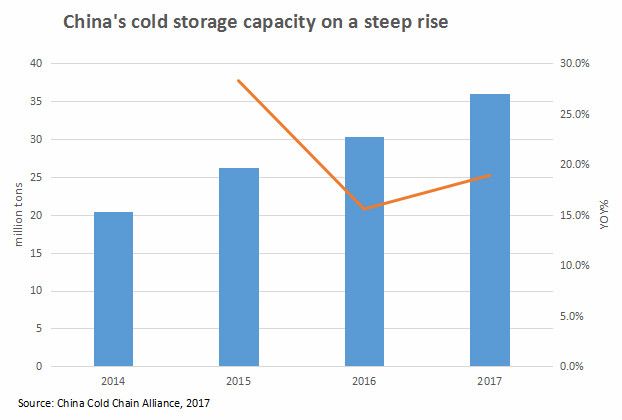

China’s cold storage industry has maintained a rapid growth thanks to booming cross-border ecommerce and mounting food safety concerns, but is constrained by an overly focus on the coastal regions and too much concentration in the temperature range of below minus 18 and minus 25 degrees Celsius.

China’s cold warehouses’ capacity grew at a CAGR of 17.4% during the past ten years to reach 107 million cubic meters, the total almost catching up with that of the US (118 million cubic meters), but per capita capacity was only one-fifths that of the US, according to Xiong Wei (熊伟), General Manager of Accenture China, who spoke in a recent cold storage conference in Shanghai.

Resources continued to converge towards the coastal areas, with East China taking up 46 per cent of the total storage capacity. Although China’s mid-west was the source of the majority of fresh produce wholesale market, refrigerated warehouses are acutely in shortage.

Xiong said that cross-border ecommerce’s explosive growth has featured as one of the prominent drivers for the cold chain industry. “Free-Trade Zones in Shanghai, Tianjin, Guangdong and Fujian provinces start building cold storage facilities massively and will create enormous demand for equipment, software and related materials in the next few years,” he said.

Cross-border ecommerce grew at a CAGR of 81 per cent during 2012 and 2016.

He also anticipates a pointed buildup of cold chain facilities along the One Belt One Road in future, as agricultural produce are expected to be in greater volumes going in and out of China from such regions and countries.

A survey the China Cold Chain Alliance (CCCA) carried out on 350 companies suggests that there are too many cold storages (between -25 and -18 degrees Celsius) for fish and meat, but not enough for vegetables and fruits (between 5 and 15 degrees Celsius).

Unlike most other industries in China, the Chinese cold storage industry shows signs of further fragmentation, he said, as more players enter the sector, that have included players previously unheard of in the industry, such as international trading companies and refrigeration manufacturers, not to mention the many more ecommerce companies that is being built up.

In 2017 the top 100 cold storage companies take up 49.6 per cent of the national total in storage capacity, down nine percentage points from that in 2016, according to CCCA. In comparison, the top 20 companies take up 59 per cent of the market in Japan.

Most refrigerated warehouses are in the range of 10,000 and 100,000 tons in storage capacity.

According to CCCA, among the top 100 players are 14 foreign companies operating in the Chinese cold chain market. They are five Japanese companies which include Mitsui & Co, four from the US, which include Swire Pacific and SinoTrans PFS, one from Korea (CJ Group), one from Singapore (Global Logistic Properties), and 2 Taiwanese companies - one being Zhejiang Tongguan Logistics Development Co. (浙江统冠物流发展有限公司), a joint venture between Taiwan’s Uni-President (统一集团) and a local frozen food manufacturer named Youkang Food (祐康食品集团).

One positive trend is that food and pharmaceutical companies tend not to build up their own cold storages, but are utilizing third-party warehouses. CCCA data show that of the 74,637 refrigerated warehouses in China as of April 2017, some 58 per cent were owned by third-party cold storage companies, which represented a year-on-year increase of up 11.6 per cent.

Cold storages have hardly raised their rents over the past decade, with the average annual profit margin languishing in the range of 8-12 per cent, which compares with 20-30 per cent in advanced countries, said Liu Jing (刘京), secretary General of CCCA. He urged the industry to actively engage in merger and acquisition to increase economies of scale, lower energy wastage, add on more temperature ranges, and actively adopt modern technology to improve the sophistication of the operation.

###

The author has three careers: journalistic writing, market research and consulting (having authored or overseen production of nearly 100 reports and presenations), and financial advisor. With the sensitivity of a journalist who started his media career in the early 1990s, and an analytical instinct and tactics of an analyst, I write articles on LinkedIn, Jianshu and ocassionally elsewhere, about trends and business model evolution in the FMCG industries. Please leave comments if any, otherwise you may reach me directly at [email protected].