绿天鹅——气候变化环境下的中央银行与金融稳定性

(The green swan —— Central banking and financial stability in the age of climate change ch 1 - ch 3整理)

Executive Summary

“green swan” concept

(i) they are unexpected and rare, thereby lying outside the realm of regular expectations;意想不到&稀缺事件

(ii) their impacts are wide-ranging or extreme;影响广泛/极端

(iii) they can only be explained after the fact.只有在事实发生后才能解释

fit fat tailed probability distributions 肥尾分布

-

As such, they cannot be predicted by relying on backward-looking probabilistic approaches assuming normal distributions (eg value-at-risk models).所以不能使用VaR模型来模拟预测;

-

Both physical and transition risks are characterised by deep uncertainty and nonlinearity, their chances of occurrence are not reflected in past data, and the possibility of extreme values cannot be ruled out (Weitzman (2009, 2011)).

与黑天鹅的不同点:

-

First, although the impacts of climate change are highly uncertain气候变化有很大不确定性。

-

Second, climate catastrophes are even more serious than most systemic financial crises:气候灾难比多数系统性金融危机更严重。

-

Third, the complexity related to climate change is of a higher order than for black swans.气候变化的复杂性比黑天鹅更甚。

**The five Cs – contribute to coordination to combat climate change:

从三方面入手:风险、事件、系统韧性

1. INTRODUCTION – “PLANET EARTH IS FACING A CLIMATE EMERGENCY”

1.1 Outline

-

There is still considerable uncertainty on the effects of climate change and on the most urgent priorities. 气候风险的不确定性很大

-

Mark Carney (2015) referred to as “the tragedy of the horizon”:

while the physical impacts of climate change will be felt over a long-term horizon, with massive costs and possible civilisational impacts on future generations, the time horizon in which financial, economic and political players plan and act is much shorter.把气候风险纳入评估需要很长时间

For instance, the time horizon of rating agencies to assess credit risks, and of central banks to conduct stress tests, is typically around three to five years. -

Our framing of the problem

It is a new type of systemic risk that involves interacting, nonlinear, fundamentally unpredictable, environmental, social, economic and geopolitical dynamics, which are irreversibly transformed by the growing concentration of greenhouse gases in the atmosphere.

-

Carbon pricing and beyond;碳定价问题

4.1. basic welfare economics——内化问题

-

Climate change is widely considered by economists as an externality that, as such, should be dealt with through publicly imposed Pigovian carbon taxes4 in order to internalise the climate externalities. 气候变化广泛被经济学家认为是外部影响,可以通过强加庇古税将其内化。

-

By this analytical framing, central banks, regulators and supervisors have little to do in the process of decarbonising the economic system.

但碳定价框架下,中央银行、监管者在经济系统脱碳过程中几乎没有起到什么作用,而这些需要非盈利公司与家庭来驱动

At most, central banks and supervisors should carefully scrutinise financial market imperfections, in order to ensure financial stability along the transition towards a low-carbon economy.

4.2. 目前来看,碳定价仍然是气候变化的唯一答案,但因为忽视了潜在的绿天鹅事件,该方法也有三点明显缺陷:

1. 即使碳定价数十年来已被认定为最佳选择,但尚未将棕色资产充分重分配到绿色资产 ;

因为政府没有起到作用,除非工会或商业压力来迫使重大政策变革;

2. 气候问题不确定性大,且危害范围广。

3. 会危害到社会的方方面面,不仅仅是市场失灵,“a cluster of elements, including technology, regulations, user practices and markets, cultural meanings, infrastructure, maintenance networks and supply networks”

- Revisiting financial stability in the age of climate change

很有可能会再度面临金融稳定性危机

2.CLIMATE CHANGE IS A THREAT TO FINANCIAL AND PRICE STABILITY

气候变化对金融与价格稳定性是威胁

2.1 Climate change as a severe threat to ecosystems, societies and economies

The impacts on economic output could be significant if no action is taken to reduce carbon emissions.气候变化或成为人类生存的严重威胁,从以下两方面:

-

Demand-side shocks:

a. Business investments could be reduced due to uncertainty about future demand and growth prospects 商业投资减少

b. dampen consumption, 抑制消费

c. disrupt trade flows 破坏贸易流动

d. reduce household wealth.家庭财产减少 -

Supply-side shocks

a. affect the economy’s productive capacity, acting through the components of potential supply: labour, physical capital and technology.通过潜在的供应要素来影响生产能力

b. massive population movements大量人口流动

c. a diversion of resources form investment in productive capital and innovation to climate change adaptation资源从“生产性资本投资”转移到“创新型”从而适应气候变化

2.2 The redistributive effects of climate change

气候变化的分布影响

-

primarily affect poor and middle-income countries主要影响贫困和中等收入国家

natural endowments, traditional carbon-intensive industries and consumption habits of poor countries and low-income households.也影响了自然资源、传统碳密集行业和贫困国家/家庭的消费习惯 -

Another popular political stance has been to dismiss the challenges posed by climate change as merely a concern of the wealthy and well protected.

另一种政治立场表明,将气候变化的挑战是为对财产的保护的一种挑战。 -

The intensity of these effects depends on the choice of the policy instrument used, the targeted sector, the design of the intervention and the country’s degree of development and socioeconomic conditions.这些影响的强度取决于所使用的政策工具的选择,目标部门,干预措施的设计以及国家的发展程度和社会经济条件。

The regressive distributional effects of many climate policies requires compensating lower-income households for their negative income effects as well as being gradual and progressive in the introduction of such policies. 许多气候政策的回归分配效应需要补偿低收入家庭的负面收入影响,并且需要逐步采取渐进的政策。 -

regional and distributional effects of climate change policies气候变化政策的区域与分布效应

相关模型与理论: a variant of the Regional Integrated model of Climate and the Economy (RICE) (a regionally disaggregated version of the Dynamic Integrated model of Climate and the Economy (DICE) )

但现有模型仍有缺陷,因为current models do not capture well household heterogeneity and proper representation of poor and vulnerable societal segments.不能很好的反映家庭异质性以及贫困脆弱的社会阶层的合适代表。

- Finally, there is an extensive literature and numerous studies pointing to the distributional impact of climate change on poor countries and the need to scale up international mechanisms to finance their transition and reduce their vulnerability to climate change-related events with well known implications for massive migration.

有大量文献和大量研究指出了气候变化对贫困国家的分布影响,以及需要扩大国际机制以资助其过渡并减少其对气候变化相关事件的脆弱性,这对大规模移民具有众所周知的意义。(扶贫|移民)

这一直是the UN Conference of the Parties (COP)重要议题。

2007年开始实施的UNFCCC下的“Adaption Fund”,富裕国家为发展中国家承担适应费用,但实际效果十分有限。

2.3 Climate change as source of monetary instability

气候变化带来的冲击可能会从需求与供给方面影响货币政策,从而影响中央银行的价格稳定指令;

1)supply-side shocks

-

Pressures on the supply of agricultural products and energy are particularly prone to sharp price adjustments and increased volatility. 农产品和能源供应的压力特别容易发生急剧的价格调整和增加的波动性;

短期价格压力:The impact of climate-related shocks on inflation, but some studies indicate that food prices tend to increase in the short term following natural disasters and weather extremes自然灾害和极端天气之后短期内食品价格往往会上涨; -

降低经济体的生产能力 : supply shocks can also reduce economies’ productive capacity

2) demand shocks

- reducing household wealth and consumption;

- 行业投资也会受到影响。

-

气候变化对通货膨胀的影响尚不清楚

In sum, the impacts of climate change on inflation are unclear partly because climate supply and demand shocks may pull inflation and output in opposite directions,气候变化相关的供给与需求冲击可能抑制通货膨胀 and generate a trade-off for central banks between stabilising inflation and stabilising output fluctuations 但需要央行在稳定通货膨胀和经济活动之间做出权衡(Debelle (2019)). Moreover, if climate-related risks end up affecting productivity and growth, this may have implications for the longrun level of the real interest rate, a key consideration in monetary policy (Brainard (2019)).但是,如果这种影响被证明更具持久性,并且有可能在整个经济中扩散的范围更大,那么就可能需要采取货币政策。 -

In the case of climate-related risks, the irreversibility of certain climate patterns and impacts poses at least three new challenges for monetary policy. 那么,不可逆转的气候变化对货币政策也有三方面的挑战:

-

This situation can lead to stagflationary supply shocks that monetary policy may be unable to fully reverse. 气候变化会导致供给滞涨,货币政策没办法充分缓解这个问题。

-

Climate change is a global problem仅有一个国家出力是没用的。

-

green swan events还需要考虑长远影响。

-

2.4 Climate change as a source of financial instability

Climate-related risks are a source of financial risk.气候变化从两方面影响金融稳定性

-

Physical risks

The destruction of capital and the decline in profitability of exposed firms could induce a reallocation of household financial wealth.资本的破坏和公司的盈利能力下降可能导致家庭金融财富的重新分配。

More broadly, damages to assets affect the longevity of physical capital through an increased speed of capital depreciation. -

Transition risks

Too rapid a movement towards a low-carbon economy could materially damage financial stability. A wholesale reassessment of prospects, as climate-related risks are re-evaluated, could destabilise markets, spark a pro-cyclical crystallisation of losses and lead to a persistent tightening of financial conditions: a climate Minsky moment.快速低碳过渡会导致一些已经发现的资源失去价值,重新评估其价值引发周期性的亏损,并导致财务状况持续收紧;

Assessing how the entire value chain of many sectors could be affected by shocks in the supply of fossil fuels is particularly challenging.重新评估又极具挑战。

-

Physical and transition risks can materialise in terms of financial risk in five main ways: with many second-round effects and spillover effects among them

a. Credit risk

A deterioration in borrowers’ ability to repay their debts, thereby leading to higher probabilities of default (PD) and a higher loss-given-default (LGD). 高违约率

the potential depreciation of assets used for collateral can also contribute to increasing credit risks.b. Market risk:

The concept of climate value-at-risk (VaR) captures this riskc. Liquidity risk

d. Operational risk

e. Insurance risk

For the insurance and reinsurance sectors, higher than expected insurance claim payouts could result from physical risks, and potential underpricing of new insurance products covering green technologies could result from transition risks 对于保险和再保险行业,物理风险可能会导致保险索赔支出高于预期,过渡风险可能导致涵盖绿色技术的新保险产品的潜在定价偏低

2.5 The forward-looking nature of climate-related risks – towards a new epistemology of risk

重新认识洗后相关的风险

If investors integrate climate-related risks into their risk assessment, then polluting assets will become more costly.如果投资者将与气候相关的风险整合到他们的风险评估中,那么造成污染的资产将变得更加昂贵。

Managing climate-related risks through a forward-looking approach can lead financial institutions to test the resilience of corporations in their portfolios to potential materialisations of physical and transition risks, their impact on key performance indicators and the adaptive capacities of these firms.

3. MEASURING CLIMATE-RELATED RISKS WITH SCENARIO-BASED APPROACHES: METHODOLOGICAL INSIGHTS AND CHALLENGES

- 使用基于场景的方法来测量与气候相关的风险:方法论的见解和挑战

- 主要研究如何度量过渡风险

- 尽管前瞻性分析潜力巨大,但仍无法完全克服上一章中讨论的概率方法的局限性,无法对“绿色天鹅”事件提供足够的对冲。

-

存在两个limitations:

-

风险间相互影响,并且存在很大的不确定性

First, the materialisation of physical and transition risks depends on multiple nonlinear dynamics (natural, technological, societal, regulatory and cultural, among others) that interact with each other in complex ways and are subject to deep uncertainty.

气候经济模型天生就不能代表所有这些相互作用,因此它们忽略了将极大影响世界发展方式的许多社会和政治力量。i) 重大方法学挑战:

a. 多种模型间的相互作用与局限性;

b. 不断变化的环境中,所有公司和价值链都将以不可预测的方式受到影响。**解决方法:**可以通过更好的数据和新模型的开发来部分解决,特别是可以更好地解释非线性,不确定性,政治经济因素和作用的非均衡模型。

-

气候相关的风险很大程度上还是无法对冲;

Second, and more fundamentally, climate-related risks will remain largely uninsurable or unhedgeable as long as system-wide action is not taken**解决方法:**只有全球社会经济体系的结构转型才能真正使金融体系免受“绿色天鹅”事件的影响。

-

- 3.1 Climate-economic models versus deep uncertainty – an overview

3.1 Climate-economic models VS deep uncertainty – an overview

1. 确定关于气候和社会经济因素将如何相互作用——以便将其转化为部门和企业层面的情景。

Determine a narrative of how climate and socioeconomic factors will interact, so that they can be translated into a sectoral and firm-level scenario.

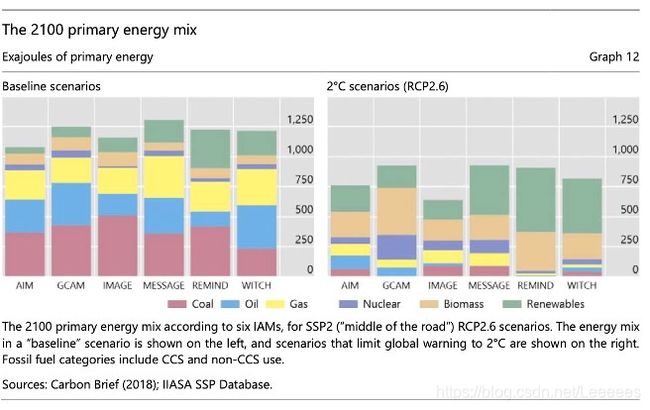

多数方法都依赖于气候经济模型(例如综合评估模型Integrated Assessment Models-IMA)将以下三要素实施到宏观经济中去。

a. What climate target is sought: 气候目标

limiting global warming to 2°C above pre-industrial temperatures by 2100

but more scenarios based on a 1.5°C limit may emerge as this latter target is increasingly understood as the more “acceptable” upper limit

b. When mitigation measures start (eg immediately and relatively smoothly, or with delay and more abruptly) and over which time horizon they take place; 缓解措施&时间

c. What kind of “shock” is applied:

-

policy shock

-

technologies is limited

Limitations

- critical assumptions about the damage functions (impacts of climate change on the economy) and discount rates (how to adjust for climate related risk) have been subject to numerous debates.

- The absence of an endogenous evolution of the structures of production.生产结构没有内生性的进化

- The choice of general equilibrium models with unrealistic assumptions on well-functioning capital markets and rational expectations. 假设资本市场运作良好且有理性预期

- The emphasis on relatively smooth transitions to a low-carbon economy and the quick return to steady state following a climate shock. 能够平滑的过渡低碳经济,并在气候危害中快速恢复。

- The suppression of the critical role of financial markets. 对金融市场有抑制作用

2. 因其与物理和过渡风险相关的深层不确定性–>金融机构应审慎对待模型结果

- 不确定性的关键来源:不确定性,不可逆性,非线性和肥尾分布。

- Deep uncertainty exists with regard to the biogeochemical processes potentially triggered by climate change.生物地球化学的不确定性

- The impacts of such biogeochemical processes on socioeconomic systems can be highly nonlinear, meaning that small changes in one part of the system can lead to large changes elsewhere in the system and to chaotic dynamics that become impossible to model with high levels of confidence.生物地球化学与经济系统非线性相关->无法直接建模

- The damage functions used by IAMs are unable to account for the tail risks related to climate change.模型无法解释尾部风险

- 过渡风险方面的不确定性,体现在对于IAM的过渡信任,从而忽视了许多可能影响世界发展方式的社会政治力量。

With regard to transition risks (see Annex 2), one of the main sources of modelling uncertainty relates to the general use of economy-wide carbon prices as a proxy for climate policy in IAMs.

3. 围绕社会技术系统和转型等概念的跨学科方法

Transdisciplinary approaches around concepts such as sociotechnical systems and transitions

由于价格/性能的改进+强大的参与者==>推动内部改革。

3 key parameter:

1. Technology

- Yet their representation in existing models fails to reflect the unpredictable and disruptive nature of technological innovations.它们在现有模型中的表示不能反映技术创新的不可预测和破坏性。

- The intermittency of renewable energy remains a considerable problem that tends to be overlooked.可再生能源仍然有很大的问题

- Other sectors may be impossible to decarbonise in the medium term regardless of carbon pricing, as we can observe (so far) not only with aviation or cement, but also with parts of the energy sector.从中期来看,其他部门都可能无法脱碳

2. socio-technical regimes社会技术体制/系统

i.e.the rules and norms guiding the use of particular technologies.

例如,交通运输系统

3. sociotechnical landscapes社会技术格局

i.e. In contexts comprising “both slow-changing trends (eg demographics, ideology, spatial structures, geopolitics) and exogenous shocks (eg wars, economic crises, major accidents, political upheavals)”

- A rather weakened multilateral order that is an important barrier to address the multiple trade-offs that a global low-carbon transition will generate.

- Hence, existing models still have a long way to go to account for the international political economy of climate change and for the principle of “common but differentiated responsibilities” enshrined in international climate negotiations. 长路漫漫

3.2 Climate-related uncertainties and the choice of scenarios

一些方法提供者不依赖IAM,而是依赖“基于技术”的模型。

Some methodology providers do not rely on IAMs but rather on “technologically-based” model.

Energy Technology Perspectives (ETP) report

Energy Technology Perspectives (ETP) report (Graph 11) seeks to offer a “technology-rich, bottom-up analysis of the global energy system”

对于负排放和CCS具有重要作用的场景自然会减少搁浅的资产数量(例如,GCAM模型),而对于负排放将需要更大规模地开发可再生能源(如MESSAGE,REMIND和WITCH模型)或显着提高能源效率(如IMAGE)。

that the financial impacts of a specific financial portfolio will be entirely different depending on which scenario is chosen.根据选择哪种方案,特定财务组合的财务影响将完全不同。

3.3 Translating a climate-economic scenario into sector- and firm-level risk assessments

Climate change mitigation and adaptation also brings opportunities related to the development of low-carbon technologies and climate-friendly policies.一些机遇

Regardless of the approach chosen, some critical sources of uncertainty to keep in mind when conducting forward-looking risk assessments concern the ability to predict: 不管使用哪种方法,以下会造成不确定性的几点要时刻谨记:

-

The development and diffusion of new technologies新技术的开发和扩散:

-

Each firm’s market power每家公司的市场力量:

-

The exposure to liability risks that have not yet arisen尚未承担的责任风险:

Overall, the outcomes provided by each methodology are therefore highly sensitive to the ways in which they account for specific scenarios and how they translate them into static or dynamic corporate metrics that take into account the scope 1, 2 and 3 emissions. Although the lack of data is commonly and rightly invoked as a barrier to the development of climate-related risk assessment, it is also important to emphasise that bridging the data gap will not fully “resolve” the sources of uncertainty discussed above.

每种方法所提供的结果因此对它们考虑特定情况的方式以及如何将其转换为考虑范围1、2和3排放的静态或动态公司指标高度敏感。尽管通常缺乏正确的数据被认为是发展与气候相关的风险评估的障碍,但同样重要的是要强调弥合数据鸿沟并不能完全“解决”上述不确定性的根源。

3.4 From climate-related risk identification to a comprehensive assessment of financial risk

- a scorecard or climate risk rating and estimates of the carbon impact of a portfolio

- calculate the specific impact on asset pricing or credit risks(e.g,value-at-risk (climate VaR),)

-

First, it is possible for investors to see the long-term risks posed by climate change, while remaining exposed to fossil fuels in the short term (Christophers (2019)), especially if they believe that hard regulations will not be put in place anytime soon.

The question of how to adjust risk modelling approaches to allow for longer time horizons remains a challenging one -

Reckoning climate-related risks can lead financial institutions to take rational actions that, while hedging them individually from a specific shock, do not hedge against the systemic risks posed by climate change.计算与气候相关的风险可以使金融机构采取合理的行动,尽管他们可以对冲特定的冲击,但它们不能对冲气候变化带来的系统性风险。

3.5 From climate-related risk to fully embracing climate uncertainty – towards a second “epistemological break”

The essential step of measuring climate-related risks presents significant methodological challenges related to:

- The inability of macroeconomic and climate scenarios to holistically capture a large range of climate, social and economic factors;

- Their translation into corporate metrics within a dynamic economic environment;

- The difficulty of matching the identification of a climate-related risk with the adequate mitigation action.

Three particular research avenues:

- working with nonequilibrium models;

- conducting sensitivity analyses

- conducting case studies focusing on specific risks and/or transmission channels.