Python时间序列--股票预测(七)

1.数据获取

import pandas as pd

import datetime

import pandas_datareader.data as web

import matplotlib.pyplot as plt

import seaborn as sns

from statsmodels.tsa.arima_model import ARIMA

from statsmodels.graphics.tsaplots import plot_acf, plot_pacf

#可以适用接口从雅虎获取股票数据

start=datetime.datetime(2000,1,1)

end=datetime.datetime(2015,12,31)

prices=web.DataReader('002578.SZ','yahoo',start,end)

prices.head()

#存入本地

prices.to_csv('data/yahoo.csv')

#从本地读取数据 本文用的是本地数据,未用接口数据

stock = pd.read_csv('data/yahoo.csv', index_col=0, parse_dates=[0])

stock.head(10)

2.训练数据

#下采样 日频数据太多

stock_week = stock['Close'].resample('W-MON').mean()

#训练数据

stock_train = stock_week['2000':'2015']

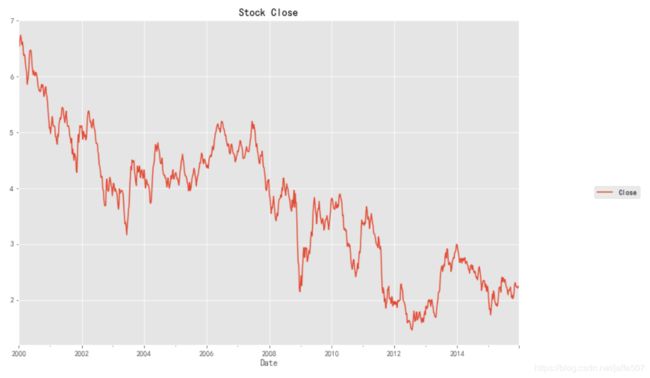

3.数据平稳性检测

#绘出数据折线图,查看数据是否平稳

stock_train.plot(figsize=(12,8))

plt.legend(bbox_to_anchor=(1.25, 0.5))

plt.title("Stock Close")

sns.despine()

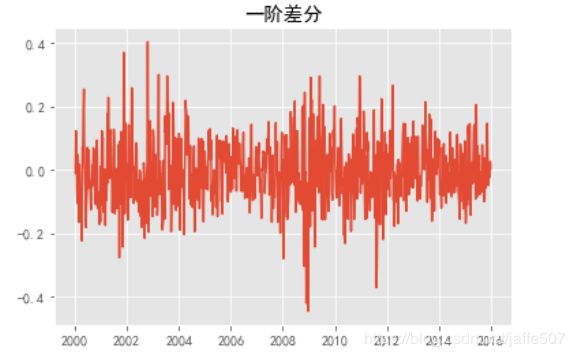

4.一阶差分

stock_diff = stock_train.diff()

stock_diff = stock_diff.dropna()

plt.figure()

plt.plot(stock_diff)

plt.title('一阶差分')

plt.show()

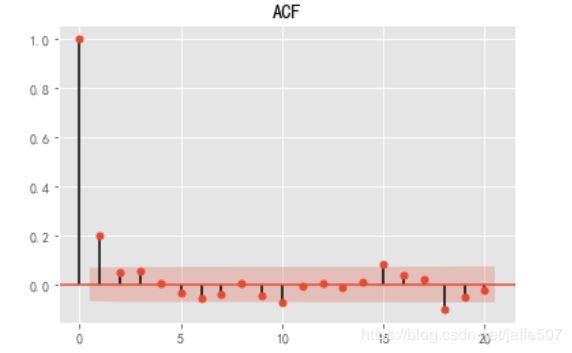

acf = plot_acf(stock_diff, lags=20)

plt.title("ACF")

acf.show()

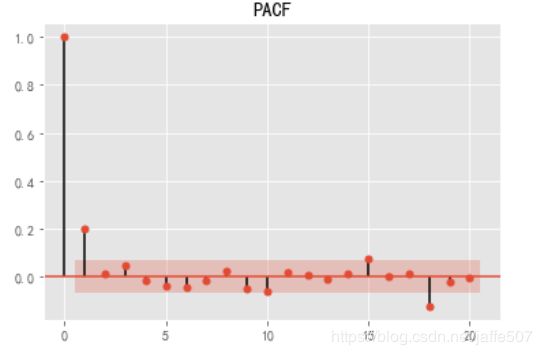

pacf = plot_pacf(stock_diff, lags=20)

plt.title("PACF")

pacf.show()

一阶差分后,ACF&PACF基本上都落在了0轴上,表明一阶差分就够用了。并且可确定pqd的的取值都为1。

5.模型训练

model = ARIMA(stock_train, order=(1, 1, 1),freq='W-MON')

model_pred = model.fit()

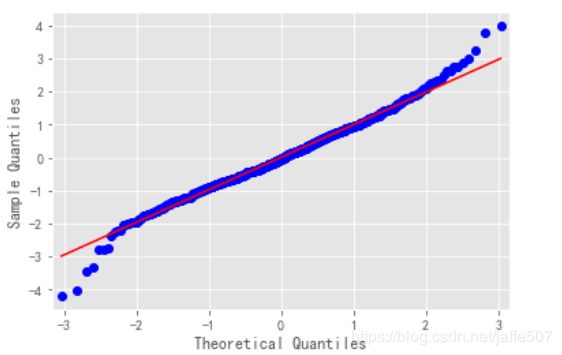

6.残差检测

from statsmodels.graphics.api import qqplot

#残差

resid=model_pred.resid.values

fig=plt.figure(figsize=(12,8))

fig=qqplot(resid,line='q',fit=True)

7.预测

pred = result.predict('20140609', '20160701',dynamic=True, typ='levels')

plt.figure(figsize=(6, 6))

plt.xticks(rotation=45)

plt.plot(pred)

plt.plot(stock_train)