.0, 74.0, 13376, 4196),

(74.0, 107.0, 7737, 1373)]

bins_df=get_woe(afterbins)

bins_df

|

min |

max |

count_0 |

count_1 |

total |

percentage |

bad_rate |

good% |

bad% |

woe |

| 0 |

21.0 |

36.0 |

14797 |

24875 |

39672 |

0.203438 |

0.627017 |

0.151467 |

0.255608 |

-0.523275 |

| 1 |

36.0 |

46.0 |

19948 |

28196 |

48144 |

0.246882 |

0.585660 |

0.204195 |

0.289734 |

-0.349887 |

| 2 |

46.0 |

54.0 |

19122 |

23205 |

42327 |

0.217053 |

0.548232 |

0.195740 |

0.238448 |

-0.197364 |

| 3 |

54.0 |

61.0 |

15743 |

12243 |

27986 |

0.143512 |

0.437469 |

0.161151 |

0.125805 |

0.247606 |

| 4 |

61.0 |

64.0 |

6968 |

3229 |

10197 |

0.052290 |

0.316662 |

0.071327 |

0.033180 |

0.765320 |

| 5 |

64.0 |

74.0 |

13376 |

4196 |

17572 |

0.090109 |

0.238789 |

0.136922 |

0.043117 |

1.155495 |

| 6 |

74.0 |

107.0 |

7737 |

1373 |

9110 |

0.046716 |

0.150714 |

0.079199 |

0.014109 |

1.725180 |

3.3.6 将选取最佳分箱个数的过程包装为函数

def graphforbestbin(DF, X, Y, n=5,q=20,graph=True):

"""

自动最优分箱函数,基于卡方检验的分箱

参数:

DF: 需要输入的数据

X: 需要分箱的列名

Y: 分箱数据对应的标签 Y 列名

n: 保留分箱个数

q: 初始分箱的个数

graph: 是否要画出IV图像

区间为前开后闭 (]

"""

bins_df=[]

DF = DF[[X,Y]].copy()

DF["qcut"],bins = pd.qcut(DF[X], retbins=True, q=q,duplicates="drop")

coount_y0 = DF.loc[DF[Y]==0].groupby(by="qcut").count()[Y]

coount_y1 = DF.loc[DF[Y]==1].groupby(by="qcut").count()[Y]

num_bins = [*zip(bins,bins[1:],coount_y0,coount_y1)]

for i in range(q):

if 0 in num_bins[0][2:]:

num_bins[0:2] = [(

num_bins[0][0],

num_bins[1][1],

num_bins[0][2]+num_bins[1][2],

num_bins[0][3]+num_bins[1][3])]

continue

for i in range(len(num_bins)):

if 0 in num_bins[i][2:]:

num_bins[i-1:i+1] = [(

num_bins[i-1][0],

num_bins[i][1],

num_bins[i-1][2]+num_bins[i][2],

num_bins[i-1][3]+num_bins[i][3])]

break

else:

break

def get_woe(num_bins):

columns = ["min","max","count_0","count_1"]

df = pd.DataFrame(num_bins,columns=columns)

df["total"] = df.count_0 + df.count_1

df["percentage"] = df.total / df.total.sum()

df["bad_rate"] = df.count_1 / df.total

df["good%"] = df.count_0/df.count_0.sum()

df["bad%"] = df.count_1/df.count_1.sum()

df["woe"] = np.log(df["good%"] / df["bad%"])

return df

def get_iv(df):

rate = df["good%"] - df["bad%"]

iv = np.sum(rate * df.woe)

return iv

IV = []

axisx = []

while len(num_bins) > n:

pvs = []

for i in range(len(num_bins)-1):

x1 = num_bins[i][2:]

x2 = num_bins[i+1][2:]

pv = scipy.stats.chi2_contingency([x1,x2])[1]

pvs.append(pv)

i = pvs.index(max(pvs))

num_bins[i:i+2] = [(

num_bins[i][0],

num_bins[i+1][1],

num_bins[i][2]+num_bins[i+1][2],

num_bins[i][3]+num_bins[i+1][3])]

bins_df = pd.DataFrame(get_woe(num_bins))

axisx.append(len(num_bins))

IV.append(get_iv(bins_df))

if graph:

plt.figure()

plt.plot(axisx,IV)

plt.xticks(axisx)

plt.xlabel("number of box")

plt.ylabel("IV")

plt.show()

return bins_df

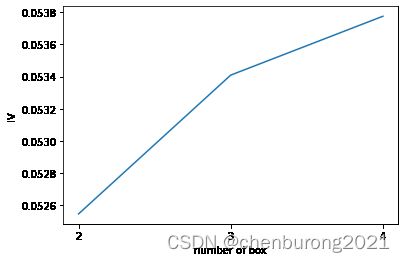

3.3.7 对所有特征进行分箱选择

model_data.columns

Index(['SeriousDlqin2yrs', 'RevolvingUtilizationOfUnsecuredLines', 'age',

'NumberOfTime30-59DaysPastDueNotWorse', 'DebtRatio', 'MonthlyIncome',

'NumberOfOpenCreditLinesAndLoans', 'NumberOfTimes90DaysLate',

'NumberRealEstateLoansOrLines', 'NumberOfTime60-89DaysPastDueNotWorse',

'NumberOfDependents', 'qcut'],

dtype='object')

for i in model_data.columns[1:-1]:

print(i)

graphforbestbin(model_data,i,"SeriousDlqin2yrs",n=2,q=20)

RevolvingUtilizationOfUnsecuredLines

age

NumberOfTime30-59DaysPastDueNotWorse

DebtRatio

MonthlyIncome

NumberOfOpenCreditLinesAndLoans

NumberOfTimes90DaysLate

NumberRealEstateLoansOrLines

NumberOfTime60-89DaysPastDueNotWorse

NumberOfDependents

model_data.describe([0.01,0.1,0.25,.5,.75,.9,.99]).T

|

count |

mean |

std |

min |

1% |

10% |

25% |

50% |

75% |

90% |

99% |

max |

| SeriousDlqin2yrs |

195008.0 |

0.499041 |

0.500000 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

1.000000 |

1.00000 |

1.000000 |

1.0 |

| RevolvingUtilizationOfUnsecuredLines |

195008.0 |

4.716073 |

151.934558 |

0.0 |

0.0 |

0.015492 |

0.099128 |

0.465003 |

0.874343 |

1.00000 |

1.353400 |

18300.0 |

| age |

195008.0 |

49.054131 |

13.916980 |

21.0 |

24.0 |

31.000000 |

39.000000 |

48.000000 |

58.000000 |

68.00000 |

84.000000 |

107.0 |

| NumberOfTime30-59DaysPastDueNotWorse |

195008.0 |

0.422429 |

0.869693 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

1.000000 |

1.00000 |

4.000000 |

13.0 |

| DebtRatio |

195008.0 |

332.471143 |

1845.205520 |

0.0 |

0.0 |

0.076050 |

0.208088 |

0.401763 |

0.848021 |

994.00000 |

5147.758259 |

329664.0 |

| MonthlyIncome |

195008.0 |

5151.967974 |

11369.838287 |

0.0 |

0.0 |

0.280000 |

2000.000000 |

4167.000000 |

6900.000000 |

10240.00000 |

22000.000000 |

3008750.0 |

| NumberOfOpenCreditLinesAndLoans |

195008.0 |

7.989144 |

5.015858 |

0.0 |

0.0 |

2.000000 |

4.000000 |

7.000000 |

11.000000 |

15.00000 |

23.000000 |

57.0 |

| NumberOfTimes90DaysLate |

195008.0 |

0.224883 |

0.718839 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

1.00000 |

3.000000 |

17.0 |

| NumberRealEstateLoansOrLines |

195008.0 |

0.878108 |

1.124510 |

0.0 |

0.0 |

0.000000 |

0.000000 |

1.000000 |

1.000000 |

2.00000 |

5.000000 |

32.0 |

| NumberOfTime60-89DaysPastDueNotWorse |

195008.0 |

0.117472 |

0.423076 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.000000 |

0.000000 |

0.00000 |

2.000000 |

9.0 |

| NumberOfDependents |

195008.0 |

0.837991 |

1.081541 |

0.0 |

0.0 |

0.000000 |

0.000000 |

0.258888 |

1.434680 |

2.32316 |

4.000000 |

20.0 |

auto_col_bins = {"RevolvingUtilizationOfUnsecuredLines":6,

"age":5,

"DebtRatio":4,

"MonthlyIncome":3,

"NumberOfOpenCreditLinesAndLoans":5}

hand_bins = {"NumberOfTime30-59DaysPastDueNotWorse":[0,1,2,13]

,"NumberOfTimes90DaysLate":[0,1,2,17]

,"NumberRealEstateLoansOrLines":[0,1,2,4,54]

,"NumberOfTime60-89DaysPastDueNotWorse":[0,1,2,8]

,"NumberOfDependents":[0,1,2,3]}

hand_bins = {k:[-np.inf,*v[1:-1],np.inf] for k,v in hand_bins.items()}

auto_col_bins

{'RevolvingUtilizationOfUnsecuredLines': 6,

'age': 5,

'DebtRatio': 4,

'MonthlyIncome': 3,

'NumberOfOpenCreditLinesAndLoans': 5}

hand_bins.items()

dict_items([('NumberOfTime30-59DaysPastDueNotWorse', [-inf, 1, 2, inf]), ('NumberOfTimes90DaysLate', [-inf, 1, 2, inf]), ('NumberRealEstateLoansOrLines', [-inf, 1, 2, 4, inf]), ('NumberOfTime60-89DaysPastDueNotWorse', [-inf, 1, 2, inf]), ('NumberOfDependents', [-inf, 1, 2, inf])])

hand_bins

{'NumberOfTime30-59DaysPastDueNotWorse': [-inf, 1, 2, inf],

'NumberOfTimes90DaysLate': [-inf, 1, 2, inf],

'NumberRealEstateLoansOrLines': [-inf, 1, 2, 4, inf],

'NumberOfTime60-89DaysPastDueNotWorse': [-inf, 1, 2, inf],

'NumberOfDependents': [-inf, 1, 2, inf]}

bins_of_col = {}

for col in auto_col_bins:

bins_df = graphforbestbin(model_data,col

,"SeriousDlqin2yrs"

,n=auto_col_bins[col]

,q=20

,graph=False)

bins_list = sorted(set(bins_df["min"]).union(bins_df["max"]))

bins_list[0],bins_list[-1] = -np.inf,np.inf

bins_of_col[col] = bins_list

bins_of_col

{'RevolvingUtilizationOfUnsecuredLines': [-inf,

0.09912842857080169,

0.29777151691114556,

0.4650029378240421,

0.9824623886712799,

0.9999999,

inf],

'age': [-inf, 36.0, 54.0, 61.0, 74.0, inf],

'DebtRatio': [-inf,

0.0174953101,

0.5034625055732768,

1.4722640672420035,

inf],

'MonthlyIncome': [-inf, 0.1, 5594.0, inf],

'NumberOfOpenCreditLinesAndLoans': [-inf, 1.0, 3.0, 5.0, 17.0, inf]}

bins_list[0],bins_list[-1] = -np.inf,np.inf

bins_of_col.update(hand_bins)

bins_of_col

{'RevolvingUtilizationOfUnsecuredLines': [-inf,

0.09912842857080169,

0.29777151691114556,

0.4650029378240421,

0.9824623886712799,

0.9999999,

inf],

'age': [-inf, 36.0, 54.0, 61.0, 74.0, inf],

'DebtRatio': [-inf,

0.0174953101,

0.5034625055732768,

1.4722640672420035,

inf],

'MonthlyIncome': [-inf, 0.1, 5594.0, inf],

'NumberOfOpenCreditLinesAndLoans': [-inf, 1.0, 3.0, 5.0, 17.0, inf],

'NumberOfTime30-59DaysPastDueNotWorse': [-inf, 1, 2, inf],

'NumberOfTimes90DaysLate': [-inf, 1, 2, inf],

'NumberRealEstateLoansOrLines': [-inf, 1, 2, 4, inf],

'NumberOfTime60-89DaysPastDueNotWorse': [-inf, 1, 2, inf],

'NumberOfDependents': [-inf, 1, 2, inf]}

3.4 计算各箱的WOE并映射到数据中

data = model_data.copy()

data = data[["age","SeriousDlqin2yrs"]].copy()

data["cut"] = pd.cut(data["age"],[-np.inf, 48.49986200790144, 58.757170160044694, 64.0,

74.0, np.inf])

data

|

age |

SeriousDlqin2yrs |

cut |

| 0 |

53 |

0 |

(48.5, 58.757] |

| 1 |

63 |

0 |

(58.757, 64.0] |

| 2 |

39 |

1 |

(-inf, 48.5] |

| 3 |

73 |

0 |

(64.0, 74.0] |

| 4 |

53 |

1 |

(48.5, 58.757] |

| ... |

... |

... |

... |

| 195003 |

32 |

1 |

(-inf, 48.5] |

| 195004 |

50 |

1 |

(48.5, 58.757] |

| 195005 |

46 |

1 |

(-inf, 48.5] |

| 195006 |

64 |

0 |

(58.757, 64.0] |

| 195007 |

53 |

1 |

(48.5, 58.757] |

195008 rows × 3 columns

data.groupby("cut")["SeriousDlqin2yrs"].value_counts()

cut SeriousDlqin2yrs

(-inf, 48.5] 1 59226

0 39558

(48.5, 58.757] 1 24490

0 23469

(58.757, 64.0] 0 13551

1 8032

(64.0, 74.0] 0 13376

1 4196

(74.0, inf] 0 7737

1 1373

Name: SeriousDlqin2yrs, dtype: int64

data.groupby("cut")["SeriousDlqin2yrs"].value_counts().unstack()

| SeriousDlqin2yrs |

0 |

1 |

| cut |

|

|

| (-inf, 48.5] |

39558 |

59226 |

| (48.5, 58.757] |

23469 |

24490 |

| (58.757, 64.0] |

13551 |

8032 |

| (64.0, 74.0] |

13376 |

4196 |

| (74.0, inf] |

7737 |

1373 |

bins_df = data.groupby("cut")["SeriousDlqin2yrs"].value_counts().unstack()

bins_df["woe"] = np.log((bins_df[0]/bins_df[0].sum())/(bins_df[1]/bins_df[1].sum()))

bins_df

| SeriousDlqin2yrs |

0 |

1 |

woe |

| cut |

|

|

|

| (-inf, 48.5] |

39558 |

59226 |

-0.407428 |

| (48.5, 58.757] |

23469 |

24490 |

-0.046420 |

| (58.757, 64.0] |

13551 |

8032 |

0.519191 |

| (64.0, 74.0] |

13376 |

4196 |

1.155495 |

| (74.0, inf] |

7737 |

1373 |

1.725180 |

def get_woe(df,col,y,bins):

df = df[[col,y]].copy()

df["cut"] = pd.cut(df[col],bins)

bins_df = df.groupby("cut")[y].value_counts().unstack()

woe = bins_df["woe"] = np.log((bins_df[0]/bins_df[0].sum())/(bins_df[1]/bins_df[1].sum()))

return woe

woeall = {}

for col in bins_of_col:

woeall[col] = get_woe(model_data,col,"SeriousDlqin2yrs",bins_of_col[col])

woeall

{'RevolvingUtilizationOfUnsecuredLines': cut

(-inf, 0.0991] 2.205113

(0.0991, 0.298] 0.665610

(0.298, 0.465] -0.127577

(0.465, 0.982] -1.073125

(0.982, 1.0] -0.471851

(1.0, inf] -2.040304

dtype: float64,

'age': cut

(-inf, 36.0] -0.523275

(36.0, 54.0] -0.278138

(54.0, 61.0] 0.247606

(61.0, 74.0] 1.004098

(74.0, inf] 1.725180

dtype: float64,

'DebtRatio': cut

(-inf, 0.0175] 1.521696

(0.0175, 0.503] -0.011220

(0.503, 1.472] -0.472690

(1.472, inf] 0.175196

dtype: float64,

'MonthlyIncome': cut

(-inf, 0.1] 1.348333

(0.1, 5594.0] -0.238024

(5594.0, inf] 0.232036

dtype: float64,

'NumberOfOpenCreditLinesAndLoans': cut

(-inf, 1.0] -0.842253

(1.0, 3.0] -0.331046

(3.0, 5.0] -0.055325

(5.0, 17.0] 0.123566

(17.0, inf] 0.464595

dtype: float64,

'NumberOfTime30-59DaysPastDueNotWorse': cut

(-inf, 1.0] 0.133757

(1.0, 2.0] -1.377944

(2.0, inf] -1.548467

dtype: float64,

'NumberOfTimes90DaysLate': cut

(-inf, 1.0] 0.088506

(1.0, 2.0] -2.256812

(2.0, inf] -2.414750

dtype: float64,

'NumberRealEstateLoansOrLines': cut

(-inf, 1.0] -0.146831

(1.0, 2.0] 0.620994

(2.0, 4.0] 0.388716

(4.0, inf] -0.291518

dtype: float64,

'NumberOfTime60-89DaysPastDueNotWorse': cut

(-inf, 1.0] 0.028093

(1.0, 2.0] -1.779675

(2.0, inf] -1.827914

dtype: float64,

'NumberOfDependents': cut

(-inf, 1.0] 0.202748

(1.0, 2.0] -0.531219

(2.0, inf] -0.477951

dtype: float64}

model_woe = pd.DataFrame(index=model_data.index)

model_woe["age"] = pd.cut(model_data["age"],bins_of_col["age"]).map(woeall["age"])

for col in bins_of_col:

model_woe[col] = pd.cut(model_data[col],bins_of_col[col]).map(woeall[col])

model_woe["SeriousDlqin2yrs"] = model_data["SeriousDlqin2yrs"]

model_woe.head()

|

age |

RevolvingUtilizationOfUnsecuredLines |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTime30-59DaysPastDueNotWorse |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

SeriousDlqin2yrs |

| 0 |

-0.278138 |

2.205113 |

-0.01122 |

-0.238024 |

-0.055325 |

0.133757 |

0.088506 |

-0.146831 |

0.028093 |

0.202748 |

0 |

| 1 |

1.004098 |

0.665610 |

-0.01122 |

-0.238024 |

-0.055325 |

0.133757 |

0.088506 |

-0.146831 |

0.028093 |

0.202748 |

0 |

| 2 |

-0.278138 |

-2.040304 |

-0.01122 |

-0.238024 |

-0.055325 |

0.133757 |

0.088506 |

-0.146831 |

-1.779675 |

-0.477951 |

1 |

| 3 |

1.004098 |

2.205113 |

-0.47269 |

-0.238024 |

0.123566 |

0.133757 |

0.088506 |

0.620994 |

0.028093 |

0.202748 |

0 |

| 4 |

-0.278138 |

-1.073125 |

-0.01122 |

0.232036 |

0.123566 |

0.133757 |

0.088506 |

0.620994 |

0.028093 |

0.202748 |

1 |

3.5建模与模型验证

vali_woe = pd.DataFrame(index=vali_data.index)

for col in bins_of_col:

vali_woe[col] = pd.cut(vali_data[col],bins_of_col[col]).map(woeall[col])

vali_woe["SeriousDlqin2yrs"] = vali_data["SeriousDlqin2yrs"]

vali_woe.head()

|

RevolvingUtilizationOfUnsecuredLines |

age |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTime30-59DaysPastDueNotWorse |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

SeriousDlqin2yrs |

| 0 |

2.205113 |

0.247606 |

1.521696 |

-0.238024 |

-0.055325 |

0.133757 |

0.088506 |

-0.146831 |

0.028093 |

0.202748 |

0 |

| 1 |

-1.073125 |

-0.278138 |

-0.011220 |

0.232036 |

0.123566 |

0.133757 |

0.088506 |

0.620994 |

0.028093 |

-0.477951 |

1 |

| 2 |

2.205113 |

1.004098 |

-0.011220 |

0.232036 |

-0.055325 |

0.133757 |

0.088506 |

-0.146831 |

0.028093 |

0.202748 |

0 |

| 3 |

2.205113 |

-0.278138 |

-0.011220 |

-0.238024 |

0.123566 |

0.133757 |

0.088506 |

-0.146831 |

0.028093 |

0.202748 |

0 |

| 4 |

-1.073125 |

-0.278138 |

-0.011220 |

-0.238024 |

0.123566 |

0.133757 |

0.088506 |

-0.146831 |

0.028093 |

0.202748 |

1 |

X = model_woe.iloc[:,:-1]

y = model_woe.iloc[:,-1]

vali_X = vali_woe.iloc[:,:-1]

vali_y = vali_woe.iloc[:,-1]

from sklearn.linear_model import LogisticRegression as LR

lr = LR().fit(X,y)

lr.score(vali_X,vali_y)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

0.7587824255767206

c_1 = np.linspace(0.01,1,20)

c_2 = np.linspace(0.01,0.2,20)

score = []

for i in c_2:

lr = LR(solver='liblinear',C=i).fit(X,y)

score.append(lr.score(vali_X,vali_y))

plt.figure()

plt.plot(c_2,score)

plt.show()

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

lr.n_iter_

array([5], dtype=int32)

score = []

for i in [1,2,3,4,5,6]:

lr = LR(solver='liblinear',C=0.025,max_iter=i).fit(X,y)

score.append(lr.score(vali_X,vali_y))

plt.figure()

plt.plot([1,2,3,4,5,6],score)

plt.show()

D:\py1.1\lib\site-packages\sklearn\svm\_base.py:1225: ConvergenceWarning: Liblinear failed to converge, increase the number of iterations.

warnings.warn(

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\svm\_base.py:1225: ConvergenceWarning: Liblinear failed to converge, increase the number of iterations.

warnings.warn(

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\svm\_base.py:1225: ConvergenceWarning: Liblinear failed to converge, increase the number of iterations.

warnings.warn(

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\svm\_base.py:1225: ConvergenceWarning: Liblinear failed to converge, increase the number of iterations.

warnings.warn(

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\svm\_base.py:1225: ConvergenceWarning: Liblinear failed to converge, increase the number of iterations.

warnings.warn(

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

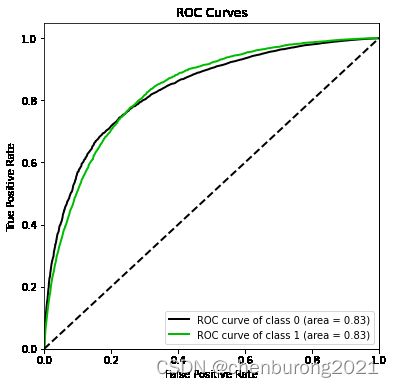

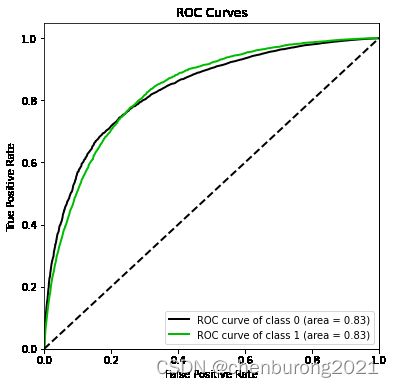

import scikitplot as skplt

vali_proba_df = pd.DataFrame(lr.predict_proba(vali_X))

skplt.metrics.plot_roc(vali_y, vali_proba_df,

plot_micro=False,figsize=(6,6),

plot_macro=False)

D:\py1.1\lib\site-packages\sklearn\base.py:493: FutureWarning: The feature names should match those that were passed during fit. Starting version 1.2, an error will be raised.

Feature names must be in the same order as they were in fit.

warnings.warn(message, FutureWarning)

3.6 制作评分卡

B = 20/np.log(2)

A = 600 + B*np.log(1/60)

B,A

(28.85390081777927, 481.8621880878296)

lr.intercept_

array([-0.00672073])

base_score = A - B*lr.intercept_

base_score

array([482.05610739])

model_data.head()

|

SeriousDlqin2yrs |

RevolvingUtilizationOfUnsecuredLines |

age |

NumberOfTime30-59DaysPastDueNotWorse |

DebtRatio |

MonthlyIncome |

NumberOfOpenCreditLinesAndLoans |

NumberOfTimes90DaysLate |

NumberRealEstateLoansOrLines |

NumberOfTime60-89DaysPastDueNotWorse |

NumberOfDependents |

qcut |

| 0 |

0 |

0.015404 |

53 |

0 |

0.121802 |

4728.0 |

5 |

0 |

0 |

0 |

0.000000 |

(52.0, 54.0] |

| 1 |

0 |

0.168311 |

63 |

0 |

0.141964 |

1119.0 |

5 |

0 |

0 |

0 |

0.000000 |

(61.0, 64.0] |

| 2 |

1 |

1.063570 |

39 |

1 |

0.417663 |

3500.0 |

5 |

1 |

0 |

2 |

3.716057 |

(36.0, 39.0] |

| 3 |

0 |

0.088684 |

73 |

0 |

0.522822 |

5301.0 |

11 |

0 |

2 |

0 |

0.000000 |

(68.0, 74.0] |

| 4 |

1 |

0.622999 |

53 |

0 |

0.423650 |

13000.0 |

9 |

0 |

2 |

0 |

0.181999 |

(52.0, 54.0] |

woeall

{'RevolvingUtilizationOfUnsecuredLines': cut

(-inf, 0.0991] 2.205113

(0.0991, 0.298] 0.665610

(0.298, 0.465] -0.127577

(0.465, 0.982] -1.073125

(0.982, 1.0] -0.471851

(1.0, inf] -2.040304

dtype: float64,

'age': cut

(-inf, 36.0] -0.523275

(36.0, 54.0] -0.278138

(54.0, 61.0] 0.247606

(61.0, 74.0] 1.004098

(74.0, inf] 1.725180

dtype: float64,

'DebtRatio': cut

(-inf, 0.0175] 1.521696

(0.0175, 0.503] -0.011220

(0.503, 1.472] -0.472690

(1.472, inf] 0.175196

dtype: float64,

'MonthlyIncome': cut

(-inf, 0.1] 1.348333

(0.1, 5594.0] -0.238024

(5594.0, inf] 0.232036

dtype: float64,

'NumberOfOpenCreditLinesAndLoans': cut

(-inf, 1.0] -0.842253

(1.0, 3.0] -0.331046

(3.0, 5.0] -0.055325

(5.0, 17.0] 0.123566

(17.0, inf] 0.464595

dtype: float64,

'NumberOfTime30-59DaysPastDueNotWorse': cut

(-inf, 1.0] 0.133757

(1.0, 2.0] -1.377944

(2.0, inf] -1.548467

dtype: float64,

'NumberOfTimes90DaysLate': cut

(-inf, 1.0] 0.088506

(1.0, 2.0] -2.256812

(2.0, inf] -2.414750

dtype: float64,

'NumberRealEstateLoansOrLines': cut

(-inf, 1.0] -0.146831

(1.0, 2.0] 0.620994

(2.0, 4.0] 0.388716

(4.0, inf] -0.291518

dtype: float64,

'NumberOfTime60-89DaysPastDueNotWorse': cut

(-inf, 1.0] 0.028093

(1.0, 2.0] -1.779675

(2.0, inf] -1.827914

dtype: float64,

'NumberOfDependents': cut

(-inf, 1.0] 0.202748

(1.0, 2.0] -0.531219

(2.0, inf] -0.477951

dtype: float64}

score_age = woeall["age"] * (-B*lr.coef_[0][1])

score_age

cut

(-inf, 36.0] -12.517538

(36.0, 54.0] -6.653503

(54.0, 61.0] 5.923113

(61.0, 74.0] 24.019569

(74.0, inf] 41.268981

dtype: float64

lr.coef_[0]

array([-0.40528794, -0.8290577 , -0.64610093, -0.61661619, -0.37484361,

-0.60937781, -0.5959787 , -0.80402665, -0.30654535, -0.55908073])

file = "D:\class_file\day08_05\ScoreData.csv"

with open(file,"w") as fdata:

fdata.write("base_score,{}\n".format(base_score))

for i,col in enumerate(X.columns):

score = woeall[col] * (-B*lr.coef_[0][i])

score.name = "Score"

score.index.name = col

score.to_csv(file,header=True,mode="a")