时序分析28 - 时序预测 格兰杰因果关系(中) python实践1

时序分析28 - 时序预测 - 格兰杰因果关系(中)

Python 实践 1

上一篇文章我们介绍了格兰杰因果关系的基本概念、背景以及相关统计检验法。本篇文章我们使用Python编程实践一下。

实践1:股票价格数据之间的格兰杰因果关系

问题:苹果公司今天的股价是否可以用来预测明天的特斯拉的股价? 数据:来自雅虎财经

import matplotlib.pyplot as plt

import seaborn as sns

import numpy as np

import pandas as pd

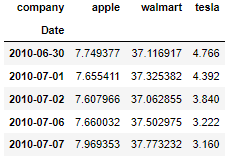

读入数据¶

df_apple = pd.read_csv('AAPL.csv')

df_walmart = pd.read_csv('WMT.csv')

df_tesla = pd.read_csv('TSLA.csv')

df = pd.merge(df_apple[['Date', 'Adj Close']], df_walmart[['Date', 'Adj Close']], on='Date', how='right').rename(columns = {'Adj Close_x':'apple', 'Adj Close_y':'walmart'})

df = df.merge(df_tesla[['Date', 'Adj Close']], on='Date', how='right').rename(columns={'Adj Close':'tesla'})

df['Date'] = pd.to_datetime(df['Date'])

df = df.set_index('Date').rename_axis('company', axis=1)

df.head()

可视化¶

df.plot(figsize=(16,8))

苹果和沃尔玛的股价趋势比较类似,而特斯拉在2020年增长了700%。

平稳性检测1:ADF Test

原假设:时序是不平稳的

备选假设:时序是平稳的

n_obs = 20

df_train, df_test = df[0:-n_obs], df[-n_obs:]

from statsmodels.tsa.stattools import adfuller

def adf_test(df):

result = adfuller(df.values)

print('ADF Statistics: %f' % result[0])

print('p-value: %f' % result[1])

print('Critical values:')

for key, value in result[4].items():

print('\t%s: %.3f' % (key, value))

print('ADF Test: Apple time series')

adf_test(df_train['apple'])

print('ADF Test: Walmart time series')

adf_test(df_train['walmart'])

print('ADF Test: Tesla time series')

adf_test(df_train['tesla'])

平稳性检验2:KPSS检验¶

原假设:时序是平稳的

备选假设:时序是非平稳的

from statsmodels.tsa.stattools import kpss

def kpss_test(df):

statistic, p_value, n_lags, critical_values = kpss(df.values)

print(f'KPSS Statistic: {statistic}')

print(f'p-value: {p_value}')

print(f'num lags: {n_lags}')

print('Critial Values:')

for key, value in critical_values.items():

print(f' {key} : {value}')

print('KPSS Test: Apple time series')

kpss_test(df_train['apple'])

print('KPSS Test: Walmart time series')

kpss_test(df_train['walmart'])

print('KPSS Test: Tesla time series')

kpss_test(df_train['tesla'])

这次p值都是小于0.05的,所以拒绝原假设,时序是不平稳的。

进行差分

import plotly.express as px

df_train_transformed = df_train.diff().dropna()

fig = px.line(df_train_transformed, facet_col="company", facet_col_wrap=1)

fig.update_yaxes(matches=None)

fig.show()

对差分后数据再次进行平稳性检验

print('ADF Test: Apple time series transformed')

adf_test(df_train_transformed['apple'])

print('ADF Test: Walmart time series transformed')

adf_test(df_train_transformed['walmart'])

print('ADF Test: Tesla time series transformed')

adf_test(df_train_transformed['tesla'])

ADF的结果告诉我们可以拒绝原假设,接受时序是平稳的这个结论。

print('KPSS Test: Apple time series transformed')

kpss_test(df_train_transformed['apple'])

print('KPSS Test: Walmart time series transformed')

kpss_test(df_train_transformed['walmart'])

print('KPSS Test: Tesla time series transformed')

kpss_test(df_train_transformed['tesla'])

KPSS检验的结果与ADF有些不同,它对Walmart的检验结果表明不能拒绝原假设,此时序仍然是非平稳的。

VAR 模型

我们先采用向量自回归模型(VAR,Vector AutoRegression),选择AIC最小的。

from statsmodels.tsa.api import VAR

model = VAR(df_train_transformed)

for i in [1,2,3,4,5,6,7,8,9,10,11,12,13,14,15]:

result = model.fit(i)

print('Lag Order =', i)

print('AIC : ', result.aic)

print('BIC : ', result.bic)

print('FPE : ', result.fpe)

print('HQIC: ', result.hqic, '\n')

results = model.fit(maxlags=15, ic='aic')

results.summary()

Summary of Regression Results

Model: VAR

Method: OLS

Date: Mon, 21, Mar, 2022

Time: 21:31:54

No. of Equations: 3.00000 BIC: 2.48026

Nobs: 2602.00 HQIC: 2.28193

Log likelihood: -13760.4 FPE: 8.75181

AIC: 2.16925 Det(Omega_mle): 8.30359

Results for equation apple

coefficient std. error t-stat prob

const 0.051964 0.016711 3.110 0.002

L1.apple -0.113389 0.022943 -4.942 0.000

L1.walmart -0.075488 0.017381 -4.343 0.000

L1.tesla 0.004845 0.004390 1.104 0.270

L2.apple -0.059288 0.023295 -2.545 0.011

L2.walmart -0.026432 0.017454 -1.514 0.130

L2.tesla 0.035496 0.004548 7.805 0.000

L3.apple -0.003051 0.023074 -0.132 0.895

L3.walmart -0.018981 0.017455 -1.087 0.277

L3.tesla 0.010515 0.004570 2.301 0.021

L4.apple 0.036423 0.023047 1.580 0.114

L4.walmart -0.064684 0.017453 -3.706 0.000

L4.tesla -0.001913 0.004607 -0.415 0.678

L5.apple 0.120294 0.023054 5.218 0.000

L5.walmart -0.032945 0.017523 -1.880 0.060

L5.tesla -0.022685 0.004599 -4.932 0.000

L6.apple -0.020840 0.023179 -0.899 0.369

L6.walmart 0.015391 0.017540 0.877 0.380

L6.tesla 0.000055 0.004675 0.012 0.991

L7.apple 0.091117 0.023229 3.923 0.000

L7.walmart 0.003089 0.017510 0.176 0.860

L7.tesla -0.005036 0.004670 -1.078 0.281

L8.apple -0.069914 0.023116 -3.024 0.002

L8.walmart -0.057101 0.017480 -3.267 0.001

L8.tesla 0.018022 0.004602 3.916 0.000

L9.apple 0.076160 0.023249 3.276 0.001

L9.walmart 0.018826 0.017526 1.074 0.283

L9.tesla -0.008462 0.004643 -1.822 0.068

L10.apple -0.070705 0.023322 -3.032 0.002

L10.walmart -0.039168 0.017570 -2.229 0.026

L10.tesla 0.019748 0.004621 4.273 0.000

L11.apple -0.095942 0.023370 -4.105 0.000

L11.walmart 0.002333 0.017561 0.133 0.894

L11.tesla 0.020593 0.004598 4.479 0.000

L12.apple 0.071664 0.023634 3.032 0.002

L12.walmart -0.025126 0.017564 -1.431 0.153

L12.tesla -0.013584 0.004647 -2.923 0.003

L13.apple 0.092046 0.023527 3.912 0.000

L13.walmart 0.005416 0.017561 0.308 0.758

L13.tesla -0.036568 0.004613 -7.927 0.000

L14.apple 0.094866 0.023734 3.997 0.000

L14.walmart -0.005898 0.017580 -0.335 0.737

L14.tesla -0.034932 0.004671 -7.478 0.000

L15.apple -0.046101 0.024021 -1.919 0.055

L15.walmart -0.005970 0.017522 -0.341 0.733

L15.tesla 0.003776 0.004729 0.799 0.425

Results for equation walmart

coefficient std. error t-stat prob

const 0.046477 0.020091 2.313 0.021

L1.apple -0.131216 0.027583 -4.757 0.000

L1.walmart -0.094210 0.020896 -4.508 0.000

L1.tesla 0.022162 0.005277 4.199 0.000

L2.apple 0.004741 0.028006 0.169 0.866

L2.walmart -0.032661 0.020984 -1.556 0.120

L2.tesla 0.007806 0.005467 1.428 0.153

L3.apple 0.017352 0.027741 0.625 0.532

L3.walmart -0.019084 0.020986 -0.909 0.363

L3.tesla 0.020965 0.005494 3.816 0.000

L4.apple -0.009350 0.027709 -0.337 0.736

L4.walmart -0.064853 0.020984 -3.091 0.002

L4.tesla 0.015744 0.005538 2.843 0.004

L5.apple 0.116771 0.027717 4.213 0.000

L5.walmart -0.041144 0.021067 -1.953 0.051

L5.tesla -0.008102 0.005529 -1.465 0.143

L6.apple 0.027990 0.027868 1.004 0.315

L6.walmart -0.030674 0.021088 -1.455 0.146

L6.tesla 0.003520 0.005621 0.626 0.531

L7.apple 0.095280 0.027927 3.412 0.001

L7.walmart 0.003876 0.021052 0.184 0.854

L7.tesla -0.012184 0.005614 -2.170 0.030

L8.apple -0.097662 0.027792 -3.514 0.000

L8.walmart -0.049246 0.021015 -2.343 0.019

L8.tesla 0.023160 0.005533 4.186 0.000

L9.apple 0.039667 0.027952 1.419 0.156

L9.walmart 0.048133 0.021071 2.284 0.022

L9.tesla 0.010389 0.005582 1.861 0.063

L10.apple -0.061275 0.028039 -2.185 0.029

L10.walmart 0.008151 0.021124 0.386 0.700

L10.tesla 0.004807 0.005556 0.865 0.387

L11.apple -0.043766 0.028097 -1.558 0.119

L11.walmart 0.047349 0.021112 2.243 0.025

L11.tesla 0.009937 0.005528 1.798 0.072

L12.apple 0.021889 0.028414 0.770 0.441

L12.walmart -0.034822 0.021116 -1.649 0.099

L12.tesla 0.007104 0.005587 1.271 0.204

L13.apple -0.012082 0.028286 -0.427 0.669

L13.walmart 0.011464 0.021114 0.543 0.587

L13.tesla -0.022868 0.005546 -4.123 0.000

L14.apple -0.047027 0.028534 -1.648 0.099

L14.walmart 0.008554 0.021136 0.405 0.686

L14.tesla -0.013390 0.005616 -2.384 0.017

L15.apple -0.040683 0.028880 -1.409 0.159

L15.walmart -0.019187 0.021066 -0.911 0.362

L15.tesla 0.002257 0.005686 0.397 0.691

Results for equation tesla

coefficient std. error t-stat prob

const 0.181504 0.082774 2.193 0.028

L1.apple -0.710340 0.113643 -6.251 0.000

L1.walmart -0.059560 0.086092 -0.692 0.489

L1.tesla 0.004835 0.021743 0.222 0.824

L2.apple -0.282365 0.115385 -2.447 0.014

L2.walmart -0.017891 0.086454 -0.207 0.836

L2.tesla 0.109113 0.022526 4.844 0.000

L3.apple 0.029439 0.114292 0.258 0.797

L3.walmart -0.030903 0.086462 -0.357 0.721

L3.tesla 0.129175 0.022636 5.707 0.000

L4.apple 0.207196 0.114161 1.815 0.070

L4.walmart -0.281576 0.086452 -3.257 0.001

L4.tesla -0.021823 0.022818 -0.956 0.339

L5.apple 0.530873 0.114193 4.649 0.000

L5.walmart -0.071527 0.086796 -0.824 0.410

L5.tesla -0.225666 0.022781 -9.906 0.000

L6.apple -0.336502 0.114814 -2.931 0.003

L6.walmart 0.166983 0.086882 1.922 0.055

L6.tesla -0.043649 0.023158 -1.885 0.059

L7.apple 0.432467 0.115061 3.759 0.000

L7.walmart -0.141216 0.086734 -1.628 0.103

L7.tesla -0.015612 0.023131 -0.675 0.500

L8.apple 0.462981 0.114502 4.043 0.000

L8.walmart 0.021005 0.086583 0.243 0.808

L8.tesla -0.062643 0.022796 -2.748 0.006

L9.apple 0.418652 0.115162 3.635 0.000

L9.walmart 0.276013 0.086811 3.179 0.001

L9.tesla -0.017033 0.022999 -0.741 0.459

L10.apple 0.034413 0.115520 0.298 0.766

L10.walmart -0.050803 0.087031 -0.584 0.559

L10.tesla 0.083882 0.022891 3.664 0.000

L11.apple -0.511340 0.115759 -4.417 0.000

L11.walmart 0.086088 0.086983 0.990 0.322

L11.tesla 0.143331 0.022774 6.294 0.000

L12.apple 0.333524 0.117064 2.849 0.004

L12.walmart 0.098182 0.086998 1.129 0.259

L12.tesla -0.047291 0.023019 -2.054 0.040

L13.apple 0.966669 0.116537 8.295 0.000

L13.walmart -0.203999 0.086987 -2.345 0.019

L13.tesla -0.072500 0.022851 -3.173 0.002

L14.apple 0.097180 0.117562 0.827 0.408

L14.walmart 0.026838 0.087079 0.308 0.758

L14.tesla -0.179990 0.023139 -7.779 0.000

L15.apple 0.267944 0.118983 2.252 0.024

L15.walmart -0.296672 0.086791 -3.418 0.001

L15.tesla -0.121926 0.023426 -5.205 0.000

Correlation matrix of residuals

apple walmart tesla

apple 1.000000 0.321701 0.431945

walmart 0.321701 1.000000 0.122985

tesla 0.431945 0.122985 1.000000

Apple & Tesla之间的相关性最大,值为 0.43

Durbin-Watson 检验

Durbin-Watson检验可以检查残差之间的自相关性。

from statsmodels.stats.stattools import durbin_watson

out = durbin_watson(results.resid)

for col, val in zip(df.columns, out):

print(col, ':', round(val, 2))

apple : 2.0

walmart : 2.0

tesla : 2.0

值为2表示没有检测出自相关性

格兰杰因果测试

from statsmodels.tsa.stattools import grangercausalitytests

maxlag=15

test = 'ssr_chi2test'

def grangers_causation_matrix(data, variables, test='ssr_chi2test', verbose=False):

df = pd.DataFrame(np.zeros((len(variables), len(variables))), columns=variables, index=variables)

for c in df.columns:

for r in df.index:

test_result = grangercausalitytests(data[[r, c]], maxlag=maxlag, verbose=False)

p_values = [round(test_result[i+1][0][test][1],4) for i in range(maxlag)]

if verbose: print(f'Y = {r}, X = {c}, P Values = {p_values}')

min_p_value = np.min(p_values)

df.loc[r, c] = min_p_value

df.columns = [var + '_x' for var in variables]

df.index = [var + '_y' for var in variables]

return df

grangers_causation_matrix(df_train_transformed, variables = df_train_transformed.columns)

上表中行y表示响应变量,x表示预测变量。每一个单元中的值表示p值;例如第一行第二列的p值为0 < 0.05,代表我们可以拒绝原假设,认为walmart_x对apple_y有格兰杰因果关系。上面的数据表明三个序列互为格兰杰因果关系。

预测

之前我们把数据进行了差分,现在我们需要将它转换回来。

lag_order = results.k_ar

df_input = df_train_transformed.values[-lag_order:]

df_forecast = results.forecast(y=df_input, steps=n_obs)

df_forecast = (pd.DataFrame(df_forecast, index=df_test.index, columns=df_test.columns + '_pred'))

def invert_transformation(df, pred):

forecast = df_forecast.copy()

columns = df.columns

for col in columns:

forecast[str(col)+'_pred'] = df[col].iloc[-1] + forecast[str(col)+'_pred'].cumsum()

return forecast

output = invert_transformation(df_train, df_forecast)

combined = pd.concat([output['apple_pred'], df_test['apple'], output['walmart_pred'], df_test['walmart'], output['tesla_pred'], df_test['tesla']], axis=1)

combined.head()

from sklearn.metrics import mean_squared_error

from sklearn.metrics import mean_absolute_error

rmse = mean_squared_error(combined['apple_pred'], combined['apple'])

mae = mean_absolute_error(combined['apple_pred'], combined['apple'])

print('Forecast accuracy of Apple')

print('RMSE: ', round(np.sqrt(rmse),2))

print('MAE: ', round(mae,2))

Forecast accuracy of Apple

RMSE: 7.31

MAE: 6.0

rmse = mean_squared_error(combined['walmart_pred'], combined['walmart'])

mae = mean_absolute_error(combined['walmart_pred'], combined['walmart'])

print('Forecast accuracy of Walmart')

print('RMSE: ', round(np.sqrt(rmse),2))

print('MAE: ', round(mae,2))

Forecast accuracy of Walmart

RMSE: 5.05

MAE: 4.52

rmse = mean_squared_error(combined['tesla_pred'], combined['tesla'])

mae = mean_absolute_error(combined['tesla_pred'], combined['tesla'])

print('Forecast accuracy of Tesla')

print('RMSE: ', round(np.sqrt(rmse),2))

print('MAE: ', round(mae,2))

Forecast accuracy of Tesla

RMSE: 125.16

MAE: 113.18