import numpy as np

import pandas as pd

from pandas_datareader import data

import datetime as dt

数据准备

'''

获取国内股票数据的方式是:“股票代码”+“对应股市”(港股为.hk,A股为.ss)

例如腾讯是港股是:0700.hk

'''

'''

定义函数

函数功能:计算股票涨跌幅=(现在股价-买入价格)/买入价格

输入参数:column是收盘价这一列的数据

返回数据:涨跌幅

'''

def change ( column) :

buyPrice= column[ 0 ]

curPrice= column[ column. size- 1 ]

priceChange= ( curPrice- buyPrice) / buyPrice

if priceChange> 0 :

print ( '股票累计上涨=' , round ( priceChange* 100 , 2 ) , '%' )

elif priceChange== 0 :

print ( '股票无变化=' , round ( priceChange* 100 , 2 ) * 100 , '%' )

else :

print ( '股票累计下跌=' , round ( priceChange* 100 , 2 ) * 100 , '%' )

return priceChange

'''

三星电子

每日股票价位信息

Open:开盘价

High:最高加

Low:最低价

Close:收盘价

Volume:成交量

因雅虎连接不到,仅以三星作为获取数据示例

'''

sxDf = data. DataReader( '005930' , 'naver' , start= '2021-01-01' , end= '2022-01-01' )

sxDf. head( )

Open

High

Low

Close

Volume

Date

2021-01-04

81000

84400

80200

83000

38655276

2021-01-05

81600

83900

81600

83900

35335669

2021-01-06

83300

84500

82100

82200

42089013

2021-01-07

82800

84200

82700

82900

32644642

2021-01-08

83300

90000

83000

88800

59013307

sxDf. info( )

DatetimeIndex: 248 entries, 2021-01-04 to 2021-12-30

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 248 non-null object

1 High 248 non-null object

2 Low 248 non-null object

3 Close 248 non-null object

4 Volume 248 non-null object

dtypes: object(5)

memory usage: 11.6+ KB

sxDf. iloc[ : , 0 : 4 ] = sxDf. iloc[ : , 0 : 4 ] . astype( 'float' )

sxDf. iloc[ : , - 1 ] = sxDf. iloc[ : , - 1 ] . astype( 'int' )

sxDf. info( )

DatetimeIndex: 248 entries, 2021-01-04 to 2021-12-30

Data columns (total 5 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 248 non-null float64

1 High 248 non-null float64

2 Low 248 non-null float64

3 Close 248 non-null float64

4 Volume 248 non-null int32

dtypes: float64(4), int32(1)

memory usage: 10.7 KB

阿里巴巴

AliDf= pd. read_excel( r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\阿里巴巴2017年股票数据.xlsx' , index_col= 'Date' )

AliDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

175.839996

176.660004

175.039993

176.289993

176.289993

12524700

2017-12-26

174.550003

175.149994

171.729996

172.330002

172.330002

12913800

2017-12-27

172.289993

173.869995

171.729996

172.970001

172.970001

10152300

2017-12-28

173.039993

173.529999

171.669998

172.300003

172.300003

9508100

2017-12-29

172.279999

173.669998

171.199997

172.429993

172.429993

9704600

AliDf. info( )

DatetimeIndex: 251 entries, 2017-01-03 to 2017-12-29

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Open 251 non-null float64

1 High 251 non-null float64

2 Low 251 non-null float64

3 Close 251 non-null float64

4 Adj Close 251 non-null float64

5 Volume 251 non-null int64

dtypes: float64(5), int64(1)

memory usage: 13.7 KB

AliChange= change( AliDf[ 'Close' ] )

股票累计上涨= 94.62 %

'''增加一列累计增长百分比'''

Close1= AliDf[ 'Close' ] [ 0 ]

AliDf[ 'sum_pct_change' ] = AliDf[ 'Close' ] . apply ( lambda x: ( x- Close1) / Close1)

AliDf[ 'sum_pct_change' ] . tail( )

Date

2017-12-22 0.989729

2017-12-26 0.945034

2017-12-27 0.952257

2017-12-28 0.944695

2017-12-29 0.946162

Name: sum_pct_change, dtype: float64

谷歌

GoogleDf= pd. read_excel( r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\谷歌2017年股票数据.xlsx' , index_col= 'Date' )

GoogleDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

1061.109985

1064.199951

1059.439941

1060.119995

1060.119995

755100

2017-12-26

1058.069946

1060.119995

1050.199951

1056.739990

1056.739990

760600

2017-12-27

1057.390015

1058.369995

1048.050049

1049.369995

1049.369995

1271900

2017-12-28

1051.599976

1054.750000

1044.770020

1048.140015

1048.140015

837100

2017-12-29

1046.719971

1049.699951

1044.900024

1046.400024

1046.400024

887500

GoogleChange= change( GoogleDf[ 'Close' ] )

股票累计上涨= 33.11 %

'''增加一列累计增长百分比'''

Close1= GoogleDf[ 'Close' ] [ 0 ]

GoogleDf[ 'sum_pct_change' ] = GoogleDf[ 'Close' ] . apply ( lambda x: ( x- Close1) / Close1)

GoogleDf[ 'sum_pct_change' ] . tail( )

Date

2017-12-22 0.348513

2017-12-26 0.344213

2017-12-27 0.334839

2017-12-28 0.333274

2017-12-29 0.331061

Name: sum_pct_change, dtype: float64

苹果

AppleDf= pd. read_excel( r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\苹果2017年股票数据.xlsx' , index_col= 'Date' )

AppleDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

174.679993

175.419998

174.500000

175.009995

174.299362

16349400

2017-12-26

170.800003

171.470001

169.679993

170.570007

169.877396

33185500

2017-12-27

170.100006

170.779999

169.710007

170.600006

169.907272

21498200

2017-12-28

171.000000

171.850006

170.479996

171.080002

170.385315

16480200

2017-12-29

170.520004

170.589996

169.220001

169.229996

168.542831

25999900

AppleChange= change( AppleDf[ 'Close' ] )

股票累计上涨= 45.7 %

'''增加一列累计增长百分比'''

Close1= AppleDf[ 'Close' ] [ 0 ]

AppleDf[ 'sum_pct_change' ] = AppleDf[ 'Close' ] . apply ( lambda x: ( x- Close1) / Close1)

AppleDf[ 'sum_pct_change' ] . tail( )

Date

2017-12-22 0.506758

2017-12-26 0.468532

2017-12-27 0.468790

2017-12-28 0.472923

2017-12-29 0.456995

Name: sum_pct_change, dtype: float64

腾讯

TencentDf= pd. read_excel( r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\腾讯2017年股票数据.xlsx' , index_col= 'Date' )

TencentDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

403.799988

405.799988

400.799988

405.799988

405.799988

16146080

2017-12-27

405.799988

407.799988

401.000000

401.200012

401.200012

16680601

2017-12-28

404.000000

408.200012

402.200012

408.200012

408.200012

11662053

2017-12-29

408.000000

408.000000

403.399994

406.000000

406.000000

16601658

2018-01-02

406.000000

406.000000

406.000000

406.000000

406.000000

0

TencentDf[ [ 'Open' , 'High' , 'Low' , 'Close' , 'Adj Close' ] ] = TencentDf[ [ 'Open' , 'High' , 'Low' , 'Close' , 'Adj Close' ] ] * 0.1277

TencentDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

51.565258

51.820658

51.182158

51.820658

51.820658

16146080

2017-12-27

51.820658

52.076058

51.207700

51.233242

51.233242

16680601

2017-12-28

51.590800

52.127142

51.360942

52.127142

52.127142

11662053

2017-12-29

52.101600

52.101600

51.514179

51.846200

51.846200

16601658

2018-01-02

51.846200

51.846200

51.846200

51.846200

51.846200

0

TencentChange= change( TencentDf[ 'Close' ] )

股票累计上涨= 114.36 %

'''增加一列累计增长百分比'''

Close1= TencentDf[ 'Close' ] [ 0 ]

TencentDf[ 'sum_pct_change' ] = TencentDf[ 'Close' ] . apply ( lambda x: ( x- Close1) / Close1)

TencentDf[ 'sum_pct_change' ] . tail( )

Date

2017-12-22 1.142555

2017-12-27 1.118268

2017-12-28 1.155227

2017-12-29 1.143611

2018-01-02 1.143611

Name: sum_pct_change, dtype: float64

亚马逊

AmazonDf= pd. read_excel( r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\亚马逊2017年股票数据.xlsx' , index_col= 'Date' )

AmazonDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

1172.079956

1174.619995

1167.829956

1168.359985

1168.359985

1585100

2017-12-26

1168.359985

1178.319946

1160.550049

1176.760010

1176.760010

2005200

2017-12-27

1179.910034

1187.290039

1175.609985

1182.260010

1182.260010

1867200

2017-12-28

1189.000000

1190.099976

1184.380005

1186.099976

1186.099976

1841700

2017-12-29

1182.349976

1184.000000

1167.500000

1169.469971

1169.469971

2688400

AmazonChange= change( AmazonDf[ 'Close' ] )

股票累计上涨= 55.17 %

'''增加一列累计增长百分比'''

Close1= AmazonDf[ 'Close' ] [ 0 ]

AmazonDf[ 'sum_pct_change' ] = AmazonDf[ 'Close' ] . apply ( lambda x: ( x- Close1) / Close1)

AmazonDf[ 'sum_pct_change' ] . tail( )

Date

2017-12-22 0.550228

2017-12-26 0.561373

2017-12-27 0.568671

2017-12-28 0.573766

2017-12-29 0.551700

Name: sum_pct_change, dtype: float64

Facebook

FacebookDf= pd. read_excel( r'C:\Users\EDY\Desktop\吧哩吧啦\学习\Untitled Folder\Facebook2017年股票数据.xlsx' , index_col= 'Date' )

FacebookDf. tail( )

Open

High

Low

Close

Adj Close

Volume

Date

2017-12-22

177.139999

177.529999

176.229996

177.199997

177.199997

8509500

2017-12-26

176.630005

177.000000

174.669998

175.990005

175.990005

8897300

2017-12-27

176.550003

178.440002

176.259995

177.619995

177.619995

9496100

2017-12-28

177.949997

178.940002

177.679993

177.919998

177.919998

12220800

2017-12-29

178.000000

178.850006

176.460007

176.460007

176.460007

10261500

FacebookChange= change( FacebookDf[ 'Close' ] )

股票累计上涨= 51.0 %

'''增加一列每日增长百分比'''

FacebookDf[ 'pct_change' ] = FacebookDf[ 'Close' ] . pct_change( 1 ) . fillna( 0 )

FacebookDf[ 'pct_change' ] . head( )

Date

2017-01-03 0.000000

2017-01-04 0.015660

2017-01-05 0.016682

2017-01-06 0.022707

2017-01-09 0.012074

Name: pct_change, dtype: float64

'''增加一列累计增长百分比'''

Close1= FacebookDf[ 'Close' ] [ 0 ]

FacebookDf[ 'sum_pct_change' ] = FacebookDf[ 'Close' ] . apply ( lambda x: ( x- Close1) / Close1)

FacebookDf[ 'sum_pct_change' ] . tail( )

Date

2017-12-22 0.516344

2017-12-26 0.505990

2017-12-27 0.519938

2017-12-28 0.522506

2017-12-29 0.510012

Name: sum_pct_change, dtype: float64

数据可视化

import matplotlib. pyplot as plt

fig= plt. figure( figsize= ( 10 , 5 ) )

AliDf. plot( x= 'Volume' , y= 'Close' , kind= 'scatter' )

plt. xlabel( '成交量' )

plt. ylabel( '股价' )

plt. title( '成交量与股价之间的关系' )

plt. show( )

AliDf. corr( )

Open

High

Low

Close

Adj Close

Volume

sum_pct_change

Open

1.000000

0.999281

0.998798

0.998226

0.998226

0.424686

0.998226

High

0.999281

1.000000

0.998782

0.999077

0.999077

0.432467

0.999077

Low

0.998798

0.998782

1.000000

0.999249

0.999249

0.401456

0.999249

Close

0.998226

0.999077

0.999249

1.000000

1.000000

0.415801

1.000000

Adj Close

0.998226

0.999077

0.999249

1.000000

1.000000

0.415801

1.000000

Volume

0.424686

0.432467

0.401456

0.415801

0.415801

1.000000

0.415801

sum_pct_change

0.998226

0.999077

0.999249

1.000000

1.000000

0.415801

1.000000

查看各个公司的股价平均值

AliDf[ 'Close' ] . mean( )

141.79179260159364

'''数据准备'''

Close_mean= { 'Alibaba' : AliDf[ 'Close' ] . mean( ) ,

'Google' : GoogleDf[ 'Close' ] . mean( ) ,

'Apple' : AppleDf[ 'Close' ] . mean( ) ,

'Tencent' : TencentDf[ 'Close' ] . mean( ) ,

'Amazon' : AmazonDf[ 'Close' ] . mean( ) ,

'Facebook' : FacebookDf[ 'Close' ] . mean( ) }

CloseMeanSer= pd. Series( Close_mean)

CloseMeanSer. sort_values( ascending= False , inplace= True )

'''绘制柱状图'''

fig= plt. figure( figsize= ( 10 , 5 ) )

CloseMeanSer. plot( kind= 'bar' )

plt. xlabel( '公司' )

plt. ylabel( '股价平均值(美元)' )

plt. title( '2017年各公司股价平均值' )

plt. yticks( np. arange( 0 , 1100 , 100 ) )

plt. grid( True , axis= 'y' )

plt. show( )

亚马逊和谷歌的平均股价很高,远远超过其他4家,但是仅看平均值并不能代表什么,下面从分布和走势方面查看

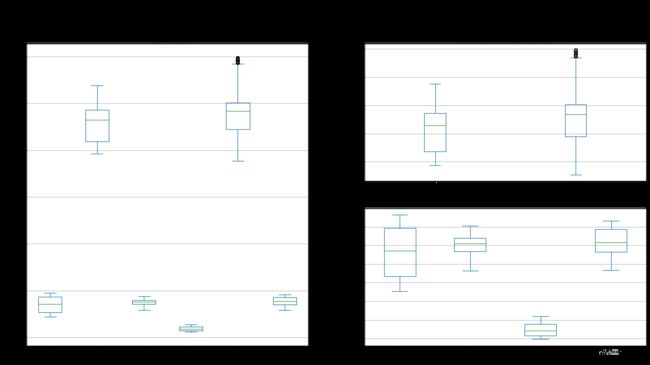

查看各公司股价分布情况

'''数据准备'''

CloseCollectDf= pd. concat( [ AliDf[ 'Close' ] ,

GoogleDf[ 'Close' ] ,

AppleDf[ 'Close' ] ,

TencentDf[ 'Close' ] ,

AmazonDf[ 'Close' ] ,

FacebookDf[ 'Close' ] ] , axis= 1 )

CloseCollectDf. columns= [ 'Alibaba' , 'Google' , 'Apple' , 'Tencent' , 'Amazon' , 'Facebook' ]

'''绘制箱型图'''

fig= plt. figure( figsize= ( 20 , 10 ) )

fig. suptitle( '2017年各公司股价分布' , fontsize= 18 )

ax1= plt. subplot( 121 )

CloseCollectDf. plot( ax= ax1, kind= 'box' )

plt. xlabel( '公司' )

plt. ylabel( '股价(美元)' )

plt. title( '2017年各公司股价分布' )

plt. grid( True , axis= 'y' )

ax2= plt. subplot( 222 )

CloseCollectDf[ [ 'Google' , 'Amazon' ] ] . plot( ax= ax2, kind= 'box' )

plt. ylabel( '股价(美元)' )

plt. title( '2017年谷歌和亚马逊股价分布' )

plt. grid( True , axis= 'y' )

ax3= plt. subplot( 224 )

CloseCollectDf[ [ 'Alibaba' , 'Apple' , 'Tencent' , 'Facebook' ] ] . plot( ax= ax3, kind= 'box' )

plt. xlabel( '公司' )

plt. ylabel( '股价(美元)' )

plt. title( '2017年阿里、苹果、腾讯、Facebook股价分布' )

plt. grid( True , axis= 'y' )

plt. subplot

plt. show( )

从箱型图看,谷歌和亚马逊的股价分布较广,且中位数偏上,腾讯股价最为集中,波动最小,相对稳定。

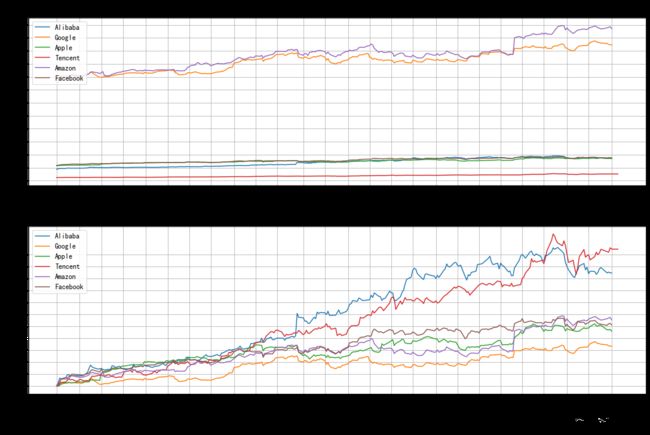

股价走势对比

fig= plt. figure( figsize= ( 15 , 10 ) , constrained_layout= True )

fig. suptitle( '股价走势对比' , fontsize= 18 )

'''绘制图像1 '''

ax1= plt. subplot( 211 )

plt. plot( AliDf. index, AliDf[ 'Close' ] , label= 'Alibaba' )

plt. plot( GoogleDf. index, GoogleDf[ 'Close' ] , label= 'Google' )

plt. plot( AppleDf. index, AppleDf[ 'Close' ] , label= 'Apple' )

plt. plot( TencentDf. index, TencentDf[ 'Close' ] , label= 'Tencent' )

plt. plot( AmazonDf. index, AmazonDf[ 'Close' ] , label= 'Amazon' )

plt. plot( FacebookDf. index, FacebookDf[ 'Close' ] , label= 'Facebook' )

plt. xlabel( '时间' )

plt. ylabel( '股价' )

plt. legend( loc= 'upper left' , fontsize= 12 )

plt. xticks( AliDf. index[ : : 10 ] , rotation= 45 )

plt. yticks( np. arange( 0 , 1300 , step= 100 ) )

plt. grid( True )

'''绘制图像2'''

ax2= plt. subplot( 212 )

plt. plot( AliDf. index, AliDf[ 'sum_pct_change' ] , label= 'Alibaba' )

plt. plot( GoogleDf. index, GoogleDf[ 'sum_pct_change' ] , label= 'Google' )

plt. plot( AppleDf. index, AppleDf[ 'sum_pct_change' ] , label= 'Apple' )

plt. plot( TencentDf. index, TencentDf[ 'sum_pct_change' ] , label= 'Tencent' )

plt. plot( AmazonDf. index, AmazonDf[ 'sum_pct_change' ] , label= 'Amazon' )

plt. plot( FacebookDf. index, FacebookDf[ 'sum_pct_change' ] , label= 'Facebook' )

plt. xlabel( '时间' )

plt. ylabel( '累计增长率' )

plt. legend( loc= 'upper left' , fontsize= 12 )

plt. xticks( AliDf. index[ : : 10 ] , rotation= 45 )

plt. yticks( np. arange( 0 , 1.2 , step= 0.1 ) )

plt. grid( True )

plt. show( )

可以看出,在2017年间,亚马逊和谷歌的股价虽然偏高,涨幅却不如阿里巴巴和腾讯。

总结

观察以上图形,可以得出一下结果: