R语言案例分析:财政收入的多元相关与回归分析

R语言案例分析:财政收入的多元相关与回归分析

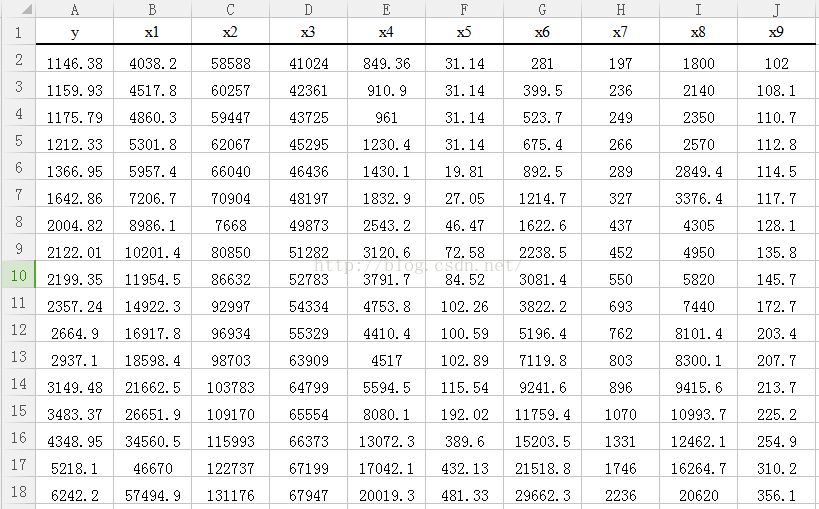

数据集下载 (mvcase3.xls)中的表Case3。

y:财政收入

x1:国内生产总值

x2:能源消费总量

x3:从业人员总数

x4:全社会固定资产投资总额

x5:实际利用外资总额

x6:全国城乡居民储蓄存款年底余额

x7:居民人均消费水平

x8:消费品零售总额

x9:居民消费价格指数

case3 <- read.table("clipboard", header = T, sep = "\t")

head(case3)1 1146 4038 58588 41024 849.4 31.14 281.0 197 1800 102.0

2 1160 4518 60257 42361 910.9 31.14 399.5 236 2140 108.1

3 1176 4860 59447 43725 961.0 31.14 523.7 249 2350 110.7

4 1212 5302 62067 45295 1230.4 31.14 675.4 266 2570 112.8

5 1367 5957 66040 46436 1430.1 19.81 892.5 289 2849 114.5

6 1643 7207 70904 48197 1832.9 27.05 1214.7 327 3376 117.7

summary(case3)Min. : 1146 Min. : 4038 Min. : 7668 Min. :41024 Min. : 849 Min. : 19.8

1st Qu.: 1643 1st Qu.: 7207 1st Qu.: 66040 1st Qu.:48197 1st Qu.: 1833 1st Qu.: 31.1

Median : 2665 Median :16918 Median : 96934 Median :55329 Median : 4517 Median :102.3

Mean : 3896 Mean :28471 Mean : 93109 Mean :57401 Mean : 9536 Mean :218.8

3rd Qu.: 5218 3rd Qu.:46670 3rd Qu.:122000 3rd Qu.:67199 3rd Qu.:17042 3rd Qu.:432.1

Max. :11444 Max. :80423 Max. :138948 Max. :70586 Max. :29855 Max. :644.1

x6 x7 x8 x9

Min. : 281 Min. : 197 Min. : 1800 Min. :102

1st Qu.: 1215 1st Qu.: 327 1st Qu.: 3376 1st Qu.:118

Median : 5196 Median : 762 Median : 8101 Median :203

Mean :14871 Mean :1149 Mean :11244 Mean :215

3rd Qu.:21519 3rd Qu.:1746 3rd Qu.:16265 3rd Qu.:310

Max. :59622 Max. :3143 Max. :31135 Max. :381

cor(case3) #相关分析y 1.0000 0.9852 0.7718 0.8337 0.9867 0.9383 0.9954 0.9866 0.9910 0.9341

x1 0.9852 1.0000 0.8254 0.8646 0.9969 0.9783 0.9848 0.9995 0.9972 0.9752

x2 0.7718 0.8254 1.0000 0.8734 0.8077 0.8392 0.7608 0.8231 0.8232 0.8863

x3 0.8337 0.8646 0.8734 1.0000 0.8453 0.8556 0.7999 0.8641 0.8688 0.9264

x4 0.9867 0.9969 0.8077 0.8453 1.0000 0.9776 0.9858 0.9953 0.9925 0.9622

x5 0.9383 0.9783 0.8392 0.8556 0.9776 1.0000 0.9398 0.9738 0.9641 0.9721

x6 0.9954 0.9848 0.7608 0.7999 0.9858 0.9398 1.0000 0.9857 0.9879 0.9260

x7 0.9866 0.9995 0.8231 0.8641 0.9953 0.9738 0.9857 1.0000 0.9986 0.9745

x8 0.9910 0.9972 0.8232 0.8688 0.9925 0.9641 0.9879 0.9986 1.0000 0.9697

x9 0.9341 0.9752 0.8863 0.9264 0.9622 0.9721 0.9260 0.9745 0.9697 1.0000

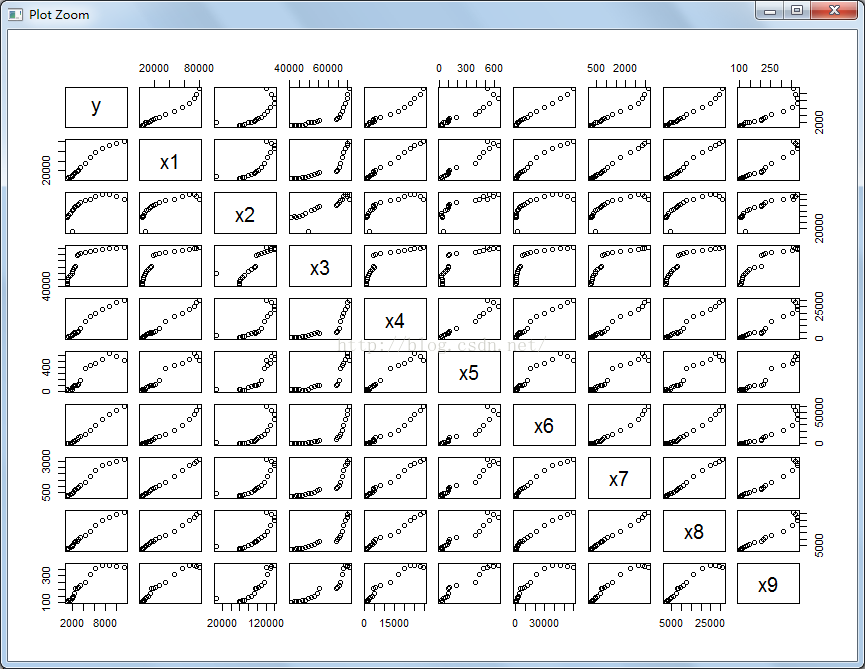

plot(case3) #矩阵散点图

library(psych)

corr.test(case3) #psych包中的corr.test()函数可进行统计显著性检验Correlation matrix

y x1 x2 x3 x4 x5 x6 x7 x8 x9

y 1.00 0.99 0.77 0.83 0.99 0.94 1.00 0.99 0.99 0.93

x1 0.99 1.00 0.83 0.86 1.00 0.98 0.98 1.00 1.00 0.98

x2 0.77 0.83 1.00 0.87 0.81 0.84 0.76 0.82 0.82 0.89

x3 0.83 0.86 0.87 1.00 0.85 0.86 0.80 0.86 0.87 0.93

x4 0.99 1.00 0.81 0.85 1.00 0.98 0.99 1.00 0.99 0.96

x5 0.94 0.98 0.84 0.86 0.98 1.00 0.94 0.97 0.96 0.97

x6 1.00 0.98 0.76 0.80 0.99 0.94 1.00 0.99 0.99 0.93

x7 0.99 1.00 0.82 0.86 1.00 0.97 0.99 1.00 1.00 0.97

x8 0.99 1.00 0.82 0.87 0.99 0.96 0.99 1.00 1.00 0.97

x9 0.93 0.98 0.89 0.93 0.96 0.97 0.93 0.97 0.97 1.00

Sample Size

[1] 21

Probability values (Entries above the diagonal are adjusted for multiple tests.)

y x1 x2 x3 x4 x5 x6 x7 x8 x9

y 0 0 0 0 0 0 0 0 0 0

x1 0 0 0 0 0 0 0 0 0 0

x2 0 0 0 0 0 0 0 0 0 0

x3 0 0 0 0 0 0 0 0 0 0

x4 0 0 0 0 0 0 0 0 0 0

x5 0 0 0 0 0 0 0 0 0 0

x6 0 0 0 0 0 0 0 0 0 0

x7 0 0 0 0 0 0 0 0 0 0

x8 0 0 0 0 0 0 0 0 0 0

x9 0 0 0 0 0 0 0 0 0 0

To see confidence intervals of the correlations, print with the short=FALSE option

从相关分析结果可以看出,y与x1,x2,x3,x4,x5,x6,x7,x8,x9 的关系都非常密切。其中,y与x6之间的关系最为密切(r=0.9954,p=0<0.001)。

fm <- lm(y~., data=case3) #线性回归summary(fm)lm(formula = y ~ ., data = case3)

Residuals:

Min 1Q Median 3Q Max

-282.0 -63.3 26.9 90.6 200.8

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -1.43e+02 6.28e+02 -0.23 0.824

x1 -1.14e-01 1.03e-01 -1.10 0.293

x2 -4.42e-03 2.85e-03 -1.55 0.149

x3 3.04e-02 1.58e-02 1.92 0.082 .

x4 2.29e-01 7.38e-02 3.11 0.010 *

x5 -7.92e-01 1.46e+00 -0.54 0.598

x6 1.16e-01 4.35e-02 2.68 0.022 *

x7 -1.49e+00 2.71e+00 -0.55 0.592

x8 3.01e-01 1.59e-01 1.89 0.085 .

x9 2.52e+00 6.84e+00 0.37 0.719

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 161 on 11 degrees of freedom

Multiple R-squared: 0.999, Adjusted R-squared: 0.997

F-statistic: 815 on 9 and 11 DF, p-value: 3.14e-14

得到的线性回归模型如下:

y = -143 - 0.114x1 - 0.0044x2 + 0.0304x3 + 0.229x4 - 0.792x5 + 0.116x6 - 1.49x7 + 0.301x8 + 2.52x9

从回归分析可知,对y(财政收入)影响显著的有 x4(全社会固定资产投资总额)和x6(全国城乡居民储蓄存款年底余额)

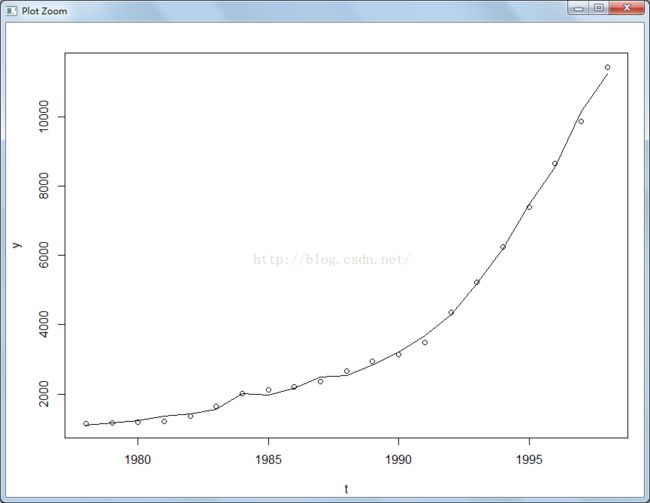

下面利用该回归模型计算出的财政收入总量与实际财政收入总量作出折线图:

y <- case3$y

yhat <- fm$fitted.values #拟合模型的预测值

t <- 1978:1998

plot(t, y)

lines(t, yhat)

拟合性相当好,点和线几乎重合。

来自《多元统计分析及R语言建模》 第四版