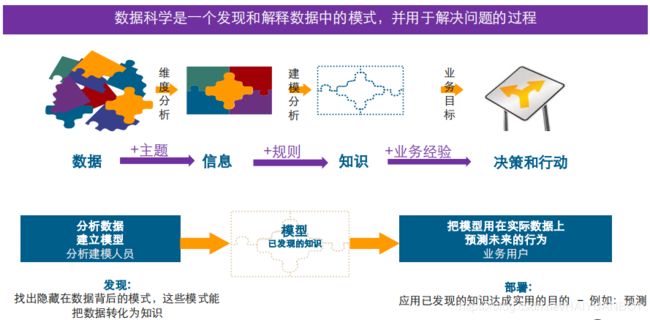

数据分析:个人贷款违约案例(逻辑回归)

数据科学方法论

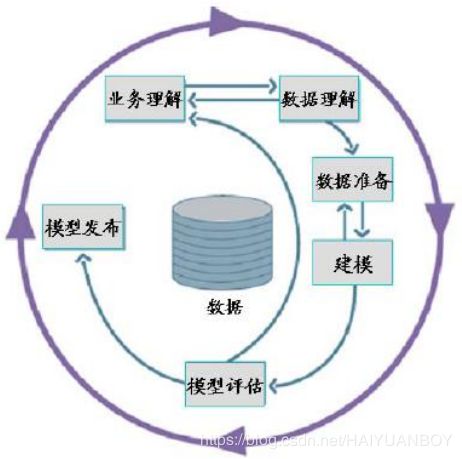

数据挖掘实施路线图

案例背景

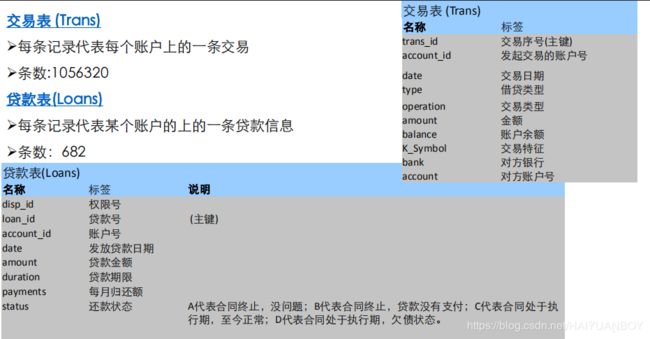

- 本数据为一家银行的个人金融业务数据集,可以作为银行场景下进行个人客户业务分析和数据挖掘的示例。这份数据中涉及到5300个银行客户的100万笔的交易,而且涉及700份贷款信息与近900张信用卡的数据。通过分析这份数据可以获取与银行服务相关的业务知识。例如,提供增值服务的银行客户经理,希望明确哪些客户有更多的业务需求,而风险管理的业务人员可以及早发现贷款的潜在损失

- 可否根据客户贷款前的属性、状态信息和交易行为预测其贷款违约行为

- 截取自一家银行的真实客户与交易数据

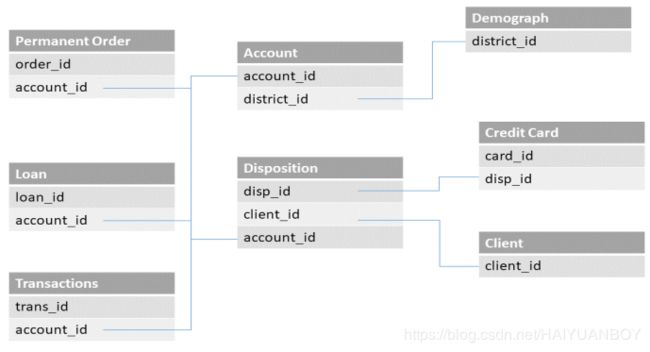

- 涉及客户主记录、帐号、交易、业务和信用卡数据

- 一个账户只能一笔贷款,“loan” 表中记录了客户贷款信息

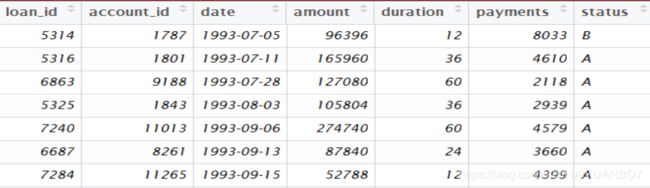

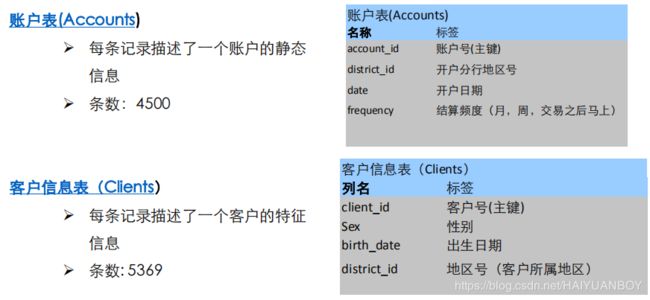

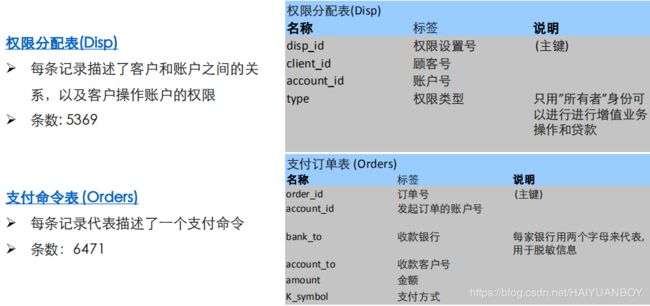

数据表

根据以往的贷款数据,状态为B和D的为违约客户,A为正常客户,C的最终状态还不明确

表的关系:数据的实体-关系图(ER图)

业务理解

思路整理

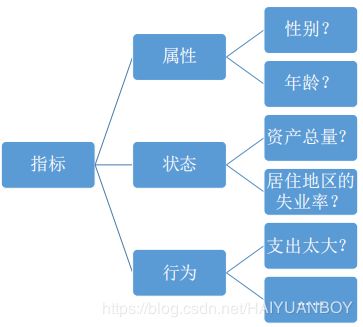

什么指标有预测能力?

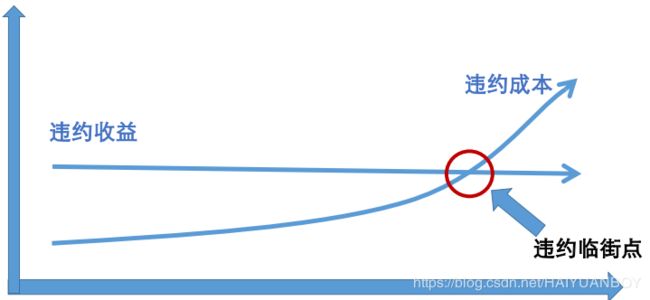

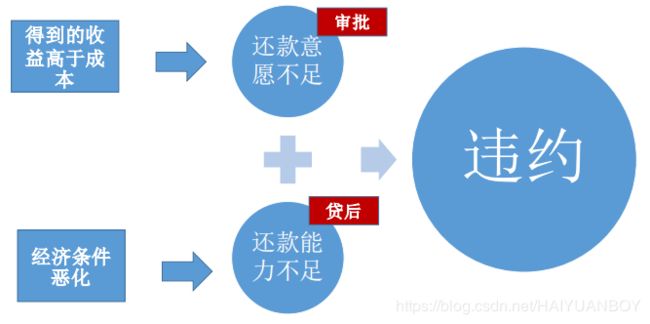

客户为什么不还钱?

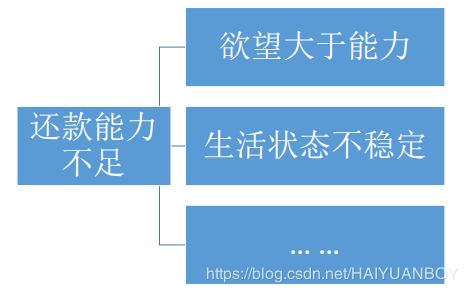

有预测价值的变量基本都是衍生变量:

- 一级衍生,比如资产余额

- 二级衍生,比如资产余额的波动率、平均资产余额

- 三级衍生,比如资产余额的变异系数

数据提取

- 相关与因果之间的关系

- 注意构建模型时数据选取的标准

不是所有具有相关关系的数据都能拿来建模,要注意搞清楚因果关系,如上世纪80年代,姚明鞋的尺寸和GDP总量明显正相关,但它们没有因果关系

建立因果关系模型

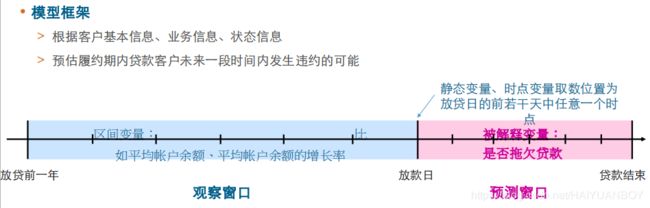

- 我们分析的变量按照时间变化情况可以分为动态变量和静态变量

- 属性变量(比如性别、是否90后)一般是静态变量,行为、状态和利益变量均属于动态变量

- 动态变量还分为时点变量和区间变量,状态变量(比如当前帐户余额、是否破产)和利益变量(对某产品的诉求)均属于时点变量。行为变量(存款频次、平均帐户余额的增长率)为区间变量

贷款违约预测的取数规则

数据处理代码

# In[ ]:

import pandas as pd

import os

# # 1 数据整理

# ## 1.1导入数据

# In[2]: 读入 csv 文件

os.chdir("D:\pydata\案例")

loanfile = os.listdir()

createVar = locals()

for i in loanfile:

if i.endswith("csv"):

createVar[i.split('.')[0]] = pd.read_csv(i, encoding = 'gbk')

print(i.split('.')[0])

# ## 1.2、生成被解释变量bad_good

# In[3]:

bad_good = {'B':1, 'D':1, 'A':0, 'C': 2}

loans['bad_good'] = loans.status.map(bad_good)

loans.head()

Out[3]:

loan_id account_id date ... payments status bad_good

0 5314 1787 1993-07-05 ... 8033 B 1

1 5316 1801 1993-07-11 ... 4610 A 0

2 6863 9188 1993-07-28 ... 2118 A 0

3 5325 1843 1993-08-03 ... 2939 A 0

4 7240 11013 1993-09-06 ... 4579 A 0

# ## 1.3、借款人的年龄、性别

# In[4]: 左连接

data2 = pd.merge(loans, disp, on = 'account_id', how = 'left')

data2 = pd.merge(data2, clients, on = 'client_id', how = 'left')

data2=data2[data2.type=='所有者']

data2.head()

Out[4]:

loan_id account_id date ... sex birth_date district_id

0 5314 1787 1993-07-05 ... 女 1947-07-22 30

1 5316 1801 1993-07-11 ... 男 1968-07-22 46

2 6863 9188 1993-07-28 ... 男 1936-06-02 45

3 5325 1843 1993-08-03 ... 女 1940-04-20 14

4 7240 11013 1993-09-06 ... 男 1978-09-07 63

# ## 1.4、借款人居住地的经济状况

# In[5]: district 表中的 district_id 为 A1 这一列

data3 = pd.merge(data2, district, left_on = 'district_id', right_on = 'A1', how = 'left')

data3.head()

Out[5]:

loan_id account_id date amount ... A13 A14 A15 a16

0 5314 1787 1993-07-05 96396 ... 3.67 100 15.7 14.8

1 5316 1801 1993-07-11 165960 ... 2.31 117 12.7 11.6

2 6863 9188 1993-07-28 127080 ... 2.89 132 13.3 13.6

3 5325 1843 1993-08-03 105804 ... 1.71 135 18.6 17.7

4 7240 11013 1993-09-06 274740 ... 4.52 110 9.0 8.4

# ## 1.5、贷款前一年内的账户平均余额、余额的标准差、变异系数、平均收入和平均支出的比例

# In[6]: amount 属于 trans 表的

data_4temp1 = pd.merge(loans[['account_id', 'date']],

trans[['account_id','type','amount','balance','date']],

on = 'account_id')

# 重新指定列名

data_4temp1.columns = ['account_id', 'date', 'type', 'amount', 'balance', 't_date']

data_4temp1 = data_4temp1.sort_values(by = ['account_id','t_date'])

data_4temp1['date']=pd.to_datetime(data_4temp1['date'])

data_4temp1['t_date']=pd.to_datetime(data_4temp1['t_date'])

data_4temp1.tail()

Out[6]:

account_id date type amount balance t_date

127263 11362 1996-12-27 借 $56 $51420 1998-12-08

127264 11362 1996-12-27 借 $4,780 $46640 1998-12-10

127265 11362 1996-12-27 借 $5,392 $41248 1998-12-12

127266 11362 1996-12-27 借 $2,880 $38368 1998-12-19

127267 11362 1996-12-27 贷 $163 $38531 1998-12-31

# ## 将对账户余额进行清洗

# In[9]:

data_4temp1['balance2'] = data_4temp1['balance'].map(

lambda x: int(''.join(x[1:].split(','))))

data_4temp1['amount2'] = data_4temp1['amount'].map(

lambda x: int(''.join(x[1:].split(','))))

data_4temp1.head()

Out[7]:

account_id date type ... t_date balance2 amount2

10020 2 1994-01-05 贷 ... 1993-02-26 1100 1100

10021 2 1994-01-05 贷 ... 1993-03-12 21336 20236

10022 2 1994-01-05 贷 ... 1993-03-28 25036 3700

10023 2 1994-01-05 贷 ... 1993-03-31 25050 14

10024 2 1994-01-05 贷 ... 1993-04-12 45286 20236

# ## 根据取数窗口提取交易数据

# In[10]: 取贷款时间和上一次交易时间相隔一年的记录

import datetime

data_4temp2 = data_4temp1[data_4temp1.date>data_4temp1.t_date][

data_4temp1.date模型构建与评估

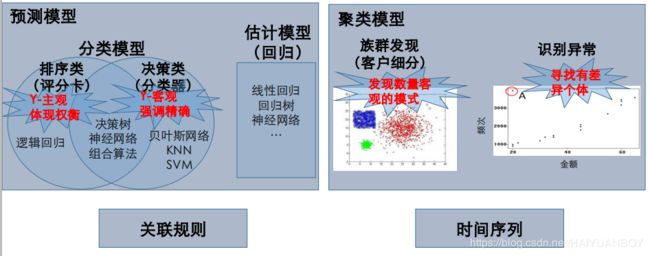

数据挖掘模型分类

此案列中,我们的信用评估是主观定义的,排序类模型反应一个人成本与收益的决策行为,而决策类模型反应的是真实情况的

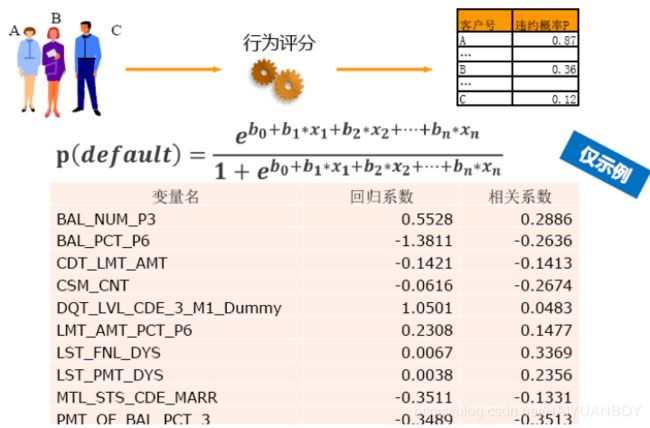

使用逻辑回归建立行为评分卡

逻辑回归预测的是一个人违约的概率,然后以概率从大到小进行排序,概率大的拒绝,概率小的接受

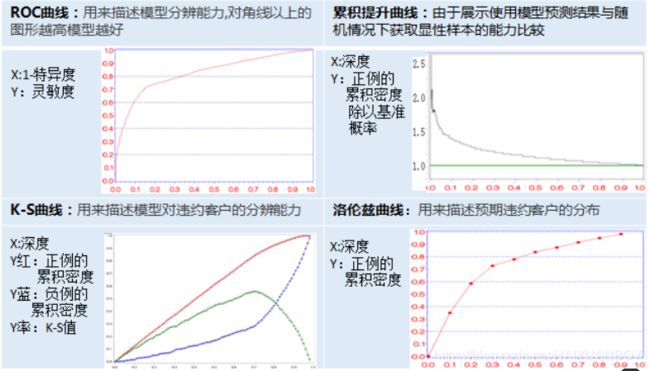

评估指标汇总

对评分卡模型,我们更多用 ROC 曲线和 K-S 曲线,ROC 曲线越偏向左上角及围的右下方面积越大模型表现越好,K-S曲线红蓝线越分离模型表现越好,绿线代表两条曲线的差值,值越大模型表现越好

评分卡模型的评估指标

建模与评测代码

训练

# In[17]:

# status 为 C 的记录不用来训练,而作为预测用

data_model=data4[data4.status!='C']

for_predict=data4[data4.status=='C']

#%%

train = data_model.sample(frac=0.7, random_state=1235).copy()

# 剩下的 30% 的样本

test = data_model[~ data_model.index.isin(train.index)].copy()

print(' 训练集样本量: %i \n 测试集样本量: %i' %(len(train), len(test)))

训练集样本量: 195

测试集样本量: 84

#%%

# 有一种说法是当训练集每一个类别数量都相等时,会提高模型性能,下面注释代码调整 3 中类别数量一致,但在这准确度反而下降了

'''

train_D = train[train['status']=='D']

train_D_1 = train_D[train['account_id']==3189]

for i in range(4):

train = pd.concat([train, train_D])

for i in range(5):

train = pd.concat([train, train_D_1])

train_B = train[train['status']=='B']

train_B_1 = train[train['account_id']==19]

for i in range(5):

train = pd.concat([train, train_B])

for i in range(13):

train = pd.concat([train, train_B_1])

print(' 训练集样本量: %i \n 测试集样本量: %i' %(len(train), len(test)))

train['status'].value_counts()

'''

# In[22]:

# 向前法

def forward_select(data, response):

import statsmodels.api as sm

import statsmodels.formula.api as smf

remaining = set(data.columns)

remaining.remove(response)

selected = []

current_score, best_new_score = float('inf'), float('inf')

while remaining:

aic_with_candidates=[]

for candidate in remaining:

formula = "{} ~ {}".format(

response,' + '.join(selected + [candidate]))

aic = smf.glm(

formula=formula, data=data,

family=sm.families.Binomial(sm.families.links.logit)

).fit().aic

aic_with_candidates.append((aic, candidate))

aic_with_candidates.sort(reverse=True)

best_new_score, best_candidate=aic_with_candidates.pop()

if current_score > best_new_score:

remaining.remove(best_candidate)

selected.append(best_candidate)

current_score = best_new_score

print ('aic is {},continuing!'.format(current_score))

else:

print ('forward selection over!')

break

formula = "{} ~ {} ".format(response,' + '.join(selected))

print('final formula is {}'.format(formula))

model = smf.glm(

formula=formula, data=data,

family=sm.families.Binomial(sm.families.links.logit)

).fit()

return(model)

# In[23]:

candidates = ['bad_good', 'A1', 'GDP', 'A4', 'A10', 'A11', 'A12','amount', 'duration',

'A13', 'A14', 'A15', 'a16', 'avg_balance', 'stdev_balance',

'cv_balance', 'income', 'out', 'r_out_in', 'r_lb', 'r_lincome']

data_for_select = train[candidates]

lg_m1 = forward_select(data=data_for_select, response='bad_good')

lg_m1.summary().tables[1]

aic is 167.43311432504638,continuing!

aic is 135.8243585604184,continuing!

forward selection over!

final formula is bad_good ~ r_lb + cv_balance

# 最后选出两个变量 r_lb 和 cv_balance 对模型结果影响最大,r_lb 反应客户的对钱的欲望,cv_balance 反应客户经济的不稳定性预测

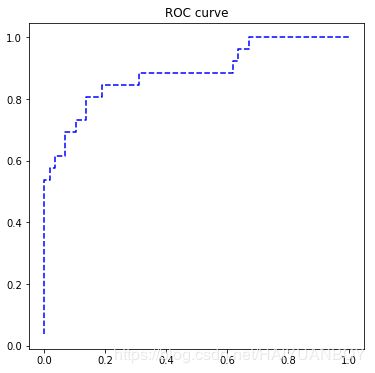

import sklearn.metrics as metrics

import matplotlib.pyplot as plt

fpr, tpr, th = metrics.roc_curve(test.bad_good, lg_m1.predict(test))

plt.figure(figsize=[6, 6])

plt.plot(fpr, tpr, 'b--')

plt.title('ROC curve')

plt.show()# In[25]:

print('AUC = %.4f' %metrics.auc(fpr, tpr))

AUC = 0.8846# In[28]:

for_predict['prob']=lg_m1.predict(for_predict)

for_predict[['account_id','prob']].head()

Out[22]:

account_id prob

23 1071 0.704914

30 5313 0.852249

38 10079 0.118128

39 5385 0.177591

42 8321 0.024302