原文链接:http://tecdat.cn/?p=13963

在精算科学和保险费率制定中,考虑到风险敞口可能是一场噩梦。不知何故,简单的结果是因为计算起来更加复杂,只是因为我们必须考虑到暴露是一个异构变量这一事实。

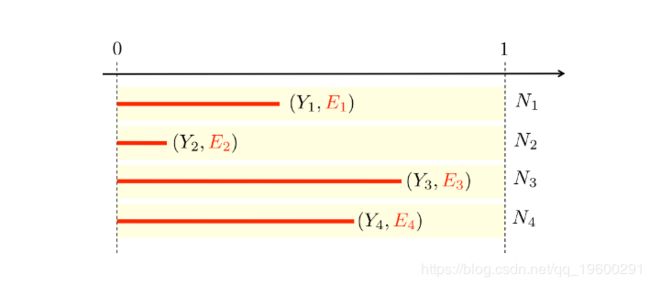

保险费率制定中的风险敞口可以看作是审查数据的问题(在我的数据集中,风险敞口始终小于1,因为观察结果是合同,而不是保单持有人),利息变量是未观察到的变量,因为我们必须为保险合同定价一年(整年)的保险期。因此,我们必须对保险索赔的年度频率进行建模。

在我们的数据集中,我们考虑索赔总数与总风险承担比率。例如,如果我们考虑泊松过程,可能性是

即

因此,我们有一个预期值的估算,一个自然估算 。

现在,我们需要估算方差,更准确地说是条件变量。

这可以用来检验泊松假设是否对频率建模有效。考虑以下数据集,

> nombre=rbind(nombre1,nombre2)

> baseFREQ = merge(contrat,nombre)在这里,我们确实有两个感兴趣的变量,即每张合约的敞口,

> E <- baseFREQ$exposition和(观察到的)索赔数量(在该时间段内)

> Y <- baseFREQ$nbre无需协变量,可以计算每个合同的平均(每年)索赔数量以及相关的方差

> (mean=weighted.mean(Y/E,E))

[1] 0.07279295

> (variance=sum((Y-mean*E)^2)/sum(E))

[1] 0.08778567看起来方差(略)大于平均值(我们将在几周后看到如何更正式地对其进行测试)。可以在保单持有人居住的地区添加协变量,例如人口密度,

Density, zone 11 average = 0.07962411 variance = 0.08711477

Density, zone 21 average = 0.05294927 variance = 0.07378567

Density, zone 22 average = 0.09330982 variance = 0.09582698

Density, zone 23 average = 0.06918033 variance = 0.07641805

Density, zone 24 average = 0.06004009 variance = 0.06293811

Density, zone 25 average = 0.06577788 variance = 0.06726093

Density, zone 26 average = 0.0688496 variance = 0.07126078

Density, zone 31 average = 0.07725273 variance = 0.09067

Density, zone 41 average = 0.03649222 variance = 0.03914317

Density, zone 42 average = 0.08333333 variance = 0.1004027

Density, zone 43 average = 0.07304602 variance = 0.07209618

Density, zone 52 average = 0.06893741 variance = 0.07178091

Density, zone 53 average = 0.07725661 variance = 0.07811935

Density, zone 54 average = 0.07816105 variance = 0.08947993

Density, zone 72 average = 0.08579731 variance = 0.09693305

Density, zone 73 average = 0.04943033 variance = 0.04835521

Density, zone 74 average = 0.1188611 variance = 0.1221675

Density, zone 82 average = 0.09345635 variance = 0.09917425

Density, zone 83 average = 0.04299708 variance = 0.05259835

Density, zone 91 average = 0.07468126 variance = 0.3045718

Density, zone 93 average = 0.08197912 variance = 0.09350102

Density, zone 94 average = 0.03140971 variance = 0.04672329可以可视化该信息

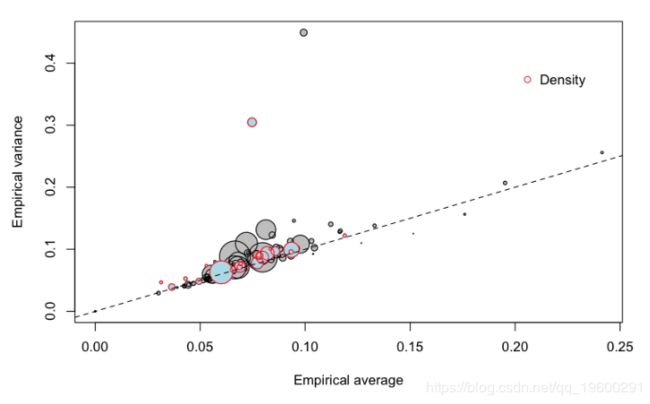

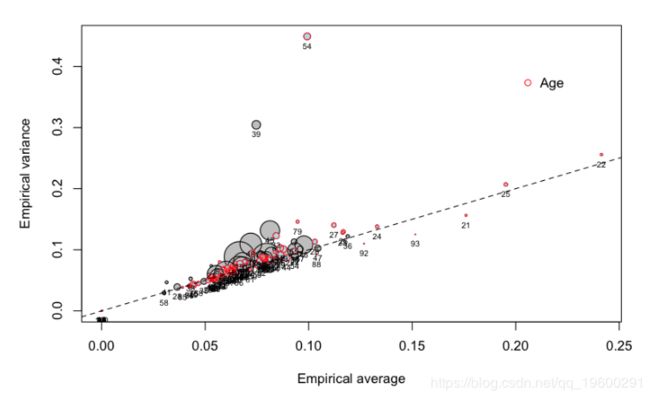

> plot(meani,variancei,cex=sqrt(Ei),col="grey",pch=19,

+ xlab="Empirical average",ylab="Empirical variance")

> points(meani,variancei,cex=sqrt(Ei))

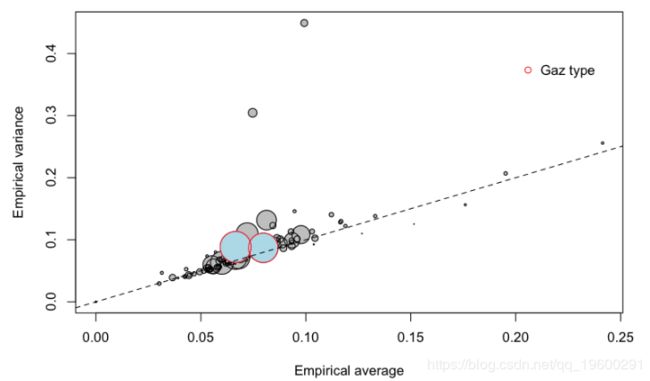

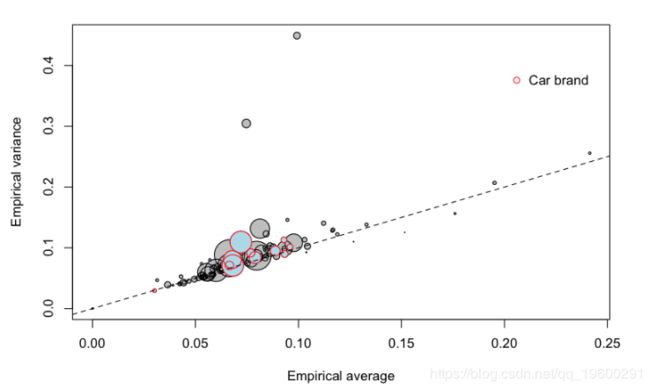

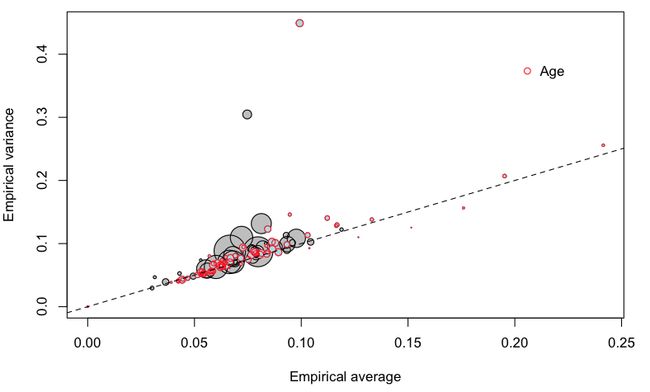

圆圈的大小与组的大小有关(面积与组内的总暴露量成正比)。第一个对角线对应于泊松模型,即方差应等于均值。也可以考虑其他协变量

或汽车品牌,

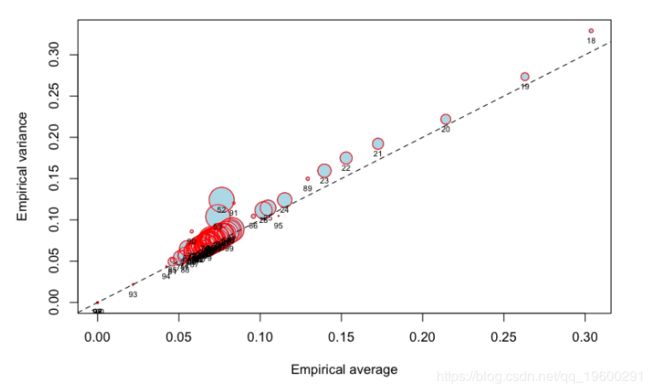

也可以将驾驶员的年龄视为分类变量

让我们更仔细地看一下不同年龄段的人,

在右边,我们可以观察到年轻的(没有经验的)驾驶员。那是预料之中的。但是有些类别 低于 第一个对角线:期望的频率很大,但方差不大。也就是说,我们 可以肯定的 是,年轻的驾驶员会发生更多的车祸。相反,它不是一个异类:年轻的驾驶员可以看作是一个相对同质的类,发生车祸的频率很高。

使用原始数据集(在这里,我仅使用具有50,000个客户的子集),我们确实获得了以下图形:

由于圈正在从18岁下降到25岁,因此具有明显的经验影响。

同时我们可以发现有可能将曝光量视为标准变量,并查看系数实际上是否等于1。如果没有任何协变量,

Call:

glm(formula = Y ~ log(E), family = poisson("log"))

Deviance Residuals:

Min 1Q Median 3Q Max

-0.3988 -0.3388 -0.2786 -0.1981 12.9036

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -2.83045 0.02822 -100.31 <2e-16 ***

log(E) 0.53950 0.02905 18.57 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

(Dispersion parameter for poisson family taken to be 1)

Null deviance: 12931 on 49999 degrees of freedom

Residual deviance: 12475 on 49998 degrees of freedom

AIC: 16150

Number of Fisher Scoring iterations: 6也就是说,该参数显然严格小于1。它与重要性均不相关,

Linear hypothesis test

Hypothesis:

log(E) = 1

Model 1: restricted model

Model 2: Y ~ log(E)

Res.Df Df Chisq Pr(>Chisq)

1 49999

2 49998 1 251.19 < 2.2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1我也没有考虑协变量,

Deviance Residuals:

Min 1Q Median 3Q Max

-0.7114 -0.3200 -0.2637 -0.1896 12.7104

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -14.07321 181.04892 -0.078 0.938042

log(exposition) 0.56781 0.03029 18.744 < 2e-16 ***

carburantE -0.17979 0.04630 -3.883 0.000103 ***

as.factor(ageconducteur)19 12.18354 181.04915 0.067 0.946348

as.factor(ageconducteur)20 12.48752 181.04902 0.069 0.945011因此,假设暴露是此处的外生变量可能是一个过强的假设。

接下来我们开始讨论建模索赔频率时的过度分散。在前面,我讨论了具有不同暴露程度的经验方差的计算。但是我只使用一个因素来计算类。当然,可以使用更多的因素。例如,使用因子的笛卡尔积,

Class D A (17,24] average = 0.06274415 variance = 0.06174966

Class D A (24,40] average = 0.07271905 variance = 0.07675049

Class D A (40,65] average = 0.05432262 variance = 0.06556844

Class D A (65,101] average = 0.03026999 variance = 0.02960885

Class D B (17,24] average = 0.2383109 variance = 0.2442396

Class D B (24,40] average = 0.06662015 variance = 0.07121064

Class D B (40,65] average = 0.05551854 variance = 0.05543831

Class D B (65,101] average = 0.0556386 variance = 0.0540786

Class D C (17,24] average = 0.1524552 variance = 0.1592623

Class D C (24,40] average = 0.0795852 variance = 0.09091435

Class D C (40,65] average = 0.07554481 variance = 0.08263404

Class D C (65,101] average = 0.06936605 variance = 0.06684982

Class D D (17,24] average = 0.1584052 variance = 0.1552583

Class D D (24,40] average = 0.1079038 variance = 0.121747

Class D D (40,65] average = 0.06989518 variance = 0.07780811

Class D D (65,101] average = 0.0470501 variance = 0.04575461

Class D E (17,24] average = 0.2007164 variance = 0.2647663

Class D E (24,40] average = 0.1121569 variance = 0.1172205

Class D E (40,65] average = 0.106563 variance = 0.1068348

Class D E (65,101] average = 0.1572701 variance = 0.2126338

Class D F (17,24] average = 0.2314815 variance = 0.1616788

Class D F (24,40] average = 0.1690485 variance = 0.1443094

Class D F (40,65] average = 0.08496827 variance = 0.07914423

Class D F (65,101] average = 0.1547769 variance = 0.1442915

Class E A (17,24] average = 0.1275345 variance = 0.1171678

Class E A (24,40] average = 0.04523504 variance = 0.04741449

Class E A (40,65] average = 0.05402834 variance = 0.05427582

Class E A (65,101] average = 0.04176129 variance = 0.04539265

Class E B (17,24] average = 0.1114712 variance = 0.1059153

Class E B (24,40] average = 0.04211314 variance = 0.04068724

Class E B (40,65] average = 0.04987117 variance = 0.05096601

Class E B (65,101] average = 0.03123003 variance = 0.03041192

Class E C (17,24] average = 0.1256302 variance = 0.1310862

Class E C (24,40] average = 0.05118006 variance = 0.05122782

Class E C (40,65] average = 0.05394576 variance = 0.05594004

Class E C (65,101] average = 0.04570239 variance = 0.04422991

Class E D (17,24] average = 0.1777142 variance = 0.1917696

Class E D (24,40] average = 0.06293331 variance = 0.06738658

Class E D (40,65] average = 0.08532688 variance = 0.2378571

Class E D (65,101] average = 0.05442916 variance = 0.05724951

Class E E (17,24] average = 0.1826558 variance = 0.2085505

Class E E (24,40] average = 0.07804062 variance = 0.09637156

Class E E (40,65] average = 0.08191469 variance = 0.08791804

Class E E (65,101] average = 0.1017367 variance = 0.1141004

Class E F (17,24] average = 0 variance = 0

Class E F (24,40] average = 0.07731177 variance = 0.07415932

Class E F (40,65] average = 0.1081142 variance = 0.1074324

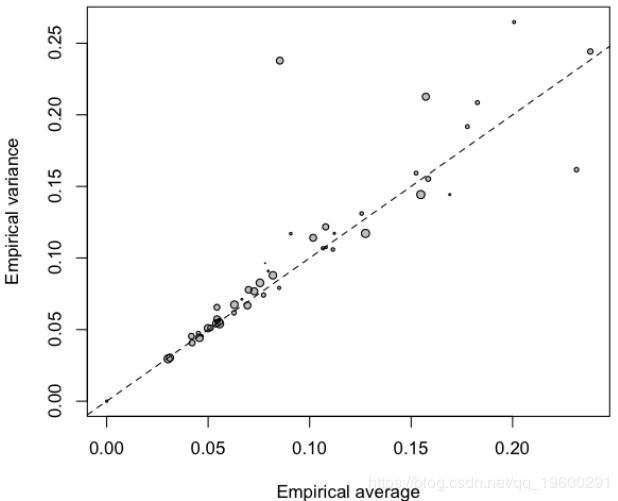

Class E F (65,101] average = 0.09071118 variance = 0.1170159同样,可以将方差与平均值作图,

> plot(vm,vv,cex=sqrt(ve),col="grey",pch=19,

+ xlab="Empirical average",ylab="Empirical variance")

> points(vm,vv,cex=sqrt(ve))

> abline(a=0,b=1,lty=2)

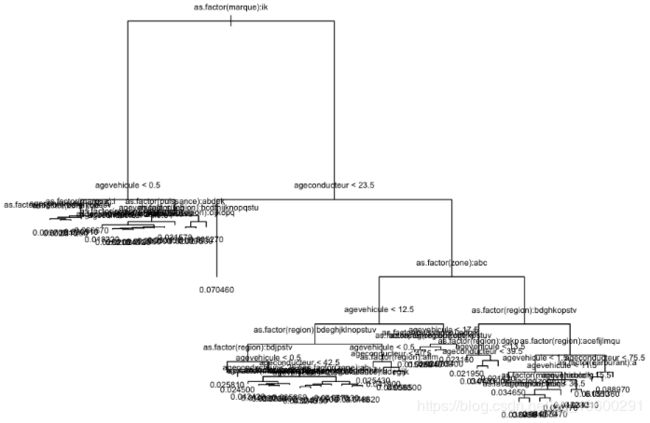

一种替代方法是使用树。树可以从其他变量获得,但它应该是相当接近我们理想的模型。在这里,我确实使用了整个数据库(超过60万行)

树如下

> plot(T)

> text(T)

现在,每个分支都定义了一个类,可以使用它来定义一个类。应该被认为是同质的。

Class 6 average = 0.04010406 variance = 0.04424163

Class 8 average = 0.05191127 variance = 0.05948133

Class 9 average = 0.07442635 variance = 0.08694552

Class 10 average = 0.4143646 variance = 0.4494002

Class 11 average = 0.1917445 variance = 0.1744355

Class 15 average = 0.04754595 variance = 0.05389675

Class 20 average = 0.08129577 variance = 0.0906322

Class 22 average = 0.05813419 variance = 0.07089811

Class 23 average = 0.06123807 variance = 0.07010473

Class 24 average = 0.06707301 variance = 0.07270995

Class 25 average = 0.3164557 variance = 0.2026906

Class 26 average = 0.08705041 variance = 0.108456

Class 27 average = 0.06705214 variance = 0.07174673

Class 30 average = 0.05292652 variance = 0.06127301

Class 31 average = 0.07195285 variance = 0.08620593

Class 32 average = 0.08133722 variance = 0.08960552

Class 34 average = 0.1831559 variance = 0.2010849

Class 39 average = 0.06173885 variance = 0.06573939

Class 41 average = 0.07089419 variance = 0.07102932

Class 44 average = 0.09426152 variance = 0.1032255

Class 47 average = 0.03641669 variance = 0.03869702

Class 49 average = 0.0506601 variance = 0.05089276

Class 50 average = 0.06373107 variance = 0.06536792

Class 51 average = 0.06762947 variance = 0.06926191

Class 56 average = 0.06771764 variance = 0.07122379

Class 57 average = 0.04949142 variance = 0.05086885

Class 58 average = 0.2459016 variance = 0.2451116

Class 59 average = 0.05996851 variance = 0.0615773

Class 61 average = 0.07458053 variance = 0.0818608

Class 63 average = 0.06203737 variance = 0.06249892

Class 64 average = 0.07321618 variance = 0.07603106

Class 66 average = 0.07332127 variance = 0.07262425

Class 68 average = 0.07478147 variance = 0.07884597

Class 70 average = 0.06566728 variance = 0.06749411

Class 71 average = 0.09159605 variance = 0.09434413

Class 75 average = 0.03228927 variance = 0.03403198

Class 76 average = 0.04630848 variance = 0.04861813

Class 78 average = 0.05342351 variance = 0.05626653

Class 79 average = 0.05778622 variance = 0.05987139

Class 80 average = 0.0374993 variance = 0.0385351

Class 83 average = 0.06721729 variance = 0.07295168

Class 86 average = 0.09888492 variance = 0.1131409

Class 87 average = 0.1019186 variance = 0.2051122

Class 88 average = 0.05281703 variance = 0.0635244

Class 91 average = 0.08332136 variance = 0.09067632

Class 96 average = 0.07682093 variance = 0.08144446

Class 97 average = 0.0792268 variance = 0.08092019

Class 99 average = 0.1019089 variance = 0.1072126

Class 100 average = 0.1018262 variance = 0.1081117

Class 101 average = 0.1106647 variance = 0.1151819

Class 103 average = 0.08147644 variance = 0.08411685

Class 104 average = 0.06456508 variance = 0.06801061

Class 107 average = 0.1197225 variance = 0.1250056

Class 108 average = 0.0924619 variance = 0.09845582

Class 109 average = 0.1198932 variance = 0.1209162在这里,当根据索赔的经验平均值绘制经验方差时,我们得到

在这里,我们可以识别剩余异质性的类。

![https://latex.codecogs.com/gif.latex?\mathcal{L}(\lambda,\boldsymbol{Y},\boldsymbol{E})=\prod_{i=1}^n%20\frac{e^{-\lambda%20E_i}%20[\lambda%20E_i]^{Y_i}}{Y_i!}](http://img.e-com-net.com/image/info8/2615b9a5949c4d3192497bbc65a5bf0c.gif)

![https://latex.codecogs.com/gif.latex?\log%20\mathcal{L}(\lambda,\boldsymbol{Y},\boldsymbol{E})%20=%20-\lambda%20\sum_{i=1}^n%20E_i%20+\sum_{i=1}^n%20Y_i%20\log[\lambda%20E_i]%20-%20\log\left(\prod_{i=1}^n%20Y_i!\right)](http://img.e-com-net.com/image/info8/fabe2c9d7b724aaa8242fd000a2ea68a.gif)