Backtrader 文档学习-Quickstart

Backtrader 文档学习-Quickstart

0. 前言

backtrader,功能十分完善,有完整的使用文档,安装相对简单(直接pip安装即可)。

优点是运行速度快,支持pandas的矢量运算;支持参数自动寻优运算,内置了talib股票分析技术指标库;支持多品种、多策略、多周期的回测和交易;支持pyflio、empyrica分析模块库、alphalens多因子分析模块库等;扩展灵活,可以集成TensorFlow、PyTorch和Keras等机器学习、神经网络分析模块。

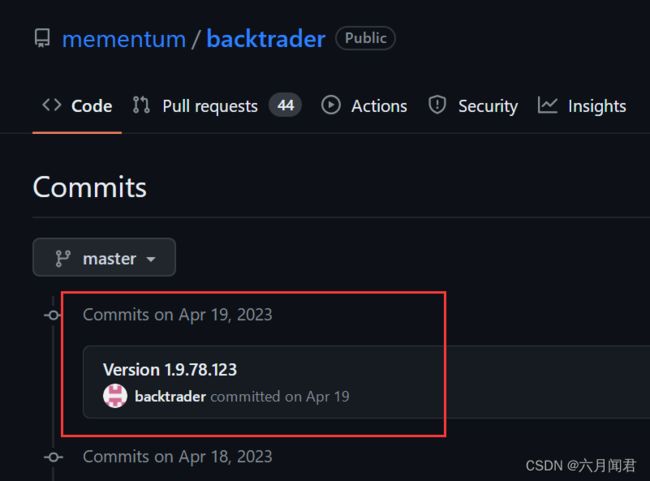

缺点:backtrader学习起来相对复杂,编程过程中使用了大量的元编程(类class),如果Python编程基础不扎实(尤其是类的操作),学习困难。另外一点,BackTrader不更新。(更正一下,GitHub上是更新的,2023-04-19 更新的最新版本1.9.78.123)

如果将backtrader包分解为核心组件,主要包括以下组成部分:

- (1)数据加载(Data Feed):将交易策略的数据加载到回测框架中。

- (2)交易策略(Strategy):该模块是编程过程中最复杂的部分,需要设计交易决策,得出买入/卖出信号。

- (3)回测框架设置( Cerebro):

需要设置:(i)初始资金(ii)佣金(iii)数据馈送(iv)交易策略(v)交易头寸大小。 - (4)运行回测:运行Cerebro回测并打印出所有已执行的交易。

- (5)评估性能(Analyzers):以图形和风险收益等指标对交易策略的回测结果进行评价。

官网说明资料详细,有演示用例,逐步跟着一步步学习。

Backtrader 官网文档

1. 两个基本概念

(1)Lines

“Lines”是backtrader回测的数据,由一系列的点组成,通常包括以下类别的数据:Open(开盘价), High(最高价), Low(最低价), Close(收盘价), Volume(成交量), OpenInterest(无的话设置为0)。Data Feeds(数据加载)、Indicators(技术指标)和Strategies(策略)都会生成 Lines。

价格数据中的所有”Open” (开盘价)按时间组成一条 Line。所以,一组含有以上6个类别的价格数据,共有6条 Lines。如果算上“DateTime”(时间,可以看作是一组数据的主键),一共有7条 Lines。当访问一条 Line 的数据时,会默认指向下标为 0 的数据。最后一个数据通过下标 -1 来访问,在-1之后是索引0,用于访问当前时刻。因此,在回测过程中,无需知道已经处理了多少条/分钟/天/月,”0”一直指向当前值,下标 -1 来访问最后一个值。

Lines包括一个或多个line,line是一系列的数据,在图中可以形成一条线(line),有6个列数据,就是股票的主要数据集,最后一列没有用。

Open, High, Low, Close, Volume, OpenInterest

包括索引列“DateTime”,日期时间类型,注意:Datetime类型,不是Date类型。

(2)Index 0 Approach

访问行中的值时,将使用索引0访问当前值;

“最后一个”输出值是用索引**-1**访问,index-1用于访问可迭代项/数组的“最后”项。

在Backtrader中提供了1个函数来度量已处理数据bar的长度:

len:返回当前系统已经处理的数据(bars)。这个和python标准的len定义差异。

(3)版本

通过 pip index versions backtrader 检查版本。

版本:backtrader (1.9.78.123)

pip index versions backtrader

WARNING: pip index is currently an experimental command. It may be removed/changed in a future release without prior warning.

backtrader (1.9.78.123)

Available versions: 1.9.78.123, 1.9.77.123, 1.9.76.123, 1.9.75.123, 1.9.74.123

2. 基本使用

(1)初始设置现金

cerebro.broker.setcash(100000.0)

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import backtrader as bt

if __name__ == '__main__':

cerebro = bt.Cerebro()

cerebro.broker.setcash(100000.0)

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.run()

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

因为没有任何策略,所以金额没有变化:

Starting Portfolio Value: 100000.00

Final Portfolio Value: 100000.00

(2)加载数据

示例使用的是Oracle的记录,实际使用,调整到国内数据。

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime # For datetime objects

import os.path # To manage paths

import sys # To find out the script name (in argv[0])

# Import the backtrader platform

import backtrader as bt

if __name__ == '__main__':

# Create a cerebro entity

cerebro = bt.Cerebro()

# Datas are in a subfolder of the samples. Need to find where the script is

# because it could have been called from anywhere

modpath = os.path.dirname(os.path.abspath(sys.argv[0]))

datapath = os.path.join(modpath, '../../datas/orcl-1995-2014.txt')

# Create a Data Feed

data = bt.feeds.YahooFinanceCSVData(

dataname=datapath,

# Do not pass values before this date

fromdate=datetime.datetime(2000, 1, 1),

# Do not pass values after this date

todate=datetime.datetime(2000, 12, 31),

reverse=False)

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

编写一个从数据库中取数据的函数使用:

注意:数据库中交易日期是date ,backtrader的数据集要求是datetime ,必须做好转换才能载入数据。

from sqlalchemy import create_engine

def get_code (stock_code):

engine_ts = create_engine(connect parameter)

# 执行sql操作

sql = "select * from ts_stock t where t.stock_code=" + stock_code + ";"

#stock_data = pd.read_sql(sql, con=engine_ts,index_col="date")

#因为BackTrader日期类型必须是datetime ,从数据库中读取的日期类型是date 。

# 读数据,先不设置索引

stock_data = pd.read_sql(sql, con=engine_ts) # ,index_col="date"

# 增加一列,select 字段名是date,赋值到trade_date,同时转datetime类型

stock_data['trade_date'] = pd.to_datetime(stock_data['date'], format='%Y%m%d %H:%M:%S')

# 删除原来的date列

stock_data.drop(columns=['date'])

# 新datetime列作为索引列

stock_data.set_index(['trade_date'], inplace=True)

# 索引列改名

stock_data.index.name='date'

# 按backtrader 格式要求,第7列openinterest ,也可以不用

# stock_data['openinterest'] = 0

data = stock_data.sort_index(ascending=True)

engine_ts.dispose()

return(data)

if __name__ == '__main__':

# Create a cerebro entity

cerebro = bt.Cerebro()

stock_hfq_df = get_code('000858')

#起止时间

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

(3)第一个策略 买入

在init方法中,可以使用载入的数据集,第一个数据是列表 self.datas[0] ,最后一个是 self.datas[-1] 。

self.dataclose=self.datas[0]。赋值close的引用,以后只需要一个间接引用dataclose ,就可以访问收盘值。

策略next方法将在系统时钟的每个bar上调用(self.datas[0]),直到符合策略条件,比如指标值设置,才能开始产生输出。

策略:

连续下跌三天,开始买入。

策略实施在next()方法中。

## 3.第一个策略

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime # For datetime objects

import os.path # To manage paths

import sys # To find out the script name (in argv[0])

# Import the backtrader platform

import backtrader as bt

# Create a Stratey

class TestStrategy(bt.Strategy):

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

if __name__ == '__main__':

# Create a cerebro entity

# delete log file

log_file = './bt_log.txt'

delete_file(log_file)

cerebro = bt.Cerebro()

# Add a strategy

cerebro.addstrategy(TestStrategy)

# 五粮液测试

stock_hfq_df = get_code('000858')

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

调整:

输出都是close数据,数据显示比较多,都放到log文件中。 日志路径:

log_file = ‘./bt_log.txt’

修改TestStrategy 中的log方法,日志写入文件,便于查询。后不赘述。

## 3.第一个策略

from __future__ import (absolute_import, division, print_function,

unicode_literals)

import datetime # For datetime objects

import os.path # To manage paths

import sys # To find out the script name (in argv[0])

# Import the backtrader platform

import backtrader as bt

import os

# delete log file

def delete_file(filename):

# if log file exist

if os.path.exists(filename):

os.remove(filename)

# Create a Stratey

class TestStrategy(bt.Strategy):

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

if __name__ == '__main__':

# delete log file

log_file = './bt_log.txt'

delete_file(log_file)

# Create a cerebro entity

cerebro = bt.Cerebro()

# Add a strategy

cerebro.addstrategy(TestStrategy)

stock_hfq_df = get_code('000858')

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

执行后,没有交易过程记录,都在日志文件中显示:

Starting Portfolio Value: 100000.00

Final Portfolio Value: 100000.00

再增加策略中的逻辑:

策略:连续三天下跌,开始买入操作

# Create a Stratey

class TestStrategy(bt.Strategy):

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

#Open, High, Low, Close, Volume, OpenInterest

self.dataclose = self.datas[0].close

self.dataopen = self.datas[0].open

self.datahigh = self.datas[0].high

self.datalow = self.datas[0].low

self.datavol = self.datas[0].volume

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

if self.dataclose[0] < self.dataclose[-1]:

# current close less than previous close

if self.dataclose[-1] < self.dataclose[-2]:

# previous close less than the previous close

# BUY, BUY, BUY!!! (with all possible default parameters)

self.log('BUY CREATE, %.2f' % self.dataclose[0])

self.buy()

说明:

- self.datas[0] 就是购买的股票。

- 默认购买单位是1,每次买1股 。position

sizer属性来记录,缺省值为1,就是每一次操作只买卖1股。当前order订单执行的时候,采用的价格是触发购买条件第二天的开盘价。

2018-01-02, Close, 80.58

2018-01-03, Close, 80.90

2018-01-04, Close, 82.99

2018-01-05, Close, 82.68

2018-01-08, Close, 82.20

2018-01-08, BUY CREATE, 82.20

2018-01-09, Close, 86.10

2018-01-10, Close, 88.90

5号第一天下跌,8日第二天连续下跌,触发购买信号,购买价格就是8号的收盘价,就是9日的开盘价。

- 当前order执行的时候,没有收佣金。佣金如何设置后续还会说明。

可以看Strategy类有什么方法、属性:

method = ""

for i in dir(bt.Strategy):

if i[:1] != '_' :

method += i + ','

print(method)

方法和属性:

IndType,ObsType,PriceClose,PriceDateTime,PriceHigh,PriceLow,PriceOpen,PriceOpenInteres,PriceVolume,StratType,add_timer,addindicator,addminperiod,advance,alias,aliased,array,backwards,bind2line,bind2lines,bindlines,buy,buy_bracket,cancel,clear,close,csv,extend,forward,frompackages,getdatabyname,getdatanames,getindicators,getindicators_lines,getobservers,getposition,getpositionbyname,getpositions,getpositionsbyname,getsizer,getsizing,getwriterheaders,getwriterinfo,getwritervalues,home,incminperiod,linealias,lines,minbuffer,next,next_open,nextstart,nextstart_open,notify_cashvalue,notify_data,notify_fund,notify_order,notify_store,notify_timer,notify_trade,once,oncestart,order_target_percent,order_target_size,order_target_value,packages,params,plotinfo,plotlabel,plotlines,position,positionbyname,positions,positionsbyname,prenext,prenext_open,preonce,qbuffer,reset,rewind,sell,sell_bracket,set_tradehistory,setminperiod,setsizer,sizer,start,stop,updateminperiod,

(4)还要卖出

- Strategy对象提供了对默认数据的位置属性的访问

- 方法buy和sell 都创建(尚未执行)执行订单

- Strategy订单状态的变化将通过notify 方法调用

- 卖出策略是:持仓5天,在第6天卖出

# 4.不但买入,还要卖出

# Create a Stratey

class TestStrategy(bt.Strategy):

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

#Open, High, Low, Close, Volume, OpenInterest

self.dataclose = self.datas[0].close

self.dataopen = self.datas[0].open

self.datahigh = self.datas[0].high

self.datalow = self.datas[0].low

self.datavol = self.datas[0].volume

# To keep track of pending orders

self.order = None

def notify_order(self, order):

# 买卖订单的状态:提交和接受,通过broker控制

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

# broker如果资金不足将reject订单

#订单状态是完成

if order.status in [order.Completed]:

#判断是买单,写日志

if order.isbuy():

self.log('BUY EXECUTED, %.2f' % order.executed.price)

#判读是卖单,写日志

elif order.issell():

self.log('SELL EXECUTED, %.2f' % order.executed.price)

#定义bar_executed 变量,记录处理bar的数量

#len:返回当前系统已经处理的数据(bars)。这个和python标准的len定义差异。

self.bar_executed = len(self)

self.bar_buffer = lenbuf(self)

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

# Write down: no pending order

self.order = None

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market

if not self.position:

# Not yet ... we MIGHT BUY if ...

#连续两天下跌,开始买入

if self.dataclose[0] < self.dataclose[-1]:

# current close less than previous close

if self.dataclose[-1] < self.dataclose[-2]:

# previous close less than the previous close

# BUY, BUY, BUY!!! (with default parameters)

self.log('BUY CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

if len(self) >= (self.bar_executed + 5):

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log('SELL CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

if __name__ == '__main__':

# delete log file

log_file = './bt_log.txt'

delete_file(log_file)

# Create a cerebro entity

cerebro = bt.Cerebro()

# Add a strategy

cerebro.addstrategy(TestStrategy)

stock_hfq_df = get_code('000858')

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

执行流程,每次买卖数量都是1股:

5日下跌,6日下跌,创建买单,9日执行买单,是9日的开盘价。

买单时,处理的是6个bar 。

从10日开始,到16日是持仓第5天,创建卖单,17日,开盘卖出。

执行结果:

2018-01-02, Close, 80.58

2018-01-03, Close, 80.90

2018-01-04, Close, 82.99

2018-01-05, Close, 82.68

2018-01-08, Close, 82.20

2018-01-08, BUY CREATE, 82.20

2018-01-09, BUY EXECUTED, 82.40

2018-01-09, Bar executed :6

2018-01-09, Close, 86.10

2018-01-10, Close, 88.90

2018-01-11, Close, 87.96

2018-01-12, Close, 91.37

2018-01-15, Close, 91.75

2018-01-16, Close, 90.82

2018-01-16, SELL CREATE, 90.82

2018-01-17, SELL EXECUTED, 90.30

2018-01-17, Bar executed :12

... ...

... ...

... ...

订单的状态是通过Order对象的status属性来表示的。status属性可以是以下几个值之一:

- Order.Submitted:订单已提交,但尚未成交。

- Order.Accepted:订单已被接受,正在等待成交。

- Order.Completed:订单已完全成交。

- Order.Canceled:订单已取消。

- Order.Margin:订单由于保证金不足而被拒绝。

- Order.Rejected:订单被拒绝,原因可能是无效的价格、数量等。

(5)考虑券商佣金

在main函数中增加

# Set the commission - 0.1% ... divide by 100 to remove the %

cerebro.broker.setcommission(commission=0.001)

修改后的策略:

增加 方法 def notify_trade(self, trade):

用于计算毛利和纯利 ,通过trade对象计算。

查看在backtrader 目录下的trade.py源码:

定义属性:

pnl定义毛利,pnlcomm定义毛利-佣金

Attributes:

- ``status`` (``dict`` with '.' notation): Holds the resulting status of

an update event and has the following sub-attributes

- ``status`` (``int``): Trade status

- ``dt`` (``float``): float coded datetime

- ``barlen`` (``int``): number of bars the trade has been active

- ``size`` (``int``): current size of the Trade

- ``price`` (``float``): current price of the Trade

- ``value`` (``float``): current monetary value of the Trade

- ``pnl`` (``float``): current profit and loss of the Trade

- ``pnlcomm`` (``float``): current profit and loss minus commission

- ``event`` (``dict`` with '.' notation): Holds the event update

- parameters

- ``order`` (``object``): the order which initiated the``update``

- ``size`` (``int``): size of the update

- ``price`` (``float``):price of the update

- ``commission`` (``float``): price of the update

'''

#5. 考虑佣金

# Create a Stratey

class TestStrategy(bt.Strategy):

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

#Open, High, Low, Close, Volume, OpenInterest

self.dataclose = self.datas[0].close

self.dataopen = self.datas[0].open

self.datahigh = self.datas[0].high

self.datalow = self.datas[0].low

self.datavol = self.datas[0].volume

# To keep track of pending orders

self.order = None

# To keep track of pending orders and buy price/commission

self.order = None

self.buyprice = None

self.buycomm = None

# 统计毛利和净利润

self.gross = 0.0

self.net = 0.0

def notify_order(self, order):

# 买卖订单的状态:提交和接受,通过broker控制

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

# broker如果资金不足将reject订单

#订单状态是完成

if order.status in [order.Completed]:

#判断是买单,写日志

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

#判读是卖单,写日志

elif order.issell():

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

#定义bar_executed 变量,记录处理bar的数量

#len:返回当前系统已经处理的数据(bars)。这个和python标准的len定义差异。

self.bar_executed = len(self)

#日志显示处理的bar数量,逐渐递增。

strlog = 'Bar executed :' + str(self.bar_executed)

self.log(strlog)

# 订单取消、保证金不足、退回

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

# Write down: no pending order

# 处理完订单,无挂起订单,重置订单为空

self.order = None

def notify_trade(self, trade):

# 如果不是平仓,返回

if not trade.isclosed:

return

# 平仓计算成本和利润

self.log('OPERATION PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

# 累计毛利和净利润

self.gross += trade.pnl

self.net =+ trade.pnlcomm

self.log ('Accumulated profit,GROSS %.2f, NET %.2f' % (self.gross,self.net))

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market

if not self.position:

# Not yet ... we MIGHT BUY if ...

#连续两天下跌,开始买入

if self.dataclose[0] < self.dataclose[-1]:

# current close less than previous close

if self.dataclose[-1] < self.dataclose[-2]:

# previous close less than the previous close

# BUY, BUY, BUY!!! (with default parameters)

self.log('BUY CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

# 持仓5天

if len(self) >= (self.bar_executed + 5):

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log('SELL CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

执行结果:

Starting Portfolio Value: 100000.00

Final Portfolio Value: 100040.35

日志内容:

2018-01-02, Close, 80.58

2018-01-03, Close, 80.90

2018-01-04, Close, 82.99

2018-01-05, Close, 82.68

2018-01-08, Close, 82.20

2018-01-08, BUY CREATE, 82.20

2018-01-09, BUY EXECUTED, Price: 82.40, Cost: 82.40, Comm 0.01

2018-01-09, Bar executed :6

2018-01-09, Close, 86.10

2018-01-10, Close, 88.90

2018-01-11, Close, 87.96

2018-01-12, Close, 91.37

2018-01-15, Close, 91.75

2018-01-16, Close, 90.82

2018-01-16, SELL CREATE, 90.82

2018-01-17, SELL EXECUTED, Price: 90.30, Cost: 82.40, Comm 0.01

2018-01-17, Bar executed :12

2018-01-17, OPERATION PROFIT, GROSS 7.90, NET 7.88

2018-01-17, Accumulated profit,GROSS 7.90, NET 7.88

2018-01-17, Close, 86.01

... ...

... ...

2019-12-12, BUY CREATE, 127.78

2019-12-13, BUY EXECUTED, Price: 128.58, Cost: 128.58, Comm 0.01

2019-12-13, Bar executed :475

2019-12-13, Close, 129.52

2019-12-16, Close, 128.83

2019-12-17, Close, 130.25

2019-12-18, Close, 130.94

2019-12-19, Close, 129.86

2019-12-20, Close, 129.10

2019-12-20, SELL CREATE, 129.10

2019-12-23, SELL EXECUTED, Price: 127.50, Cost: 128.58, Comm 0.01

2019-12-23, Bar executed :481

2019-12-23, OPERATION PROFIT, GROSS -1.08, NET -1.11

2019-12-23, Accumulated profit,GROSS 36.59, NET -1.11

2019-12-23, Close, 128.14

2019-12-23, BUY CREATE, 128.14

2019-12-24, BUY EXECUTED, Price: 128.44, Cost: 128.44, Comm 0.01

2019-12-24, Bar executed :482

2019-12-24, Close, 128.70

2019-12-25, Close, 128.10

2019-12-26, Close, 128.15

2019-12-27, Close, 129.00

2019-12-30, Close, 132.82

2019-12-31, Close, 133.01

2019-12-31, SELL CREATE, 133.01

可以看出

2018-01-17, SELL EXECUTED, Price: 90.30, Cost: 82.40, Comm 0.01

盈利:90.30 - 82.40 = 7.90元,佣金0.01

2018-01-17, OPERATION PROFIT, GROSS 7.90, NET 7.88

毛利:7.90元 ,买卖两次,佣金0.02

净利润:7.90 - 0.02 = 7.88 元

(6)优化策略参数

在main函数中增加,每次购买10股,默认是1股。

# Add a FixedSize sizer according to the stake cerebro.addsizer(bt.sizers.FixedSize, stake=10)

在TestStrategy(bt.Strategy) 类定义中,增加参数。

params = (

('exitbars', 5),

)

用于持仓天数,默认是5天。

修改后代码:

#6. 优化参数

# Create a Stratey

class TestStrategy(bt.Strategy):

params = (

('exitbars', 5),

)

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

#Open, High, Low, Close, Volume, OpenInterest

self.dataclose = self.datas[0].close

self.dataopen = self.datas[0].open

self.datahigh = self.datas[0].high

self.datalow = self.datas[0].low

self.datavol = self.datas[0].volume

# To keep track of pending orders

self.order = None

# To keep track of pending orders and buy price/commission

self.order = None

self.buyprice = None

self.buycomm = None

# 统计毛利和净利润

self.gross = 0.0

self.net = 0.0

def notify_order(self, order):

# 买卖订单的状态:提交和接受,通过broker控制

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

# broker如果资金不足将reject订单

#订单状态是完成

if order.status in [order.Completed]:

#判断是买单,写日志

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

#判读是卖单,写日志

elif order.issell():

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

#定义bar_executed 变量,记录处理bar的数量

#len:返回当前系统已经处理的数据(bars)。这个和python标准的len定义差异。

self.bar_executed = len(self)

#日志显示处理的bar数量,逐渐递增。

strlog = 'Bar executed :' + str(self.bar_executed)

self.log(strlog)

# 订单取消、保证金不足、退回

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

# Write down: no pending order

# 处理完订单,无挂起订单,重置订单为空

self.order = None

def notify_trade(self, trade):

# 如果不是平仓,返回

if not trade.isclosed:

return

# 平仓计算成本和利润

self.log('OPERATION PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

# 累计毛利和净利润

self.gross += trade.pnl

self.net =+ trade.pnlcomm

self.log ('Accumulated profit,GROSS %.2f, NET %.2f' % (self.gross,self.net))

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market

if not self.position:

# Not yet ... we MIGHT BUY if ...

#连续两天下跌,开始买入

if self.dataclose[0] < self.dataclose[-1]:

# current close less than previous close

if self.dataclose[-1] < self.dataclose[-2]:

# previous close less than the previous close

# BUY, BUY, BUY!!! (with default parameters)

self.log('BUY CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

# 持仓5天

if len(self) >= (self.bar_executed + self.params.exitbars):

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log('SELL CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

if __name__ == '__main__':

# delete log file

log_file = './bt_log.txt'

delete_file(log_file)

# Create a cerebro entity

cerebro = bt.Cerebro()

# Add a strategy

cerebro.addstrategy(TestStrategy)

stock_hfq_df = get_code('111969')

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Set the commission - 0.1% ... divide by 100 to remove the %

# 按万一的佣金 ,买卖操作都要扣除

cerebro.broker.setcommission(commission=0.0001)

# Add a FixedSize sizer according to the stake

cerebro.addsizer(bt.sizers.FixedSize, stake=10)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

执行输出结果:

Starting Portfolio Value: 100000.00

Final Portfolio Value: 100403.51

由于每次购买10股,盈利增加。

日志:

2018-01-02, Close, 80.58

2018-01-03, Close, 80.90

2018-01-04, Close, 82.99

2018-01-05, Close, 82.68

2018-01-08, Close, 82.20

2018-01-08, BUY CREATE, 82.20

2018-01-09, BUY EXECUTED, Price: 82.40, Cost: 824.00, Comm 0.08

2018-01-09, Bar executed :6

2018-01-09, Close, 86.10

2018-01-10, Close, 88.90

2018-01-11, Close, 87.96

2018-01-12, Close, 91.37

2018-01-15, Close, 91.75

2018-01-16, Close, 90.82

2018-01-16, SELL CREATE, 90.82

2018-01-17, SELL EXECUTED, Price: 90.30, Cost: 824.00, Comm 0.09

2018-01-17, Bar executed :12

2018-01-17, OPERATION PROFIT, GROSS 79.00, NET 78.83

2018-01-17, Accumulated profit,GROSS 79.00, NET 78.83

2018-01-17, Close, 86.01

一次买卖,平仓后,净利润和毛利都增加。

(7)增加指示器indicator

上面的例子,买入是连跌三天,卖出是持仓5天。策略简单粗暴。

通过indicator的均线,做买入卖出指标,更加合理一点。

- 如果收盘价高于平均值,则买入

- 如果收盘价小于平均值,则卖出

- 只允许1个交易活动操作,买一单,卖出一单的模式

修改内容:

- 策略增加参数,SMA周期参数,默认设置30日 。

params = ( ('maperiod', 30),('exitbars', 5), )

- 在next方法中,调整买卖的判断。

#7. 使用指示器

# Create a Stratey

class TestStrategy(bt.Strategy):

params = (

('maperiod', 30),('exitbars', 5),

)

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

#Open, High, Low, Close, Volume, OpenInterest

self.dataclose = self.datas[0].close

self.dataopen = self.datas[0].open

self.datahigh = self.datas[0].high

self.datalow = self.datas[0].low

self.datavol = self.datas[0].volume

# To keep track of pending orders

self.order = None

# To keep track of pending orders and buy price/commission

self.order = None

self.buyprice = None

self.buycomm = None

# 统计毛利和净利润

self.gross = 0.0

self.net = 0.0

# Add a MovingAverageSimple indicator

# 使用简单移动平均线确定买入和卖出操作

self.sma = bt.indicators.SimpleMovingAverage(

self.datas[0], period=self.params.maperiod)

def notify_order(self, order):

# 买卖订单的状态:提交和接受,通过broker控制

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

# broker如果资金不足将reject订单

#订单状态是完成

if order.status in [order.Completed]:

#判断是买单,写日志

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

#判读是卖单,写日志

elif order.issell():

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

#定义bar_executed 变量,记录处理bar的数量

#len:返回当前系统已经处理的数据(bars)。这个和python标准的len定义差异。

self.bar_executed = len(self)

#日志显示处理的bar数量,逐渐递增。

strlog = 'Bar executed :' + str(self.bar_executed)

self.log(strlog)

# 订单取消、保证金不足、退回

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

# Write down: no pending order

# 处理完订单,无挂起订单,重置订单为空

self.order = None

def notify_trade(self, trade):

# 如果不是平仓,返回

if not trade.isclosed:

return

# 平仓计算成本和利润

self.log('OPERATION PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

# 累计毛利和净利润

self.gross += trade.pnl

self.net =+ trade.pnlcomm

self.log ('Accumulated profit,GROSS %.2f, NET %.2f' % (self.gross,self.net))

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market

if not self.position:

# Not yet ... we MIGHT BUY if ...

#收盘穿过简单平均移动线,买入

if self.dataclose[0] > self.sma[0]:

# current close less than previous close

if self.dataclose[-1] < self.dataclose[-2]:

# previous close less than the previous close

# BUY, BUY, BUY!!! (with default parameters)

self.log('BUY CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

#收盘穿过简单平均移动线,买入

if self.dataclose[0] < self.sma[0]:

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log('SELL CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

if __name__ == '__main__':

# delete log file

log_file = './bt_log.txt'

delete_file(log_file)

# Create a cerebro entity

cerebro = bt.Cerebro()

# Add a strategy

cerebro.addstrategy(TestStrategy)

stock_hfq_df = get_code('111969')

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Set the commission - 0.1% ... divide by 100 to remove the %

# 按万一的佣金 ,买卖操作都要扣除

cerebro.broker.setcommission(commission=0.0001)

# Add a FixedSize sizer according to the stake

cerebro.addsizer(bt.sizers.FixedSize, stake=10)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

执行结果:

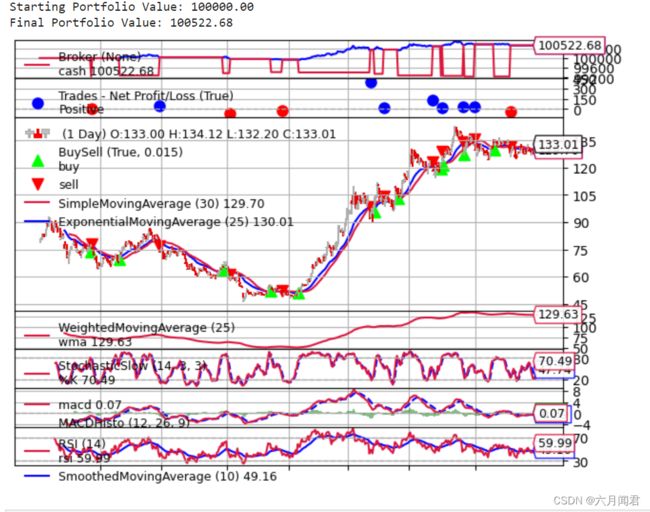

Starting Portfolio Value: 100000.00

Final Portfolio Value: 100522.68

比简单判断下跌买入,持仓5天卖出的策略,收益高119.17。

Starting Portfolio Value: 100000.00

Final Portfolio Value: 100403.51

(8)可视化

内置的plot方法,参数如下:

def plot(self, plotter=None, numfigs=1, iplot=True, start=None, end=None, width=16, height=9, dpi=300, tight=True, use=None, **kwargs):

说明:如果在jupyter中直接绘图,报错

cerebro.plot()

报错:Javascript Error: IPython is not defined

解决方法:

%matplotlib inline

调用绘图:

cerebro.plot(iplot=False)

在jupyter中可以绘图。

在init方法中增加绘图指示器指标:

# Indicators for the plotting show

bt.indicators.ExponentialMovingAverage(self.datas[0], period=25)

bt.indicators.WeightedMovingAverage(self.datas[0], period=25,

subplot=True)

bt.indicators.StochasticSlow(self.datas[0])

bt.indicators.MACDHisto(self.datas[0])

rsi = bt.indicators.RSI(self.datas[0])

bt.indicators.SmoothedMovingAverage(rsi, period=10)

bt.indicators.ATR(self.datas[0], plot=False)

#8. 可视化

# Create a Stratey

class TestStrategy(bt.Strategy):

params = (

('maperiod', 30),('exitbars', 5),

)

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

#print('%s, %s' % (dt.isoformat(), txt))

with open(log_file, 'a') as file:

file.write('%s, %s' % (dt.isoformat(), txt))

file.write('\n')

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

#Open, High, Low, Close, Volume, OpenInterest

self.dataclose = self.datas[0].close

self.dataopen = self.datas[0].open

self.datahigh = self.datas[0].high

self.datalow = self.datas[0].low

self.datavol = self.datas[0].volume

# To keep track of pending orders

self.order = None

# To keep track of pending orders and buy price/commission

self.order = None

self.buyprice = None

self.buycomm = None

# 统计毛利和净利润

self.gross = 0.0

self.net = 0.0

# Add a MovingAverageSimple indicator

# 使用简单移动平均线确定买入和卖出操作

self.sma = bt.indicators.SimpleMovingAverage(

self.datas[0], period=self.params.maperiod)

# Indicators for the plotting show

bt.indicators.ExponentialMovingAverage(self.datas[0], period=25)

bt.indicators.WeightedMovingAverage(self.datas[0], period=25,

subplot=True)

bt.indicators.StochasticSlow(self.datas[0])

bt.indicators.MACDHisto(self.datas[0])

rsi = bt.indicators.RSI(self.datas[0])

bt.indicators.SmoothedMovingAverage(rsi, period=10)

bt.indicators.ATR(self.datas[0], plot=False)

def notify_order(self, order):

# 买卖订单的状态:提交和接受,通过broker控制

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# Check if an order has been completed

# Attention: broker could reject order if not enough cash

# broker如果资金不足将reject订单

#订单状态是完成

if order.status in [order.Completed]:

#判断是买单,写日志

if order.isbuy():

self.log(

'BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

self.buyprice = order.executed.price

self.buycomm = order.executed.comm

#判读是卖单,写日志

elif order.issell():

self.log('SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f' %

(order.executed.price,

order.executed.value,

order.executed.comm))

#定义bar_executed 变量,记录处理bar的数量

#len:返回当前系统已经处理的数据(bars)。这个和python标准的len定义差异。

self.bar_executed = len(self)

#日志显示处理的bar数量,逐渐递增。

strlog = 'Bar executed :' + str(self.bar_executed)

self.log(strlog)

# 订单取消、保证金不足、退回

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log('Order Canceled/Margin/Rejected')

# Write down: no pending order

# 处理完订单,无挂起订单,重置订单为空

self.order = None

def notify_trade(self, trade):

# 如果不是平仓,返回

if not trade.isclosed:

return

# 平仓计算成本和利润

self.log('OPERATION PROFIT, GROSS %.2f, NET %.2f' %

(trade.pnl, trade.pnlcomm))

# 累计毛利和净利润

self.gross += trade.pnl

self.net =+ trade.pnlcomm

self.log ('Accumulated profit,GROSS %.2f, NET %.2f' % (self.gross,self.net))

def next(self):

# Simply log the closing price of the series from the reference

self.log('Close, %.2f' % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market

if not self.position:

# Not yet ... we MIGHT BUY if ...

#收盘穿过简单平均移动线,买入

if self.dataclose[0] > self.sma[0]:

# current close less than previous close

if self.dataclose[-1] < self.dataclose[-2]:

# previous close less than the previous close

# BUY, BUY, BUY!!! (with default parameters)

self.log('BUY CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

#收盘穿过简单平均移动线,买入

if self.dataclose[0] < self.sma[0]:

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log('SELL CREATE, %.2f' % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

%matplotlib inline

if __name__ == '__main__':

# delete log file

log_file = './bt_log.txt'

delete_file(log_file)

# Create a cerebro entity

cerebro = bt.Cerebro()

# Add a strategy

cerebro.addstrategy(TestStrategy)

stock_hfq_df = get_code('111969')

start_date = datetime.datetime(2015, 1, 1) # 回测开始时间

end_date = datetime.datetime(2019, 12, 31) # 回测结束时间

data = bt.feeds.PandasData(dataname=stock_hfq_df, fromdate=start_date, todate=end_date) # 加载数据

# Add the Data Feed to Cerebro

cerebro.adddata(data)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

# Set the commission - 0.1% ... divide by 100 to remove the %

# 按万一的佣金 ,买卖操作都要扣除

cerebro.broker.setcommission(commission=0.0001)

# Add a FixedSize sizer according to the stake

cerebro.addsizer(bt.sizers.FixedSize, stake=10)

# Print out the starting conditions

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

# Run over everything

cerebro.run()

# Print out the final result

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.plot(iplot=False)

#cerebro.plot() # Javascript Error: IPython is not defined