The Dilemma of Crytocurrency

When Asian countries like Korea and Japan are busy paving the way for crytocurrency trading by providing a more cryto-friendly environment, there are callings for the government to step in and introduce stronger regulation in European countries and America.Even Bill Gates and Warren Buffett, two world-class giants, bashed the tokens respectively as “ rat poison” and “kind of a pure 'greater fool theory' type of investment.”

"I agree I would short it if there was an easy way to do it," Gates added.

It seems that governments are deeply divided over Bitcoin and other crytocurrencies and the tokens are in the dilemma of whether to go legal or not.

This article is going to investigate the cause of crytocurrency’s dilemma from different aspects.

1.Being extremely volatile in price and highly-speculative in investment

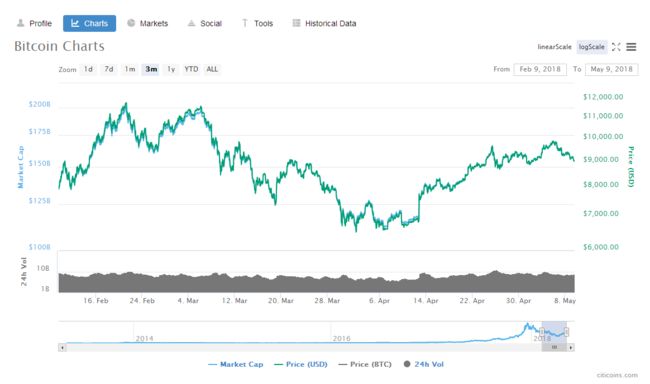

There is always coverage about the fluctuation of crytocurrency’s price. For example, shortly after the news reporting Bitcoin was on the way to approach $10,000, the price fell down to $9188.66, from over $9900 because of some criticism from the financial colossus. As a rather “sensitive” and “newly-invented”currency that hasn’t been widely-recognized by all the government and has no sophisticated system, the price of crytocurrencies tends to be rather changeable and volatile, and is easily influenced by the government’s policy and comments from some influential celebrities. Even the lightest touches from the government could arouse wild fluctuation in price, and it somehow poses a potential threat to financial stability in the market , and will furthor influence the world economy for it is a borderless currency.

data from citicoin.com

According to Wikipedia, crytocurrencies,such as Bitcoin, Verge and Stellar, is a type of digital currencies, alternative currencies and virtual currencies. However, the token now is rather an asset than a currency. People incline to buy up it and turn it into profit, rather than using it as a medium of exchange, in other words, they are not using it as payment and they are merely speculating on it . Then the speculation activity drives up Bitcoin price to a rocket-high level in a rather short term.

data from citicoin.com

As Warren Buffett said to CNBC, “The fact that it's clever computer science doesn't mean it should be widely used, and that respectable people should encourage other people to speculate on it.” and it actually produce nothing.” Then it can, to some extent, be assumed as the “tulip bubble” which has not yet and will burst in the end. Because everyone expects to sell the coin at a higher price to the next person and push up the price to a level which not many people could afford. Then eventually they run up the buyer and the bubble bursts.

2.Being difficult to regulate and easy to be used for criminal activity

The crytocurrency is actually an alternative for people to avoid regulation from government and financial institutions, which is both the part of the good and the bad reputation for the digital coins. It protects people’s privacy by launching business anomalously on the platform, while it also helps people to commit a crime easily for it raises barriers for criminal tracking. As Britain's Prime Minister Theresa May said in Davos“Cryptocurrencies like Bitcoin, we should be looking at these very seriously, precisely because of the way that they can be used, particularly by criminals.”

3.The increasing difficulty in mining and being less profitable

This part may be only be the truth for Bitcoin, for the issuing mechanism of other coins is quite different.

The process of mining Bictoin is a competition on computing power and more computing power is needed as more and more coins had been dug out, for the system will automatically adjust the difficulty of the task, which means it will be harder on computing power.

Then this mechanism actually changes the way of how miners dig out the coin.Miners initially mined with CPU, then they figured, it was not adequate for them to work out the task and they turned to GPU for help. And now, miners tends to join together into the mining pool to work out the task together, where each miners contribute hash power and then distribute coins in proportion to the contribution. Then what’s the next?

The point is the coin is limited, a total of 21 billion, and there is data showed that up to April 7th ,2018, over 80% percent of Bitcoin has been mined, with the amount of 17million, and only 4 million is left.

Then as we mentioned above , the system will automatically adjust the difficulty of the task to control the speed of mining. The truth is miners are gaining less even though they had spent a lot of money in buying more advanced equipment and paying electricity bills. Then this makes mining too costly and less profitable which is the conflict inherent in Bitcoin system.