Nonterrestrial Networks (NTN) for 5G and Beyond

Overview

In this paper, we’ll take a look at the current state of NTNs, some of the new applications being explored, and crucially, the technical challenges that we’ll need to overcome to make it a viable market. Finally, we’ll get an overview of the work NI is doing with NTN to achieve effective and efficient test that can be such a crucial part in the design, development, and implementation of satellite communications.

Contents

What Is NTN?

Why Nonterrestrial Networks?

NTN Use-Cases

NTN Capabilities and Technical Challenges

NI Solutions for NTN

Conclusion

Next Steps

What Is NTN?

Nonterrestrial Networks are wireless communication systems that operate above the Earth’s surface, involving satellites at low Earth orbit (LEO), medium Earth orbit (MEO) and geostationary orbit (GEO), high-altitude platforms (HAPS) and drones. Let’s begin by clarifying some satellite communications terminology. While NTN is a form of satellite communication, it’s just a portion of a wider set of applications that includes military, defense, research, and private aerospace. For this paper, we’ll use the term “NTN” to refer to the different commercial wireless use-cases (broadband data networks, narrowband data expansion (Internet of Things [IoT]-NTN/SOS), and emerging nonterrestrial cellular networks) that encompass most of the recent developments in NTN.

Whether NTN is appropriate for certain commercial applications depends on the challenges it is needed to solve. And, largely, these challenges depend on the location and population density (and, therefore, existing infrastructure) where it is being implemented. For example, more well-developed areas will not use NTN to connect people and their devices to the wider cellular network, but it can provide connection for large-scale IoT devices or provide connectivity in emergencies.

| Device Location | Use-Case |

|---|---|

| Urban | 1、Overlay and traffic overload 2、Hotspot on demand 3、Network resilience and emergency 4、Fixed wireless access |

| Rural | 1、Network resilience and emergency 2、Fixed wireless access 3、Wide-area connectivity 4、Public protection and disaster relief (PPDR) |

| Remote | 1、 Network resilience 2、Backhaul 3、PPDR and emergency 4、Wide-area connectivity |

| Isolated | 1、Aeronautical 2、Maritime 3、Remote hotspots 4、PPDR and emergency |

Many of these use-cases require different satellite orbits to optimize the needs of a specific application. Different orbits introduce different technical challenges and can present trade-offs in performance and capabilities. For example, while farther orbits introduce higher latency, support lower throughput, and require much more power, they can cover a much larger surface area to provide connections in the most remote locations. The low throughput and high latency may be tolerable for low-bandwidth connections that otherwise would have no connectivity at all, but can introduce difficulties in a network supporting hundreds of simultaneous connections, with constant UL and DL traffic communications that require low latency. For this, LEO might be a better alternative, with the tradeoff that many more satellites are required to provide wide-ranging coverage. Different orbit types are shown in Table 2.

| Orbit | Beam Footprint (KM) | Roundtrip Delay (MS) | Orbit Distance | Orbit Time | Satellite Lifetime | Number of Satellites Required | Doppler, 2 GHZ, 45 Degree Elevation (KHZ) | Velocity (KM/S) |

|---|---|---|---|---|---|---|---|---|

| LEO | 50-1000 | 2-20 | 300 km to 3,000 km | 1.5 hours | 5-7 years | 30-60 | 72.9-61.5 | 6.5-7.7 |

| Medium Earth Orbit (MEO) | 100-1,000 | 47- 167 | 7,000 to 25,000 km | 2-8 hours | 5-10 years | 10-20 | 51.5-33.6 | 4-5 |

| Geostationary Earth Orbit (GEO) | Entire hemisphere (200-3,500) | 239 | 35,786 km | 24 hours | 10-15 years | 3-6 | 0 | 0 |

At first glance, the lack of Doppler shift, zero relative velocity, long life span, and area coverage of GEO may seem appealing. However, GEO introduces much greater delays and very large pathloss, and is much more expensive per satellite to achieve orbit distance than MEO or LEO. GEO accounts for about 12 percent of all satellites in orbit. Furthermore, targeted low data rate/low-bandwidth IoT use cases are delay-insensitive.

MEO provides a middle ground between GEO and LEO and is where GPS satellites orbit. Doppler and large pathloss are present, although manageable. While less expensive than GEO, typically, cost is still too high to be feasible for commercial applications.

LEO is at the opposite end of the spectrum from GEO. While Doppler shift is significant, latency is much lower, pathloss is the least of all orbit types, and, relatively speaking, it is inexpensive to put a satellite into LEO. In fact, most of the satellites being launched today will use LEO, and it holds appealing characteristics for many commercial applications. While it is gaining significant interest commercially, there are still many technical challenges that need to be overcome—and we’ll cover these later.

Another factor to consider for NTN implementation, apart from orbit type, is the frequency of operation. Not all frequencies are ideally suited across different orbit types—or even available, depending on regulations within a given region or country. For these reasons, NTN can span frequencies from the L band to the Ka band and even potentially into the E band.

| Band | Downlink | Uplink |

|---|---|---|

| Frequency Range | Bandwidth | |

| L band | 1,525 MHz-1,559 MHz | 34 MHz |

| S band | 2,170 MHz-2,200 MHz | 30 MHz |

| KU band | 10.7 GHz-12.7 GHz | 2 GHz |

| KA band | 17.3 GHz-20.3 GHz | 3 GHz |

| E band | 71.0 GHz-76.0 GHz | 5 GHz |

Table 3: NTN Frequencies and Bandwidths for UL and DL

Just like in terrestrial communications, modulation schemes, antennas, RF transceivers, and other factors can vary widely between low frequency and mmWave. It is worth noting in Table 3 that, although NTN frequencies are wide- ranging, NTN only operates with FDD due to the long round-trip times.

While this table summarizes the frequencies used for any sort of satellite communications, 3GPP has proposed a set of bands for use with standardized, commercial wireless applications.

| 3GPP Proposed Bands | Band | Uplink | Downlink | Duplex |

|---|---|---|---|---|

| 3GPP NTN FR1 (L band and S band) | n255 | 1,626.5 MHz-1,660.5 MHz | 1,525 MHz-1,559 MHz | FDD |

| 3GPP NTN FR1 (L band and S band) | n256 | 1,980 MHz-2,010 MHz | 2,170 MHz-2,200 MHz | FDD |

| 3GPP NTN FR2-0/FR2-1 (K band and KA band) VSAT | n510 | 17.7 GHz-20.2 GHz | 27.5 GHz-30 GHz | FDD |

| 3GPP NTN FR2-0/FR2-1 (K band and KA band) VSAT | n511 | 17.7 GHz-20.2 GHz | 28.35 GHz-30 GHz | FDD |

| 3GPP NTN FR2-0/FR2-1 (K band and KA band) VSAT | n512 | 17.7 GHz-20.2 GHz | 27.5 GHz-30 GHz | FDD |

Table 4: 3GPP Proposed Bands for NTN Communications

Why Nonterrestrial Networks?

Nonterrestrial networks (NTNs) have been around since the early days of satellite communications. Whether through GPS, satellite television, dedicated satcom equipment, or military and defense applications, the concept of connecting globally through a network of interconnected satellites has been proven and maintained for quite some time. However, it typically has been a complex and expensive endeavor requiring complex infrastructure, specialized RF technology, and dedicated systems for proper use. For this reason, commercialization was not feasible until recently.

NTN is at an inflection point in the commercial space. While 3GPP has offered standards or studies around NTN as far back as Rel-15, 5G NTN standards in Rel-17 and Rel-18 (5G Advanced) are gaining serious momentum and interest for practical use. Many cellular user equipment (UE) is enabled with some form of NTN capabilities, and the increase in both commercial and defense use cases has made operation more cost-effective. The cost per kilogram of placing something in orbit has decreased dramatically over the past few decades, and communications equipment now has more capability packed into less weight, leading to significant interest from cell network operators, UE manufacturers, operators of satellite constellations, and most commercial companies and defense contractors that operate as of part of the satellite communications supply chain.

Figure 1: Cost to Send a 1 kg Payload to LEO has Decreased by 100X over the Last Two Decades

Lower cost and more functionality per kilogram has led to a much more viable commercial space market. In the 1960s, sending 1 kilogram into low-earth orbit (LEO) cost around $10,000 USD. By 2006, that figure was $1,000—and some estimates predict a figure of around $50/kg in the next few decades.1 That drop equals a 200X decrease within approximately 60 years. Additionally, as chipsets and semiconductors become smaller and simultaneously more powerful, the cost of integrating the same capabilities into a satellite will fall at an even greater rate.

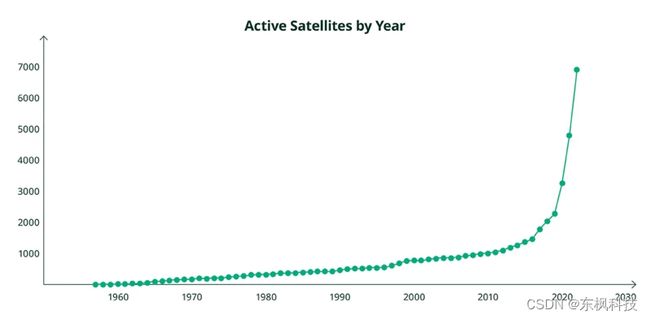

Another factor affecting the commercialization of space is the number of satellites launched into orbit. More satellites now launch every year because economies of scale have begun to take effect. Design, production, maintenance, and other factors all benefit from more satellites, as the total cost can be distributed among more satellites, lowering the cost per unit.

Figure 2: Number of Active Satellites by Year

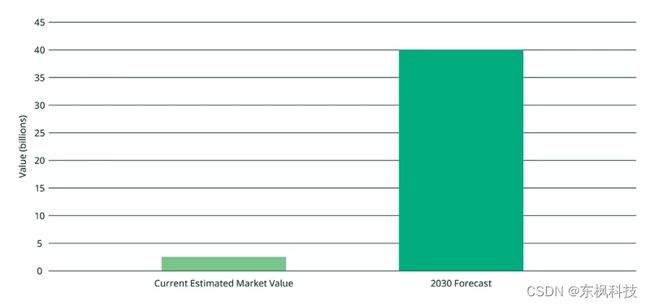

NTN technology will help to fuel this commercialization with its predicted growth over the next few decades. Estimates for market growth predict an increase to more than $40 billion by 2030

Figure 3: Estimated NTN Market Size by 2030

NTN Use-Cases

Within the NTN market, many types of companies play a part in the supply chain, operation, and development of NTN infrastructure. The expertise and primary needs addressed vary, but all are involved in the commercialization of space. These relationships can impact how component, subsystems, and device-level tests are performed.

To simplify and summarize a diverse and wide-ranging NTN market, we’ll generalize to group NTN use cases into three categories. While this generalization will not apply to all applications, we can use it to discuss the most common use cases and provide a summary of each.

-

Broadband Data Networks—This application includes private, broadband connectivity providers that use propriety equipment on a closed network. These networks usually require dedicated terminals or ground equipment for connection.

-

Narrowband Data Expansion (IoT-NTN/SOS)—This group includes existing networks that are providing more services to more users. Services could be large-scale, data-driven devices that connect from wide-ranging geographical regions, including meteorology/climatology, agricultural data collection, infrastructure monitoring, remote industrial equipment health, and perhaps the most relevant use case today: Emergency (SOS) connection to 5G UEs.

-

Emerging Nonterrestrial Cellular Networks—This application describes the use of commercial UEs with minimal or no significant changes made to their antennas or design, for both voice and data connections on a larger global communication network.

These categories encompass specific challenges (technical, operational, and political) that affect the full context of the NTN ecosystem. We’ll discuss them in the subsequent sections.

Broadband Data Networks

Networks in this category are characterized by their proprietary nature and the need for specialized proprietary ground terminals for connectivity. Various commercial, proprietary constellations have made significant progress over the last few years to provide users with broadband data connections from anywhere, at any time.

| Operator | Satellite System (Deployed) | Spectrum | Technology | Operational | Services |

|---|---|---|---|---|---|

| SpaceX (Starlink) | 12,000+ (3,580) | Ku band | Proprietary | Yes | Broadband |

| OneWeb | 648 (542) | Ku band | Proprietary | TBD | Broadband |

| Kuiper | 3,236 (0) | Ka band | Proprietary | Estimated 2024 | Broadband |

| GalaxySpace | 1,000 (7) | Q/V spectrum | Proprietary | TBD | Broadband |

| Boeing | 147 NGSO (1) | V band | Proprietary | TBD | TBD |

| Inmarsat | 14 GEO (14) | TBD | Proprietary | TBD | Broadband to loT |

| Telesat | 188 (2) | C, Ku, Ka bands | Proprietary | TBD | Broadband |

| EchoStar | 10 GEO (10) | Ku, Ka, S bands | Proprietary | Yes | Broadband |

| Hughesnet | 3 GEO (2) | Ka band | Proprietary | Yes | Broadband |

| Viasat | 4 GEO (4) | Ka band | Proprietary | Yes | Broadband |

Table 5: Overview of NTN Broadband Data Providers (Source: 5G Americas)

While these proprietary networks can provide strong and reliable connections, the closed infrastructure makes it difficult or impossible to integrate with existing UEs or cellular networks. This lack of integration means that terrestrial to nonterrestrial network links and shared connectivity for ubiquitous connections are made more difficult—or impossible. The potential cost reduction of these networks is also limited, as scalability is limited by the closed network. Lastly, they require dedicated, proprietary ground terminals, increasing operation, development, and maintenance costs.

While we’ve yet to see how the broadband data networks connect to existing terrestrial and nonterrestrial networks, broadband networks will continue to grow, and likely will be a part of NTN communications for the foreseeable future. In fact, 3GPP Rel-18 (5G Advanced) includes Ka-band support that may lead to a future of 3GPP NTN support for broadband data networks.

Narrowband Data Expansion (IoT-NTN/SOS)

Perhaps a first step towards unmodified UE connectivity with NTNs, we’ve seen significant exploration and development in this category over the past few years. Many applications fall under the umbrella of IoT-NTN–industrial monitoring, meteorological data collection, connected agricultural assets, and others—but one with perhaps the most significant impact to cellular communications is the incorporation of emergency (SOS) capabilities from modern flagship smartphones. In fact, many of the latest-generation UEs are enabled with some sort of emergency SMS or voice capability, providing a connection from anywhere and anytime with (mostly) unmodified UEs.

| Operator | Satellite System (Deployed) | Spectrum | Technology | Operational | Services |

|---|---|---|---|---|---|

| Dedicated providers | |||||

| SpaceX | 2,016 LEO (0) | MNO spectrum/ 2 GHz MSS | Pre-Rel-17 3GPP | 2024 | Messaging, Speech, Broadband |

| AST SpaceMobile | 243 LEO (1) | MNO spectrum | Pre-Rel-17 3GPP | 2024 | Messaging, Speech, Broadband |

| Lynk | 5,000 LEO (3) | MNO spectrum | Pre-Rel-17 3GPP | 2Q 2023 | Messaging, LDR (Low-Data Rate) |

| Sateliot | 250 LEO (1) | 2.0 GHz MSS | Rel-17 NB-loT (NB-NTN) | TBD | NB-loT |

| Iridium | 66 LEO | L band | Proprietary | Yes | LDR/Messaging |

| ORBCOMM | 31 LEO | 137-150 MHz | Proprietary | Yes | Assets Tracking |

| Globalstar | 24 LEO | L/S band | Proprietary | Yes | Assets Tracking |

| Ligado | 1 GEO | L band | Rel-17 NB-loT (NB-NTN) | TBD | NB-loT |

Partnerships

| T-Mobile/SpaceX | 2,016 LEO (0) | MNO spectrum | 3GPP-Rel 12 | 2024 | Messaging Data, Voice, Video |

|---|---|---|---|---|---|

| AT&T/AST | 243 LEO (1) | MNO spectrum | 3GPP-Rel 12 | 2024 | Messaging Data, Voice, Video |

| Verizon/Kuiper | 3,236 (0) | Ka band | Proprietary | TBD | Ground Sites Backhaul-LTE and 5G |

| Apple/Globalstar | 24 LEO | L band, S band | Proprietary | 4Q 2022 | Emergency Messaging |

| Qualcomm/Iridium | 66 LEO | L band | Proprietary | 4H 2023 | Messaging |

| MediaTek/Skylo/Bullitt | 6 GEO (Inmarsat) | L band | 3GPP-NTN | 1Q 2023 | Messaging |

| Skylo/Ligado/Viasat | 1 GEO (Ligado) | L band | 3GPP-NTN | 2H 2023 | NB-loT, Messaging, LDR |

Table 6: IoT Service Providers in 2023 (Source: 5G Americas)

NB/NTN will continue to become an increasingly important part of the global communications infrastructure. NB/NTN is laying the foundations and developing the critical technologies required for the next generation of NTNs, a 3GPP-standardized form of NTN.

Emerging Nonterrestrial Cellular Networks

There are two concurrent bodies of work that are exploring technologies and methodologies for emerging nonterrestrial cellular networks. These 3GPP-focused efforts also have had an impact on the previous two categories (3GPP Rel-18 for broadband and 3GPP Rel-17 for IoT use cases) and non-3GPP developments.

3GPP Efforts

This category of NTN use cases is perhaps furthest from widespread adoption because standardization on a common set of uses and applications is challenging—but it potentially can have the greatest effect on global communicate. This form of NTN involves high-throughput, ubiquitous connections to NTN networks from mostly unmodified 5G commercial UEs, and it will complement coverage with terrestrial base stations to provide greater connectivity and value to users. Timelines for standards creation and implementation are still unknown, as it could be a major topic in 3GPP Rel-19, Rel-20, or potentially later, because of difficulties anticipated in deployment. Challenges include global spectrum allocations, deploying network infrastructure for use in a harsh space environment, and developing connections to UE antennas that are not optimized or dedicated for NTN communications.

We expect that most networks in this category will provide coverage with LEO satellites, given the higher potential throughput and lower latency achievable with LEO. While these are benefits for a network supporting many simultaneous UL, DL, and sidelink connections from mostly unmodified UEs, LEO also requires a larger quantity of satellites, with a potentially shorter average life.

Non-3GPP Efforts

While we don’t yet know the exact implementation criteria, many early trials for new nonterrestrial cellular network satellite infrastructure involve large phase-array antennas on the satellites themselves. With hundreds of individual elements and spanning hundreds of square feet, networks using this infrastructure will be challenging to develop, maintain, and deploy.

The reason for such large antenna arrays is because of the requirement to use unmodified UEs. While the current generation of UEs have antennas that are not optimized for NTN communications, companies have a strong business case touse commercially available UEs with widespread adoption. Using unmodified, existing UEs will lower the burden of adoption and implementation tremendously.

Figure 4: Large phase-array antennas could enable NTN connection to unmodified UEs (not to scale)

Because this type of antenna component uses unmodified UEs, it has the potential to change the NTN ecosystem dramatically; however, it comes with challenges.

When the number of components to be tested increases, it is accompanied by an even larger increase in the number of test cases, as each component has its own set that engineers must iterate through. With so many antenna elements incorporated into these satellites—each with its own set of test cases—automation, data analytics, and efficient test development becomes even more crucial for cost-effective, on-time, and insightful product development.

The increase in test requirements and number of test cases can impact time to market and total cost of test, and the increase in test cases and therefore test time is compounded across every unit produced. While this may not have been an issue in the past, many more satellites are now being produced, and unlike previous private/government SATCOM applications, time-to-market could play a big part in growing market share and user base for newer NTN use cases.

Testing the large antenna arrays and NTN systems/components altogether is a complex task, and one that is only possible with the right set of hardware and software to meet the needs of your test organization.

Trend: Integrating Terrestrial and Nonterrestrial Networks

Many of the recent NTN developments have been largely independent of existing terrestrial networks and infrastructure. However, there is a growing trend for more of the current NTN providers to partner with the cellular carriers to converge in services. These range from providing emergency messaging from anywhere in the world (Apple and GlobalStar), to providing voice and data services to unmodified phones (AST Space Mobile, SpaceX/ T-Mobile, and Lynk).

A 3GPP-standardized world is emerging, with the goal to promote all necessary processes to make an open and accessible network, mirroring how terrestrial cellular networks operate today.

NTN Capabilities and Technical Challenges

NTN introduces many technical challenges not seen with terrestrial networks. NTN’s long-range, high-noise, transient communications nature means we must pay particular attention to certain technical factors to ensure consistent, reliable communications. Overcoming these challenges is crucial to the viability and implementation of truly ubiquitous, global connections, integrated with terrestrial cellular networks.

Doppler Shift

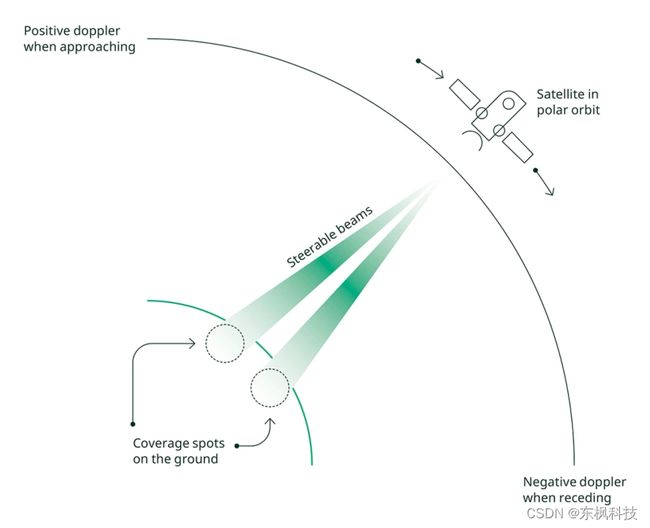

The large changes in relative speed of the satellite as it communicates with UEs stationary on Earth’s surface means thatwe must consider Doppler shift in NTN communications. Satellite speed can exceed 30,000 kph, which causes a significant shift in the frequency of transmitted signal, especially as a satellite is first approaching, and then the frequency recedes, thus changing from positive to negative Doppler.

In addition, the high speed causes the antenna beam to move quickly, meaning that coverage spots on the ground of a particular antenna constantly change, both in location and beam footprint.

Figure 5: Relative Speed and Elevation Changes as a Satellite Orbits Earth

Reliable communications with a UE require steerable beams that account for relative speed and beam footprint on the ground. The satellite must account for these variables and transition connections to the next satellite, or it loses visibility to the UE. Devices and satellites alike must know the location and speed of one another and adjust the frequency to compensate for the Doppler shift.

Figure 6: Beam Coverage and Doppler Are Constantly Changing

Latency (Round-Trip Delay)

Low latency is a pillar of modern, high-speed cellular networks. Customers expect cell networks in dense urban environments to support high-throughput, low-latency use cases including video calls, streaming, gaming, and XR.

Figure 7: Different Orbital Distances (Source: Attributed to 5G Americas)

With terrestrial networks, UEs are typically much closer to the base station, making this low latency a matter of infrastructure optimizations, duplexing techniques, and capable UEs. However, with NTN, the vast distance means that round-trip transmitted signal travel times are on the order of tens of milliseconds for LEO and hundreds of milliseconds for GEO, instead of microseconds, as in terrestrial networks. While still a fraction of a second, that round trip time is 1,000 to 10,000-times-longe. Not only is that difference enough to affect the many simultaneous UE connections and backhaul links, users can notice it on a video or voice link.

Figure 8: Round-trip travel times are four to five orders of magnitude larger with NTN than with terrestrial networks

High latency limits certain technologies that have become common in 5G networks; so NTN must operate with certain limitations and restrictions, unlike in terrestrial cellular networks. For example, NTN is limited to FDD, as the long travel times make TDD unfeasible. This limitation, in turn, can limit the flexibility of how the network accounts for changes in network demands and can place limits on how the DL and UL traffic is prioritized and addressed. While this restriction is not impossible to overcome, it is yet another nuance of NTN that must be addressed.

Attenuation Due to Rain, Clouds, and Scintillation

The path an RF waveform takes from UE to satellite is not consistent in distance or direction, nor in weather or time of day. This can lead to more degradation in the signal as it encounters more noise before it is received, either by the UE or the satellite. An easy way to overcome noise and the resulting loss of signal integrity is to limit NTN to lower order modulation schemes to allow for more uncertainty and retain reliable connections. While helpful, a lower order modulation scheme limits the throughput of the network at any one time.

Pathloss

At this point, we have established that the orbital distance and associated speed relative to Earth’s surface present many unique technical challenges in NTN. Another challenge in NTN implementation is the high pathloss caused by the sheer distance of satellites from the UEs they are connected to. LEO has a minimum orbit of 300 km, making these connections already many times farther than terrestrial network connections. All else being equal, free space path loss (FSPL) at 300 km is about 50 dB higher than at 1 km. To compound the challenge, 50 dB FSPL is an ideal UE to satellite connection. This ideal connection accounts for beam angle or position of the UE within the beam, as both can further deteriorate the received signal power.

Figure 9: FSPL as a Function of Distance

To overcome this challenge, we needhigher transmit output power and/or more TX or RX antenna gain. The cost, design implications, and quantity of UEs already in the market may make it infeasible for UEs to use much larger antennas, and existing UE antennas tend to have poor performance because of their form factor and design. Additionally, manufacturers typically can’t increase the power consumption of battery-powered handheld UEs because of cost and shorter battery life—transmit power greater than about 23 dBm is not possible. If UE manufacturers are hesitant or are unable to change design, or if the intent is to use existing UEs, the only other solutions are much larger phased-array satellites with greater gain, higher power from base-station components on satellites, or a combination of the two. Implementing higher power at the base-station side comes at a higher cost and brings additional technical and regulatory challenges that need to be accounted for in the design and validation of these components.

The need for high power and overcoming path loss is a substantial hurdle in the development of NTN; but it can, in part, be addressed with test tools and solutions that can help increase product performance.

NI Solutions for NTN

PXI VST

The PXI Vector Signal Transceiver (VST), combines an RF and baseband vector signal analyzer and generator with a user-programmable FPGA and high-speed serial and parallel digital interfaces. The PXI VST is well-suited for NTN test. With transmit and receive capabilities, the PXI VST can test both UL and DL, as well as provide a stimulus for a specific DUT. Combine these features with frequency coverage from baseband to mmWave and with excellent RF performance;, and all the tools are in place for NTN device and infrastructure design, validation, and production.

The latest PXI VST, the PXIe-5842, brings 2 GHz of instantaneous bandwidth and frequency coverage up to 26.5 GHz—enough to cover most of the proposed 3GPP and non-3GPP NTN channels. These frequency specifications, along with exceptional RF performance, means that the PXIe-5842 can address NTN test requirements now and in the future, as 3GPP standards for NTN continue to develop.

Figure 10: The PXIe-5842 and RFmx software enable signal generation analysis from baseband to mmWave

RFmx

RFmx is a set of interoperable software applications that optimize NI RF instrumentation for general-purpose, cellular, connectivity, and aerospace/defense test applications. With RFmx, you can perform and debug measurements quickly and easily with interactive software front panels, create and play back open, unlocked waveforms with RFmx Waveform Creator, and speed up automated testing with the performance-optimized API. RFmx also offers general-purpose demodulation tools for testing custom modulation types. RFmx products include options for support for the current LTE and 5G NR versions of NTN in 3GPP Rel-17. RFmx LTE was extended to support enhancement machine-type communication (eMTC) and narrowband IoT (NB-IoT) use cases into NTN.

RFmx NB-IoT/eMTC extends the capability of NI RF instrumentation for NB-IoT and eMTC cellular signal generation and analysis. Using this software, you can analyze LTE Cat-NB1/NB2 and LTE Cat-M1/M2 uplink signals with standard-compliant, physical-layer measurements such as error vector magnitude (EVM), adjacent channel leakage ratio (ACLR), spectrum emission mask (SEM), and more.

Learn more about RFmx, or contact NI for more information—and stay tuned for the corresponding application note.

Figure 11: InstrumentStudio™ Software RFmx Interactive Soft Front Panel

USRP Hardware

NI’s USRP (Universal Software Radio Peripheral) Software Defined Radio Devices are RF transceivers with which you rapidly can prototype and deploy advanced wireless applications. SDRs are used for wireless communications and deploying signals intelligence systems, or as building blocks for multichannel test beds. The small form-factor, high-channel-density devices are perfectly suited for radio-prototyping applications such as phased-array and beam-steering for large-scale NTN test beds.

Satellite Link Emulators (SLEs)

Engineers tasked with creating future satellite communication systems need to simulate, construct, and assess real-world scenarios before launch to assess and predict system behavior. They frequently encounter difficulties while examining various channel emulator settings. For assured, consistent outcomes, merging model-based simulations with hardware-in-the-loop (HIL) testing proves to be more efficient.

Figure 13: Satellite Link Emulation Block Diagram

NI’s Platform and Test Methodology for NTN

While many tools are readily available for NTN test, requirements and test methodologies will continue to evolve as market needs and technical requirements change. NI’s application-specific software and versatile hardware are a foundation on which to expand and create novel test systems that can adapt as requirements evolve.

Conclusion

Because NTN is a wide-ranging topic, gaining a full understanding of them and their test requirements requires more than the overview given here. Contact a technical expert for more information and to learn how NI can help you achieve your goals with NTN test.