深度学习(7):基于LSTM算法的股票走势预测

目标:基于LSTM网络实现对股票走势分析,将股票指数输入LSTM模型训练和推理,最后将判断结果进行输出。

一、原理

先了解RNN,参考博客

好好学习第三天:RNN与股票预测_流萤数点的博客-CSDN博客_rnn 预测

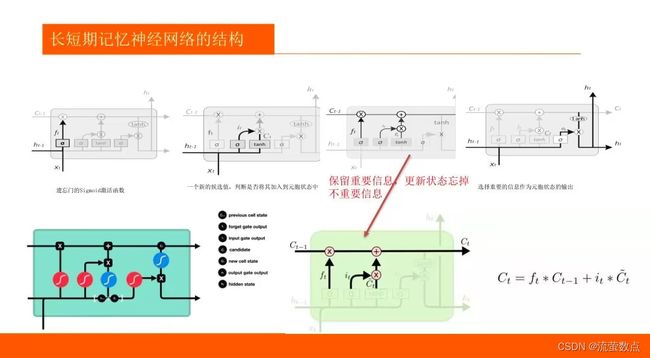

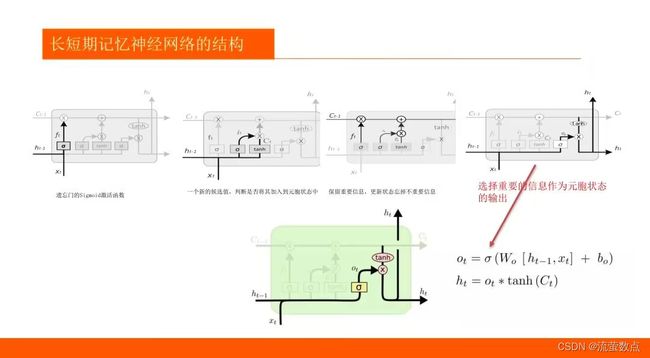

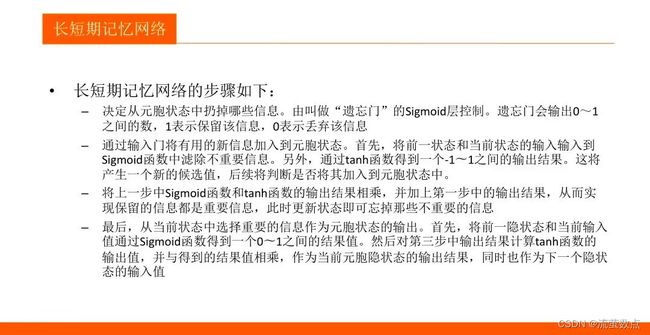

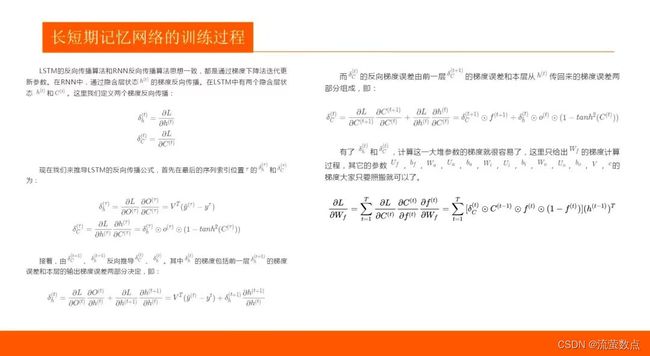

1.了解LSTM算法的基本原理

2.熟悉LSTM趋势预测的常规方法

3.掌握LSTM训练的方法

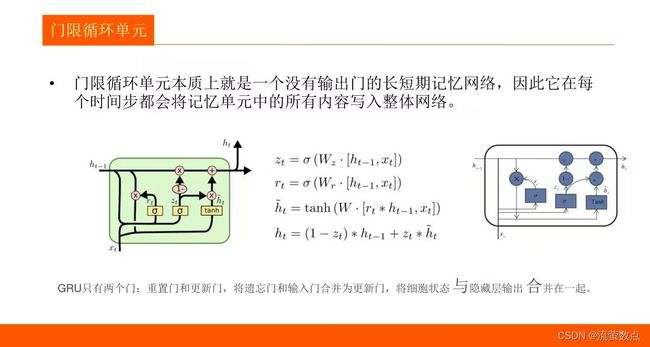

4.LSTM 和 GRU 是解决短时记忆问题的解决方案,它们具有称为“门”的内部机制,可以调节信息流。

二、过程

1.导入库

import numpy as np

import pandas as pd

import math

import sklearn

import sklearn.preprocessing

import datetime

import os

import matplotlib.pyplot as plt

import tensorflow as tf2.导入数据

#准备数据,从OSS中获取数据并解压到当前目录:

import oss2

access_key_id = os.getenv('OSS_TEST_ACCESS_KEY_ID', 'LTAI4G1MuHTUeNrKdQEPnbph')

access_key_secret = os.getenv('OSS_TEST_ACCESS_KEY_SECRET', 'm1ILSoVqcPUxFFDqer4tKDxDkoP1ji')

bucket_name = os.getenv('OSS_TEST_BUCKET', 'mldemo')

endpoint = os.getenv('OSS_TEST_ENDPOINT', 'https://oss-cn-shanghai.aliyuncs.com')

# 创建Bucket对象,所有Object相关的接口都可以通过Bucket对象来进行

bucket = oss2.Bucket(oss2.Auth(access_key_id, access_key_secret), endpoint, bucket_name)

# 下载到本地文件

bucket.get_object_to_file('data/c12/stock_data.zip', 'stock_data.zip')![]()

#解压数据

!unzip -o -q stock_data.zip

!rm -rf __MACOSX

!ls stock_data -ilht ![]()

3.可视化

# import all stock prices

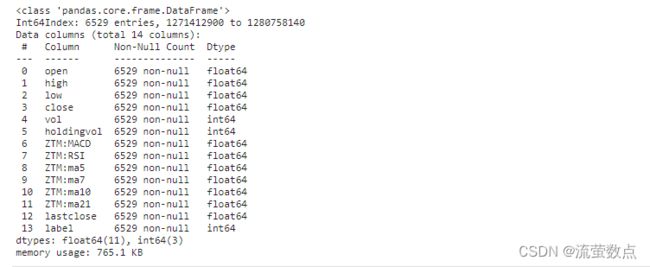

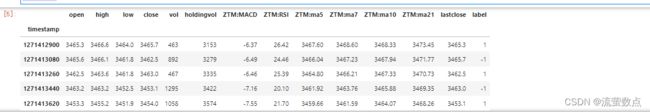

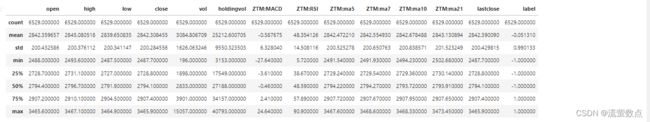

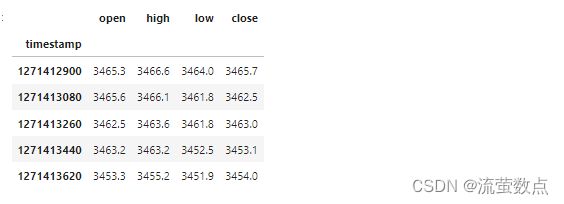

df = pd.read_csv("./stock_data/sh300index.csv", index_col = 0)

df.info()df.head()df.describe()plt.figure(figsize=(15, 5));

plt.subplot(2,1,1);

plt.plot(df.open.values, color='red', label='open')

plt.plot(df.close.values, color='green', label='close')

plt.plot(df.low.values, color='blue', label='low')

plt.plot(df.high.values, color='black', label='high')

plt.title('stock price')

plt.xlabel('time [days]')

plt.ylabel('price')

plt.legend(loc='best')

plt.subplot(2,1,2);

plt.plot(df.vol.values, color='black', label='volume')

plt.title('stock volume')

plt.xlabel('time [days]')

plt.ylabel('volume')

plt.legend(loc='best');

plt.show()4.数据预处理

# 按照80%/10%/10% 划分训练集、验证集和测试集

valid_set_size_percentage = 10

test_set_size_percentage = 10 # min-max 归一化

def normalize_data(df):

min_max_scaler = sklearn.preprocessing.MinMaxScaler()

df['open'] = min_max_scaler.fit_transform(df.open.values.reshape(-1,1))

df['high'] = min_max_scaler.fit_transform(df.high.values.reshape(-1,1))

df['low'] = min_max_scaler.fit_transform(df.low.values.reshape(-1,1))

df['close'] = min_max_scaler.fit_transform(df['close'].values.reshape(-1,1))

return df# 划分数据集

def load_data(stock, seq_len):

data_raw = stock.to_numpy() # pd to numpy array

data = []

# create all possible sequences of length seq_len

for index in range(len(data_raw) - seq_len):

data.append(data_raw[index: index + seq_len])

data = np.array(data);

valid_set_size = int(np.round(valid_set_size_percentage/100*data.shape[0]));

test_set_size = int(np.round(test_set_size_percentage/100*data.shape[0]));

train_set_size = data.shape[0] - (valid_set_size + test_set_size);

x_train = data[:train_set_size,:-1,:]

y_train = data[:train_set_size,-1,:]

x_valid = data[train_set_size:train_set_size+valid_set_size,:-1,:]

y_valid = data[train_set_size:train_set_size+valid_set_size,-1,:]

x_test = data[train_set_size+valid_set_size:,:-1,:]

y_test = data[train_set_size+valid_set_size:,-1,:]

return [x_train, y_train, x_valid, y_valid, x_test, y_test]# 去除冗余指标

df_stock = df.copy()

df_stock.drop(['vol'],1,inplace=True)

df_stock.drop(['lastclose'],1,inplace=True)

df_stock.drop(['label'],1,inplace=True)

df_stock.drop(['ZTM:ma5'],1,inplace=True)

df_stock.drop(['ZTM:ma7'],1,inplace=True)

df_stock.drop(['ZTM:ma10'],1,inplace=True)

df_stock.drop(['ZTM:ma21'],1,inplace=True)

df_stock.drop(['holdingvol'],1,inplace=True)

df_stock.drop(['ZTM:MACD'],1,inplace=True)

df_stock.drop(['ZTM:RSI'],1,inplace=True)

#查看输入数据

df_stock.head()#输出输入列名

cols = list(df_stock.columns.values)

print('df_stock.columns.values = ', cols)![]()

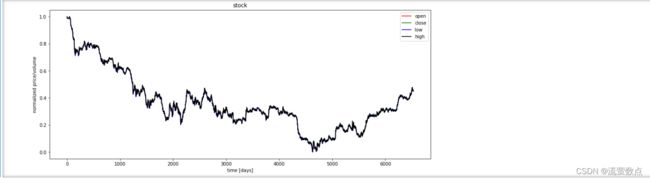

对指标进行归一化处理:

df_stock_norm = normalize_data(df_stock)

# 查看训练集、验证集和测试集情况

seq_len = 20 # 设置最长序列长度

x_train, y_train, x_valid, y_valid, x_test, y_test = load_data(df_stock_norm, seq_len)

print('x_train.shape = ',x_train.shape)

print('y_train.shape = ', y_train.shape)

print('x_valid.shape = ',x_valid.shape)

print('y_valid.shape = ', y_valid.shape)

print('x_test.shape = ', x_test.shape)

print('y_test.shape = ',y_test.shape)#对指标数据进行可视化

plt.figure(figsize=(15, 6));

plt.plot(df_stock_norm.open.values, color='red', label='open')

plt.plot(df_stock_norm.close.values, color='green', label='close')

plt.plot(df_stock_norm.low.values, color='blue', label='low')

plt.plot(df_stock_norm.high.values, color='black', label='high')

plt.title('stock')

plt.xlabel('time [days]')

plt.ylabel('normalized price/volume')

plt.legend(loc='best')

plt.show()5.RNN建模-LSTM/GRU

#对训练数据随机化处理

index_in_epoch = 0;

perm_array = np.arange(x_train.shape[0])

np.random.shuffle(perm_array)

# 数据读取方法

def get_next_batch(batch_size):

global index_in_epoch, x_train, perm_array

start = index_in_epoch

index_in_epoch += batch_size

if index_in_epoch > x_train.shape[0]:

np.random.shuffle(perm_array) # shuffle permutation array

start = 0 # start next epoch

index_in_epoch = batch_size

end = index_in_epoch

return x_train[perm_array[start:end]], y_train[perm_array[start:end]]#定义超参

n_steps = seq_len-1

#输入大小(与指标数量对应)

n_inputs = 4

n_neurons = 200

#输出大小(与指标数量对应)

n_outputs = 4

#层数

n_layers = 2

#学习率

learning_rate = 0.001

#批大小

batch_size = 50

#迭代训练次数

n_epochs = 20

#训练集大小

train_set_size = x_train.shape[0]

#测试集大小

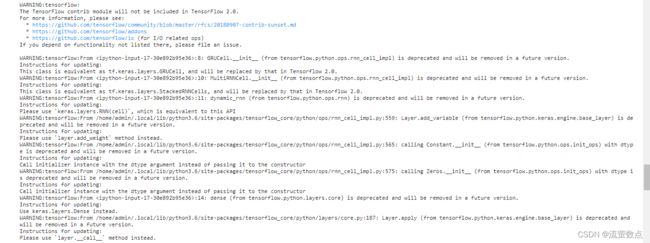

test_set_size = x_test.shape[0]定义网络结构:

tf.reset_default_graph()

X = tf.placeholder(tf.float32, [None, n_steps, n_inputs])

y = tf.placeholder(tf.float32, [None, n_outputs])

# 使用GRU单元结构

layers = [tf.contrib.rnn.GRUCell(num_units=n_neurons, activation=tf.nn.leaky_relu)

for layer in range(n_layers)]

multi_layer_cell = tf.contrib.rnn.MultiRNNCell(layers)

rnn_outputs, states = tf.nn.dynamic_rnn(multi_layer_cell, X, dtype=tf.float32)

stacked_rnn_outputs = tf.reshape(rnn_outputs, [-1, n_neurons])

stacked_outputs = tf.layers.dense(stacked_rnn_outputs, n_outputs)

outputs = tf.reshape(stacked_outputs, [-1, n_steps, n_outputs])

outputs = outputs[:,n_steps-1,:] # 定义输出

loss = tf.reduce_mean(tf.square(outputs - y)) # 使用MSE作为损失

optimizer = tf.train.AdamOptimizer(learning_rate=learning_rate)

training_op = optimizer.minimize(loss)开始训练:

# 执行训练

with tf.Session() as sess:

sess.run(tf.global_variables_initializer())

for iteration in range(int(n_epochs*train_set_size/batch_size)):

x_batch, y_batch = get_next_batch(batch_size) # fetch the next training batch

sess.run(training_op, feed_dict={X: x_batch, y: y_batch})

if iteration % int(5*train_set_size/batch_size) == 0:

mse_train = loss.eval(feed_dict={X: x_train, y: y_train})

mse_valid = loss.eval(feed_dict={X: x_valid, y: y_valid})

print('%.2f epochs: MSE train/valid = %.6f/%.6f'%(

iteration*batch_size/train_set_size, mse_train, mse_valid))

y_train_pred = sess.run(outputs, feed_dict={X: x_train})

y_valid_pred = sess.run(outputs, feed_dict={X: x_valid})

y_test_pred = sess.run(outputs, feed_dict={X: x_test})

6.模型应用-预测

对比查看股票指数的历史值和未来值情况:

ft = 0 # 0 = open, 1 = close, 2 = highest, 3 = lowest

#结果可视化

plt.figure(figsize=(15, 5));

plt.subplot(1,2,1);

plt.plot(np.arange(y_train.shape[0]), y_train[:,ft], color='blue', label='train target')

plt.plot(np.arange(y_train.shape[0], y_train.shape[0]+y_valid.shape[0]), y_valid[:,ft],

color='gray', label='valid target')

plt.plot(np.arange(y_train.shape[0]+y_valid.shape[0],

y_train.shape[0]+y_test.shape[0]+y_test.shape[0]),

y_test[:,ft], color='black', label='test target')

plt.plot(np.arange(y_train_pred.shape[0]),y_train_pred[:,ft], color='red',

label='train prediction')

plt.plot(np.arange(y_train_pred.shape[0], y_train_pred.shape[0]+y_valid_pred.shape[0]),

y_valid_pred[:,ft], color='orange', label='valid prediction')

plt.plot(np.arange(y_train_pred.shape[0]+y_valid_pred.shape[0],

y_train_pred.shape[0]+y_valid_pred.shape[0]+y_test_pred.shape[0]),

y_test_pred[:,ft], color='green', label='test prediction')

plt.title('past and future stock prices')

plt.xlabel('time [days]')

plt.ylabel('normalized price')

plt.legend(loc='best');

plt.subplot(1,2,2);

plt.plot(np.arange(y_train.shape[0], y_train.shape[0]+y_test.shape[0]),

y_test[:,ft], color='black', label='test target')

plt.plot(np.arange(y_train_pred.shape[0], y_train_pred.shape[0]+y_test_pred.shape[0]),

y_test_pred[:,ft], color='green', label='test prediction')

plt.title('future stock prices')

plt.xlabel('time [days]')

plt.ylabel('normalized price')

plt.legend(loc='best');