量化交易Python数据分析

基于python的量化交易分析

采用:

1. N日择时策略+ATR风险控制

# N日择时策略+ATR

def Nbreakstrategy(self,data, N1, N2, n_win, n_loss):

# N1天内最高价

global start

data['N1_high'] = data.High.rolling(window=N1).max()

data['N1_high'] = data.N1_high.shift(1)

max_val = data.Close.expanding().max()

data['N1_high'].fillna(value=max_val, inplace=True)

# N2天内最低价

data['N2_low'] = data.Low.rolling(window=N2).min()

data['N2_low'] = data.N2_low.shift(1)

min_val = data.Close.expanding().min()

data['N2_low'].fillna(value=min_val, inplace=True)

# ATR止盈止损判断

buy_price = 0

for k_index, today in data.iterrows():

tick = round(today.Close * 0.01, 2)

# 买入

if (today.Close - tick) > today.N1_high:

print('N day buy: {} {}'.format(k_index,today.Close))

buy_price = today.Close

data.loc[k_index, 'signal'] = 1

# 止损,收盘价少于买入价,卖出

elif (buy_price != 0) and (buy_price > today.Close + tick) and ((buy_price - today.Close - tick) > n_loss * today.atr14):

#print('stop loss: {} {} {}'.format(k_index, today.Close, buy_price))

data.loc[k_index, 'signal'] = 0

buy_price = 0

# 止盈:收盘价多于买入价,卖出

elif (buy_price != 0) and (buy_price < today.Close - tick) and ((today.Close - buy_price + tick) > n_win * today.atr14):

#print('stop win: {} {} {}'.format(k_index, today.Close, buy_price))

data.loc[k_index, 'signal'] = 0

buy_price = 0

elif today.Close + tick < today.N2_low:

#print('N day sell: {} {}'.format(k_index, today.Close))

data.loc[k_index, 'signal'] = 0

buy_price = 0

else:

pass

# 买入 / 卖出信号list

data['signal'].fillna(method='ffill', inplace = True)

data['signal'] = data.signal.shift(1)

data['signal'].fillna(method='bfill', inplace=True)

for k_index, today in data.iterrows():

# 买入/卖出 执行

if today.signal == 1 and self.hold_state == 0: # 买入

start = data.index.get_loc(k_index) # 区间开始日期

self.hold_state = -1

self.stock_num = int(self.init_money / today.Close) # 资金转化为股票

# 仓位管理

self.send_order(code=self.stock_code, amount=int(self.init_money * 0.01 / today.atr14),

price=today.Close, order_type='buy')

self.init_money = 0

self.graph_trade.annotate('买入',xy=(k_index,data.Close.asof(k_index)),

xytext=(k_index,data.Close.asof(k_index)+2),

arrowprops=dict(facecolor='r',shrink=0.1),

horizontalalignment='left',verticalalignment='top')

elif today.signal == 0 and self.hold_state == -1: # 卖出

end = data.index.get_loc(k_index)

# 手续费:印花税1‰,手续费5元

profit = self.stock_num * today.Close

fee = profit * 0.0001 - 5

self.init_money = round((profit - fee),1) # 股票转化为资金

self.hold_state = 0

self.market_value = 0

# 仓位管理

self.send_order(code=self.stock_code, amount=self.hold_available(code = "600410.SS"), price=today.Close, order_type='sell')

if data.Close[end] < data.Close[start]:

# 赔钱,绿色

self.graph_trade.fill_between(data.index[start:end],0,

data.Close[start:end],color='green',alpha=0.8)

else:

# 赚钱 红色

self.graph_trade.fill_between(data.index[start:end], 0,

data.Close[start:end], color='red', alpha=0.8)

self.graph_trade.annotate('卖出',xy=(k_index,data.Close.asof(k_index)),

xytext=(k_index+datetime.timedelta(days=5),

data.Close.asof(k_index)+2),

arrowprops=dict(facecolor='g',shrink=0.1),

horizontalalignment='left',verticalalignment='top')

latest_val = self.latest_assets(today.Close)

data.loc[k_index, 'total_position'] = latest_val

if self.hold_state == -1: # 持股状态

self.market_value = int(self.stock_num * today.Close)

data.loc[k_index, 'total'] = self.market_value

else: # 空仓

data.loc[k_index, 'total'] = self.init_money

print('total value is {}'.format(data['total'][-1]))

self.resultanalysis(data)

return data['total'][-1] # 每次返回

复制代码2. 蒙特卡洛优化算法优化策略输入参数

# 使用蒙特卡洛方法挑选出最优的N1,N2,止盈,止损点

# 25,5,2.3,0.7

def montcarlo(self,data, n):

n1_min, n1_max = 10, 30

n2_min, n2_max = 5, 15

win_min, win_max = 1.5, 3

loss_min, loss_max = 0.5, 1.2

ma_ls = []

profit_ls = []

# 每次随机生成一组N1,N2,止盈,止损倍数,循环N日择时策略并把每次执行策略的最终资产存入数组

# 最终得到n次执行后,得到最大资产的一组随机数,作为最优策略的输入参数

for i in range(0, n+1):

n1 = int(random.uniform(n1_min,n1_max))

n2 = int(random.uniform(n2_min, n2_max))

win = round(random.uniform(win_min, win_max),1)

loss = round(random.uniform(loss_min, loss_max),1)

ma_ls.append([n1,n2,win,loss])

# 策略代码

trade = QuantAnalysis()

profit_ls.append(trade.Nbreakstrategy(data, n1, n2, win, loss))

profit_max = max(profit_ls)

ma_max = ma_ls[profit_ls.index(profit_max)]

print("maximize the profit is %s and correspond parametes are %s " % (profit_max, ma_max))

return ma_ls

复制代码3. 基于ATR的仓位管理

# 仓位管理

self.send_order(code=self.stock_code, amount=int(self.init_money * 0.01 / today.atr14),price=today.Close, order_type='buy')

self.send_order(code=self.stock_code, amount=self.hold_available(code = "600410.SS"), price=today.Close, order_type='sell')

复制代码4. 滑点收盘价的1%

在每一次买入卖出,止盈止损的过程中加入滑点值,让结果没那么‘完美’,更符合实际的情况。

复制代码5. 印花税 1‰,手续费5元

在卖出时将印花税,手续费加入

profit = self.stock_num * today.Close

fee = profit * 0.0001 - 5

复制代码6. 结果生成图像:

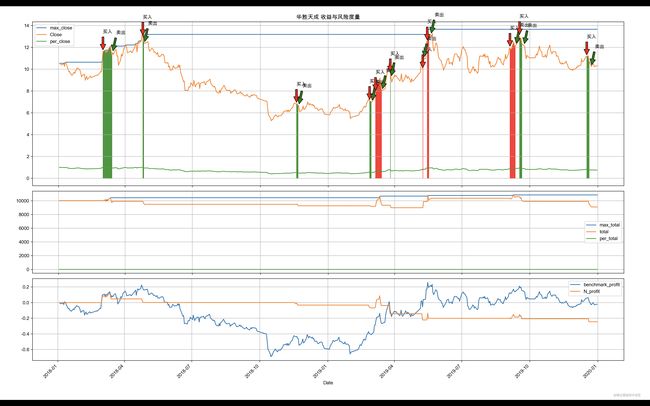

a. 买卖区间图

b. 基准收益/策略收益对比图

c. 总资产图(无策略的总资产+N日择时策略下的总资产+仓位管理的总资产+最大总资产)

无仓位管理,无手续费,经过蒙特卡洛筛选出最优N日择时策略后的执行结果图

复制代码

增加仓位管理,增加手续费后的结果图,可以对比看出仓位管理的优势,总资产比不实施仓位管理要高了很多

复制代码

从图中可以看出当买入点较高时,股票开始下跌,策略能够及时止损,本次策略使用的止损点为0.7,卖出时能够较好的获利,止盈点为2.3。

采用量化分析的方式,可以对一只股票的交易历史有一个很好的分析,通过模拟策略来进行买卖,检验自己策略的好坏,但是有个疑问,怎么