Python金融大数据分析——第6章 金融时间序列 笔记

- 第6章 金融时间序列

- 6.1 pandas基础

- 6.1.1 使用DataFrame类的第一步

- 6.1.2 使用DataFrame类的第二步

- 6.1.3 基本分析

- 6.1.4 Series类

- 6.1.5 GroupBy操作

- 6.2 金融数据

- 6.3 回归分析

- 6.4 高频数据

- 6.1 pandas基础

第6章 金融时间序列

6.1 pandas基础

6.1.1 使用DataFrame类的第一步

import pandas as pd

import numpy as np

df = pd.DataFrame([10, 20, 30, 40], columns=['numbers'], index=['a', 'b', 'c', 'd'])

df

# numbers

# a 10

# b 20

# c 30

# d 40

df.index

# Index(['a', 'b', 'c', 'd'], dtype='object')

df.columns

# Index(['numbers'], dtype='object')

df.loc['c']

# numbers 30

# Name: c, dtype: int64

df.loc[['a', 'b']]

# numbers

# a 10

# b 20

df.loc[df.index[1:3]]

# numbers

# b 20

# c 30

df.sum()

# numbers 100

# dtype: int64

df.apply(lambda x: x ** 2)

# numbers

# a 100

# b 400

# c 900

# d 1600

df ** 2

# numbers

# a 100

# b 400

# c 900

# d 1600

df['floats'] = (1.5, 2.5, 3.5, 4.5)

df

# numbers floats

# a 10 1.5

# b 20 2.5

# c 30 3.5

# d 40 4.5

df['floats']

# a 1.5

# b 2.5

# c 3.5

# d 4.5

# Name: floats, dtype: float64

df.floats

# a 1.5

# b 2.5

# c 3.5

# d 4.5

# Name: floats, dtype: float64

df['names'] = pd.DataFrame(['Yves', 'Guido', 'Felix', 'Francesc'], index=['d', 'a', 'b', 'c'])

df

# numbers floats names

# a 10 1.5 Guido

# b 20 2.5 Felix

# c 30 3.5 Francesc

# d 40 4.5 Yves

df.append({'numbers': 100, 'floats': 5.75, 'names': 'Henry'}, ignore_index=True)

# numbers floats names

# 0 10 1.50 Guido

# 1 20 2.50 Felix

# 2 30 3.50 Francesc

# 3 40 4.50 Yves

# 4 100 5.75 Henry

df = df.append(pd.DataFrame({'numbers': 100, 'floats': 5.75, 'names': 'Henry'}, index=['z', ]))

df

# floats names numbers

# a 1.50 Guido 10

# b 2.50 Felix 20

# c 3.50 Francesc 30

# d 4.50 Yves 40

# z 5.75 Henry 100

df.join(pd.DataFrame([1, 4, 9, 16, 25], index=['a', 'b', 'c', 'd', 'y'], columns=['squares', ]))

# floats names numbers squares

# a 1.50 Guido 10 1.0

# b 2.50 Felix 20 4.0

# c 3.50 Francesc 30 9.0

# d 4.50 Yves 40 16.0

# z 5.75 Henry 100 NaN

df = df.join(pd.DataFrame([1, 4, 9, 16, 25],

index=['a', 'b', 'c', 'd', 'y'],

columns=['squares', ]),

how='outer')

df

# floats names numbers squares

# a 1.50 Guido 10.0 1.0

# b 2.50 Felix 20.0 4.0

# c 3.50 Francesc 30.0 9.0

# d 4.50 Yves 40.0 16.0

# y NaN NaN NaN 25.0

# z 5.75 Henry 100.0 NaN

df[['numbers', 'squares']].mean()

# numbers 40.0

# squares 11.0

# dtype: float64

df[['numbers', 'squares']].std()

# numbers 35.355339

# squares 9.669540

# dtype: float646.1.2 使用DataFrame类的第二步

a = np.random.standard_normal((9, 4))

a.round(6)

# array([[ 0.109076, -1.05275 , 1.253471, 0.39846 ],

# [-1.561175, -1.997425, 1.158739, -2.030734],

# [ 0.764723, 0.760368, 0.864103, -0.174079],

# [ 2.429043, 0.281962, -0.496606, 0.009445],

# [-1.679758, -1.02374 , -1.135922, 0.077649],

# [-0.247692, 0.301198, 2.156474, 1.537902],

# [ 1.162934, 2.102327, -0.4501 , 0.812529],

# [-0.374749, -0.818229, -1.013962, -0.476855],

# [ 0.626347, 2.294829, -1.29531 , -0.031501]])

df = pd.DataFrame(a)

df

# 0 1 2 3

# 0 0.109076 -1.052750 1.253471 0.398460

# 1 -1.561175 -1.997425 1.158739 -2.030734

# 2 0.764723 0.760368 0.864103 -0.174079

# 3 2.429043 0.281962 -0.496606 0.009445

# 4 -1.679758 -1.023740 -1.135922 0.077649

# 5 -0.247692 0.301198 2.156474 1.537902

# 6 1.162934 2.102327 -0.450100 0.812529

# 7 -0.374749 -0.818229 -1.013962 -0.476855

# 8 0.626347 2.294829 -1.295310 -0.031501

df.columns = [['No1', 'No2', 'No3', 'No4']]

df

# No1 No2 No3 No4

# 0 0.109076 -1.052750 1.253471 0.398460

# 1 -1.561175 -1.997425 1.158739 -2.030734

# 2 0.764723 0.760368 0.864103 -0.174079

# 3 2.429043 0.281962 -0.496606 0.009445

# 4 -1.679758 -1.023740 -1.135922 0.077649

# 5 -0.247692 0.301198 2.156474 1.537902

# 6 1.162934 2.102327 -0.450100 0.812529

# 7 -0.374749 -0.818229 -1.013962 -0.476855

# 8 0.626347 2.294829 -1.295310 -0.031501

df['No2'][3]

# 0.2819621128403918

dates = pd.date_range('2018-01-01', periods=9, freq='M')

dates

# DatetimeIndex(['2018-01-31', '2018-02-28', '2018-03-31', '2018-04-30',

# '2018-05-31', '2018-06-30', '2018-07-31', '2018-08-31',

# '2018-09-30'],

# dtype='datetime64[ns]', freq='M')data_range函数参数

| 参数 | 格式 | 描述 |

|---|---|---|

| start | 字符串/日期时间 | 生成日期的左界 |

| end | 字符串/日期时间 | 生成日期的右界 |

| periods | 整数/None | 期数(如果start或者end空缺) |

| freq | 字符串/日期偏移 | 频率字符串,例如5D (5天) |

| tz | 字符串/None | 本地化索引的时区名称 |

| nonnalize | 布尔值,默认None | 将star和end规范化为午夜 |

| name | 字符串,默认None | 结果索引名称 |

df.index = dates

df

# No1 No2 No3 No4

# 2018-01-31 0.109076 -1.052750 1.253471 0.398460

# 2018-02-28 -1.561175 -1.997425 1.158739 -2.030734

# 2018-03-31 0.764723 0.760368 0.864103 -0.174079

# 2018-04-30 2.429043 0.281962 -0.496606 0.009445

# 2018-05-31 -1.679758 -1.023740 -1.135922 0.077649

# 2018-06-30 -0.247692 0.301198 2.156474 1.537902

# 2018-07-31 1.162934 2.102327 -0.450100 0.812529

# 2018-08-31 -0.374749 -0.818229 -1.013962 -0.476855

# 2018-09-30 0.626347 2.294829 -1.295310 -0.031501data_range函数频率参数值

| 别名 | 描述 |

|---|---|

| B | 交易日 |

| C | 自定义交易日(试验性) |

| D | 日历日 |

| W | 每周 |

| M | 每月底 |

| BM | 每月最后一个交易日 |

| MS | 月初 |

| BMS | 每月第一个交易日 |

| Q | 季度末 |

| BQ | 每季度最后一个交易日 |

| QS | 季度初 |

| BQS | 每季度第一个交易日 |

| A | 每年底 |

| BA | 每年最后一个交易日 |

| AS | 每年初 |

| BAS | 每年第一个交易日 |

| H | 每小时 |

| T | 每分钟 |

| S | 每秒 |

| L | 毫秒 |

| U | 微秒 |

通常可以从一个 ndarray 对象生成 DataFrame 对象。 但是也可以简单地使用NumPy的array函数从DataFrame 生成一个 ndarray。

np.array(df).round(6)

# array([[ 0.109076, -1.05275 , 1.253471, 0.39846 ],

# [-1.561175, -1.997425, 1.158739, -2.030734],

# [ 0.764723, 0.760368, 0.864103, -0.174079],

# [ 2.429043, 0.281962, -0.496606, 0.009445],

# [-1.679758, -1.02374 , -1.135922, 0.077649],

# [-0.247692, 0.301198, 2.156474, 1.537902],

# [ 1.162934, 2.102327, -0.4501 , 0.812529],

# [-0.374749, -0.818229, -1.013962, -0.476855],

# [ 0.626347, 2.294829, -1.29531 , -0.031501]])6.1.3 基本分析

df.sum()

# No1 1.228750

# No2 0.848540

# No3 1.040888

# No4 0.122816

# dtype: float64

df.mean()

# No1 0.136528

# No2 0.094282

# No3 0.115654

# No4 0.013646

# dtype: float64

df.cumsum()

# No1 No2 No3 No4

# 2018-01-31 0.109076 -1.052750 1.253471 0.398460

# 2018-02-28 -1.452099 -3.050176 2.412210 -1.632274

# 2018-03-31 -0.687376 -2.289807 3.276313 -1.806353

# 2018-04-30 1.741667 -2.007845 2.779707 -1.796908

# 2018-05-31 0.061909 -3.031585 1.643786 -1.719259

# 2018-06-30 -0.185783 -2.730387 3.800259 -0.181357

# 2018-07-31 0.977152 -0.628061 3.350160 0.631172

# 2018-08-31 0.602403 -1.446289 2.336198 0.154317

# 2018-09-30 1.228750 0.848540 1.040888 0.122816

df.describe()

# No1 No2 No3 No4

# count 9.000000 9.000000 9.000000 9.000000

# mean 0.136528 0.094282 0.115654 0.013646

# std 1.300700 1.465006 1.256782 0.972826

# min -1.679758 -1.997425 -1.295310 -2.030734

# 25% -0.374749 -1.023740 -1.013962 -0.174079

# 50% 0.109076 0.281962 -0.450100 0.009445

# 75% 0.764723 0.760368 1.158739 0.398460

# max 2.429043 2.294829 2.156474 1.537902

np.sqrt(df)

# No1 No2 No3 No4

# 2018-01-31 0.330266 NaN 1.119585 0.631236

# 2018-02-28 NaN NaN 1.076447 NaN

# 2018-03-31 0.874484 0.871991 0.929571 NaN

# 2018-04-30 1.558539 0.531001 NaN 0.097184

# 2018-05-31 NaN NaN NaN 0.278656

# 2018-06-30 NaN 0.548815 1.468494 1.240122

# 2018-07-31 1.078394 1.449940 NaN 0.901404

# 2018-08-31 NaN NaN NaN NaN

# 2018-09-30 0.791421 1.514869 NaN NaN

np.sqrt(df).sum()

# No1 4.633104

# No2 4.916616

# No3 4.594098

# No4 3.148602

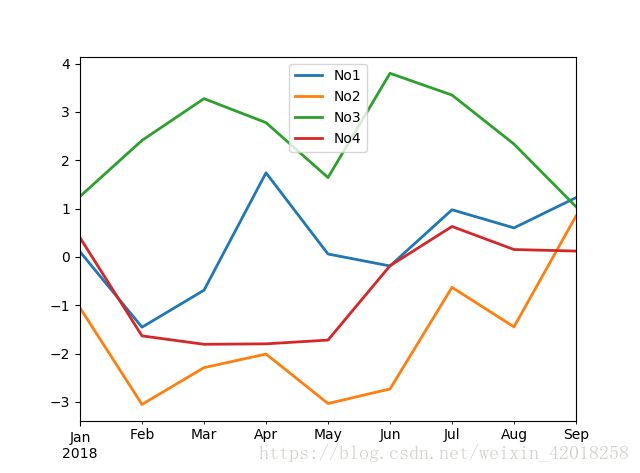

# dtype: float64df.cumsum().plot(lw=2.0)| 参数 | 格式 | 描述 |

|---|---|---|

| x | 标签/位置,默认None | 只在列值为x刻度时使用 |

| y | 标签/位置,默认None | 只在列值为x刻度时使用 |

| subplots | 布尔值,默认False | 子图中的绘图列 |

| sharex | 布尔值,默认True | 共用x轴 |

| sharey | 布尔值,默认False | 共用y轴 |

| use_index | 布尔值,默认True | 使用DataFrame.index作为x轴刻度 |

| stacked | 布尔值,默认False | 堆叠(只用于柱状图) |

| sort_columns | 布尔值,默认False | 在绘图之前将列按字母顺序排列 |

| title | 字符串,默认None | 图表标题 |

| grid | 布尔值,默认False | 水平和垂直网格线 |

| legend | 布尔值,默认True | 标签图例 |

| ax | matplotlib轴对象 | 绘图使用的matplotlib轴对象 |

| style | 字符串或者列表/字典 | 绘图线形(每列) |

| kind | ‘line’ : line plot (default) ‘bar’ : vertical bar plot ‘barh’ : horizontal bar plot ‘hist’ : histogram ‘box’ : boxplot ‘kde’ : Kernel Density Estimation plot ‘density’ : same as ‘kde’ ‘area’ : area plot ‘pie’ : pie plot ‘scatter’ : scatter plot ‘hexbin’ : hexbin plot |

图表类型 |

| logx | 布尔值,默认False | x轴的对数刻度 |

| logy | 布尔值,默认False | y轴的对数刻度 |

| xticks | 序列,默认index | x轴刻度 |

| yticks | 序列,默认Values | y轴刻度 |

| xlim | 二元组,列表 | x轴界限 |

| ylim | 二元组,列表 | y轴界限 |

| rot | 整数,默认为None | 旋转x刻度 |

| secondary_y | 布尔值/序列,默认False | 第二个y轴 |

| mark_right | 布尔值,默认True | 第二个y轴自动设置标签 |

| colormap | 字符串/颜色映射对象,默认None | 用于绘图的颜色映射 |

| kwds | 关键字 | 传递給matplotlib选项 |

6.1.4 Series类

type(df)

# pandas.core.frame.DataFrame

df['No1']

# 2018-01-31 0.109076

# 2018-02-28 -1.561175

# 2018-03-31 0.764723

# 2018-04-30 2.429043

# 2018-05-31 -1.679758

# 2018-06-30 -0.247692

# 2018-07-31 1.162934

# 2018-08-31 -0.374749

# 2018-09-30 0.626347

# Freq: M, Name: No1, dtype: float64

type(df['No1'])

# pandas.core.series.Series

# DataFrame的主要方法也可用于Series对象

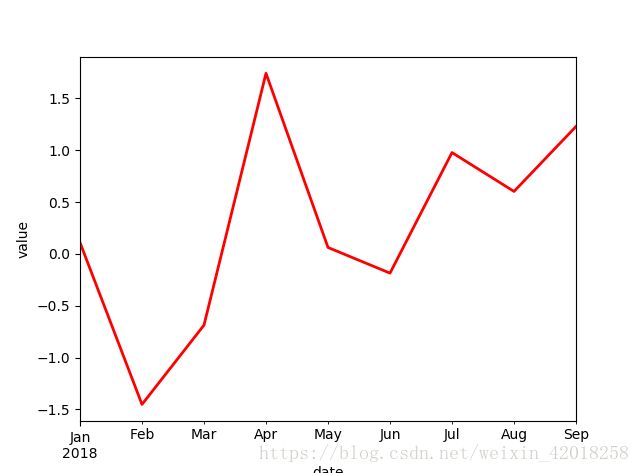

# 6-2 Series对象的线图

import matplotlib.pyplot as plt

df['No1'].cumsum().plot(style='r', lw=2)

plt.xlabel('date')

plt.ylabel('value')DataFrame的主要方法也可用于Series对象

Series对象的线图

import matplotlib.pyplot as plt

df['No1'].cumsum().plot(style='r', lw=2)

plt.xlabel('date')

plt.ylabel('value')6.1.5 GroupBy操作

df['Quarter'] = ['Q1', 'Q1', 'Q1', 'Q2', 'Q2', 'Q2', 'Q3', 'Q3', 'Q3']

df

# No1 No2 No3 No4 Quarter

# 2018-01-31 0.109076 -1.052750 1.253471 0.398460 Q1

# 2018-02-28 -1.561175 -1.997425 1.158739 -2.030734 Q1

# 2018-03-31 0.764723 0.760368 0.864103 -0.174079 Q1

# 2018-04-30 2.429043 0.281962 -0.496606 0.009445 Q2

# 2018-05-31 -1.679758 -1.023740 -1.135922 0.077649 Q2

# 2018-06-30 -0.247692 0.301198 2.156474 1.537902 Q2

# 2018-07-31 1.162934 2.102327 -0.450100 0.812529 Q3

# 2018-08-31 -0.374749 -0.818229 -1.013962 -0.476855 Q3

# 2018-09-30 0.626347 2.294829 -1.295310 -0.031501 Q3

groups = df.groupby('Quarter')

groups.mean()

# No1 No2 No3 No4

# Quarter

# Q1 -0.229125 -0.763269 1.092104 -0.602118

# Q2 0.167198 -0.146860 0.174649 0.541665

# Q3 0.471511 1.192976 -0.919790 0.101391

groups.max()

# No1 No2 No3 No4

# Quarter

# Q1 0.764723 0.760368 1.253471 0.398460

# Q2 2.429043 0.301198 2.156474 1.537902

# Q3 1.162934 2.294829 -0.450100 0.812529

groups.size()

# Quarter

# Q1 3

# Q2 3

# Q3 3

# dtype: int64

df['Odd_Even'] = ['Odd', 'Even', 'Odd', 'Even', 'Odd', 'Even', 'Odd', 'Even', 'Odd']

groups = df.groupby(['Quarter', 'Odd_Even'])

groups.size()

# Quarter Odd_Even

# Q1 Even 1

# Odd 2

# Q2 Even 2

# Odd 1

# Q3 Even 1

# Odd 2

# dtype: int64

groups.mean()

# No1 No2 No3 No4

# Quarter Odd_Even

# Q1 Even -1.561175 -1.997425 1.158739 -2.030734

# Odd 0.436899 -0.146191 1.058787 0.112190

# Q2 Even 1.090676 0.291580 0.829934 0.773673

# Odd -1.679758 -1.023740 -1.135922 0.077649

# Q3 Even -0.374749 -0.818229 -1.013962 -0.476855

# Odd 0.894640 2.198578 -0.872705 0.3905146.2 金融数据

import datetime

import pandas_datareader.data as web

start = datetime.datetime(2016, 1, 1) # or start = '1/1/2016' or '2016-1-1'

end = datetime.date.today()

prices = web.DataReader('AAPL', 'yahoo', start, end)

# 从雅虎财经拉取的苹果股价

prices.head()| Open | High | Low | Close | Adj | Close | Volume | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2015-12-31 | 107.010002 | 107.029999 | 104.820000 | 105.260002 | 100.540207 | 40635300 | |

| 2016-01-04 | 102.610001 | 105.370003 | 102.000000 | 105.349998 | 100.626175 | 67649400 | |

| 2016-01-05 | 105.750000 | 105.849998 | 102.410004 | 102.709999 | 98.104546 | 55791000 | |

| 2016-01-06 | 100.559998 | 102.370003 | 99.870003 | 100.699997 | 96.184654 | 68457400 | |

| 2016-01-07 | 98.680000 | 100.129997 | 96.430000 | 96.449997 | 92.125244 | 81094400 |

DataReader函数参数(源代码的参数说明已经很详细了)

| 参数 | 格式 | 描述 |

|---|---|---|

| name | 字符串 | 数据集名称——通常是股票代码 |

| data_source | 如“yahoo” | “yahoo”:Yahoo! Finance, ”google”:Google Finance, ”fred”:St. Louis FED (FRED), ”famafrench”:Kenneth French’s data library, ”edgar-index”:the SEC’s EDGAR Index |

| start | 字符串/日期时间/None | 范围左界(默认”2010/1/1”) |

| end | 字符串/日期时间/None | 范围右界(默认当天) |

指数历史水平

prices['Close'].plot(figsize=(8, 5))指数和每日指数收益

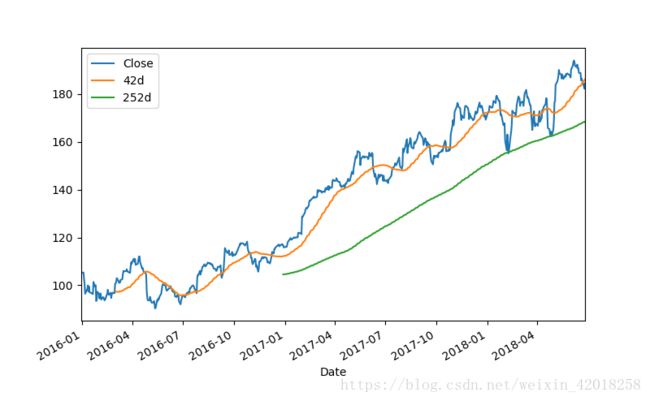

prices[['Close', 'Return']].plot(subplots=True, style='b', figsize=(8, 5))指数及移动平均线

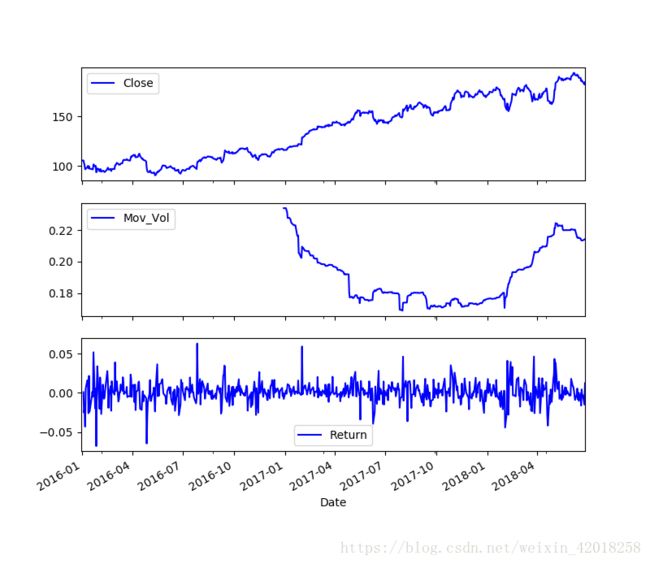

prices[['Close', '42d', '252d']].plot(figsize=(8, 5))指数和移动年化波动率

import math

prices['Mov_Vol'] = pd.rolling_std(prices['Return'], window=252) * math.sqrt(252)

prices[['Close', 'Mov_Vol', 'Return']].plot(subplots=True, style='b', figsize=(8, 7))6.3 回归分析

import pandas as pd

import urllib.request

es_url = 'https://www.stoxx.com/document/Indices/Current/HistoricalData/hbrbcpe.txt'

vs_url = 'https://www.stoxx.com/document/Indices/Current/HistoricalData/h_vstoxx.txt'

es_txt = 'E:/data/es.txt'

vs_txt = 'E:/data/vs.txt'

urllib.request.urlretrieve(es_url, es_txt)

urllib.request.urlretrieve(vs_url, vs_txt)

# 数据处理

lines = open(es_txt, 'r').readlines()

lines = [line.replace(' ', '') for line in lines]

# 生成一个新的文本文件

es50_txt = 'E:/data/es50.txt'

new_file = open(es50_txt, 'w')

new_file.writelines('date' + lines[3][:-1] + ';DEL' + lines[3][-1]) # DEL用来占位

new_file.writelines(lines[4:])

new_file.close()

new_lines = open(es50_txt, 'r').readlines()

new_lines[:5]

# ['date;SX5P;SX5E;SXXP;SXXE;SXXF;SXXA;DK5F;DKXF;DEL\n',

# '31.12.1986;775.00;900.82;82.76;98.58;98.06;69.06;645.26;65.56\n',

# '01.01.1987;775.00;900.82;82.76;98.58;98.06;69.06;645.26;65.56\n',

# '02.01.1987;770.89;891.78;82.57;97.80;97.43;69.37;647.62;65.81\n',

# '05.01.1987;771.89;898.33;82.82;98.60;98.19;69.16;649.94;65.82\n']

es = pd.read_csv(es50_txt, index_col=0, parse_dates=True, sep=';', dayfirst=True)

es.head()

# SX5P SX5E SXXP SXXE SXXF SXXA DK5F DKXF DEL

# date

# 1986-12-31 775.00 900.82 82.76 98.58 98.06 69.06 645.26 65.56 NaN

# 1987-01-01 775.00 900.82 82.76 98.58 98.06 69.06 645.26 65.56 NaN

# 1987-01-02 770.89 891.78 82.57 97.80 97.43 69.37 647.62 65.81 NaN

# 1987-01-05 771.89 898.33 82.82 98.60 98.19 69.16 649.94 65.82 NaN

# 1987-01-06 775.92 902.32 83.28 99.19 98.83 69.50 652.49 66.06 NaN

# 辅助列已经完成了使命,可以删除

del es['DEL']

es.info()

# pd.read_csv参数

pd.read_csv(filepath_or_buffer, sep=’,’, delimiter=None, header=’infer’, names=None, index_col=None, usecols=None, squeeze=False, prefix=None, mangle_dupe_cols=True, dtype=None, engine=None, converters=None, true_values=None, false_values=None, skipinitialspace=False, skiprows=None, nrows=None, na_values=None, keep_default_na=True, na_filter=True, verbose=False, skip_blank_lines=True, parse_dates=False, infer_datetime_format=False, keep_date_col=False, date_parser=None, dayfirst=False, iterator=False, chunksize=None, compression=’infer’, thousands=None, decimal=b’.’, lineterminator=None, quotechar=’”’, quoting=0, escapechar=None, comment=None, encoding=None, dialect=None, tupleize_cols=False, error_bad_lines=True, warn_bad_lines=True, skipfooter=0, skip_footer=0, doublequote=True, delim_whitespace=False, as_recarray=False, compact_ints=False, use_unsigned=False, low_memory=True, buffer_lines=None, memory_map=False, float_precision=None)

import datetime as dt

data = pd.DataFrame({'EUROSTOXX': es['SX5E'][es.index > dt.datetime(1999, 1, 1)]})

data = data.join(pd.DataFrame({'VSTOXX': vs['V2TX'][vs.index > dt.datetime(1999, 1, 1)]}))

data = data.fillna(method='ffill')

data.info()

# EURO STOXX 50和VSTOXX对数收益率

rets=np.log(data/data.shift(1))

rets.head()

# EUROSTOXX VSTOXX

# 1999-01-04 NaN NaN

# 1999-01-05 0.017228 0.489248

# 1999-01-06 0.022138 -0.165317

# 1999-01-07 -0.015723 0.256337

# 1999-01-08 -0.003120 0.021570

# EURO STOXX 50和VSTOXX对数收益率

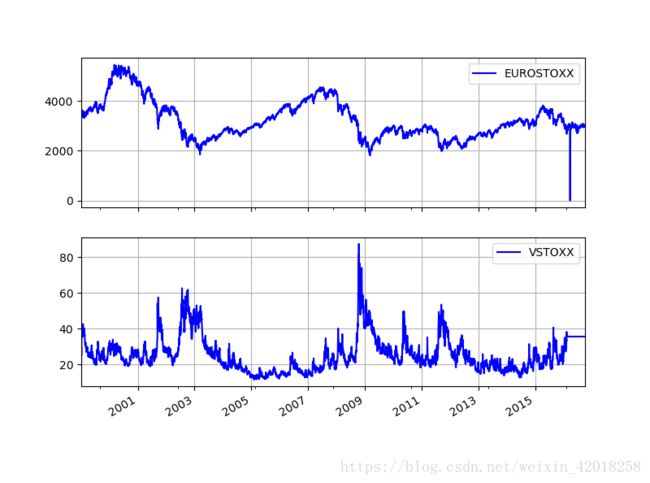

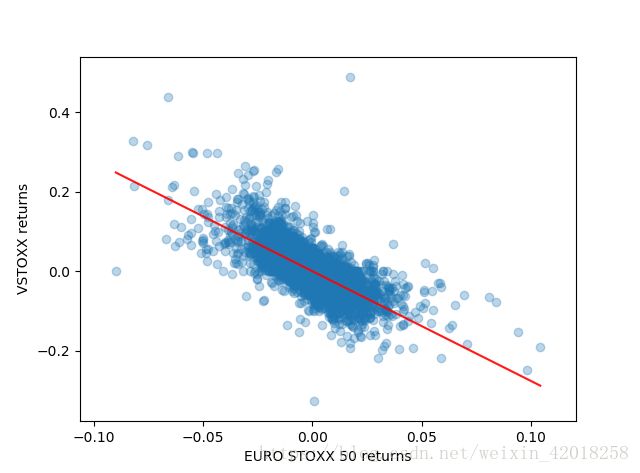

rets.plot(subplots=True,grid=True,style='b',figsize=(8,6))对数收益率散点图和回归线

# 对数收益率散点图和回归线

y = rets.VSTOXX # 结果变量

X = rets.EUROSTOXX # 预测变量

p_inf=float("inf") # 正无穷

n_inf=float("-inf") # 负无穷

y = y.map(lambda x: y.median() if x == p_inf or x == n_inf or np.isnan(x) else x)

X = X.map(lambda x: y.median() if x == p_inf or x == n_inf or np.isnan(x) else x)

import matplotlib.pyplot as plt

import statsmodels.api as sm

model = sm.OLS(y, X)

model = model.fit()

model.summary()

# EURO STOXX 50和VSTOXX之间的滚动相关

rets.corr()

# EUROSTOXX VSTOXX

# EUROSTOXX 1.000000 -0.724945

# VSTOXX -0.724945 1.000000

pd.rolling_corr(rets.EUROSTOXX,rets.VSTOXX,window=252).plot(grid=True,style='b')6.4 高频数据

一个交易日的股价分时数据和交易量

import numpy as np

import datetime as dt

import tushare as ts

import datetime

import matplotlib.pyplot as plt

plt.rcParams['font.sans-serif'] = ['SimHei'] # 用来正常显示中文标签

plt.rcParams['axes.unicode_minus'] = False # 用来正常显示负号

# 这里用tushare获取了600118中国卫星一周的5分钟分时数据

k_5 = ts.get_k_data(code="600118", start="2018-06-18", end="2018-06-22", ktype='5')

k_5.head()

# 这个接口返回的数据和查询条件有些对不上,当测试数据还是可以的

# date open close high low volume code

# 0 2018-06-12 14:55 20.57 20.57 20.58 20.54 489.0 600118

# 1 2018-06-12 15:00 20.56 20.56 20.57 20.54 1163.0 600118

# 2 2018-06-13 09:35 20.48 20.30 20.48 20.26 2895.0 600118

# 3 2018-06-13 09:40 20.30 20.34 20.39 20.30 1258.0 600118

# 4 2018-06-13 09:45 20.35 20.40 20.45 20.35 535.0 600118

k_5['date'] = k_5['date'].map(lambda x: datetime.datetime.strptime(x, '%Y-%m-%d %H:%M'))

# 筛选出一天的数据

plot_data = k_5[['date','close', 'volume']][(k_5['date'] > dt.datetime(2018, 6, 20)) & (k_5['date'] < dt.datetime(2018, 6, 21))]

# 横坐标

l = plot_data.index

lx = plot_data['date'].map(lambda x: datetime.datetime.strftime(x,'%m-%d %H:%M'))

# 画图

fig, (ax1, ax2) = plt.subplots(2, sharex=True, figsize=(8, 6))

# 折线图

ax1.plot(l, plot_data['close'].values)

ax1.set_title('中国卫星')

ax1.set_ylabel('index level')

# 柱状图

ax2.bar(l, plot_data['volume'].values.astype('int'), width=0.5)

ax2.set_ylabel('volume')

plt.xticks(l, lx, rotation=270)

fig.subplots_adjust(bottom=0.3)

plt.show()