用户存续期价值评估CLV(三) Gamma-Gamma模型 Python模拟

Gamma-Gamma模型

前面已经提到过,Pareto/NBD和BG/NBD模型只对客户存续时间和交易次数进行建模,并不涉及客户未来交易所带来的现金价值。

Gamma-Gamma模型就是对这个问题的一个扩展解决方案。

Gamma-Gamma模型做了如下假设:

- 从客户角度上来说,交易金额在每个客户的平均交易价值上随机波动。(这一点并不是很有说服力)

- 所观察到的交易价值均值是隐含价值均值 () 的非完美计量

- 交易价值均值在客户中是变化的,即使这个值是稳定的(这个假设非常大)

- 在客户中的平均交易价值的分布与交易过程无关。换句话说,就是现金价值与客户购买次数和客户存续时间可以分开建模。 (在真实场景下,这个假设很可能不成立)

如果我们令 z 1 , z 2 , . . . , z x z_1,z_2,...,z_x z1,z2,...,zx 为客户历史上的每次交易的价值序列,所观测到的历史交易价值均值为 z ˉ = ∑ i = 1 x z i / x \bar{z}=\sum_{i=1}^{x}z_i/x zˉ=∑i=1xzi/x

模型认为:

- z i z_i zi 服从 g a m m a ( p , v ) gamma(p,v) gamma(p,v)分布,根据Gamma分布的可加性,在 x x x 个交易的总价值的分布服从 g a m m a ( p x , v ) gamma(px,v) gamma(px,v) ; 而根据gamma分布的尺度特性, z ˉ \bar{z} zˉ 服从 g a m m a ( p x , v x ) gamma(px,vx) gamma(px,vx)

- v v v 服从 g a m m a ( q , γ ) gamma(q,\gamma) gamma(q,γ)

模型的条件期望为:

E ( M ∣ p , q , γ , m x , x ) = ( γ + m x x ) p p x + q − 1 = ( q − 1 p x + q − 1 ) γ p q − 1 + ( p x p x + q − 1 ) m x E(M|p,q,\gamma,m_x,x)=\frac{(\gamma+m_xx)p}{px+q-1}=(\frac{q-1}{px+q-1})\frac{\gamma p}{q-1}+(\frac{px}{px+q-1})m_x E(M∣p,q,γ,mx,x)=px+q−1(γ+mxx)p=(px+q−1q−1)q−1γp+(px+q−1px)mx

m x m_x mx是观测的交易价值均值

可采用最大似然估计来估算参数

采用lifetimes包中包含经济价值的数据来拟合模型

from lifetimes.datasets import load_cdnow_summary_data_with_monetary_value

summary_with_money_value = load_cdnow_summary_data_with_monetary_value()

summary_with_money_value.head()

returning_customers_summary = summary_with_money_value[summary_with_money_value['frequency']>0]

print(returning_customers_summary.head())

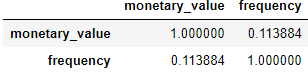

returning_customers_summary[['monetary_value', 'frequency']].corr()

from lifetimes import GammaGammaFitter

ggf = GammaGammaFitter(penalizer_coef = 0)

ggf.fit(returning_customers_summary['frequency'],

returning_customers_summary['monetary_value'])

print(ggf)

print(ggf.conditional_expected_average_profit(

summary_with_money_value['frequency'],

summary_with_money_value['monetary_value']

).head(10))

print("Expected conditional average profit: %s, Average profit: %s" % (

ggf.conditional_expected_average_profit(

summary_with_money_value['frequency'],

summary_with_money_value['monetary_value']

).mean(),

summary_with_money_value[summary_with_money_value['frequency']>0]['monetary_value'].mean()

))

训练Gamma-Gamma模型,并预测平均交易价值

from lifetimes.datasets import load_cdnow_summary

from lifetimes import BetaGeoFitter

data = load_cdnow_summary(index_col=[0])

bgf = BetaGeoFitter(penalizer_coef=0.0)

bgf.fit(data['frequency'], data['recency'], data['T'])

bgf.fit(summary_with_money_value['frequency'], summary_with_money_value['recency'], summary_with_money_value['T'])

print(ggf.customer_lifetime_value(

bgf, #the model to use to predict the number of future transactions

summary_with_money_value['frequency'],

summary_with_money_value['recency'],

summary_with_money_value['T'],

summary_with_money_value['monetary_value'],

time=12, # months

discount_rate=0.01 # monthly discount rate ~ 12.7% annually

).head(10))